Business

Soybean, cotton markets hope for US-China trade resolution

The United States and China are expected to conduct more meetings this week. Markets wait for both countries to reach a trade dispute resolution.

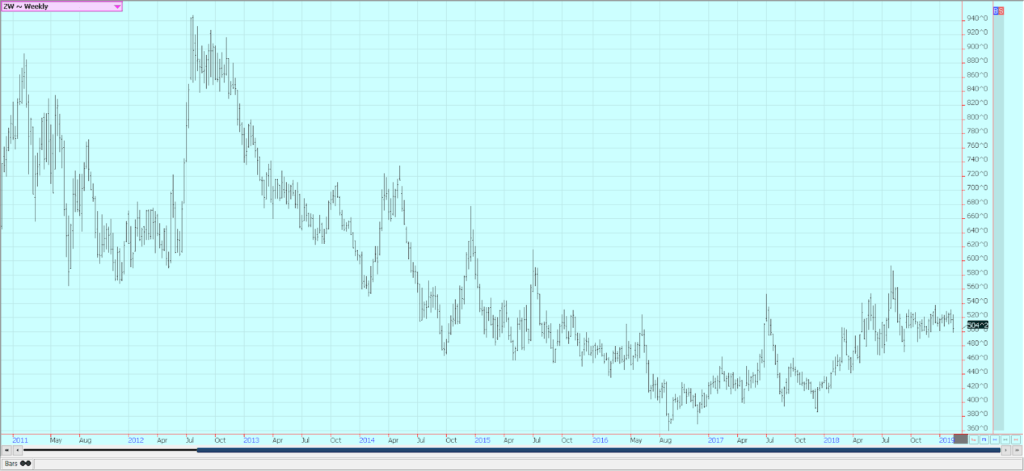

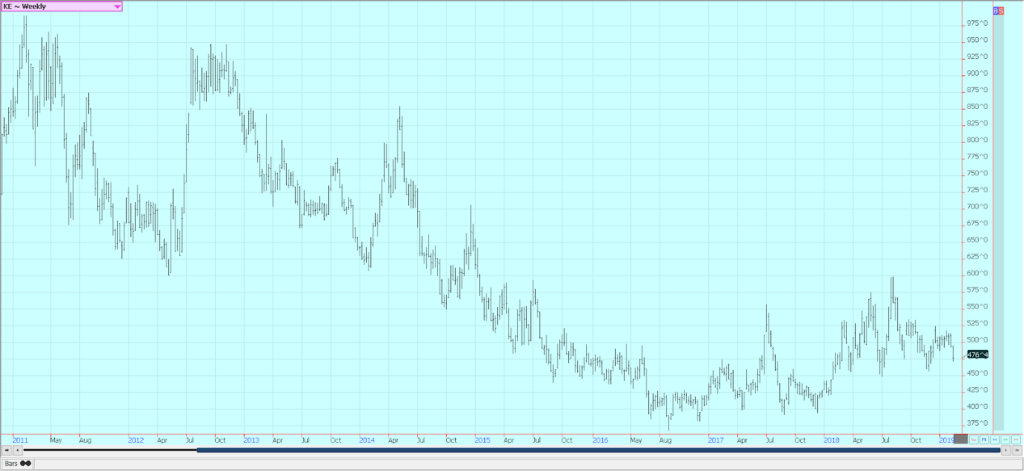

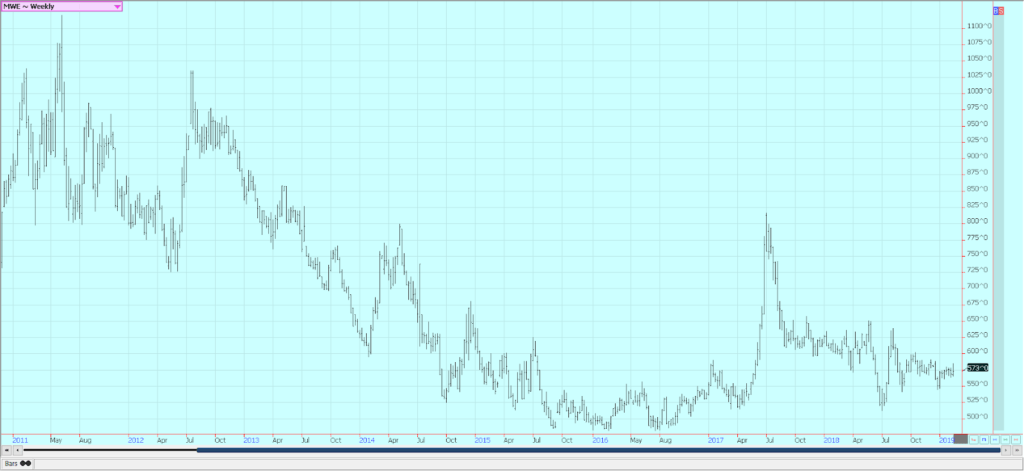

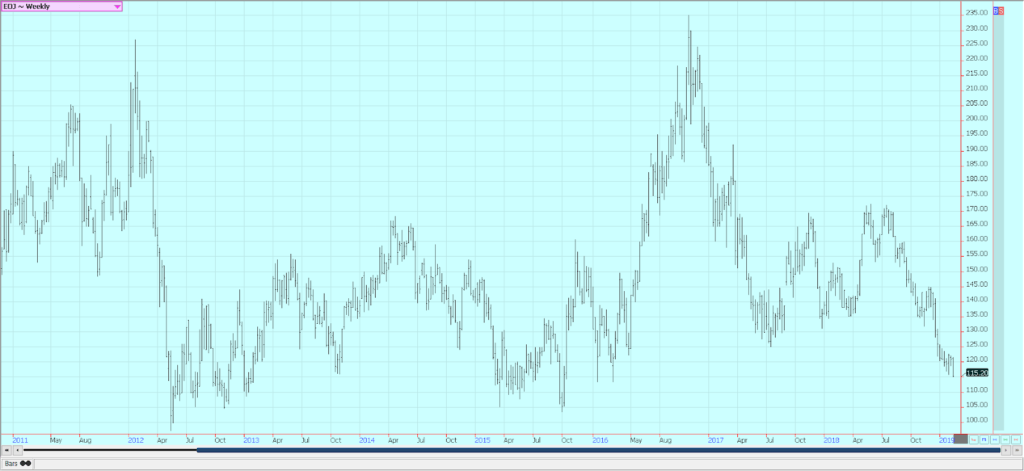

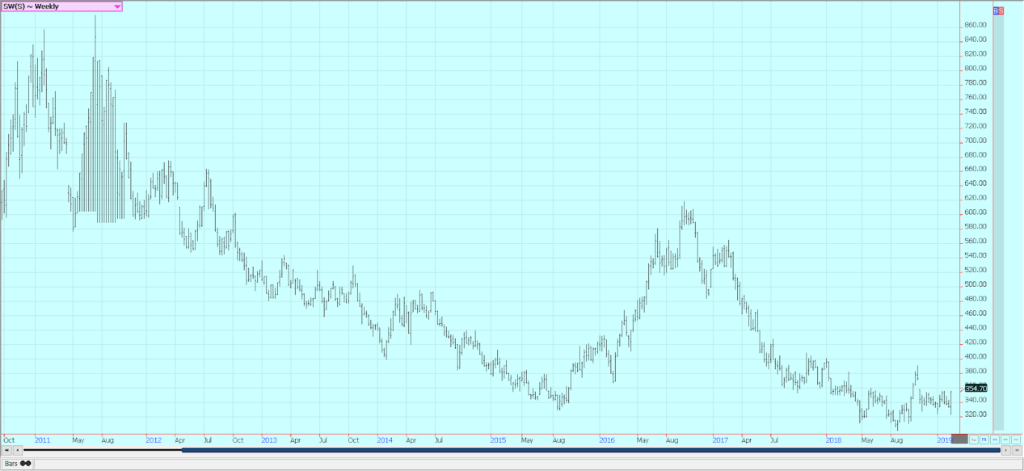

Wheat

Winter wheat markets were a little lower on Friday and mixed for the week. Chicago winter wheat markets were lower on speculative selling based on the lack of demand and the stronger US dollar. World wheat prices were softer as well. Minneapolis spring wheat markets held firm amid very cold weather in the northern US Great Plains and the Canadian Prairies. Attitudes on wheat prices remain generally positive, but the price trends in Chicago have started to turn down, and only Minneapolis is holding any strength on the daily and weekly charts.

The wheat seedings report was below trade projections and showed a decrease in planted area at 31.3 million acres for All winter wheat. The smaller planted area came because of very bad planting weather in the Great Plains and Midwest and low prices. The fall season in both regions featured a lot of rain that hurt harvest and planting all season long.

Wet weather has continued for much of the winter, and it is likely that the crop will have good soil moisture to work with as it comes out of dormancy in the next month. World wheat prices have been sideways to lower recently, and the US dollar has been strong. The stronger US dollar has hurt the competitive position of US wheat in the world market. Russia continues to export wheat, and France just made a big sale to Algeria last week.

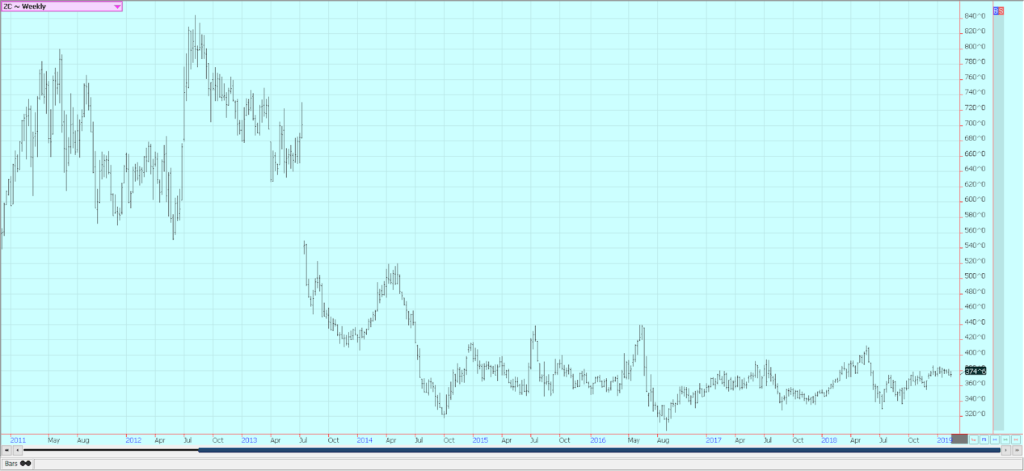

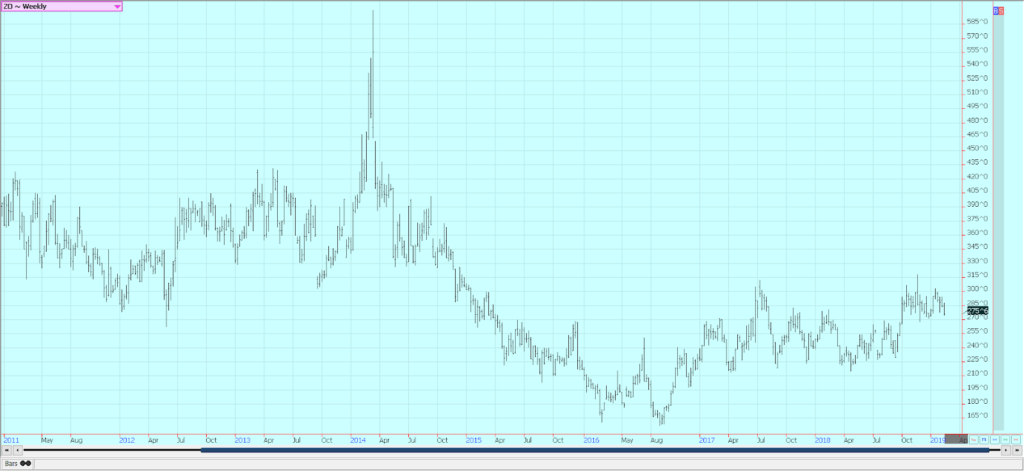

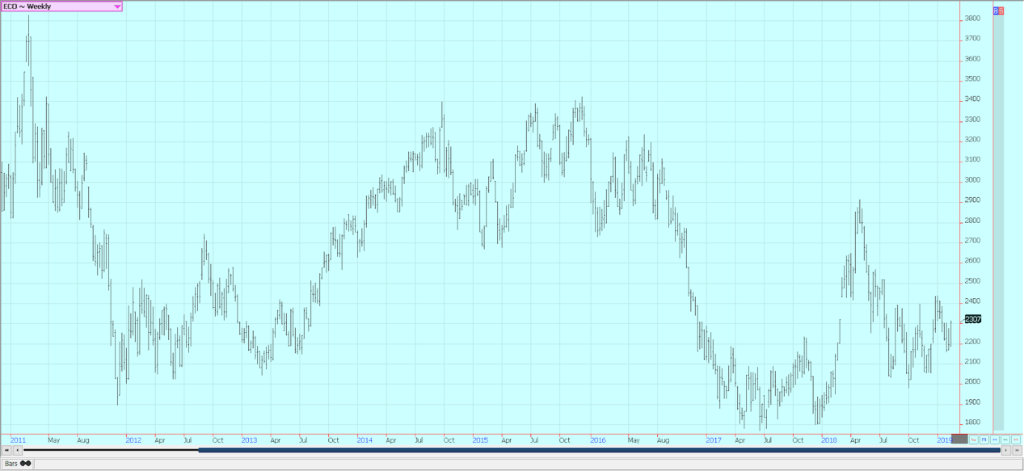

Corn

Corn and oats closed about unchanged for the week on Friday. Trade attention is on Washington as it moves to resolve trade problems with China, Europe, and Japan, among others, and pushes for passage of the new North American trade agreement. There were reports of good progress last week in China, and the meetings will be continued this week in the US. The markets hope that enough progress is made so that increased tariffs by the US on China are not imposed next month.

South American weather is improving as more showers are reported in central and northern Brazil. The winter corn crop is being planted as soybeans get harvested, so the rains are very beneficial after an extended dry season. Increased buying is still expected on moves lower and current short term patterns suggest that futures should not be able to move below 365 March.

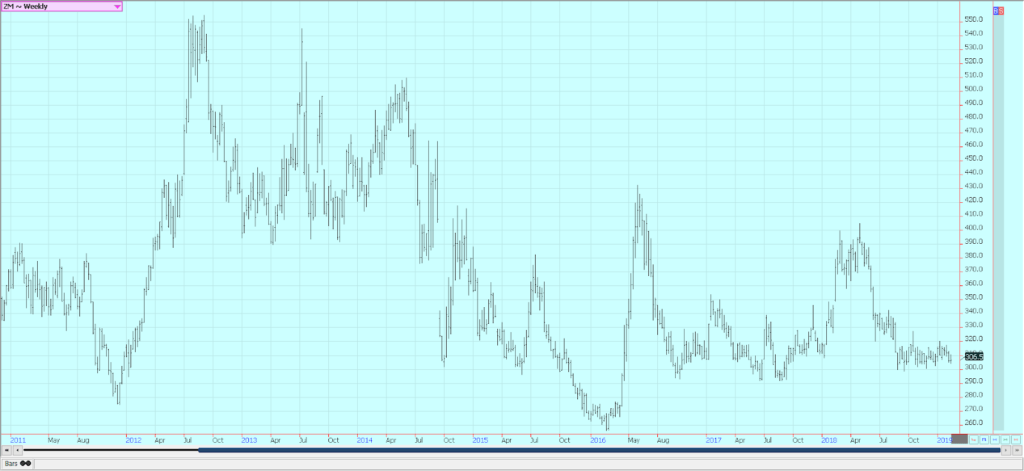

Soybeans and soybean meal

Soybeans were a little lower and soybean meal were slightly higher last week, but a little higher on Friday. Everyone is waiting for the resolution of the US-China trade dispute. Good progress was reported from China last week, and more meetings are scheduled in the US this week. There are hopes that the threat for increased tariffs next month will be at least postponed. However, it will get harder for the US to make sales to China or anyone else now.

Brazil has reduced production, but Argentine production appears good, and both countries are now offering at prices that compete with the US for sales. On the other hand, producers in both North and South America are not real interested in selling right now due to lower prices. The supplies for the world are there, but will need to be pried out of the hands of the sellers. Trends are sideways on the weekly charts for these markets, and the fundamentals of big supplies might keep rallies in check. Trends are sideways to down on the daily charts.

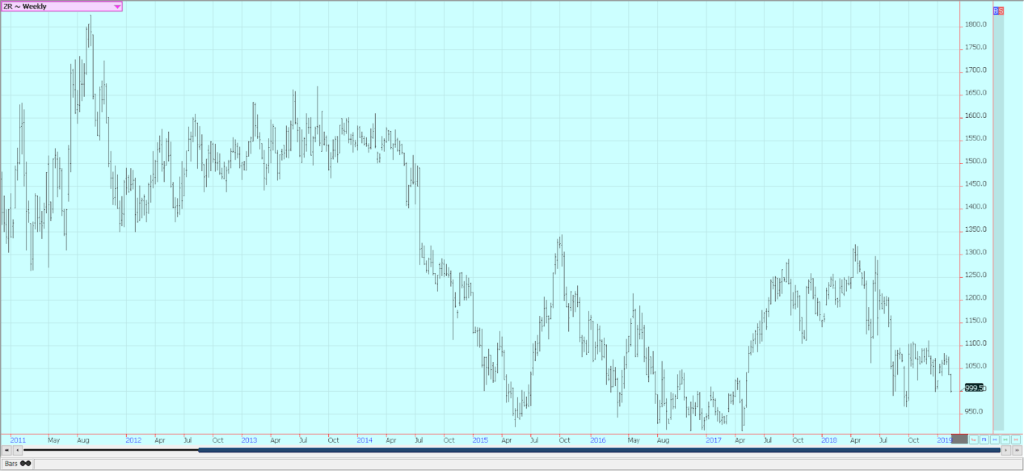

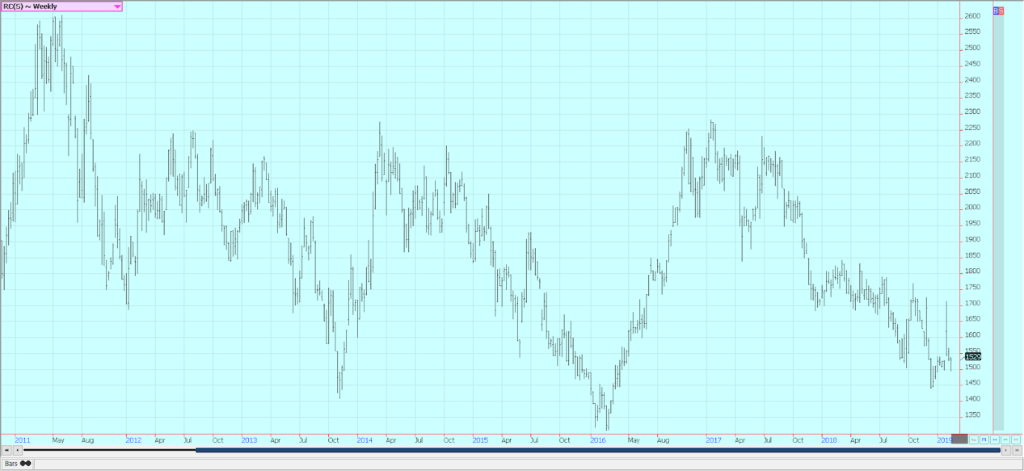

Rice

Rice was lower again Friday on speculative selling. The selling pushed futures lower for the week and to a support area on the weekly charts. Much of the day featured traders rolling from March to May contracts before the deliveries start at the end of the month. The trade will concentrate now on the weather and any potential planting delays as well as any new demand news.

Delays in initial fieldwork are being reported in Texas, but longer term forecasts are giving hope that Gulf area producers can get started in the next month or so. USDA is slowly releasing its weekly export sales reports and should be caught up within 10 days. The export pace has been very solid so far and the trade will look for good demand to continue. Private sources suggest that domestic mills are slowly but surely getting covered on needs for the current crop year.

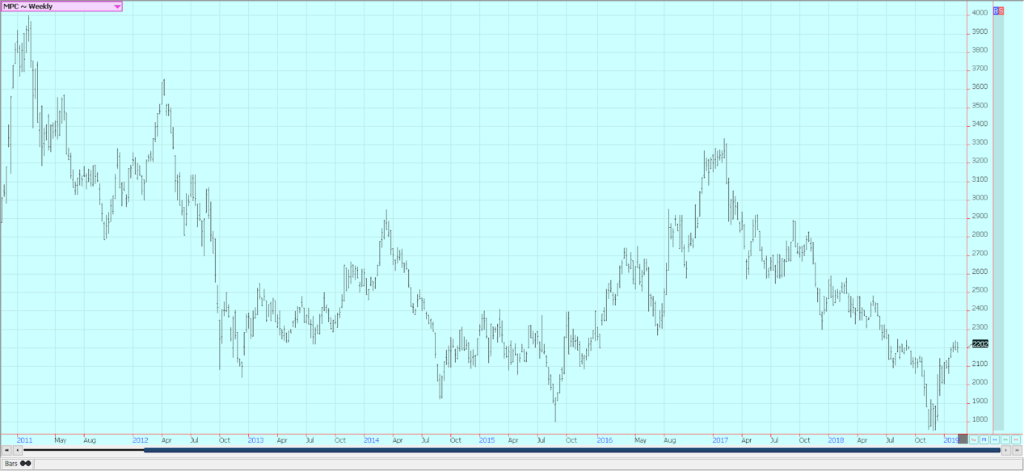

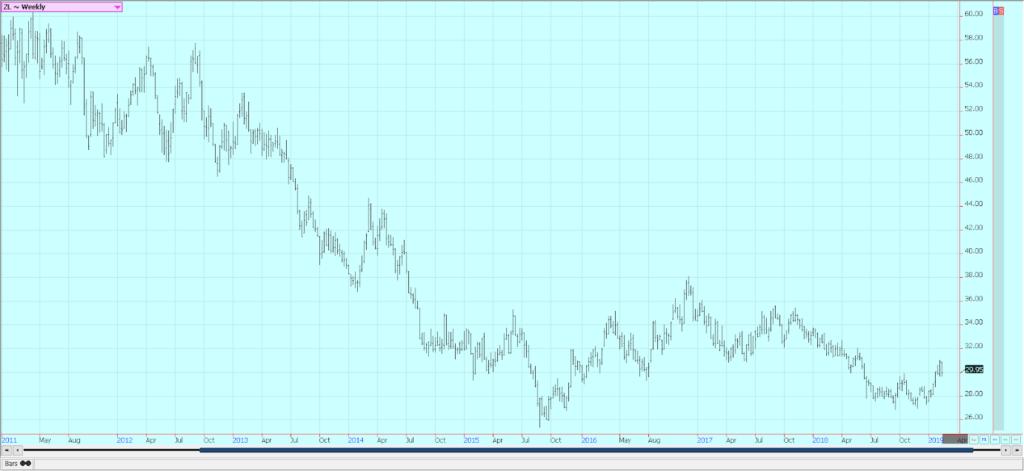

Palm oil and vegetable oils

World vegetable oils prices were mixed, with palm oil higher and the other markets lower. Futures for palm oil are trading at levels not seen since last Summer and Soybean Oil is at levels seen last Spring. Reports suggest that demand is improving, and palm oil production is starting to seasonally decline. MPOB showed a decline in production in reports released after the Lunar New Year holiday, and the recent demand reports from the private surveyors showed a sharp increase in demand for the export market.

Wire reports on Friday also highlighted reduced Malaysian Palm Oil production along with the increased demand. Soybean Oil was lower on chart based selling and ideas of big supplies. NOPA reported a very high crush rate on Friday, so Soybean Oil is available to those who want it. Canola is the weaker market as the Canadian Dollar has been strong and due to worries about Chinese demand.

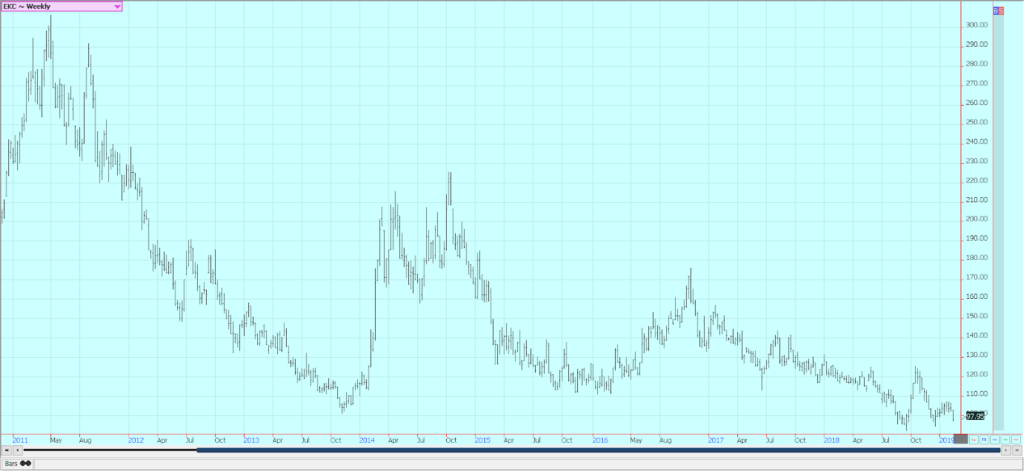

Cotton

Cotton was lower last week and made new lows for the move. Trends are down on the daily and the weekly charts. The weekly export sales reports have started to show improved demand for US cotton, but USDA is still catching up on the data. It should be caught up on the weekly reports by February 22. New demand from China would be great for the market.

China and the US are meeting again this week in hopes of finding a trade agreement. There had been talk of less production from exporter countries like India. Indian and Pakistani sources will continue to insist that production is less than projected by USDA. Cotton futures will have to look for news to cause rallies at this time. Supplies are there, so demand will have to improve as USDA releases more export sales reports in the next couple of weeks.

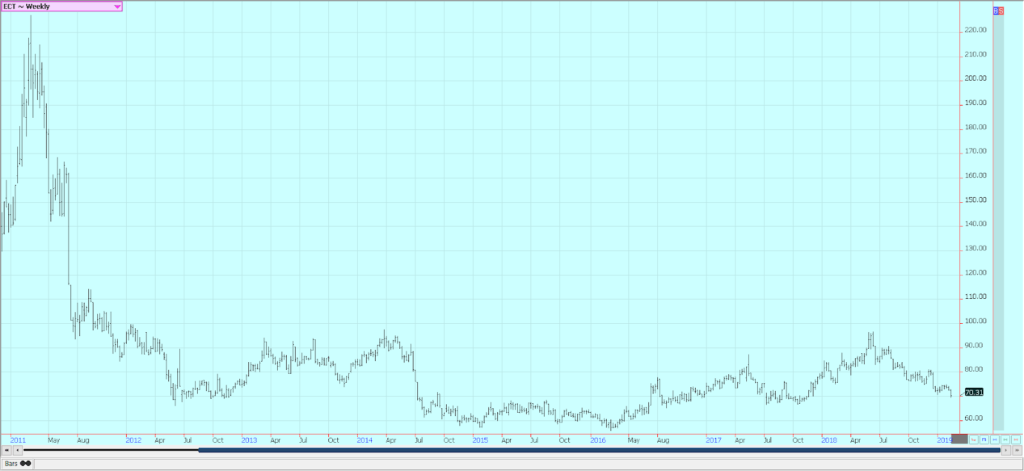

Frozen concentrated orange juice and citrus

FCOJ was lower and made new lows for the week. Trends are down on the weekly charts. The market has absorbed speculative long liquidation and producer selling through the Winter as no freeze has developed, and futures can now move seasonally higher. Longer range forecasts show that there is little chance for a freeze to develop this month, and then it will be getting to be too late for a freeze to be seen in the state of Florida. The oranges harvest is active in Florida as the weather is warm and mostly dry.

The fruit is abundant. Florida producers are seeing small sized to good sized fruit, and work in groves maintenance is active. Irrigation is being used in all areas. Packing houses are open to process fruit for the fresh market, and all processors are open in the state to take packing house eliminations and fresh fruit. Mostly good conditions are reported in Brazil, and some beneficial rains should be seen this week.

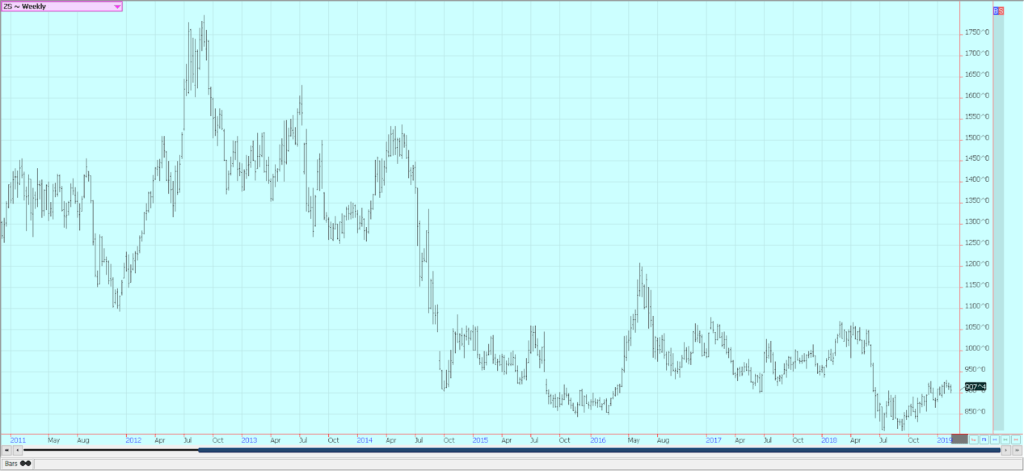

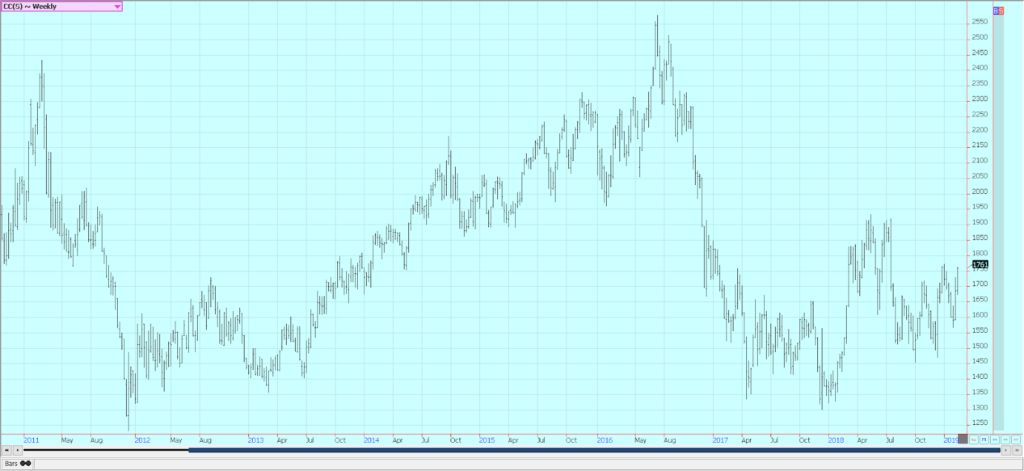

Coffee

Futures were lower for the week in New York and near unchanged in London. Both markets were higher on Friday. New York failed once again to turn trends up, but prices still held the recent trading range. Weekly chart trends are sideways in London. January export data from Brazil was very strong and much above expectations, and the stronger US dollar encouraged some selling, mostly from speculators. Brazil should be getting past the gut slot of its harvest, and the strong export pace from the country should start to turn down. Brazil had a big production year for the current crop, but the next crop should be less as it is the off year for production.

Ideas are that the current production of 62 or 63 or more million bags can become about 52 million bags next year. El Nino is fading, but remains in the forecast, and coffee areas in Brazil could be affected by drought that could hurt production even more. Showers are in the forecast for this week. Vietnam is active in its harvest. Selling will increase this week as the Lunar New Year holiday is now over. Production in Vietnam is estimated less than 30 million bags due to uneven weather during the growing season.

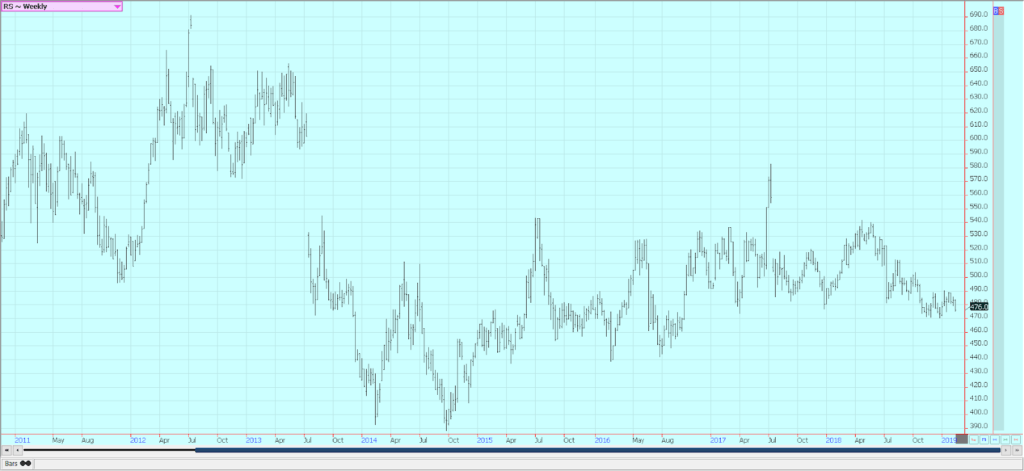

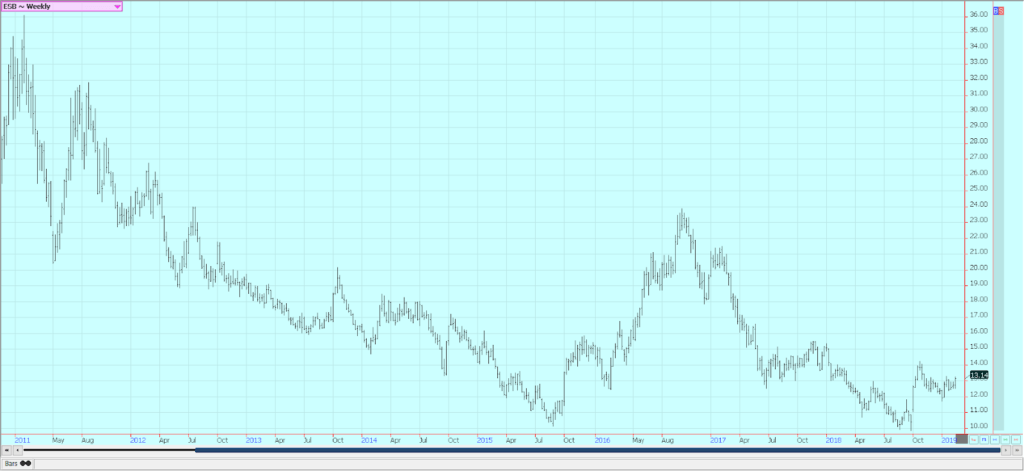

Sugar

Both markets were high for the week. London weekly charts show a key reversal higher, and chart patterns on the weekly charts in both markets imply that higher prices are coming. Reports that Brazilian mills might pause and give sugarcane production a chance to improve helped support the market. Brazil weather is improving in all areas as there is less rain in southern areas and more to the north. Petroleum futures strength seems to be helping change the tone in sugar. Brazil has been using the majority of its sugarcane harvest to produce ethanol this year instead of sugar. Very good conditions are reported in Thailand.

Cocoa

Futures closed higher for the week in New York and in London as the new main crop harvest comes to an end in West Africa. The mid crop harvest is still a month or more away. Trends are up. The main crop harvest is active in West Africa, and Ivory Coast arrivals are strong. Some early week showers and cooler temperatures were beneficial, it is warmer now and mostly dry. Conditions appear good in East Africa and Asia. Demand is said to be improving as offers from the new harvest start to increase.

(Featured image by PointImages via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech1 week ago

Biotech1 week agoUniversal Nanoparticle Platform Enables Multi-Isotope Cancer Diagnosis and Therapy

-

Fintech2 weeks ago

Fintech2 weeks agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Impact Investing4 days ago

Impact Investing4 days agoMainStreet Partners Barometer Reveals ESG Quality Gaps in European Funds

-

Biotech2 weeks ago

Biotech2 weeks agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness