Business

US is moving to limit imports of biofuels from Argentina

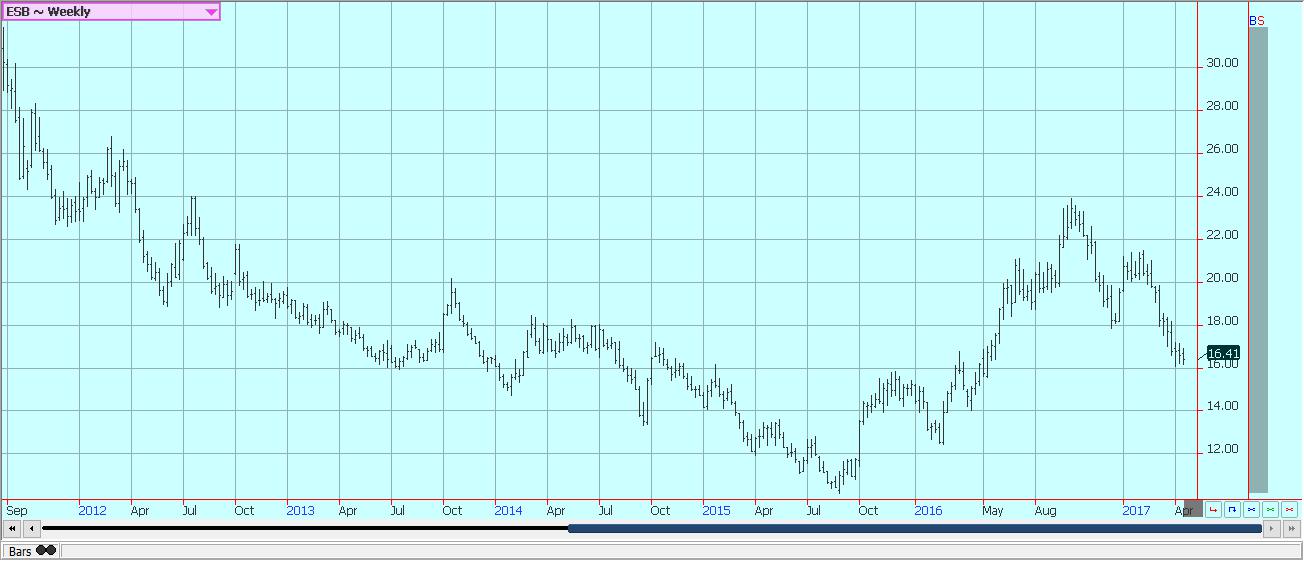

The US is moving to limit imports of biofuels from Argentina right now on reports that the fuels are being dumped into the US market. Less competition will mean more demand for US Soybean Oil for fuel oil purposes.

Latest agriculture news: The US is moving to limit imports of biofuels from Argentina right now on reports that the fuels are being dumped into the US market. Less competition will mean more demand for US soybean oil for fuel oil purposes.

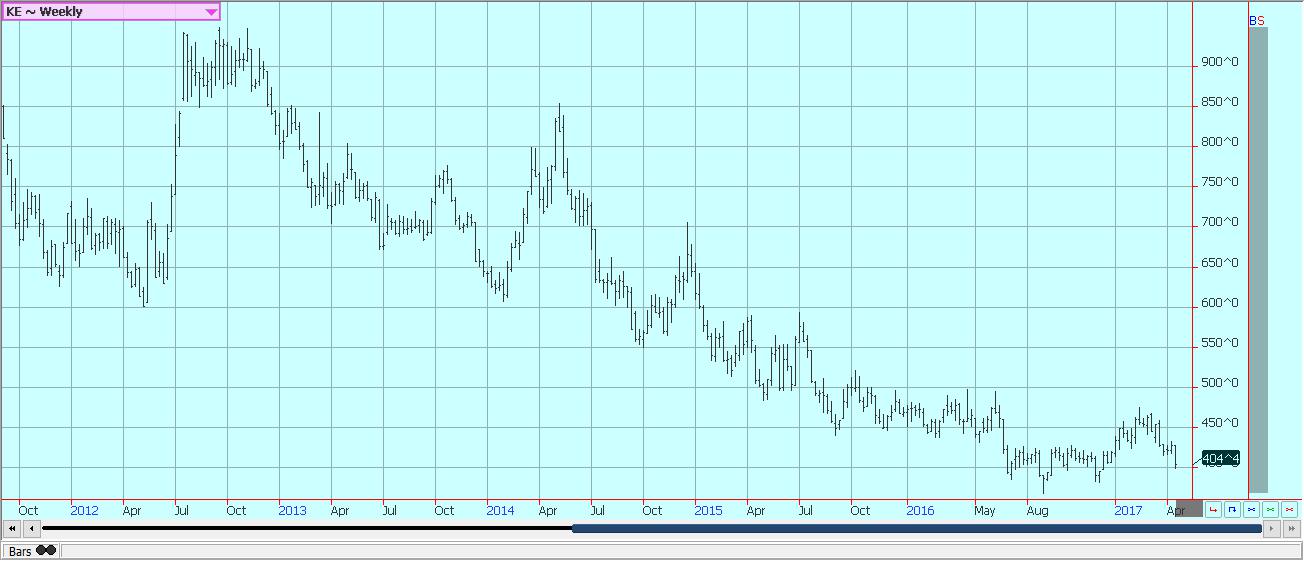

Wheat

US markets were lower last week, with the Winter Wheat markets leading the way. Both Soft Red Winter and Hard Red Winter suffered price weakness on reports of very good looking crops. The crops in the Midwest appear to be in very good condition after frequent periods of precipitation in the last few weeks. Top yields are possible. There were some disease reports heard about the SRW crops a couple of weeks ago, but this talk has faded as a market factor. Hard Red Winter crops have benefitted from recent rains in the Great Plains and crops conditions have improved. USDA is expected to show improved crop conditions in its reports again this week. The daily charts show that both Chicago markets have moved to new contract lows, and the weekly charts show that trends in both markets could be turning down for the medium term. Minneapolis Spring Wheat contracts held better last week and remain in a trading range for now. The market is noting the slow planting pace for crops in both the US and Canada and has been more willing buyers in this market. Canadian producers have indicated that they will plant less area to Wheat this year due to the overall price weakness on world markets. They plan to plant 23.182 million acres of Wheat this year, from 22.212 million last year. It has been wet and cold in the northern US and into Canada so far this year, and farmers have been slow to do initial fieldwork and planting. There is some talk that more oilseeds could be planted and less Spring Wheat if conditions do not improve. A wet outlook is given from various weather services, so the market will keep a close eye on the situation and could react in a big way in one direction or the other depending on how the weather and planting progress evolves over the next could of weeks.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

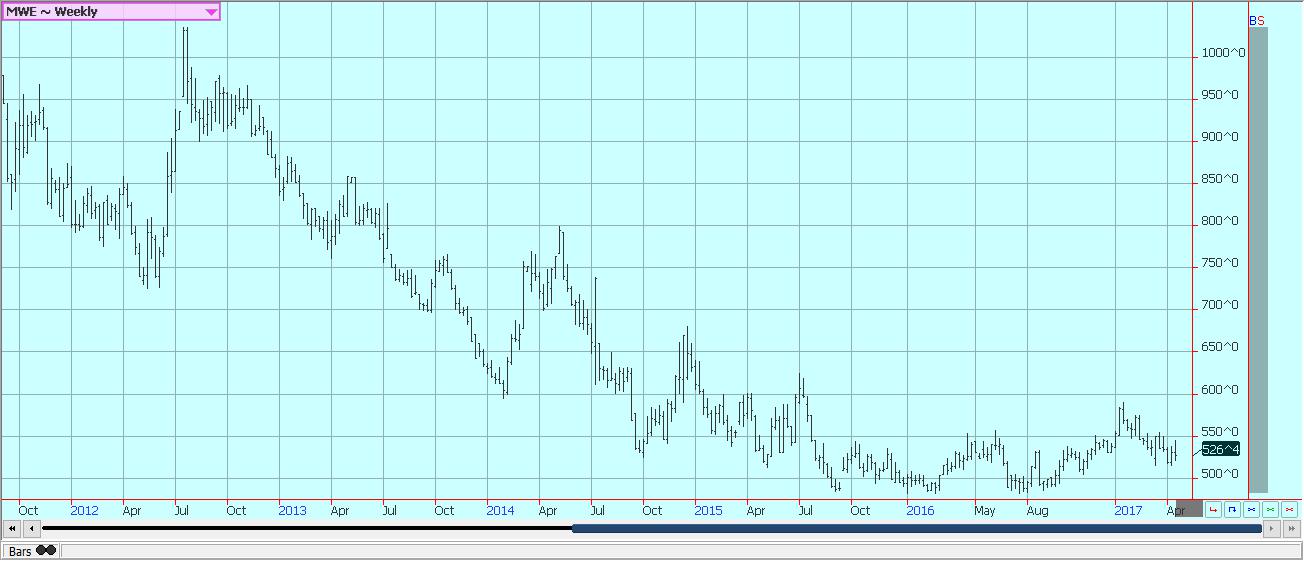

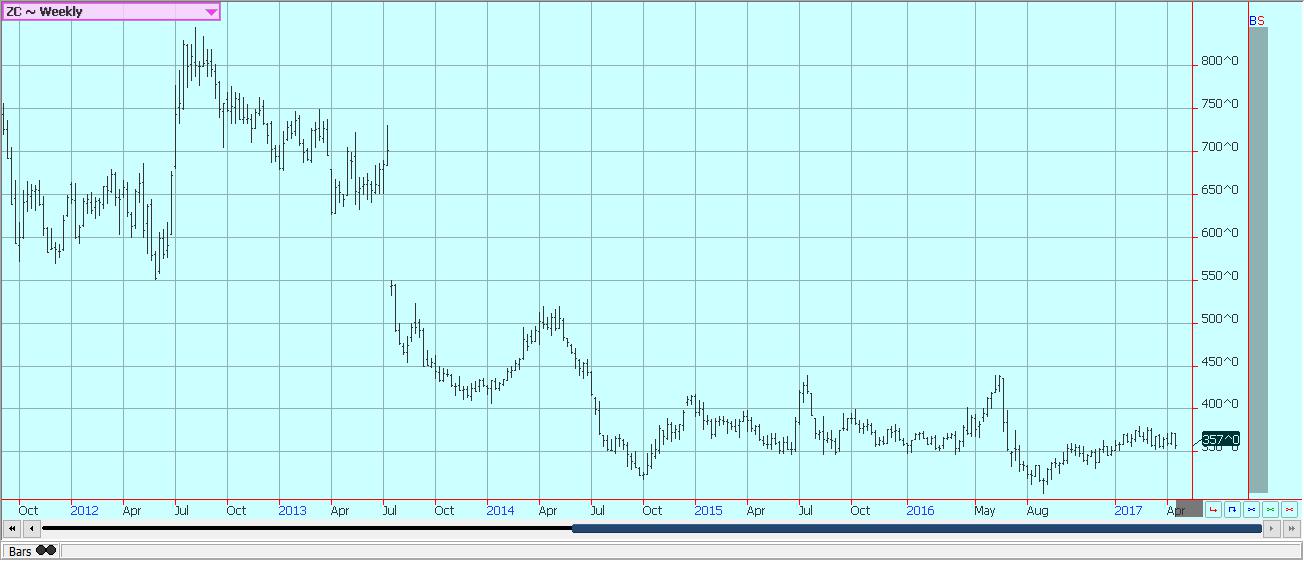

Corn

Corn was lower last week on the fund and commercial selling. The selling came on ideas of big supplies available in the US and increasing supplies available in South America against ideas of limited demand. Demand in the export market for US Corn has been dropping but is still strong as exp[ort sales remain well ahead of the pace of last year and are at least strong enough to meet USDA’s targets. Feed demand got a slight boost on Friday from the Cattle on Feed monthly reports that showed strong placements of new cattle into feedlots. Ethanol demand remains very strong as well. Midwest weather is becoming and increasing market factor and will become more important in the next couple of weeks. It has been wet in the Midwest and into the Delta and Southeast and planting progress has been slower than the average. More wet weather is in the forecast for the next couple of weeks so planting progress can remain slow. The is not really a big problem right now as it is still early, but could become a big market factor if planting conditions do not improve soon. Most producers want to plant Corn as early as possible in the year to avoid pollination in the heat of the Summer, but this might be difficult this year. Producers have the equipment to plant the crop very quickly, but still, need that window of opportunity from the weather to make it happen. The weekly charts show that Corn futures are now resting against some important support areas, so price action this week could have important longer-term implications in either direction.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

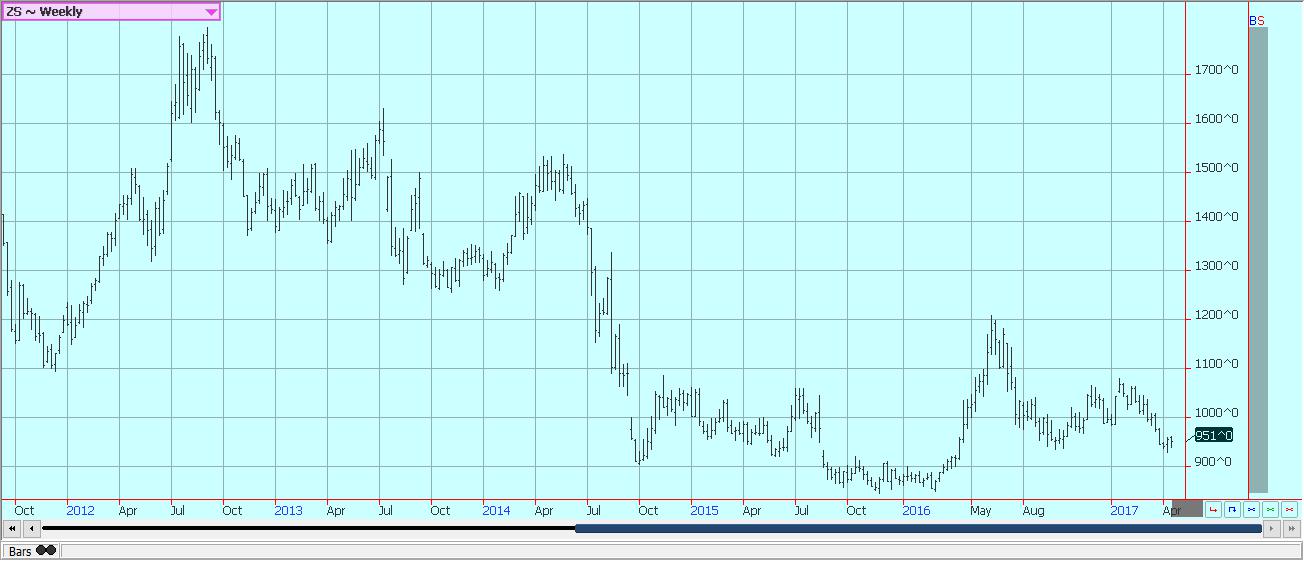

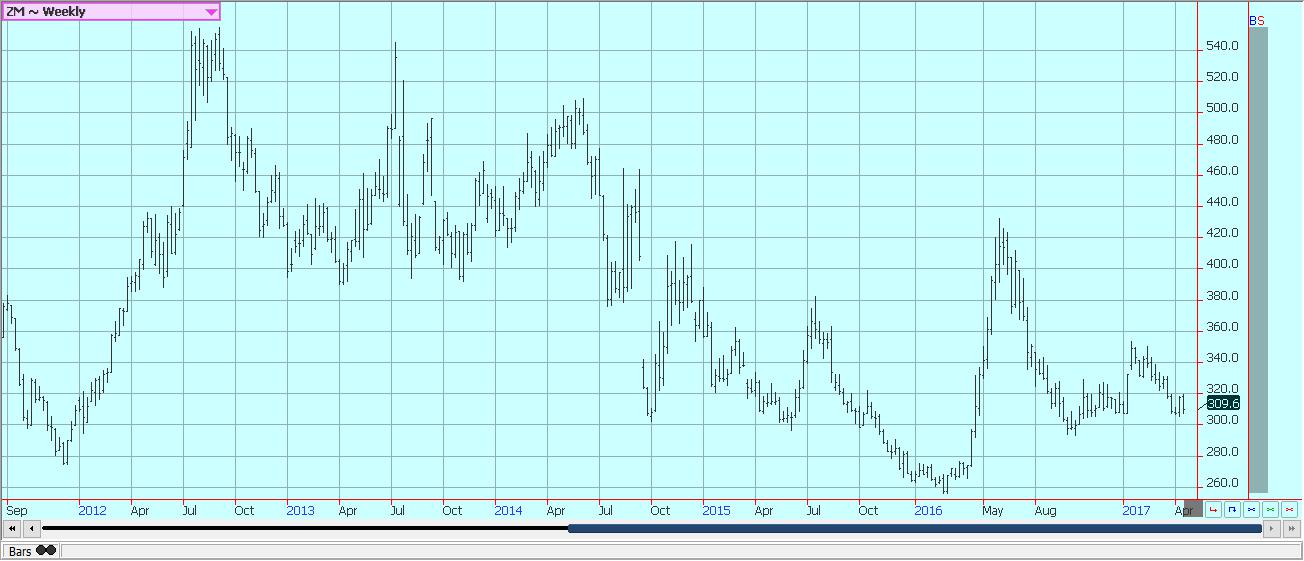

Soybeans and soybean meal

Soybeans and Soybean Meal were slightly lower again last week as the market anticipates big supplies and less demand for US Soy products. However, the market has seen much better demand than expected and in fact, USDA has been forced to raise export demand once and will most likely be forced to raise export demand in future monthly updates. The domestic crush has also held strong. USDS cut residual demand in the updates from a couple of weeks ago as the demand is good. However, it looks like the US crop was a little underestimated last month, so USDA is using residual demand to account for the difference in actual supplies against harvest production totals. Demand for US Soybeans and products could remain strong. US prices for Summer months are now competitive again with those from South America as producers in Brazil and Argentina have been reluctant sellers recently. The strong Real and weaker Chicago futures have really hurt profit potential for South American producers and they hope for rallies in the Summer to sell into. That means any rally potential this Summer is diminished as there will be plenty of supplies even with weather problems here. The trade in the US is also thinking of the potential for even bigger the US planted area if weather conditions do not improve in the short term for planting Corn and Spring Wheat. So, the demand is good, but the prospects for more than ample supplies remain. Overall price action might remain weak unless or until actual US weather problems develop this Summer.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Futures closed lower and prices fell back into the longer term trading range on the weekly charts. It is still possible that the market has found a longer term low and will work generally higher over time. Chart targets for the move higher should be close to 1100 and then 1200 on the weekly charts. The fundamentals of the market are starting to change even if the current cash market remains quiet and steady. Prices have held and improved slightly in some areas as the last of the crop appears to be mostly sold in Texas and southern Louisiana. There is still plenty of Rice available in Arkansas, mostly from the cooperative pools. US producers will plant significantly less Rice this year, and the US ending stocks will most likely be much less next year than they are this year. Farmers near the Gulf Coast are planted now or will be done in the very short term. Texas farmers have also mostly got the crop planted. Initial development reports have been good. Farmers have been active planting in Mississippi and north into Arkansas and Missouri, with some now done but most likely to finish in the next couple of weeks. Growing conditions have generally been good although some producers have expressed minor concern about the cooler and wetter weather that has been seen until recently. Initial growth has been a little on the slow side in the north.

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

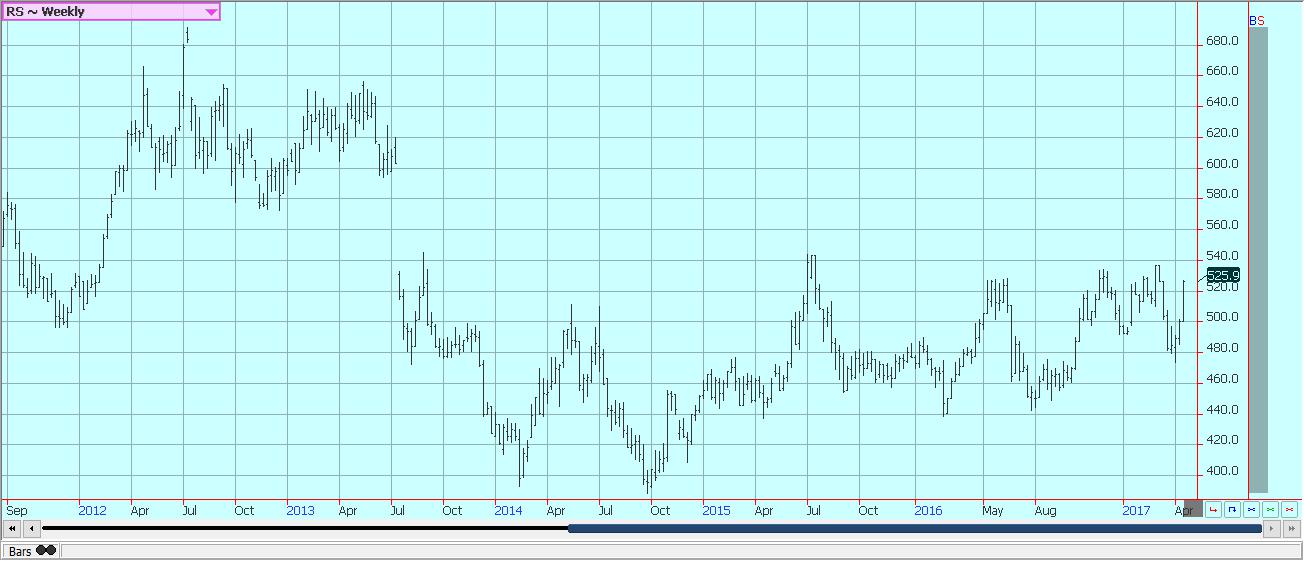

World vegetable oils markets were mixed. Palm Oil was the weakest market as the April contract expired and May traded below April prices. The private surveyors report improved demand for Palm Oil this month, but demand seemed to fade a bit last week. Early month data showed about a 12% increase, but the month to month increase was only about 5% last week. However, trees in both Indonesia and Malaysia have been slow to respond to improved conditions. Trees have seen plenty of rain and production should be seasonally increasing, and traders will watch for these tendencies in the updates. Ideas are that the increase so far has been less than expected and that the production is not increasing at the expected rate. Canola closed higher last week amid tight Canadian market conditions. Short sellers in this market are getting squeezed now. Some Canola was left in the fields last Fall as the snows came early, and farmers have not been big sellers in the local cash markets. Demand from both the processor side and the export side has been strong enough to generally support the market although selling was seen in recent weeks from speculators liquidating long positions. It looks like this selling pressure has faded. Soybean Oil is trying to turn trends up on the daily charts from what appears to be a bottom formation. Ideas are that demand for biofuels can remain strong. The US is moving to limit imports of biofuels from Argentina right now on reports that the fuels are being dumped into the US market. Less competition will mean more demand for US Soybean Oil for fuel oil purposes.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Futures moved higher last week as the mills with on-call positions against May futures finally were forced to cover those positions. That buying kept the market firm for most of the week, with May the strongest month. May gave up part of the gains on Friday once the price fixing was completed, but the rest of the months were able to move a little higher. The market is still enjoying strong demand in the export market and the demand is supporting values. Export sales were below 300,000 bales for the first time in several weeks last week, but the overall pace of sales remains strong and above forecast levels from USDA. Planting progress was slow last week due to the rains and should be slow again this week. The slow planting pace is not a concern yet, and the moisture overall is welcomed by producers. However, the dry and warm weather will be needed soon to avoid big planting delays. Trends are up on the daily and weekly charts.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ closed a little higher but held inside the trading range of the last few weeks. The market remains in a bullish supply market mode, with less and less domestic demand hurting any upside potential. Domestic production remains very low due to the greening disease and drought. Trees now are showing small fruit as the bloom season has ended. Irrigation is being heavily used to prevent loss, although there were a few showers reported in parts of the state last week. The harvest has been very active. Early and Mid Oranges are now harvested. The Valencia harvest is moving to processors and into the fresh market and will start to wind down at this time. Major freezes in southern Europe this Winter have damaged the citrus production. Reports are that losses are extensive. Brazil crops remain in mostly good condition. Brazil imports will arrive after May and will provide some space for juice producers who are hurt by the lower Florida production.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower and New York made new contract lows last week. Ideas of good supplies and reports of weak demand kept selling in the market. Futures broke support areas in the second half of last week and found renewed chart-based selling. The chart-based selling should fade early this week. The ICO has noted that overall world supplies remain ample and that production prospects for the next production year are good. It expects prices to generally work lower over time. The cash market remains slow. Offers remain in the cash market, and differentials are stable to weak. Buyers remain quiet and appear ready to use already contracted supplies. This is in line with the narrative of big supplies in importer countries and is seen in official statistics like the month GCA reports highlighting the big supplies. New York has featured buying support from commercials as they fix prices for differentials purchases. Speculators have been the best sellers. London had been trading sideways as supplies available to the market remain tight, but the market finally broke last week due to weak demand. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Indonesia and Brazil are also very low on supplies.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures closed a little lower in New York and London. Both markets are trying to establish lows at this time. Ideas are that prices can remain generally weak. The fundamentals appear to be changing from a tight situation to one with more available to the market. However, the market has support from some positive demand news last week. India will allow 500,000 tons to be imported after insisting in the face of all contrary evidence that no imports were needed. The EU also said that it was considering imports as internal supplies have run low. Production conditions have been better this year in Brazil, and a better harvest is anticipated in the next couple of months. Production is also less in India and Thailand. India had lower production last year due to the uneven monsoon rains, but the weather service there expects a normal monsoon with good rain distribution this year. That has increased hopes for a strong rebound in production and has kept import ideas to a minimum. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remains too dry. Center South areas have had plenty of rain. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures © Jack Scoville

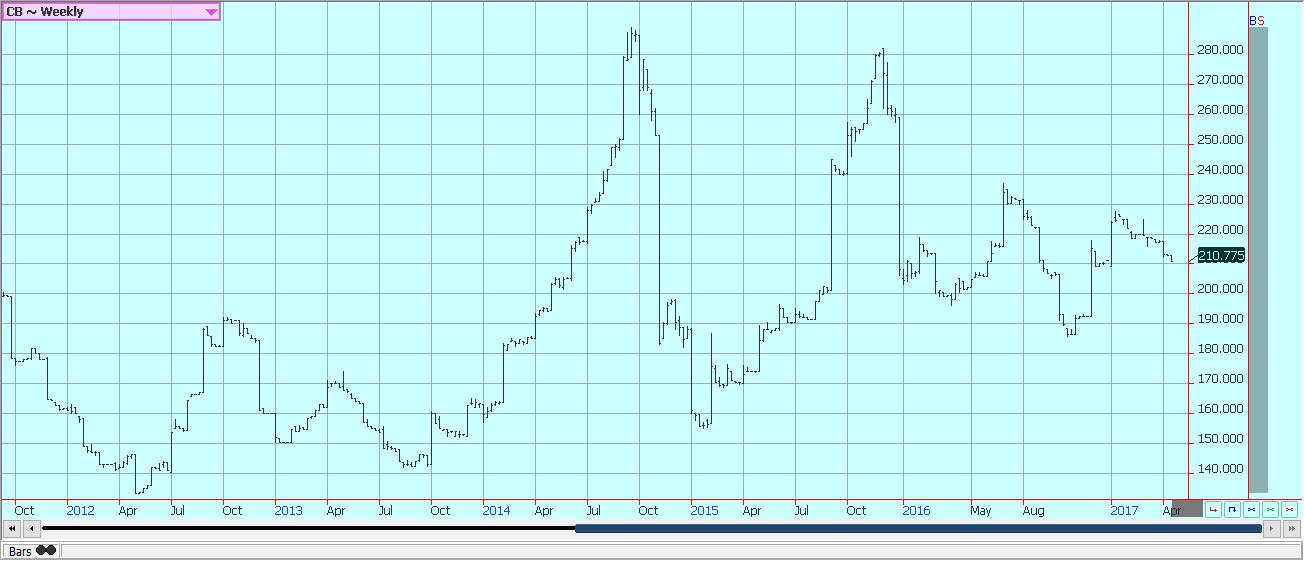

Cocoa

Futures markets were lower last week, with all of the losses seen on Friday as the market broke to new lows out of a congestion formation. Funds and other speculators were adding to short positions, but everyone pointed to increasing offers in world cash markets and increasing supplies certified for delivery in New York as reasons to keep prices under selling pressure. The main crop harvest continues in West Africa under good weather conditions. However, there are reports that suggest that the quality of the remaining main crop is not good and that much of the Cocoa delivered recently is not of exportable quality. The mid-crop harvest should be in full swing next month. Ivory Coast and Ghana are searching for ways to support farmers due to the weak world prices that are now below the cost of production and delivery into the ports for many. They are finding some support from world organizations in the form of eased rules. The demand from Europe is reported weak over all, and the North American demand has been weaker. New grind data is coming soon. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big on the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and meat

Dairy markets were higher. Supplies are strong seasonally in all areas as the annual flush is active in the US. Demand is good for cream, and cheese makers are displaying increasing demand. Cream demand for Butter has been very good as orders for print butter have increased. However, butter inventories in cold storage are increasing in some areas. Demand for Ice Cream has been mixed depending on the region. Cheese demand appears to be getting stronger due to promotions on the retail level. Exports are reported to be stronger. Dried products prices are generally weaker. Bottled milk demand has been steady to lower due to school holidays.

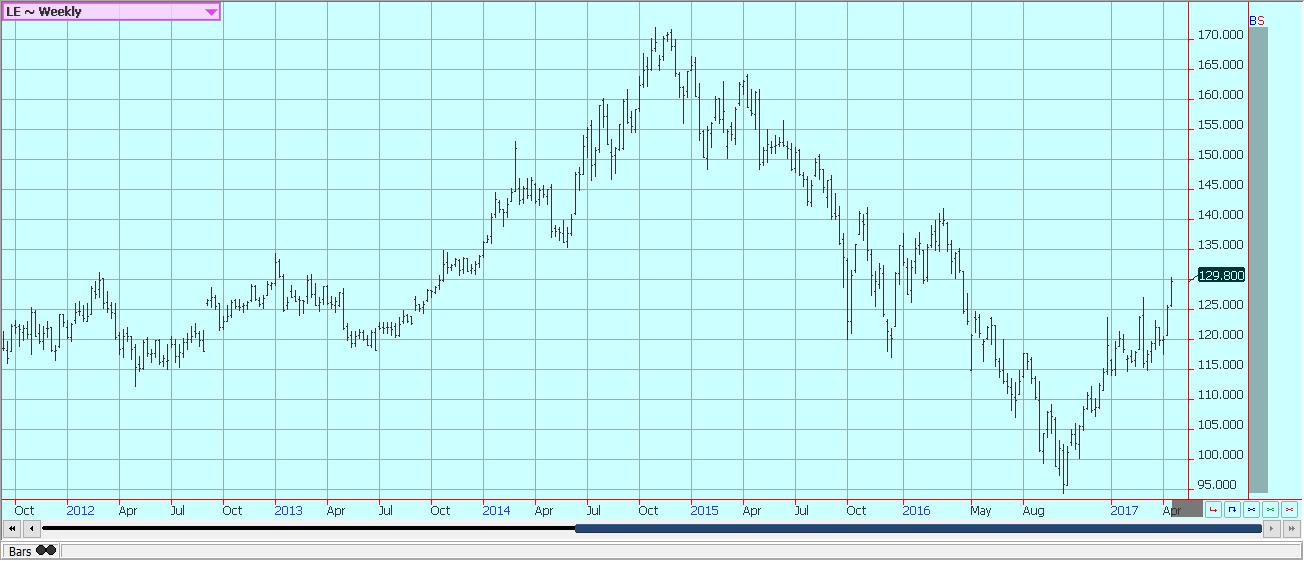

US cattle and beef prices were higher. The beef market has been strong and packers paid higher prices for cattle this week. The Cattle on Feed report was released on Friday afternoon and showed that feedlots are very current with supplies. Placements were higher than expected and were considered bearish for deferred months, but marketings and on feed data were in line with trade expectations. The trade is worried about a trend change to down given that the market has been very strong.

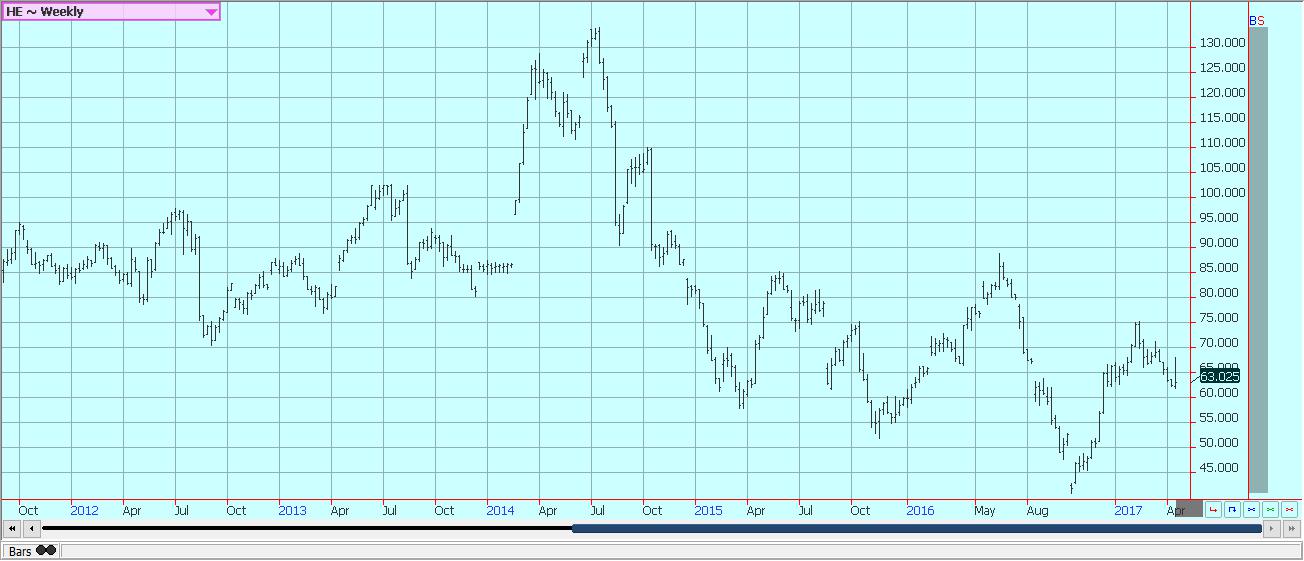

Pork markets and Lean Hogs futures were weaker last week on reports of large supplies. Pork demand remains stronger than expected, but packers have been pulling back from the market as they sense increasing supplies are coming. Packer demand has been very good until now. There are big supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEU Eases CO2 Tax Burden on SMEs with Revised CBAM Rules

-

Fintech11 hours ago

Fintech11 hours agoRobinhood Expands to Europe with Tokenized Stocks and Perpetual Futures

-

Business1 week ago

Business1 week agoAmerica’s Debt Spiral: A $67 Trillion Reckoning Looms by 2035

-

Crowdfunding5 days ago

Crowdfunding5 days agoTasty Life Raises €700,000 to Expand Pedol Brand and Launch Food-Tech Innovation

You must be logged in to post a comment Login