Markets

Global Sugar Markets Steady Amid Mixed Trends and Brazilian Weather Challenges

New York and London markets closed higher but remain range-bound with a slight downside bias. Brazilian rains slow harvesting but may boost next year’s production, though earlier droughts and fires have impacted yields. Brazilian sugar exports dropped to 3.39 million tons in November. Indian and Thai mills anticipate strong cane crops despite mixed market trends.

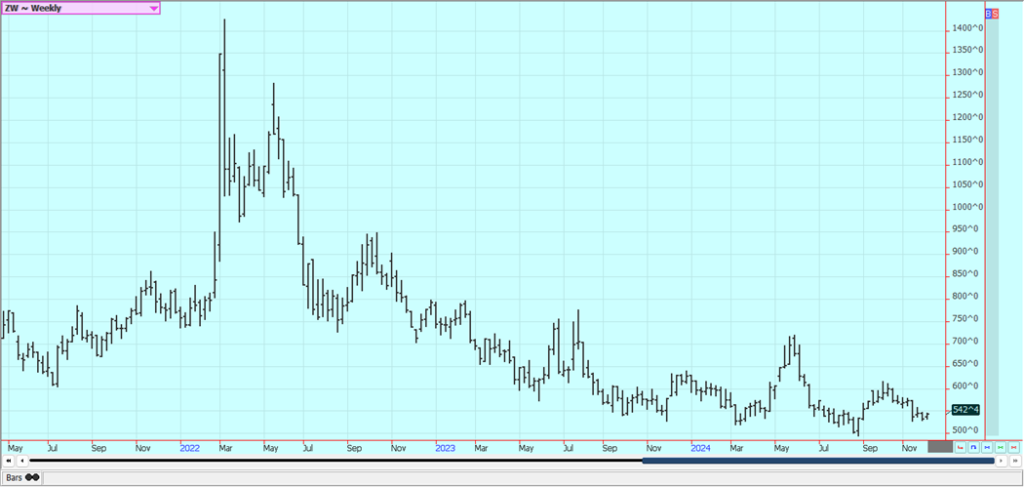

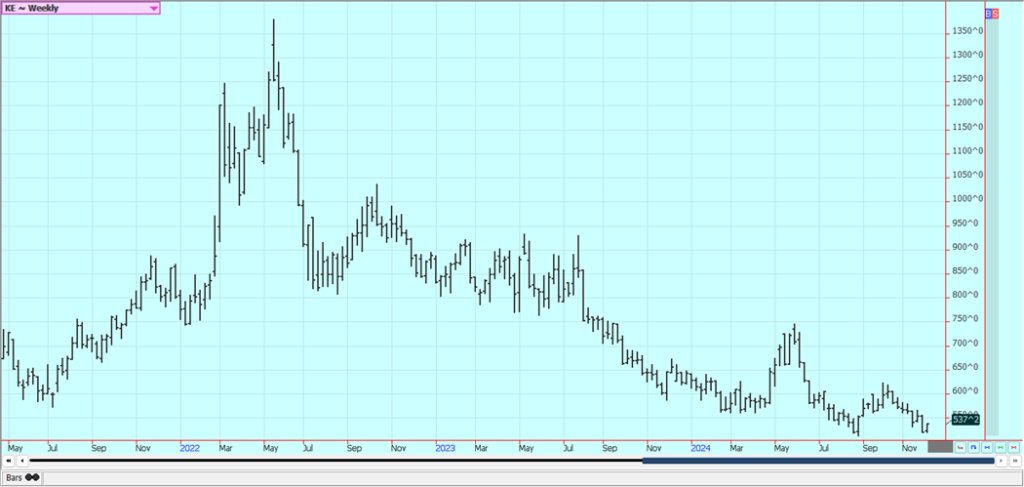

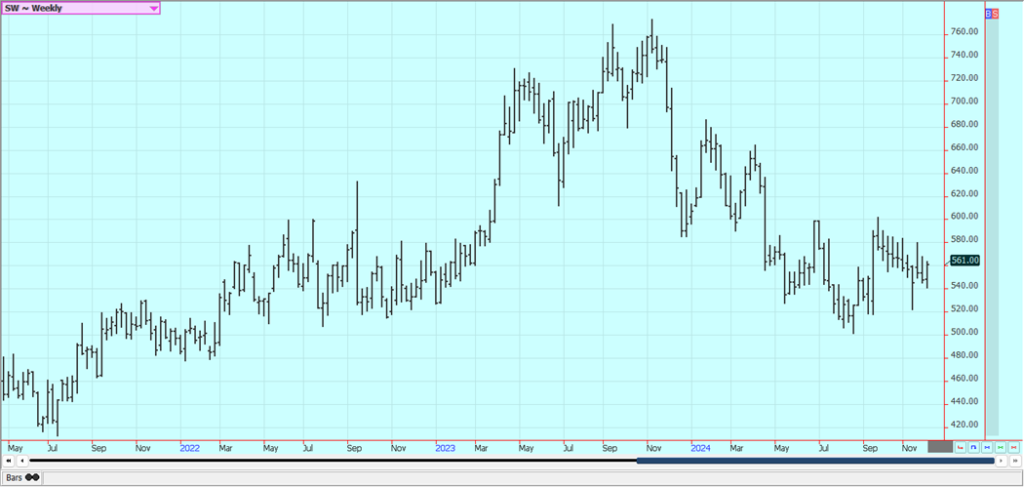

Wheat: The markets were higher last week for Winter Wheat, but a little lower in Minneapolis Spring Wheat. Egypt is moving its Wheat buying to a new agency that will close deals privately and make it harder to track Russian prices. It is something the Russian government wanted. Tensions remined high between Ukraine, the US, and Russia.

The growing conditions in the US are very good. Reports of very beneficial rains for the Great Plains and Midwest and reports of weaker offers in Russia and Argentina were negative for prices. Wheat farmers in the US can plant the Winter crops under good conditions. Australia has seen too much rain recently that has downgraded about 4.0 million tons of production to feed instead of food. Australia still has a very big crop to sell into world markets.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

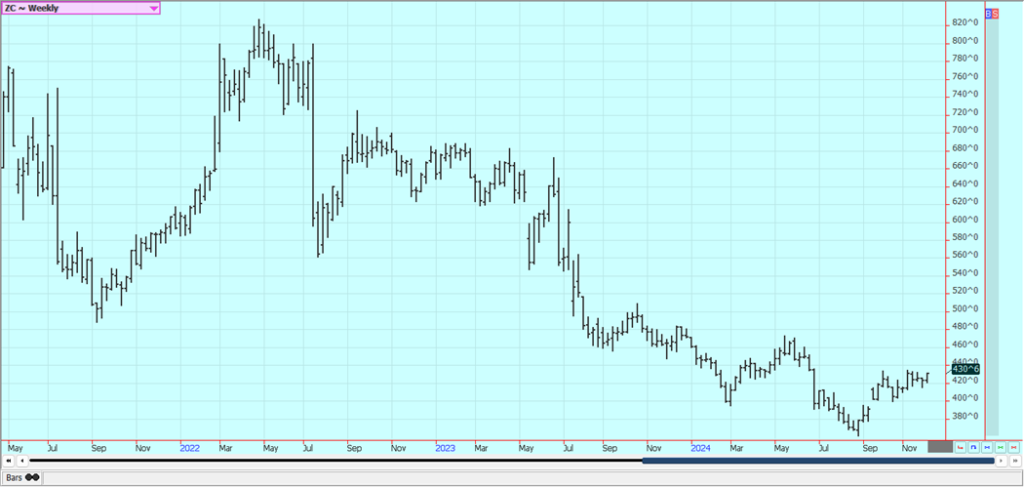

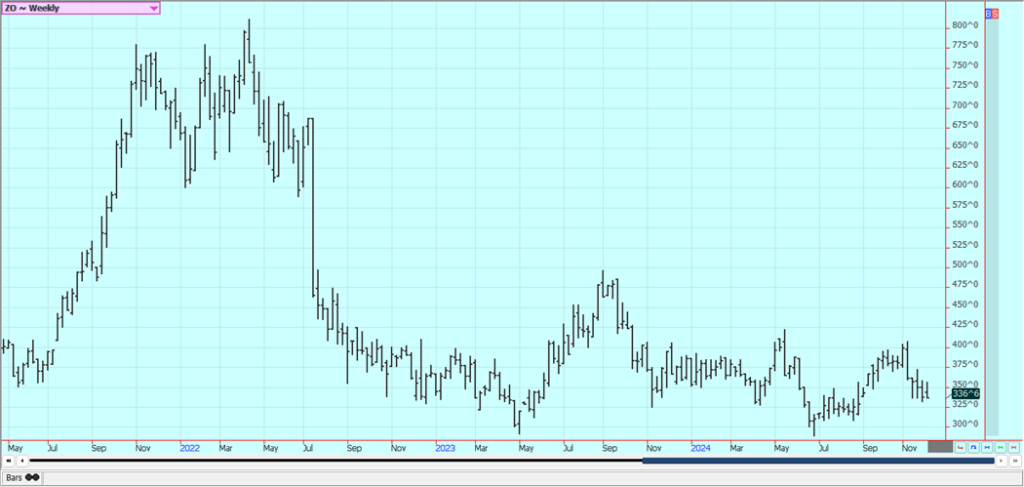

Corn: Corn closed higher last week as the US harvest wraps up and as demand remains strong. The weekly export sales report showed strong sales. The export demand in recent weeks has been very strong and it seems like some of the buying is in anticipation of the new presidential regime starting here in January.

President Trump has promised new tariffs on goods and services and some buyers may be making purchases now to avoid the potential for the tariff at a later date. There were no sales announcements in the daily reports from USDA in the last week. Trading volumes are down and it feels like the holiday market is already here. Oats were lower. Canada is also looking at 25% tariffs imposed on exports to the US. The majority of the Oats consumed in the US comes from Canada.

Weekly Corn Futures

Weekly Oats Futures

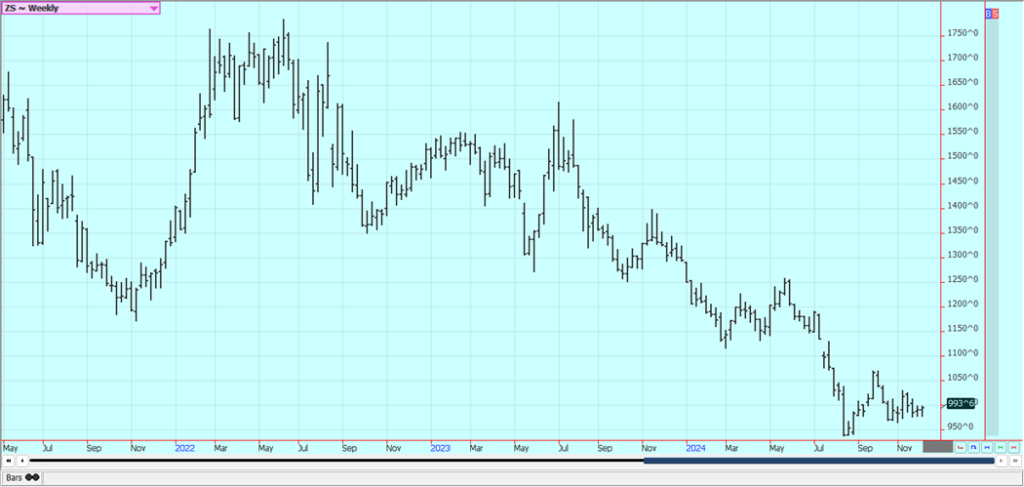

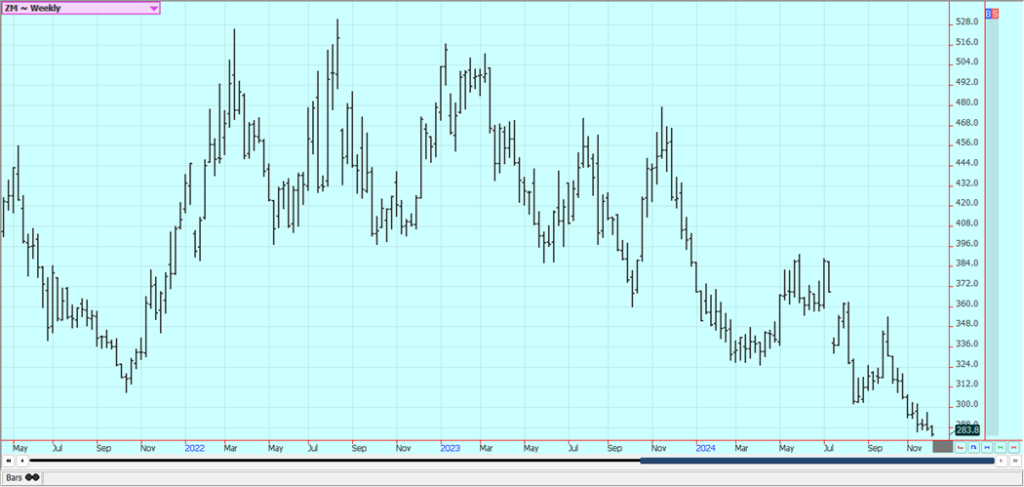

Soybeans and Soybean Meal: Soybeans and Soybean Oil were higher last week as ideas of big south American production potential of Soybeans continue. The weekly export sales report was strong. Soybean Meal was lower on spreading against Soybean Oil. Trump has proposed to bring tariffs to China that could raise the price of used cooking oil to levels unprofitable for US makers of bio fuels. A major competitor to Soy Oil for bio fuels would be removed.

The tariffs that Trump plans to impose could be another detriment to sales of all products. Brazil looks to produce much more than a year ago and some estimates range as high as 175 million tons for the country. Brazilian farmers are planting what is expected to be a very big crop in central and northern areas of the country. Warm and dry weather in the Midwest this year has hurt US production ideas due to ideas of small and very dry beans in the pods. Soybeans are often harvested at moisture levels below 10% this year. Central and northern Brazil rains will continue. Soils are in much better shape in southern Brazil and Argentina.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

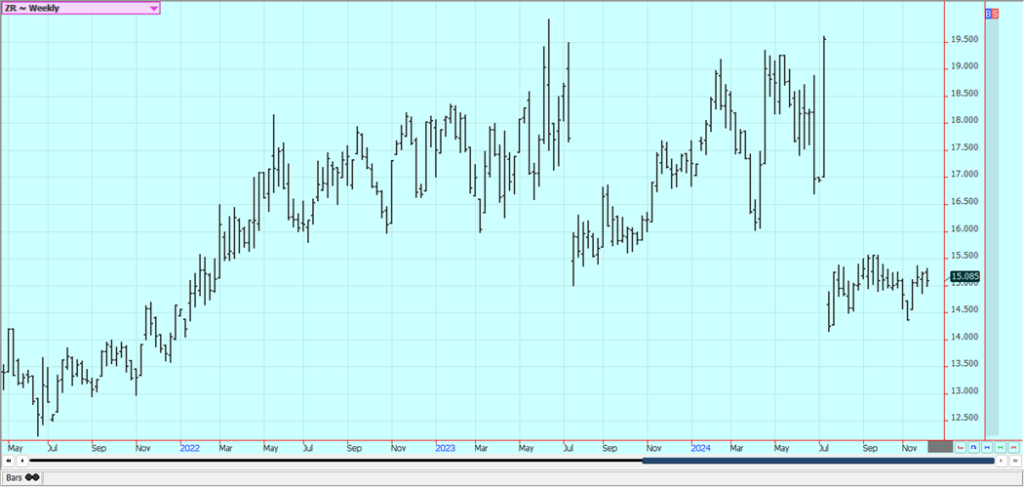

Rice: Rice closed lower last week. The trends are still mixed on the charts. Lower Asian prices are still reported. Brazil prices remain strong and well above US prices. The harvest is over now and the crops are being stored. Increased producer selling interest is likely at this time as futures have rallied above 15.00/cwt.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was a little higher last week. Demand from China has not been good, but demand from India has been seasonally strong. Ideas of weaker production caused by too much rain and reports of good demand provided support.

The private surveyors have indicated that exports have been weaker so far this month. Canola was higher and the charts show that a low has been completed. The harvest is winding down in Canada and the crops are locked away in the bin. Producers will try to wait for higher prices before selling much.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

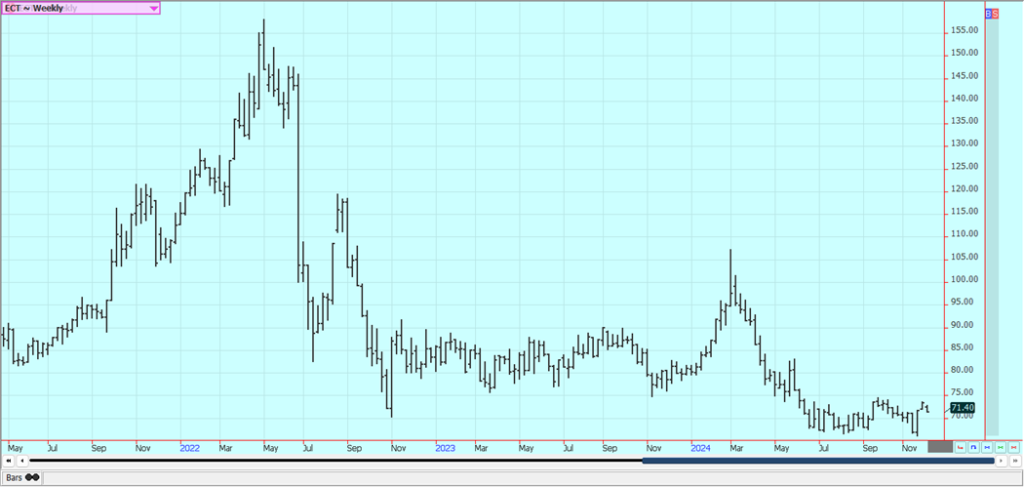

Cotton: Cotton was lower last week after a weaker weekly export sales report and the trends are turning down. There was not much in the way of news or action in outside markets to spur Cotton in one direction or the other. Selling came from news that Trump will impose some big tariffs on China, but the tariffs posted were not as high as he had threatened before during the campaign.

China has big problems with its domestic economy with consumer buying interest not strong and many people not working. There are still reports of weaker demand potential against an outlook for improved but still rather low US production in the coming year.

Weekly US Cotton Futures

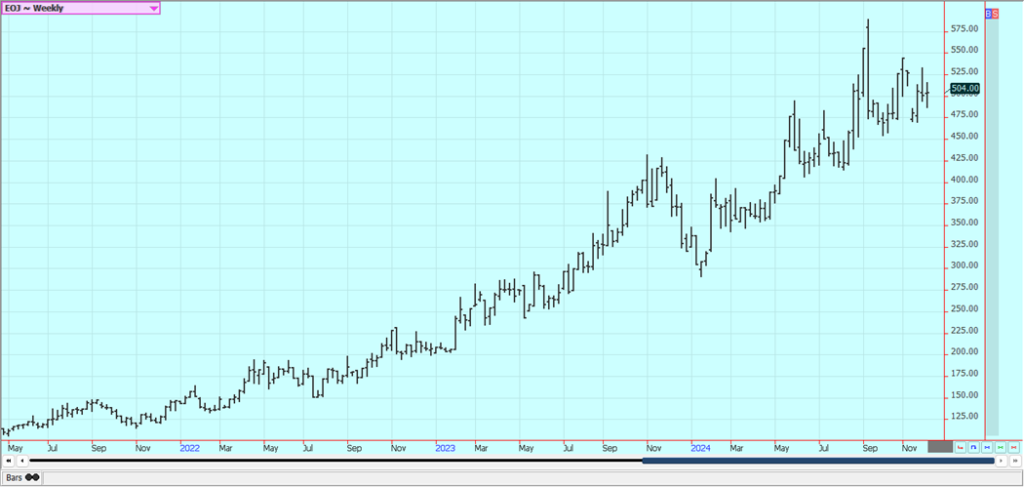

Frozen Concentrated Orange Juice and Citrus: FCOJ closed a little higher last week and the chart trends are mixed. The short term supply scenario remains very tight. The market remains well supported in the longer term based on forecasts for tight supplies in Florida. The reduced production appears to be mostly at the expense of the greening disease and some extreme weather seen in the last couple of years. There are no weather concerns to speak of for Brazil right now.

Weekly FCOJ Futures

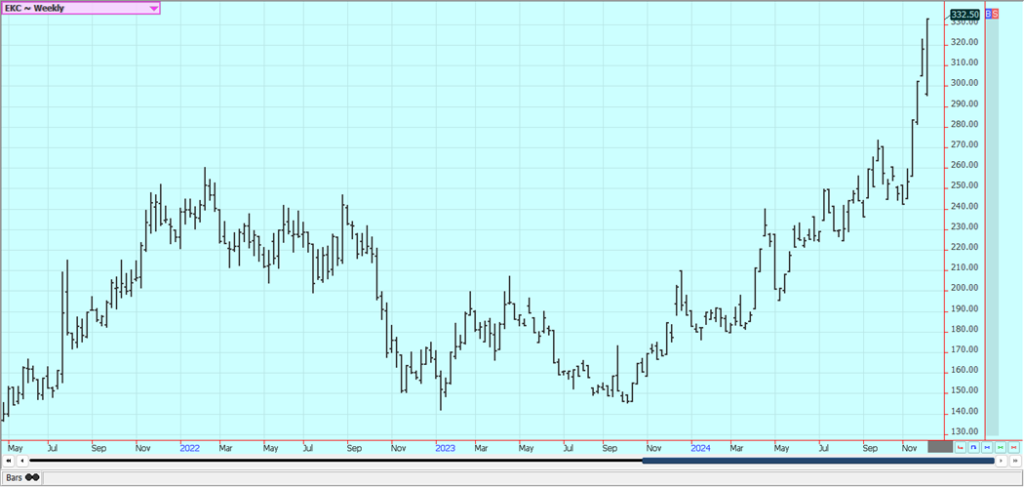

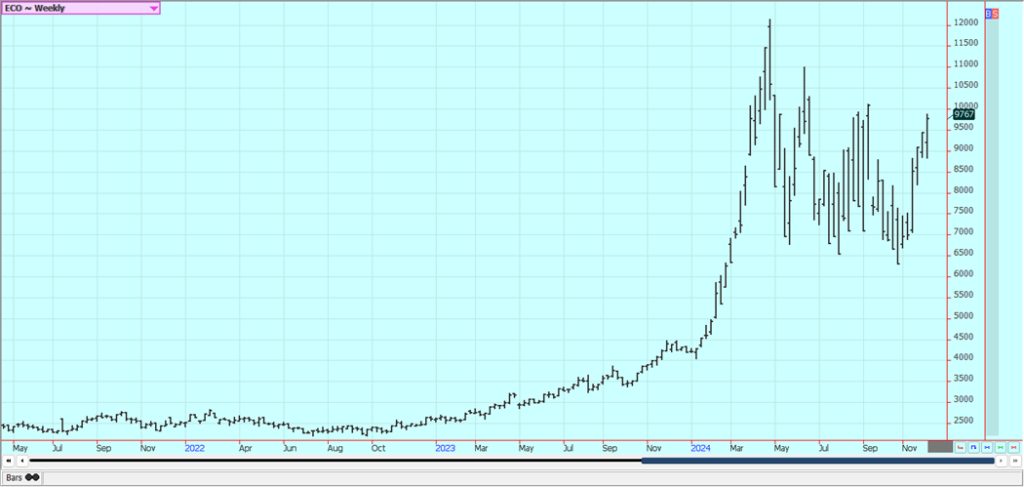

Coffee: New York moved to new highs on the weekly continuation charts and London closed lower last week on what appeared to be speculative buying seen later in the week in New York. Commercials also bought and were leaving short hedges. Reports of reduced offers from Brazil on weather induced short crops continue and there are also reports of too much rain in parts of Central America damaging crops there.

There are reports from Brazil that producers have already sold a lot of Coffee and are holding back on selling more even with good demand. Offers from Vietnam are increasing now as the harvest has been expanding. The chart trends are still up in both markets. There are reports for good rains in Brazil as the rainy season is now under way after very dry conditions.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

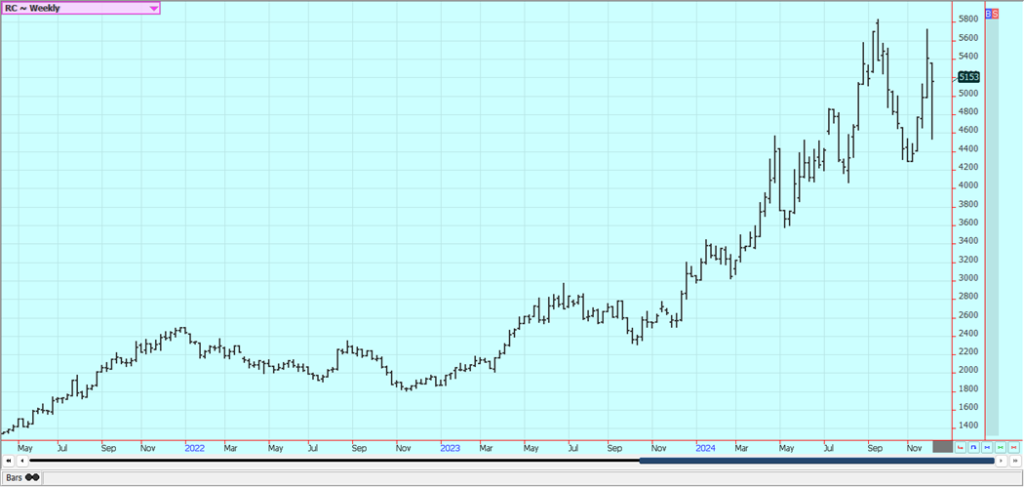

Sugar: New York and London closed higher last week. Both sugar markets remain in ranges with a slight downside bias. The current Brazil rains have kept the harvest and crushing pace down but could provide a boost to production for next year. Trends are mixed in both markets on the daily charts and mixed on the weekly charts. Indian and Thai sugar mills are expecting strong crops of cane. It is also wet in Brazil, and this has affected harvest progress.

Sugar supplies available to the market could be less in the next six months due to adverse growing conditions seen in Brazil during the production period. Total Brazil sugar production has been affected by drought seen earlier in the year and the fires that destroyed crops in some areas. Brazil exported 3.39 million tons of Sugar in November, from 3.64 million last year.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

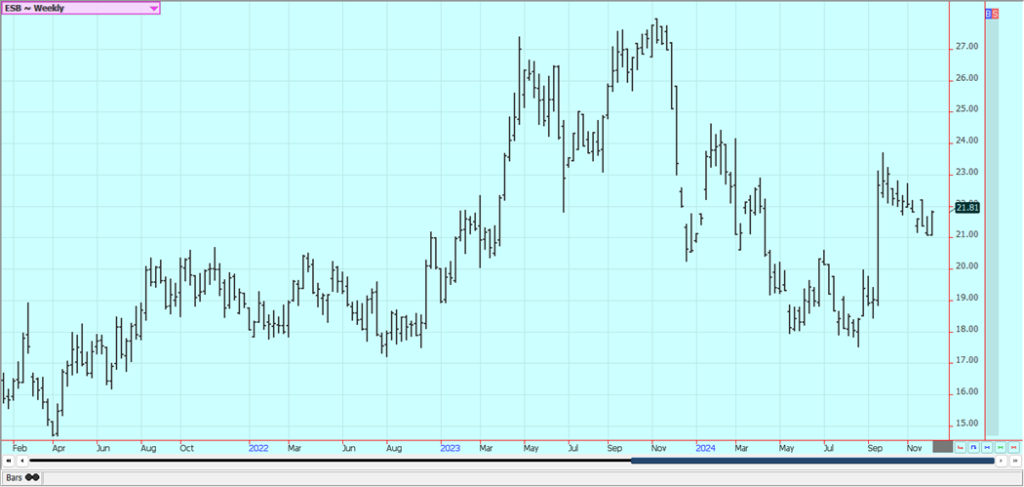

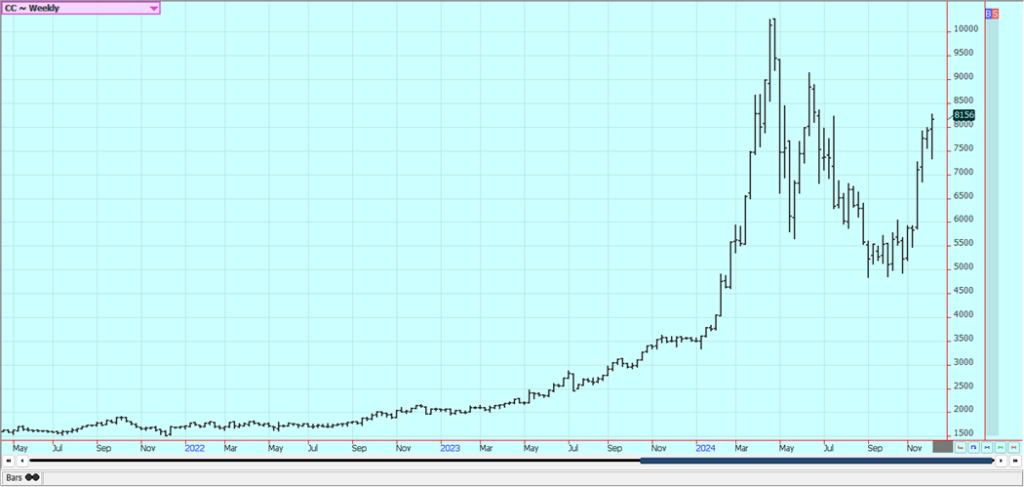

Cocoa: New York and London closed higher on some weather induced buying. There is talk that pro-duction will be short of demand for the fourth year in a row. Chart trends are up in both markets on the daily charts. Producers in Ghana and in Ivory Coast have been fighting against too much rain that has made it hard to harvest and deliver crops. It has been very wet in West Africa lately and this is bringing concerns that pod disease could develop.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Towfiqu barbhuiya via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever.

Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Biotech6 days ago

Biotech6 days agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Fintech2 weeks ago

Fintech2 weeks agoImpacta VC Backs Quipu to Expand AI-Driven Credit Access in Latin America

-

Fintech3 days ago

Fintech3 days agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

-

Impact Investing1 week ago

Impact Investing1 week agoClimate Losses Drive New Risk Training in Agriculture Led by Cineas and Asnacodi Italia