Business

Russia leads global wheat market; US exports likely to struggle because of dollar

The US dollar may be increasing in value however US wheat exports are falling.

The internet is full of Russia, Russia, Russia and it’s not political this time. It’s about wheat and it’s worth noting that the mighty Russians have firmly secured the crown of the global wheat market. Not a great headline to read after a USDA gut punch to the corn market last week.

However, one of the bright spots of the corn’s WASDE report was exports. Increasing by 75 million bushels, the USDA also raised feed and residual to help keep the balance sheet from posting a massive 2.5XX ending stock.

After beating up the corn balance sheet, the USDA gave a friendly pass on wheat. Not only did US ending stocks fall but so did global wheat stocks; unlike corn and soybeans which saw growing global balance sheets.

Then came Monday. The wheat complex started the Sunday evening session under pressure throughout the night and didn’t get much relief after the morning break. Re-opening at 8:30 am, central time, selling pressure remained strong. Pitiful export inspections of only 301,039 metric tonnes (MT), wheat requires 513,275 per week to meet the USDA target of 27.22 million metric tonnes (MMT) or 1 billion bushels. Another line item the USDA raised in its November WASDE. US domestic use of hard red spring wheat was raised as well as exports for hard red winter wheat.

The greater sadly is if these export increases are justified. After export inspections today, soybeans stand at 27.7% versus the five-year average of 28.7 percent. Corn is at 12.6 percent versus 16.3 percent and wheat is at 44.2 percent versus 47.1 percent. Trailing their 5-year averages by 1.0 percent in soybeans, 3.7 percent in corn and 2.9 percent for wheat.

Export sales are dragging along as well with soybeans behind their five-year average by 14.0 percent; corn behind by 4.7 percent and wheat behind by only 0.6 percent. Now, the wheat outlook is appearing better, however, sales can be canceled or delayed.

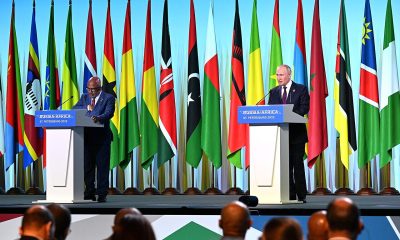

US export sales are dragging along since 1990 while Russia is starting to dominate the global wheat market. (Source)

Export demand decline

Since 1990/91 the US has been losing, on average, 70,000 MT in export demand. Unlike corn and soybeans which gained on average 187,000 MT per year for corn and a massive 1.707 MMT per year for soybeans. Even more, concerning for wheat; like corn and soybeans, the US is losing its place as dominating the global production scene. Thus, making the world less reliant on US crops.

Then add in surprisingly high yields from the Dakota’s to Iowa, mid-summer weather premium might be hard to come by, not only for wheat but corn as well. Both markets continue to be each other’s anchor and while the hopes of a heavily short managed money could spark a short covering rally, that might be the worst case as it would re-position them to lean into the short side again.

Rallies, albeit limited, maybe a gift for bushels sitting around collecting storage fees. In the event of a short covering rally, the Dec17/Dec18 spread has been stretched far; given slacking exports, deferred contract months may continue to make new contract lows as they approach. Dec18 is currently trading near 386 with March 19 near 395.

While the USDA offered longer-term hope to the markets with increasing exports, the global landscape is much less dependent on the tried and true stability of the US production line.

With the US dollar appearing to be heading higher, exports are likely to struggle in the near future.

However, all of this is known and has been known for some time now. Russian headlines today didn’t create new contract lows and even corn’s ability to hold 340 in the face of record yields was able to hold its ground.

The best cure for low prices is low prices in the sense of either more demand or less production. Global demand continues to rise while our competitive edge fades.

—

DISCLAIMER: Trading commodity futures and options involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge and financial resources.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoNewcleo Raises $85 Million to Advance Fourth-Generation Nuclear Reactors

-

Markets2 days ago

Markets2 days agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Biotech1 week ago

Biotech1 week agoDNA Origami Breakthrough in HIV Vaccine Research

-

Cannabis6 days ago

Cannabis6 days agoWhen a Cutting Becomes a Cannabis Plant: Court Clarifies Germany’s Three-Plant Rule

You must be logged in to post a comment Login