Business

Should you pay taxes using your credit card?

Credit cards are used for purchases, money transfers, house or car loans, and cash advances. Can they be used for tax payments too?

With the new tax reform bill in effect, there are plenty of questions going around. With TSYS reporting on the rise in popularity using credit cards, many are asking if they’re accepted for paying taxes.

Can you pay your taxes with a credit card?

The short answer is yes, you’re allowed to pay federal taxes on a credit card. However, the main question is should you?

First of all, if you aren’t disciplined with your credit card, there is no point in paying your taxes off with it. You’ll end up paying more in interest if you don’t pay off the credit card balance in time. There are zero percent introductory APR credit card offers that give you an extended period to pay off your credit card balance. Once again, you must be responsible and keep track of the time frame given to you to pay your balance off in full.

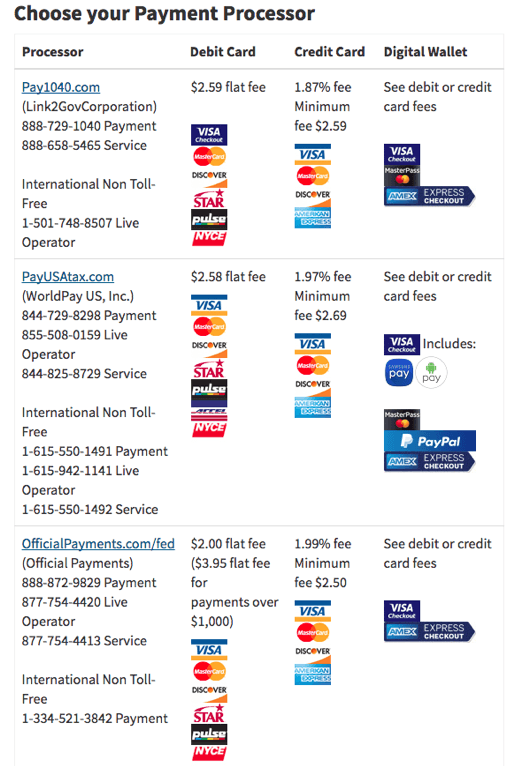

Credit card processors also charge an extra fee on top of your tax bill when using a credit card. The fee to pay with a credit card is usually around 2 percent with a minimum fee, depending on the processor you use.

(Source: IRS)

Keep your credit limits in mind as you make your decision. A large tax bill with a low credit limit creates increases to your credit utilization. This refers to the percentage of your credit limit you’re using. Higher credit utilization scores can lower your credit scores.

Can you earn rewards?

Depending on your credit card, you’ll earn rewards when using it to pay your taxes. Yet, the return is usually not significant. Most cash back rewards cards have a ceiling of 2 percent back, and points cards will offer a similar return. Paying your taxes with your credit card could help you reach the minimum spend to receive an introductory bonus.

It is possible to pay your taxes with credit cards. If you decide to pay with a credit card, make sure you have high credit limits and plan to pay the balance off in full. Using an introductory zero percent APR credit card will increase the length of time to pay off your balance. Also, you’ll benefit if your card offers a bonus reward for hitting a minimum amount. Processors charge an additional fee to pay with a credit card. Make sure the value you receive in return outweighs the fees paid.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Africa2 weeks ago

Africa2 weeks agoBank of Africa Launches MAD 1 Billion Perpetual Bond to Boost Capital and Drive Growth

-

Markets2 days ago

Markets2 days agoCoffee Prices Decline Amid Rising Supply and Mixed Harvest Outlooks

-

Crypto1 week ago

Crypto1 week agoBitcoin Recovers After U.S. Strikes Iran, While Altcoins Face Sharp Losses

-

Africa7 days ago

Africa7 days agoMorocco’s Wheat Dependency Persists Despite Improved Harvest

You must be logged in to post a comment Login