Business

Rent to live, buy to rent: A real estate strategy to live by

Use your equity and cash flow from owned rentals to buy the far cheaper foreclosures then rent them out for even more profits.

Did you read Andrea Riquier’s two articles on Market Watch last year about real estate strategies? Definitely worth it!

The first was “The new housing play: helping priced-out renters become long-distance landlords.” It was a strategy aimed at people living in unaffordable areas like San Francisco, Los Angeles, Miami, or New York.

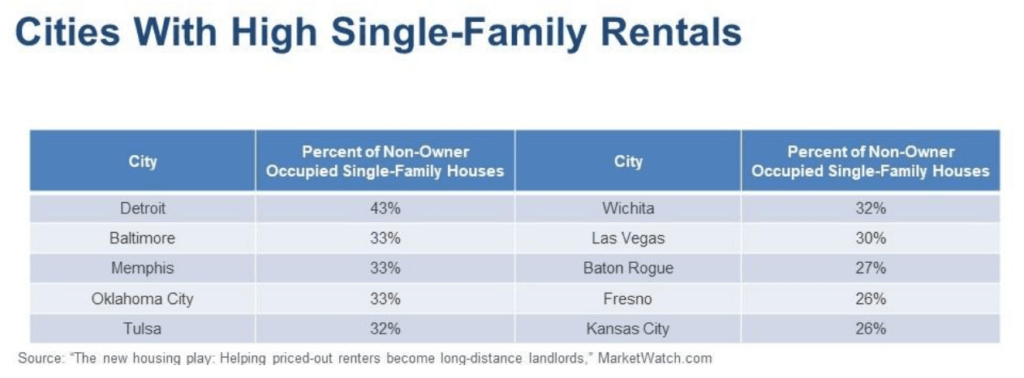

Rent in those areas to avoid the high purchase costs and a major bubble burst (when it inevitably comes). Then use your freed-up borrowing power to buy a house in an affordable area where renting for income is more lucrative, and far less risky. We’re talking places with high percentages of single-family rentals, like Detroit, Las Vegas, or Kansas City and a few more listed below.

Except for Baltimore, these cities aren’t on the expensive coasts. Rather, they’re more towards the center of the country.

They have more struggling middle- or lower-income families who can’t afford to buy, even in these less over-valued areas. And besides Denver — to a degree — none of these are bubble cities that are likely to crash and crucify you.

Pick your poison

In her second article called “Pick your poison,” Riquier showed that there are two ways to make money in real estate.

Look at this chart that rates areas by the quality of life.

The “A” areas appreciate the most at 21 percent annually. That’s about twice as much as the “B” and “C” areas.

The worst – “F” areas – have slightly negative appreciation rates at -0.4 percent.

While “F” areas are NOT places you want to buy, “A” areas are the worst at this time because they’re out of reach of most buyers and will get hit the worst when this second real estate bubble bursts.

Now, look at the average rental returns

They’re the highest in the poorer “F” areas, at 10.1 percent, which is damn good.

Rentals don’t vary as much as appreciation and are still good at 7.9 percent in the “A” areas. But there, again, your risk is that the property value falls by 30 percent to 50 percent while you own it and wipes out many years of rental gains.

Rental appreciation rates are also higher in lower quality areas.

There are now online companies — Roofstock, Home Union, Investability, and OwnAmerica – that help you identify, purchase, and manage such long-distance rentals.

One of the best sites at this point appears to be Roofstock.com. They charge a 2.5 percent brokerage fee to the seller, and 0.5 percent to the buyer. That’s cheaper than the standard 6 percent commission.

The ultimate strategy

But here’s the ultimate strategy, and you should do this NOW, before the next crash, while it’s easier to borrow. In the crash, rentals will tend to hold up. Housing prices will fall.

Use your equity and cash flow from owned rentals to buy the far cheaper foreclosures (often by just taking over the payments at a discount), then rent them out for even more profits.

This is what the smart money did during and after the 2008 crisis.

Hedge funds and individual investors bought single-family houses for cheap, then rented them out for strong, positive cash flow. And it gave them the potential to both buy more as the downturn progressed and to sell down the road when the market was better.

Single-family rentals attract older, more family-oriented renters that stay twice as long as they would in apartments (three years compared to one and a half years on average). And they’re less likely to default or burning down the house!

You can choose to sell the houses in a better market later down the road, and your renters may become the buyers.

Or you can just keep renting them out at stronger returns and then buy the house of your dreams in a once-expensive city of your choice when its bubble finally bursts!

(Featured image by DepositPhotos)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing6 days ago

Impact Investing6 days agoGlobal Energy Shift: Record $2.2 Trillion Invested in Green Transition in 2024

-

Fintech2 weeks ago

Fintech2 weeks agoPayrails Secures $32M to Streamline Global Payments

-

Crowdfunding2 days ago

Crowdfunding2 days agoDolci Palmisano Issues Its First Minibond of the F&P “Rolling Short term” Program

-

Markets1 week ago

Markets1 week agoShockwaves of War: U.S. Strikes Iran, Markets Teeter, Global Risks Rise