Crypto

RWA Tokenization Is Taking Off + 3 Ways to Get Exposure Now!

Right now, billions are flowing into tokenized real-world assets, and this is just the beginning, with Boston Consulting Group forecasting RWA tokenization is on track to become a $16 trillion market. Here we look at three ways you can get exposure today, from direct RWA plays to traditional stocks and RWA blockchain tokens like $RIO and $PROPS to set yourself up for colossal gains.

If you want to make serious money, there’s really only one way to go about it: get ahead of the “next big thing” before it takes off.

So what’s the next big thing?

That’d be Real World Asset Tokenization, or RWA tokenization for short.

If you don’t believe me, hear me out for a second.

Here’s a Major Signal RWA Tokenization Is the Next Big Thing

To see the signs that RWA tokenization is the next big thing, let’s start by taking a look at the “last big thing” — generative AI.

Back in the day — well, a couple of years ago — the biggest names in finance were all over generative AI. Goldman Sachs, for one, said it was going to boost GDP by 7% and replace 300 million jobs.

Fast forward to June of this year, and Goldman did an about-face. They said AI was “too much spend, too little benefit”.

Now, let’s imagine you’d bought into the generative AI hype right as Goldman and co. were pumping it and you bought, let’s say, a bunch of Nvidia [NASDAQ: NVDA] shares.

Today, you would’ve made 4x-10x, depending on how early you got in.

Now imagine you’d bought right at the moment Goldman declared AI was “too much spend, too little benefit.”

If you did that, you’d be lucky to be at break-even today — Nvidia’s pretty much gone sideways since.

Looks like keeping your ear to the ground and paying attention to where the big money’s flowing has a way of paying real dividends.

And here’s what you’d be hearing if you were doing just that:

- The month after GS went cold on generative AI, the 150-year-old beast decided it was all in on RWA tokenization instead, and announced the launch of three tokenization funds by the end of this year.

- BlackRock is reportedly on track to tokenize $10 trillion worth of RWAs. And that’s not just empty talk, either. They launched their first fund in April this year (BUIDL — BlackRock USD Institutional Digital Liquidity Fund Token) and, just a few months later, it’s already crossed the $500 million mark.

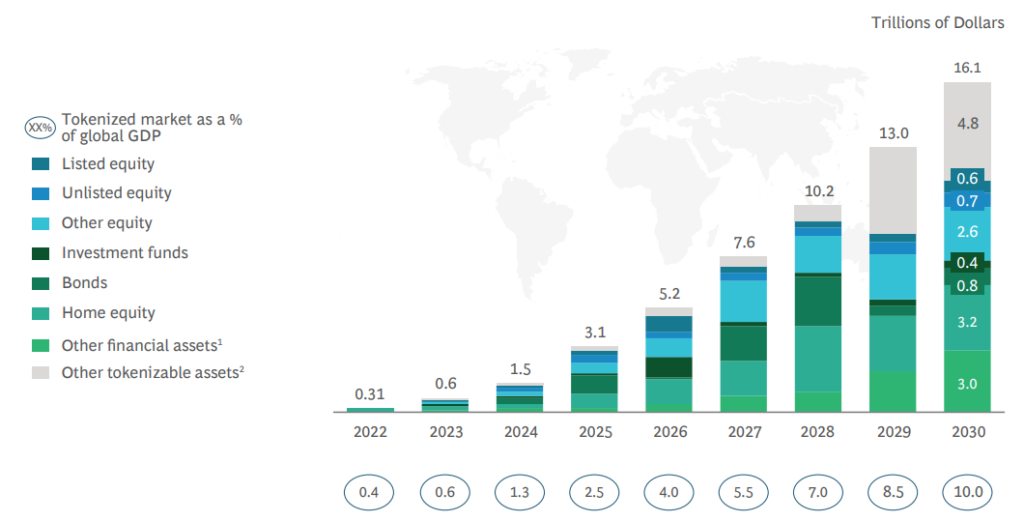

- The Boston Consulting Group forecasts that RWA tokenization will be a $16 trillion market by 2030.

Read those last two again.

Especially that last one: $16 trillion by 2030. Here’s a chart of how that looks:

To put that into perspective, that $16 trillion figure is bigger than the combined market cap of every big tech company (Microsoft, Nvidia, Google, Apple, Meta, Netflix, etc.).

It’s also equivalent to 30% of the entire US stock market ($55 trillion).

Or, even more shockingly, it’s also equivalent to 55% of the US GDP ($28.6 trillion).

That’s mind-numbingly huge.

So why’s nobody really talking about it?

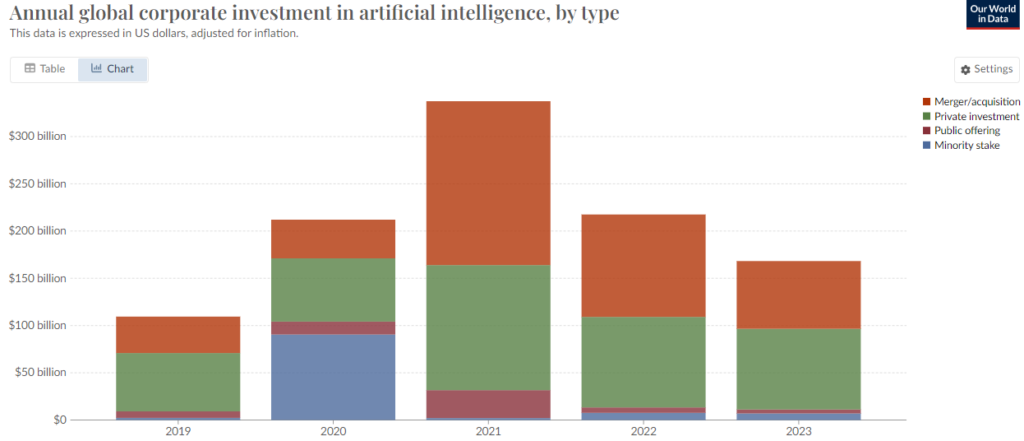

Well, remember back to 2021 and early 2022? Back then, no one was really talking about generative AI apart from smart money insiders, who were all piling money into AI. (Surpirse, surprise, guess who was cutting 8-figure venture deals with AI startups like AlphaSense and Aisera back then? Yep, Goldman Sachs.)

But then, suddenly, ChatGPT dropped and everyone wanted in.

The market exploded.

Anyone who got in early made mega bucks.

And now the exact same thing’s about to happen with RWA tokenization.

Q: Why’s RWA Tokenization So Hot?

Alright, I’m not going to delay the answer to this one. So here it is.

A: Because Rich People Love It!

If you were waiting for me to drop the usual crypto/blockchain spiel about how RWA tokenization will lead to “democratization”, “decentralization”, and a bunch of other “for the people” stuff, then sorry, but I’m about to disappoint you.

The major reason why RWA tokenization will go to the moon is because rich people love it.

Seriously.

To understand why, go take a look at the Boston Consulting Group paper I linked earlier. In it, they raise something really important — in the US, the majority of assets held by institutions and HNW individuals are illiquid.

BCG also notes that “all else being equal, illiquid assets typically trade at a discount vs. liquid assets.”

Said another way, the more liquid an asset becomes, the more valuable it becomes.

Or, in other words, increasing liquidity = free money.

So now you understand why all the big-money players love RWA tokenization. The moment their illiquid assets get a liquidity boost, they get richer.

So how does RWA tokenization create liquidity?

Well, let’s start with the problems that drive illiquidity. Again, I’m going to paraphrase BCG for this:

- High Entry Cost: Large ticket sizes ($250,000 to $5 million) limit affordability for most investors.

- Inability to Fractionalize: Difficulty in sharing the utility of assets among many investors.

- Information Gap: Knowledge gaps prevent investors from accessing certain assets.

- Restricted Access: Many assets often remain exclusive to elite groups.

- Regulatory Barriers: Restrictions on investment eligibility and foreign investor limitations.

- Complex Access Process: Complicated procedures across multiple platforms without a unified interface.

- Lack of Scalable Technology: Absence of advanced solutions to unlock liquidity for such assets.

Now let’s work through that list one by one to see how RWA tokenization solves it.

- High Entry Cost: RWA tokenization is specifically designed to fractionalize assets, leading to lower entry costs.

- Inability to Fractionalize: See above.

- Information Gap: This is the one thing RWA tokenization doesn’t solve, per se. But, with the power to invest comes the interest in doing research, so this gap will close. (See the list of ways to get RWA tokenization exposure below for a great example of this.)

- Restricted Access: Two big reasons for restricting access to certain assets are a high entry price combined with illiquidity. See #1 and #2 for how RWA tokenization fixes this.

- Regulatory Barriers: Again, RWA tokenization doesn’t solve this per se.

- Complex Access Process: The best RWA tokenization platforms have already simplified the process of investing in alternative assets to the point that it’s more or less like buying shares.

- Lack of Scalable Technology: Until the NFT boom woke the finance community up to the true power of blockchain, technology was a problem. Today, the same tokenization technology is being used to fractionalize legitimate, real-world assets with real-world value.

Basically, RWA tokenization is the magic pill that cures 90% of the problems that create illiquid assets.

So let’s recap what we have so far:

- Most assets held by HNW individuals and institutions are illiquid.

- Illiquidity deflates asset values.

- This gives holders of illiquid assets the motivation to find ways to improve liquidity.

- RWA tokenization will unlock massive liquidity for any asset class that it touches.

And that is why so much big-money money is pouring into RWA tokenization right now, even if you’ve barely heard about it.

Do you wanna see what happened last time a bunch of insider money started flowing into something?

Take a look at this graph (source):

If you look closely, you’ll see investment in AI peaked in 2021. ChatGPT hit in 2022. And the rest, as they say, is history.

Or, said another way, if people with money want something bad enough, they’ll just keep throwing money at it until they get it.

And you can bet they want RWA tokenization just as much as they want AI.

3 Ways to Get Exposure to RWA Tokenization Now

Here’s the bit where all of this RWA tokenization goodness gets even better.

If you’d had your ear to the ground in 2021 and had realized that AI was about to go bananas, there wasn’t a lot you could put your money into at the time, aside from a small handful of stocks.

With RWA tokenization, however, things are looking very different.

Now, admittedly, some of the opportunities coming onto the market are relatively boring — see BlackRock’s contribution to #1 below for this. But, as for the others, that’s a whole other story. Things are about to get big.

So here’s three ways to invest in RWA tokenization today.

#1 — Invest Directly in Tokenized Assets

While it’s still early days, tokenized real-world assets are already starting to come onto the market.

BlackRock is probably the biggest name here with its BUIDL Fund. But, this is also one of the more boring opportunities. That’s because the fund is focussed on cash and cash-equivalent assets like US T-Bills — a nice way to earn a safe, single-digit percentage return on your money, but nothing to get too excited about.

However, there are way more exciting opportunities there.

One of the best examples here is the reinsurance tokens (DeltaCat Re and EpsilonCat Re) being issued by SurancePlus, an Oxbridge Re [NASDAQ: OXBR] subsidiary. Their first issuance returned a staggering 49% return in its first year. And this year’s issuance is forecast to hit a 42% return.

#2 — Invest in RWA Blockchain Tokens

Blockchain is the technology powering the RWA tokenization movement. And that means tokens are what powers the actual buying and selling — the settlement — of RWA assets.

Think about it like this — if you wanted to buy NFTs back in the day, then 99% of the time, that meant transacting in Ethereum.

Of course, as much as that worked for NFTs, Ethereum has a couple of major issues. The first is that it was never really built with RWA tokenization in mind, meaning it lacks important features. And then, more critically, there’s that scaling problem it has — a major issue if, as Boston Consulting Group forecasts, RWA tokenization is going to be worth as much as 55% of US GDP ($16 trillion by 2030).

To solve this, a bunch of new blockchains tailored to RWA tokenization have since cropped up.

One example is Avalanche — a blockchain built specifically to meet finance industry requirements. It’s also the blockchain on which SurancePlus issued its first round of reinsurance tokens on (although SurancePlus has since changed, but we’ll get to that later).

Avalanche isn’t the only one, either. To name just a couple more, there’s also Propbase and the Realio Network, both of which are quickly gaining a big foothold in the enormous RWA tokenization movement.

And yes, everything I’ve just listed above has a token you can buy. Avalanche has $AVAX, Realio has $RIO, and Propbase has $PROPS.

As for what makes each of these tokens so interesting is that their value is fundamentally tied to how many assets are tokenized on their respective blockchains. The bigger RWA tokenization gets, the bigger the value of these tokens gets.

#3 — Invest in Traditional Stocks

Okay, so investing in traditional stocks probably wasn’t what you were expecting here. But, if you do your research, some of the biggest gains are going to be found here.

How?

Well, we looked at one of these opportunities just three months ago — Oxbridge Re [NASDAQ: OXBR], the parent company of SurancePlus. (And yes, that’s the SurancePlus we were talking about just before — the SurancePlus that delivered its token investors a 49% return in one year.)

At the time, we were conservatively estimating Oxbridge will 4x with RWA tokenization, but more realistically 10x or more. The logic here was reasonably simple. I’ll summarize it here (but do take a look at the article for all the details):

- Comparing SurancePlus (Oxbridge Re’s tokenization subsidiary) to fundamentally similar, but standalone tokenization startups showed SurancePlus alone is worth more than Oxbride’s entire market cap.

- However, Oxbridge investors are failing to see Oxbridge as anything other than a boring old small-time reinsurance company.

Since we did that analysis, not much has changed. Our conviction is still the same — Oxbridge Re [NASDAQ: OXBR] is still undervalued by at least 10x.

What has changed, however, is a little thickener has been added to the plot.

First, Oxbridge issued this PR, announcing it was seeking “strategic alternatives”. In that PR, Oxbridge made a pretty big deal about RWA tokenization in general, including its SuracePlus subsidiary.

Then, just last month, Oxbridge issued another PR, this time talking about its intention to attend a bunch of RWA tokenization events.

What’s most interesting here, however, has nothing to do with the events. Instead, it’s the fact they’re appearing alongside another RWA tokenization player they’re referring to as a “strategic partner”. That partner, ZoniqX, is one of the leading RWA tokenization platforms right now. We’ve since seen this “strategic partner” language cropping up a bunch of times.

Now, obviously, all we’ve got to go on is two Oxbridge PRs. The first said they were looking for “strategic alternatives”. The second said they had a new “strategic partner”. But, if I were you, I’d be keeping a very close eye on this.

A really close eye.

At the moment, my best guess is that one of two things will happen:

- SurancePlus and ZoniqX will merge.

- SurancePlus and ZoniqX are looking to combine forces to massively scale up the tokenization of RWAs.

In either case, the partnership makes sense.

SurancePlus brings the TradFi know-how needed to deal with the complexities of tokenizing traditional RWAs.

And ZoniqX has the platform that allows SurancePlus to execute on its know-how and sell that product to investors.

Put the two together working hand in hand, and there’s a very good chance that, once its industry event schedule calms down, we’re about to see some major activity from these two.

__

(Featured image by Geralt via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Cannabis1 week ago

Cannabis1 week agoColombia Moves to Finalize Medicinal Cannabis Regulations by March

-

Markets4 days ago

Markets4 days agoMiddle East Escalation Sparks Market Uncertainty as Oil and Gold Poised to Rise

-

Cannabis2 weeks ago

Cannabis2 weeks agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions

-

Fintech2 days ago

Fintech2 days agoMeta Plans New Dollar-Backed Stablecoin for Facebook, Instagram, and WhatsApp