Business

TopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Stake Affiliate Program]

There’s a big fat affiliate opportunity to turn a tidy profit off of a bunch of Canadian degens right now. But if you wanna know more, you’re just gonna have to read on. But, to give you a hint, we’ve also got a great affiliate program ahead, too: the Stake Affiliate Program. And yes, the Canadian degen opportunity is very much adjacent to this program. Curious? Then you know what to do.

Quick Disclosure: We’re about to tell you how the Stake Affiliate Program is pretty great. And we really mean it. Just know that if you click on a Stake Affiliate Program link, we may earn a small commission. Your choice.

So this week, this just happened.

So now this is happening.

“I am Kamala Harris, my pronouns are she and her, and I am a woman sitting at the table wearing a blue suit.”

byu/PlanetFord inJordanPeterson

Now, if I was a betting man, I’d say the stakes just got raised for Trump.

Oh, and speaking of stakes and casinos… let’s go make us some money.

Topranked.io Affiliate Program of the Week — Stake Affiliate Program

So, you wanna make some money?

Here’s a good place to start — the Stake Affiliate Program.

Don’t believe me?

Read on… you will.

Stake Affiliate Program — The Product

Yeah, I dropped a hint in the intro. But in case you missed it, the product behind the Stake Affiliate Program is, of course, a casino.

And a very good one at that, too.

Much like everything else in the Stake Affiliate Program, the upfront casino offering is slick, polished, and is exceptionally hard to fault.

Basically, from the basics like game variety and promotions through to the subtler things like UI/UX, with the Stake Affiliate Program, you’re gonna be promoting a product that pretty much converts itself.

But, as we all know, conversions are sometimes a dime a dozen… and sometimes, they’re a buck each. Wanna know how much a Stake Affiliate Program conversion is worth?

Stake Affiliate Program — Commissions

Usually, explaining commissions is a pretty simple affaire. All I have to do is say some word like “rev share” or “CPA”, throw out some percentage figure, and you know what I’m talking about.

The Stake Affiliate Program is a little different, though… in a totally good way.

What sets the Stake Affiliate Program apart from just about any other affiliate program is that there’s no “net revenue” thing going on here. That means, even if your Stake Affiliate Program referrals are winning, you’re still earning.

So, what exactly is the Stake Affiliate Program doing?

Well, you get paid a percentage of the “house edge” on every wager your Stake Affiliate Program referrals place.

Now, I know this kinda works out a bit like net revenue in the long run… after all, on aggregate, the house edge is what determins net revenue.

But, if you’ve ever had a negative carry, you probably also know that net revenue isn’t always the most stable. The Stake Affiliate Program commission plan offers a decent alternative.

Stake Affiliate Program — Next Steps

As usual, if you wanna learn a bit more about the Stake Affiliate Program before signing up, your next step is simple. Head over to TopRanked.io and check out our Stake Affiliate Program review.

Otherwise, if you’re a bit more of a go-get-em type and wanna start now, head here to sign up with the Stake Affiliate Program.

Affiliate News Takeaways

Canadian Degens

When you think of Canada, you probably think of nice, polite people without a bad bone in any one of their bodies.

But, if you look a little closer, you’ll soon see there are a few up north who’re outright degens.

And I’m not just talking about a few bad eggs tagging highway overpasses, either.

This week, iGaming Ontario dropped its Q2 2024 report.

And guess what?

The numbers are big.

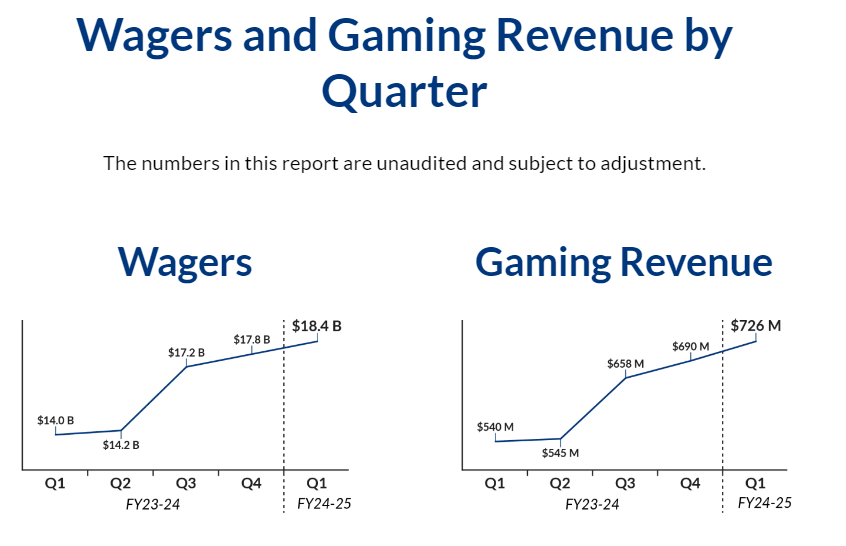

Let’s kick off with the headline new — in the last few months, Ontarians dropped $18.4 billion on casino and sportsbook wagers.

That’s over $6 million a month.

It’s also 31% up over the start of last year.

But it’s not just total handle that’s going up. Just about everything else is, too.

Take total player numbers, for example.

In the same period last year, they totaled 920,000. But in Q2 this year, they’re now at 1.9 million active player accounts.

That’s some serious growth. Although, judging by the fact that players more than doubled while handle only went up 33%, there’s a chance the new bettors coming in are smaller fish than the initial influx that came after Ontario first legalized iGaming in 2022.

In any case, growth is growth. And 33% is still nothing to turn your nose up at. Even if it’s in Canadian dollars — the most easily-laundered currency in the world.

Oh, and speaking of dollars, the other “growth” stat to look at is net gaming revenues… after all, any affiliate can tell you that gross handle doesn’t pay the bills. Not if the gamers are actually winning.

That’s when you end up with a negative carry.

Luckily, gamers in Ontario don’t seem much luckier than anywhere else in the world, with revenue tracking more or less in lock step with handle.

Now, of course, this is all well and good. Any sane person should be convinced by now that Canada (if Ontario is anything to go by) is a great target market.

But and sane person also knows there’s more to gaming than just gaming. I mean, there’s sportsbooks, there’s casino… and you can even break it down further than this into things like live poker, slots, etc.

So, where’s the real growth?

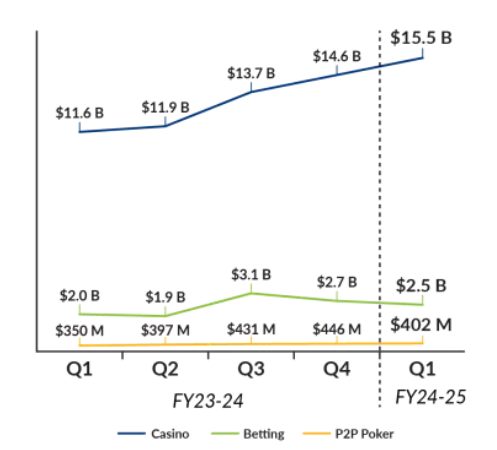

Turns out, that’s coming from casino games like slots. In fact, this is pretty much driving the entire industry, accounting for a full 84% of all wagers as the canucks from Ontario dropped a cool $15.5 billion on them last quarter.

But It’s Not All Casino

Of course, if you compare the $15.5 billion wagered on casino games last quarter to the $18.4 billion in total industry handle, you might notice there are a few billion going unaccounted for.

Turns out, most of that’s coming from sports betting. Specifically, $2.5 billion worth of wagers.

Unfortunately for sportsbook operators, that figure’s only $500 million up from the $2 billion handle from the same period last year. And, if you’re wondering why I’m saying “unfortunately”, it’s ‘cause that only represents 25% growth — less than the 33% the industry total.

But before you say “buy hey, that’s still good”, just wait… it get’s worse.

In Q3 2023, the sports handle actually jumped all the way up to $3.1 billion. And yeah, that means it’s actually on a steady decline since then — Q4 2023 was $2.7 billion.

Oh, and for the mathematically-inclined who noticed that subtracting $2.5 billion (sports handle) and $15.5 (casino handle) from $18.4 billion (total handle) still leaves $0.4 billion unaccounted for, well, here it is:

Yep, the rest of the money’s in “P2P poker”. You know, as in real people playing against real people.

Takeaway

Who would’ve thunk our friendly friends up north were such gambling degens?

And who would’ve thought that a Zamboni republic (fine, I guess they’ve got mines, too) hell-bent on ice hockey and curling would actually prefer casinos over sports betting? (PS: Speaking of curling, check out our CamSoda affiliates review edition for something interesting.)

Anyway, as luck would have it, turns out the Stake Affiliate Program just so happens to offer exactly that — a casino.

And, here’s the kicker.

When you see the difference between total handle and net revenue ($18.4 billion handle vs just $726 million revenue), you kinda understand why the Stake Affiliate Program commission structure is actually kinda interesting.

X Turns I

This week marked the one-year anniversary for Twitter’s rebranding to X.

Naturally, there has been a little about it in the news. A lot of it is the usual dunking on Musk.

A popular dunk here is to dig up some of Musk’s past promises, like that one time he “promised” Twitter would have a billion monthly active users by 2024.

Of course, with 2024 now here and Twitter not quite at the billion MAU point (you’ll see exactly where it is soon…), people love to pull out the old “ha, you see, he failed” thing.

Now, of course, if you were paying attention and saw that I put quote marks around “promise”, there was a good reason for that. I mean, let’s get serious. Anyone who really takes anything Musk says seriously needs to get their head checked.

Sure, maybe way back in the early 2010s it was understandable to take Musk seriously. But there’s only so many years in a row someone can promise “full self-driving by next year”, or “robotaxis in two years” before it becomes clear he’s a bit of a hypeman.

But, just in case it wasn’t clear to you yet, here’s a website dedicated to tracking the status of Musk’s bold claims. No prizes for guessing what’s right at the top.

Or, just take a look at this:

Still think you can take everything the man says at face value?

Anyway, the point of all that is to say that when Musk promises “a billion users” or anything grandiose like that, the point is not the exact number. The real point is “the direction things are heading”.

So what direction is “a billion users”?

That’s right — it’s up.

So, did X move up from where Twitter was?

Let’s take a look.

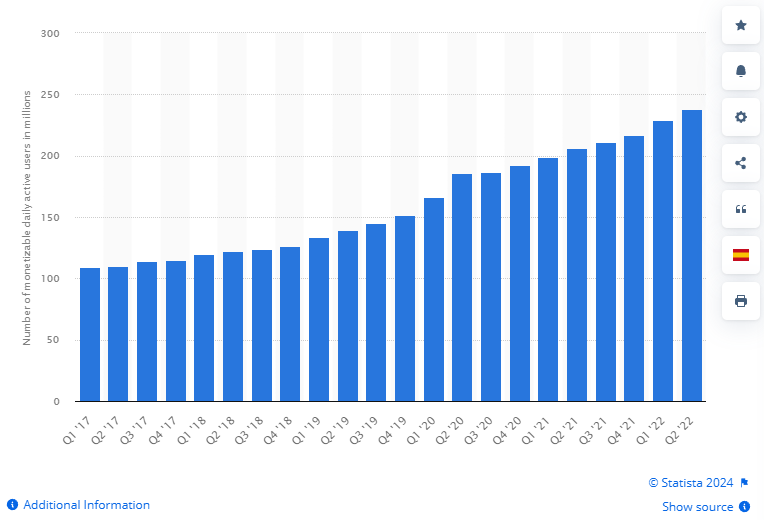

Here’s a chart of Daily Active Users on Twitter up until 2022 when Musk took it private.

If you squint, you’ll see DAUs topped out at a bit over 200 million people in 2022. If you squint really hard, you’ll see that it was precisely 237.8 million.

And now guess where they are today?

Yep. They’re up. 250 million, to be precise.

The same trend applies if you look at Monthly Active Users.

Now, I know, I know. For a once-was-a-hypergrowth platform, those numbers aren’t exactly mind-blowing.

But, if you take a look at just about any platform, the story’s the same — the hypergrowth days are over. If you don’t believe me, go take at the nosedive Facebook’s in right now, which we looked at in our uMobix affiliate program review edition.

Even TikTok is starting to run up against some limits — it’s only grown total users by about 6% since 2023, despite it being the undisputed king of social right now.

With that said, it’s not all fun and games at X right now.

Ask anyone who’s been buying ads on the platform in both the pre- and post-Musk days, and yeah, ads are dirt cheap right now.

In fact, X is so desperate for ad dollars right now that they’ll basically refund your entire “verified organization” fee in free ad credits. Which means, right now you can either get a free verified organization account (yellow check mark), or a few g in free ad credits, depending on which way you look at it.

But, of course, that’s got little to do with actual platform statistics. The whole ad revenue thing probably has a little more to do with the whole “OMG X formerly Twitter not brand safe” thing.

This probably didn’t help much either:

Takeaway

Twitter’s growing and its ad prices are dirt cheap.

Heck, if you want to sign up as a verified organization, those ads are basically for free. Plus you get the massive algo boost that comes with it.

But even if you stick with the free route, X is still a totally viable platform.

Just remember, if you’ve got any chance of being seen as a non-verified member, you’re gonna have to make an impact.

Lucky for you, there are still some spaces where this is pretty easy.

If you need an example, just go take a look at the casino content on X right now. It’s bad.

Like, really bad.

Here’s what shows up at the top of the search when I look for casino content.

Yeah It really is that bad. Like, it’s cheap cologne advertising bad.

It’s so bad, that I’m going to make a bet.

Actually, make that 2.

My first bet — I bet you can come up with something a billion times catchier than “step into the ultimate paradise.”

My second bet — I bet you can make a pretty penny monetizing whatever you come up with using Stake Affiliate Program.

Closing

If I ask you the question “What’s at stake”, hopefully, your answer is, “Duh, the Stake Affiliate Program — great product, even greater commissions.”

But, if you somehow skipped everything above and landed here, you might be thinking more along the lines of risk and reward.

Now, often we like to think of risk vs reward as some sort of fixed equation.

Risk this, maybe get that.

But, if you get a little creative there’s no reason why it has to be so rigid.

Here’s an example.

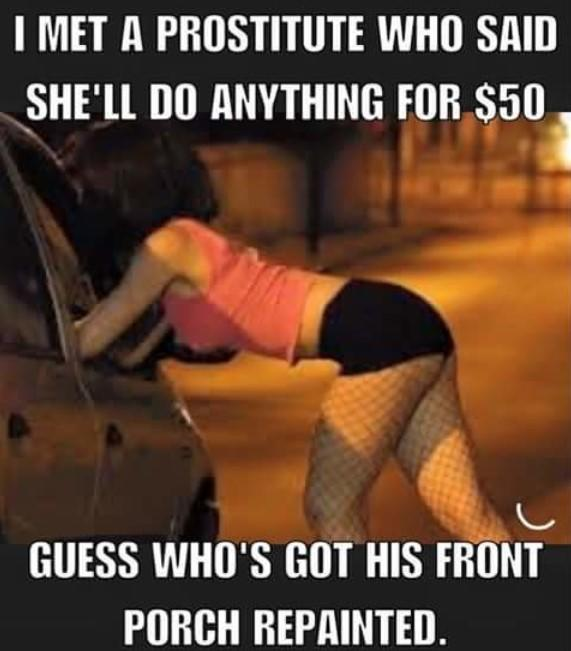

Imagine you’re in your car at night and some “lady of the night” comes up to you and says, “I’ll do anything for $50”.

What’re you gonna think the risk-reward equation is…?

… yeah, I know what you’re thinking…

… but what if I showed you this:

You see, risk vs reward ain’t so fixed after all.

The best part about this framework is you don’t even have to be that creative with how you reframe risk vs reward.

I mean, take something simple.

Maybe the whole time thing — the “opportunity cost” — is the only thing holding you back from testing out the Stake Affiliate Program?

You got your way of marketing things, so you know just how much time you’ll have to risk to test something new.

But, in much the same way as ladies of the night are capable of painting a front porch, you’re also capable of doing something different, too.

I mean, are you really risking anything much by taking 5 minutes of downtime to sign up for the Stake Affiliate Program, head over to X, and churn out a handful of “my slots in bio” tweets?

Heck, you could do it next time you’re taking a dump.

That way, you’re risking basically nothing, but maybe gaining something.

But the only way you’ll know is if you join the Stake Affiliate Program now… wink wink.

__

(Featured image by SevenStorm JUHASZIMRUS via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Cannabis2 weeks ago

Cannabis2 weeks agoCannabis Clubs Approved in Hesse as Youth Interest in Cannabis Declines

-

Business7 hours ago

Business7 hours agoThe Dow Jones Teeters Near All-Time High as Market Risks Mount

-

Crowdfunding1 week ago

Crowdfunding1 week agoWorld4All, a Startup that Makes Tourism Accessible, Surpasses Minimum Goal in Its Crowdfunding Round

-

Crypto4 days ago

Crypto4 days agoThe Crypto Market Rally Signals Possible Breakout Amid Political Support and Cautious Retail Sentiment