Crypto

Stock markets record all-time highs amid Bitcoin crossing $7000 level

The market cap of cryptocurrencies is between $180 to $200 billion but Bitcoin will seemingly continue to grow.

“To the moon, Alice!”- Ralph Kramden, The Honeymooners

Weekly Update

And at the current rate, it might not be too long before it’s actually there. The moon, that is. No, not Alice—Bitcoin. Yes, Bitcoin crossed $7,000 this week. It was less than a month ago Bitcoin passed $5,000. The riches are dazzling as Bitcoin is up 640% this year alone. Bitcoin now has a market cap of $100 billion. How much longer before it’s bigger than Amazon or Apple or worth more than the entire gold stock market?

But the question continues to beg—is Bitcoin a historic bubble? Until it bursts, the question is strictly academic. And don’t forget, not only is there Bitcoin but there are now over 1,000 other cryptocurrencies. And Bitcoin has forks as well called Bitcoin cash and Bitcoin gold.

Okay, we are not going to get into a huge discussion of Bitcoin and how it is structured and what blockchains are all about. It is mind-boggling enough trying to figure all of that out. We will have further comments on our weekly “Bitcoin Watch!” commentary.

The stock markets made new all-time highs again this past week. That comes against the backdrop of the terrorist attack in New York City, indictments in the Russia investigation including former top aides of President Donald Trump, and possible brewing trouble in the Mid-East. There is also the escalating crisis in Catalonia in the heart of the EU, ongoing trouble between Kurds and Iraq/Iran/Turkey, and continued moves afoot to lessen the use of the US$ in world trade. As well, a new Fed chairman has been proposed. But all the stock market cares about is the potential to pass the tax bill that could put billions into corporations and the 1% even as it could create deficits estimated at up $1.5 trillion over the next decade.

Maybe the stock markets are also headed for the moon, albeit at a much slower pace. Still, the records just keep on falling and there seems to be little in the way of stopping it. We may wring our hands over the alleged terrorist attack that killed 8 and injured many more but largely ignore an attack in a Walmart in Colorado that left 3 dead that occurred not long after the NYC attack. And I might add as we prepare this for distribution another attack in some small Texas town in a church that has left multiple fatalities.

One can only suppose that it would take an attack on the scale of 9/11 to catch the market’s attention. In the Mid-East, another Israeli aerial bombing inside Syria drew a retaliation of missile fire from Syria and followed with the threat of more. The incident was largely ignored (except by Israel), but if actual war broke out between Syria and Israel that would catch the attention of the markets given that both are backed by the US and Russia respectively and with the presence of both US and Russia military in Syria.

As if the US doesn’t have its hands filled with North Korea. As at the time of writing US B1 bombers were skirting North Korea, which accuses the US of “seeking to ignite a nuclear war.” What if war actually broke out? Well, the markets would not take to it kindly.

The first indictments were laid down by special counsel Robert Mueller in the Russia investigation. They were largely as expected but there is now considerable concern in Washington as to where this is going. If it escalates further and it appears that the Trump Presidency is under investigation (it is but the first indictments gave few clues to that), that would catch the attention of the markets. The Mueller investigation is showing signs of growing especially as it delves into Trump’s tax returns.

The threat of Trump firing Mueller is real. If it happened, it would be comparable to the infamous “Saturday Night Massacre” under Richard Nixon. It could well cause a panic in the markets. As well, Trump and the Republicans are working feverishly to shift the focus on to Hillary Clinton on what she may have or not done with regard to emails, uranium sales, and others.

The Catalonia crisis is a Spanish problem but it is also an EU problem. That arrests have been made and the leader of Catalonia has gone into exile in another EU country threatens to broaden this crisis against the backdrop of continued street protests in Catalonia against the Spanish government. The Euro has taken a considerable hit of late of which the Catalonia crisis is one of the reasons.

The Kurdish separation crisis has calmed for the moment but it is a dilemma as the Kurds were a key ally of the US in the fight against ISIS. Turkey is a NATO member and Iraq has also been backed by the US. Only Iran is the outlier and the US wants to back out of the nuclear deal with Iran that was signed along with Russia, China, UK, France, Germany and the EU. The US also wants to re-impose sanctions against Iran which would put the US at odds with the others including the EU.

Taken to its full extent, that could also wind up rattling markets. The Kurdish crisis has put Canada in a bind where Canadian forces were providing advise-and-assist to both the Kurds and Iraq in the fight against ISIS. Canada has suspended providing military aid to both sides.

The markets may be singing the praises of the appointment of Jerome Powell to head the Fed. Powell is a long-time Fed governor, Wall Street lawyer, and investment banker and is in the vein of outgoing Fed Chair Janet Yellen. That should translate into a steady-as-she-goes Fed for monetary policy, interest rate hikes, and the economy. It is almost like re-appointing Janet Yellen herself, the first time an outgoing chair was not given a second term in decades. As one pundit noted—meet the new boss, same as the old boss.

Powell still has to be confirmed. But being a Republican himself he should face easy, going from Congress and the Senate. Heck, he even spent time in the Treasury Department under Bush 1 and was a partner in the Carlyle Group, a private equity firm loaded with Bush groupies. And he is a multi-millionaire, one of the wealthiest ever to head the Fed. He couldn’t be more Yellen then Yellen herself except for the wealthy part. In fact, there is little to really attack him on except some have intimated he might be too beholden to Trump when the position requires complete independence.

At some point, Powell may have to face a recession and what’s key is how he and the Fed might respond to one. After all, expansions don’t last forever. The current expansion is already eight years long, one of the longest on record. With so many asset bubbles appearing at once it has to be a question of when not if something bursts. There have been instances where two consecutive terms of a Presidency saw no recession and a stock market correction of at least 20%, the most recent ones being the Presidencies of Bill Clinton and Barrack Obama. There is no supportive history for going three consecutive terms without a recession and a sharp stock market correction. George W. Bush faced two recessions and two stock market corrections exceeding 20%.

Powell is not one who is going to upset the apple cart in the mode of John Taylor or Kevin Warsh, two others who were being considered for the position. With the filling of the Fed Chair, the Trump administration still needs to fill three more spots on the Fed including the Vice Chair. Leaving the positions unfilled is not a wise idea according to many Fed watchers.

The Trump administration needs a winner. After the failure of the repeal of Obamacare in the Senate, the Trump administration is looking for a winner with its tax reform plan. It is apparently going to be tough sledding. Democrats are adamantly against it with accusations that the tax reform plan is a gift to the rich and things like the phase-out of inheritance taxes are a gift to Trump and members of his family and cabinet, amongst others.

There is also discontent amongst Republicans, especially deficit hawks where the plan is estimated to saddle the US with an additional $1.5 trillion in deficits over the next decade. The US national debt currently stands at $20.5 trillion. There is opposition elsewhere as well from US states, small business associations, and others. Passing this before year-end is iffy. The stock market loves it and rallied once again to new all-time highs.

This week also brought us the monthly nonfarm payrolls and employment numbers. We cover them below.

It was a busy week in some respects. Central banks were busy as the Bank of England (BOE) hiked interest rates for the first time in 10 years. This came against the backdrop of the Brexit that is spinning wheels. The Fed indicated that the December rate hike may well happen. Coupled with the appointment of Jerome Powell it helped once again to boost the US$. Gold reacted positively to the Powell announcement but faded quickly as the US$ kept moving higher. We cover the US$ and gold in our commentaries that follow.

Bitcoin Watch!

© David Chapman

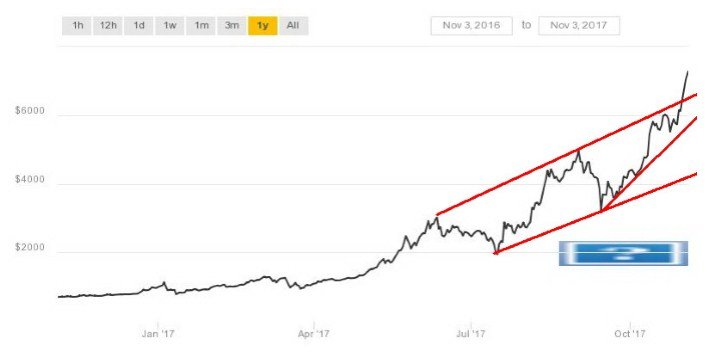

The rise in Bitcoin is leaving us speechless. Bitcoin has now blown through the top of the most recent bull channel and is now off on another trajectory. The corrective action is seen through June/July and again into September may actually be what we technical analysts call a running correction. The A wave would have bottomed in July and the B wave top in at the end of August followed by the C wave bottom in September. Then the market takes off again. The argument against it is usually the correction is seen as an ABC with the three waves unfolding as 3-3-5 correction. The B wave above appears as a possible 5-wave advance. The pattern above shows like a 3-5-3 pattern. Unusual, yes. But let’s assume for the moment it is a running correction. If we treat it that way, we have a potential target up to $7,900. The next target after that would be up to $9,700. $10,000 here we come!

Bitcoin got a bid when the CME (Chicago Mercantile Exchange) announced it planned on introducing Bitcoin futures by year end. The CME cited demand from clients as a reason. But that could bring the CFTC (Commodity Futures Trading Commission) into the picture. Other regulatory agencies may also want to look at it. We understand the SEC is looking at it and here in Canada, the OSC is looking at it and the BofC is looking at it. Bitcoin may be popular with a small but growing crowd but as it expands the regulators will most likely want to control it. There have already been stories of scams and fraud. Regulators are also concerned about money laundering (FINTRAC).

Bankers are looking at Bitcoin as well. When something is going up like Bitcoin has been, bankers, investment dealers, and others want to get in on the action. Trouble is there is hesitancy on their part because it is not a simple case of the bank or dealer just jumping in. These huge financial institutions have in-house compliance departments and they have to look at all aspects. Many have expressed concerns that Bitcoin is just in a huge bubble that will burst and come crashing down leaving investors in ruin. Some have called Bitcoin not dissimilar to Collateralized Debt Obligations (CDOs) that were pedaled during the financial crisis. Many collapsed leaving banks, dealers, and others with large losses. And of course, the financial system had to be bailed out by the taxpayer and the central banks.

Bitcoin’s market cap is growing and is now up to $121 billion. The market cap of all cryptocurrencies is estimated to be between $180 to $200 billion. That makes cryptocurrencies as big as Goldman Sachs and Morgan Stanley together. With the chart breakout, it appears Bitcoin is going to become even larger. The question is: how does one get in on it? Speculative fever is not a very good reason to be leaping into the unknown.

(Chart is courtesy of CoinDesk.)

__

DISCLAIMER: David Chapman is not a registered advisory service and is not an exempt market dealer (EMD). We do not and cannot give individualized market advice. The information in this article is intended only for informational and educational purposes. It should not be considered a solicitation of an offer or sale of any security. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor before proceeding with any trade or idea presented in this article. We share our ideas and opinions for informational and educational purposes only and expect the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor.

-

Biotech2 weeks ago

Biotech2 weeks agoAsebio 2024: Driving Biotechnology as a Pillar of Spain and Europe’s Strategic Future

-

Business9 hours ago

Business9 hours agoDow Jones Nears New High as Historic Signals Flash Caution

-

Business1 week ago

Business1 week agoFed Holds Interest Rates Steady Amid Solid Economic Indicators

-

Fintech5 days ago

Fintech5 days agoMuzinich and Nao Partner to Open Private Credit Fund to Retail Investors

You must be logged in to post a comment Login