Featured

Markets keep on recording all-time highs but it will eventually end

The markets will continue to rise and there is no indication that a correction will happen soon.

Just as we think the markets might have a correction it makes new all-time highs once again. We are in the sweet spot for markets, given the period from November to April constitutes the best 6 months historically for stock markets.

In December, we get the “Santa Claus” rally. Maybe Christmas is coming early this year. The period before and just after the U.S. Thanksgiving Day is traditionally strong as well. The month of November is traditionally the second or third strongest month of the year. Everyone knows the Fed is going to hike interest rates in December so that is not a factor. U.S. politics remain in turmoil and markets actually like it that way as that usually means gridlock. Gridlock, it seems, is good for markets.

©David Chapman

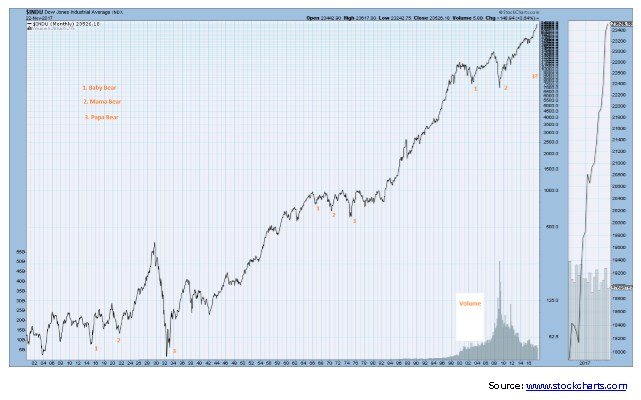

Eventually, however, all bull markets end. We are not going out on a limb to predict when that will happen. The current bull has already lasted 3,185 days or 8 years, 8 months, and 18 days. It is currently short by about 200 days in making it one of the longest bull markets in history (the one during 1990–2000 lasted 3,382 days). Along the way, there have been two significant corrections in 2011 and 2015/2016. Both were less than 20% so neither qualified as an official bear market.

The Fed has become concerned there are growing financial imbalances that could cause a sharp reversal in asset prices. These were outlined in the recent FOMC minutes. The Fed is concerned this could impact their decision-making. It has sent a note of caution to the Fed. This is interesting given the new Fed Chair, Jerome Powell, takes over in February from outgoing chair Janet Yellen. Ms. Yellen has stated she is stepping down and will no longer serve as a Fed governor. Current economic conditions have led many to call the current economy a “Goldilocks economy.”

Murray Gunn, a fund manager and economist, recently wrote an article titled Goldilocks & the Three Bears. He describes the current economy as not too hot or too cold, but just right. Mr. Gunn believes that “Goldilocks” has returned. The current economy can do no wrong and seems impervious to the political goings-on in Washington and elsewhere.

Mr. Gunn believes the current market and social mood are ensconced in the “words of celebrated economist Irving Fisher.” Mr. Fisher said on October 17, 1929:

“Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever, a 50 or 60-point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months.”

Mr. Fisher made his statement mere days from the most famous stock market crash in history. We mention Mr. Gunn’s article as we were intrigued by his chart of the MSCI World Index. The chart shows the long bull market that got underway from the low in 1974 to the top in 2000. He refers to that bull market as “Goldilocks” market. It was subsequently followed by two devastating bear markets. The first was the bursting of the high-tech/dot.com bubble 2000–2002 saw the market fall about 38% (as represented by the Dow Jones Industrials (DJI)). The second was the bursting of the sub-prime mortgage market 2007–2009 that saw the market collapse by almost 54%. Mr. Gunn refers to these two bear markets as a “Baby Bear” and a “Mama Bear.” He believes the next one will be the “Papa Bear.”

Interesting. We wondered whether that had happened before. Technical analysis patterns have a habit of repeating even if they are years apart. While we wouldn’t call them a pure pattern it seems Goldilocks and the Three Bears have visited in the past. Back in the early days of the previous century panics were not unusual. The stock market as represented at the time by the DJI rose from the depths of the 1890s depression to a peak in 1912. It was a period that one might have trouble calling a Goldilocks economy but it was a period of relative peace and economic growth even as there were two stock market waves of panic: first in 1901 and again in 1907.

“Goldilocks” ended abruptly with the outbreak of war in 1914. When the dust cleared the DJI was down about 40%. We labeled that the “Baby Bear.” The market recovered and 1915 was a terrific year as the U.S. benefitted, supplying all of the combatants. The entry of the U.S. into the war in 1917 brought a sharp correction, but the market recovered and rose sharply in 1919. The outbreak of influenza following the war, coupled with the war let-down and the growing strength of labor unions that led to a series of devastating strikes, saw the markets collapse from 1919 to 1921 losing roughly 47%. We labeled that the “Mama Bear.”

What followed was the “Roaring Twenties” as mass production, technological innovations in electricity, communications, and the assembly line led to a roaring stock market. Many thought it would never end but end it did with the devastating Wall Street Crash of 1929. That led to the Great Depression and the greatest stock market collapse in history. The DJI lost roughly 89% 1929–1932, looking very much like the “Papa Bear.”

Our second observation came following the huge bull market that effectively got underway in 1942 and topped in 1966. On the way, there were numerous stock market corrections in 1946, 1949, 1953, 1956, 1960, and 1962. Some such as the 1946 and the 1962 mini-bears exceeded 20% qualifying them officially as bear markets. But February 1966 marked an important stock market top for the next 16 years.

The first collapse occurred in 1966 and saw the market down roughly 25%. We labeled that one the “Baby Bear.” Following a sharp rebound, the market topped again in 1968. The subsequent drop 1968–1970 saw the market fall about 36%—“Mama Bear.” Once again, the market recovered leading to a top in early 1973 that was actually called the “Nifty Fifty” rally. We wouldn’t quite term this as a Goldilocks economy but following the top, in January 1973 the DJI lost 45% to December 1974 as the effects of a political crisis in Washington (Watergate) and then the Arab oil embargo weighed on markets—“Papa Bear.”

This leads us to today. As we have noted so many times in the past, the current market has been fuelled by years of quantitative easing (QE) by the major central banks, historically low-interest rates and a massive borrowing binge. Now, central banks are taking away the punch bowl as they reign in QE, hike interest rates and banks begin to clamp down on borrowing as authorities and the financial institutions themselves become concerned about the massive amount of debt out there particularly household debt but they should also be worried about massive government and corporate debt as well. Stock markets have been led higher by once again technological innovations and the FAANGs (Facebook, Apple, Amazon, Netflix, and Google). Many believe the current market will never end. Sound familiar?

Since the market topped in 2000 we have seen “Baby Bear” and “Mama Bear.” Of course, we don’t know for sure but following this long bull market we suspect “Papa Bear” is lurking out there somewhere. As Murray Gunn concludes, the story of “Goldilocks & the Three Bears” may seem like child’s play compared to what is to come.

Bitcoin Watch!

©David Chapman

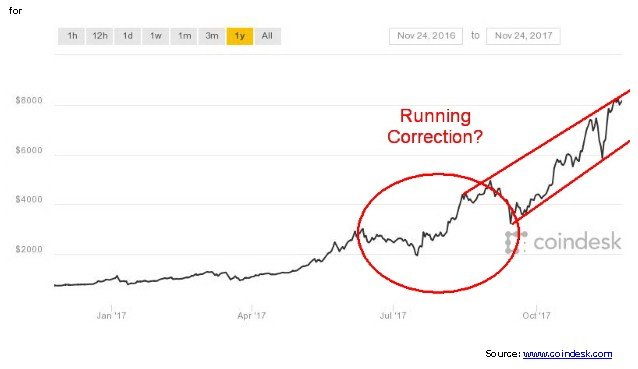

It seems like only yesterday we were noting a drop in Bitcoin to $5,500. Then, poof, just like that it soared to $8,362 for a fast gain of 52% (as we prepare our report for distribution we note that Bitcoin has now soared to $9,468 for a gain of 72%). If you blinked you probably missed it. Such is life in the cryptocurrency lane. Maybe instead of buying Bitcoin one should be buying the graphics processors that are essential to cryptocurrency “mining.” We learned Bitcoin alone consumes as much electrical energy as a country such as Nigeria. Is there actually a limit to Bitcoin and other cryptocurrencies?

None of this has stopped those predicting where Bitcoin and other cryptocurrencies are headed. We read one that said Bitcoin will soar to $5,000,000. Yes, that is a 5 with 6 zeros. Gee, not that long ago it was a 5 alright but only 4 zeros. The mind boggles. And we are still seeing those offering courses on how you can get “rich, rich, rich” buying cryptocurrencies. The mind boggles, again.

We are now hearing, of course, that gold is being dumped to buy Bitcoin. It’s better than gold after all. Or at least so it goes. We have heard of junior miners switching to become cryptocurrency companies. Last time we heard that was in the late 1990s, early 2000 when junior gold mining companies were being converted to dot.com companies. We know how well that turned out.

There may even be another craze forming in marijuana stocks. It’s all based on marijuana becoming legal here in Canada (and maybe elsewhere too). Who knows—we may have to start a marijuana watch. We could call it “Up in Smoke, Watch!”

The trouble is, what is Bitcoin? Is it really an alternative currency like we are being told? Or is it just the latest speculative craze that will end badly for those invested in it? Indeed, it’s digital gold. Maybe better than gold.

Bitcoin does not rely on third parties like the government, banks, or credit cards. But Bitcoin is not a replacement for gold. Gold actually has a highly liquid market. We dare anyone to put in a market order for Bitcoin—who knows where you would get filled. Cryptocurrencies are a highly fragmented market. There are upwards of 1,500 of them and we bet 80% at the minimum will fail. Given Bitcoin’s huge volatility it is not a hedge against stocks. It is well-known gold is non-correlated with both stocks and bonds. Gold coins and bars, unlike cryptocurrencies, cannot be hacked. Vaults holding gold coins and bars are insured. So Bitcoin and other cryptocurrencies are not a substitute for gold. The wild market in Bitcoin and other cryptos may in the end actually help gold and silver.

The bull channel that Bitcoin has been climbing in continues to hold. The chart shows Bitcoin trading along the top of the channel. Could Bitcoin soon be an experiencing another little meltdown? The bottom of the channel looks enticing. If Bitcoin were to fall below $6,000 the market would look dangerous. For Bitcoin lovers, we guess they had better hope it just keeps on climbing.

Markets and Trends © David Chapman

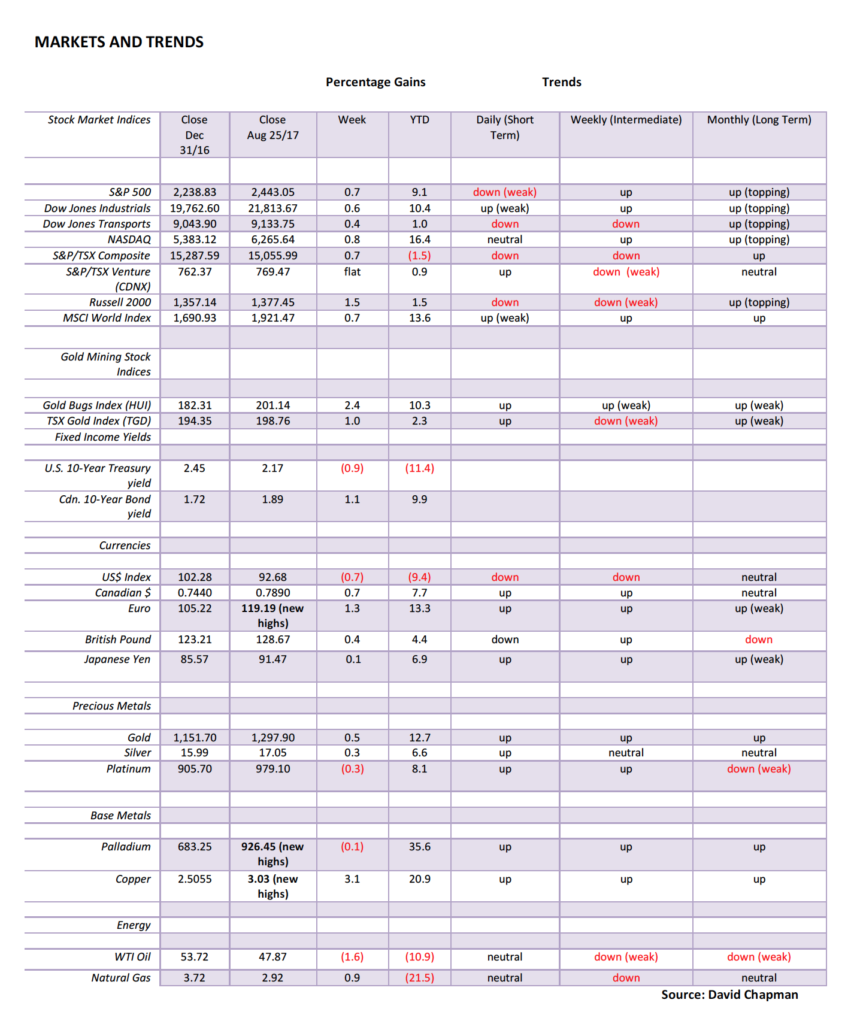

Note: For an explanation of the trends, see the glossary at the end of this article. New highs/lows refer to new 52-week highs/lows.

© David Chapman

It is the running of the bulls. Just as you think we might actually have a correction, then the market reverses and makes new highs—again. Everywhere we read the expectations are the market is going to go higher. It is extremely difficult to find a bear anywhere. Most likely most of them have been trampled to death. The Dow Jones Industrials (DJI) wasn’t alone either. The S&P 500, the NASDAQ, the Value Line Indices, the small caps, and the mid-caps all joined in the party. The exception was the Dow Jones Transportations (DJT) that continues to languish below its all-time highs. The DJT remains a divergence to the DJI, as the indices (DJI & DJT) have not yet confirmed each other. There were a few others that did not confirm including the S&P 100 (OEX), the Dow Jones Utilities (DJU) and the NYSE Composite Index.

That last low for the DJI on November 15, 2017, at 23,242 now becomes important. If that breaks then a more serious correction may unfold. But the DJI and the other indices must continue to make new highs if the “party” is to continue. As we move past Thanksgiving we move into December when the traditional “Santa Claus” rally usually unfolds. Maybe Santa Claus is coming early this year. One has to be wary. When so many are voicing expectations of more to come in 2018 one has to wonder: just where is the buying power going to come from if everyone has already bought?

©David Chapman

Here once again is the big picture. The chart is of the S&P 500 from the important Intermediate Wave 4 low of February 2016. Our targets for the S&P 500 based on Intermediate Wave 4 were at 2,458 (achieved) and next 2,658. With a close this week at 2,602, we remain short of that target. Our expectations are that the target should be hit. Curiously, our next target above 2,658 is at 2,982 or just shy of 3,000. Our labeling of the move from February 2016 differs from what we see at Elliott Wave International. We do consider EWI experts in their field and ourselves mere amateurs. Where we differ is we don’t believe we have seen the end of wave (iii) yet. So remaining is wave (iv) and (v). Once wave (v) is in place we would then see wave ((iv)) followed by wave ((v)) to complete wave 3 (waves 1 and 2 culminated in the Brexit panic). All of this would seem to suggest that we have ways to go complete Intermediate wave 5. We can see the steam coming out of the bull’s nose. Bears are running away in fear.

Key points are 2,557 the last daily low, 2,417 the last significant weekly low, and 2,084 the last significant monthly low (and also the 2016 election low). Below that level a serious bear market could get underway.

©David Chapman

Here is the Russell 2000, a proxy for the small-cap market. The index made new all-time highs this past week. This confirms the uptrend. If the small caps are rising then it is a continued sign of a strong bull market. Its wave count may differ from the S&P 500. That is interesting in itself. What we might expect is the Russell 2000 could top before the S&P 500.

©David Chapman

Have international markets topped? Very few international markets made new all-time highs this past week. While not all were down on the week they were not with exceptions making new all-time highs. Exceptions were the Hong Kong and Singapore exchanges as both made new all-time highs. But everywhere else the international indices failed their highs. Of the majors the Shanghai Exchange (SSEC) shown above was down 0.9% on the week but the Paris CAC 40 was up 1.1%, the German DAX gained 0.1%, the Tokyo Nikkei Dow (TKN) was up 0.6% and the London FTSE jumped 0.4%. But none made new all-time highs. The TSX Composite gained 0.7% and is now just shy of new all-time highs. Worst performing is the Mexican Bolsa Exchange which is down 8% from its all-time high. The Mexican index is being hurt by the thought of the U.S. cancelling NAFTA.

©David Chapman

The U.S. 10-year Treasury note is showing some resilience. The 10-year fell by only 1 bp, but it continues what well may be a consolidation following the move from 2.05% to 2.46%. Still, it is holding above the key MAs and the 50-day MA is crossing over the other key MAs. Our expectations remain that once this corrective period is over we could continue towards potential targets up near 3%. We continue to believe we are either in a C wave to the upside or a 3 wave to the upside. There is support down to around 2.25% but below that level we could see rates fall further.

©David Chapman

The 2–10 year spread continues to narrow. This past week it fell from 0.62% to 0.59% after hitting a low at 0.58%. Once major support at 0.75% fell we noted the downtrend could be swift. So far, we have not been disappointed. We are, however, a long way from a negative spread that would indicate a recession is probable. A bounce this coming week is not out of the question. But with the break of 0.75% we believe that the 2–10 spread will inevitably fall towards zero and even go negative.

©David Chapman

Despite affirmations that the Fed is likely to hike interest rates again in December, plus a U.S. economy that shows few signs of slowing despite potential trouble zones such as high levels of debt, the US$ Index fell again this past week. The US$ Index failed up at the 165 exponential MA and has now fallen back below the 50- and 100-day MAs. The US$ Index is now within hailing distance of the October low of 92.59. Once it breaks that low it should confirm that a top is in and the US$ Index may be embarking on wave 5 to the downside. The move from the September low of 90.99 now appears to have unfolded in an ABC corrective pattern.

Once the US$ Index drops below 90.99 potential targets for wave 5 could down to 86.90. A fall in the US$ Index should also be positive for gold. The caveat is a rebound that takes us back up over the recent high at 95.07. That would suggest that wave 4 is still unfolding. But, overall, the pattern appears bearish for the US$ and the fact that the US$ is not responding to what should be good news is also a bearish sign. The prime benefactor has been the Euro although this past week the Pound Sterling despite Brexit and the Japanese Yen were also higher against the US$. Only the Cdn$ appears sticky at the moment. We continue to target the Cdn$ down to 75.

©David Chapman

Gold continues to trade in a very tight range with $1,295 as upside resistance and support appearing good down to $1,270. This past week started off with a bang as someone once again dumped 15,000 contracts of gold in under 2 minutes on November 20, 2017. That’s not real gold. It’s paper gold. Each contract is worth 100 troy ounces, so 15,000 contracts are the equivalent of 1.5 million troy ounces with a value of about $2 billion at $1,290/ounce. This was after Friday when gold leaped and appeared to be on its way to breaking out over $1,300.

Clearly someone does not want it to break out over $1,300, or at least not yet. That’s the negative. The positive is despite the dump, gold once again held its 50-day MA, and then rebounded as the week went on. Yes, gold closed the week down losing 0.7% and silver was hit harder losing 2.2%, but the good news is both rebounded quickly from Monday’s sell-off. Despite someone clearly trying to push gold prices down (the second such dump in the past two/three weeks) there are buyers out there snapping it right back up again.

The CFTC did not release the usual Commitment of Traders (COT) report on Friday because of the Thanksgiving holiday. It should be out on Monday but no later than Tuesday. So we have nothing to report as for whether there are signs that the commercials are covering on these dumps. Our key point for gold remains at $1,300 to $1,320. Once through that resistance gold should be able to rise to retest the recent high at $1,362 and the July 2016 high of $1,377.

Despite everything, gold has been making a series of higher highs and higher lows since the important low in December 2015. The rise has been quite irregular with setbacks as almost as deep as the rises. Given the series of higher highs and higher lows, we view all of this action as bullish. The period December/March has given rise to some strong rallies over the past few years. Given the current depressive state for gold another strong rise could soon be on its way. A decline below $1,260 would not change the scenario but it would delay it. A move to new highs above $1,362/$1,377 would soon put gold over $1,400 and probably send it towards $1,500. Ultimate targets for gold appear to be up around $1,700.

©David Chapman

Silver appears to be tracing out a very tight triangle pattern. The pattern may not be quite finished yet so another drop towards the recent low of $16.60 or even a drop below that level could still be in the works. Silver was negative this past week, falling with the gold dump on Monday. Like gold, it rebounded but not enough to put in a positive week. Silver finished the week down 2.2%. The triangle breaks out to the upside above $17.40 but a downside break would occur under $16.90. Upside targets would be at least $18.10 but a downside break could imply a drop to near $16. Ultimately an upside breakout over $18.40 could imply a move to at least $23. Overall, the larger pattern for silver appears to be bullish. We put lower odds on a downside breakdown.

©David Chapman

The gold stocks remain stuck in a rut. We are not excited about the pattern shown here for the TSX Gold Index (TGD). But when we go and look at individual stocks that make up the index we note more than a few where the patterns appear to be quite positive. Gold/silver stocks whose patterns appear quite bullish to us include Agnico Eagle (AEM), Alamos Gold (AGI), Argonaut Gold (AR), Alacer Gold (ASR), AngloGold (AU), B2Gold (BTO), Buenaventura (BVN), China Gold (CGG), Detour Gold (DGC), Franco Nevada (FNV), Goldcorp (G), Randgold (GOLD), Harmony Gold (HMY), Kinross (K), OceanaGold (OGC), Osisko Gold (OR), Premier Gold (PG), Pretium (PVG), Royal Gold (RGLD), Sibanye Gold (SBGL), Wheaton Precious Metals (WPM), Sandstorm Gold (SSL), Yamana Gold (YRI), and Pan American Silver (PAA).

This is not a comment on the companies themselves, merely that their technical patterns appear positive to us. All are producers. If a strong rally gets underway for gold stocks it is the major producers that usually lead the way followed by the junior producers. The junior producers usually have the best upside potential but are of higher risk. Finally, the junior exploration stocks are the last to move even as they have the highest upside potential along with the highest risk.

The TGD does not break out until it is over 205. Upside potential from there is a move up to 265. The July 2016 high was at 284. We doubt the breakdown scenario but until we break out it remains a possibility. The breakdown occurs under 190 but especially new lows under 172. Over the past few weeks, we have flirted with the 190 zone but have not broken under that level.

©David Chapman

We thought we would close this week with a look once again at the bigger picture for gold. We have shown the above chart in the past. Since Janet Yellen became Fed Chair gold has largely traded between $1,160 and $1,375 with the bulk of the trading coming in the $1,200 to $1,330 zone. What has formed appears to be a large head and shoulders pattern with the neckline and breakout currently at $1,350. A firm breakout over that level could imply a move to $1,740. We remain quite positive towards gold going forward and its chances, particularly in this upcoming seasonally strong period of December to March. Only a serious breakdown under $1,200 could change this scenario.

(All charts are courtesy of Stock Charts and COT Price Charts. Featured image via DepositPhotos)

__

DISCLAIMER: David Chapman is not a registered advisory service and is not an exempt market dealer (EMD). We do not and cannot give individualized market advice. The information in this article is intended only for informational and educational purposes. It should not be considered a solicitation of an offer or sale of any security. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor before proceeding with any trade or idea presented in this article. We share our ideas and opinions for informational and educational purposes only and expect the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor.

-

Biotech2 weeks ago

Biotech2 weeks agoAsebio 2024: Driving Biotechnology as a Pillar of Spain and Europe’s Strategic Future

-

Business9 hours ago

Business9 hours agoDow Jones Nears New High as Historic Signals Flash Caution

-

Business1 week ago

Business1 week agoFed Holds Interest Rates Steady Amid Solid Economic Indicators

-

Fintech5 days ago

Fintech5 days agoMuzinich and Nao Partner to Open Private Credit Fund to Retail Investors

You must be logged in to post a comment Login