Business

Orange juice continues rally; Palm oil moves up in weekly charts

Florida fruit harvesting makes for a higher orange juice production this week. Palm oil closed higher despite the short week due to Malaysian elections.

Wheat

Wheat markets were lower, with much of the selling in reaction to the USDA reports released on Thursday. The reports showed increased production estimates from a month ago despite the horrible weather in the western Great Plains. Estimates were slightly higher for winter wheat and higher for spring wheat. Ending stocks were little changed for the current crop year, but above expectations for the next crop year that gets underway next month. World data showed reduced ending stocks expectations.

The market is also seeing selling pressure on forecasts for some very beneficial rains in the Black Sea growing areas and also cheap world prices. Black Sea prices remain the cheapest. Warmer and drier weather is expected for the Midwest to help speed crop development after some big rains this week. Warmer weather should also move out of the northern Great Plains and Canadian Prairies to allow for some fieldwork to start in spring wheat areas. USDA showed that fieldwork is much behind normal this week.

Progress in planting spring wheat should increase with the warmer weather for the next week. The market has also been concerned about warm and dry weather in Ukraine and southern Russia. There had been a talk of the potential for significant yield losses if rains did not appear in the short term. However, rains were reported in these areas last week. Demand remains the big problem for wheat traders. The competition from eastern Europe and the Black Sea area remains very tough, and US prices are currently well above the competition.

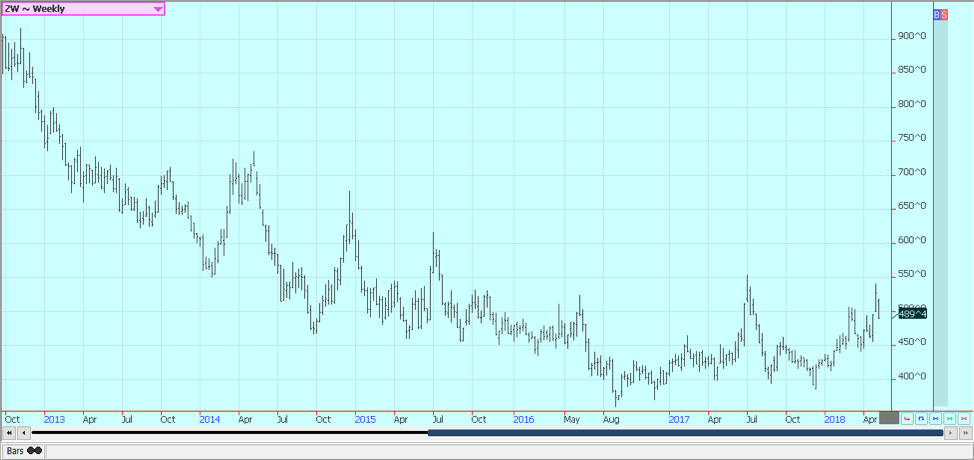

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

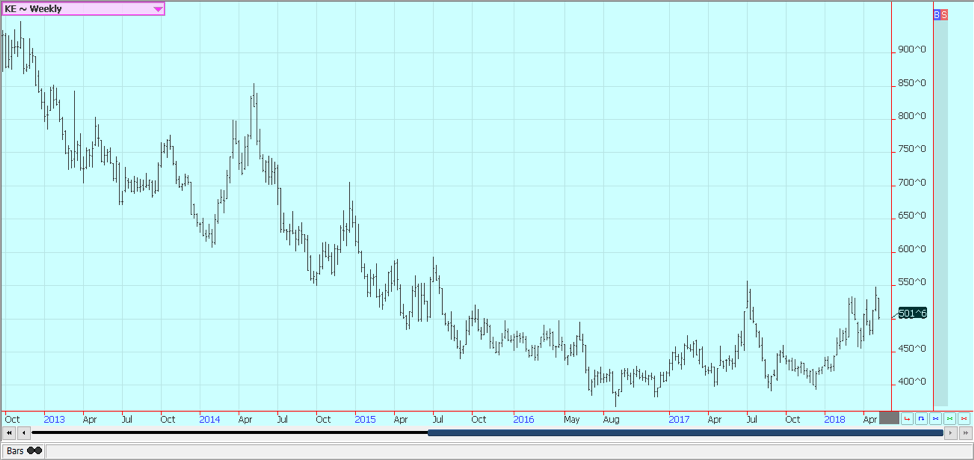

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

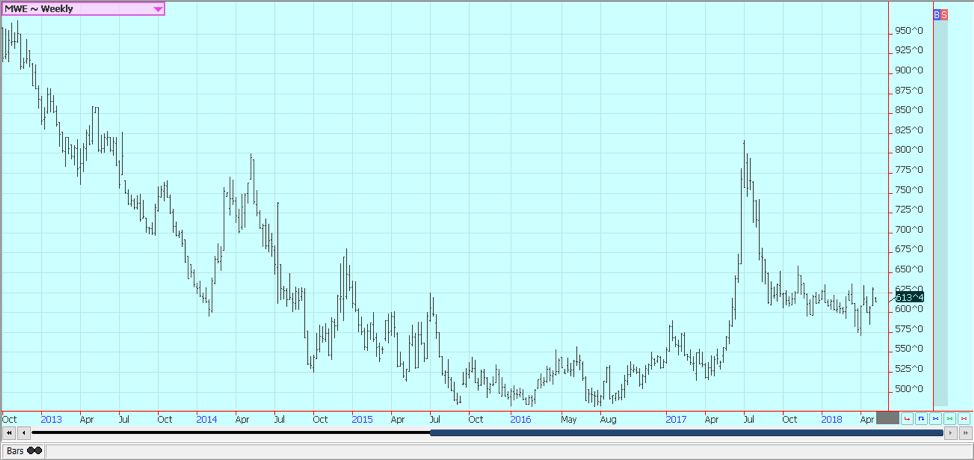

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

Corn closed lower for the week. USDA released its projections for the coming crop year. The US data was considered mixed for prices. Production was at or below trade expectations, but ending stocks were above the average trade guess as USDA trimmed its demand outlooks for the current crop and the next crop. World ending stocks estimates were in line with trade estimates for the current year, but much below trade estimates for next year as China and others are expected to reduce domestic supplies in storage.

The trade continues to worry about second crop corn production potential in Brazil. The Safrinha crop is in trouble in parts of Parana and Mato Grosso at a key time in its development cycle. It is pollination and kernel fill time, but the weather has already turned hot and dry. It could be that the rainy season has ended early. If so, yield potential will shrink dramatically as the development of the crop will be sharply reduced.

Planting progress made big strides in the southern half of the Midwest but remains very slow in Minnesota and Wisconsin. Michigan and Ohio have seen spotty progress. USDA could show that about two-thirds of the crop has now been planted. Strong domestic and export demand ideas remain the best support for futures, but there is increasing talk of stronger competition from South America and Ukraine. The worries of less demand are a direct result of the Trump administration threats against trading partners in world markets.

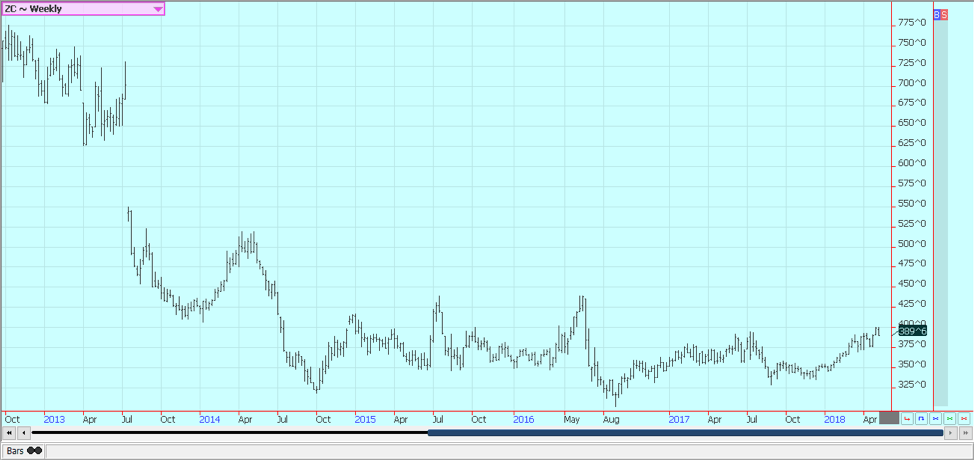

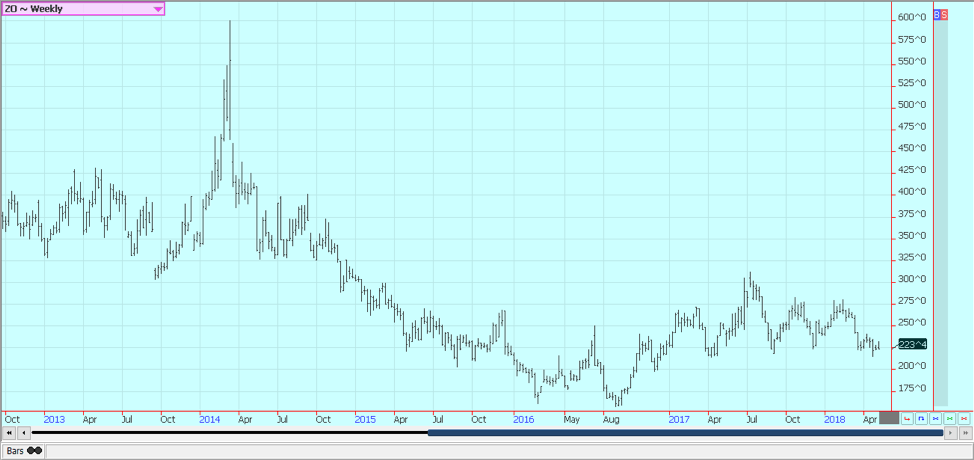

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

Soybeans were lower last week. USDA showed strong production and higher than expected demand potential in its reports last week. USDA used its standard metrics and did not make any adjustments for the potential of lost demand with China in the data for next year, so ending stocks levels were lower than anticipated by the trade. World ending stocks estimates were a little higher than trade expectations for the current year, but below trade expectations for the next crop year. The US and China will continue talks this week to try to resolve the trade dispute. An agreement was found on some issues in the first round of meetings, but there are still a lot of issues that need to be resolved, and the differences are said to be big on some of these.

Demand is still an issue with traders as the tariff threats with China remain alive, but there are still hopes that the issues with China can be resolved before any punitive tariffs are enacted. There are very high-level meetings scheduled between the two sides this week. The trade also hopes for a peaceful solution to the NAFTA talks to keep Mexican and Canadian demand alive.

China still prefers Brazilian soybeans due to the tariff threats and as the new crop Brazil harvest is now available, and the US stands to lose demand in coming weeks from that buyer and maybe others as Brazil expands market share. Farmers in parts of the southern Midwest are planting soybeans. Planting of corn and soybeans will increase in the north this week.

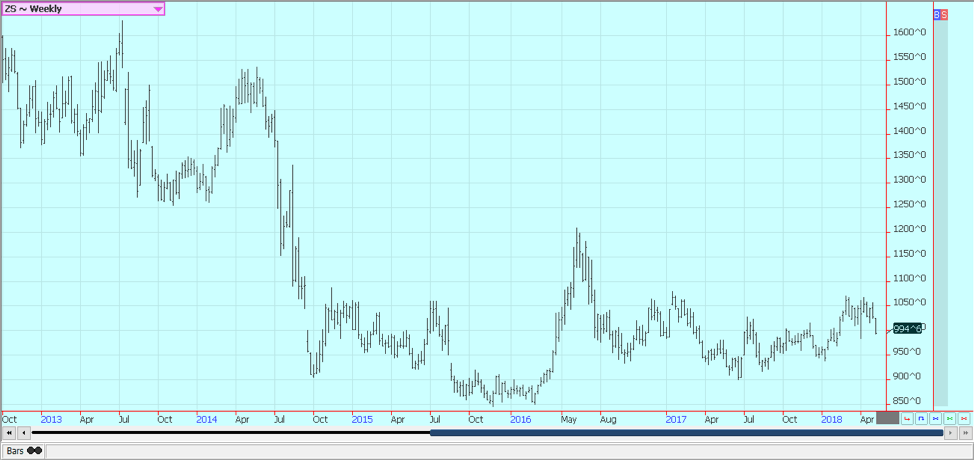

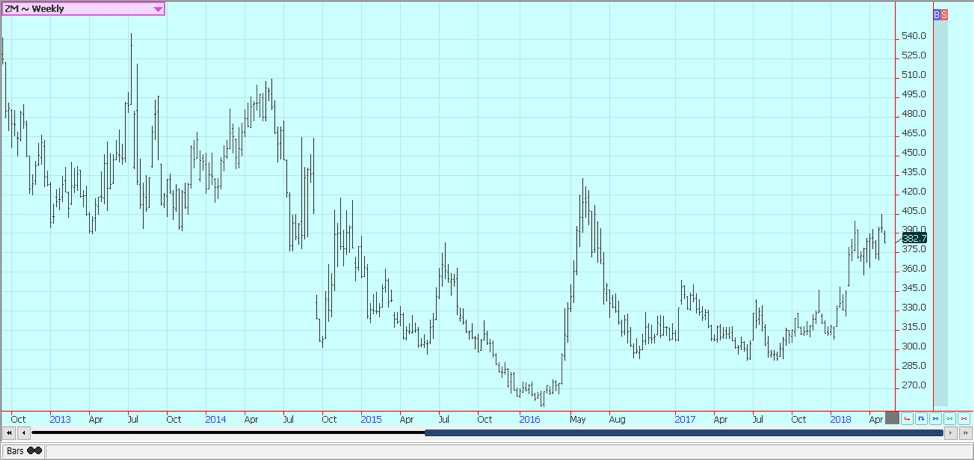

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

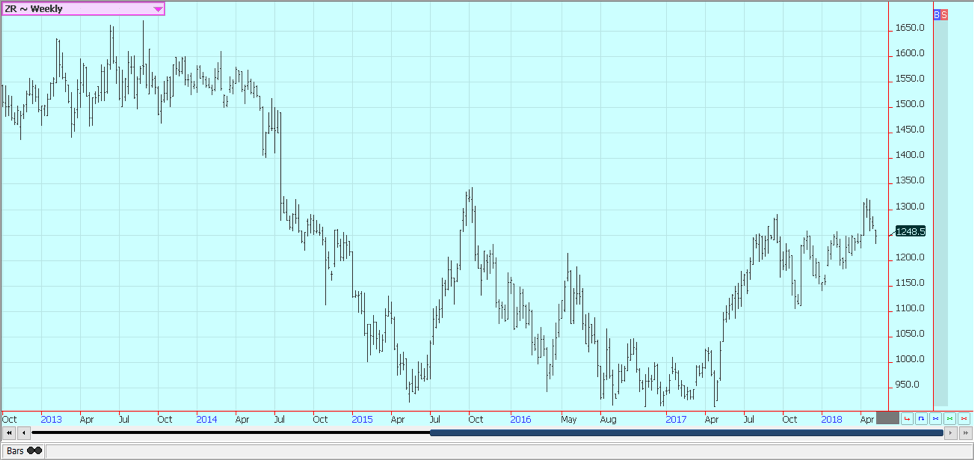

Rice

Rice was higher on Friday on what appeared to be late short covering from speculators but was lower for the week. Sources in Arkansas say that planting has been active on warmer weather and that crops are finally starting to emerge. Some producers switched to soybeans for some of the areas due to price and the bad weather. Planting is also about done along the Gulf Coast. It remains very dry in Texas and producers are having to flush crops more than normal. There are worries that are starting to be heard about yield potential for the state.

USDA increased imports for the current crop year and added these imports to ending stocks. It also showed increased production for the coming crop. Domestic and export demand was increased, but not as much as production, so ending stocks went higher. The overall feel for the report was that there will be enough rice for the market next year and a return to more normal supply and demand considerations for the coming year.

Ideas are that little old crop rice is available in the cash market, and the situation is not likely to improve before the new crop becomes available late this Summer as farmers are mostly sold out. Farmers will plant more rice this year, but the increase in planted area is not considered burdensome.

Weekly Chicago Rice Futures © Jack Scoville

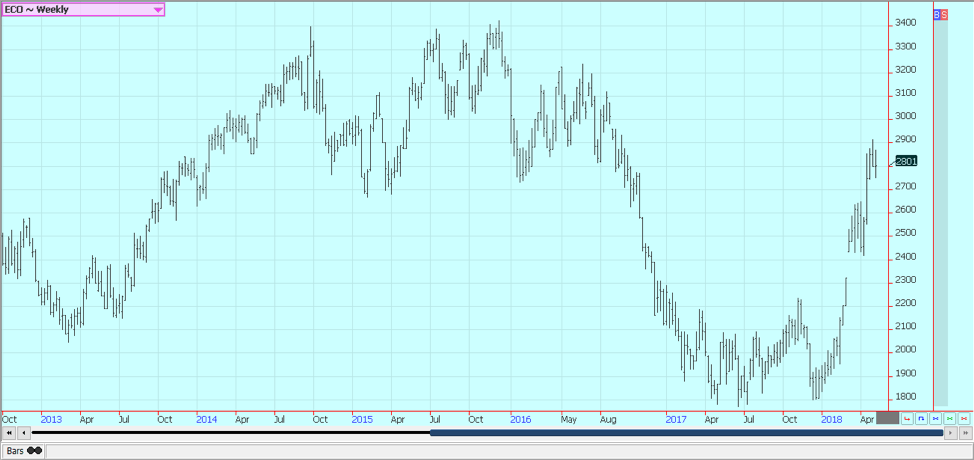

Palm oil and vegetable oils

World vegetable oils prices were a little higher last week. Palm oil moved higher during a holiday-shortened week of trade. Malaysia had elections last week and the market was closed for two days. MPOB released its monthly data during the holiday period. The data was considered neutral to prices. Malaysian private sources reported that exports for April were well below those for March.

China has been importing mostly from Indonesia and India is out of the market for now. China has been crushing a lot of soybeans and has been producing its own soybean oil. The weekly charts show that palm oil trends have turned down again as the weaker demand is being met by reports of better production. A downtrend can continue.

Soybean oil was locked in a sideways to downtrend all week but still managed to close higher. Canola found some support from the trade war and also from the very cold weather in the Canadian Prairies. The cold weather has made any fieldwork impossible at this time. The region looks to turn warmer this week.

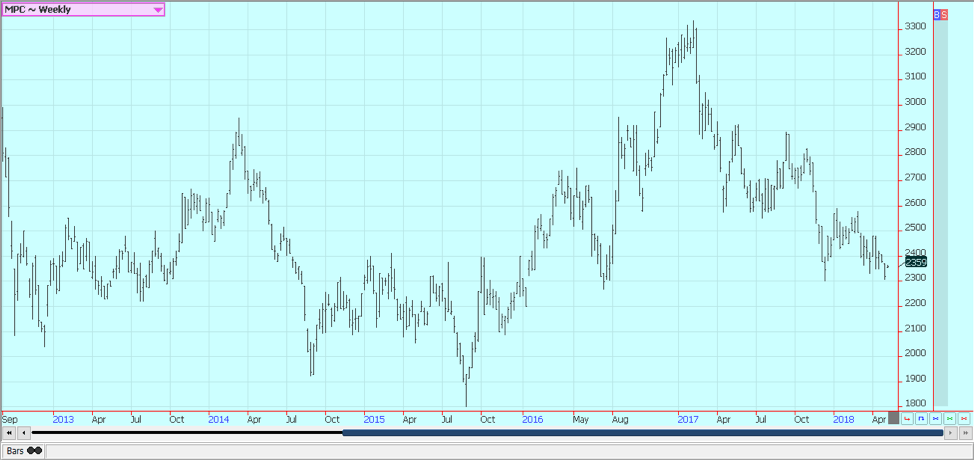

Weekly Malaysian Palm Oil Futures © Jack Scoville

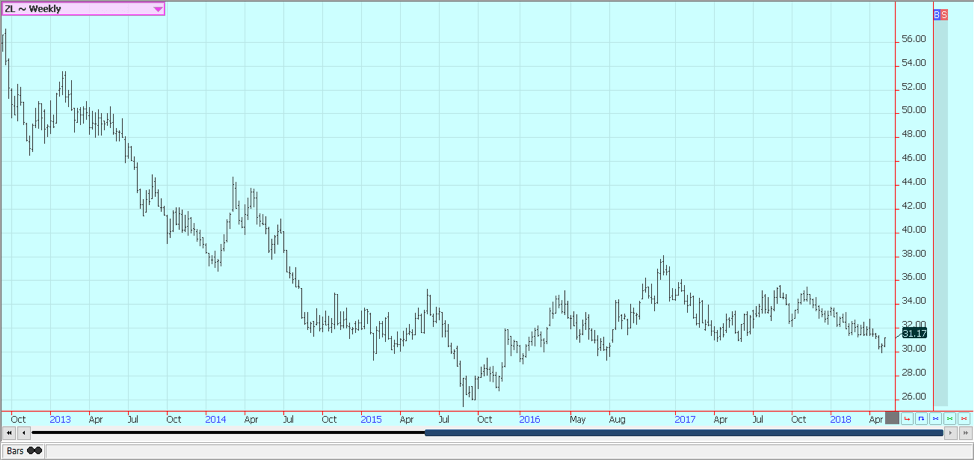

Weekly Chicago Soybean Oil Futures © Jack Scoville

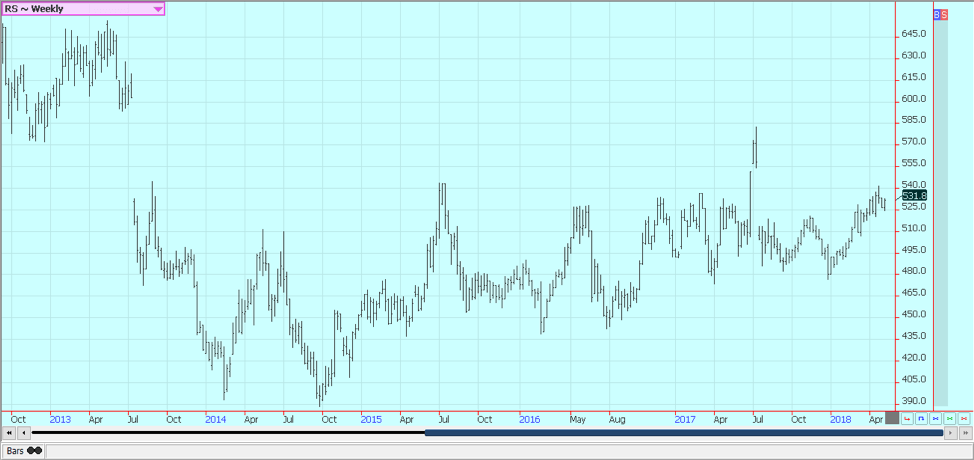

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was lower for the week after testing previous highs on the weekly charts near 8800. Further weakness now could mean that the market has made an important top. It is still a weather market due to the poor weather in Texas and there are still ideas of tight available supplies. There are ideas that the US is now running short of high-quality cotton to deliver to the exchange and to overseas buyers. Demand remains strong in export markets as the weekly export sales report showed strong volumes last week.

Chart trends are mixed on daily charts and on weekly charts. New crop planting has been slow but not unusually slow when compared to last year and the five-year average. The weather in the western Great Plains is still mostly dry. Forecasts call for mostly dry weather for the next couple of weeks, and producers in the western Great Plains are likely to wait for better rains before planting more cotton.

In contrast, farmers in the Delta and Southeast have seen too much rain and have had delays as soils dry out. The overall planting pace is likely to remain slow. The USDA reports showed that production might not increase even if the area is increased. However, the supply and demand estimates implied that there will be more than enough cotton for buyers to choose from.

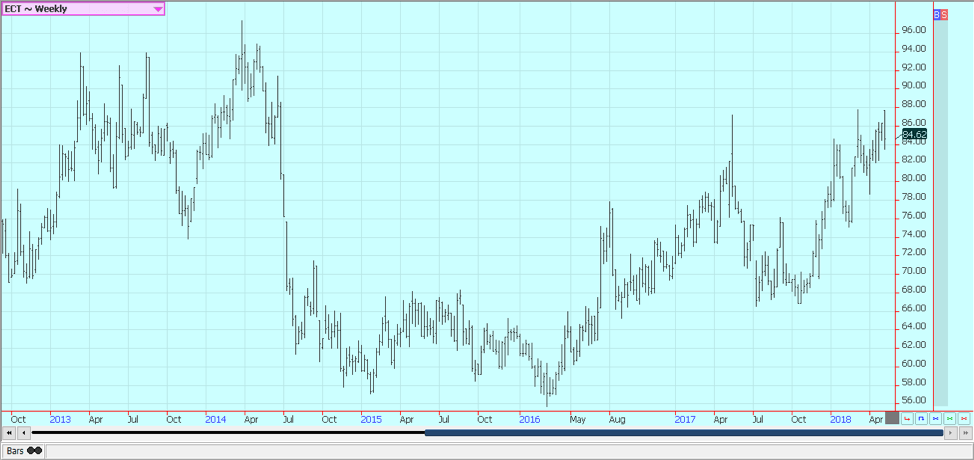

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

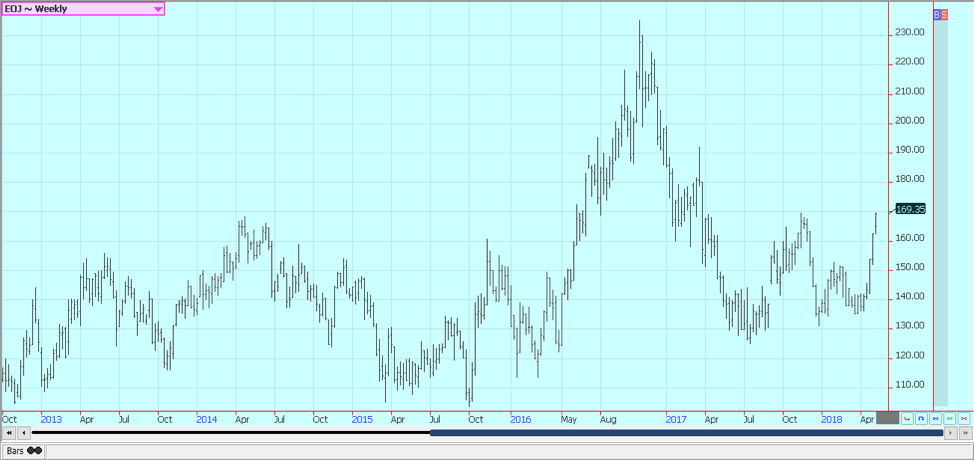

FCOJ was higher as the rally continued. Funds and other speculators have been the best buyers, and producers here and in Brazil have not been selling that much. FCOJ is in a weather market as dry conditions are reported in Florida and in production areas of Brazil. The weather has been dry and the harvest is starting to wind down in some areas of Florida. The market is still dealing with a short crop against weak demand.

The current weather is good as temperatures are warm and it is mostly dry, but some rains were reported over the weekend. The harvest is progressing well and fruit is being delivered to processors. Producers are now into the Valencia crop. Florida producers are seeing marble-sized to golf ball-sized fruit. Conditions are reported as generally good. Irrigation is being used. Brazil also could use more rain as Sao Paulo has been hot and dry. Generally good conditions are reported in Europe and northern Africa.

Weekly Frozen Concentrated Orange Juice Futures © Jack Scoville

Coffee

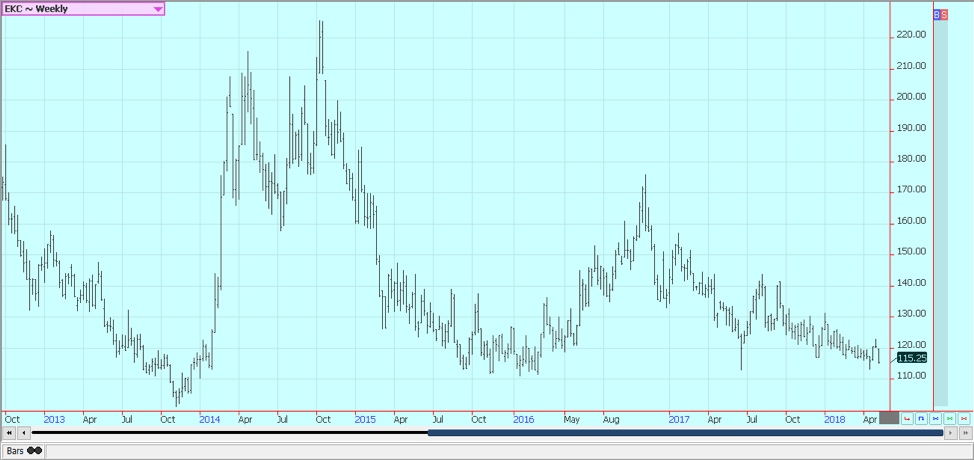

Futures in New York were lower for the week as strong commercial buying started to fade in anticipation of the Brazil harvest that is about to get started. Ideas are that about 55 million bags of coffee will be harvested. The weather is dry in Arabica areas, but there have been some showers in Conillon areas. London was lower as well and is testing chart support.

Origin is still offering in Central America and is still finding weak differentials. Good business is getting done and exports are active. Traders anticipate big crops from Brazil and from Vietnam this year and have remained short in the market. Robusta remains the stronger market as Vietnamese producers and merchants are not willing to sell at current prices and are willing to wait for a rally. Vietnamese cash prices were steady again last week with good supplies noted in the domestic market.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

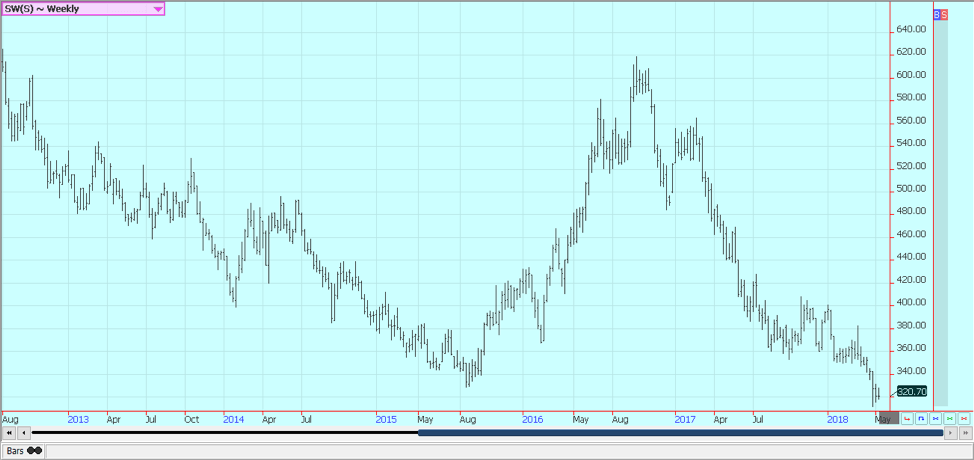

Sugar

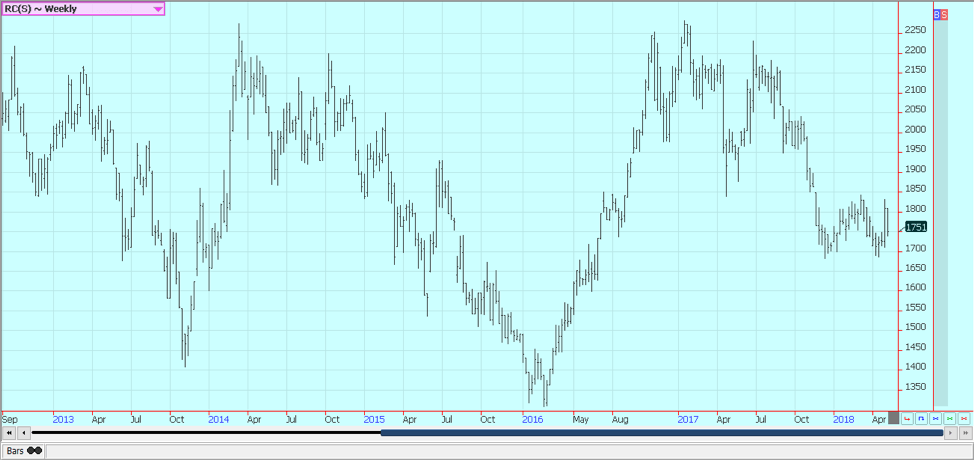

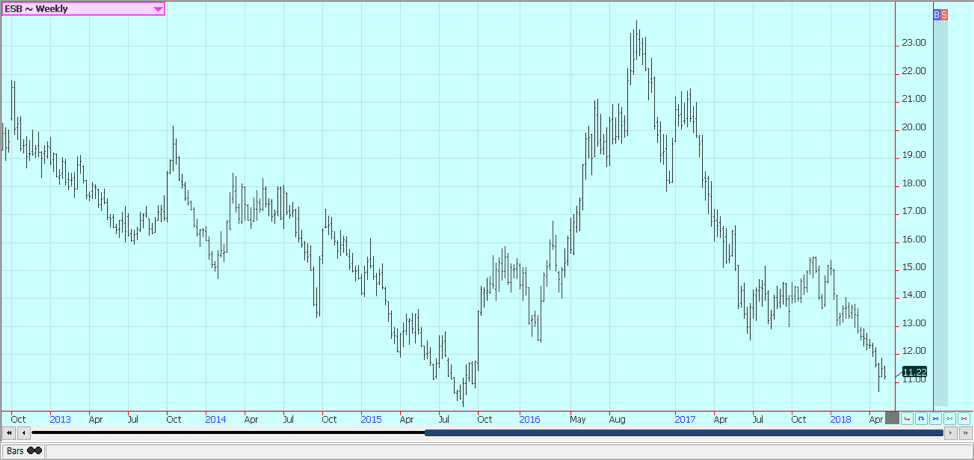

Futures were lower in both markets for the week. Ideas of big world supplies against average at best world demand keep the tone of the market weak. The Brazil season is off to a big start, causing the selling interest as the market now expects even more sugar to be available. There has been little in the way of positive news for traders in the last year as production estimates have climbed and demand estimates have not. The fundamentals remain little changed, and there does not seem to be much, for now, that can shake the market out of its current trend.

Ideas that sugar supplies available to the market can increase in the short term have been key to any selling. India is back to export sugar this year after being a net importer for the last couple of years. They hope to export 2.0 million tons this year but will have a surplus that is double that amount. Thailand has produced a record crop and is selling. Brazil still has plenty of sugar to sell, and the EU has had overproduction in the past year.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

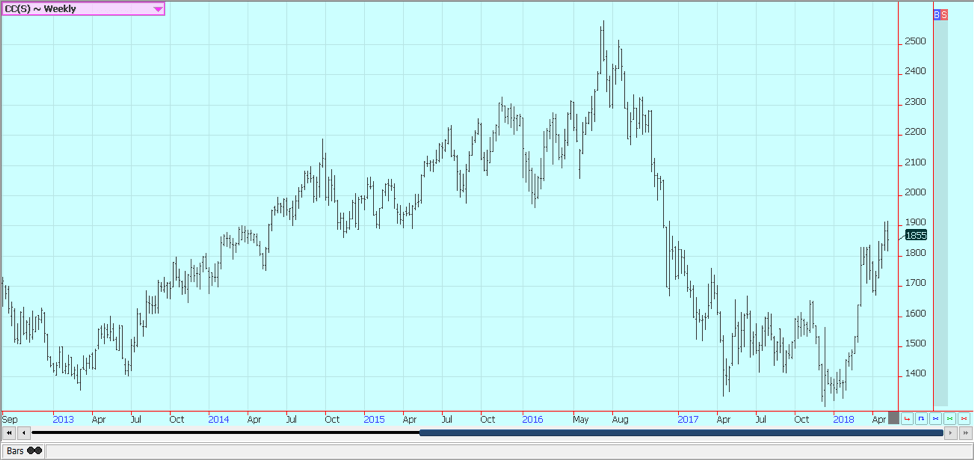

Cocoa

Futures were near unchanged in New York, but lower London last week. The spread between New York and London has now begun to correct back to more normal levels as New York is losing its steam to move higher but as London continues to rally. This is due to fund buying in New York, and also due to the need to pay higher to attract African supplies. Asian supplies are now less available since Asian grinding capacity has increased, so New York has space for African cocoa.

Ideas that world production has been largely sold remain part of the rally. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions in West Africa. The mid-crop harvest is starting, and wire reports indicate that some initial mid-crop harvest is underway in all countries. Estimates imply that variable yields can be expected. Nigeria expects big crops. The harvest is underway now in Ivory Coast and Ghana.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoThe Youth Program at Enzian Shooting Club Is Expanding Thanks to Crowdfunding

-

Crypto1 week ago

Crypto1 week agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Markets2 weeks ago

Markets2 weeks agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Crypto4 days ago

Crypto4 days agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

You must be logged in to post a comment Login