Crypto

Quantum Stocks Are Exploding – But Don’t Miss This Trillion-Dollar RWA Opportunity

Quantum stocks are popping right now as companies like Quantum Computing Inc. [QUBT] go 4x seemingly overnight. But, before we get ahead of ourselves, there’s a question we need to ask. Does the quantum thesis have the steam to turn into a real, market-moving moment? The answer, it turns out, is probably not. But that’s not to say there isn’t something huge brewing in the markets right now.

In case you missed the memo, quantum computing’s hot stuff right now. Just take a look at what these quantum stocks have done in the last week.

- IonQ, Inc. [NYSE: IONQ] went from $29 to a high of just over $47.

- D-Wave Quantum Inc. [NYSE: QBTS] has almost tripled in price.

- Rigetti Computing, Inc. [NASDAQ: RGTI] is on track to quadruple.

- And Quantum Computing Inc. [NASDAQ: QUBT] has already crossed into the 4x club after skyrocketing from a low of under $6 to a high of over $27.

So, does this mean now’s the moment to start stockpiling quantum stocks in preparation for the next big thing?

Maybe. Maybe not.

To be honest, it could go either way. Maybe we’ll see a pullback and this moment goes down as “that quantum blip at the end of 2024.”

Or, if a bunch of stars align, then maybe we’ll find the whole quantum stocks thesis gains a whole lot of momentum during 2025.

But that’s the key. We need a bunch of stars to align. And, so far, the only star we’ve got is Google’s “breakthrough” Willow chip that kicked this whole quantum stocks saga off.

Now let me tell you about where I’m putting my money instead.

Follow the Money — The #1 Reason Why Now’s Not the Time for Quantum Stocks

There’s a dirty little secret in tech that could have a huge impact on the potential of quantum stocks.

For several years now, nothing in tech gets off the ground unless there’s a boatload of money behind it.

Long gone are the days when a nerd in a college dorm room could single-handedly launch the next big thing — e.g., Meta [NASDAQ: META] — or where some sandal-clad gremlin in his mom’s garage could gaffer tape his way to a $2 billion acquisition using little more than a bunch of off the shelf components (Oculus).

As for why this is, think low-hanging fruit here and I think you’ll see my point. The last two decades of startup hype have pretty much wiped out all the easy pickings.

That means today, if something’s gonna take off fast, then it’s gonna need a ton of money.

And I mean a ton.

To put things in perspective, let’s take a look at the current “big” thing — AI.

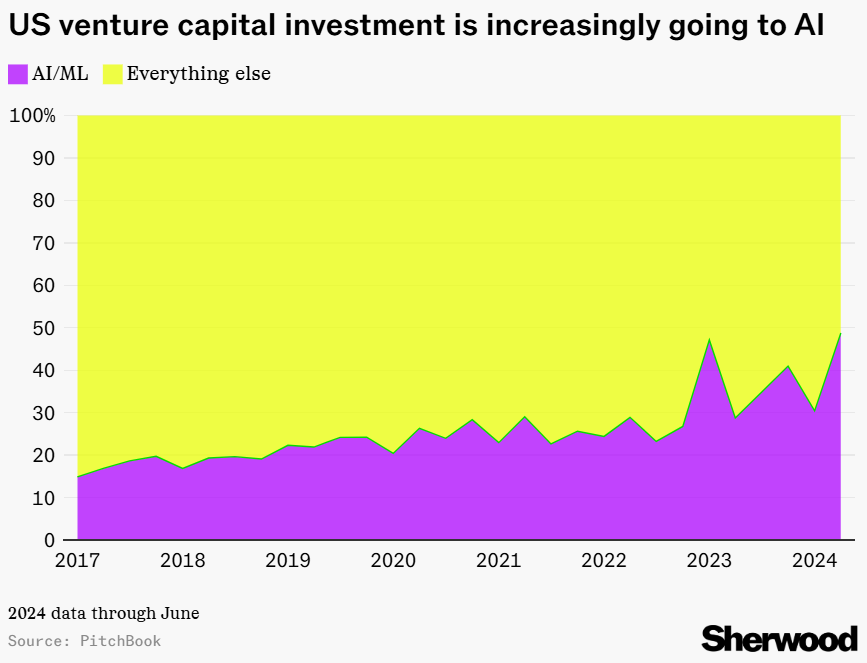

Here’s a chart I ripped off of Sherwood that should put things into perspective.

Now, the key thing to look at here is the level of venture funding pre-2022, when ChatGPT kicked everything off.

Even in 2017, AI ate up $16 billion worth of venture funding — about 15 to 20 cents for every VC dollar.

Or, in other words, AI was swimming in money.

There was a bunch of VC dollars building up pressure behind it.

And so, it was literally just a matter of time until it went pop.

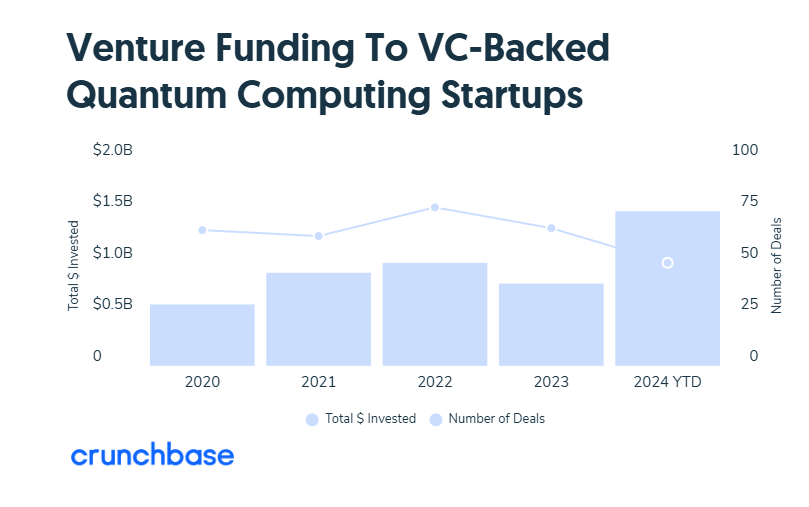

Now let’s look at where quantum stocks are in terms of VC dollars backing them.

Now, granted, 2024 was a bumper year for quantum. So maybe that’s something to get excited about.

But before we get too carried away, take a moment to look at the numbers.

$1.5 billion in VC investments in quantum for the whole year.

That makes up less than 1% of the $171 billion in total VC funding this year.

Or, to put a different spin on it, OpenAI was closing billion-dollar rounds years before ChatGPT was even a thing (e.g., its $1 billion Series D in 2019).

But… But… Quantum Stocks Are Flying!

Let me give you another example of why now’s not the time for quantum stocks.

Cast your mind back to this time in 2017.

That’s the moment Bitcoin really popped for the first time when it went 4-5x seemingly overnight.

Sound familiar? (Yep, the exact same thing just happened to a bunch of quantum stocks.)

Now, do you remember what happened next?

That’s right, Bitcoin pretty much fizzled out right away, and 90% of the people who got into it were left holding the bag.

Those who held that bag for years did end up making a pretty penny. But anyone who didn’t keep the faith for the better part of half a decade lost big time.

And that’s probably what’s going to happen with the current quantum stocks cycle — there’s only so much momentum a bunch of retail traders can create. And yes, quantum stocks are currently very much a retail thing.

Kinda like how most of the Bitcoin hype was back in 2017 — it was mostly retail hype.

But now think about what happened with crypto since.

VC dollars started flowing in by the billions. Real pressure started building up behind crypto.

And now, we’re seeing much stronger, more sustained upswings in crypto. And that’s because you need real money (i.e., more than just retail money) to really move markets.

To put things into perspective yet again, a16z alone is close to $8 billion deep in crypto. That’s right, a single VC fund has invested more in crypto than the combined total of all VC funding for quantum computing combined.

Even if you take just a single quarter’s funding for crypto (Q3 saw $2.4 billion in crypto deals), you’ve already surpassed an entire year’s worth of funding for quantum computing.

Speaking of Crypto and Money — Here’s Something With TRILLIONS Behind It

By now, we should all agree that you need real money behind something before it will amount to anything more than a blip on the radar.

So that leads us to the next question — where’s the real money been heading over the last year?

Well, that leads us right back to crypto.

But not just any crypto.

The real buzz in the institutional/VC world has been in making crypto and the real world come together.

For instance, while crypto investments rose 16% this year, the real headline numbers are coming from investments with a real-world/physical bent. E.g., DePin (Decentralized Physical Infrastructure Network) investments shot up 300%.

And that’s not even the big one.

The really, really big one — the one that’s got literal trillions of dollars building up behind it — is Real-World Asset tokenization. Or RWAs for short.

For those who missed this one, RWA tokenization is basically all about tokenizing real-world assets on the blockchain. It’s kinda like NFTs, but with real-world stuff that actually has value replacing janky, worthless JPEGs.

That — RWA tokenization — is in the crosshairs of MAJOR money. Blackrock [NYSE: BLK] alone has committed to dropping $10 trillion into it.

And yes, that’s “trillion” with a “T”.

And no, that’s not empty talk either — the wheels are already in motion.

Earlier this year, they launched the BUIDL fund, which crossed the $500 million mark seemingly overnight. And, most recently, news dropped that Blackrock had dropped a boatload of cash into tokenized Muni Bonds.

Already, we’re talking about close to an entire year’s worth of money in funding for quantum stocks. And that’s just from a couple of Blackrock deals alone.

And they’re not the only ones. Joining them we see names like Goldman Sachs, HSBC [NYSE: HSBC], and all the usual VC suspects like a16z jumping into RWA tokenization.

Basically, this thing’s about to get HUGE.

Dump Your Quantum Stocks and Buy This Instead — Oxbridge Re [NASDAQ: OXBR]

Alright, so you’re convinced. You wanna move on from quantum stocks and get into RWA tokenization stocks.

Sadly, there ain’t a whole lot of options available just yet. Or, at least, there aren’t a whole lot of pure-play options. Most of the publicly traded stocks in this space right now are massive institutional players where you won’t be getting much in the way of pure, direct exposure to RWA tokenization.

But there is one option — and it’s a good one.

That option is Oxbridge Re [NASDAQ: OXBR], specifically for its SurancePlus subsidiary, which is fast becoming a major mover and shaker in the tokenization of reinsurance securities.

Now, as for the specific reasons for picking Oxbridge Re [NASDAQ: OXBR], I only just covered this last week when we dropped the Blackrock tokenized Muni Bonds news. But, instead of rehashing the same thing again, I’ll simply suggest you go take a look at that article. Skip over the first half to get to the good stuff.

Long story short — this one’s got way more built-up potential to really go boom in 2025 than any of the quantum stocks popping right now.

__

(Featured image by Dynamic Wang via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa1 week ago

Africa1 week agoCameroon’s Government Payment Delays Exceed 200 Days, Straining Businesses and Public Finances

-

Africa4 days ago

Africa4 days agoMorocco’s Industrial Activity Stalls in January 2026

-

Crypto2 weeks ago

Crypto2 weeks agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Crypto2 days ago

Crypto2 days agoBitcoin Surges Past $72K as Crypto Market Rallies and Kraken Secures US Banking License