Featured

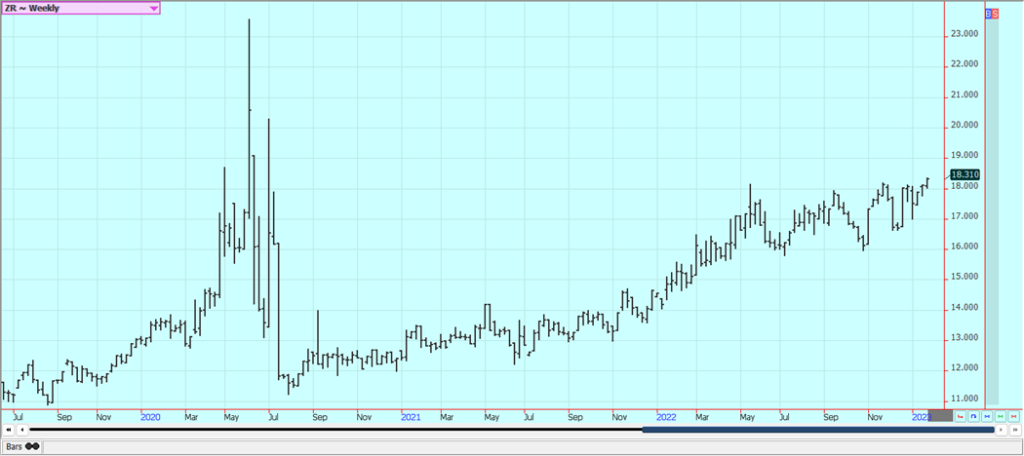

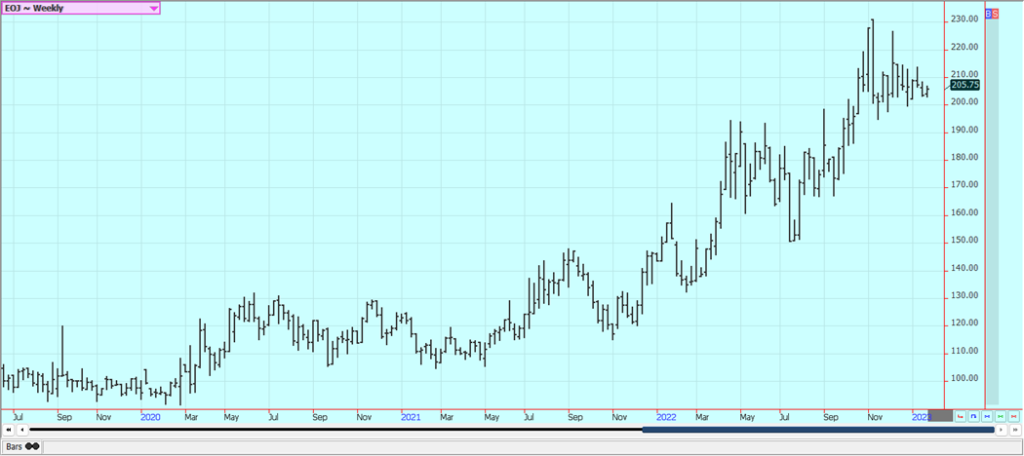

Rice Futures Were Higher in Both London and New York

Rice was higher again. Futures appear poised to test resistance above the market now. Demand should be a problem for bullish traders moving forward. There is not much going on in the domestic market right now although some Rice moved in Texas at what were called very good prices. Demand in general has been slow to moderate for Rice exports and solid for domestic uses.

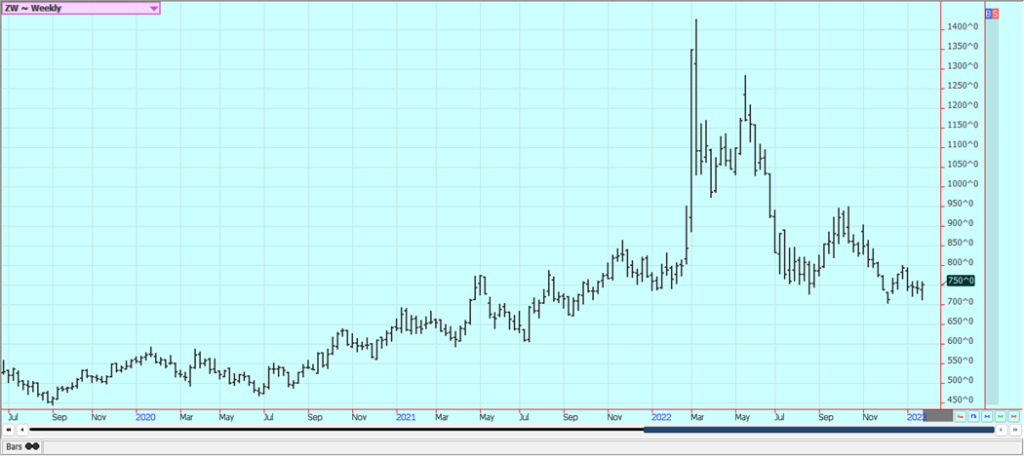

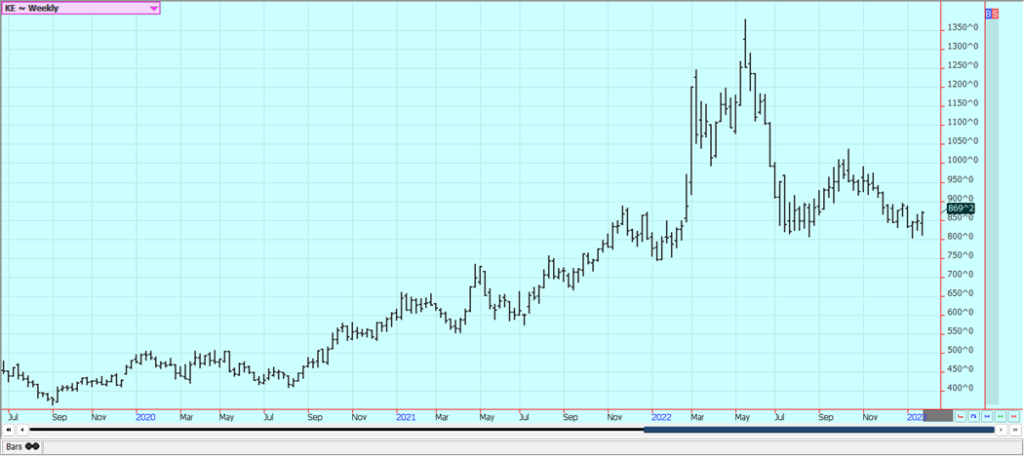

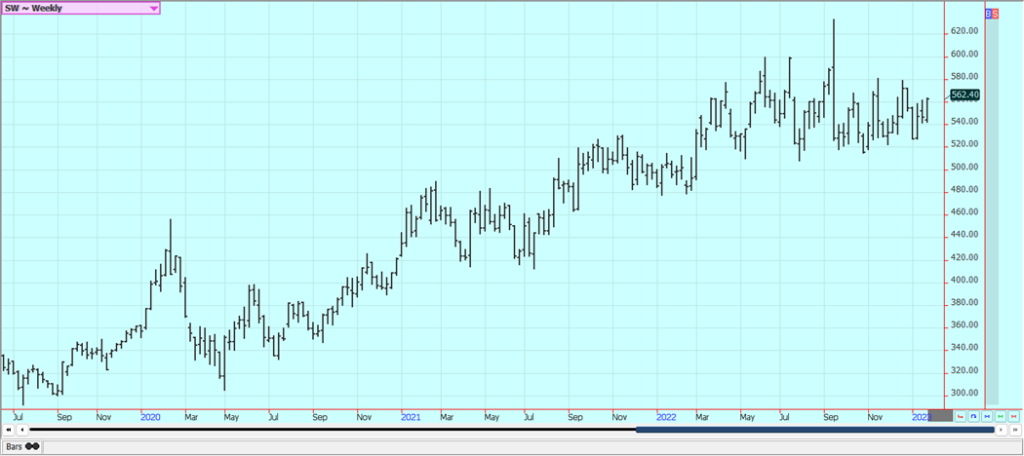

Wheat: Wheat markets were higher last week and trends are sideways in all three markets on the daily and weekly charts. Big Russian production goes against the difficulty of moving grain from the Black Sea due to insurance requirements, but so far the lack of insurance has not increased demand for US Wheat as the Russian Wheat is still moving. There are still ideas of weak demand and big Russian production that should help foster price weakness in the world market. The demand for US Wheat in international markets has been a disappointment all year and has been hindered by low prices and aggressive offers from Russia. Ukraine is also looking for new business for its crops and Russia is aggressive in the world market as it looks for cash to fund the war. The demand for US Wheat still needs to show up and there is still not enough demand news to help support futures.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

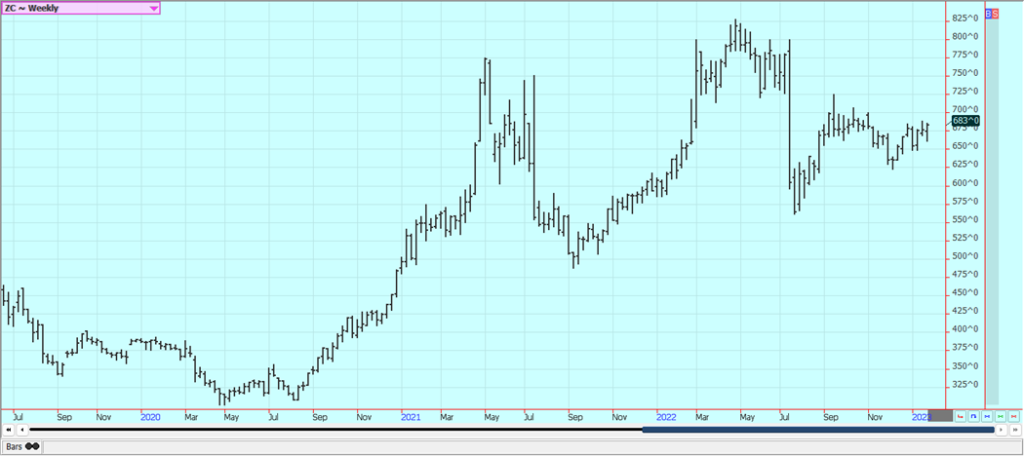

Corn: Corn and Oats closed higher last week and both markets remain in up trends established in early December. The export demand was solid last week even though demand remains well behind the pace to make USDA objectives. Brazil has been hanging on for its Summer crop although losses are now being reported. Argentina has suffered through some extreme drought. The Brazil Winter crop is harvested. The Summer crop and the Argentine crop is developing under stressful conditions. Weak demand overall for US Corn remains a big problem for the market. There are increasing concerns about demand with the Chinese economic problems caused by the lockdowns creating the possibility of less demand as South America has much better crops this year to compete with the US for sales. China is now moving rapidly to open the economy and allow people to move around with no lockdowns so the demand could start to improve. The improvement might take some time as the Chinese people get Covid, but they should be past this episode in a few weeks and demand might start to improve at that time.

Weekly Corn Futures

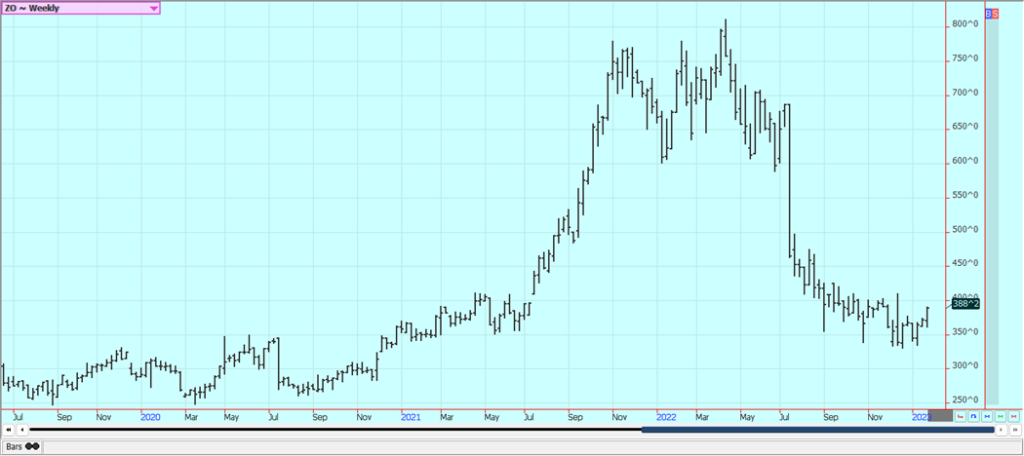

Weekly Oats Futures

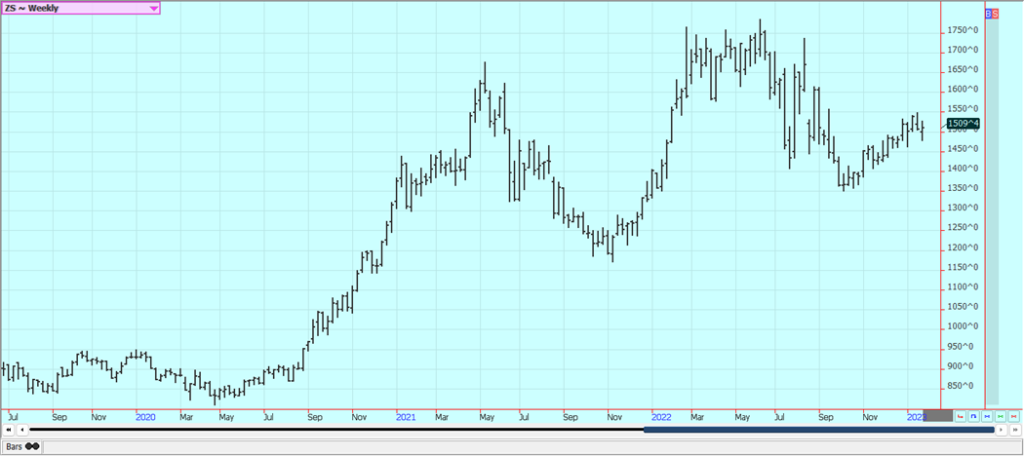

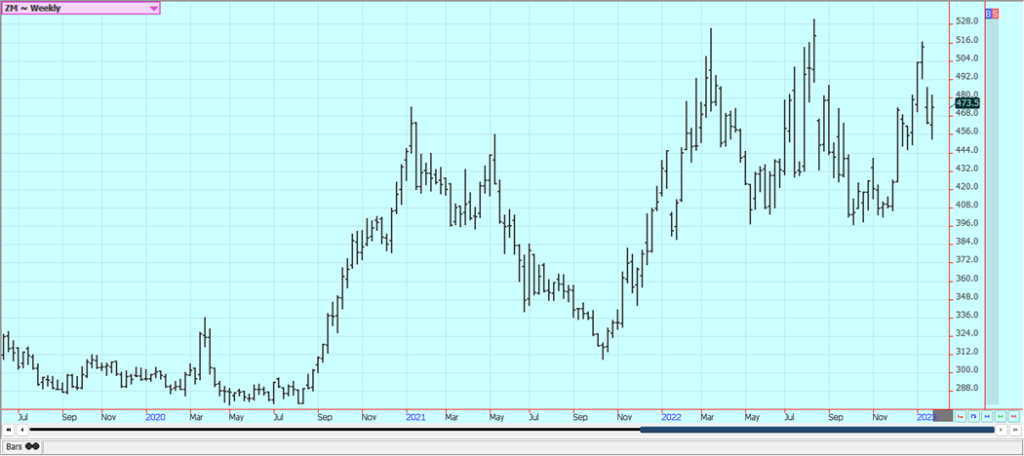

Soybeans and Soybean Meal: Soybeans and Soybean Meal were higher last week despite the news that Argentina and southern Brazil weather changed to a much wetter pattern over the weekend. More precipitation is expected. Price trends are mixed for Soybeans and Soybean Meal as the harvest in Brazil starts to expand in central and northern areas. The weekly charts show that Soybeans are trying to hold an uptrend line established in October while Soybean Meal seems to be bouncing off or support areas established a few weeks ago. Soybean Oil is still in a down trend. Current forecasts suggest that the showers currently in the forecast for early this week will make a real dent in the drought. Central and northern Brazil remain in very good condition with scattered showers reported. Production potential for the Brazil is called very strong even with potential problems and losses in the south. Even so, production of less than 150 million tons is possible now although most estimates remain near 153 million tons. Argentine production ideas continue to drop with the drought as planting is delayed and the crops already in the ground are stressed. Production estimates are now closer to 40 million tons than original projections near 50 million. Ideas that Chinese demand will improve, but this could take a few more weeks as a very large part of the population now has Covid. This has delayed a robust economic return for the country.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was higher again yesterday. Futures appear poised to test resistance above the market now. Demand should be a problem for bullish traders moving forward. There is not much going on in the domestic market right now although some Rice moved in Texas at what were called very good prices. Demand in general has been slow to moderate for Rice for exports and solid for domestic uses.

Weekly Chicago Rice Futures

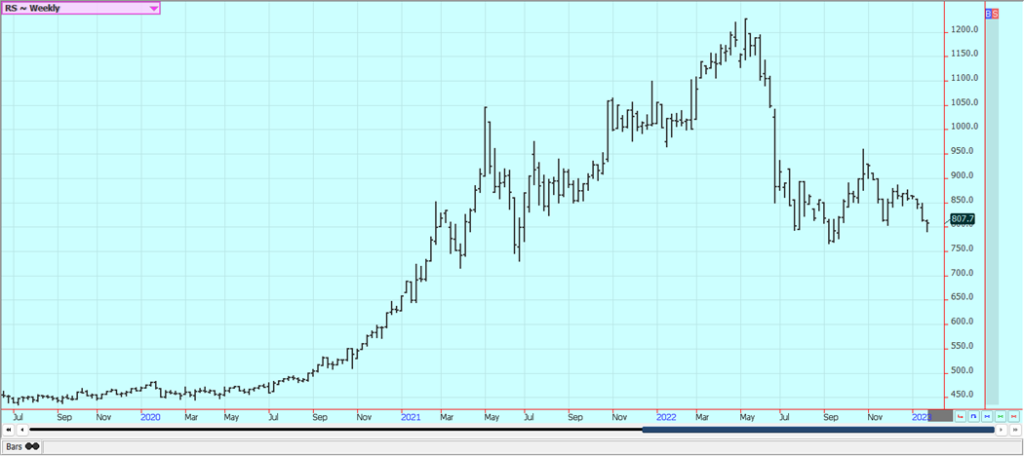

Palm Oil and Vegetable Oils: Palm Oil was sharply higher Friday on strength seen in world oilseeds markets but still closed a little lower for the week. Export demand remains less this month. Current forecasts call for the rainy season to end soon and for fieldwork and harvest conditions to improve. China has tried to relax some Covid restrictions so that the economy can start to function again. However, new outbreaks of the virus are being reported and infection rates are rapidly increasing but will start to decrease soon as most have now had Covid. Ideas are that supply and production will be strong, but demand ideas are now weakening and the market will continue to look to the private data for clues on demand and the direction of the futures market. There are still reports of too much rain in Malaysia. Canola was little lower last week. Reports indicate that domestic demand has been strong due to favorable crush margins. Production was much improved this year on better weather during the Summer.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was a little lower and still remains inside the trading range created since the beginning of November. Futures are showing bad demand fundamentals. Overall, the demand for US Cotton has not been strong although better demand has developed over the last couple of weeks. Some ideas that demand could soon increase as China could start to open its economy in the next couple of months as Covid outbreaks should start to weaken as people get vaccinated or immune. Covid is now widespread in China so the beneficial economic effects of the opening are being delayed but these effects should start to be felt as the people there achieve immunity over the next few weeks.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ was a little higher last week and is coiling to break out in one direction or the other as it remains in a trading range on the weekly charts. Trends are mixed as the market has fallen back into a trading range after making a spike high after the reports were released. Demand should start to improve now with the holidays now over. Historically low estimates of production due in part to the hurricanes and in part to the greening disease has hurt production remain in place but are apparently part of the price structure now. The weather remains generally good for production around the world for the next crop but not for production areas in Florida that have been impacted in a big way by the two storms. Brazil has some rain and the conditions are rated good. Mostly dry conditions are in the forecast for the coming days.

Weekly FCOJ Futures

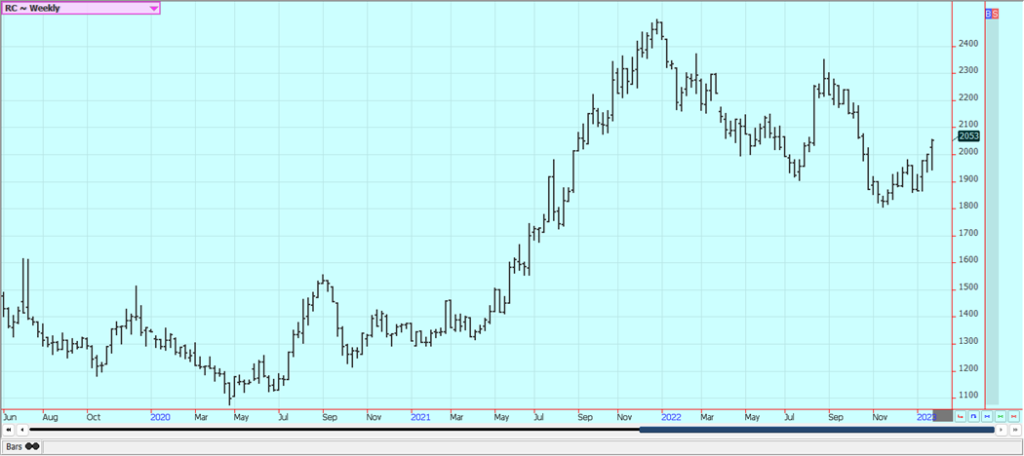

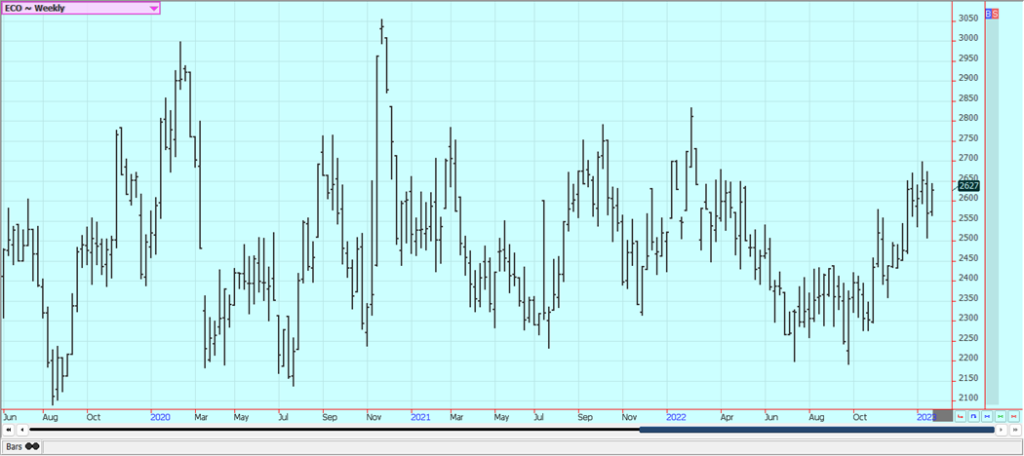

Coffee: New York and London closed higher last week. The weekly charts show that New York rejected a move to new lows two weeks ago and now is trying to complete a bottom that could be significant to medium-range pricing. London weekly charts show a market that has been working a little higher almost every week since November. Ideas of a big production for Brazil continue due primarily to rains falling in Coffee production areas now and as offers stayed strong from Brazil and increasingly from Vietnam. Ideas are that the buy side needs Coffee now. There are ideas that the production potential for Brazil had been overrated and reports of too much rain in Vietnam affected the harvest progress. The weather in Brazil is currently very good for production potential but worse conditions seen earlier in the growing cycle hurt the overall production prospects as did bad weather last year. Ideas are that the market will have more than enough Coffee either way when the next harvest comes in a few months.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

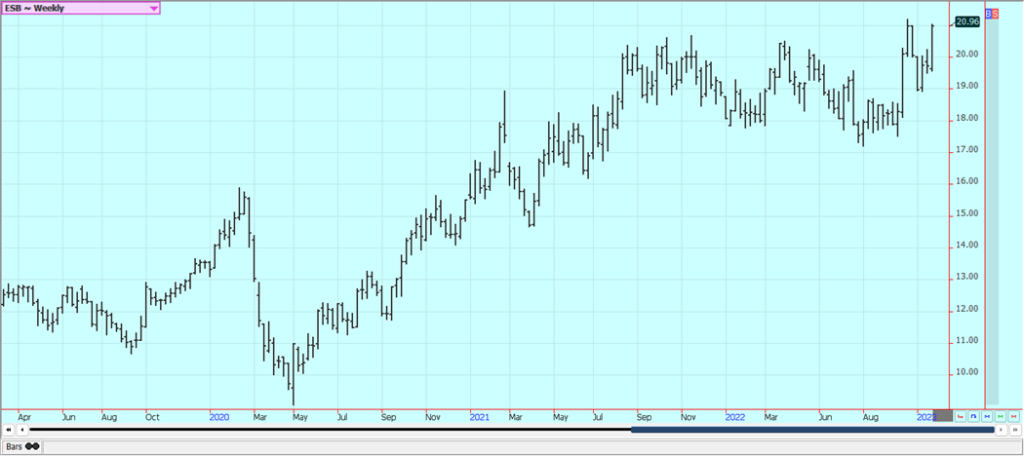

Sugar: New York and London closed higher last week and chart patterns indicate that prices can move higher again this week. The weekly charts show that New York is about to challenge recent highs at 2118 March while London charts show that futures are trending to the upper end of a trading range that has held since September. Rains have returned to much of southern Brazil since the weekend. Cane production prospects should be improved. Good production prospects are seen for crops in central and northern areas. The harvest has been delayed in Thailand. Australian and Central American harvests are also delayed. There is talk that production in India will be reduced this year after some bad weather and reduced yields reported in Maharashtra. Ideas are that India will produce about 34.3 million tons of Sugar this year, about 4% less than the previous outlook.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

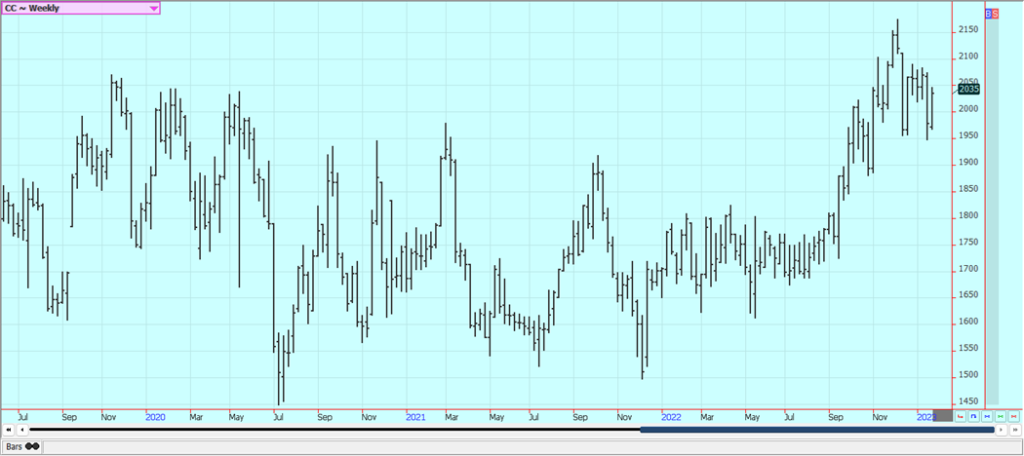

Cocoa: New York and London closed higher last week and the weekly charts of both markets show that futures are back inside the middle of a trading range after rejecting significant probes lower. Weaker demand is shown by the grind data that got released last week. The talk is that hot and dry conditions reported in Ivory Coast could curtail mid-crop production, but main crop production ideas are strong. Ghana has reported disease in its Cocoa to hurt production potential there. The rest of West Africa appears to be in good condition. The North American grind was 8.1% lower and the EU and Asian grinds were about 2% lower. Good production is reported for the main crop and traders are worried about the world economy moving forward and how that could affect demand. Supplies of Cocoa are large at ports. The weather is good in Southeast Asia.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by allybally4b via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoThe Youth Program at Enzian Shooting Club Is Expanding Thanks to Crowdfunding

-

Africa1 day ago

Africa1 day agoMorocco’s Industrial Activity Stalls in January 2026

-

Crypto1 week ago

Crypto1 week agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Crypto6 days ago

Crypto6 days agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi