Biotech

How is the Spanish pharmaceutical sector coping with the crisis

Grifols, Almirall, Reig Jofre, Rovi, Pharma Mar, and Faes Farma totaled €1 billion at the end of last year. Almirall, the Gallardo’s pharmaceutical company and owner of Almax, had a cash flow of €117.4 million at the end of last year. This figure is 31% higher than in 2018, when the company registered €86.3 million. Pharma Mar’s cash flow was €21.9 million, while Reig Jofre’s was €10.1 million.

One of the best ways companies can weather the coronavirus crisis is to have healthy reserves of cash on hand. Companies which have more money will be able to face the crisis and come out stronger. The ‘big six’ in the Spanish pharmaceutical sector, Grifols, Almirall, Reig Jofre, Rovi, Pharma Mar and Faes Farma, had a cash balance of €1 billion at the end of their last financial year, according to the latest annual reports.

Read the latest business headlines in the biotech sector and find out important information about the Spanish bio-pharmaceutical companies such as PharmaMAr and Almirall with the Born2Invest mobile app. Be the first to find out the most important news in the biotech sector with our companion app.

Grifols had a cash flow of €742 million in 2019

The Catalan giant, which specializes in plasma derivatives and is owned by the Grífols family, had total cash and cash equivalents of €742 million at the end of last year. The company also has undrawn financing lines totalling €532 million, bringing its liquidity position to €1.27 billion.

Last March, the Grifols company signed a multilateral collaboration agreement with the US Advanced Biomedical Research and Development Authority (Barda), the US Drug Agency (FDA) and federal public health agencies to collect plasma from patients recovered from Covid-19, process it and produce hyperimmune immunoglobulins. The agreement also includes collaboration on the development of preclinical and clinical studies necessary to determine the effectiveness of anti-SARS-CoV-2 hyperimmune immunoglobulin therapy to treat Covid-19.

Rovi partnered with HM Hospitals to conduct clinical trials on patients with COVID-19

Almirall, the Gallardo’s pharmaceutical company and owner of Almax, had a cash flow of €117.4 million at the end of last year. This figure is 31% higher than in 2018, when the company registered €86.3 million. The company also has a €120 million loan from the European Investment Bank (EIB) signed in 2019. For its part, the cash of the pharmaceutical laboratory Rovi amounted to €67.4 million last year.

Also, as of December 31st, 2019, loans from credit institutions increased by €29.4 million. In December 2017, Rovi announced that the EIB had granted it a €45 million loan to support its investments in research, development and innovation, according to the company’s information.

In the fight against COVID-19, Rovi has partnered with HM Hospitals to conduct a clinical trial on patients with coronavirus. In addition, the company donated one million masks to the Ministry of Health, among other actions.

Pharma Mar’s cash flow was double than that of Reig Jofre

Pharma Mar once again produced drugs such as cisatracurium and midazolam, which are essential in ICUs Faes Farma closed 2019 with €52.8 million in cash. According to the company, this level will enable it to continue investing in organic and inorganic production plants, such as the purchase of the BCN Medical group in Colombia last October, for which part of the financial availability was earmarked (€20 million).

Pharma Mar’s cash flow was €21.9 million, while Reig Jofre’s was €10.1 million. The Catalan firm has converted its factories to fight the coronavirus. In fact, the company’s management indicated that it had returned to producing essential medicines that the company was not producing, such as cisatracurium and midazolam, which are essential for ICUs, now collapsed, and injectable antibiotics.

__

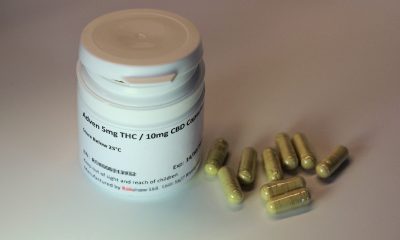

(Featured image by PublicDomainPictures via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PlantaDoce, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Crypto2 weeks ago

Crypto2 weeks agoCaution Prevails as Bitcoin Nears All-Time High

-

Fintech3 days ago

Fintech3 days agoOKX Integrates PayPal to Simplify Crypto Access Across Europe

-

Africa1 week ago

Africa1 week agoBridging Africa’s Climate Finance Gap: A Roadmap for Green Transformation

-

Business1 week ago

Business1 week agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [uMobix Affiliate Program Review]