Business

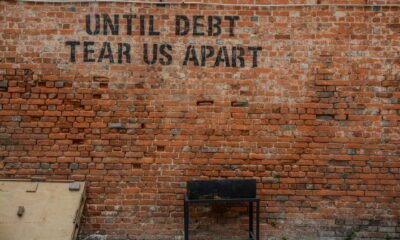

Why is it becoming harder for millennials to be homeowners?

With the rising cost of homeownership, houses seem to be far too ideal for millennials. Here are five reasons why millennials can’t afford buying homes.

The rising costs of home prices and mortgages are forcing millennials to choose between homeownership and cost of living, and most are choosing cost of living. To them, it’s easier and safer than risking homeownership. Real estate professionals who are reaching out to millennial buyers must understand why and adjust their strategies accordingly. Moreover, reasons for homeownership delay revolve around finances and family.

Too frugal

The desire to spend cash, checks and debit cards over credit cards and loans began after the recession. It was a time where everyone chose not to splurge and purchase only the necessities. It was acceptable for the time, but as the economy recovered, their habits stayed the same. Spending cash, checks and debit cards became an unbreakable routine. To millennials, frugal spending equals being cautious.

Student loans

When they do splurge, millennials go big. Student loans are a worthwhile gamble because it leads to a higher-paying job in a new career. Sadly, success after college comes gradually, not suddenly, so millennials must rely on current job offers to pay off student debt, which won’t suffice. Even with a higher paying job, the huge debt makes it too risky for them to welcome additional debt, including homeownership.

Mortgage predicaments

Frugal spending and student loans affect the mortgage process. Specifically, two mortgage-related issues, a down payment and no credit, are turning millennials away from mortgages altogether. Lenders expect a down payment upfront, and millennials don’t have surplus funds to pay immediately. Therefore, paying 20 percent of the desired home’s value is a sacrifice millennials won’t make. In addition, they don’t have the finances to pay closing costs, property taxes and supplemental homeownership fees too.

Credit history is important because it allows banks to gauge if millennials are able to pay mortgages or not. Sadly, a lot of millennials lack credit history. (Source)

Meanwhile, no credit report is a problem for millennials. Mortgage lenders determine a person’s trustworthiness through credit. Credit is debt or outstanding bills paid monthly. Examples include credit cards, car payments, insurance, utilities, and loans. Credit history is crucial in mortgage approval decisions, and lenders reject applications from millennials who don’t have credit history on TransUnion, Experian and Equifax. Unfortunately, millennials became comfortable living from bank accounts, so a credit report doesn’t mesh well with their lifestyle.

Alternative living arrangement

No mortgage approval or lack of funds to buy homes in cash forces millennials to think about alternative living arrangements such as renting and living with parents. In renting, many choose to live independently or with a roommate. Apartments, townhouses, houses, and lofts provide endless apartment choices accommodating all budget types. The second accommodation, living with parents, is embarrassing by society’s standards, yet very perceptive for a millennial. Regardless of whether parents charge rent or allow rent-free living, it’s less costly than paying the high rental cost alone or dealing with a roommate’s issues.

Family delays

Finances, mortgage, and living arrangements affect starting a family. Millennials heavily concentrate on resolving financial issues and overcoming living arrangements first, and they should. The challenge is the timeframe. It’s taking longer than expected to overcome these obstacles. Something has to give to offset this issue, and family becomes the sacrifice. On the bright side, millennials are willing to become first-time homebuyers with a fiancé/fiancée, married spouse, or family member, but they prefer a family.

Combine the sum of those parts and you get a millennial that is living in a never-ending domino effect nightmare with no way out. After all, buying a home today is harder than when their parents purchased a home. Of course, millennials want to be homeowners, but the dilemma is they expect the stars to align and the right time to arrive before making a move. Since resolving financial issues, family desires, and real estate buying hindrances won’t magically disappear simultaneously, millennials will continue to struggle. Real estate professionals must value these concerns and show millennials they can have it all.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing15 hours ago

Impact Investing15 hours agoEuropeans Urge Strong Climate Action Amid Rising Awareness and Support

-

Africa2 weeks ago

Africa2 weeks agoAgadir Welcomes Nearly 570,000 Tourists by May 2025

-

Cannabis1 week ago

Cannabis1 week agoRecord-Breaking Mary Jane Fair in Berlin Highlights Cannabis Boom Amid Political Uncertainty

-

Biotech6 days ago

Biotech6 days agoVytrus Biotech Marks Historic 2024 with Sustainability Milestones and 35% Revenue Growth

You must be logged in to post a comment Login