Business

US-China trade wars screw over crops

Trade wars between the US and China hurt crops as futures remain volatile despite closing high on wheat, palm oil, vegetable oil and rice.

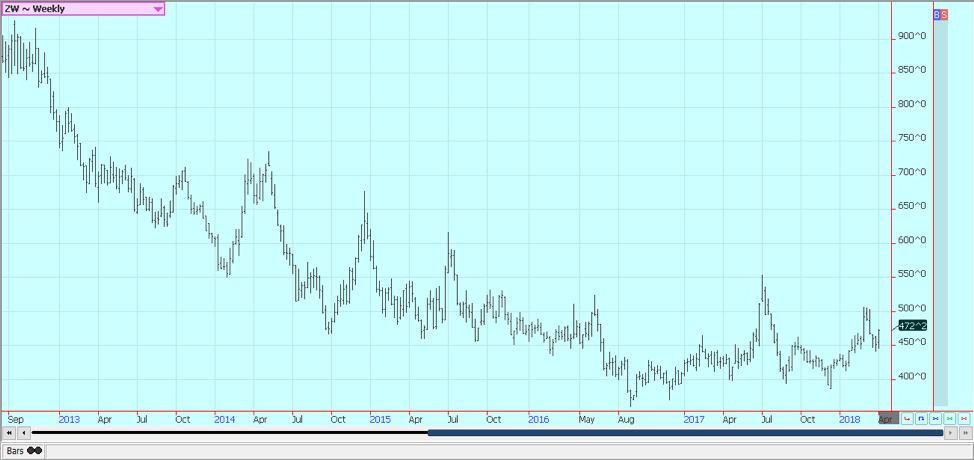

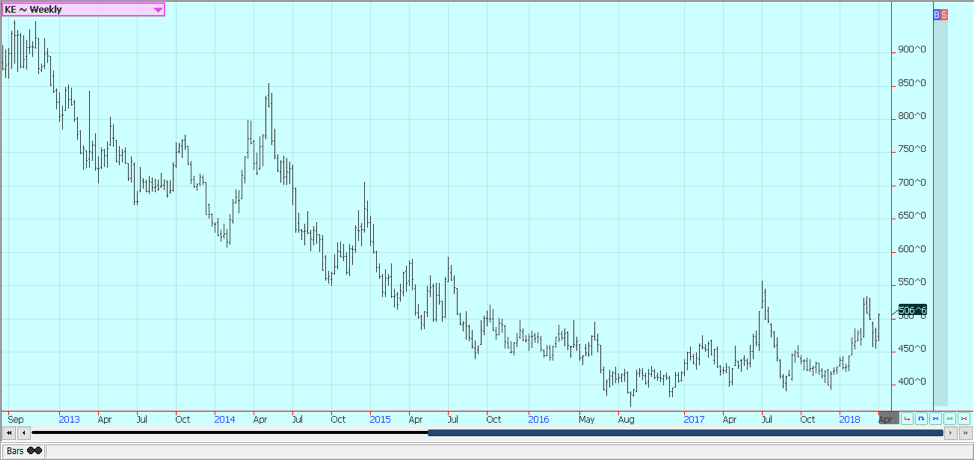

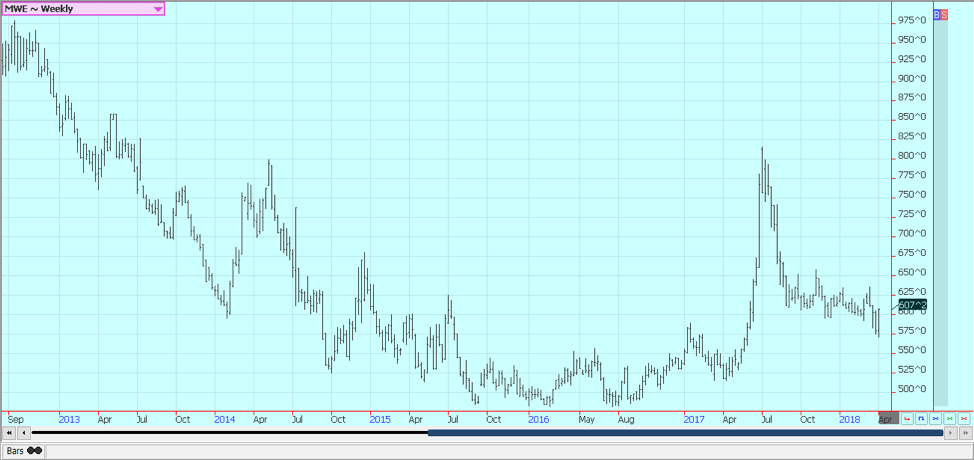

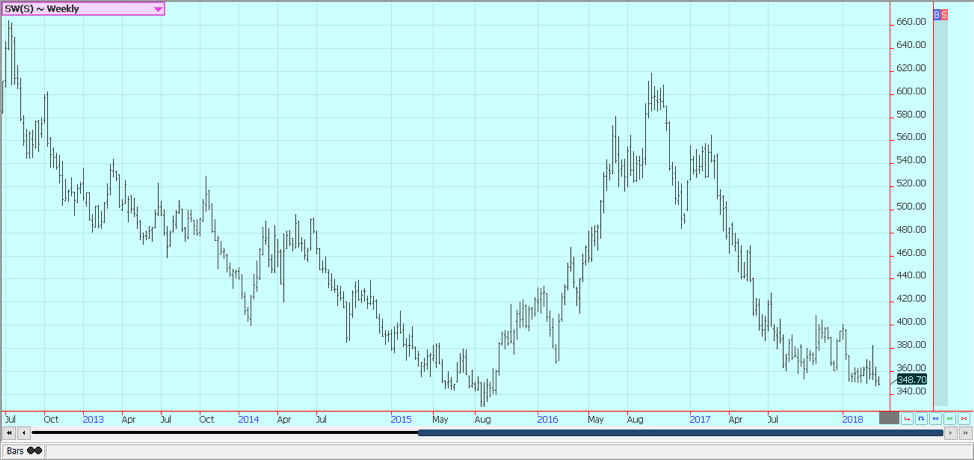

Wheat

Wheat markets were higher as weather returned as a dominant factor in the market. Forecasts still call for dry weather in Texas and Oklahoma and it is dry again in Kansas. There is no real relief in sight, as temperatures finally turn warmer in the eastern two-thirds of the US.

USDA showed generally poor crop ratings in its initial crop progress and condition reports last week, and the crop seems to be regressing. New crop ratings will be released by USDA on Monday afternoon and no improvement is expected. The weekly export sales report was poor, and cumulative sales and shipments remain behind the pace needed to make USDA targets. USDA will issue its monthly supply and demand reports on Tuesday, and an uptick in ending stocks estimates is possible due to the poor export demand until now.

The daily charts for all three markets show stability in prices, and the charts for HRW are showing potential for uptrends. The weekly charts still show weakness, but the markets seem to be cheap enough due to the ongoing weather problems in the Great Plains. Minneapolis is also starting to turn to at least sideways trends as the weather remains very cold in Canada and the northern Great Plains. Farmers want to start on fieldwork, but the cold temperatures have made that an impossible task. The Canadian Prairies and northern Great Plains look to stay cold this week, and snow is possible early in the week.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

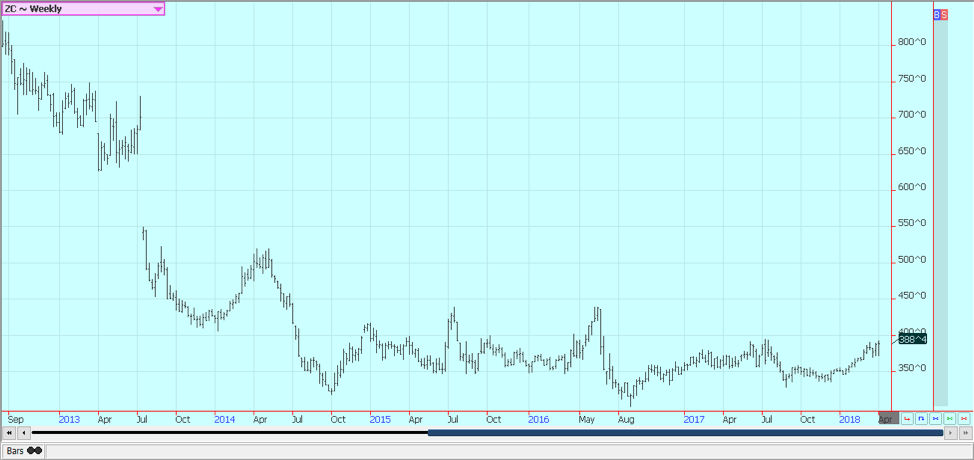

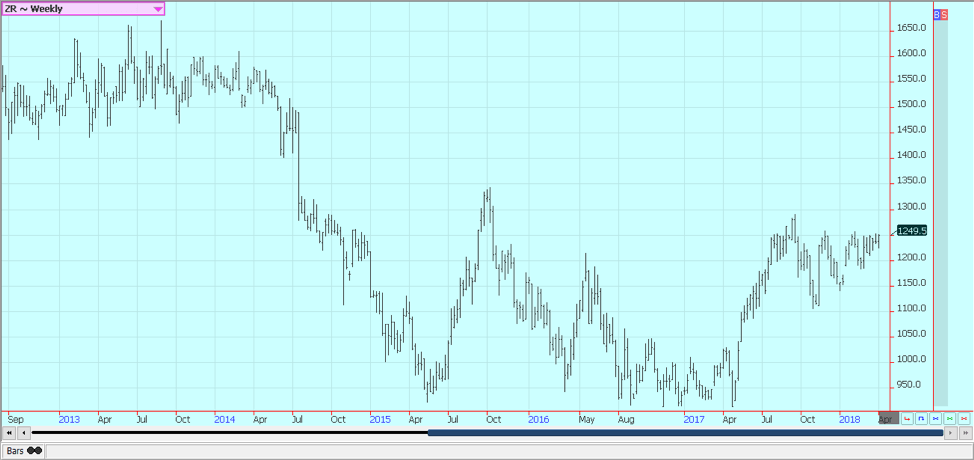

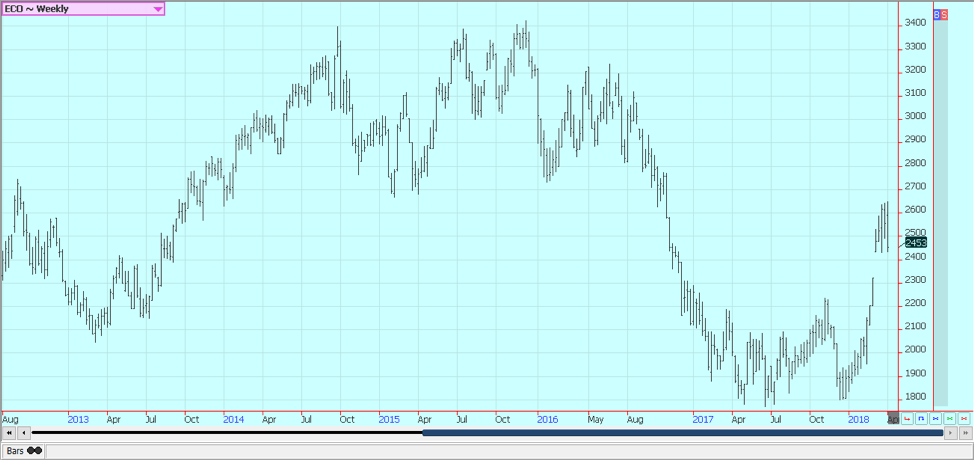

Corn

Corn closed little changed for the week after a wild week of trading. Futures found support early in the week from follow through buying related to the Perspective Plantings report issued the previous week. The market tried to sell off in reaction to the Trump decision to impose tariffs on Chinese imports and potentially create a trade war.

The US does not really sell much Corn to China, but futures traded much lower initially in reaction to the news. The US government will not be able to start tariffs for a while under law, and this relieved some of the selling pressure.

Strong domestic and export demand finally allowed futures to recover by the end of the week. The trade is now waiting for the monthly USDA supply and demand updates that will be released on Tuesday morning, and increased export demand and lower ending stocks are very possible.

Weather in the Midwest remains too cold, and it has been very wet in southern production areas. Fieldwork has been stalled in almost all areas. It will finally turn warmer in the Midwest over the second half of this week, and some initial fieldwork might finally be possible. The market focus will move more from old crop to new crop from now on as traders start to monitor new crop progress and condition along with the old crop demand.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

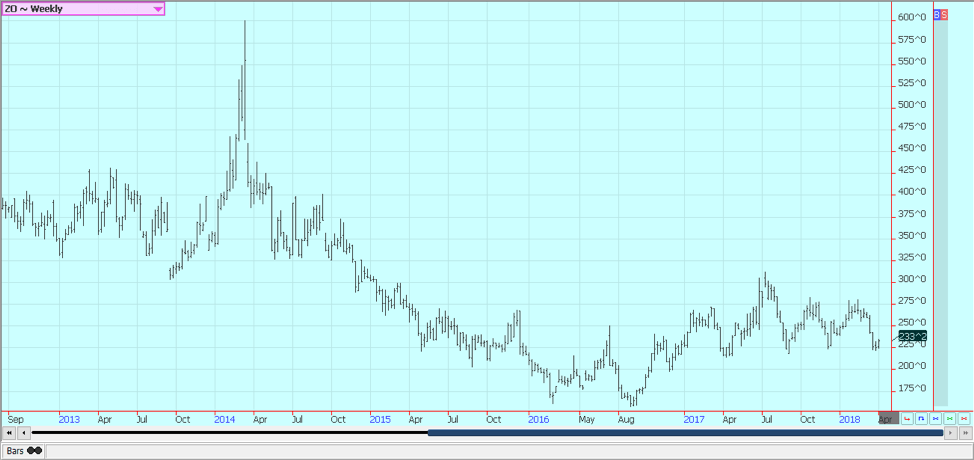

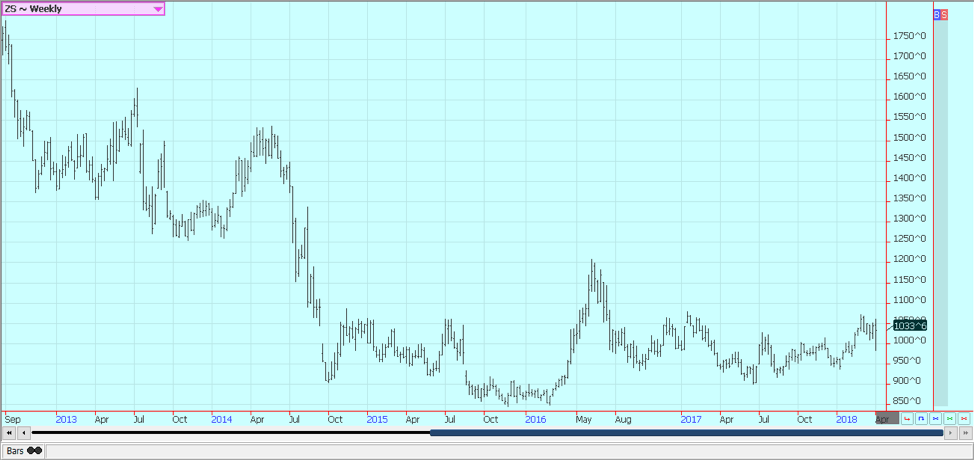

Soybeans and Soybean Meal

Soybeans were lower after dealing with some follow-through buying related to lower than expected plantings intentions seen late in the previous week, then the threat by the US to impose tariffs on Chinese exports to the US. China said it would retaliate in part by taxing US Soybeans by 25% above the normal tax rate.

China accounts for about one-third of US Soybeans demand, so the threat sent prices sharply lower in US futures markets. News that Chinese buyers were leaving the US market and increasing purchases in Brazil sent Brazil premiums soaring to cover a big amount of the potential percentage increase in taxes. The tariff threats by the US and China have turned into a financial boon for the Brazilian producer, and they have taken advantage of the great prices by selling.

Brazil premiums did settle back a bit at the end of the week on news that some European crushers had cancelled Brazil purchases to take advantage of the far cheaper US prices. All these cash market trends can continue this week.

USDA will issue its latest supply and demand estimates, and there is doubt over how USDA will handle the trade threats and changes. Chances are that USDA will wait and see what actually happens to US demand before making many changes. USDA will likely cut Argentine production due to the continuing drought there, but increase production in Brazil due to reports of good yields there. Prices will likely remain volatile until the tariff threat is clarified. This might take at least a couple of months due to US laws and the desire expressed by the US and China to find a negotiated solution.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

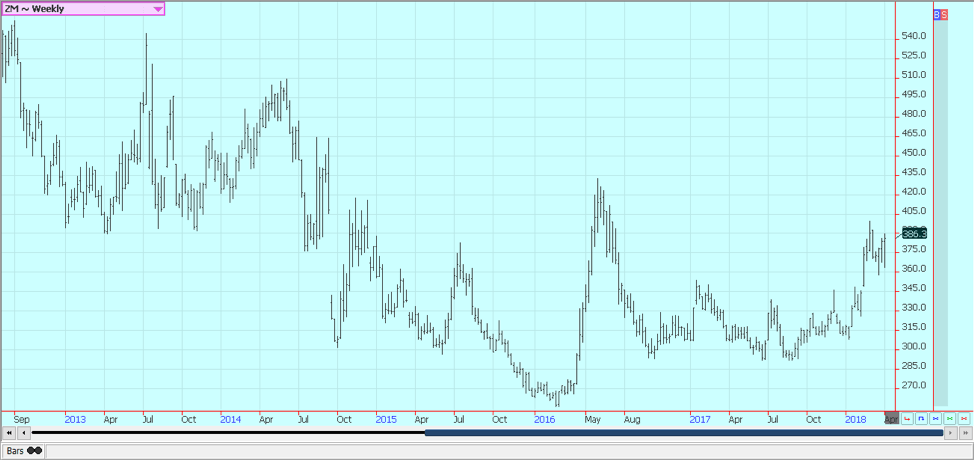

Rice

Rice was higher and closed near the highs for the week. Prices continue to push against important resistance areas on the weekly charts near 1250 May, but a move above this level is expected sooner or later.

Ideas are that little old crop Rice is available in the cash market, and the situation is not likely to improve before the new crop becomes available late this Summer. The situation might not get much better next year. On farm, stocks are now very low as most farmers have already sold. Farmers will plant more Rice this year, but the increase in planted area is not considered burdensome.

Planting progress has been ahead of average so far, but has stalled recently due to cool and wet weather in Gulf coastal areas. It has been very wet and cold in the northern Delta states as well, but warmer temperatures are likely to appear later this week. Indications are that producers are more willing to plant other crops instead of Rice, and early ideas of a significant increase in planted Rice area have gone away. Farmers and bankers are worried about profitability, and planting other crops such as Soybeans or Cotton could mean better returns for some producers.

Weekly Chicago Rice Futures © Jack Scoville

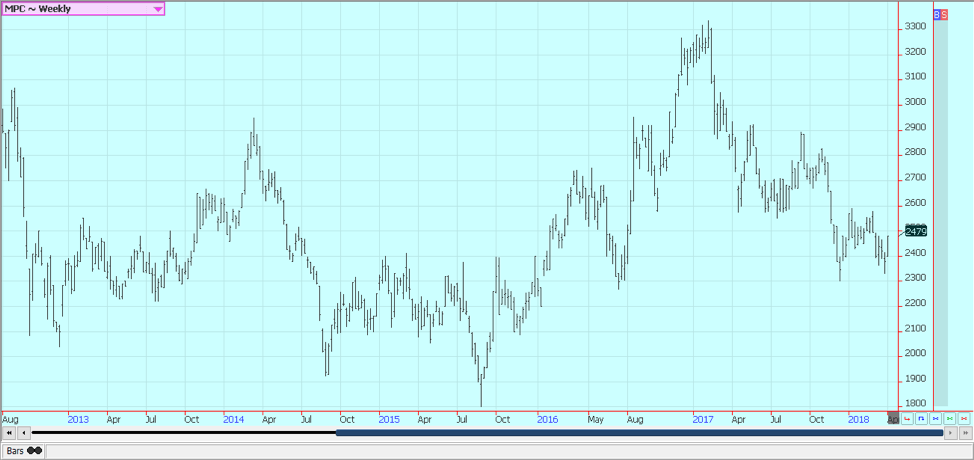

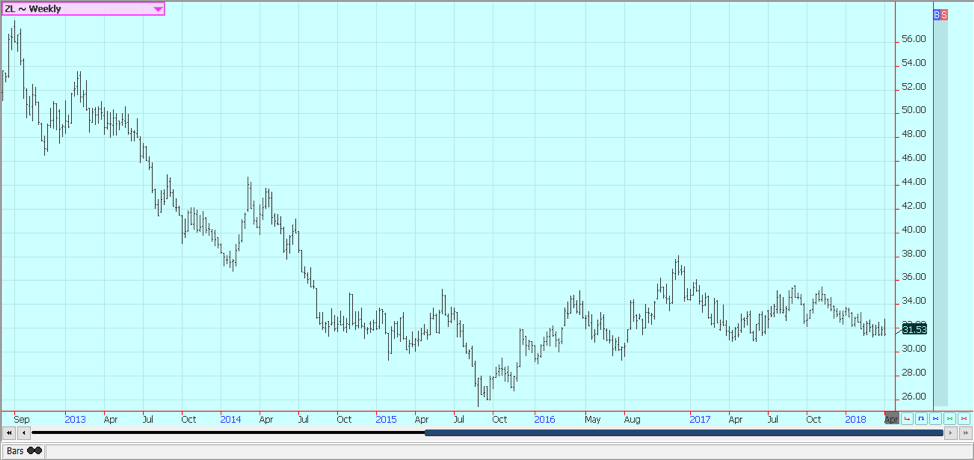

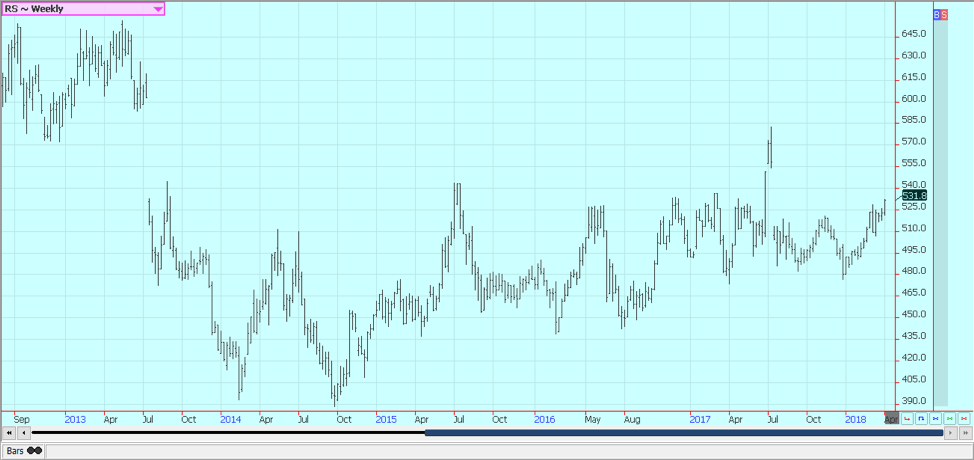

Palm Oil and Vegetable Oils

World vegetable oils prices were mostly higher last week as the markets tried to understand the trade war between the US and China and what it could mean to demand for world vegetable oils. Palm Oil moved higher on ideas that demand for Palm Oil can improve. China has been crushing a lot of Soybeans and has been producing its own Soybean Oil, but any disruption in the crush could mean that more Palm Oil is needed.

Demand has been better this month, anyway, and the better demand has meant higher prices. The weekly charts show that Palm Oil remains in a trading range as the better demand is being met by reports of better production. A sideways trend can continue, although somewhat firmer prices are possible this week.

Soybean Oil found some support early in the week from news that the US government has finally imposed punitive tariffs on imports of vegetable oils and biofuels from Argentina and Indonesia. However, the overall move was small as the US had announced the tariffs months ago and has just now completed the regulatory process to put the tariffs into action.

Canola found some support from the trade war and also from the very cold weather in the Canadian Prairies. The cold weather has made any fieldwork impossible at this time. The region looks to stay cold this week, although temperatures might moderate a bit late in the week. It is not likely to get warm enough for any work to get done for at least a couple of weeks now, so the market will keep the weather forecasts in focus.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

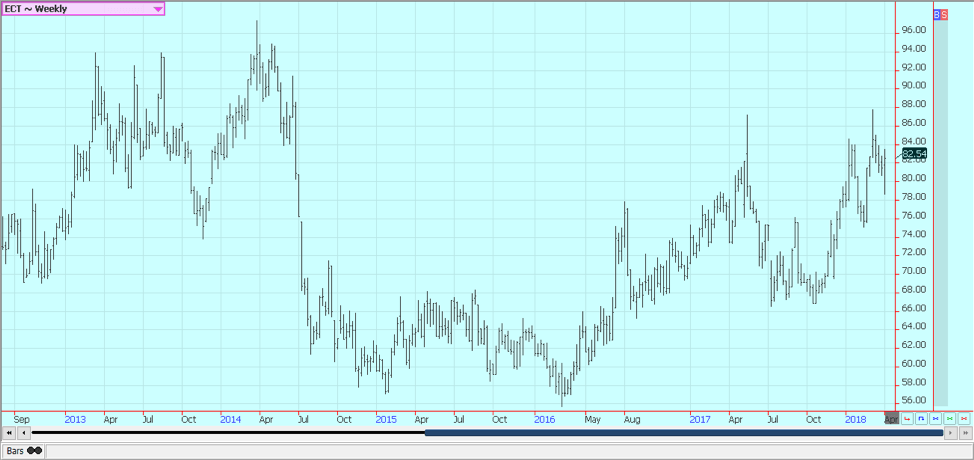

Cotton

Cotton was higher last week as this market saw good demand in the weekly export sales report and dealt with the fallout of its own from the potential US-China trade war. It was a big range week in response to the threats. China is a good buyer of US Cotton as it uses the high quality US product to blend with its own production. The US also sells a lot of Cotton to Southeast Asia and some of this makes its way to China in the form of finished products.

US farmers in just about all production areas plan to plant more Cotton. It is drier in the Delta and Texas after some big rains that hit again in the second half of last week, and drier weather will be seen in the Southeast. The drier Delta and Southeast weather will be welcome after some big rains in recent days. Warmer temperatures would be beneficial.

Prices overall have been much higher than most commercials had expected, but the recent carry spread weakness could be a sign that merchants have been able to get covered in the last couple of weeks. Prices could remain strong until closer to harvest, but there is a chance that the highs have been seen.

Weekly US Cotton Futures © Jack Scoville

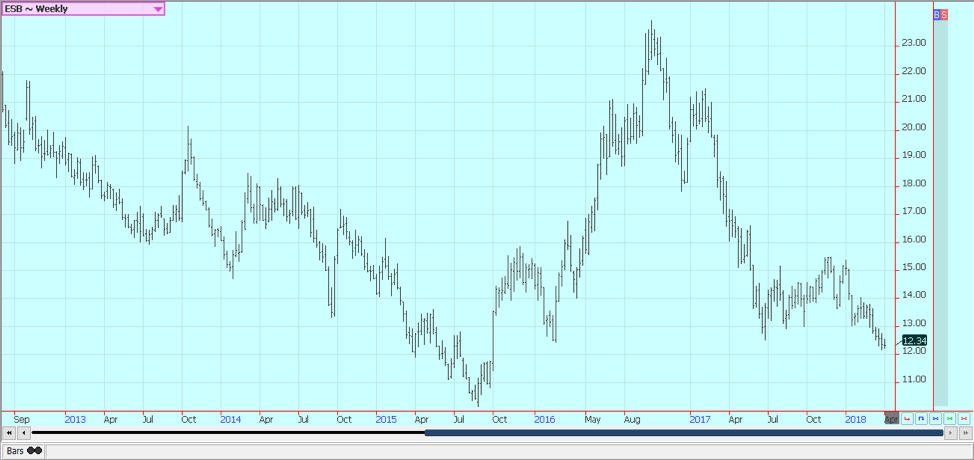

Frozen Concentrated Orange Juice and Citrus

FCOJ was lower in range trading last week. The market is still dealing with a short crop against weak demand. USDA should highlight the short crop when it releases its citrus reports tomorrow. It last estimated the crop at 45 million boxes and there is no real reason to expect any big changes to that estimate.

The current weather is good as temperatures are warm and it is mostly dry, but some big rains are reported in northern parts of the state. The harvest is progressing well and fruit is being delivered to processors. Producers are now into the Valencia crop with the early and mid harvest completed. Florida producers are actively harvesting and performing maintenance on land and trees. Flowering is mostly over, and fruit is forming and starting to develop. Irrigation is being used.

Weekly FCOJ Futures © Jack Scoville

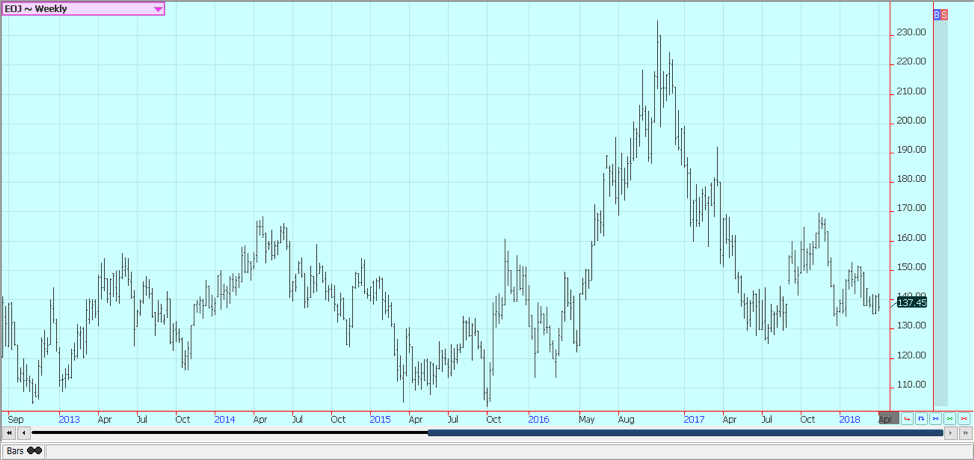

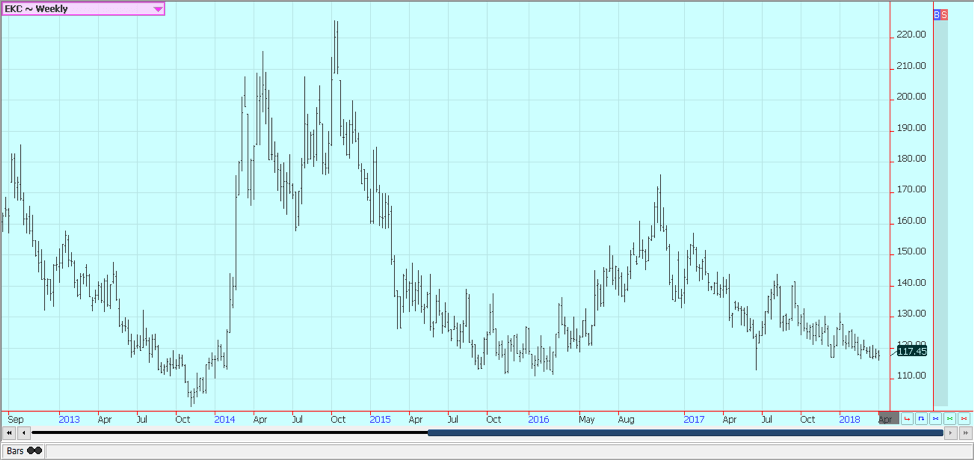

Coffee

Futures in New York were slightly lower at the end of the week after moving to new contract lows earlier in the week. London was also lower and is now at an important support area left from last Fall. Trends are sideways to down on the charts. Funds and other speculators were the best sellers and industry is the best buyer.

Traders still sense the underlying interest in buying the market due to the industry buying, but the buy side of the market has not shown interest in pushing prices higher. They have been able to let the speculators come to their price level. Origin is still offering in Central America and is still finding weak differentials.

Good business is getting done and exports are active. Traders anticipate big crops from Brazil and from Vietnam this year and have remained short in the market. New York traders are talking about good weather currently being reported in Brazil and expect another bumper crop. Robusta remains the stronger market as Vietnamese producers and merchants are not willing to sell at current prices and are willing to wait for a rally.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

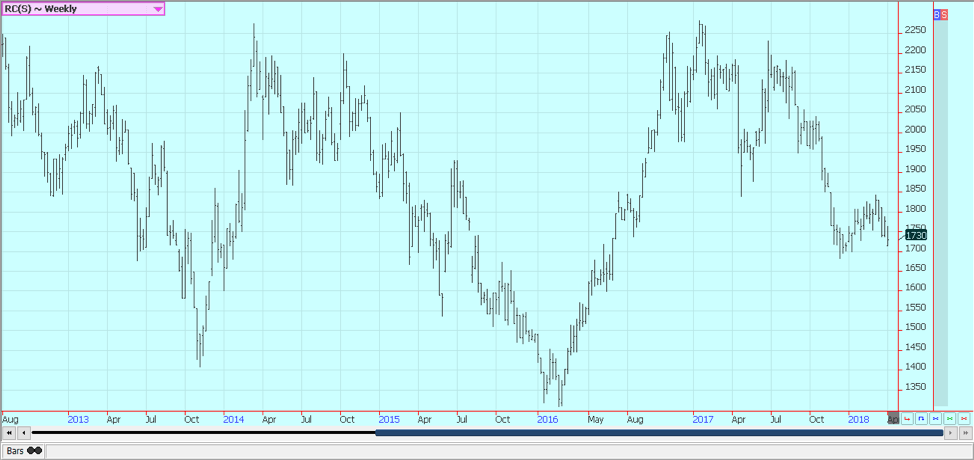

Sugar

Futures were lower for the week in both New York and London. London is holding a support area on the weekly charts for now, but New York continues to work lower. Trends are down in both markets. The fundamentals remain little changed, and there does not seem to be much, for now, that can shake the market out of its current trend.

Traders hear about big production from the world producers and little in the way of special demand that could absorb some of the surplus. Ideas that Sugar supplies available to the market can increase in the short term have been key to any selling. India will export up to 4.0 million tons of Sugar this year after being a net importer for the last couple of years. The government there is reducing or eliminating export taxes in an effort to promote selling in world markets. It has a significant surplus after several years of lower production. Thailand has produced a record crop and is selling. Mills in Brazil have decided to make more Ethanol as world Crude Oil and products prices have been very strong. Brazil still has plenty of Sugar to sell even with the different refining mix.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

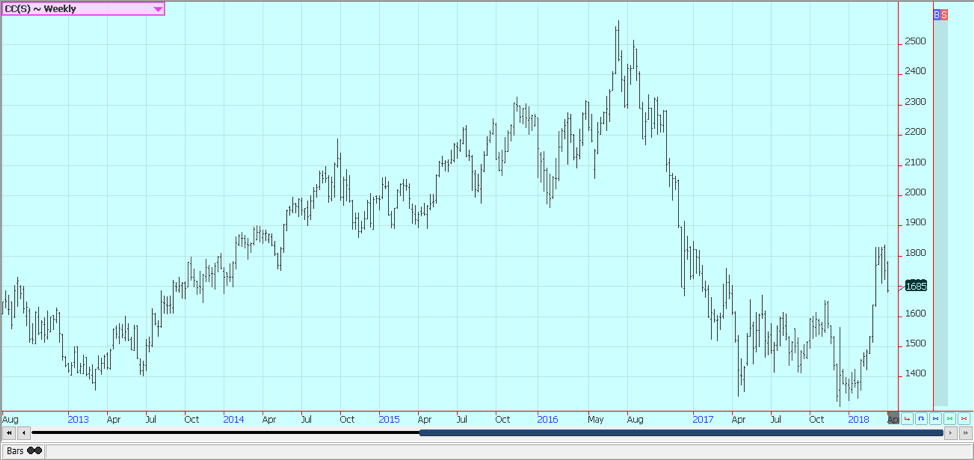

Cocoa

Futures were lower last week. New York is testing a support level on the weekly charts but appears ready to move lower. Futures could move to the 2420 level to fill a big gap left on the weekly charts. London could also work lower and might test support near 1600. Ideas of smaller world production that has been largely sold remain part of the rally, and ideas of strong demand from processors remain the other part of the rally.

Most in the trade anticipate the increased demand, and current West Africa weather is hot enough and dry enough to create production concerns. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions. The mid crop harvest is starting, and wire reports indicate that some initial mid crop harvest is underway in Nigeria. No yield reports have been seen yet, but estimates from the country imply that variable yields can be expected. The harvest should begin soon in Ivory Coast and Ghana. Demand has been improving and is likely to continue to improve as processing margins are said to be very strong.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

_

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Markets1 week ago

Markets1 week agoRising U.S. Debt and Growing Financial Risks

-

Business2 weeks ago

Business2 weeks agoDow Jones Near Record Highs Amid Bullish Momentum and Bearish Long-Term Fears

-

Africa4 days ago

Africa4 days agoCameroon’s Government Payment Delays Exceed 200 Days, Straining Businesses and Public Finances

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoThe Youth Program at Enzian Shooting Club Is Expanding Thanks to Crowdfunding

You must be logged in to post a comment Login