Business

Soybeans, soybean meal markets dropped last week due to weaker demand

Aside from the soybeans and soybean meal markets, rice also declined slightly last week.

The soybeans and soybean meal markets struggled this past week. The factor that pulled them down is the decrease in demand.

Wheat

US markets were higher on Friday, but a little lower for the week in Chicago and about unchanged in Minneapolis. US winter wheat planting has been active amid mostly dry conditions. Over a quarter of the crop has been planted so far. Some rains moved through the Midwest over the weekend, slowing harvest of corn and soybeans, but bringing needed precipitation to many areas for the winter wheat planting.

Reports indicate that planting of winter crops has been active in Europe and Russia as well. Russia thinks it can produce another bumper crop this year, news that has served to keep US futures prices under some pressure. Russian prices continue to firm now due to the demand there and farmer holding.

Australia still suffers from hot and dry weather at key times in the growing cycle, but rains were forecast for Queensland that could have moved into important growing areas of New South Wales over the weekend to bring some much-needed relief. Production ideas are now near or below 20 million tons for the country, but ideas are dropping as it is still dry and the plants are trying to fill kernels. Argentina has suffered from too much rain.

US export demand has been good, but not enough to excite much new buying in the markets. The demand so far has been in line with USDA projections. The charts how that Chicago futures are trying to hold to a seasonal trend to higher prices, while Minneapolis is looking to complete a bottom after the big rally and precipitous fall earlier this year.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

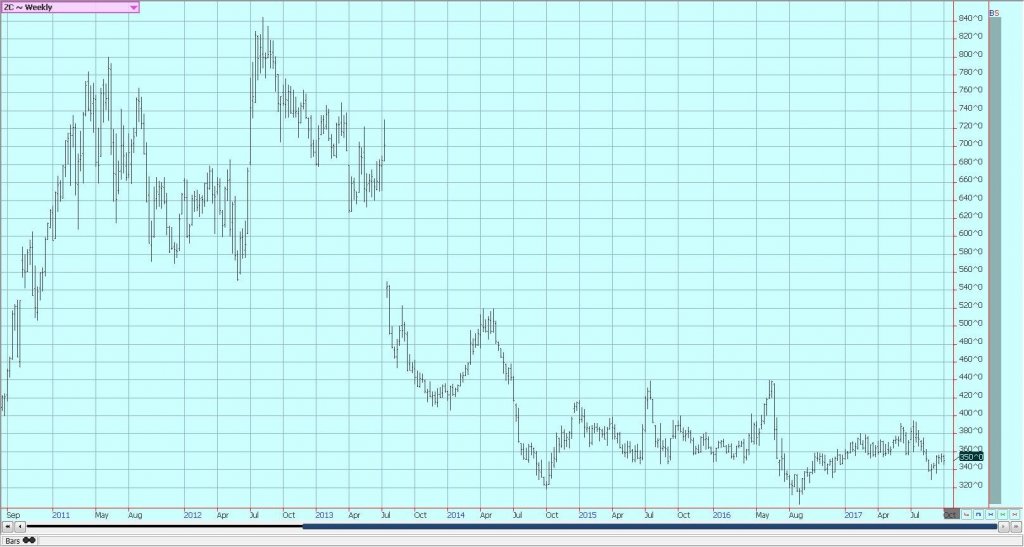

Corn

Corn held to the lower end of its trading range and oats closed near unchanged for the week as the US corn harvest expands in much of the Midwest. Some price pressure was seen in the market as interior basis levels were under some extreme pressure due to logistical problems. The Mississippi and Illinois rivers have been low due to lack of rainfall and barge transportation has been difficult and very expensive. A lock on the Ohio River was closed for emergency repairs and that caused transportation problems on that river system.

Some rains have been moving through the Midwest in the last week so river levels could start to improve in the short term, and that should ease pressure on freight prices and interior basis levels. The market is hearing actual harvest results as activity moves north into central parts of the Corn Belt and also gets active in the east. Yields have been relatively strong, but the harvest pace has been a little slow as producers have been concentrating more on getting the Soybeans harvested and letting the corn dry in the fields. The warmer and frequently drier weather of the last couple of weeks pushed the corn to maturity and aided in solidifying yield potential.

Harvest results so far from the Delta and Southeast point to very good yields in these areas. Many traders expect more variable yields to be reported as the harvest moves forward and anticipate that USDA might have to cut its yield estimate slightly in coming production reports. Export demand has been a sore spot for the market and less than had been hoped for. However, corn export demand was improved last week. Domestic demand for feed and industrial use is called good.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

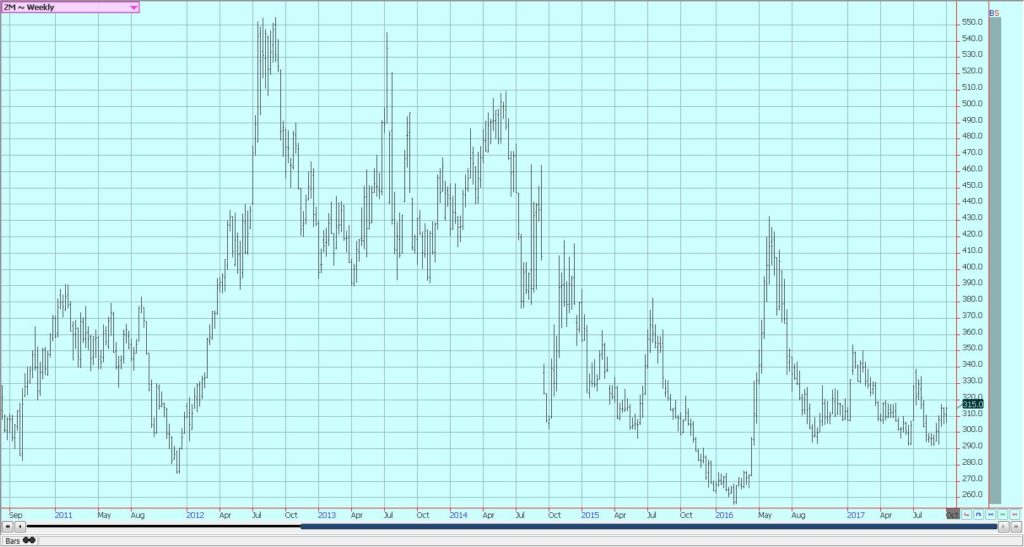

Soybeans and Soybean Meal

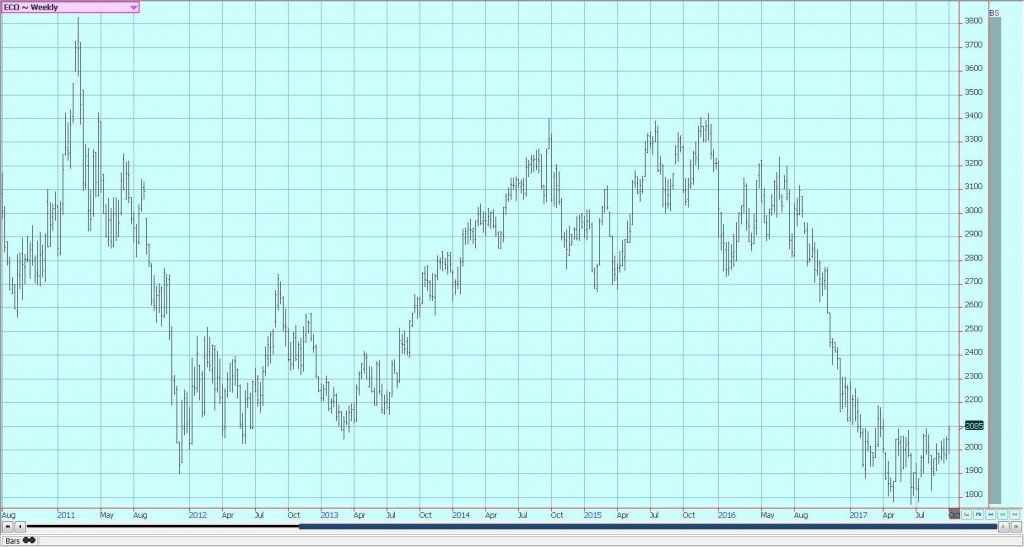

Soybeans and soybean meal were a little lower last week on weaker demand. China was on holiday last week and buying was not seen from anyone in that country. This should be temporary, and strong buying interest could develop this week as the industry there returns to work. The market also saw much weaker interior US basis levels as transportation logistics turned bad. River levels on the Mississippi and Illinois rivers have turned very low due to little rainfall in the last several weeks. The high transportation costs have caused the interior basis levels to fall as elevators were filled.

Some rains were seen last week and over the weekend in the Midwest, so there are hopes that river levels can improve and that transportation costs can now start to ease. The sales have countered any harvest pressure as the harvest starts to expand in the Midwest. There was a lock closed on the Ohio River for repairs that snarled traffic there.

Harvest yield reports have been generally strong in the Midwest, but some traders expect more variable yield reports to develop later. Harvest has been active in central and eastern p[arts of the Midwest, but very slow in the west. For now, the estimates would imply that the USDA yield and production estimates are not all that far off and that a strong crop is coming to market. Brazil is too dry for good planting in the north and too wet in the south. Northern Argentina is too wet.

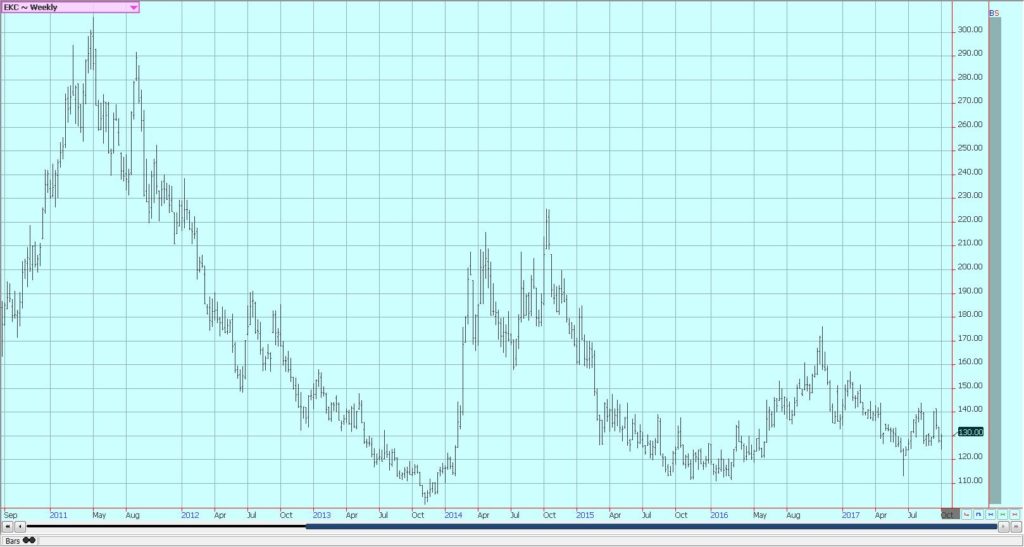

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

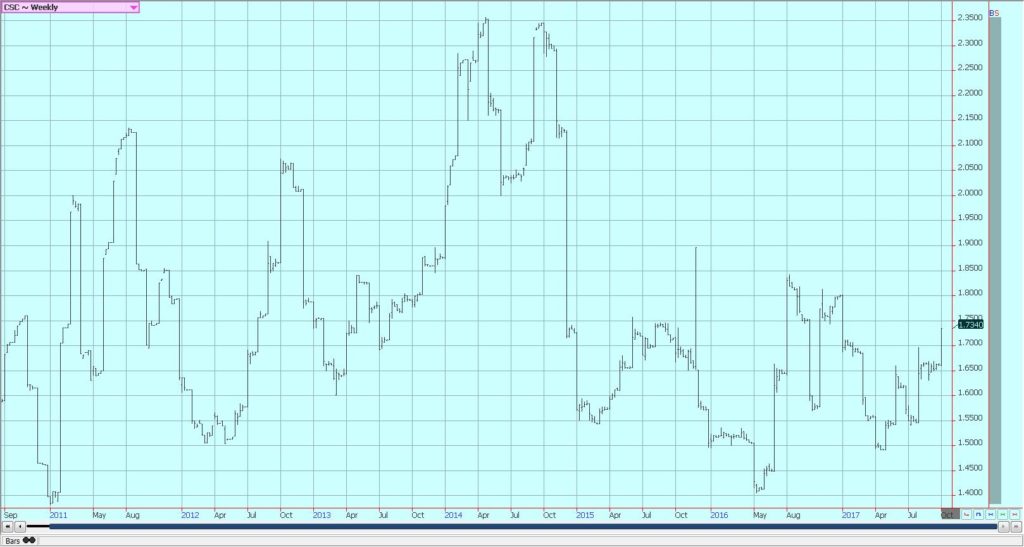

Rice closed a little lower again last week in what seemed to be mostly a consolidation week for prices. Cash market prices held steady again last week amid only light volume farmer selling and good buying interest. Harvesting is over in Texas and Louisiana, and field yield reports have been variable to good in Louisiana and good in Texas. Quality reports, in general, have been good to very good.

Crops are being harvested in areas from Mississippi to Missouri, but this harvest is now just about over. Crop potential in these states is apparently very good, with good quality crops and good yields. Most producers appear ready to store crops and wait for higher prices. California is still harvesting, and yield reports are down from trade and USDA forecasts, apparently due to the shorter growing season caused by somewhat delayed planting.

Asian prices are stable and might be near a seasonal bottom amid harvest activities in that region. The Asian market has been weaker in the last few weeks due to the harvest pressure. Growing conditions are improved in India as the monsoon has been better as monsoon rains have generally been good, if uneven in many areas. Rice areas appear to have had generally good rains. Bangladesh has been hurt by flooding and is preparing to import a lot of Rice this year. Most of Indochina and Southeast Asia have seen good weather.

Weekly Chicago Rice Futures © Jack Scoville

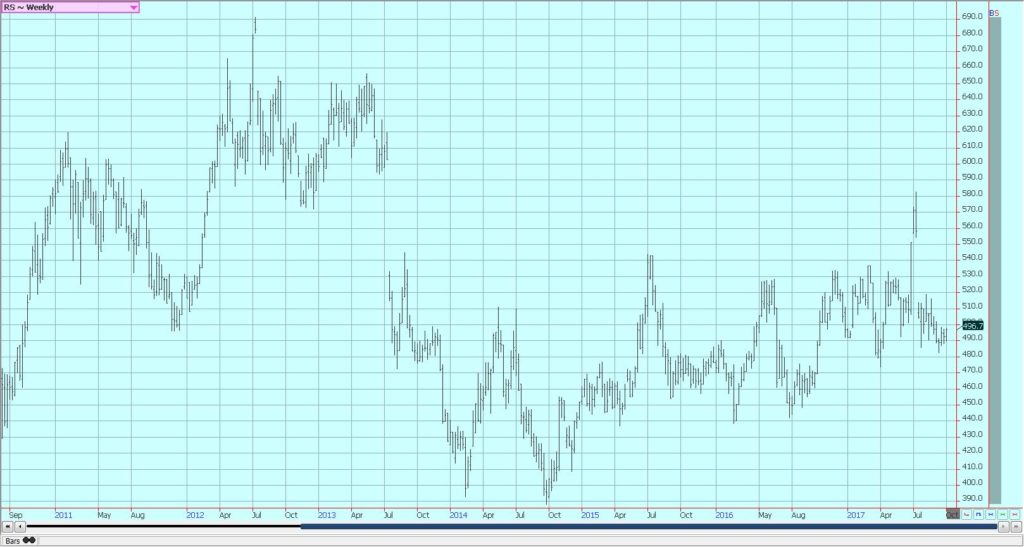

Palm Oil and Vegetable Oils

Palm oil futures moved a little higher last week after testing and holding at support areas. Demand was lower as China was on a holiday, but China is back now and demand should start to improve again. Both markets will start to look ahead now to the monthly supply and demand statistics and projections that will be out this week. Palm oil traders expect MPOB to show somewhat reduced production that is a normal seasonal occurrence. Demand should be strong as ween in the reports from the private surveyors, so ending stocks should be down.

Canola was higher as the weather hurt harvest progress and despite farm selling amid increasing harvest activity. Farmers have started to more actively sell and deliver as the harvest starts to move into its final stages. Yield reports yet imply a good but not great crop in just about all areas of the Prairies. Farmers in the Prairies are facing variable weather conditions that for now are somewhat too wet to promote a very active harvest.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

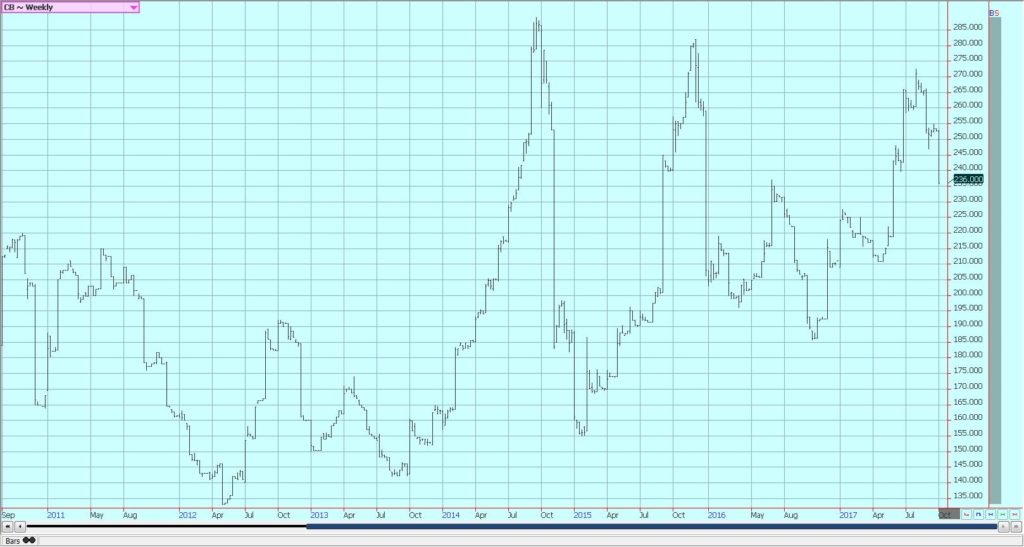

Cotton was a little higher last week in narrow range trading. Futures show no real chart formation to go up or down in a big way, and it could be that the market moves in a sideways pattern for now. How big a crop is out there and what the export demand might remain the important topics that will get partially answered via the USDA monthly production and supply and demand reports later this week. There are still ideas of losses in parts of Texas and the Southeast from the storms, and USDA has shown some lower crop conditions in its past few weekly updates.

Harvest is more active and will continue to expand as more and more of the crop comes to maturity, Bolls are open or are opening now in just about all production areas, but harvest remains a little behind normal. West Texas conditions are called good and the Southwest should be good despite hot weather this year. Demand has been OK but not really strong so far this year. Export sales will need to increase to absorb the big crop.

There is strong production potential in Asia, and mostly in India and Pakistan due to improved monsoon rains. Some rains are expected in most areas this week amid relatively moderate temperatures. Chinese growing conditions are good. Areas to the south of Russia are in good condition.

Weekly US Cotton Futures © Jack Scoville

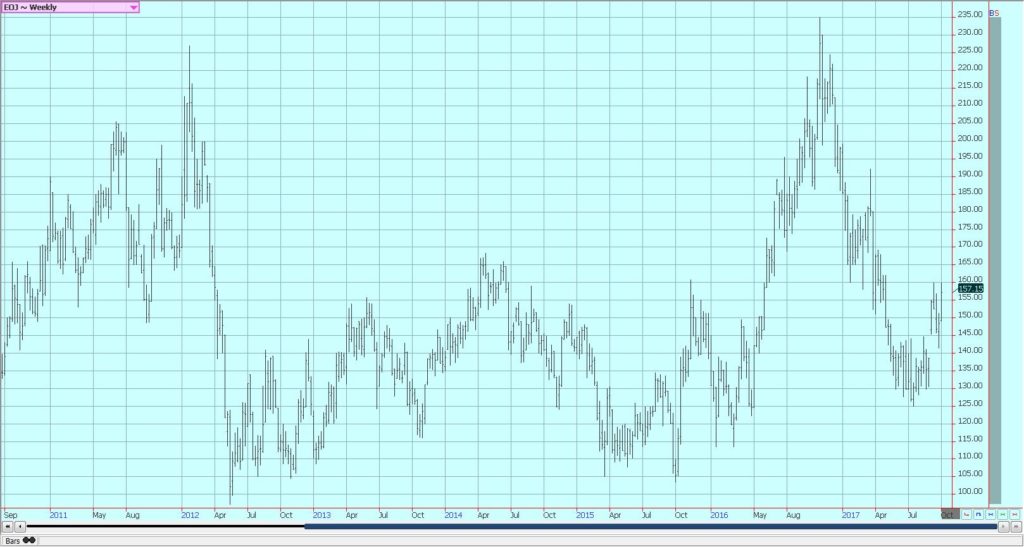

Frozen Concentrated Orange Juice and Citrus

FCOJ closed higher and still acts as if a further price recovery is possible. The weekly charts show that futures closed slightly higher after partially filling a chart gap left a few weeks ago. The lows of last week might hold for quite a while due to the loses to crops in Florida due to Hurricane Irma. Hurricane Nate moved north from Central America, but stayed west of Florida and should not have damaged crops. Ideas remain that the Orange groves are badly damaged in Florida due to Irma.

New reports from growers associations suggest that crops in many areas were almost completely destroyed. Other areas suffered losses of 50% or more of the crop. Some growers say that trees will be stressed again next year due to the winds and rains from Irma. Florida weather is now drier. The demand side remains weak and there are plenty of supplies in the US. Trees that are still alive now are showing fruit of good sizes, although many have lost a lot of the fruit. Brazil crops remain in mostly good condition.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were higher in New York and in London last week, with commercials scale down buyers and speculators starting to cover some short positions in New York. The trends are down on the charts in New York as traders look at the potential for a big crop in Brazil. London trends turned sideways last week. The Brazil weather and tree condition is the main fundamental reason for lower New York prices.

Rains appeared in Brazil late recently, then it turned dry again. These rains should be enough to promote new flowering. The rains will need to continue as it has been very dry and trees have been stressed. Even so, there are some hopes for a very good crop. Cash market conditions in Central America are more active as the next harvest continues. There is coffee to sell and offers are on the table for the next crop. Colombia has reported some difficult growing conditions, but exports have held well as production appears to be good.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures were a little higher in New York and in London, and price trends are sideways to down in both markets. Both markets gave back gains on Friday, but held support areas on the weekly charts and will probably try to extend gains this week. New York was able to recover from significant losses last week, and London showed a partial recovery as both markets closed on a firm note. There was some talk of renewed interest in white sugar purchases to cause the buying in futures, and London was considered the stronger market at the end of the week.

The market expects firmer prices over time as the Indian harvest could be delayed due to wet conditions that would delay Sugarcane harvesting. There are questions about the Indian production this year as the distribution on monsoon rains was not uniform. Some areas saw flooding rains while others got well below normal totals. The monsoon is starting to recede now.

Overall upside potential is limited as there are still projections for a surplus in the world production, and these projections for the surplus seem to be getting bigger over time. Production potential in Thailand seems strong as monsoon rains have been better than last year.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures markets were higher again last week, and are once again in a broad trading range. Trends are starting to turn up on the weekly charts, and it could be that just about all of the bad news is now in the market. The weekly charts suggest that futures are completing what could be an important low at this time. Any new buying early this week could create a sharp short covering rally. The supply for the coming year would seem to be good and enough for the market.

However, the market is also now thinking of better demand as world economies start to improve, and will look to quarterly grind data that will be released starting this week for indications that this is true. Nigeria and Cameroon have both noted strong production from the initial harvest. Prices have been higher in Nigeria in the last couple of weeks as buyers have paid for better quality. Ghana said it now expects higher production, and Ivory Coast is harvesting what is expected to be a bumper crop.

The demand should continue to increase if prices remain relatively cheap and as retail prices continue to move lower in important consuming areas like Europe. World consumer markets, in general, seem to be getting better economically, also supporting better demand ideas. Grinders and chocolate manufacturers are able to make plenty of money with current differentials.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and Meat

Dairy markets were lower last week as futures appear to have made a short-term top. Milk and Cheese demand has been mixed, but Butter demand has weakened and prices in this market have moved sharply lower. Demand is good for cream, but cream has generally been available to meet the demand. Cream demand for butter has been very good.

Demand for ice cream has been mixed depending on the region but is becoming less now as the US Summer comes to a close. Cheese demand still appears to be weaker and inventories appear high. US production conditions have featured some abnormally hot weather in the west that is hurting milk production. Production in the rest of the country has been strong.

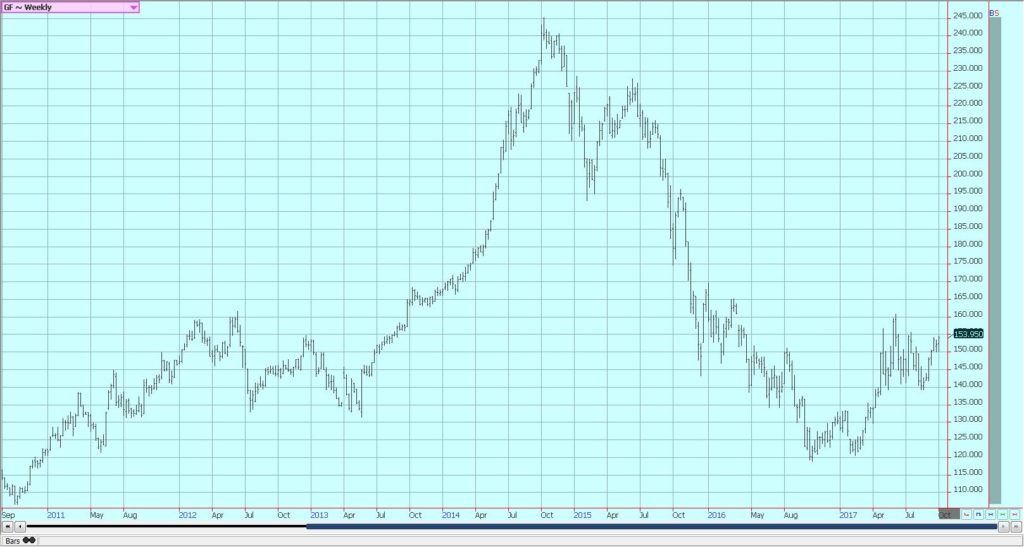

US cattle and beef prices were higher as traders anticipated better cash market conditions. Ideas are that packers are enjoying strong margins at this time and can afford to pay more for cattle. The beef market was somewhat better last week to support ideas that prices for cattle could start to improve.

Cattle prices were steady to slightly weaker in early dealings and amid lighter than expected volume. It is the threat of increased supplies down the road that keeps the packers from buying aggressively. Feedlots are filled and cattle will continue to be offered to the cash market. However, ideas are that more supplies are coming as weight per carcass is high and more cattle is coming to the market.

Pork markets and lean hogs futures were weaker on a seasonal trend to lower demand. The market made new lows for the move on Thursday, then recovered as the market absorbed the inventory report. The report showed higher current supplies and higher supplies in the pipeline but was mostly as anticipated by the trade. Ideas are that futures are reflecting the weaker supply and demand fundamentals now. Demand has been lower for the last couple of weeks and this has affected pricing.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech1 week ago

Biotech1 week agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

-

Impact Investing7 days ago

Impact Investing7 days agoEU Industrial Accelerator Act: Boosting Clean Industry and Resilient Supply Chains

-

Cannabis2 weeks ago

Cannabis2 weeks agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat

-

Fintech3 days ago

Fintech3 days agoVivid Expands Multi-Currency Interest Accounts for Business Clients

You must be logged in to post a comment Login