Featured

The price to earnings ratio: When cheap means crap

There are key differences between earnings growth and price-earnings. Knowing them could spell success or failure to investors in stock market.

Everyone loves cheap, especially investors. But when cheap becomes crap, cheap becomes expensive. In the stock market, investors are seduced by low-quality stocks looking cheap and promising at first sight. The moment of happiness lasts until they realize that the stock’s performance is moderate at best. And low-quality stocks often result in capital losses and dividend cuts.

A notorious dazzler

Dividing price by earnings is a common metric to determine a stock’s valuation. Unfortunately, “common” does not equal “correct.” In an open market, whenever something looks cheap, something is rotten. The stock market is one of the most open markets, thus cheap means something must be very rotten.

Don’t believe? Let’s have a look what “cheap” really means.

How cheap looks like

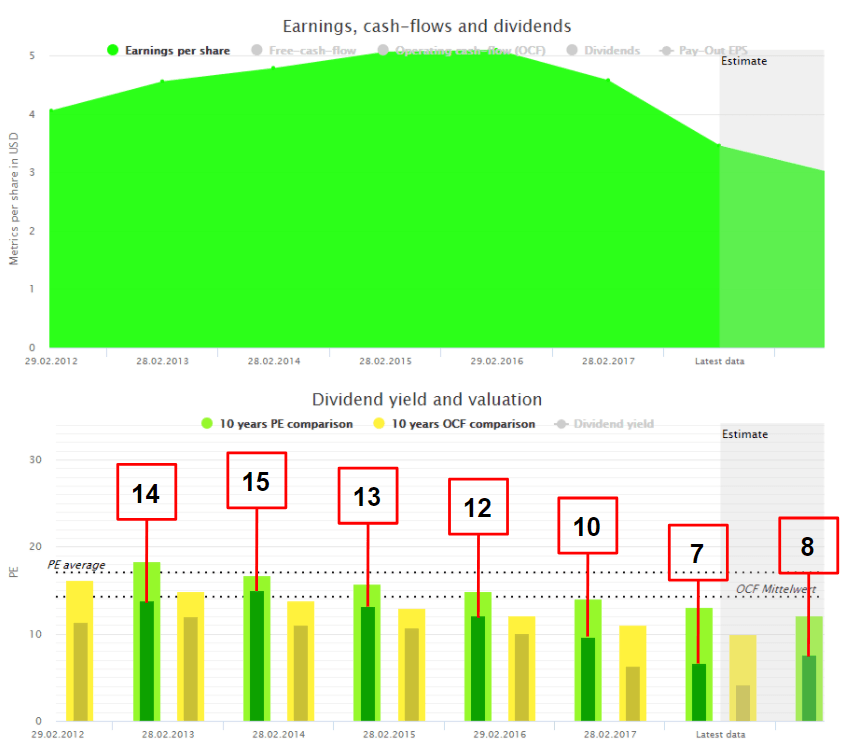

These charts show the relationship between earnings growth and price-earnings. As earnings decline, the stock price declines even faster, leading to a contraction of the price-earning-ratio. The stock becomes “cheap” because the company is in serious “earnings” trouble, and the market does not believe in fast recovery.

(Source: DividendStocks.Cash)

The stock price tumbled from above $70 in 2014 to less than $23 now. A painful capital loss for anybody invested. If you “took the chance” and bought in 2017 when the price-earnings-ratio was “only” 10, you still lost about 50 percent. Sole consolation: when all earnings are gone, there is no price-earnings-ratio anymore.

No price-earnings-ratio — then what?

Long-term investors should always invest in high-quality stocks, but the price-earnings-ratio has no clue about quality. That’s the problem, and that’s why we need other metrics. Which one, I’ll tell another time.

P.S.: The same goes for the price-to-book-ratio.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto3 days ago

Crypto3 days agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Markets1 week ago

Markets1 week agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Crypto6 hours ago

Crypto6 hours agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Cannabis1 week ago

Cannabis1 week agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

You must be logged in to post a comment Login