Crypto

Old School Stocks + New School Finance = 100x Gains (For Real)

The 2020-21 crypto boom delivered massive gains. But the biggest wins weren’t in crypto. Instead, the biggest wins were in crypto-correlated stocks like MARA and RIOT, which delivered well over 100x returns in the space of a year. Right now, a similar opportunity is brewing as RWA tokenization gathers momentum, setting up companies like SurancePlus and Oxbridge Re for a similar 100x story.

Everyone knows how much money stocks in good companies have made investors. Anyone can rattle off names like Microsoft [NASDAQ: MSFT], Apple [NASDAQ: AAPL], and Netflix [NASDAQ: NFLX], just to name a few.

And most people know just how much more money early crypto investors made when cryptocurrencies like Ethereum [$ETH], Bitcoin [$BTC], and Dogecoin [$DOGE] shot up.

But what most people don’t know is that the people who’ve outperformed both of these investors are those who made a combination play. That is, buying good old traditional stocks that had a strong correlation with crypto.

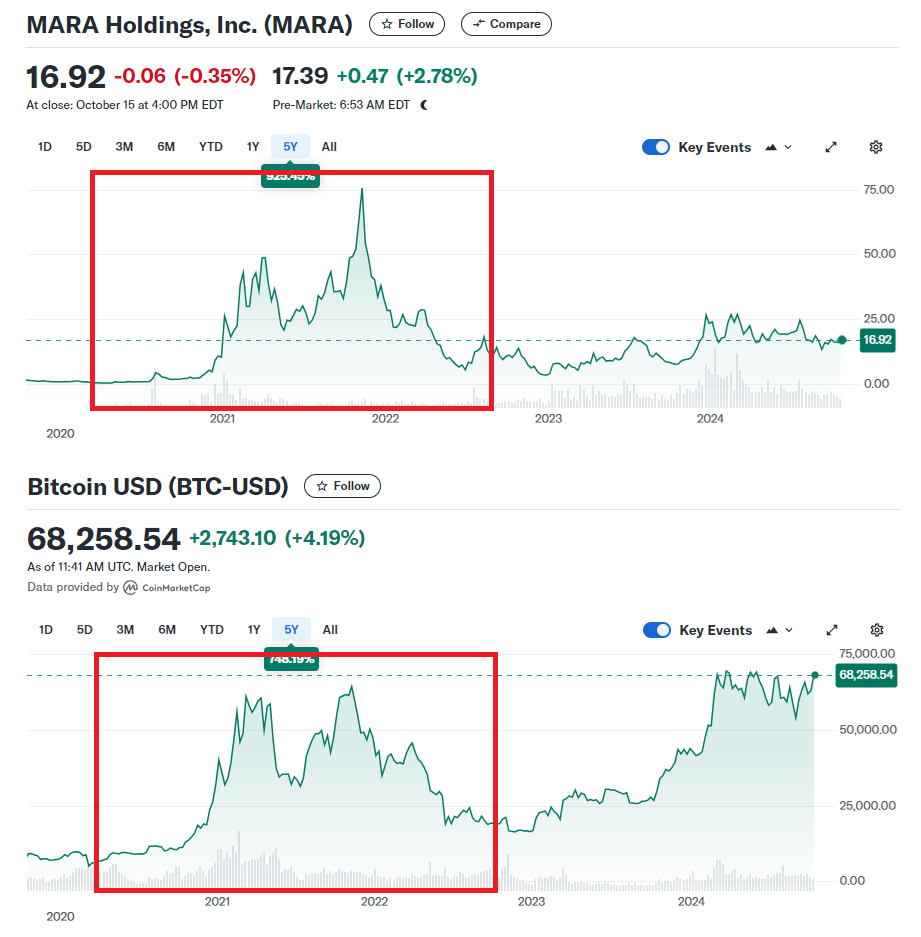

Let me give you some idea of just how insane the gains to be had here were. To do that, let’s take a look at a couple of the more prominent stocks that were playing in the crypto/Bitcoin mining space back in 2020-21 — Riot Platforms [NASDAQ: RIOT] and MARA Holdings [NASDAQ: MARA].

Now, back in 2020, both were still trading at well under a buck each. Depending on the exact month, you might have even nabbed these stocks for under 50c a pop.

But, by 2021, barely a year later, Riot was trading at over $70 a share, and MARA shot well over $80.

To help you with the maths here, that’s well over a 100x gain on both counts.

In contrast, Bitcoin hit a low of just over $4k in 2020 before peaking just shy of $70k in 2021. With perfect timing, that’s not even a 20x return over the same period.

And yet, Riot and MARA returned over 100x.

And yep, those returns were 100% correlated to the cryptocurrency boom — the combined play I mentioned just above.

Here, take a look for yourself.

Now, I know what you’re thinking right here — the past has already passed, so what good are these stocks to me now?

Well, here’s the thing.

We’re not here to talk about those stocks. They were just an illustration of what’s to come (stocks delivering 100x gains off the back of a correlated asset class).

To be more specific, what we are here to talk about is Real World Asset (RWA) tokenization, a little-known company called SurancePlus — a subsidiary of Oxbridge Re Holdings [NASDAQ: OXBR] — and what we can expect from both in 2025. (And just in case the title and last few paragraphs didn’t give away, it’s 100x returns)

Here, let me give you the background.

Real World Asset (RWA) Tokenization — The Next Big Thing

Alright, so part one of my thesis is that buying stocks correlated to new financial assets like cryptocurrencies can outperform pretty much anything else out there.

Part two of my thesis — and this isn’t just my opinion — is that RWA tokenization is the next big thing in new school finance.

For those of you who aren’t in the loop yet, RWA tokenization is basically the practice of taking a real-world asset and tokenizing it on the blockchain. In many ways, it’s kind of a whole lot like regular stocks — take a giant company and split it up into a million shares (or some other arbitrary number).

The big difference with RWA tokenization is that you can apply it to just about anything.

One of the more popular use cases right now is real estate tokenization. But, the use cases for RWA tokenization are essentially endless. Oxbridge’s [NASDAQ: OXBR] SurancePlus, for example, is a big mover and shaker in the tokenization of reinsurance contracts.

Now, as for why RWA tokenization is tipped to be the next big thing, here are a few quick facts:

- Boston Consulting Group (BCG) tips RWA tokenization to become a $16 trillion market.

- BlackRock wants a piece of that action and has committed to tokenizing $10 trillion worth of RWAs.

- Dozens of other big-money names are jumping in, like Goldman Sachs, HSBC, and just about anyone that’s anybody in finance.

- And yet, most people have never even heard of RWA tokenization… yet.

Now, on that last point. There’s a good reason why most people haven’t heard about RWA tokenization yet. Quite simply, most of the movement in the space has only just started kicking into gear this year. Blackrock, for instance, only just launched its first RWA fund barely six months ago.

And, if you’re still not convinced, then take a look at this article about why those trillions of dollars worth of institutional money more or less guarantee RWA tokenization is going to happen.

So with that out of the way, let’s get to part three — the stocks set to soar to 100x returns.

The Stocks Set to 100x on the RWA Wave

Now we get to the good part — the stocks that could make you 100x as RWA tokenization takes off.

Now, unfortunately, there’s some bad news here. But, there’s also some good news.

Let’s start with the bad — I looked far and wide, and only one name came up. Oxbridge Re Holdings [NASDAQ: OXBR]. Or, more specifically, its SurancePlus subsidiary, which is currently a major player in reinsurance contract tokenization.

Now for the good news.

Oxbridge/SurancePlus is an absolute cracker. And, the best part is, there’s even a sweet little kicker that could really turbocharge this like nothing we’ve seen so far.

But, we’ll get to that little kicker later.

First, I wanna talk a little bit about SurancePlus and Oxbridge and the similarities it has to other 100x companies like Riot Platforms [NASDAQ: RIOT] and MARA Holdings [NASDAQ: MARA].

But to get there, we’re first gonna have to get one thing straight. Both of those companies were playing in the crypto ‘mining’ space. However, no such thing really exists in RWA tokenization — you can’t just spin up a bunch of GPUs and hope to spit out a bunch of real-world assets.

That would be impossible.

But, lucky for us, there is a slightly more analog equivalent — you create a bunch of real-world assets and tokenize them on the blockchain, and hey presto, you pretty much just ‘mined’ a bunch of RWA ‘crypto’, albeit without burning through quite so much electricity.

And that more or less sums up precisely what SurancePlus is doing right now. It’s taking reinsurance contracts issued by its parent company, Oxbridge Re, and tokenizing them.

That more or less makes SurancePlus the RWA tokenization equivalent of a Bitcoin miner during the crypto boom — the equivalent to Bitcoin miners whose stocks went boom to the tune of 100x returns.

Oxbridge Re/Surance Plus — The Kicker

Alright, so I promised there was a sweet little kicker coming at the end. So here it is.

There’s more or less a 100% chance that Oxbridge Re Holdings [NASDAQ: OXBR] is going to spin out its SurancePlus subsidiary into its own publicly traded company.

This. Is. Huge.

Almost as big as the giant returns it’s already set to get on the back of RWA tokenization taking off.

Here’s why.

Currently, Oxbridge Re is massively undervalued. Even if RWA tokenization doesn’t take off quite like we’re expecting, it’s still undervalued by at least 4x. We looked at the reasons why Oxbridge is undervalued a little while ago, but here’s the summary:

- Currently, investors see Oxbridge Re as being little more than a boring old slow-growth reinsurance company.

- SurancePlus, while one of the earlier movers in the RWA space, has since been slow to expand its RWA tokenization offerings.

- Both of these issues come down to Oxbridge leaving SurancePlus somewhat on the backburner.

- For example, the company barely even mentioned its SurancePlus subsidiary in its communications (e.g., Press Releases) until recently, leaving most investors in the dark.

- And yet, based on current valuations for similar RWA companies (and I repeat, I’m talking about current valuations, not ‘potential’ valuations), SurancePlus alone is worth at least 4x the market cap of its parent company, Oxbridge Re.

Now, the good news here is that in the last few months, Oxbridge has started getting serious about SurancePlus (I guess all the hubbub we’ve seen this year finally woke it up to the sleeper it was sitting on). In fact, Oxbridge even stated as much in a press release.

Now, admittedly, the press release was kinda vague. But, if you’d been following the company like I have, then you’d probably have a much better idea of what’s going on.

Here, watch this video and fast forward to the 45-minute mark to hear the company’s CEO, Jay Madhu, spell out exactly what’s coming next.

If you missed it, here’s what he said: “SurancePlus is a wholly-owned subsidiary of our publicly traded company [Oxbridge Re], so what we’re working towards is spinning out SurancePlus as its own publicly traded entity.”

And there you have it — the secret “strategic alternative” alluded to in that PR from a few months ago.

But why’s this huge?

Well, remember how we were just talking about how investors are valuing Oxbridge Re solely based on its dusty old-school reinsurance business?

Guess what happens when the spin-off happens and Oxbridge shareholders find each of their Oxbridge stocks converted into an Oxbridge share and a SurancePlus share?

Any guesses?

Alright, here’s what happens:

- Post spin-off, Oxbridge shares will likely retain their current valuation. After all, current investors are valuing Oxbridge for its traditional reinsurance business, which is what it will retain post-spin-off.

- SurancePlus shares will take on whatever valuation the market gives them. Even a low-ball valuation in the early days equals an instant profit for anyone holding Oxbridge Re stocks at the time of the split.

- When news breaks that “the only publicly traded RWA stock on the Nasdaq” has arrived (and it will), there will instantly be a bunch of eyes from the RWA crowd drawn to it, pushing valuations right up.

- In the short term, based on current valuations for similar RWA companies, we’re looking at a market cap of approximately 4x Oxbridge Re’s current valuation.

- In the next year or so, once RWA really starts gathering momentum, we’re going to see a repeat of the crypto heyday — RWA-correlated stocks are going to soar well over 100x.

- If no one else lists between now and then, SurancePlus/Oxbridge Re is more or less your only ticket to ride.

Now, if that doesn’t sound like one of the hottest stocks we’ve seen in a while, then I don’t know what is.

__

(Featured image by Gilly via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Biotech1 week ago

Biotech1 week agoInterministerial Commission on Drug Prices Approves New Drugs and Expanded Treatment Funding

-

Fintech5 days ago

Fintech5 days agoPomelo Raises $160 Million to Power AI-Driven Digital Payments Across Latin America

-

Biotech2 weeks ago

Biotech2 weeks agoUniversal Nanoparticle Platform Enables Multi-Isotope Cancer Diagnosis and Therapy

-

Fintech2 days ago

Fintech2 days agoRevolut Seeks US Banking License to Expand Into American Market