Business

Trust a trust to better protect your legacy

The use of various entities such as limited liability companies, limited partnerships and corporations can provide substantial creditor protection. However, this protection is substantially enhanced through the use of various trust vehicles.

A very common estate planning mistake is to fail to take advantage of the various tools available to protect assets. We live in a free society where anyone is free to sue anyone else over anything. The protection of assets from future lawsuits, divorce and creditors is a top concern for a majority of my clients.

The use of various entities such as limited liability companies, limited partnerships and corporations can provide substantial creditor protection. However, this protection is substantially enhanced through the use of various trust vehicles.

A basic living trust is, by its own terms, a revocable trust and, therefore, offers no meaningful protection against creditors. Substantial amounts of family wealth may often be unnecessarily and irretrievably lost because the right types of trusts are not being used.

Even those children or heirs who are fully capable of appropriately managing assets should not inherit outright. Instead, these children or heirs should inherit in a beneficiary-controlled trust designed to provide greater asset protection. Those beneficiary controlled trusts should be designed to provide the following:

-

Distributions of income and principal are totally discretionary and not mandated even for Health, Education, Maintenance and Support.

-

The child would be given a special power of appointment to rewrite or revise the trust for future generations.

-

The trust continues perpetually for the child’s lifetime and then to successive generations protected from exposure to lawsuits, divorce or other claimants.

-

When the ages of projected maturity are attained, instead of receiving mandated outright distributions, the child or other future descendant is put in control of the trust.

-

Rather than making distributions to the beneficiary who would then acquire the assets, future assets be acquired (including a business) as an investment of the trust.

Trusts can also better protect the owner’s assets. The owner may also be called the “grantor” when a trust is created. There are a variety of asset protection trust techniques available which should be custom designed for each particular client. The following is a discussion of only a few such alternatives.

Asset protection trusts were initially developed overseas. These trust concepts are currently embraced by seventeen (17) states which now have law which provides for the creation of asset protection trusts. Nevada, South Dakota and Wyoming are just a few. Each state has separate laws governing the trusts created under that state. Key factors in determining the appropriate state to utilize include whether the state has an income tax, how long the trust must be in place for protection from future or preexisting creditors, whether the state permits decanting or changes, and protection from child support and spousal claims such as in divorce. Attorney Steve Oshins publishes an excellent annual state rankings chart which identifies the relative state positions on these issues. The state ranking chart can be found here.

One of the strongest asset protection tools is a fully funded foreign or off-shore asset protection trust. These trusts rely upon the laws of a variety of countries including the Cook Islands, Belize, Bahamas, Nevis and the Cayman Islands. The Cook Islands are generally recognized as providing the basis for the first true asset protection trust, known as a Self-Settled Spend Thrift Trust.

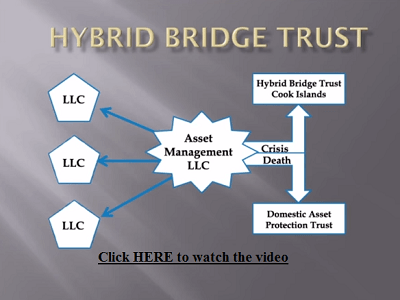

While a Foreign Asset Protection Trust (FAPT) provides substantial protection, the FAPT also results in higher cost and complexity. The FAPT also triggers additional income tax filings and perhaps greater scrutiny by the Internal Revenue Service. The Hybrid Bridge Trust, also sometimes known as the Nevada Off-Shore Trust, provides a unique alternative.

The Nevada Off-Shore Trust begins life as a DAPT. However, the Nevada Off-Shore Trust is accepted for administration by an off-shore trustee such as in the Cook Islands from the outset. In the absence of a crisis or other call to action, the routine administration is handled as a DAPT. The additional costs and complexity of a FAPT are avoided.

In the event of a crisis or call to action, the Nevada trustee resigns and the Cook Islands trustee steps in to act. Due to the unique provisions of the Nevada Off-Shore Trust, there is now a fully functioning and operating FAPT. The cost of the additional complexity is not desired because of the additional protection from that crisis.

Depending upon the nature of the threat and nature of the assets held by the Trust, account and funds may be moved to the foreign jurisdiction. To determine the liability of the Trust or Trust assets, the Nevada Off-Shore Trust is governed by the laws of the Cook Islands or other foreign jurisdiction selected. The jurisdiction of the Cook Islands would generally require that any litigation suit seeking to access the assets must be filed in the Cook Islands. This places a significant cost impediment to pursuing the claim. In addition, the burden of proof for a civil claim in the Cook Islands is significantly higher than in the United States Court system. In the United States, the burden of proof for a civil claim is predicated upon the “preponderance of the evidence” or more likely than not. In the Cook Islands, the standard for proving a civil claim is “beyond reasonable doubt”. This standard is much higher or difficult and is comparable to a criminal trial in the United States. An example of the application of these two (2) standards can be seen with O.J. Simpson who was found not guilty in the criminal trial yet found liable to the Brown family in the civil case. Another interesting fact is that the Cook Islands does not permit contingent fees which allow a lawyer to not bill the litigant unless and until the lawyer prevails. Many believe that the contingent fee system creates greater risk.

Liquid assets or semi-liquid assets are easier to protect in this manner. Each asset protection plan should be custom-designed, drafted and often utilizes a modular approach for the greatest protection. This modular design or approach is very much list a large ship or submarine. Many steel doors and compartments are available to contain leaks. In the event of a crisis, the doors are closed, compartments are sealed, risks are segmented and contained and the entire ship or submarine is not lost. The modular asset protection plan provides multiple firewalls for greater overall protection. An example of greater modular design is in the diagram below.

(Source)

This article discusses only a few of the myriad of asset protection tools available. The first step is to understand your risks, concerns and goals. Each plan should be carefully crafted to attain the family’s goals, needs and income tax objectives.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Africa6 days ago

Africa6 days agoMorocco’s Industrial Activity Stalls in January 2026

-

Crypto2 weeks ago

Crypto2 weeks agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Crypto4 days ago

Crypto4 days agoBitcoin Surges Past $72K as Crypto Market Rallies and Kraken Secures US Banking License

-

Crypto2 weeks ago

Crypto2 weeks agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

You must be logged in to post a comment Login