Featured

As the stock market remains unstable, here’s a friendly reminder: Don’t fight the Fed!

Today, as the Dow crosses 26,000, happy days await the stock market. But with a minimal growth pattern, the market can fall when growth seems just fine.

On March 9, 2009, The Wall Street Journal’s Money and Investing section posed this ominous question: “How low can stocks go?” The stench of economic malaise was suffocating as the Dow Jones Industrial Average (DJIA) rounded off its fourth straight week of losses, and the S&P 500 touched below 700 for the first time in 13 years. Goldman Sachs cautioned the S&P could fall to 400 while CNBC’s Jim Cramer was busily calculating the stock valuations of the DJIA components based on balance sheet cash levels.

Yet miraculously, as the stock market pundits stood despondently believing there was nothing positive on the economic horizon and that no stock was worth buying at any price, investors stared into the abyss and took a leap of faith. And just like that, the market had bottomed. Dow 6,440.08 was a buying opportunity, and with the Fed’s QE spigot operating on full throttle, the Dow was poised for a historic take-off.

Oh, what a difference nine years make! Today, the Dow has crossed the then-unimaginable of 26,000. The rationalizations abound; lower corporate taxes, less regulation and sizzling business and consumer confidence all scream “happy days are here again!” With nothing but blue skies ahead, the only question left for Wall Street to ponder is the uncertainty of how many days it will take before the Dow crosses another 1,000-point milestone.

But not so fast … Remember, the stock market climbs a wall of worry, and in 2009 that wall was seemingly insurmountable. Back then the sentiment was that nothing could go right — yet the market endured as economic and financial Armageddon loomed around every corner. Today, the exact opposite scenario is evident. The belief prevails that nothing can go wrong. However, hiding in plain sight, there is one gigantic cliff the stock market has already started to head down. But the real reason behind the next violent crash in the equity market is the current bursting of the worldwide bond bubble.

The stock market now resembles an unstable uranium 235 isotope. The splitting catalyst will be the result of slamming $10 trillion worth of negative-yielding sovereign debt and $230 trillion worth of total global debt into the reversal of central bank money printing and unprecedented interest rate suppression.

Remember this truth: If the market can rise on sluggish growth, it can also fall when growth seems fine.

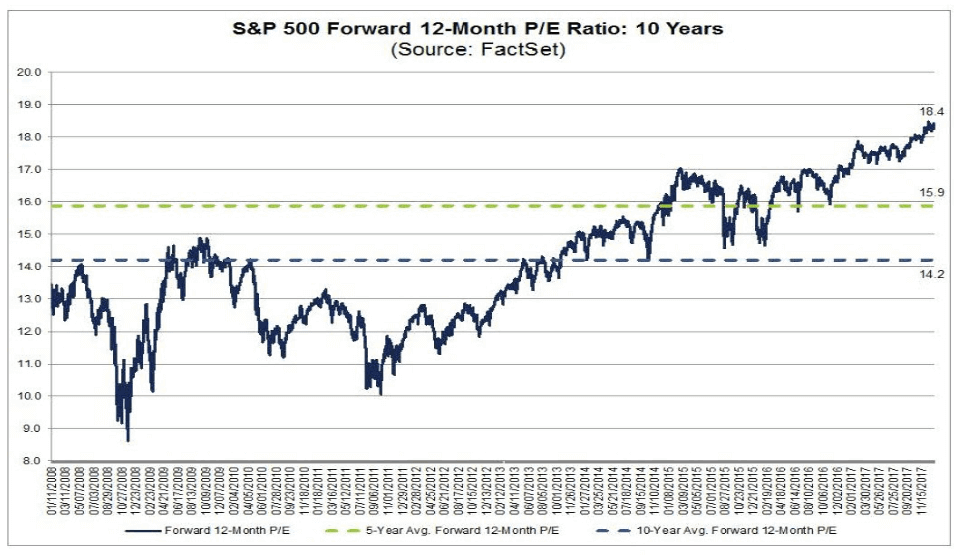

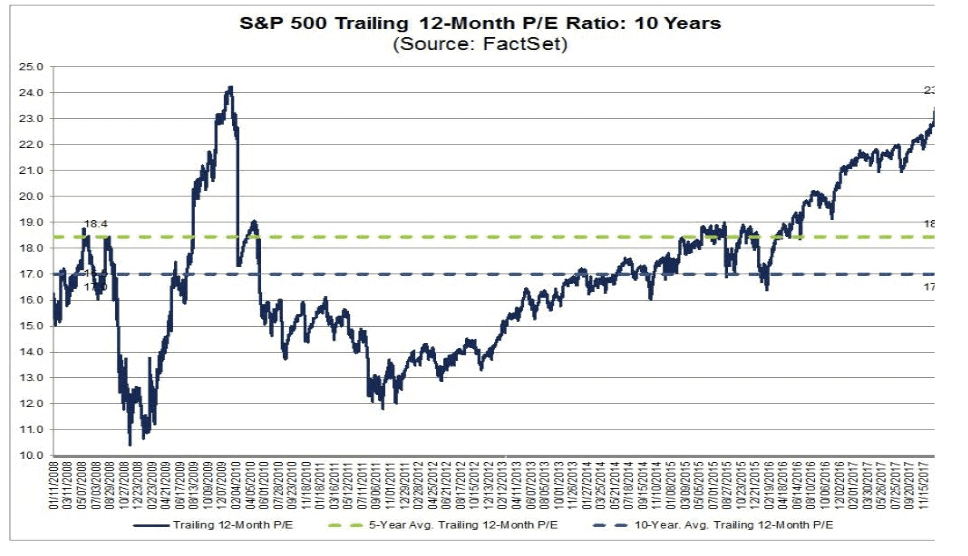

Investors must determine what has already been priced into shares and what lies ahead for growth. It is essential to keep in mind that the market is over-priced according to almost every metric. For instance, even if all the rosy economic projections pan out for the tax cuts, the market is still trading at 18.6 times forward 2018 earnings, according to FACT SET — the market trades typically closer to 15 times earnings. The trailing PE ratio is now at its highest going back to 2009.

In addition to this, we have cash levels at all-time lows and margin debt at all-time highs. Mutual funds and ETFs that focus on stocks just recently raked in $58 billion in new money, according to Bank of America Merrill Lynch. And at 150 percent, the total market capitalization of equities has never been higher in relation to the underlying economy.

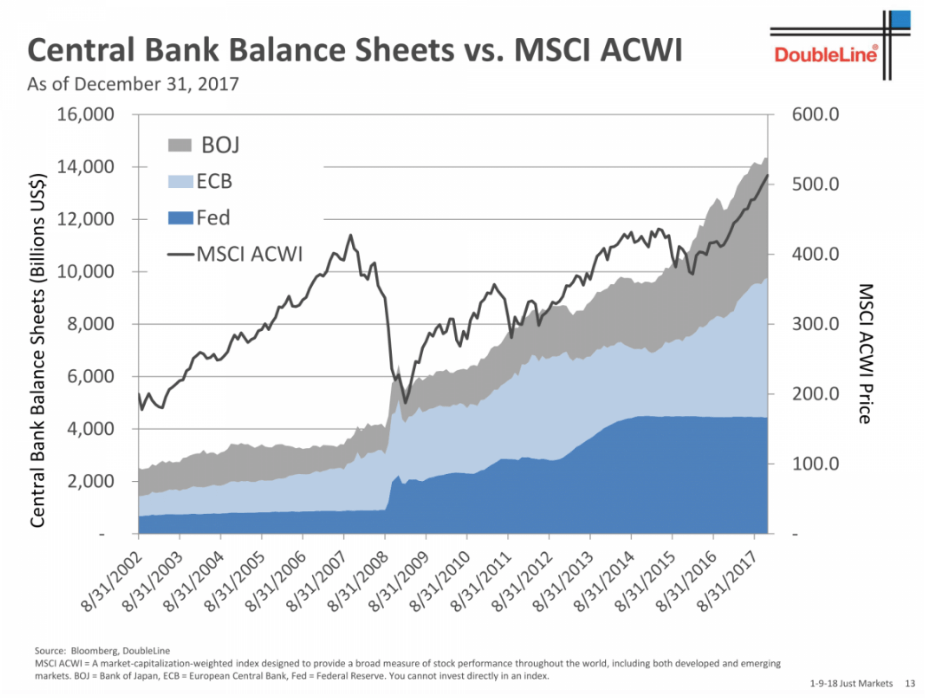

Since the bottom in 2009, the markets have been driven higher by oceans of central bank liquidity (QE).

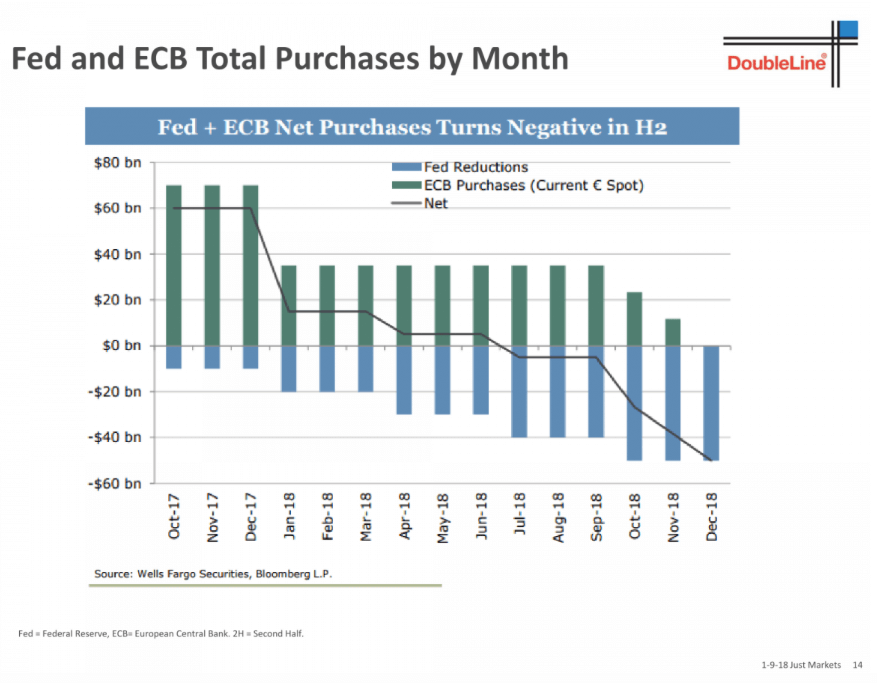

But the most salient point here is that the QE party is winding down in all corners of the globe. Even in Japan, where the central bank’s balance sheet has started to decline for the first time since 2012. In case you forgot, Japan opted for the even more potent “QQE” (Qualitative and Quantitative Easing). Under QQE the Bank of Japan had been buying Japanese Government Bonds, corporate bonds, REITs, and equity ETFs. But, they have recently announced taperings in the size of its asset purchases.

In order to be bullish of stocks today, you have to also be willing to fight not just the Fed, ECB and BOJ; you have to go against a plethora of the globe’s central banks that are in various stages of tightening monetary policy. In addition to the banks just mentioned, you have to throw in China, Canada, England, Turkey, Malaysia, Mexico and even Ukraine that have recently made hawkish moves.

We’ve all heard the mantra “Don’t fight the Fed,” and history has proven that axiom to be correct. Therefore, to ride against the global tide of central bank tightening is much more than merely unwise. It is unprecedentedly inane and dangerous! Especially given this coordinated hawkish turn occurs in the context of a record amount of debt and massive asset bubbles that pervade worldwide.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing1 week ago

Impact Investing1 week agoClimate Losses Drive New Risk Training in Agriculture Led by Cineas and Asnacodi Italia

-

Crowdfunding6 days ago

Crowdfunding6 days agoReal Estate Crowdfunding in Mexico: High Returns, Heavy Regulation, and Tax Inequality

-

Africa2 weeks ago

Africa2 weeks agoAgadir Allocates Budget Surplus to Urban Development and Municipal Projects

-

Cannabis3 days ago

Cannabis3 days agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions

You must be logged in to post a comment Login