Business

Inflation: Cost of Eating Out Continues To Rise, a Potential Boon for Restaurant Discounters Like Restaurant.com

With ongoing restaurant menu price inflation continuing to run at high levels, diners are increasingly seeking out sharp discounts and promotions. While this trend may wreak havoc on the bottom line of many restaurants, Restaurant.com [OTC: RSTN] finds itself poised to deliver a banner year of growth in 2024 as increasingly discount-driven diners turn to its meal discounts platform.

It seems like every week, there’s another “the analysts got it wrong” story.

And this week, we got a big one combining the hot-button topic du jour (inflation) with the biggest Wall St. sell-off in a year:

Wall St Ends Sharply Lower as Hot Inflation Sparks Sell-off [Reuters]

Fast forward to today, and everyone’s split. Some pundits reckon the sell-off was a giant overreaction. Others claim it was an overdue correction.

As for me, personally, I have no idea.

But here’s what I do know. Trying to read the macroeconomic tea leaves is like trying to predict the weather next Christmas — it’s insanely complicated, and your chances of getting it right are precisely equal to random chance.

And I don’t like betting on random chance.

That’s why I’m betting on a simpler inflation story instead. Here are a couple of headlines as a hint of where I’m headed:

Inflation: Cost of Eating Out Continues to Rise, a Potential Hit to Restaurant Chains [Yahoo Finance]

Surging Restaurant Prices Are Making Dining Out a Luxury [CNN]

And here’s the bet I’m making:

Restaurant.com [OTC: RSTN] is headed for a banner year on the back of shifting consumer behavior.

Now let me explain why.

Restaurants Are Going to Suffer in 2024: But There Is Some Good News

When it comes to understanding the impact of inflation, you have two options.

The first is to listen to economic analysts making convoluted proclamations based on their complicated models. But they always get it wrong.

So that leaves us with the second option — get your ear to the ground and listen to what people at the coalface of the economy are saying.

Or, in this case, the restaurateurs at the literal gas burners of the economy.

Right now, they’re all telling us the same thing. With “Food Away From Home” (i.e., menu price) inflation still running high at 5.1%, consumers are changing their habits.

And when I say “they’re all telling us the same thing”, I mean it. This is affecting everyone from the local mom and pop diner through to the chains like McDonald’s [NYSE: MCD], Taco Bell [NYSE: YUM], Domino’s Pizza [NYSE: DPZ], and Wendy’s [NASDAQ: WEN].

Now, I hear you. This alone doesn’t give us much in the way of something to make investment bets on.

But, if you listen a little closer to what the restaurateurs are all telling us, a bigger picture starts to emerge.

Take McDonald’s CEO Chris Kempczinski, for example. He said the effects of inflation right now are resulting in either “some transaction size reduction” or “some trade down” among consumers.

And then there’s Brinker International [NYSE: EAT] CEO, Kevin Hochman. He revealed that Chilli’s is “seeing improved responsiveness to TV ads that showcase really sharp value.”

Do you see the bigger story yet?

Here, let me spell it out for you — people still want to dine out, but they’re finding it harder to afford it.

And that is very good news for anyone in the restaurant game who can capitalize on this growing wave of discount-driven demand.

Restaurant.com Is Set For Major Growth as Consumers Seek Discounted Dining Options

While discount-seeking consumers might seem like a bit of an “it’s all bad news” situation for the restaurant industry, it’s not quite as simple as that.

Yes, it’s probably bad news for traditional restaurant businesses like McDonald’s [NYSE: MCD], Taco Bell [NYSE: YUM], Domino’s Pizza [NYSE: DPZ], Wendy’s [NASDAQ: WEN], etc.

Chances are, a toxic combination of shrinking revenues and tightening margins lie ahead.

But just as there’s more than one way to skin a cat, there’s also more than one way to get a restaurant discount. And today, one of the more popular options among consumers is through discounting platforms like Restaurant.com [OTC: RSTN].

And that’s why I think Restaurant.com is headed for a banner year.

To understand why, we first need to understand that Restaurant.com will not see its margins impacted by increased inflation-driven discounting. As a restaurant marketing platform where restaurants can advertise and sell discounted “meal certificates” to consumers, its margins will remain stable.

As for the second element of the Restaurant.com banner year story, that bit is simple as well. The more consumers start to penny-pinch, the more they will actively seek discounts. This will drive them straight towards Restaurant.com.

And this last bit to the story isn’t just some wild theory I’ve cooked up, either. Remember what I said earlier about listening to people at the coalface of the economy before?

Turns out, there’s plenty of research out there about what consumers are saying, too.

Let’s take a look.

As Inflation Runs Rampant, Consumers Want to Spend Less But Dine Out Just as Much

Although the news headlines about the impact of inflation on “Food Away From Home” are only just starting to appear, the shift in consumer trends has been in process for a while.

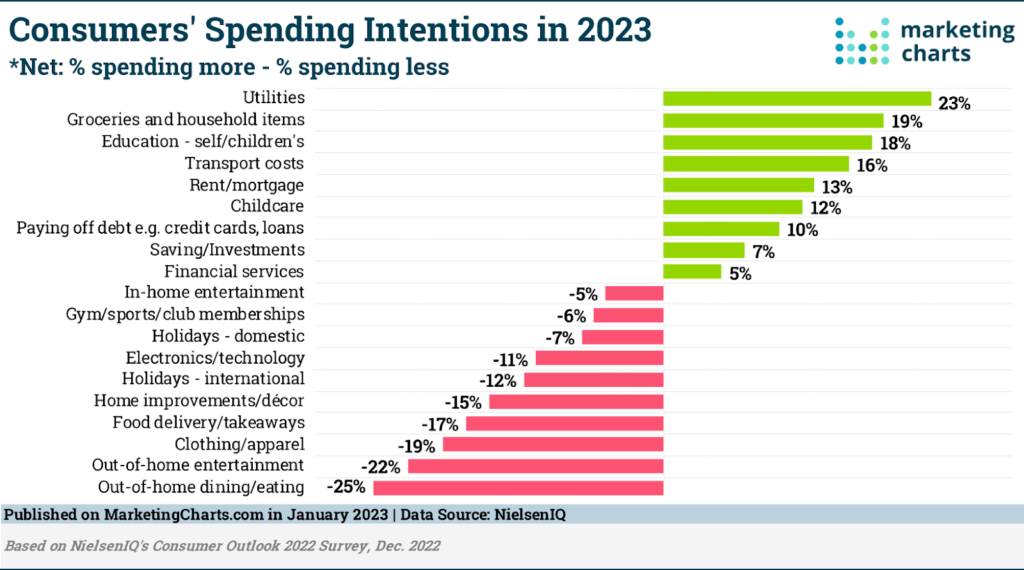

To illustrate what’s happening here, let’s start with these NielsenIQ findings about consumer spending intentions from last year.

And then let’s follow this up with a couple of key findings from a separate Deloitte study (also from last year):

- The number of diners hitting restaurants was trending up.

- 37% of dine-in guests and 40% of takeout customers were looking for less expensive options along with promotions and discounts.

- 60% of discount seekers were unlikely to accept lesser quality.

Now, we’ve already covered both of these findings quite extensively here before when we looked at the $240M Vegas.com valuation. But, it was worth pulling them up again because as high menu price inflation continues into 2024, the trend they outlined is deepening. That is:

- More people are dining out more often.

- However, inflation is driving them to seek discounts.

- Meanwhile, 60% of discount seekers basically want the “same for less” (i.e., they don’t want to revert to cheaper restaurants or menu items)

- This is driving them to actively seek out promotions and discounts.

And that is precisely why the current, inflation-driven restaurant environment is a major boon Restaurant.com [OTC: RSTN].

Beyond Restaurants and Inflation — Why This Could Be Really Big

The story around Restaurant.com is already quite compelling.

On both sides of the coin, restaurants and consumers are telling us the same story — in today’s climate, discounts are increasingly becoming the driving force behind diner’s choices today. And that story is setting Restaurant.com up for a banner year.

But there’s a little bit more to this story than first meets the eye.

For starters, Restaurant.com falls under the umbrella of RDE, Inc. [OTC: RSTN], the company that’s also behind CardCash.com.

For reference, CardCash.com is another discount-driven marketplace with a lot of crossover with Restaurant.com. For example, it offers discounted gift cards to places like Texas Roadhouse [NASDAQ: TXRH], Domino’s Pizza [NYSE: DPZ], Pappa John’s [NASDAQ: PZZA], Chipotle [NYSE: CMG], and many other major chains. It’s also set to capture a bunch of other discount-seeking behavior across a range of other consumer goods and services categories.

However, alongside discount-seeking consumers, what’s really setting RDE up for a banner year is its pending Nasdaq Capital Markets uplisting.

That news item alone could drive a massive rally (and I truly do mean massive — see this run down). Now combine that with the latest news about 2024’s discount-heavy restaurant climate, and you see why this is one bet I’m telling the world about.

__

(Featured image by Helena Lopes via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa1 week ago

Africa1 week agoTunisia Holds Interest Rate as Inflation Eases, Debate Grows

-

Crypto2 weeks ago

Crypto2 weeks agoEthereum’s Growing Capacity Puts Pressure on Layer 2 Platforms

-

Fintech2 days ago

Fintech2 days agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Cannabis1 week ago

Cannabis1 week agoCannabis and the Aging Brain: New Research Challenges Old Assumptions