Featured

Are there any risks to making a Bitcoin investment?

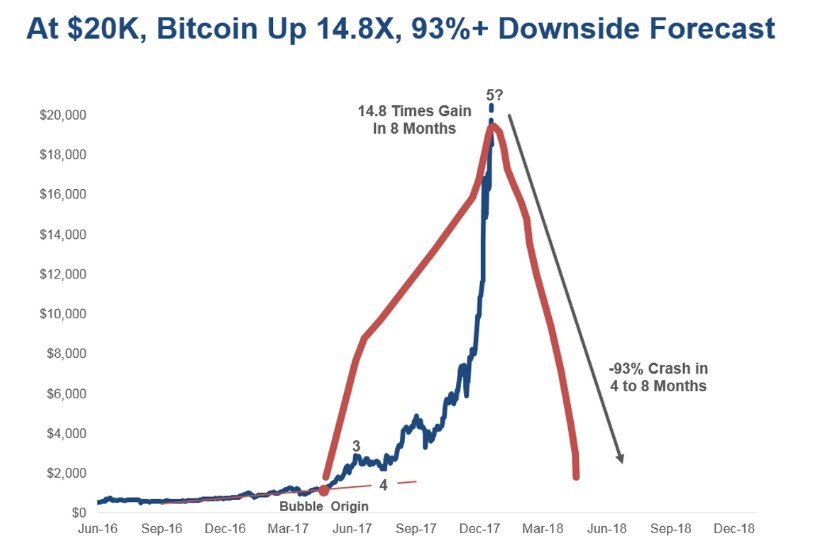

As Bitcoin prices become steeply inflated, the potential for collapse is inevitable.

The Bitcoin bubble looks a lot like the internet bubble that inflated in the final phase—the orgasm—the great tech bubble of December 1994 into March 2000. It crashed faster and harder than the Nasdaq bubble—down 93 percent compared to 78 percent. It was also a leading indicator for the Nasdaq crash as it only retested its January high rather than exceeding it.

The internet bubble went up 7.5 times in just 16 months. At close to $20,000, Bitcoin has gone up 14.8 times in just eight months.

That’s twice as high in half the time!

It’s now the steepest and most extreme bubble of all time. Literally. It’s even surpassed the infamous tulip bubble of the 1630s, which is similar to the Bitcoin bubble because it too had little against which to measure any real value.

At least we could calculate the price-to-earnings ratio on the Nasdaq or AOL. But there’s no measure of valuation on these digital coins. So, like tulips, its price is only a function of what people are willing to pay.

It’s not all totally speculative though. There are two tools we can use to try to get some handle on this extreme bubble.

The first comes from the lost chapter of my “Sale of a Lifetime” book.

The most important calculation for estimating the downside of a bubble, even before it peaks, is the bubble origin. But that’s not the last major low. Instead, it’s the point at which the market starts to diverge from the fundamental trends.

Look at the Bitcoin chart:

© Harry Dent

The bubble origin for Bitcoin was at $1,355 on April 24, 2017.

That means that, from the most recent high of $19,395 (at least at time of writing), this bubble could shed 93% to return to that point of origin, which is what bubbles typically do when they burst.

That’s a massacre!

As an aside, Ethereum’s bubble origin was at $51. It has had similar gains to Bitcoin, reaching 14.4 times gain at its recent highs. A crash from $733 would represent the same 93% downside.

And the higher the highs get, in both Bitcoin and Ethereum, the more devastating the collapse will be.

The second tool with which to get a handle on this bubble is Elliott Wave patterns (which I’ve marked up on the chart above as well).

The first surge or Wave 1 peaked on November 30, 2013 at $1,082 (note that is not shown on the chart but was a clear first peak).

The second wave correction bottomed at $203 on January 14, 2015 (also not shown on the chart).

The middle and steeper surge or Wave 3 peaked at $2,840 on June 9, 2017.

The fourth wave correction, into $2,162 on July 17, 2017, marked the best place to buy into the most powerful fifth wave bubble, which we are currently experiencing. Gains since then have been a whopping nine-fold!

At this point, it’s far too late in this bubble to get in. Don’t worry, there are plenty of other opportunities out there and, once this Bitcoin bubble has burst, you’ll have a second chance to invest (although it’s unlikely we’ll see highs like this as quickly the next go around).

The most important question now is: When do you get out?

I suggest setting a stop loss level just below the trendline of higher lows, at $16,500. That’s about 20% below that $20,000 mark.

All bubbles burst with mind-numbing swiftness, so if you’re going to stick with your Bitcoin investment to ride along for any potential future gains, at the very least, make sure you have an exit strategy.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]

-

Business1 week ago

Business1 week ago2.5 Billion People Watch Quiz Shows Every Day. Masters of Trivia (MOT) Is Letting Them Compete

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets

-

Crypto3 days ago

Crypto3 days agoMiddle East Tensions Shake Crypto as Bitcoin and Ethereum Slip

You must be logged in to post a comment Login