Crypto

From Raiden to ICOs to EEAs: Analyzing Ethereum’s price movements

Investors should watch out for the major catalysts affecting the prices of Ethereum.

“People say you can’t run everything in the world on the blockchain, but I really, really think it’s possible,” blockchain guru Joseph Poon said to CoinDesk back in August.

Poon knows what he’s talking about. He co-wrote the initial whitepaper for Bitcoin’s “Lightning Network,” which is key to scaling the cryptocurrency. And, more recently, he worked on a roadmap for Ethereum with none other than Vitalik Buterin, the founder of Ethereum.

Both men believe that Ethereum can eventually become a “world computer,” replacing all the server farms from Google and Amazon.

It’s important to remember this endgame because cryptocurrency volatility is blinding on a day-to-day basis.

One day of double-digit gains makes you feel like Leonardo DiCaprio at the start of The Wolf of Wall Street. Meanwhile, a big swing to the downside makes you feel like…well, Leonardo DiCaprio at the end of The Wolf of Wall Street.

Don’t let either of these scenarios distract you from the big picture. Our Ethereum price forecast is based on its fundamental growth.

There are three major catalysts for this trend, and that’s what we should be watching.

Raiden

If you’re wondering, no, we are not referring to Raiden, the thunder god from Mortal Kombat. (Which, by the way, always struck me as weird. If he has the power to conjure lightning, why call him the “thunder god”? Those are two separate things.)

“Raiden” is a payment infrastructure that will make Ethereum scalable. Think of it as Ethereum’s answer to the Bitcoin Lightning Network (Raiden, Lightning—it’s obvious the cryptocurrency guys spent a lot of time indoors). It creates a lightweight shell for the core blockchain, allowing for more payments to be processed per second.

Are Bitcoins as truly a reserve form of money? (Source)

Initial Coin Offerings (ICOs)

Peter Thiel recently called Bitcoin a “reserve form of money.” He’s not alone, either; I’ve heard a lot of people make similar claims. They’re essentially arguing that investors will treat Bitcoin like gold, rushing to it in times of uncertainty when the world is falling apart.

But that argument ignores the fact that most currencies are coming into existence on the Ethereum platform. All the ICOs you hear about are on Ethereum, meaning that they are raising money in Ether.

Shouldn’t this make ETH a safe haven as well?

Ethereum Enterprise Alliance

There’s no question that the Ethereum Enterprise Alliance (EEA) is the largest consortium of corporations and blockchain experts. If we’re going to see cryptocurrencies make inroads into the Fortune 500, it’ll likely be via the EEA.

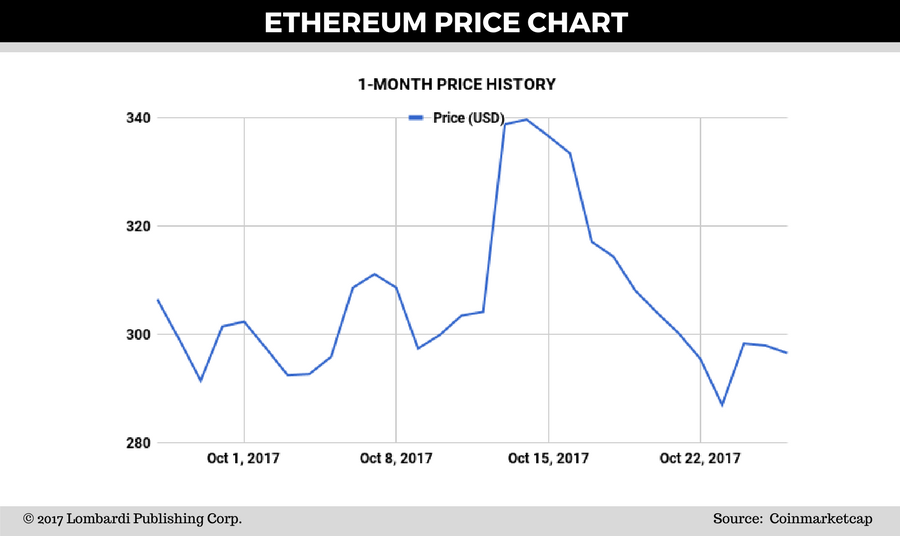

Daily Ethereum chart

Analyst take

We believe it’s important for investors to keep an eye on these tailwinds because two months from now, it won’t matter that ETH prices dropped 0.52% on Friday morning. It won’t matter that the Ethereum to USD rate is near $297.86, or that it’s hovered at that level for a few days.

The daily Ethereum news will have changed by then, but the underlying catalysts will be very much the same: Raiden, ICOs, and the Ethereum Enterprise Alliance.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business2 weeks ago

Business2 weeks agoFed Holds Interest Rates Steady Amid Solid Economic Indicators

-

Crypto12 hours ago

Crypto12 hours agoBitcoin Surges Toward $110K Amid Trade News and Solana ETF Boost

-

Fintech1 week ago

Fintech1 week agoMuzinich and Nao Partner to Open Private Credit Fund to Retail Investors

-

Crypto3 days ago

Crypto3 days agoBitcoin Traders on DEXs Brace for Downturn Despite Price Rally

You must be logged in to post a comment Login