Featured

Speculative buying on the futures market brought coffee futures up

Coffee futures were higher in both markets last week on what appeared to be speculative buying. The US Dollar was lower to help the buyers but there was not a lot of news to support futures besides the currency moves. Cash market buyers are not buying that much Coffee these days. Vietnam producers have not sold since the Tet holiday but are expected to start selling soon.

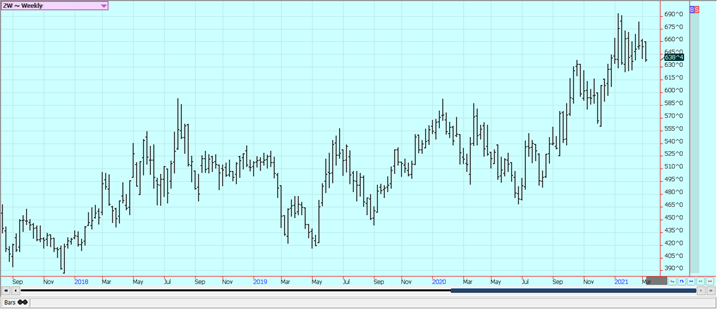

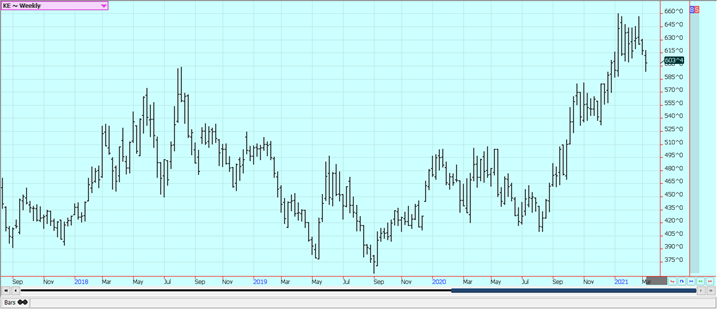

Wheat: Wheat markets were lower and were led lower by the HRW market. The weekly charts show downtrends in HRW and SRW. Minneapolis trends are mixed. Demand was a problem once again as the weekly export sales report last week showed poor sales. Ideas are that rain that is falling in the Great Plains will help injured Winter Wheat. The threat of Winterkill production losses in the western Great Plains now appears to be part of the price. Temperatures dropped below 0F in many areas and that is cold enough to kill an unprotected crop. The actual damage will take some time to see under warmer temperatures and it might take until harvest to see the full effects of the recent extreme cold. USDA issued its latest WASDE estimates early last week and made no important changes to domestic or world estimates.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

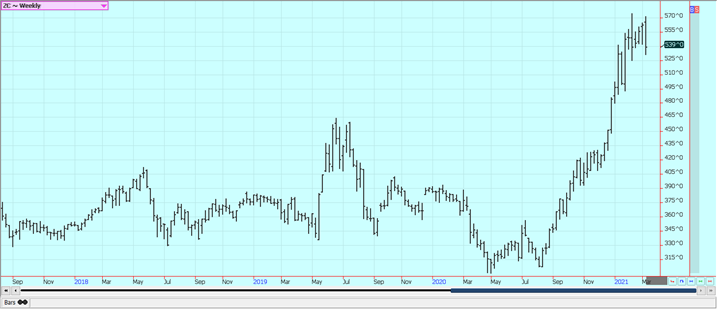

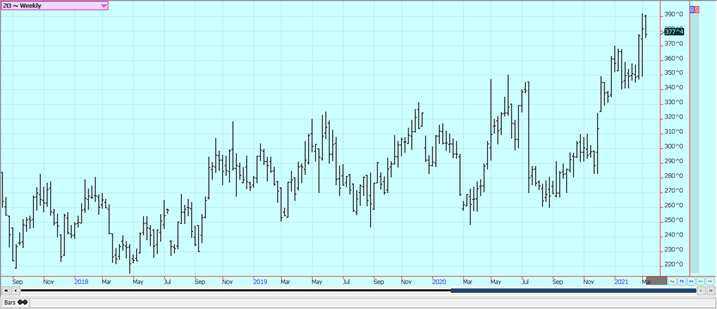

Corn: Corn closed lower last week in part in response to the disappointing WASDE estimates and Oats were a little lower after testing weekly chart highs. USDA made no changes in its WASDE Corn estimates early in the week. Traders had expected increased demand and fewer ending stocks. The weekly export sales report from USDA last week showed improved sales but did not include much in the way of new sales to China. Reports of Asian Swine Fever in China hurt Corn buying and brought buying into hogs. Chinese demand had been strong until recently and it looks like they need the Corn either way. Prices inside China for Corn remain extremely high. It is still raining in central and parts of northern Brazil, but farmers were still able to harvest some of the Soybeans area and plant some of the Winter Corn around the precipitation. The Winter Corn crop is on a very slow pace to be planted and progress is well behind normal. Argentina is now drier and Corn in Argentina could be stressed. Beneficial rains are forecast for later this week. Southern Brazil got dry conditions but is also expecting beneficial rains later this week. The main crop harvest has started in parts of Brazil, but progress will be slow due to the late planting dates due to dry conditions earlier in the year. The second crop of Corn planting is also being delayed and yield estimates for South American Corn have been reduced.

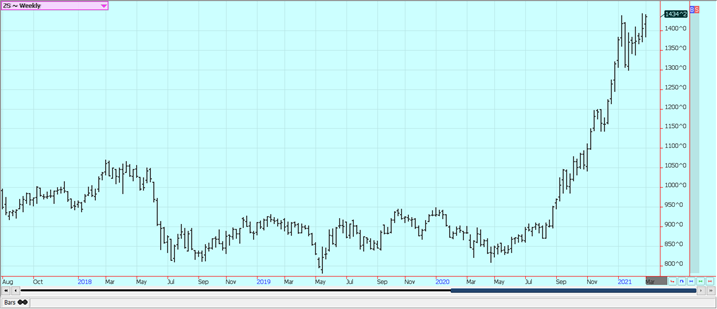

Weekly Corn Futures:

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and Soybean Meal closed a little lower. Weekly chart trends are still sideways for Soybeans but are down in Soybean Meal. The monthly USDA WASDE estimates were considered disappointing by the trade as no changes were made for demand or ending stocks for the US. World data showed a one million ton production increase for Brazil on higher planted and harvested area and a half million-ton production decrease for Argentina due to drought and reduced yields. Selling came on ideas that the impending Brazil harvest will kill the current demand for US Soybeans. Demand was improved last week in the weekly export data and the US has now sold 99% of its target amount of Soybeans for the marketing year. The Brazil harvest has been delayed due to late planting dates early due to dry weather and now too much rain that has caused harvest delays and some quality problems in the north as well. Rains are coming to an end in some areas so harvest activities have increased but the harvest remains very slow overall. China has been buying for this year and next year here but now mostly in South America. US internal demand has also been strong as seen in the crush data. The strong demand for exports and for domestic use means there is little room for error and that the US could even come close to running out of Soybeans to sell.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was higher last week on commercial short-covering and speculative selling. The weekly export sales report was moderately strong. The cash market has not felt any increased demand lately and mill operations are reported to be on the slow side. Exports were moderate last week. Texas is about out of Rice, but there is Rice available in the other states, especially Arkansas. Asian and Mercosur markets were steady to firm last week.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil closed higher on ideas of tight supplies. Ideas are that supply could start to increase soon. The production of Palm Oil is down in both Malaysia and Indonesia as plantations in both countries are having trouble getting workers into the fields. Wet weather has caused even more delays. The weather is improved and trees seasonally increase production about now. Soybean Oil higher for the week on ideas of increasing demand and Canola was lower on what appeared to be speculative profit-taking. Worries about South American production are supporting both markets.

Weekly Malaysian Palm Oil Futures:

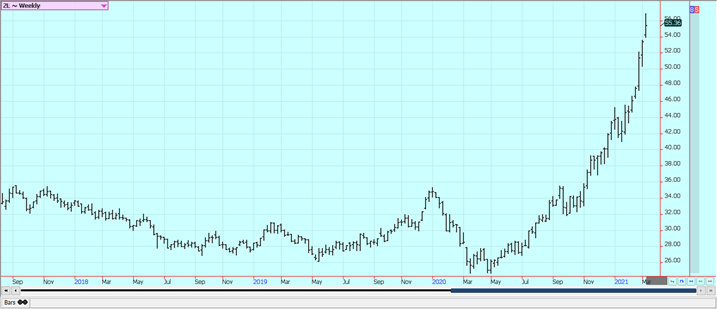

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Futures were lower on Friday but higher for the week in reversal type trading. The chart trends are mixed on the daily charts. The passage of the Covid 19 stimulus package by Congress weakened the UDS Dollar and helped promote better demand ideas. The weekly export sales report showed solid Cotton demand. USDA cut ending stocks slightly by cutting production and also domestic demand. USDA said that the domestic industry was slow to rebound after the Coronavirus kept many at home. The demand for US Cotton in the export market has been strong even with the Coronavirus and the strong demand could continue as USDA also cut Brazil production due to reduced planted area this year. The US Dollar has started to firm recently and could be hurting demand. The US stock market has been generally firm to help support ideas of a better economy here and potentially increased demand for Cotton products.

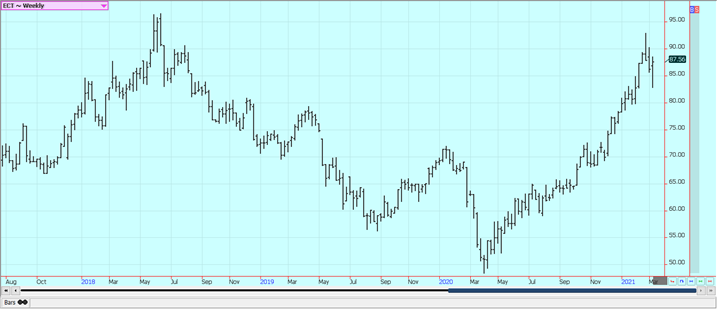

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed a little higher in range trading on Friday and were a little higher for the week. The tone of the market is mixed on the daily charts but the weekly charts are showing a completed bottom formation. USDA cut Florida production once again but raised US production due to increased production in California in its production estimates released on Tuesday. Texas estimates were higher than last year but unchanged last month. Some damage to leaves and open flowers was possible in Texas and northern Mexico in the wake of the recent hard freeze, but ideas are that the overall damage was minor. Moderate temperatures are expected for Florida this week. The weather in Florida is good with a few showers to promote good tree health and fruit formation. Showers are falling in Brazil now and crop conditions are called good even with drier than normal soils. Mexican crop conditions in central and southern areas are called good with rains, but earlier dry weather might have hurt production. It is dry in northern and western Mexican growing areas. The Florida Movement and Pack report last week showed that inventories are now about 17% below a year ago.

Weekly FCOJ Futures

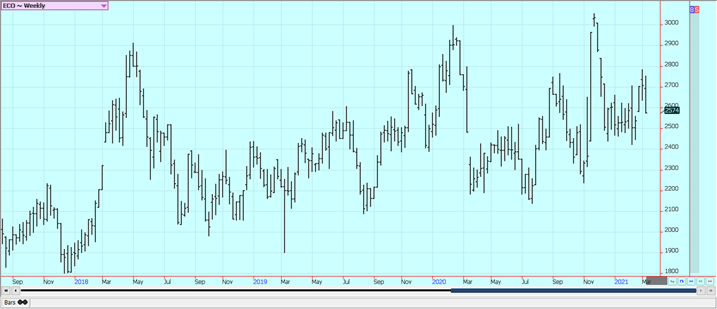

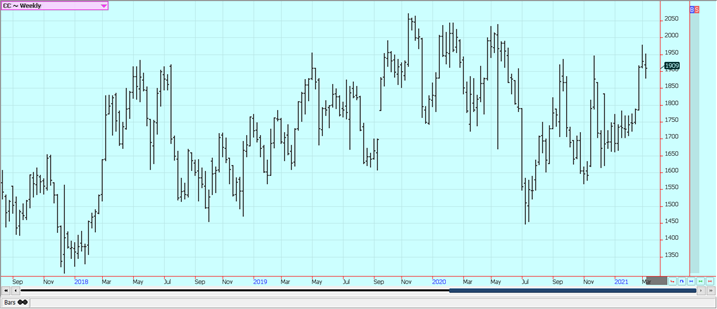

Coffee: Futures were higher in both markets last week on what appeared to be speculative buying. The US Dollar was lower to help the buyers but there was not a lot of news to support futures besides the currency moves. Cash market buyers are not buying that much Coffee these days. Vietnam producers have not sold since the Tet holiday but are expected to start selling soon. There are reports of good weather in Vietnam for the harvest. Indonesia has had good weather but has little coffee to sell now. Brazil was dry for flowering and initial fruit development. Rains have been falling that should be very beneficial but it is turning drier again now. Central America is also drier for harvesting but production might have been reduced due to very wet conditions during the growing season. Good growing conditions are reported in Colombia and Peru. Africa is also noting good growing conditions.

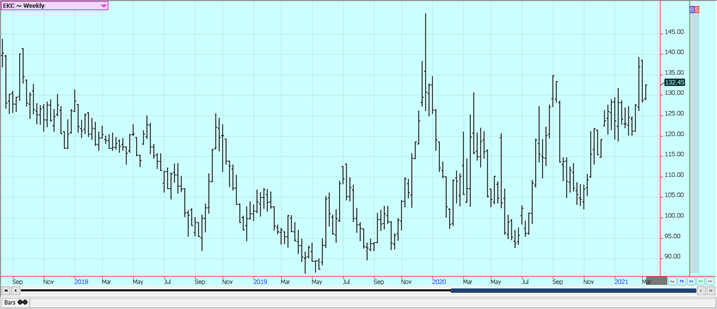

Weekly New York Arabica Coffee Futures

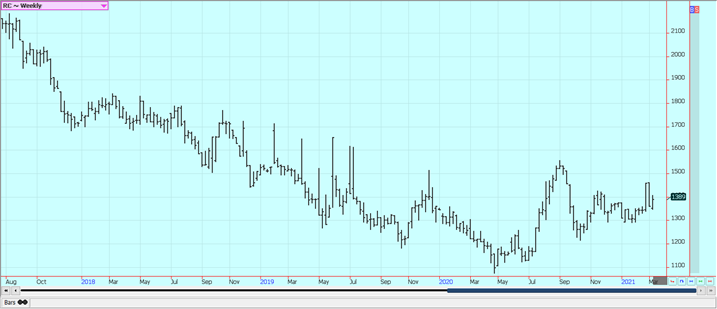

Weekly London Robusta Coffee Futures

Sugar: New York and London closed lower on a weaker Brazilian Real. The chart trends are mostly sideways in both markets on the daily charts, but mostly down on the weekly charts. The market appears to be searching for a new source of demand to complement the traditional buying. Reports indicate that industrial users of Sugar have been the most active consumers. Rains were reported again in Brazil. It has been raining in south-central Brazil and the production of cane is looking solid for the next harvest. Production has been hurt due to dry weather earlier in the year. India is producing less Sugar and more Ethanol and has reported less cane production than expected.

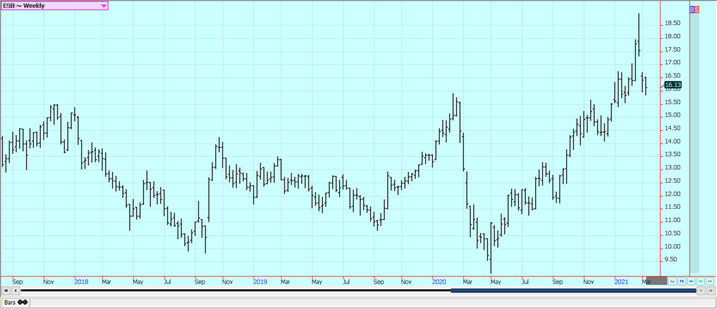

Weekly New York World Raw Sugar Futures

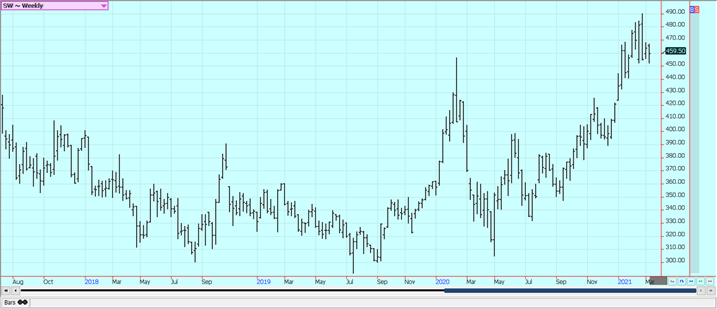

Weekly London White Sugar Futures

New York and London both closed lower for the day on Friday and for the week. Futures seem to be factoring in the large supply against weaker demand at this time. Demand should improve as the Covid vaccinations get administered and as at least some governments around the world invest in fiscal stimulus on their economies. Production appears to be good this year and the supply surplus is growing. The ICCO said that the Cocoa surplus would be about 100,000 tons this year. Ivory Coast estimates its main crop production at 1.65 million tons. There were reports of demand for Cocoa in Ivory Coast, although the reports noted that there is a lot to sell there. The grind data has been weaker in recent months. There are ideas of big supplies at origin.

Cocoa: New York and London both closed lower for the day on Friday and for the week. Futures seem to be factoring in the large supply against weaker demand at this time. Demand should improve as the Covid vaccinations get administered and as at least some governments around the world invest in fiscal stimulus on their economies. Production appears to be good this year and the supply surplus is growing. The ICCO said that the Cocoa surplus would be about 100,000 tons this year. Ivory Coast estimates its main crop production at 1.65 million tons. There were reports of demand for Cocoa in Ivory Coast, although the reports noted that there is a lot to sell there. The grind data has been weaker in recent months. There are ideas of big supplies at origin.

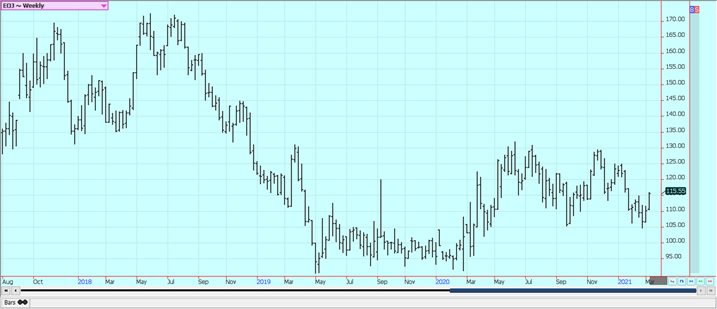

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

_

(Featured image by Couleur via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crypto6 days ago

Crypto6 days agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Markets2 weeks ago

Markets2 weeks agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

-

Impact Investing1 day ago

Impact Investing1 day agoGreen vs. Brown Stocks: Climate Policy, Capital Costs, and the Battle for Market Returns

-

Business2 weeks ago

Business2 weeks agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]