Business

Rice, cotton, soybean rally on Trump’s tweet about meeting with China

President Donald Trump’s tweet about meeting with Chinese President Xi triggered a rally among rice, cotton and soybean on prospects of better trade deals.

Wheat

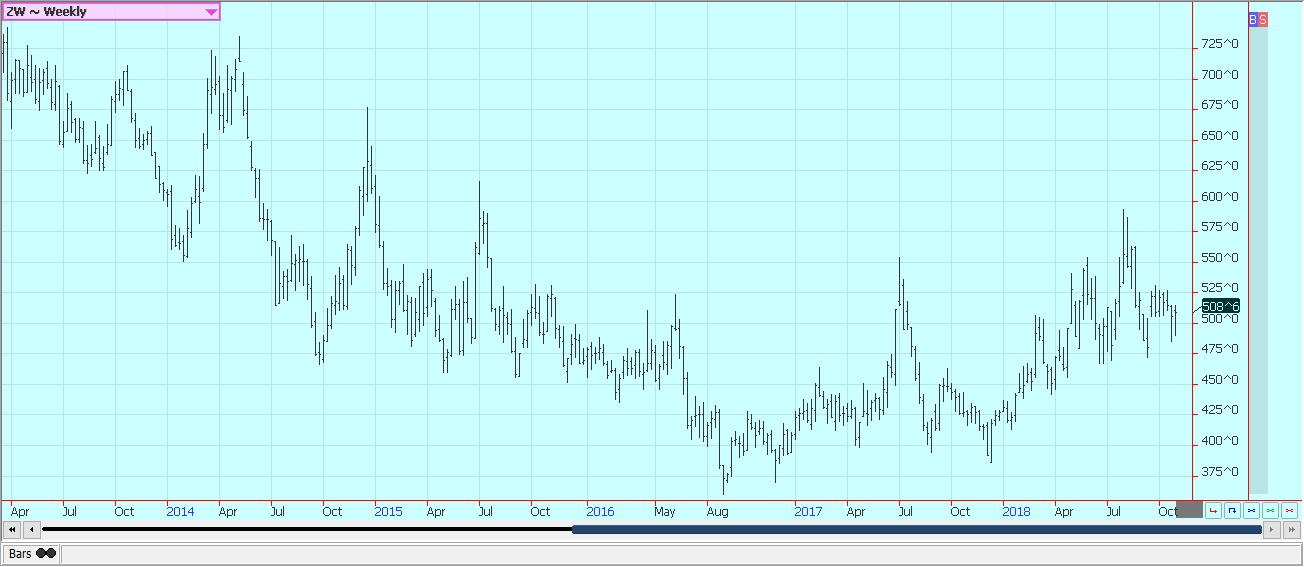

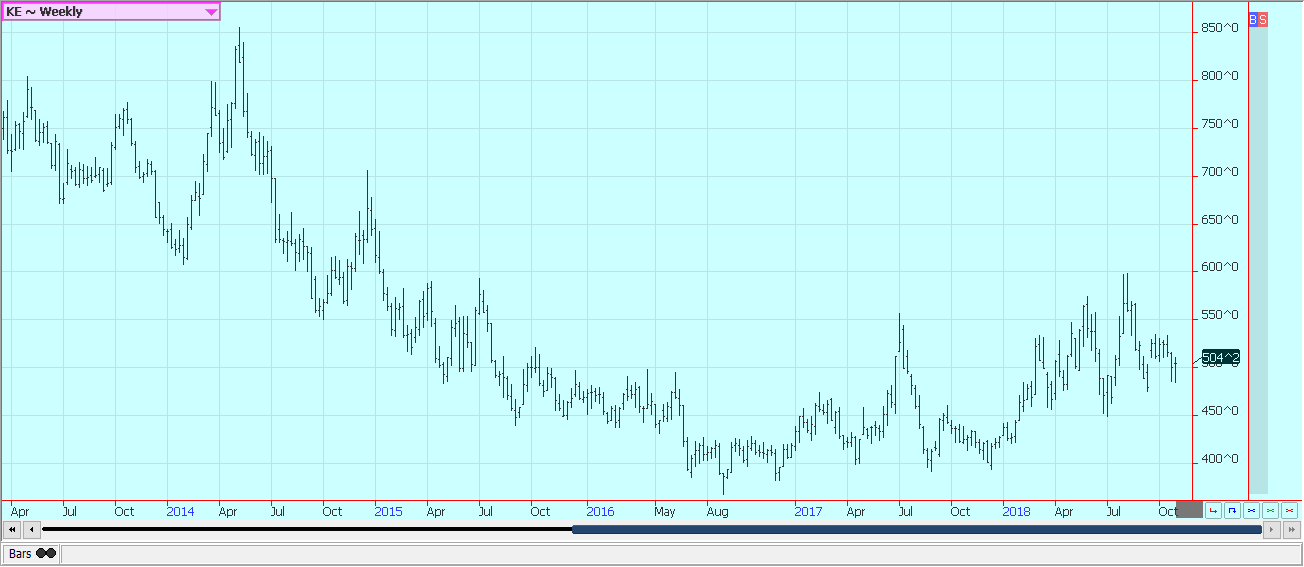

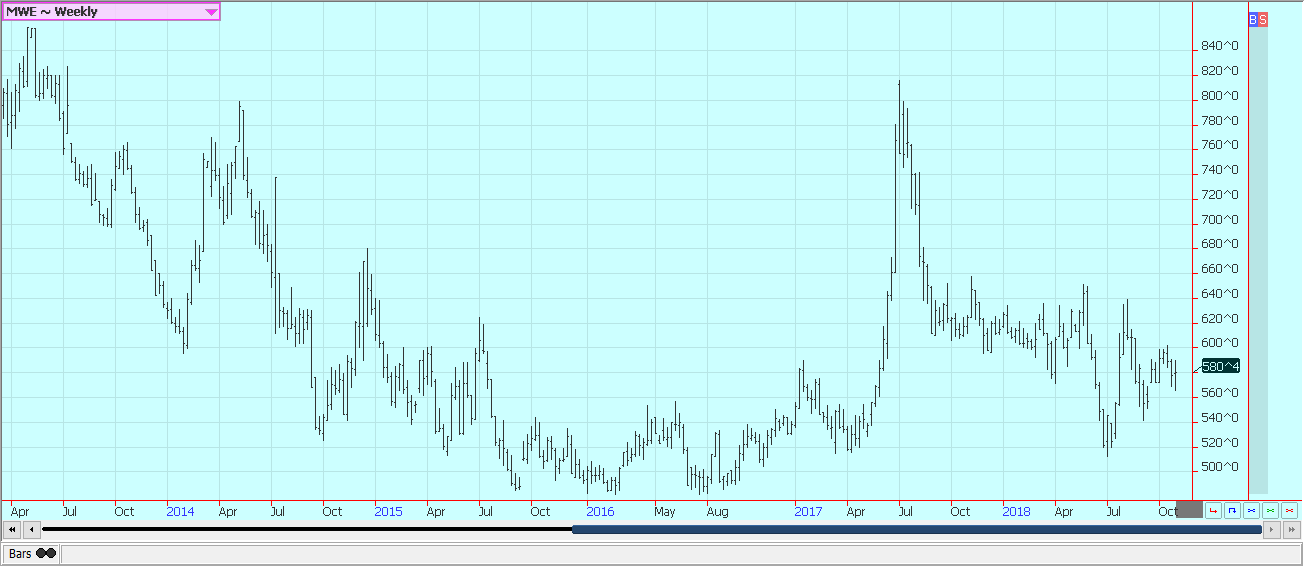

Wheat was higher on Friday and slightly higher for the week. World crop reports continue to indicate less production and tightening supplies. Firm prices extend from Russia to Australia on reduced world production.

It remains very dry in Australia. It is reported to be wet and cold in Siberia for the Spring wheat harvest there, and planting conditions are reported to be dry near the Black Sea.

The Spring wheat harvest in Siberia has been delayed. The problem is that these production problems have not translated into new demand for US wheat. That might be changing as export sales were improved in the latest weekly report. Traders think it is just a matter of time before most world buyers turn to the US as the other major exporters would be out of wheat for export. This is especially true for Russia, who has been exporting as much wheat as possible for the last few months. Reports indicate that the government is increasingly concerned about tight internal supplies and higher prices and is thought to be ready to regulate exports in the near future. It has already made life more difficult for its exporters by making quality inspections more difficult to pass.

US wheat quality this year is good. The weather in the US is improved for planting the next Winter wheat crop as much of the Great Plains is getting rains and soil moisture conditions are thought to be very good. However, the frequent rains have delayed planting from the Midwest to the Great Plains, and there is some concern that not all the crop will be planted timely. USDA issues new supply and demand estimates for wheat this week. The US data should feature no change in production. Demand ideas are mixed, but either way, ample ending stocks are projected.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

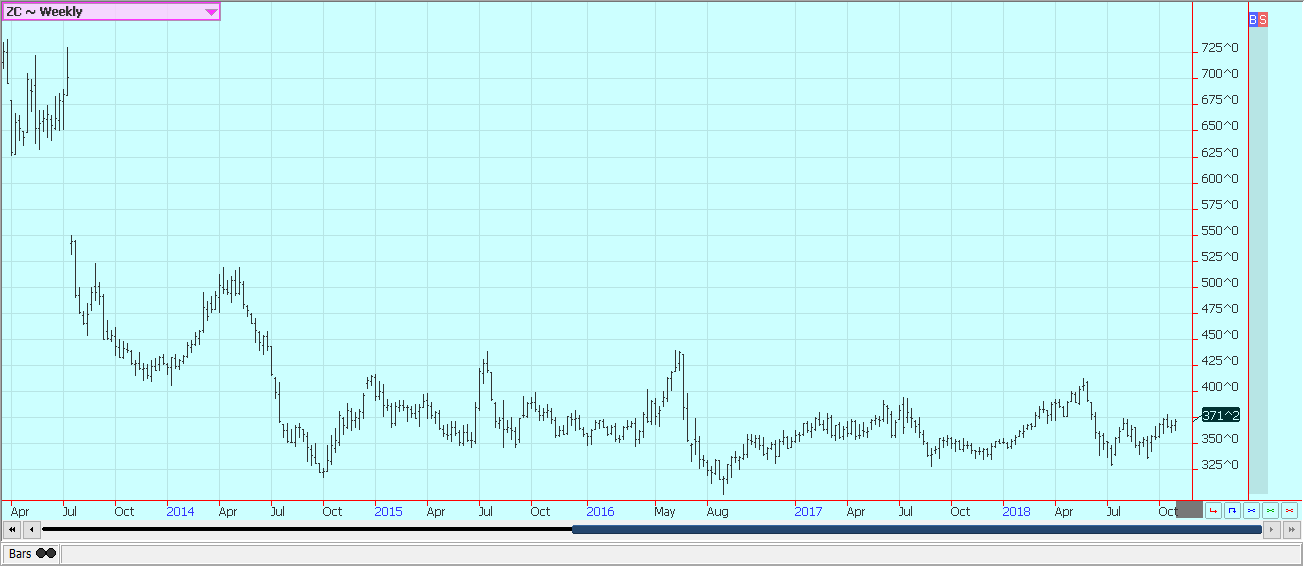

Corn

Corn was higher for the week. Demand was a problem as the weekly export sales report was very bad on Thursday. However, there were some daily sales announcements to Mexico last week, so demand should be better in the reports next week. The harvest continues and farmers are wrapping up the Soybeans harvest in many areas of the Midwest and going after the Corn harvest.

Rain continued to delay harvest progress last week, and conditions remain more variable with some rain and dry weather mixed together and cool temperatures. Snow is possible in Chicago at the end of this week.

USDA will issue new production and supply and demand estimates this week. It could be that USDA has overestimated production, but there appears to be a big crop either way. We expect USDA to cut yields by a couple of bushels per acre and to cut production. The production losses might not be big enough to materially change price outlooks, but could be enough to help keep a floor under futures prices into the Winter.

The weekly price charts suggest that prices can continue to move higher, but the fundamentals suggest that any upside moves should be limited, especially if prices try to move above $4.00 to $4.25 per bushel.

Weekly Corn Futures © Jack Scoville

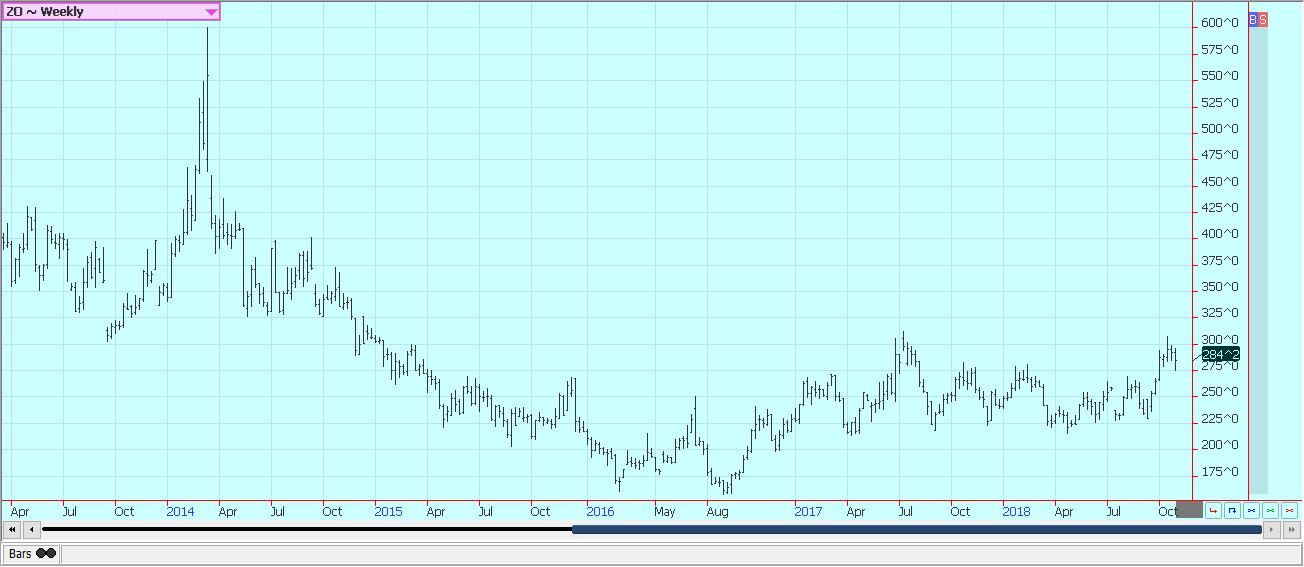

Weekly Oats Futures © Jack Scoville

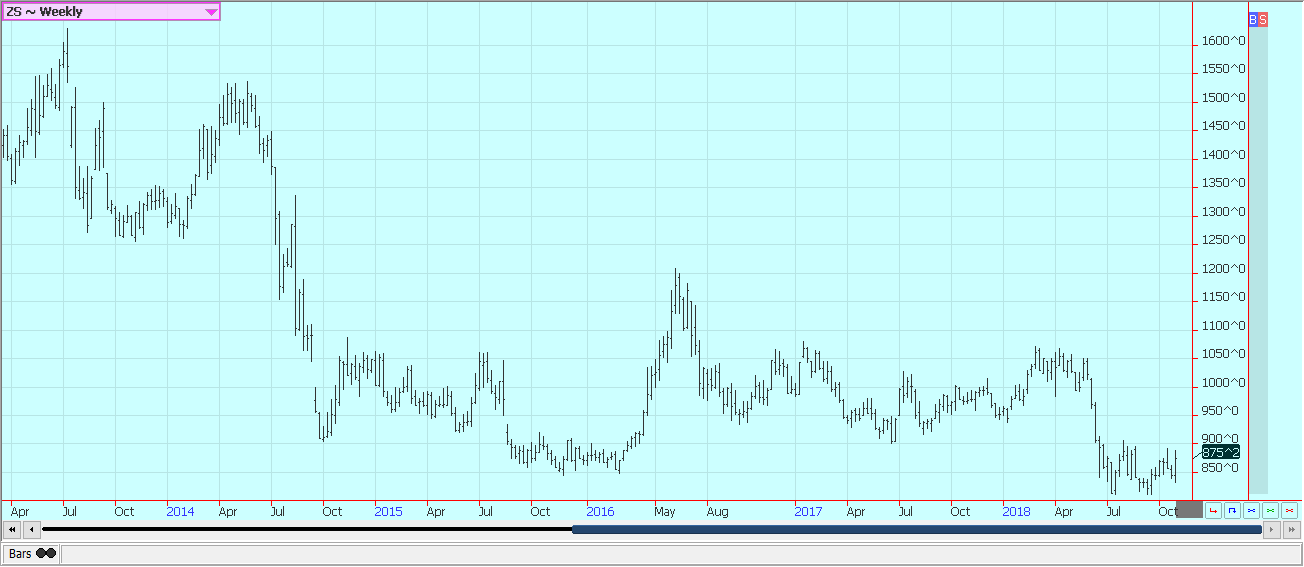

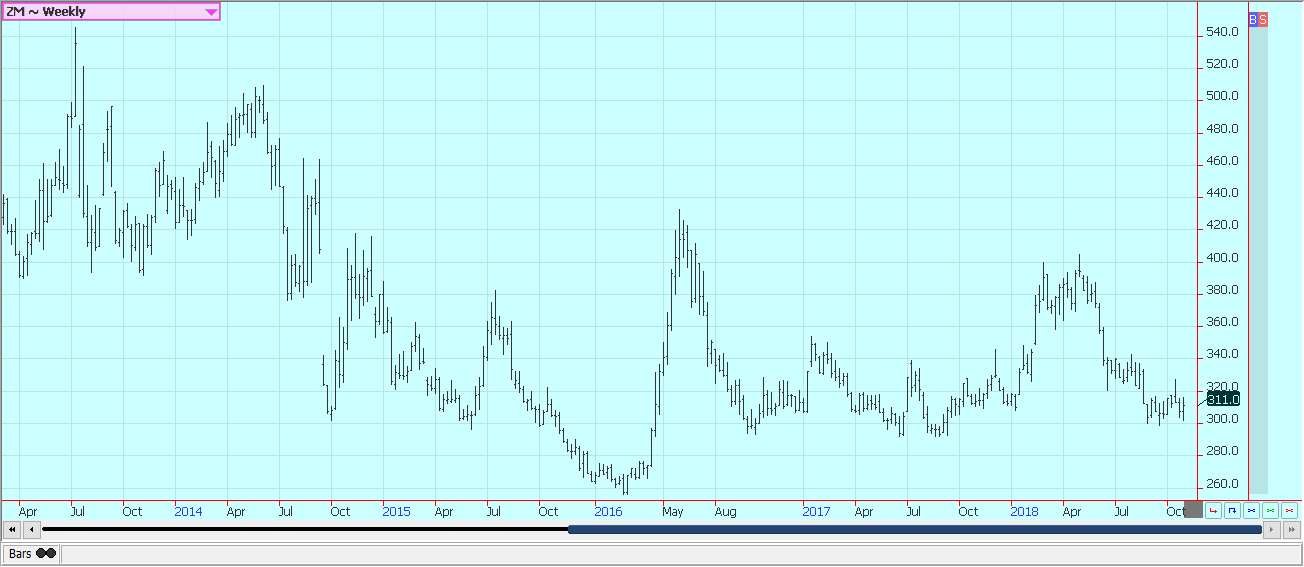

Soybeans and soybean meal

Soybeans and products were higher last week. The rally was triggered by President Trump and his Twitter feed. He wrote that he had talked with President Xi of China and that the talks about trade and North Korea had gone well. There were reports on Friday that were denied by economic advisor Kudlow that the president had asked his cabinet to draw up proposals on trade issues to be discussed and possibly approved at the G-20 meetings at the end of this month in Argentina. This was also denied, but the two presidents will; have a meeting there.

Futures are still supported by disease reports as wet Soybeans were getting molded and were sprouting in some areas along with some variable yield estimates from producers. The reports indicated less production than expected, but it is still expected to be a huge crop, and the US might have trouble getting it moved to the point where ending stocks are small enough to make a difference in prices. Current ending stocks estimates are still more than ample.

US producers are still trying to harvest, and most are finally about done with Soybeans and are moving back to Corn. Showers are likely this week that will keep field work sporadic. Some producers in Iowa and to the west are reporting yield losses and quality losses from the rains that have caused some sprouting and mold to form. Futures appear to have made seasonal lows, but trade ideas are that upside potential is no more than $9.00 per bushel right now. The weekly Soybeans price charts are increasingly bullish, and a move above $9.00 per bushel could create a move to $9.50 and then $10.00 over time.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

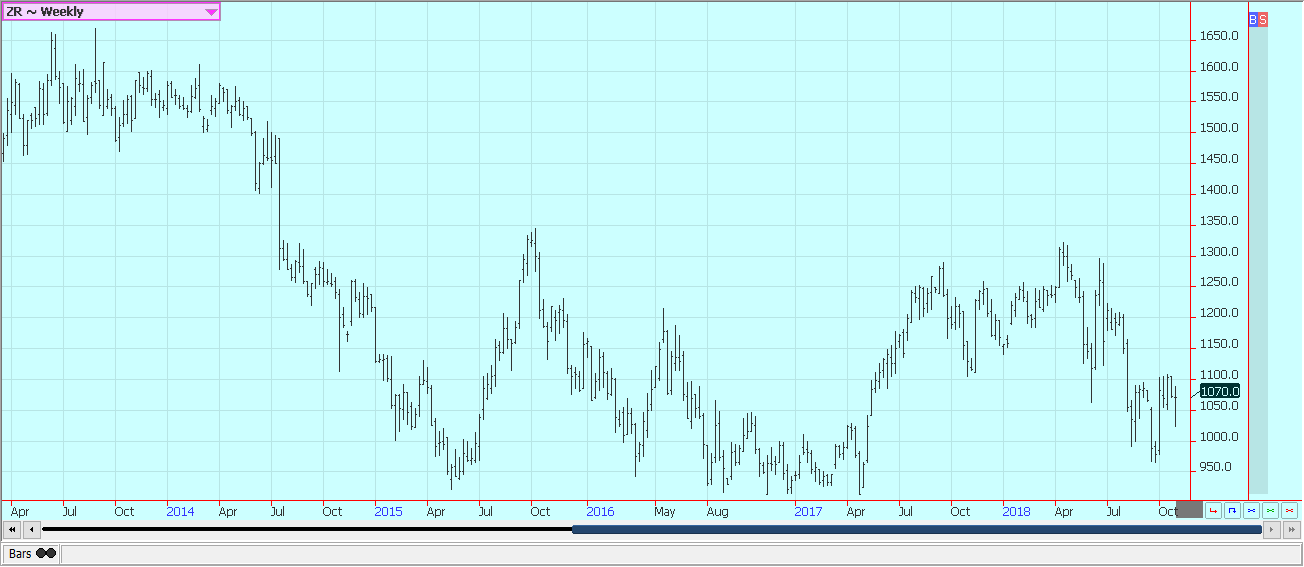

Rice

Rice was lower but rebounded from the lows set early in the week to close with only minor losses. Buying was triggered in part by the presidential tweets even though China is not a buyer of US Rice. The US Dollar was weaker late last week, and this supported Rice futures. The chart patterns show that futures have held on every test of the lows set in 2016 and 2017 and that prices should start to move higher again.

The harvest is over in many parts of the Mid South, although there was still a little left to do in Mississippi and Arkansas, and as Texas and Louisiana were just starting to harvest the second crop. Farmers are storing crops and waiting or doing other activities. Storage is said to be difficult to find near the Gulf Coast and in Texas. Good to excellent yields were reported in Texas and Louisiana, and good to very good yield reports are being made in Mississippi and Arkansas.

USDA should continue to show very strong production, although production could be a little less than estimated last month due to harvest delays caused by too much rain and some yield losses resulting from the delays. Cash prices are holding at somewhat weaker levels as mills and elevators fill up. Milling yields have been acceptable to very good. Export demand has been good and the sales report was solid last week.

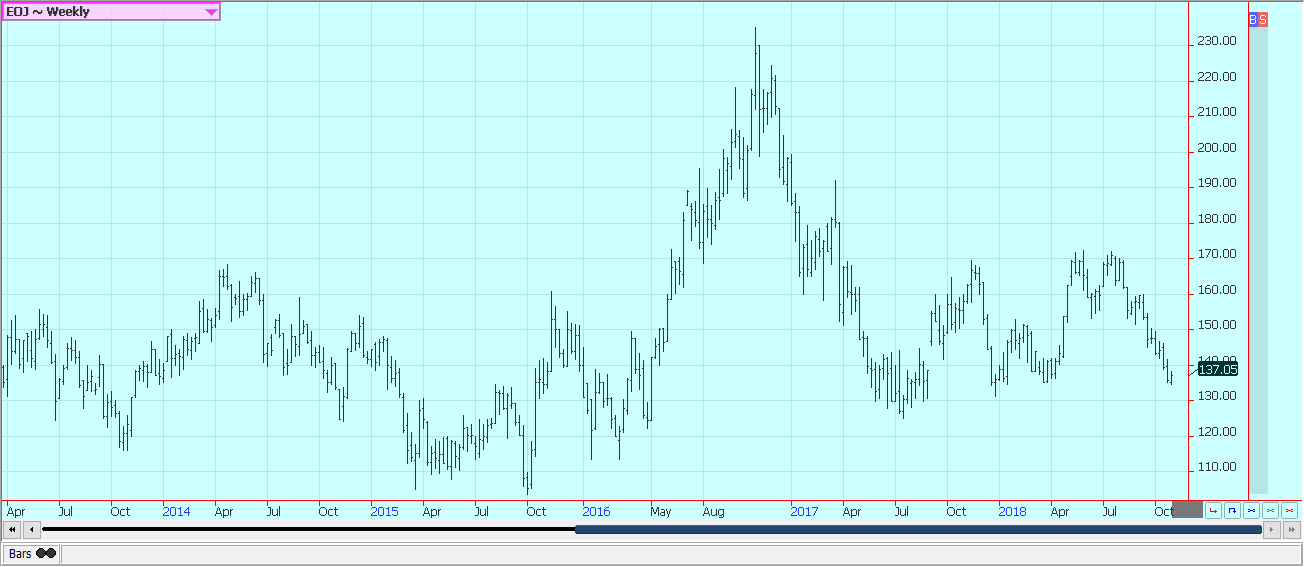

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils prices were generally lower last week, with most in the market worried about finding enough demand to take up the increasing supplies. Palm Oil was lower as the demand for export slowed in comparison to the previous month. Demand in October was much less than in September according to the reports from the private surveyors. Ideas are that production is increasing, so the trade will expect an increase in monthly ending stocks figures once the data is released later this week.

MPOB released a report last week that anticipates strong production for the coming year. It also projects very strong demand and expects year to year ending stocks to be less. Daily and weekly charts show futures in a down trend. Soybean Oil closed slightly higher in reaction to the USDA monthly crush data that showed smaller Soybean Oil supplies than expected. Selling came as the petroleum markets are collapsing and causing bio fuels markets to move lower. Support is also coming from less offer from South America and on higher Canola prices.

Canola was lower on improved weather and as the harvest started to get done. Farmers have had a tough time getting into the fields due to rains, especially in the west. Progress to date has been significantly behind normal, so the trade expects to yield new losses. Yield reports so far are said to be below expectations. Wire reports indicate that farmers have been active sellers despite the lower prices.

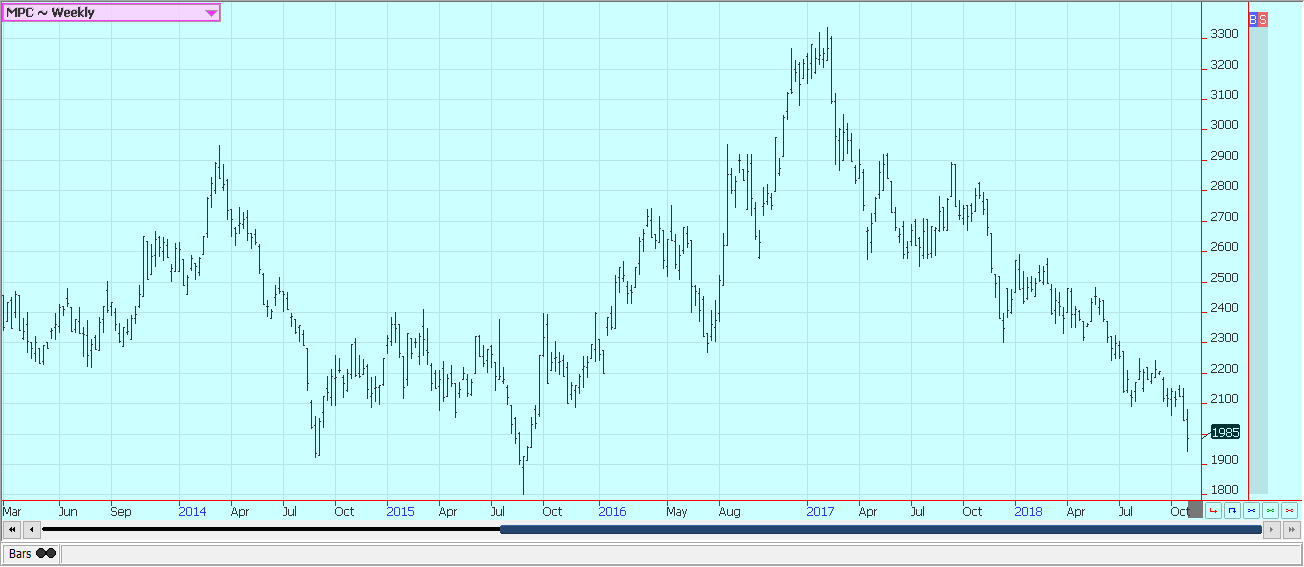

Weekly Malaysian Palm Oil Futures © Jack Scoville

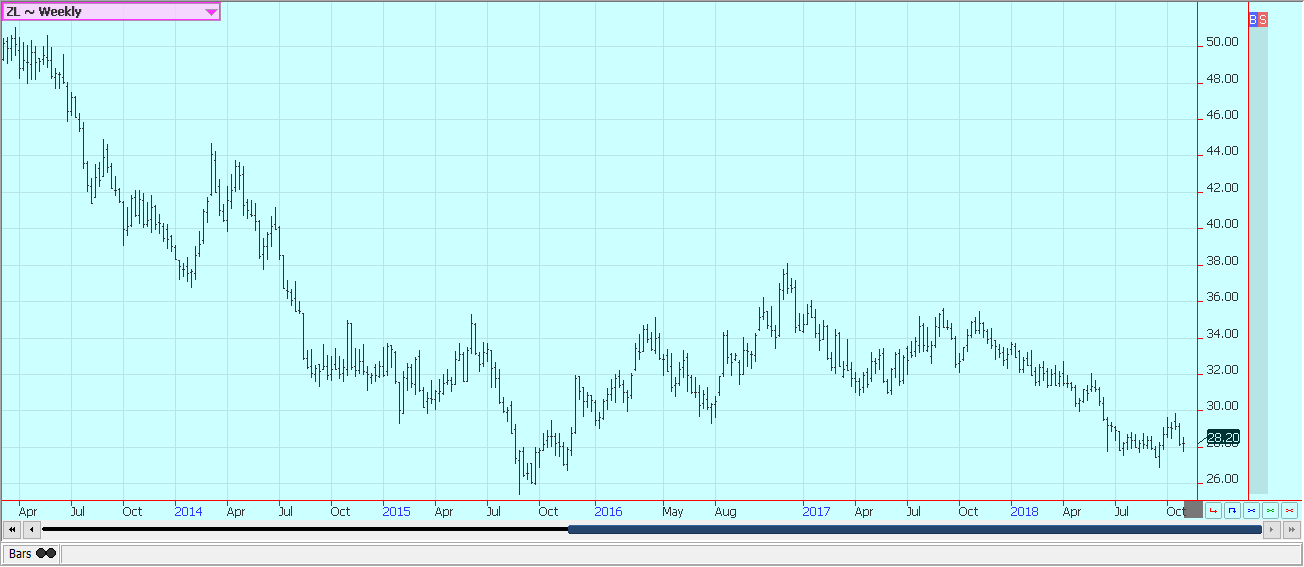

Weekly Chicago Soybean Oil Futures © Jack Scoville

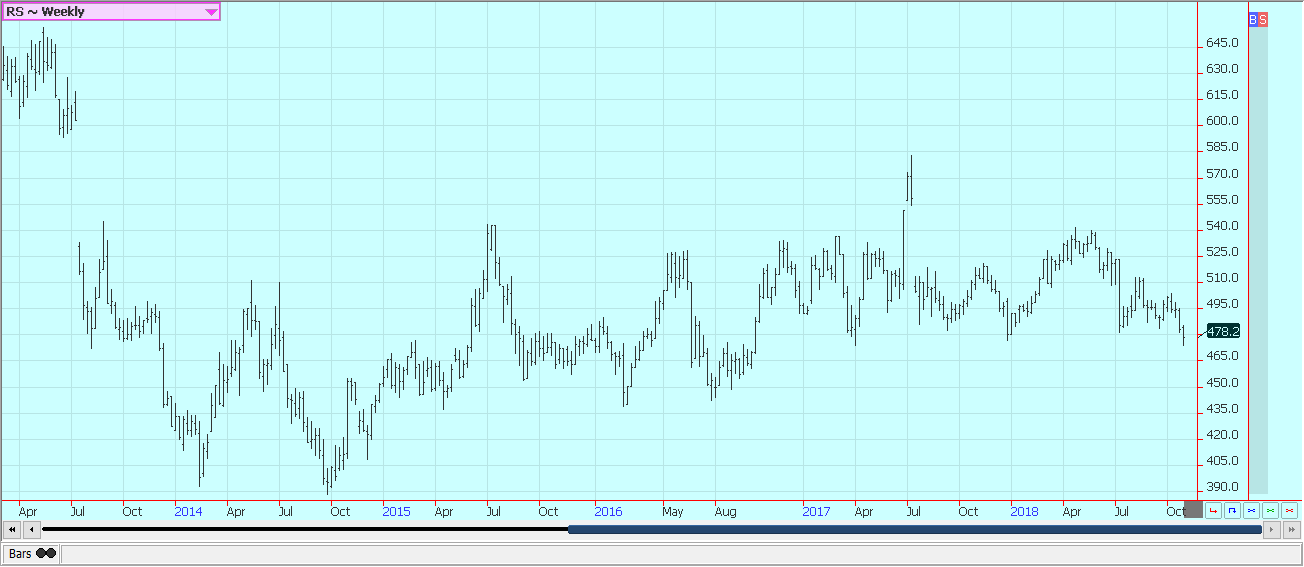

Weekly Canola Futures © Jack Scoville

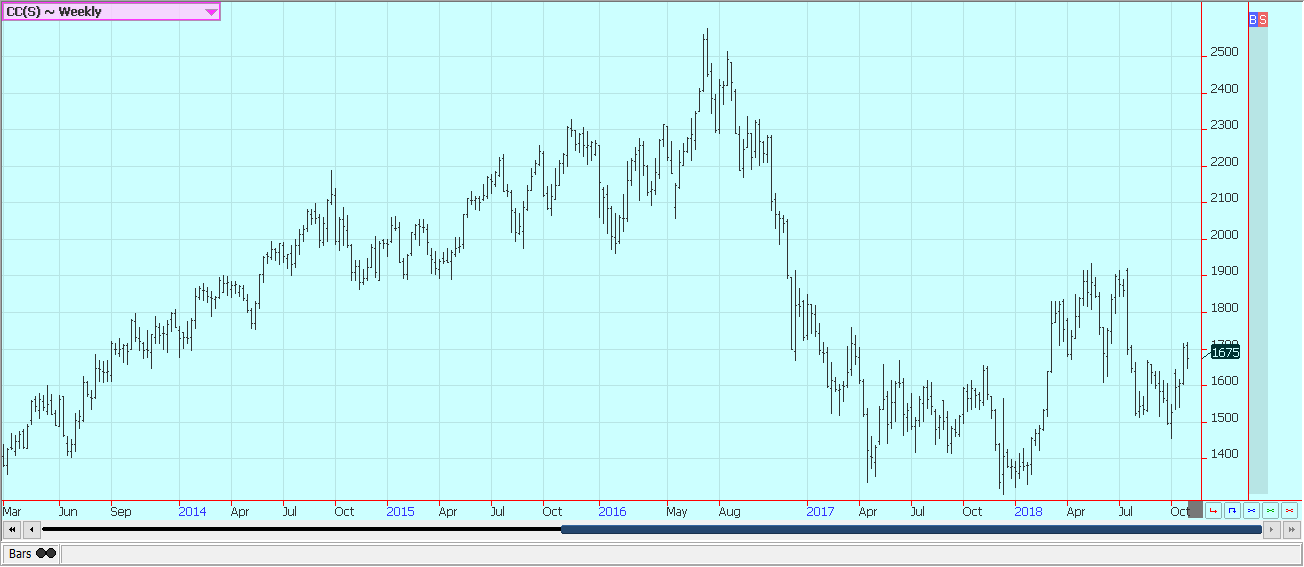

Cotton

Cotton was slightly lower, but once again about in mid-range for the week after holding inside the range from the previous week. The market is now waiting for the new USDA production and supply and demand estimates from USDA and is wondering about production losses in the Carolinas from Hurricane Florence and especially production losses in Georgia from Hurricane Michael. The Georgia hurricane had the potential to be devastating as the most powerful part of the storm passed directly over the more important production areas in the state. Georgia is the second largest producer of Cotton in the US, so losses there would be important to the final estimate.

Texas is far and away the largest producer of Cotton in the US, but it had some extreme weather of its own during the Summer growing season and should have less production as well. USDA estimates have been held high even with the weather and extremely variable growing conditions, so it will be an important report for the supply side of the market.

The weekly export sales report was bad again and the market needs new demand. Export sales for the last few weeks have been poor and show no real signs of improvement for now. Export demand needs to improve soon for prices to rally significantly this year, but any increase in demand has to come with no purchases from China for a while. China has been active in India buying and will buy as much as possible there to make up for production losses inside of China.

USDA estimated production down in India and Pakistan due to bad weather during the growing season, so India might not be able to cover all the demand from China. The market rallied on Thursday in response to the Trump tweets about the chances for a new deal with China as the US could become a primary source for additional imports from China.

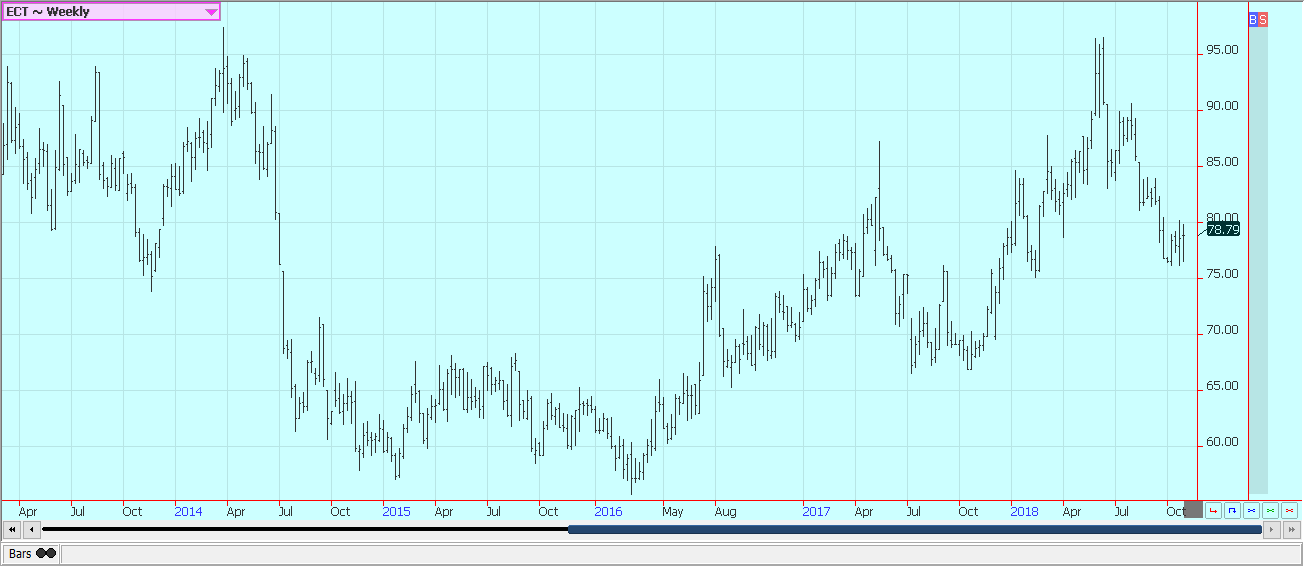

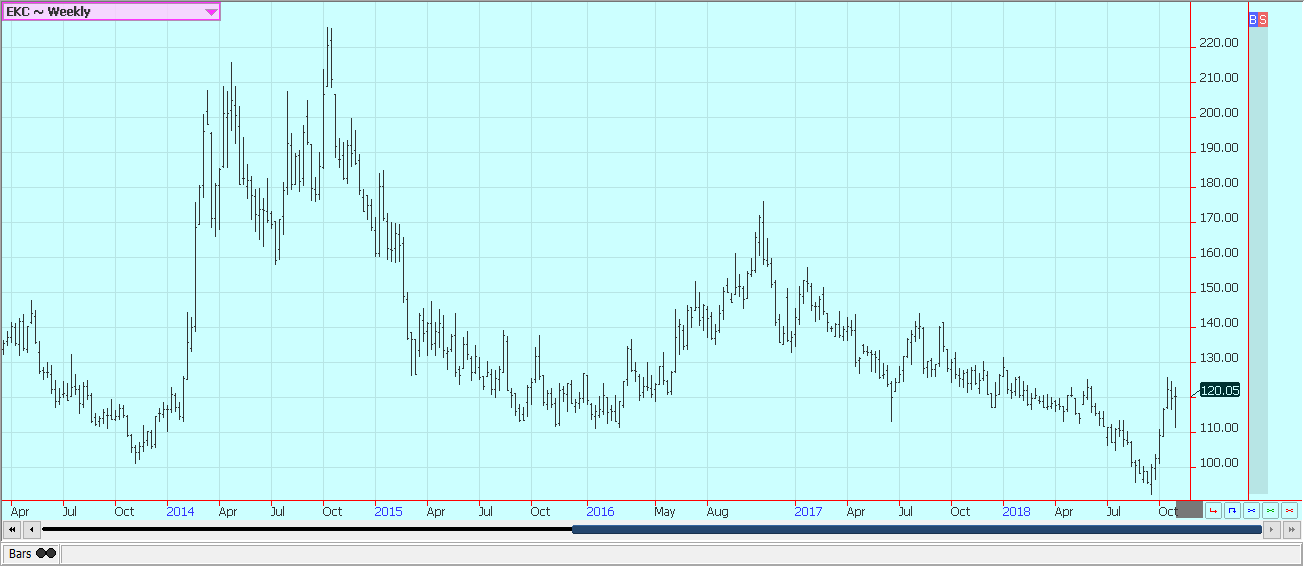

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was a little higher last week as futures held the lows of the previous week. The Oranges harvest is underway in Florida under good weather conditions. Chart trends are still mostly down. Overall growing conditions in Florida are good to very good, and there is no storm development in the Atlantic at this time. Florida producers are seeing good sized fruit, and work in groves maintenance is active.

Irrigation is being used. Packing houses are open to process fruit for the fresh market, and a couple of major processors are open in the state to take packinghouse eliminations. The hurricane season is winding down, and the next weather market will be the freeze season that won’t really get started for another month or more. The problem for the freeze season is that previous freeze events have pushed most of the production farther and farther south to escape most of the potential damage. That means that the freeze even will need to be very strong to have any hope of hurting the Orange crop.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures rallied in the second half of the week after moving lower early in the week in correction trading. New York closed out the week with small gains, while London closed unchanged. Trends are still up in both markets. It has been primarily a short covering rally as funds and other speculators have been buying out short positions due mostly to trend changes in the Brazilian Real. The Real has found support as the right-wing candidate for president in Brazil won the elections and is now expected to pursue a much more business-oriented economic program. The program would also free up agricultural interests to expand and diversify.

Vietnam is getting close to its next harvest, and ideas are that producers there need to sell more of the previous crop to create new storage space. Producers in both countries are not selling much. Some problems with too much rain have been noted in Central America. Drier conditions are wanted for harvesting, and mostly dry weather is in the forecast as the calendar turns to November.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

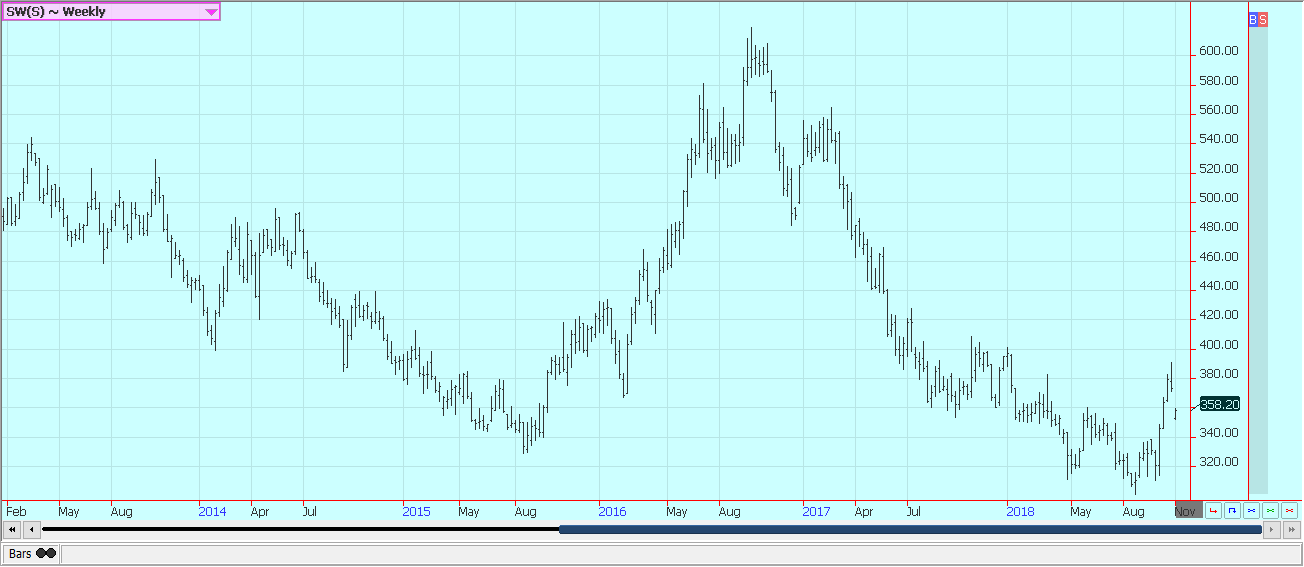

Sugar

New York closed lower last week. London was lower as well. Prices fell in part to the weakness in petroleum futures and on ideas that there are plenty of supplies out there. The down side potential of the market should be limited on ideas that world production is in fact dropping and might be less than though just a few weeks ago.

Sugar was supported by reduced selling in Brazil due to the stronger Real against the US Dollar. The elections for the new president in Brazil created some buying interest in the Real on ideas that the new government will be business friendly. The Real has been gaining on the US Dollar as a result and this has served to limit export interest in Brazil. There are now doubts on just how much production will be seen this year in India. Wire reports indicate that pests have invaded Sugarcane fields and are eating and destroying the crop. There is no indication of losses yet, but the implication of the reports is that the losses could be significant.

Northwest India had been experiencing hot and dry weather that could cut yields. Dry conditions continue in Brazil, the EU, and Russia, but conditions are mostly good in Ukraine. Very good conditions are reported in Thailand. Brazil producers are worried about Cane production, and the market still talks about less production there this year. The dry weather in much of Europe and in southern Russia near the Black Sea has hurt Sugarbeets production potential in these areas.

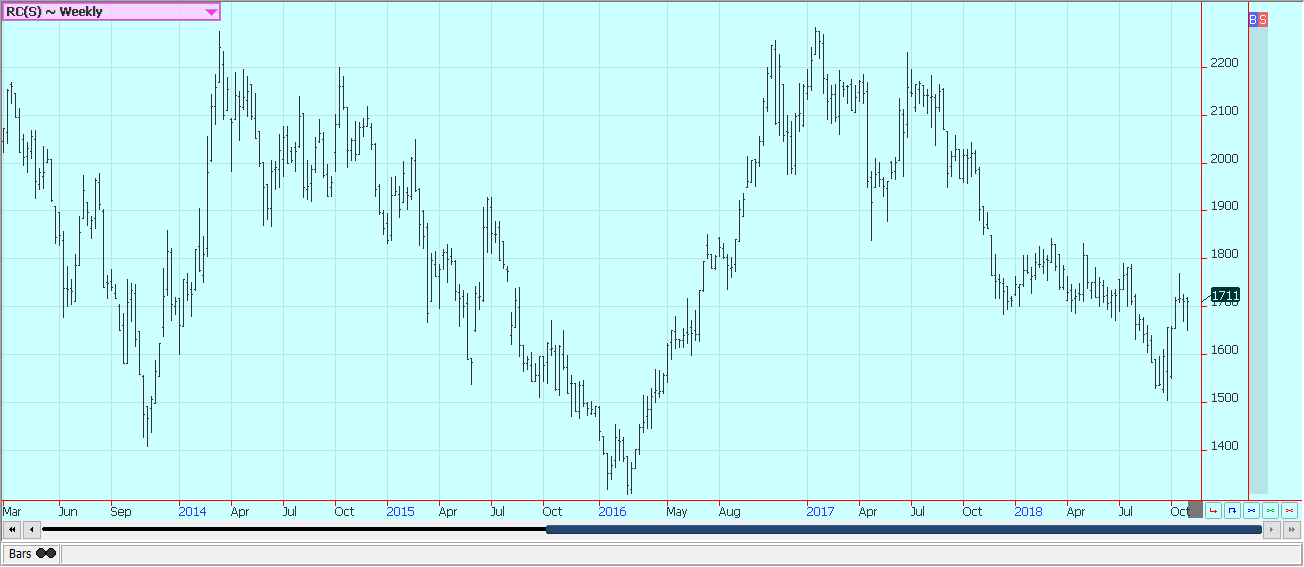

Weekly New York World Raw Sugar Futures © Jack Scoville

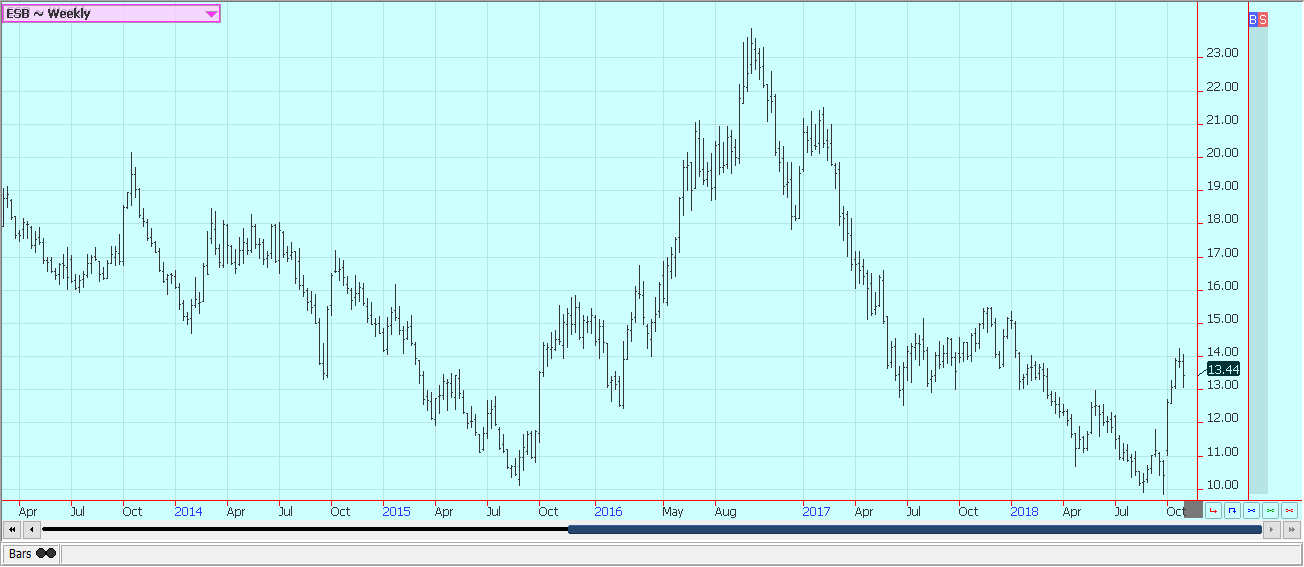

Weekly London White Sugar Futures © Jack Scoville

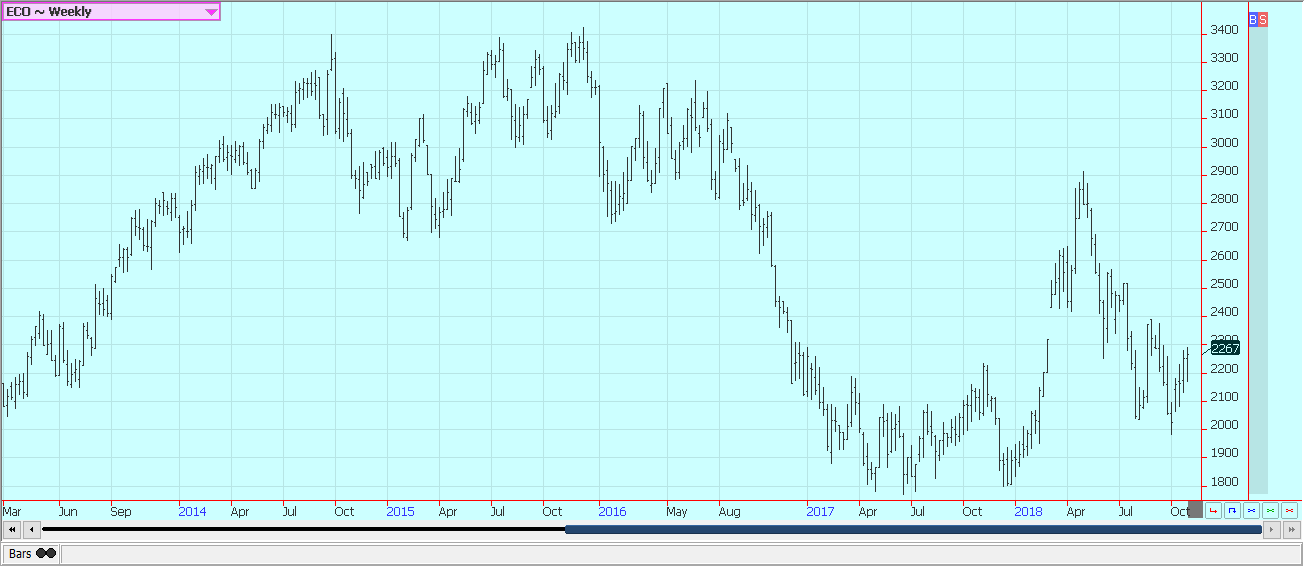

Cocoa

Futures closed higher in New York and lower in London as the new main crop harvest comes to market in West Africa. US Dollar weakness supported New York and hurt prices in London. Trends are sideways on the weekly charts for New York but are still up in London. The recovery has been impressive as it is time for offers from the West Africa harvest to start increasing.

The outlook for strong production in the coming year is still around, but there are some disease concerns for West Africa as a lot of humid air has promoted some concerns that Black Pod Disease could spread. In fact, initial harvest reports from Nigeria indicate reduced yields due to too much rain as the main crop was maturing. The main crop harvest is in its earliest stages in some parts of West Africa.

Main crop production ideas for Ivory Coast and Ghana are being reduced, with Ivory Coast now estimating its main crop production at 1.985 million tons, down from previous estimates just over 2.0 million tons. Conditions appear good in East Africa and Asia. Demand is said to be improving as offers from the new harvest start to increase.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

(Featured image by DepositPhotos)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Fintech2 days ago

Fintech2 days agoFindependent: Growing a FinTech Through Simplicity, Frugality, and Steady Steps

-

Impact Investing1 week ago

Impact Investing1 week agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

-

Impact Investing4 days ago

Impact Investing4 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

You must be logged in to post a comment Login