Business

How to choose from three investment models on the real estate market

The choice depends on the investor´s appetite for risk.

Investors can choose from three basic investment models the real estate market has to offer: simple rental business, loans secured by property and financial participation in a construction project.

Commercial property is not just buildings but also the cash flow they generate. Therefore, in the commercial property market, it´s logical to buy not a set of technical specifications, but an idea: the right business model to invest in so as to obtain the right yield-to-risk balance.

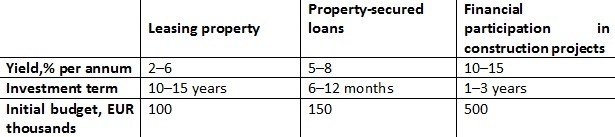

Investors can choose from three basic investment models on the real estate market: simple rental business, loans secured by property and financial participation in construction projects. These schemes imply different yields, investment terms, risks and required capital volumes.

Investment models

Source: Tranio.com

Leasing property

The main idea of a rental business is to acquire commercial property, lease it out and receive regular payments from the tenants.

The budget to enter the market depends on the property type and starts from:

– €100,000 for flats;

– €2.5M for high street retail and supermarkets;

– €10M for hotels and shopping centres.

For instance, an investor buys a flat in Nuremberg (Bavaria), rents it out and receives 3.8% or €12,500 per annum.

The rental business is suitable for first-time investors and has the following advantages:

– the investor buys a ready-to-lease property and does not take on construction risks;

– the investor can select a property with a rental agreement already in place and so will not have to look for tenants;

– when leasing out over longer terms, the investor can have the lease agreement signed for the entire investment term (10–15 years and above) and obtain a predictable cash flow for the duration of this time;

– this is a passive investment: all the issues (property maintenance and search for tenants) are resolved by a management company;

– the investor obtains a lifetime ownership of the property and the income it generates with the right of inheritance.

But it also has disadvantages:

– the yields are relatively low: 2–6% per annum;

– part of the revenue is swallowed up by expenses: acquisition, registration (additional costs amounting to 10–20% of the property price), maintenance, management and property tax costs;

– the property may be difficult to sell in the future: the process may take too long or the price may have to be reduced.

Property-secured loans

This strategy implies that the investor offers a loan of at least €150,000 and receives interest payments from it. The borrower is usually an entrepreneur who is waiting to receive a cheaper bank loan but needs capital right now. The borrower uses their property as collateral for the loan, encumbering it for 6–12 months.

For example, an investor lends £210,000 against a £350,000 London property. The loan term is nine months. The loan interest rate (as well as the yield for the investor) is 7% per annum.

The advantages of this strategy are the following:

– the investment is secured against a property whose value exceeds the loan amount by 1.5–2 times;

– the yield level is known in advance: the interest rate for the loan is specified in the agreement. It usually is 5–8% per annum.

Disadvantages:

– the invested funds cannot be recovered prior to the loan term expiration;

– where the borrower defaults, the loan term may increase the time needed to repossess and sell the collateral.

Financial participation in construction projects

Under this strategy, the investor provides a developer with capital to construct or redevelop a building in exchange for a fixed amount of interest on the funds provided, in addition to a share of the profit made on the project. The investor generally has to lend at least €500,000 and wait 1–3 years for the building to be completed.

Having put €2M into a construction project in Germany, such as that of a hotel in Munich, for instance, the investor can earn 16% per annum and exit the project after two and a half years.

The advantages of the strategy:

– the highest potential yields can be achieved with this method (10–15% per annum on average);

– independent appraisal: the creditor-bank performs an audit on the project’s financial model and evaluates the developer´s reputation.

Disadvantages:

– the investor takes on the risks of the development (risk of a budget deficit, failure to receive local authority permission, sale at a lower than expected price);

– the bank has the priority property right in the case of the project’s bankruptcy. The investor is only compensated after all the bank demands have been satisfied;

– the investor cannot exit the project before it is completed.

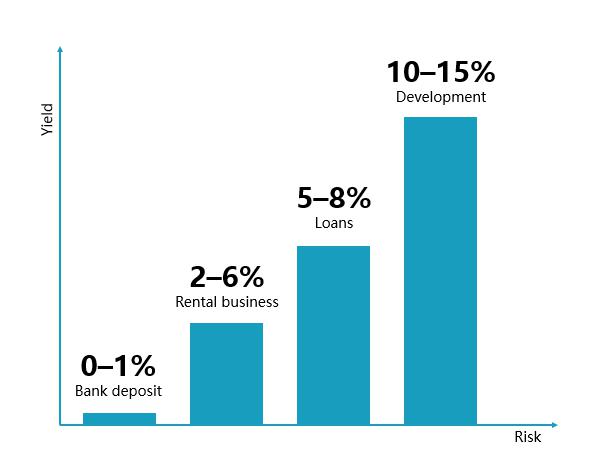

What model to choose

The choice depends on the investor´s appetite for risk. The lower the yields; the lower the risks that something will go wrong:

Investing in the rental business is recommended for those aiming for capital maintenance and personal wealth creation rather than making quick returns.

Source: Tranio.com

Those interested in short-term investments, whilst being ready to take on moderate risks should consider putting their funds into loans secured by the property.

Experienced real estate investors with an appetite for risk will find it attractive to put their money into construction projects. When managed wisely, this strategy proves to be the most profitable, with the average yield amounting to 10–15% per annum.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoFrance’s Nuclear Waste Dilemma Threatens Energy Future

-

Fintech1 week ago

Fintech1 week agoKraken Launches Krak: A Game-Changing Peer-to-Peer Crypto Payment App

-

Impact Investing4 days ago

Impact Investing4 days agoEuropeans Urge Strong Climate Action Amid Rising Awareness and Support

-

Cannabis2 weeks ago

Cannabis2 weeks agoRecord-Breaking Mary Jane Fair in Berlin Highlights Cannabis Boom Amid Political Uncertainty

You must be logged in to post a comment Login