Business

Taxing the wealthy to solve income inequality

It’s Tax Monday. Have you filed your taxes yet?

A tax professional friend of mine told me recently that he’s surprised every year to see how many people leave their tax filing to the last minute.

Maybe they’re too busy. Maybe they live under a rock.

Regardless, they can’t escape it. As U.S. citizens, we wear the IRS ankle brace wherever we go.

So, when I moved to Puerto Rico in May 2016, the tax implications didn’t cross my mind. I packed up and shipped out to be closer to my vacation home on Culebra, not only to expedite its completion but to enjoy it more freely. In hindsight, the move brought with it some much-welcomed tax benefits…

And with what lies ahead, I count my blessings for them.

They always go up

I have always warned that in the Economic Winter Season, as in the 1930s and now, taxes go up — often substantially. The Economic Fall boom creates financial asset bubbles that make the rich richer, faster.

By 1929, the top one percent controlled 50 percent of the wealth and 20 percent of the income.

Currently, they control 40 percent of the wealth and 15.9 percent of the income. Some studies put that control of wealth closer to 50 percent.

When the great crash and deleveraging hits in the Economic Winter, those bubbles burst, sending those holding most of the assets through the ringer. They have the most going into the crash. They lose the most through the crash.

Also, as the economic seasons change, the democratic party tends to take control because the extreme income inequality becomes increasingly intolerable for those on the wrong end of the arrangement. To reign in the rich, they raise marginal tax rates.

The wealthy ended up paying as much as 90 percent on their income during the 1930s, although it’s hard to compare given that there were more deductions and loopholes back then.

Unsurprisingly, Alexandria Ocasio Cortez, the young rising democratic congressperson, is recommending a 70 percent marginal rate on income over $1 million.

Billionaires like Bill Gates, Warren Buffett, and even Ray Dalio are recommending increased taxes on the likes of themselves as well.

From a wealthy perspective

Dalio was on 60 Minutes on Sunday talking to Bill Whitaker. He founded today’s largest hedge fund, Bridgewater Associates, in 1975 and it now manages $160 billion.

Like me, he sees a sluggish (if not outright deflationary) global economic environment ahead, and some serious trouble with China. And, as he said four days ago, wealth inequality is a national emergency.

In his words, “the American Dream is lost.”

In my words, “this is all part of this 90-year Bubble Buster Cycle.”

His suggested solution is higher taxes. The problem with that is, a higher tax on $1 million-plus would only affect the top 0.1 percent.

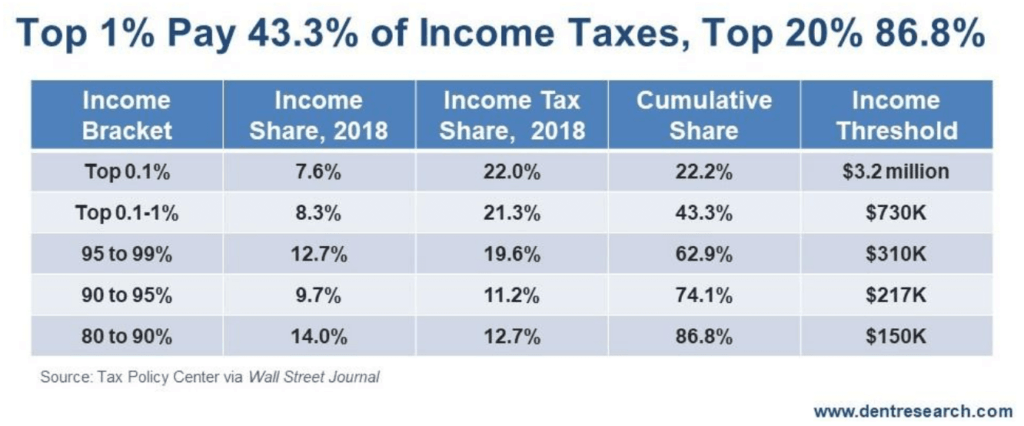

Look who’s paying the most…

©Harry Dent

To most affluent people, this looks and sounds unfair. Afterall, the top 0.1 percent earn 7.6 percent of the income but pay 22 percent of the taxes – three times their share. The top 1 percent earn 15.9 percent, but pay a whopping 44.3 percent (cumulative column). The top 20 percent earn 52.3 percent – which is why I maintain that the top 20 percent of college-educated professionals are really 50 percent of the economy – and pay almost all the income taxes at 86.8 percent.

Why tax these poor rich people even more?

Unfortunately, Dalio’s idea is on the right track. The best direct way to curb the extreme income inequality – and the twice-as-extreme wealth inequality – is to tax the rich more. Doing so would also help solve the runaway budget deficit and federal debt problem, which doubles about every eight years or two administrations.

A more effective approach to increase revenue and curb inequality would be to focus on the top five percent that now pays 62.9 percent of the taxes.

Tax income above $300,000 at 42 percent instead of the 37 percent top rate now.

Tax income above $700,000 at 50 percent.

Tax income above $1 million at 60 percent.

Sounds pretty horrendous to me, and you too, I’m sure — especially when you add in state and local taxes that aren’t deductible anymore. But know this: It’s irrelevant if we want or don’t want this to happen. It’s damn near inevitable, as is a democratic takeover if I’m right about a major crash and depression setting in next year, before the election.

(Featured image by create jobs 51 via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech1 week ago

Biotech1 week agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Business5 hours ago

Business5 hours agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech1 week ago

Fintech1 week agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoClimate Losses Drive New Risk Training in Agriculture Led by Cineas and Asnacodi Italia