Crypto

How to monitor your Bitcoin investments

The unpredictability of cryptocurrencies needs a good crypto-investor eye. Here’s a rundown of three portfolio tracking apps that can help you with that.

Are you a so-called crypto-investor but want to monitor your Bitcoins?

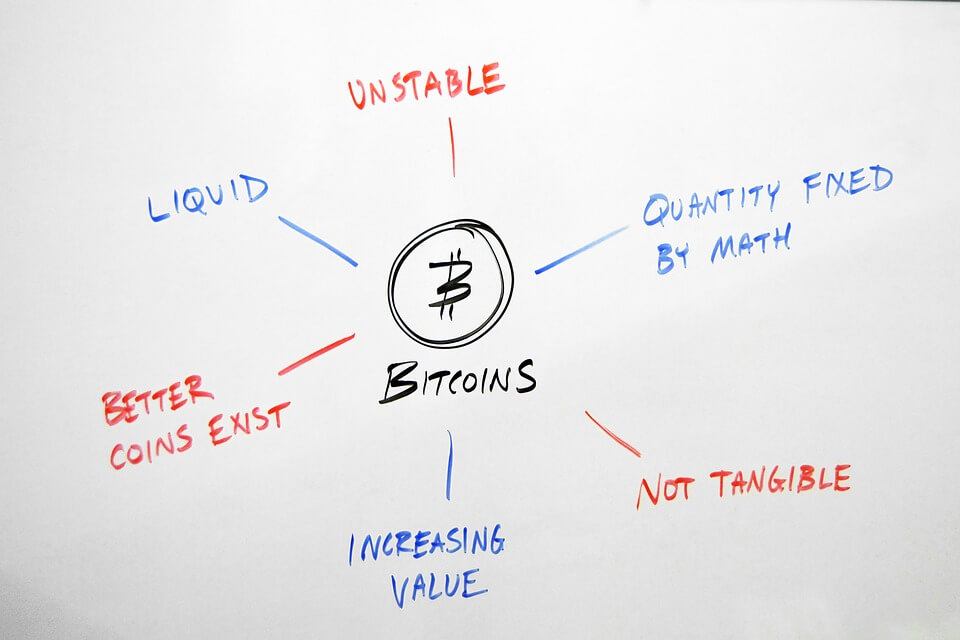

Because the virtual currency world is a volatile one, rules with regard investing in stocks where you can get high dividends or assets with low risks of losses don’t apply there, according to a Mashable article.

“There are no low-risk assets. Prices swing up and down in double-digit percentages on a weekly basis. One month in crypto is like a year in the real world. Something that’s valuable now could be completely gone in a few years,” the site said.

That is why a crypto-investor uses an app to know the status of his Bitcoin investments during the day.

Not perfect

Cryptocurrency tracking apps are imperfect though.

Mashable said some apps are “versatile and pretty but don’t track all the coins out there” while others are “updated and track all coins but don’t have all the options” that a crypto-investor needs.

The site listed three great portfolio-tracking apps with their strengths and weaknesses.

1. Blockfolio

Plus points:

- Blockfolio is the most popular portfolio tracker and is free.

- Tracks a large number of coins.

- Has varied options “including checking the actual order book and on different exchanges for each coin, and a basic but usable news feed.” The app alerts a user when a coin reaches a certain price. The alerts “can be used for a quick profit cash-in or reducing your losses when the price starts dropping.”

- It can be customized, so a user can lock the app with a password, share screenshots, hide his or her balances and only see percentage changes, and more.

- Visually pretty with charts and a choice between a dark and white user interface.

- Blockfolio can be downloaded for Android or iPhone.

Minus points:

- Only available for mobile phones.

- Slow to list new coins at times.

- The prices it shows “can be inaccurate.”

- Servers are sometimes unavailable.

Compared to other portfolio trackers, one of Delta’s plus points is its fast and highly reliable crypto-investor services. (Source)

2. Delta

Plus points:

- Delta is “a little faster” to list new coins than Blockfolio and more reliable.

- Has options like a watchlist and can track several separate portfolios.

- Has a minimized layout under “Other Options” that removes blank spaces in the app’s default view.

- Can be downloaded for free for Android or an iPhone.

Minus points:

- Lacks versatility in tracking individual coins so a user “cannot look at a coin’s actual order book on an exchange, only a chart of price changes over time, and there are no volume indicators on its charts.”

- The user interface is “predominantly dark.”

3. Cryptopanic

Plus points:

- It’s a webpage that’s available on both mobile and desktop.

- Has dual functions. It’s “a news aggregator and a portfolio tracker.” “It offers an extremely good overview of the latest crypto-news, with the ability to filter by coin and relevance.”

- Tracks coins “amazingly well.” A user can search for a coin, enter the amount he or she owns, and it’s added to his or her portfolio. “You cannot track prices on individual exchanges, but Cryptopanic is doing a solid job at tracking prices, and it also has an ‘extended’ view mode which shows you the price of coins in several currencies: USD, ETH and BTC.” Tracking the price in ETH is a feature lacking in most portfolio trackers, Mashable said.

- Has a minimalist design.

- It’s free and has a “Pro mode that lets a user add custom news sources and disable existing news sources” for $9 monthly or $99 annually.

No minus points.

What’s next?

A “crypto-investor” can choose from three apps recommended by Mashable that can track your cryptocurrency investments.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto1 week ago

Crypto1 week agoThe Crypto Market Rally Signals Possible Breakout Amid Political Support and Cautious Retail Sentiment

-

Crypto4 days ago

Crypto4 days agoBitcoin Hits New Highs in USD, But Euro Investors See Limited Gains

-

Crypto2 weeks ago

Crypto2 weeks agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Crypto1 day ago

Crypto1 day agoCrypto Markets Surge on Inflation Optimism and Rate Cut Hopes

You must be logged in to post a comment Login