Business

Frozen concentrated orange juice ended Friday session on a positive note amid storms

Despite heavy rains in various parts of the United States, the frozen concentrated orange juice market experienced an increase last Friday.

While storms bring some rain down on the U.S., the frozen concentrated orange juice market concluded Friday with an increase.

Wheat

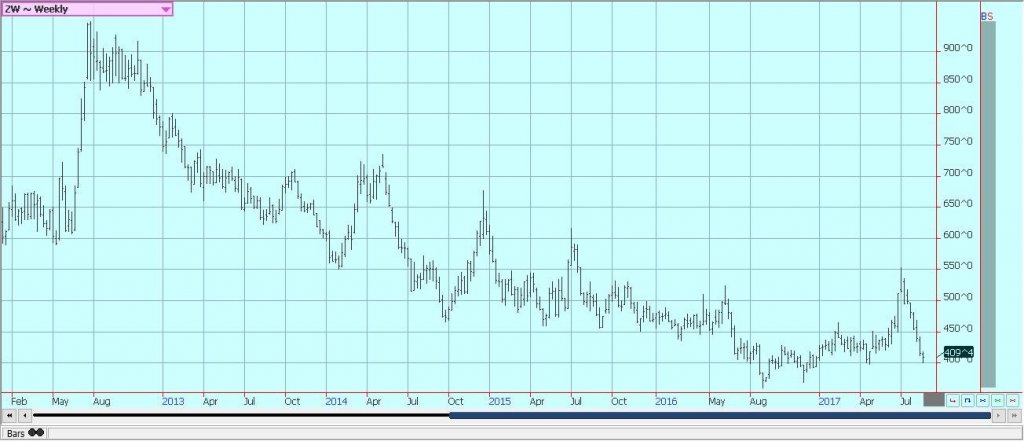

US markets were generally lower again last week, but again found some buying interest late in the week as some shorts elected to cover their positions. The market is still under pressure from ideas that there will be plenty of Wheat available in the world market due to the big increase in production in Russia. However, the US and many other exporter countries have less this year, with only Russia the major exporter with more.

Canada has suffered through conditions very much like the US, with hot and dry weather in western sections of the Prairies and some areas that were too wet in eastern sections. Australia also suffered from the hot and dry weather at key times in the growing cycle, although conditions have improved over the last month. Europe has had some wet weather in northern areas as the crop tried to mature and there will be at least a big quality loss from this area.

US export demand is improving again as US prices are very competitive in the world market, and the recent trend to a weaker US Dollar has helped. Algeria tendered for Wheat last week and bought optional origin Wheat. It is very probable that some of the Wheat will be sourced from the US as well as from France and Russia. The German and Polish crops have deteriorated from all of the rains in northern Europe. Demand for US Wheat remains primarily for HRW and HRS, the higher protein wheats grown in the US.

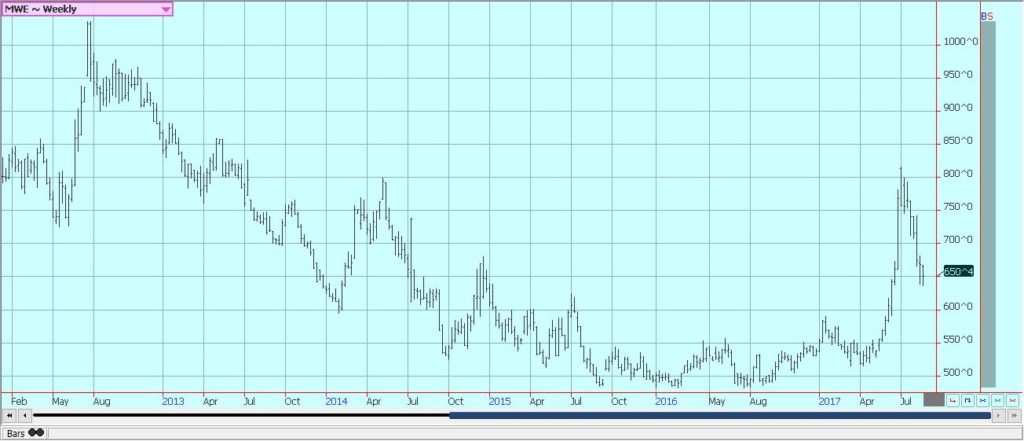

The US futures markets have given back about all the gains seen due to the bad weather, but really have no reason to work lower unless the Dollar were to rally sharply or something. Futures could hold current support areas on the weekly charts and try to rally in the short term. Minneapolis charts are showing some price stability as well and it could be that the current move to lower prices in Spring Wheat is about over.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

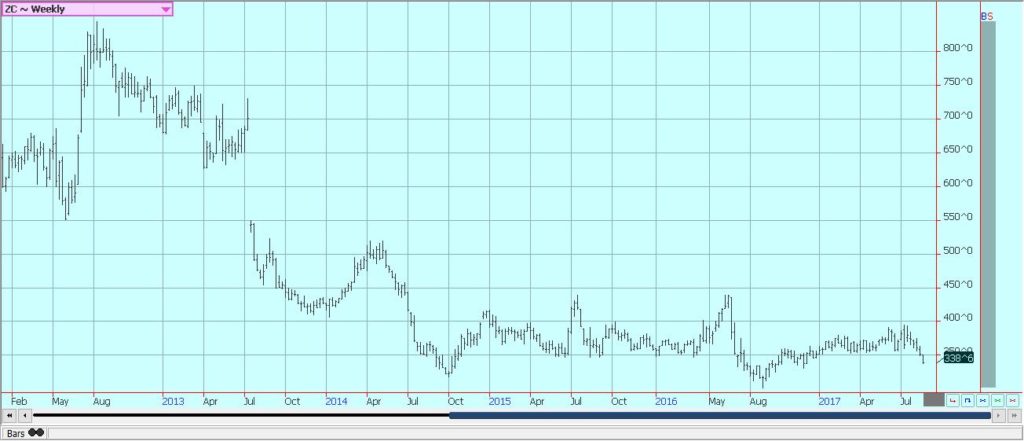

Corn was lower last week as some rain and cooler temperatures moved through the Midwest. The Farm Journal crop tour was last week and crop scouts found better than expected production potential for the corn crop this year. There were some problem areas, but final yield estimates from the tour were at 167 bushels per acre and the tour production estimate was just under 14 billion bushels. The estimates imply that the US will have more than enough corn for internal needs and projected export demand.

Variable growing conditions continue as kernel fill continues. A major hurricane hit Texas, but the Corn in the area should be harvested. Sorghum losses are likely. The USDA data next month is now expected to show strong production potential and might be little changed from this month. However, the best data from USDA will not be seen until October. There are still supplies from the previous crop to be sold by US producers, and ideas are that these supplies are big.

A big offer despite weaker production will hurt any rally potential for prices. Funds have been selling and are now with a big short position that might get bigger in the next couple of weeks. Near term price weakness is possible for the next couple of weeks as futures have moved through some support areas on the weekly charts.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

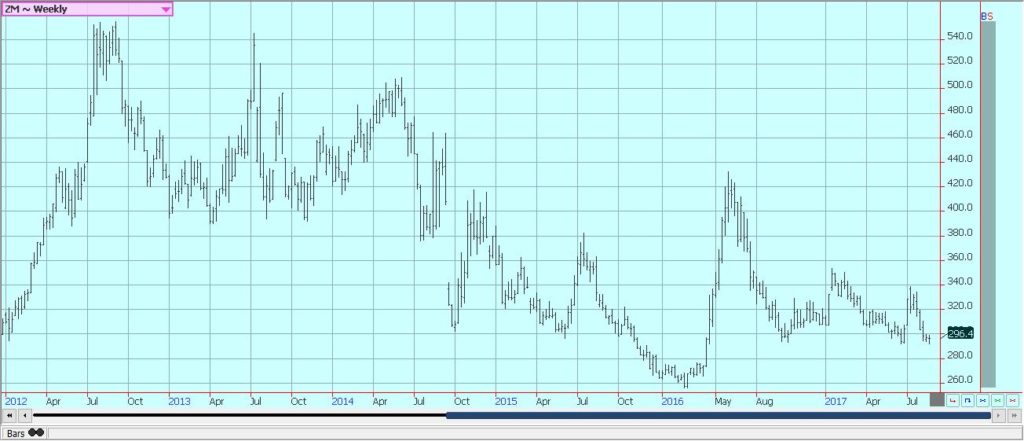

Soybeans and Soybean Meal

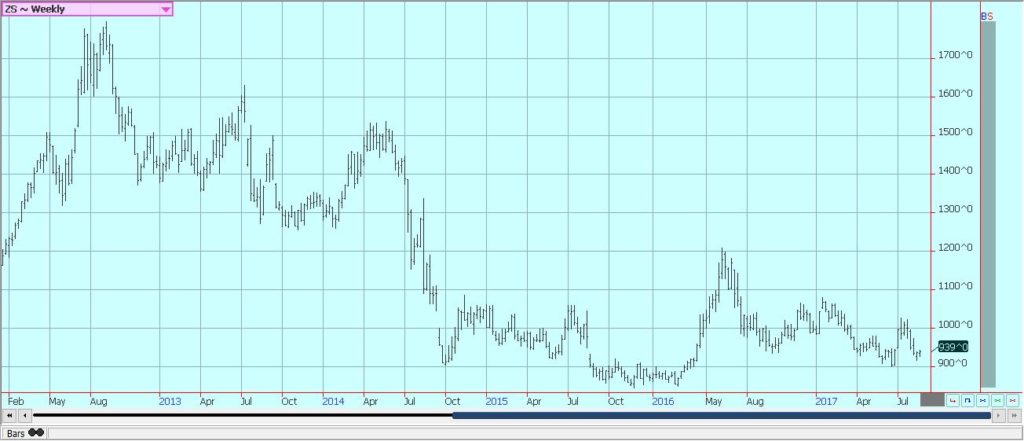

Soybeans and soybean meal were mixed last week on ideas of somewhat better rains for the crops in the Midwest. There was rain, but these rains hit areas already with plenty of moisture. The driest areas of Illinois and Iowa were missed. There is not a lot of rain in the forecast for this week for the Midwest, but temperatures should be moderate. The crop was planted late in many areas and is only starting to flower and set pods now.

The weather has been variable. Parts of Iowa and Missouri and central and southern Illinois have been dry and topsoil moisture levels are low. Crops in the east have been hurt where conditions have been too wet, and the plants are very small in Ohio and much of Indiana and into Michigan. Eastern Illinois showed some of the same features as other eastern states. US Soybeans are flowering and setting pods.

The crop progress is behind last year. The Farm Journal, formerly Pro Farmer Crop tour that kicks off today. Crop scouts should see highly variable conditions all week before a final estimate is released at the end of the week. Ideas are that variable conditions will force USDA to lower production estimates next month.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

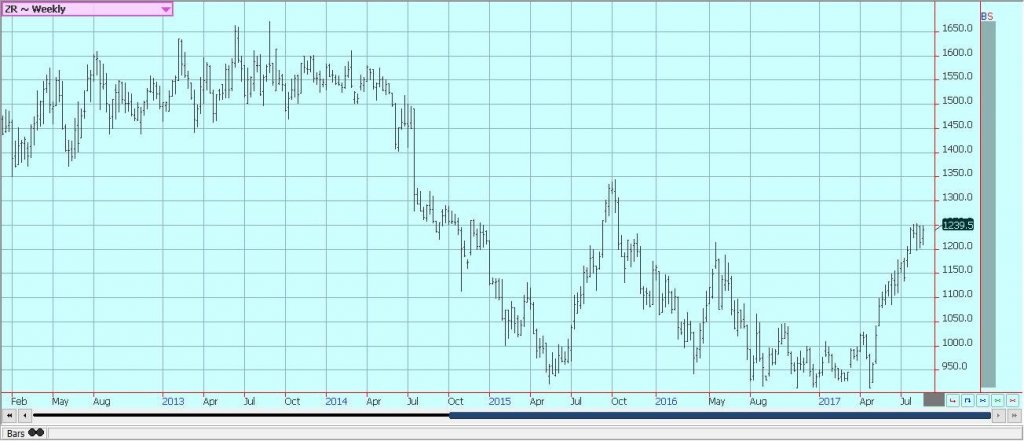

Rice

Rice closed higher last week and held between 1200 and 1250 basis the September contract. Rice futures appear to be in a consolidation phase right now as the harvest is set to expand just as a major hurricane moved into Texas. Over half of the Texas harvest is done, but there are still some fields left to be done. The storm came ashore on Friday and dumped up to three feet of rain on some parts of the state. Most of these worst hit areas were near the shore, but inland areas saw excessive rains and unharvested crops are at risk of yield and quality losses.

The big rains moved at least as far west as San Antonio and covered just about the entire rice area in the state. The market will watch now to see if the storm moved into Louisiana and the Delta, or even if just the big rains move into these areas. The Delta is really just getting started now although Louisiana has done a lot of harvesting already. Big rains now would at least hurt the quality of the crop and could hurt field and milling yields as well.

Asian prices remain soft. The Asian market has been weaker in the last few weeks as the next harvest comes closer in many countries. Growing conditions are improved in India as the monsoon has been better, but coverage of rains has been spotty until now and there are still chances for weaker production than expected in India this year. Most of Indochina and Southeast Asia have seen good weather.

Weekly Chicago Rice Futures © Jack Scoville

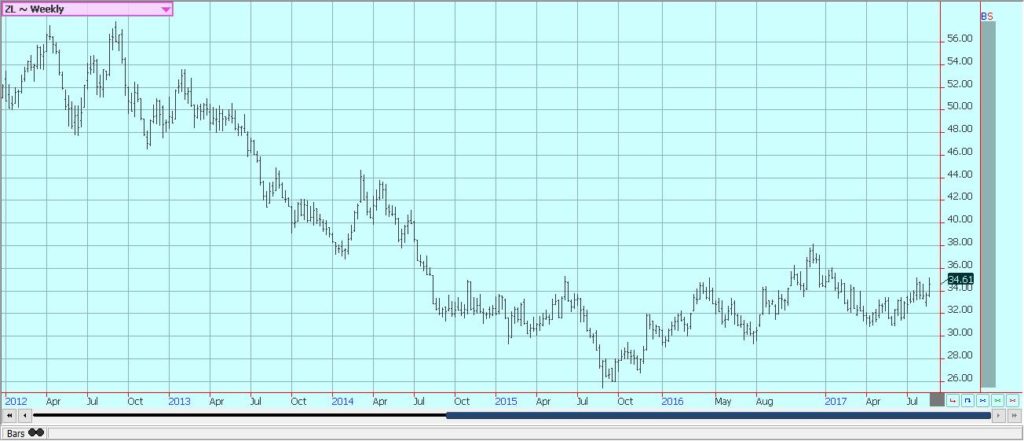

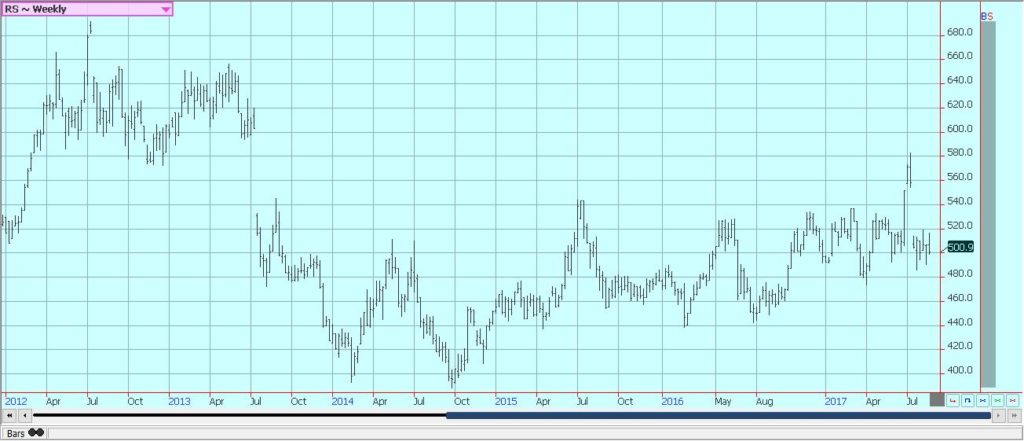

Palm Oil and Vegetable Oils

World vegetable oils markets were mixed again last week, with palm and soybean oil turning higher and canola a little lower. Palm oil futures found new buying interest on news that China has entered talks with Indonesia and Malaysia to introduce diesel fuels with a blend of 5% of palm oil and palm products. It would be a big demand boost for palm oil and so the governments are ready to make a deal.

Demand has been good this year, but export demand is running about 8% less than last month according to the private surveyors. It also held well on ideas that production data is now topped out and that trends will be for lower monthly production for the next several months. Price trends turned up last week for palm oil. Soybean oil rallied again last week as the US government moved to impose dumping duties on imports of Argentine and Indonesian bio fuels. The move could mean increased domestic production of bio fuels mostly involving Soybean Oil.

Both Indonesia and Argentina would only be able to offer at prices that would effectively keep them out of the US market because of the new duties. Canola remains relatively strong but is starting to turn weaker as the harvest is now underway. Farmers have not really been selling yet, but probably will need to start soon as the futures market keeps giving negative vibes. A primary negative for prices remains the strength of the Canadian Dollar against the US Dollar.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

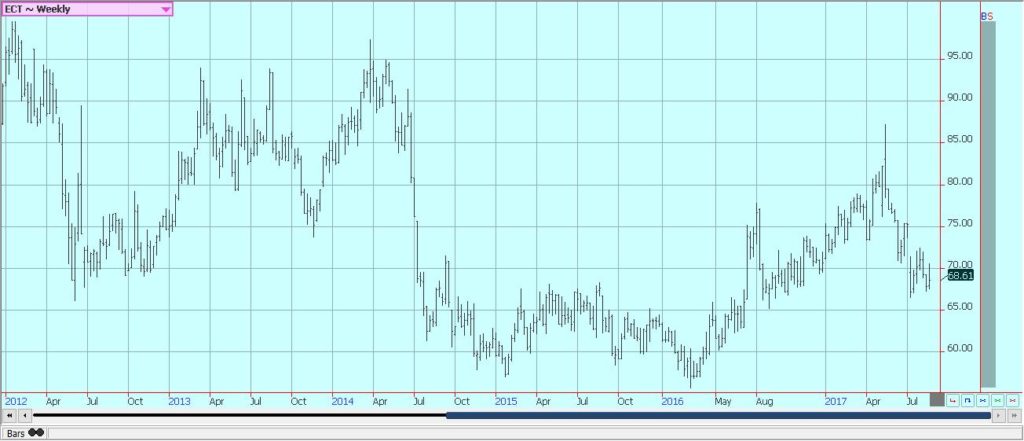

Cotton

Cotton was rallied for much of the week as Hurricane Harvey approached the Texas coast, then collapsed on Friday. The storm was expected to bring big rains of up to three feet into Texas and potentially hurt the quality and harvest progress in some áreas of the state. Reports indicate that about 600,000 acres of high-quality cotton could be damaged or destroyed in southern parts of the state. Cotton in the Texas Panhandle was not expected to be affected in any big way.

Big rains could move into the Delta this week as well. Bolls are open or are opening now in just about all production areas. West Texas conditions have improved with recent precipitation. Delta and Southeast areas have also had generally good conditions and good production is expected as long as the storm does not bring heavy rains to these areas this week.

There is increased production potential in Asia, and mostly in India and Pakistan due to improved monsoon rains. Some rains are expected in most areas this week amid relatively moderate temperatures. Chinese growing conditions have improved, but crops appear to be uneven there. It has been very hot and dry in Turkey and there is a talk of crop losses there. Areas to the south of Russia are in good condition.

Weekly US Cotton Futures © Jack Scoville

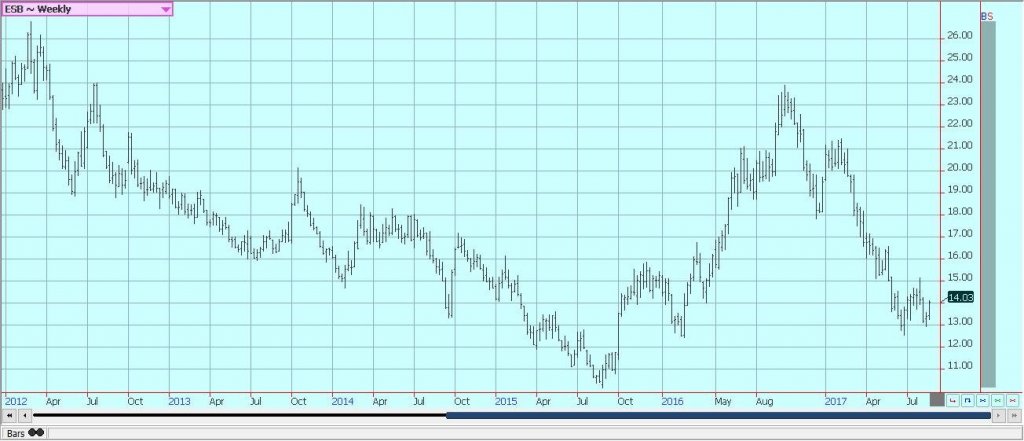

Frozen Concentrated Orange Juice and Citrus

FCOJ closed mostly higher on Friday as some tropical storms threaten to hit the US, although no damaging weather is expected for Florida. Futures were lower for the week, but both the daily and weekly charts show sideways trends. The market price remains generally weak due to ideas of better production potential for the coming harvest and reports of weak demand.

Last week, Elizabeth Steger estimated Florida production for the coming year at 75.5 million boxes, from 68 million boxes for the previous year. Dreyfus should reléase its estimates soon. Neilsen said last week that demand remains soft. Florida weather is very good as it is now drier, but showers are still around and some big rains could be coming. There are no systems in the Atlantic to cause concern about tropical storm development that could be detrimental to trees and fruit.

The demand side remains weak and there are plenty of supplies in the US. Trees now are showing fruits of good sizes and overall conditions are called good. Brazil crops remain in mostly good condition and production estimates are climbing after recent rains.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were stable last week. The trends are down on the charts in New York, but sideways in London. Speculators are reported to have been the best sellers in both markets and industry is thought to be buying. Brazil is now at harvest, and traders and producers are reporting low quality and small beans. There is some concern about the dry weather there, but it is the dry season and rains are expected to begin to promote good first flowering soon.

Cash market conditions in Central America remain quiet as that part of the world is between harvests. There is coffee to sell, but little buying interest from major roasters. Differentials in the region have been bad due to the lack of buying interest and producers are discouraged. London had been stronger as supplies in the cash market are tight due to reduced Vietnamese selling and tight supplies in the country. Indonesia and Brazil have been very low on supplies as well, but Brazil is now harvesting its next Robusta crop.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures in London and New York were higher again last week. Both markets show that short term bottoms have formed on the daily charts, but both markets still show down trends on the weekly charts. Traders remain bearish on prices for the foreseeable future. Ideas are that there will be plenty of sugar available to the market this year after several years when production was below demand.

The big harvest in Brazil continues, although some rain last week delayed harvest by a few days. Some of the processing will probably switch now to ethanol due to tax changes, but reports indicate that there is still a big offer of sugar from there into the world market.

Production potential in India and Thailand seems improved for now as monsoon rains have been better than last year. It is raining in much of India now as the monsoon is active, and the rains have become better distributed in the last couple of weeks. Just about all areas have seen some precipitation and the only spots with too much rain now are Bangladesh and northeast India.

Pakistan appears to have good conditions. Thailand is getting enough rains for a good crop this year. The rest of Southeast Asia is seeing average to above average rains so far this year. Some problems are being reported in Europe and Russia for the beet sugar production as some areas have seen too much rain and others have been hot and dry.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

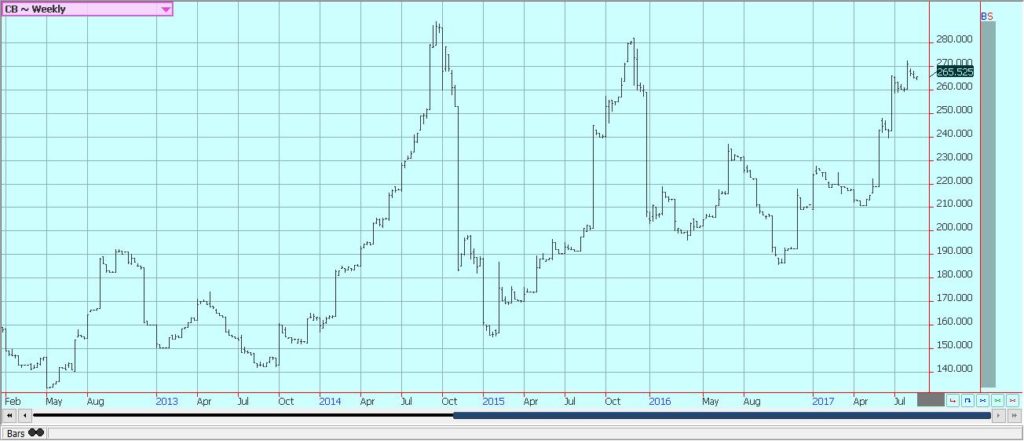

Cocoa

Futures markets were higher last week and trends turned up on the daily charts on Friday. The market is between harvests in West Africa, so offers are less and selling is with less urgency. The next harvest gets underway in the next month or so. The demand should continue to increase if prices remain relatively cheap and as retail prices continue to move lower in important consuming areas like Europe. The next production cycle still appears to be big as the growing conditions around the world are generally very good, but might be smaller than last year due to lower prices. the

Offers from West Africa have been very strong until recently, and now offers have backed off as prices have fallen and amid talk that the production might be a little smaller than anticipated. West Africa has seen much better rains this year and now getting some showers mixed with hot and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

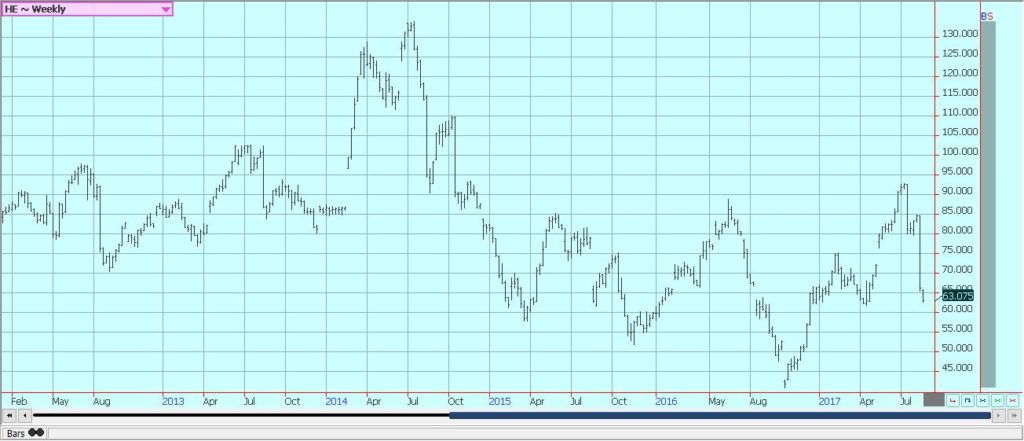

Dairy and Meat

Dairy markets were lower last week, but longer term trends remain up. Butter prices continue to be the strength of the market on reports of very good demand and adequate supplies. However, these prices moved lower last week and back to support levels. These levels held, so some price strength might be seen this week. Cheese prices have been relatively weak, but are holding firm now.

Demand is good for cream, but cream has generally been available to meet the demand. However, there are some shortages of cream in a few locations. Cream demand for butter has been very good. Demand for ice cream has been mixed depending on the region. Cheese demand still appears to be weaker. US production conditions have featured some abnormally hot weather in the west that is hurting milk production. The weaker US Dollar is helping on export ideas that might not mean much as US prices are higher, but the US Dollar weakness takes the edge off the higher internal prices.

US cattle and beef prices were lower and trends in cattle futures remain down. The beef market remains weaker in the last couple of weeks, and cattle prices have been under pressure since the release of the monthly cattle on feed report and the semiannual inventory report that showed bigger supplies are coming. Feedlots are filled and cattle will continue to be offered to the cash market. However, ideas are that more supplies are coming as weight per carcass is high and more cattle is coming to the market. A seasonal demand increase is likely now, and October is very cheap to cash, so downside potential in futures might be limited.

Pork markets and Lean Hogs futures were weaker on a seasonal trend to lower demand. Ideas are that futures are too cheap to cash and that the spread between the two need to come together more than they are now. Demand has been lower for the last couple of weeks and this has affected pricing. Demand starts to work lower as most of the Summer buying is done. There are big supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech5 days ago

Fintech5 days agoFindependent: Growing a FinTech Through Simplicity, Frugality, and Steady Steps

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

-

Crypto9 hours ago

Crypto9 hours agoBitcoin Surges Past $69K as Ethereum Staking Hits Record Levels

-

Impact Investing1 week ago

Impact Investing1 week agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

You must be logged in to post a comment Login