Markets

How political uncertainty affects the stock markets

Political uncertainty makes for market uncertainty. And in that respect, the market uncertainty usually translates itself into falling stock markets and rising gold prices.

In light of recent political uncertainty connected with the firing of James Comey and talks of impeachment, the effects on the stock markets are inevitable.

The center of the universe appears to remain in Washington. Following the firing of FBI Director James Comey, an event that was almost without precedent, and, what’s worse, made personal by the President, the talk in Washington circles is actually turning to impeachment. The basis is that the firing of FBI Director James Comey was obstruction of justice given the investigation into possible coordination between Russia and the Trump campaign. With Comey sidelined, the justice department appointed former FBI director Robert S. Mueller III to serve as special counsel and lead the investigation into Russian meddling.

Where all this leads is moot as the firing, ongoing investigation, and talk of impeachment are unnerving markets. The initial reaction was a 300-point drop in the Dow Jones Industrials (DJI). By the end of the week, the bounce back only left the US stock markets off roughly 0.4% on the week. The record-setting NASDAQ suffered only marginally more, losing 0.6% while the Dow Jones Transportations (DJT) dropped 1.4%. Buy on the dip mentality appears to be alive and well.

Impeachment is a very rare event in US politics. Only two Presidents have been impeached by Congress—Andrew Johnson in 1868 and Bill Clinton 130 years later in 1998. The Senate acquitted both Johnson and Clinton. Impeachment proceedings were started against Richard Nixon; however, he resigned before Congress voted. If impeachment proceedings are undertaken against Trump it would mark the third time since 1970 where impeachment proceedings were started when it had only occurred once in the previous 190 years. Impeachment proceedings can be extremely divisive and no one really wins.

With a Republican-controlled Congress, any proceedings at this stage are likely to fail. Also, as Republicans hold a small margin in the Senate, it is unlikely the Senate would support impeachment with the required 62% majority. Things could change, however, following the 2018 midterms if the Democrats were to regain control of Congress and the Senate. Irrespective of that possibility, just the threat of impeachment could consume Washington, sideline Trump’s agenda, and bring the country to a halt. That, in turn, could have a negative impact on markets.

Remember that following what was known as the “Saturday Night Massacre” in October 1973 when Richard Nixon fired special Watergate prosecutor Archibald Cox leading to the resignations of Attorney General Elliot Richardson and Assistant Attorney General William Ruckelshaus stock markets fell by 43% over the next 14 months while gold soared 85%. Richard Nixon resigned in August 1974 rather than face certain impeachment in the Democrat controlled Congress and Senate.

Could the same thing happen again even if Trump is never actually impeached? The early verdict could be yes, but it is so far a “skimpy” yes. Since the firing of James Comey on May 9, 2017 the stock market as represented by the S&P 500 is off less than 1%. Gold, on the other hand, has jumped 3.1%. The US$ has also suffered as the US$ Index has fallen 2.4%. Political uncertainty makes for nervous markets.

(Source)

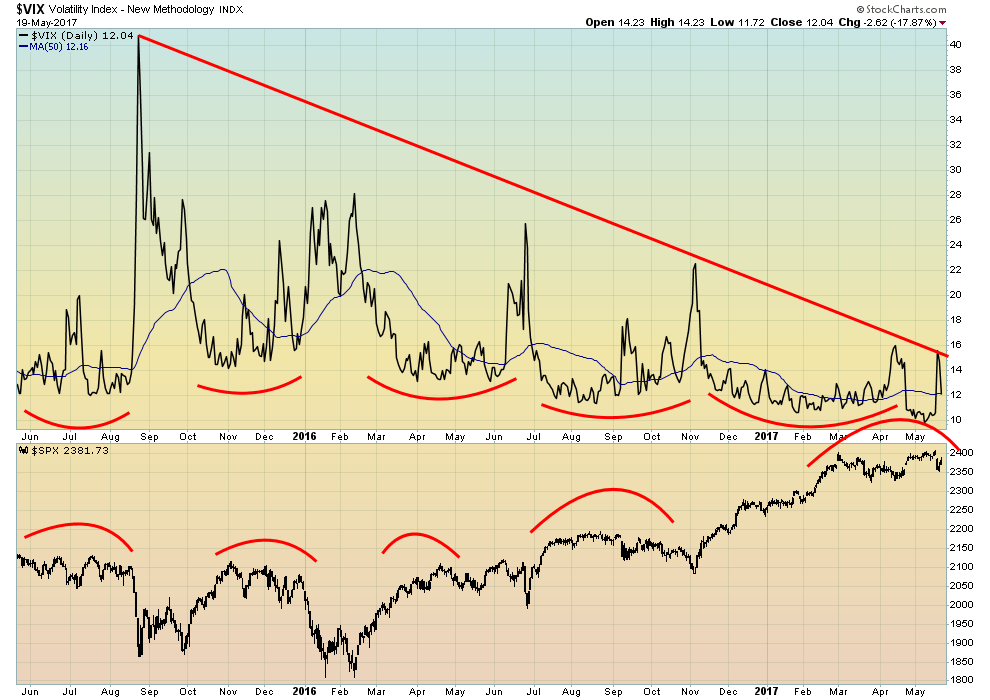

Extreme volatility can sometimes be short-lived. Despite the drop this past week, the VIX volatility indicator didn`t even approach the level seen at the time of the Brexit in June 2016. The S&P 500 becomes far more dangerous if it were to break the lows of the potential topping pattern. Those levels are seen at roughly 2,320 to 2,325. A firm break under 2,300 could project the S&P 500 to fall to the 2,230 to 2,240 level. Note that the 200-day MA is currently at 2,258. The 200-day MA is often tested during a bull market so a dip under the level is not unusual. A sustained decline under the 200-day MA would signal the start of a new bear market.

We are also reminded that the current bull market is quite narrow in breadth. Five stocks consume almost 42% of the NASDAQ and 12.5% of the S&P 500 by market weighting. The five, referred to by Gordon Long of MATASII Strategic Investment Insights as the “Generals” are Amazon (AMZN), Microsoft (MSFT), Facebook (FB), Apple (AAPL), and, Alphabet (GOOGL). It reminds us of other narrow breadth markets such as the “Nifty Fifty” rally of 1972 that preceded the 1973-1974 stock market collapse, as well as the last days of the 1987 rally preceding the 1987 stock market crash and finally the high tech and internet market of the late 1990`s preceding the tech wreck crash of 2000-2002. Gordon Long also noted that the market cap of the five “Generals” is about $1.5 trillion in a global stock market of about $70 trillion.

It remains our belief until proven otherwise, that the current decline is a wave 4 within the context of fifth of fifth waves to the upside. That leaves the door open to another rise to new highs once this decline is over. Impeachment or no impeachment, proceedings rattle markets. But as the proceedings ebb and flow so will the market until a new trend is established. It remains our belief that we are in the final throes of the current bull market and once complete a new bear market could get underway.

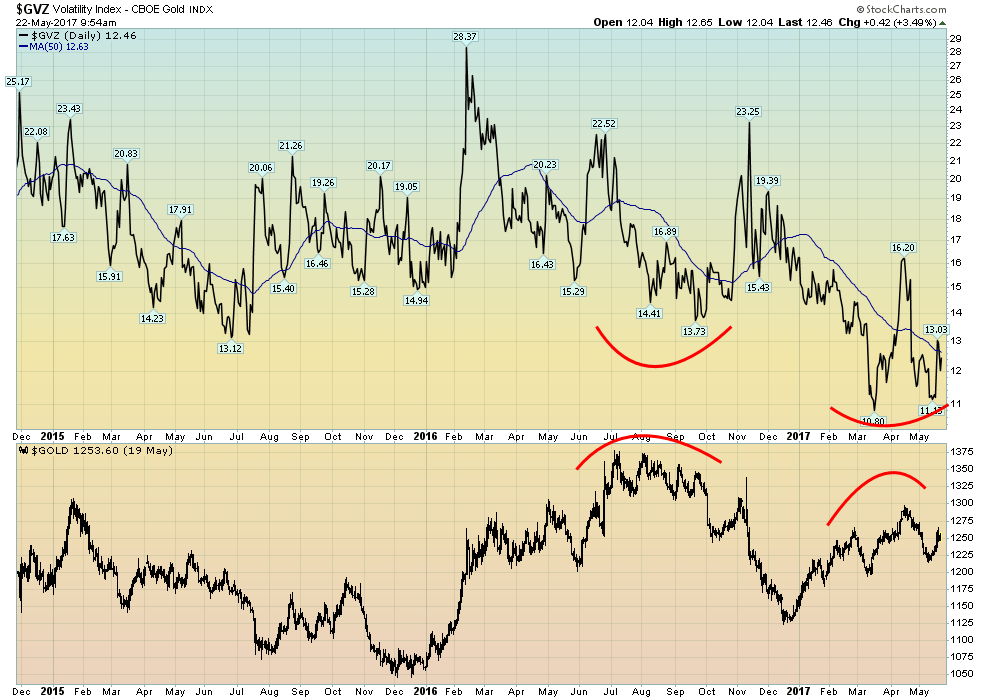

If the stock markets falter during an impeachment battle gold benefits as was seen in 1973-1974. Gold has been steadily rising in 2017. This is seen by generally rising highs and rising lows in 2017. Results were as follows – January high $1,220, low $1,147, February high $1,265 low $1,200, March high $1,261 low $1,195, April high $1,297 low $1,245, May (to date) high $1,272 low $1,214. Despite a “bump” in March and May slightly underperforming so far the trend for gold has thus far been up in 2017.

(Source)

As long as gold remains above $1,220 gold should continue to move higher. A firm break above $1,265 would suggest that the April high of $1,297 should be taken out. Once over $1,300 gold should continue higher and eventually take out the high of 2016 at $1,377.

Political uncertainty makes for market uncertainty. And in that respect, the market uncertainty usually translates itself into falling stock markets and rising gold prices. Despite the bumps in gold prices from 2011 to 2015 gold remains the best performing asset since 2000 with a gain of 333%. The S&P 500 is up 62%. Yet it is gold that is maligned as the “barbarous relic.” The value of all of the gold in the world is only about $7 trillion vs. a global stock market 10 times the size.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoRipple Launches EVM Sidechain to Boost XRP in DeFi

-

Impact Investing6 days ago

Impact Investing6 days agoShein Fined €40 Million in France for Misleading Discounts and False Environmental Claims

-

Impact Investing3 days ago

Impact Investing3 days agoVernazza Autogru Secures €5M Green Loan to Drive Sustainable Innovation in Heavy Transport

-

Cannabis2 weeks ago

Cannabis2 weeks agoCannabis Company Adopts Dogecoin for Treasury Innovation

You must be logged in to post a comment Login