Featured

Too good to be true? Markets continue to advance despite global problems

This week, the Dow Jones made two new all-time highs, the 64th and 65th of the past year.

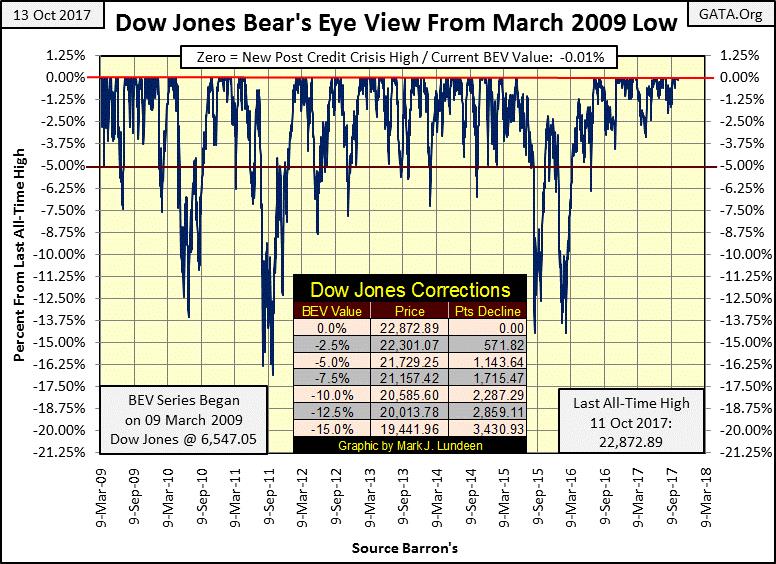

As we’ve come to expect in the current advance, there’s no indication of a market correction, however tiny that may be, to be seen on the horizon in the Dow Jones’ BEV chart below. The Dow hasn’t seen a 5% decline from an all-time high since June of 2016. A quick look at the Dow Jones’ BEV chart below shows us that sixteen months between 5% (or more) corrections is a long time.

How much longer can this continue? That’s the 64 trillion dollar question.

© Mark Lundeen

This market may continue advancing longer than I believe possible. After all, considering all of the problems the world is having now, including the real risk of seeing military action against nuclear North Korea, with the complications of Chinese and Russian involvement should this happen, I don’t even understand why this market is going up, let alone when it will stop advancing.

I’m just telling my readers the truth; this market is a real mystery to me. The only answer that makes sense is that the massive amounts of “liquidity” flowing from the global central banking cartel continues flowing into financial assets because it doesn’t know any better. This advance may be only a pernicious bad habit taken up in the past three decades since Alan Greenspan began inflating bubbles in the financial markets in 1987.

Okay, I admit it; concerning what the heck is going on in this market – I am totally ignorant; nothing makes sense to me. But admitting my ignorance in the current situation doesn’t mean I’m stupid. On the contrary, admitting it helps me resist any impulse of jumping into this rising market, as doing something with money based on ignorance usually guarantees something less than desirable as an outcome.

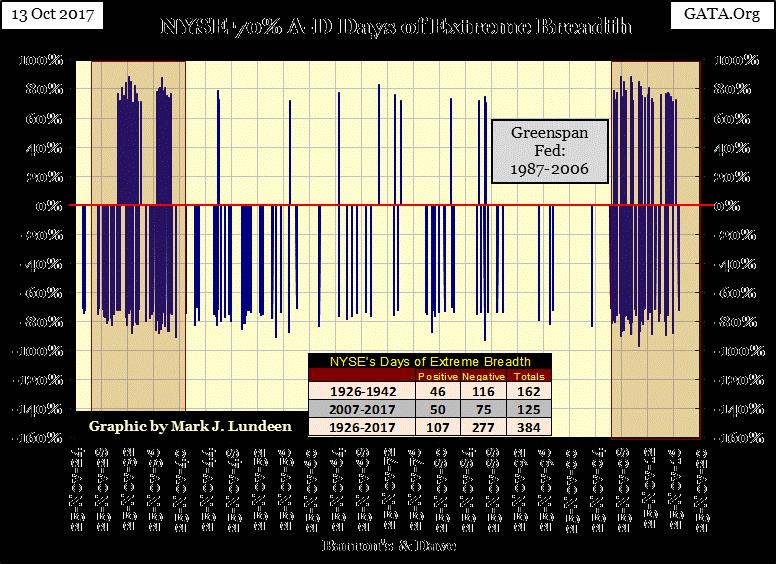

So, what indication or market event I’m waiting for that will signal the market is once again behaving in a manner I understand? What I’m waiting for is a return of extreme days in the stock market, signaling that a top in the market is at hand, or possibly actually past us. I’m talking about Dow Jones 2% days, days the Dow Jones have moved up or down 2%, or more, from a previous day’s closing price and days of extreme market breadth, NYSE 70% A-D days.

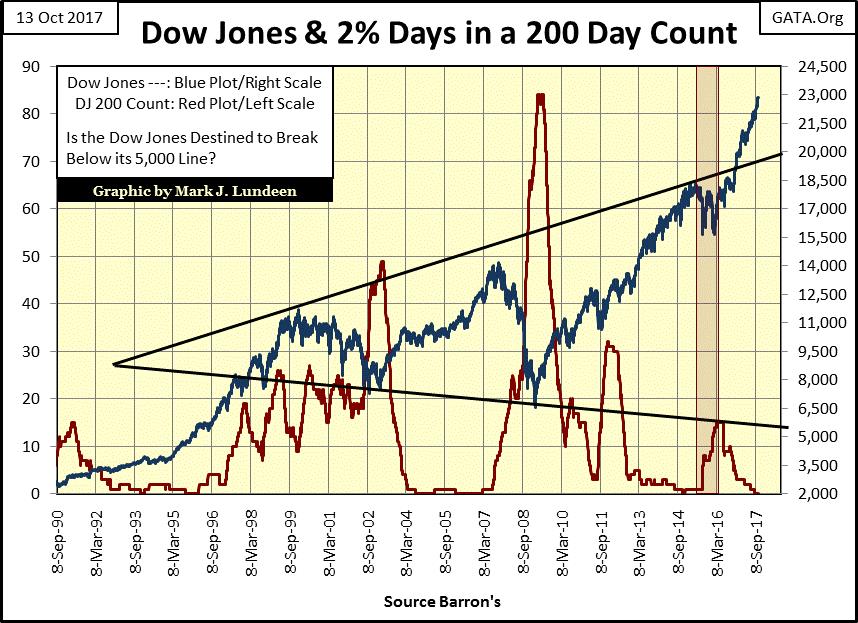

Dow Jones and 200-day count

Next, we see the Dow Jones and its 200 counts (the number of 2% days in a running 200-day count) going back to 1990. Market advances are associated with low market volatility (declining 200 counts), market declines with increasing volatility, rising 200 counts.

Currently, the Dow Jones’ 200 count is at zero, and market volatility isn’t going any lower than that, and the Dow Jones is reacting favorably to this. If history is any guide, and it usually is, when the 200 count once again begins to rise, it will signal the pending termination of the current advance.

© Mark Lundeen

As market volatility, and market breadth has been docile for well over a year, either type of extreme day will create big news. For the Dow Jones, seeing it move up or down by over 460 points, or more, in a single trading session will create the first 2% day in over a year, and lots of buzzing in the financial media. And should the NYSE see over 2,700 advancing or declining issues of the 3000 or so that trade daily at the NYSE, that also would produce the first NYSE 70% day since last March, and generate much market commentary on this happening.

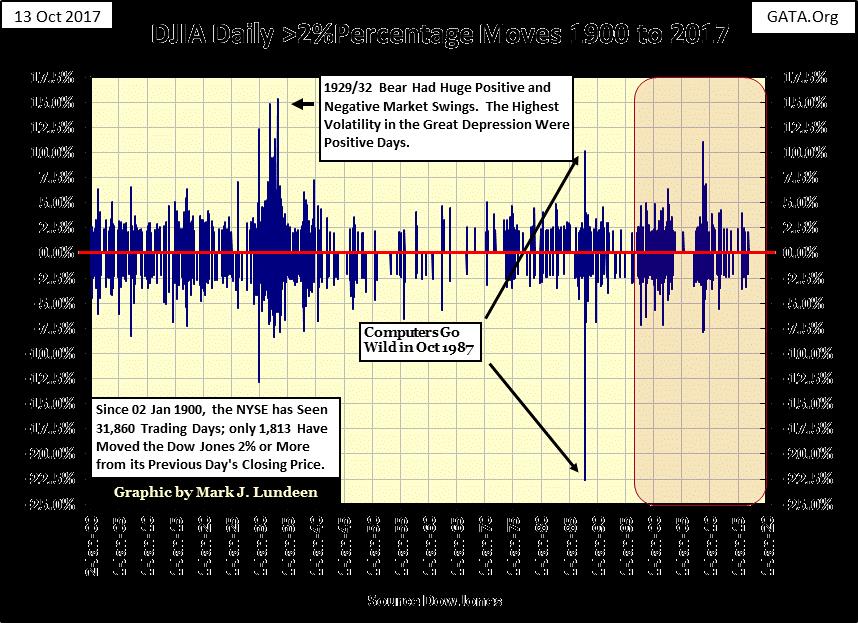

After the top is in, we can count on the market producing both types of extreme market events on a frequent basis, two to five a week on a major decline. I’ve plotted below the 1813 NYSE trading sessions from January 1900 to October 2017 where the Dow Jones has moved 2% or more from a previous day’s closing price.

It’s counterintuitive, but keep in mind that historically the big daily advances of 2% or more are almost exclusively bear market events. During the Great Depression, the Dow Jones saw days where it ADVANCED by 10% or more, each a bear-market event that devastated the shorts in the market. Ultimately, these huge daily advances in a bear market do nothing for the bulls, except to bait them to enter Mr. Bear’s meat grinder one more time.

Also, note the sub-prime mortgage bear market (2007-09). Its largest daily move was an ADVANCE of over 10% (28 October 2008). And as expected, it didn’t signal the end of the bear market, it was just the opposite.

© Mark Lundeen

Actually, if one was going to play the short side of the market, never short a stock or buy put options during a market decline in a bear market. That’s what most people do, and most people lose money doing it. Wait for one of these big bear-market daily advances to go short or buy a put, and then close out your position on the coming market decline. It takes guts doing this, as you’ll be going against human psychology in doing so.

Am I recommending my readers do this? No way, I’m no one’s financial advisor! I’m just a guy with a lot of historical market data doing his personal due diligence research which I share with anyone who finds it interesting. Still, if you want to be a real shoot-em-up-cowboy in the coming bear market, this is how it’s done.

NYSE trading sessions

Here’s a chart plotting the 384 NYSE trading sessions producing a NYSE 70% A-D day, each an extreme day of market breadth since 1925. Note the menacing cluster of days of extreme market breadth that began to form after March 2007, much like the menacing cluster that formed during the 1920s & 30s. Do you remember how that cluster ended? This cluster of extreme days has been in the making for over ten years now and shows no sign of ending—just yet.

© Mark Lundeen

What am I planning to do then? Absolutely nothing as I already have my position in for the coming bear market. But if you’re in the market, and if what you’re doing is making you money—keep doing it. Just don’t believe that the current market advance is a permanent feature of the stock market because it’s not.

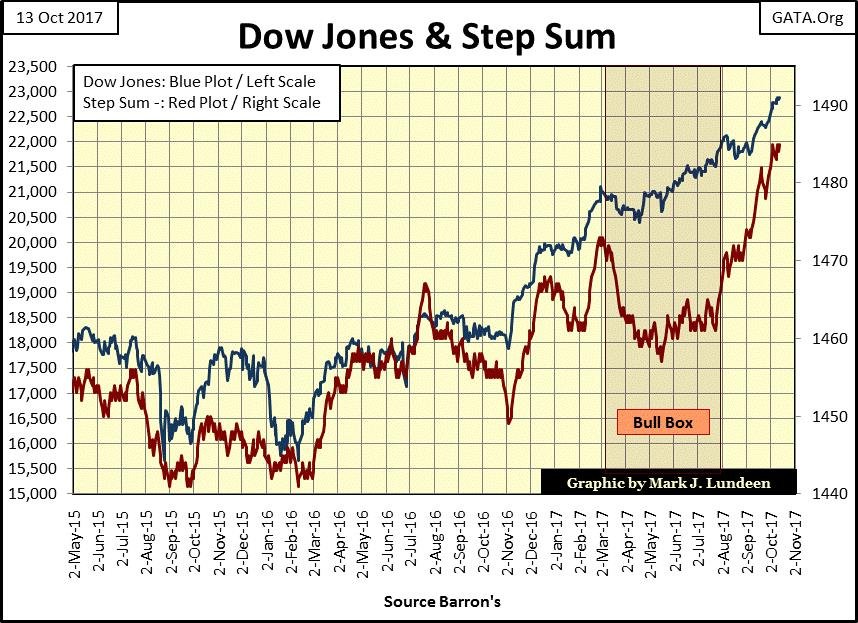

Dow Jones and step sum

However, looking at the Dow Jones’ step sum (market sentiment) below, there are currently lots of people who do believe the upside to the Dow Jones is unlimited. Since breaking out of its bull box below, advancing days in the Dow Jones have overwhelmed decliners.

We didn’t see the Dow close above 23,000 last week, but still, the Dow Jones did make two new all-time highs, leaving it only 130 points below the 23K level. I’m expecting we’ll see it over 23,000 by the close of next week, or the week after.

© Mark Lundeen

Daily gold and step sum

I really have nothing bad to say about gold and its step sum plots below either. Gold broke below its 1275 level on Monday but then bounced back above it, closing the week above 1300. And this week its step sum also reversed its downward trend. It’s all good, but like everyone else, I’m tired of waiting for the old monetary metals to do something spectacular. Like I’ve said before, patience is a virtue at times such as these.

Gold and silver this week didn’t make the headlines as did the stock market. But in the coming year, I expect a lot of people will have wished they sold into the strength the stock market saw this week and bought gold and silver on their latest price reversal.

© Mark Lundeen

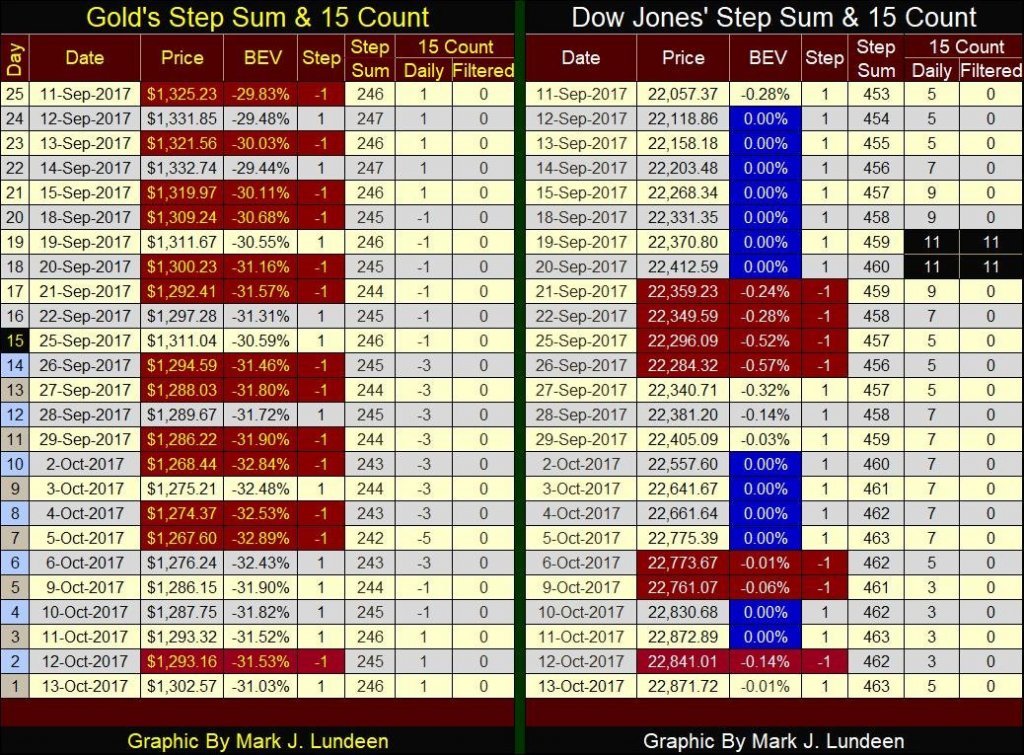

Here are gold and the Dow Jones’ step sum tables. Clearly, the selling that dominated the gold market these past few months has come to an end. There was only one down day for gold in the last six trading sessions, and that down day took the price of gold down only $0.16.

It appears that the part of the market cycle where the bears dominate the market is now over, and the bulls in the gold market will soon have an opportunity to show everyone what they can do. If the bulls are going to take out the highs of 2016 before the end of the year, this is the setup where such things are done, and I’m optimistic that the bulls can do it.

© Mark Lundeen

Moving over to the Dow Jones side of the table, the bulls are still in full control of the stock market. In the past twenty-five trading days, the Dow Jones’ step sum has advanced by a net of ten advancing days. That’s a big move, and all those net advancing days are having a good effect on the value of the Dow Jones.

But on a closer examination of the market, clearly, the stock market is approaching a top while gold is coming off a bottom. Look at the gold market since September 11th, the dominating feature in its table above are its many down days, highlighted in red and gold. Yet after all that, gold on October 13th finds itself only $22.66 below where it was on September 11th.

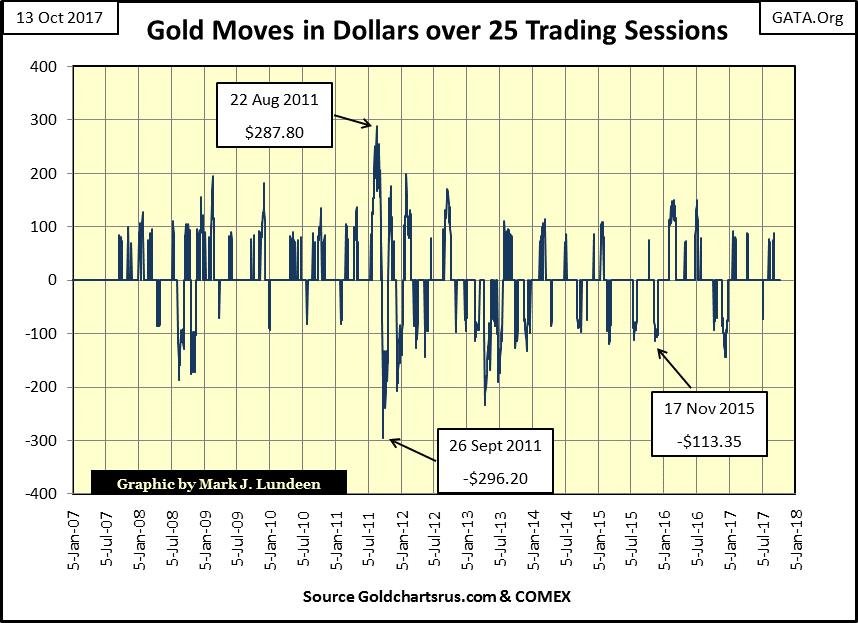

There were times in 2011 and 2013 when those many down days would have pushed gold down more than $150. In fact on 26 September 2011, at the beginning of its latest decline, gold over this same twenty-five trading day span had dropped by $296 (chart below).

Then note at the gold market’s bottom of late 2015, when market sentiment for gold was bleak (see gold’s step sum chart above), looking at the moves in the price of gold over a twenty-five trading day span below, the bears only managed to push the price of gold down by $113 in November 2015. In December of last year, the bears only managed a $143 price decline during this twenty-five trading session period as gold made its bottom for 2016.

© Mark Lundeen

As you can see, since September 2011 the big declines became smaller and it’s been about a year since gold had declined over $100 during the twenty-five trading day period seen in gold’s step sum table above. That tells me that now in October 2017, the bears in the gold market have pretty much spent themselves, and the bad old days in the gold market are behind us. We have good reason to expect much better days ahead of us.

But the day is coming when the Dow Jones side of the step sum table will appear as gold’s does at the end of the week. When it does, I expect the Dow Jones will fare no better than gold did in 2011 & 2013, and quite possibly much worse. Many of the bulls in the stock market will scatter at the first whiff of Mr. Bear’s grapeshot.

I’m finding it difficult writing about this market. Each week is more or less the same as the week before it. As I haven’t given the mainstream media (MSM), FOMC, our elected leaders in Washington and their market regulators the attention they so richly deserve since last summer, I thought I’d do so this week.

I’m a retired Chief Electrician (Interior Communications). For my readers from the other armed services: an E7. One of my tours of duty was on the USS Midway during Desert Storm. The Midway is now a museum in San Diego; one of these days I’d like to go back and visit her.

One of the things I enjoyed about being in the “Old Goat Locker” (Chiefs Mess) on an aircraft carrier was the different people there, and the different things they did for the ship. I became a friend with an Intelligence Specialist Senior Chief, a “spook.” In port he was always found reading newspapers, really any periodical in print. It was part of his job. Once as he read, in jest I asked him if he was learning anything. He looked at me as if I was an idiot. I remembered that look from someone who really knew something about what is actually going on, that the news media had little interest in informing people what’s actually going on in their world.

I began following GATA’s Bill Murphy and Chris Powell and I.M. Vronsky’s Gold Eagle sites in the late 1990s. The superb research offered to the public by these wonderful people and their contributors was, and is amazing. But what was disheartening, in a world where credit and debt were (and are) expanding towards infinity, with hundreds of trillions in interest-rates derivatives resting quietly in corporate balance sheets, like a roadside IED, our self-styled “market experts” didn’t and still don’t care.

Warren Buffet warned the public in 2002 of the dangers derivatives posed to the financial markets:

“The derivatives genie is now well out of the bottle, and these instruments will almost certainly multiply in variety and number until some event makes their toxicity clear—[They] are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal. Calling derivatives garbage is an insult to garbage.” —Warren Buffett, 2002 letter to Berkshire Hathaway shareholders

Six years later during the 2007-09 credit crisis, Buffet’s warning of pending disaster with derivatives became painfully clear. Fifteen years later the same is still true. Not that this matters to the Main Stream Media (MSM), “professional journalists” who have no interest in properly covering the important topics of debt and credit expansion as well as derivatives in 2002, 2008 or even now.

Even at the height of the sub-prime mortgage crisis, a crisis in “structured finance” (derivatives), the MSM’s focus on its coverage of the crisis wasn’t on the massive fraud Wall Street perpetrated on the financial markets, but on the importance of bailing out the same Wall Street criminal empire that perpetrated the crisis.

These people in the financial media and the financial industry they cover are vile. Lives were ruined during the sub-prime mortgage crisis, but now that Wall Street’s fraudulent scams are back on track once again, it doesn’t seem to bother the media or the government’s market regulators. And a personal grievance of mine, and I’m sure of others, Wall Street, its regulators and their flacks in the financial media are personally responsible for gold, silver and their miners remaining underperforming assets for decades.

Their slipshod coverage of economy and markets of the past few decades may prove to be one of their least offenses against the consumers of their “financial news.” The financial media’s lame coverage of the industry they claim expertise in has enabled the malignant narcissists in government and finance to circumvent the market’s natural feedback mechanisms.

Promoting a policy of perpetually seeking pleasure and avoiding pain in the financial markets, the financial media went along to get along with the Powers that Be. In doing so, they’ve succeeded in outlawing debt-purging bear markets and market-driven punitive-interest rates, and it’s been this way since Alan Greenspan became Fed Chairman in 1987. There will be consequences for all of what has been done by the FOMC and their cheerleading media these past three decades.

Unlike today’s “policymakers”, I value my Judeo-Christian Heritage for the wealth of wisdom it offers anyone who cares to seek it, such as:

“They that sow the wind, shall reap the whirlwind.”—(Hosea 8-7)

In other words; the coming bear market in financial assets will be of Biblical Proportions. When Mr. Bear returns, you’ll be glad for any gold, silver or precious metals mining shares you have.

This fraudulent coverage of our world by the MSM isn’t limited to the markets. I’ve been aware of Alex Jones for years. I enjoyed listening to him, but never mentioned it to anyone for fear of being classified a “conspiracy theorist.” With Alex it was always the CIA did this, the FBI did that. No doubt Alex was pro American, someone who valued the small federal government the American constitution chartered. But I refused to believe my federal government was that bad! Jeez Louise, I actually went to war for those people.

Then came the Trump presidential election campaign, and the WikiLeaks disclosures of last year. The NSA and CIA are actually recording every phone conversation and digital means of communication on planet Earth, and so much more! It’s illegal and dangerous, but nothing happens to them because Congress, past Presidents and members of the Supreme Court are fully aware that America’s intelligence services have compromising intelligence on them.

The spying agencies Congress created to protect us have turned on us, and the FBI for decades has been doing its own thing too. This is real banana republic stuff and I’m outraged, and you should be too!

But as is typical of them, the MSM made its report on this breach of law by America’s intelligence agencies over a year ago, and like Hillary’s 30,000 missing e-mails, or Congressman Wiener’s laptop with child pornography and its infamous “Life Insurance” file (I’d love to see what in that!), these issues of massive government scandals have been intentionally avoided by the media since then hoping they’d go away.

To keep themselves occupied for the past year “journalists” have committed themselves to their relentless coverage of the biggest conspiracy theory of all time—the fictitious connection between Trump and Russia in his 2016 presidential campaign victory. Get this: the same FBI that declared there was no ISIS connection to the Las Vegas sniper within hours of the incident, can’t seem to come to a conclusion about Trump’s Russian connection after over a year of intensive investigation. What’s with that?

I have no desire to listen to the “Never Trumpers’” nonsense anymore. Trump needs to clean house. There are lots of people in and now out of government in dire need of a fair trial, and then sent to prison for the outrageous crimes they’ve committed.

To illustrate the slipshod investigating done by the Fed’s, and substandard reporting we’ve come to expect from the MSM, here’s a clip from Alex Jones’ Infowars on the Las Vegas sniper story. From day one InfoWars exposed the official narrative of Federal Government’s law enforcement agencies and the MSM for the bumblers they are.

Hollywood sex scandals are big news this week too. Infowars and their contributors have been covering this topic for years, along with Hollywood’s Satanic connection and the entertainment industry’s elites’ pedophilia, the same years CNN and their ilk have chosen to ignore them.

Life is more than just making money in the markets. We live in a world that daily forces us to choose between good and evil in things both little and big. But if you are someone who chooses to do good, you can only be effective if you have a good source of information. CNN and the other outlets of the MSM have chosen not to provide that to the public, and so should be avoided.

In the service a point frequently made was don’t tell the boss about a problem; tell him about the problem along with your solution to it. Following that line of reasoning, the more I follow Alex Jones’ Infowars, the more I like it as a source of information I feel good about recommending to my readers. They admit they aren’t perfect, but they more than make up for this imperfection by always striving to tell the truth no matter where it leads. That is something that can’t be said for America’s contemptable mainstream media.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post. I encourage any reader to do their own diligent research first before making any investment decisions.

(Featured image via Deposit Photos)

-

Crowdfunding6 days ago

Crowdfunding6 days agoTasty Life Raises €700,000 to Expand Pedol Brand and Launch Food-Tech Innovation

-

Biotech2 weeks ago

Biotech2 weeks agoDiscovery of ACBP Molecule Sheds Light on Fat-Burning Tissue Suppression and Metabolic Disease

-

Cannabis1 day ago

Cannabis1 day agoCannabis Clubs Approved in Hesse as Youth Interest in Cannabis Declines

-

Impact Investing1 week ago

Impact Investing1 week agoFrance’s Nuclear Waste Dilemma Threatens Energy Future

You must be logged in to post a comment Login