Business

US wheat market under pressure due to Russia’s increase in production

The American wheat market is feeling the pressure as Russia reportedly gains momentum in its wheat output.

The US wheat market is having some pressure from the news of Russia providing more wheat in the world market because of its output increase.

Wheat

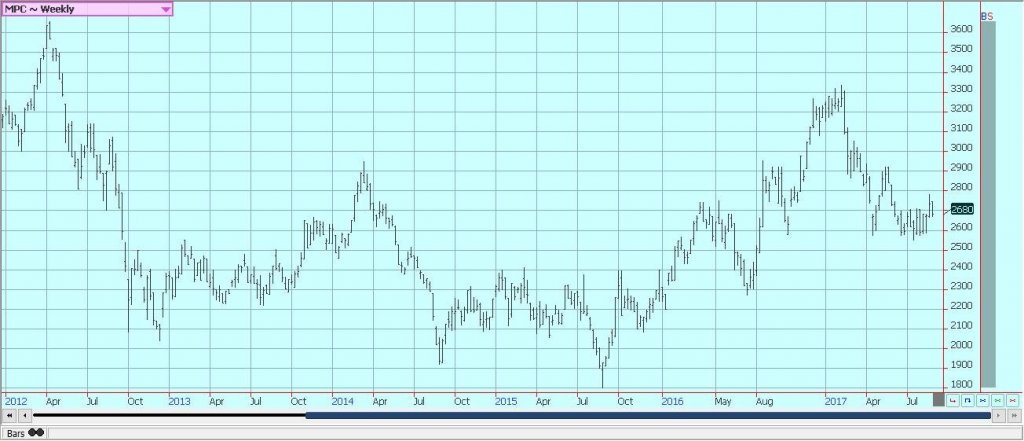

US markets were mixed, with Chicago markets moving higher and Minneapolis markets moving lower. Minneapolis moved lower on bigger than expected production projections for Canadian Spring Wheat from StatsCan last week. Minneapolis remains in a down trend, but might soon run out of sellers as the market has already moved down a lot from its highs a couple of months ago. Chicago markets appear ready to form a base again after extended down moves of their own. Chicago featured reversal type trading last week.

The market has been under pressure from ideas that there will be plenty of wheat available in the world market due to the big increase in production in Russia. However, the US and many other exporter countries have less this year, with only Russia the major exporter with more.

Canada has suffered through conditions very much like the US, with hot and dry weather in western sections of the Prairies and some areas that were too wet in eastern sections. Australia also suffered from the hot and dry weather at key times in the growing cycle, and less production has been forecast by ABARES and other sources.

Europe has had some wet weather in northern areas as the crop tried to mature and there will be at least a big quality loss from this area. Germany and Poland have been the most hurt. The lower qualities in these two countries will hurt Europe’s ability to export higher protein wheat.

US export demand is improving again as US prices are very competitive in the world market, and the recent trend to a weaker US Dollar has helped. Demand for US Wheat remains primarily for HRW and HRS, the higher protein wheats grown in the US. The US futures markets have given back about all the gains seen due to the bad weather. Futures could hold current support areas on the weekly charts and try to rally in the short term.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

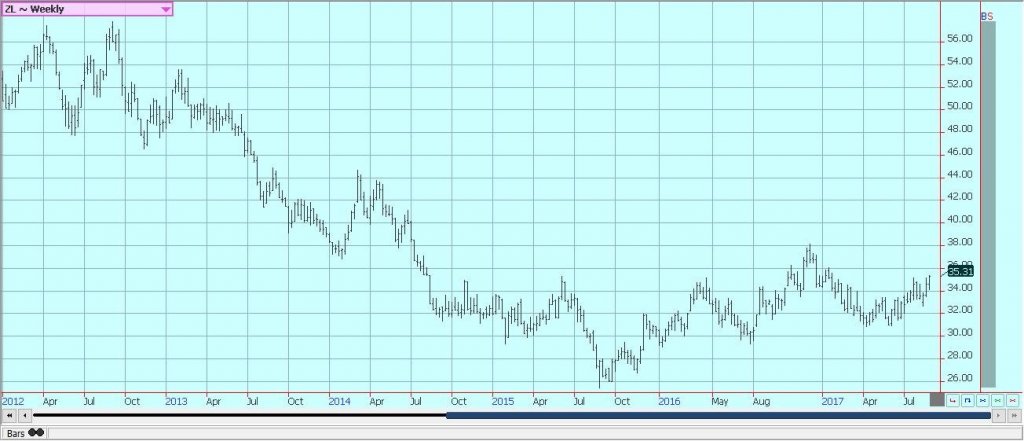

Corn was a little higher last week while Oats closed lower. There was some active farm selling before the start of September Corn deliveries, but the selling died down on Friday. Oats were lower all week, and extended losses from the good potential production in Canada displayed in the StatsCan estimates released late last week. The market will now start to get ready for the USDA production estimates on September 12. Private estimates started to be released last week and generally show good production potential. More private estimates and the averages will be heard this week.

The Farm Journal crop tour found better than expected production potential for the corn crop this year. The private estimates imply that the US will have more than enough corn for internal needs and projected export demand. Variable growing conditions continue as kernel fill continues. The Midwest will see cool weather and limited precipitation this week. The crop needs warmer weather to return to help push development towards maturity before temperatures can dip below freezing and hurt yield potential.

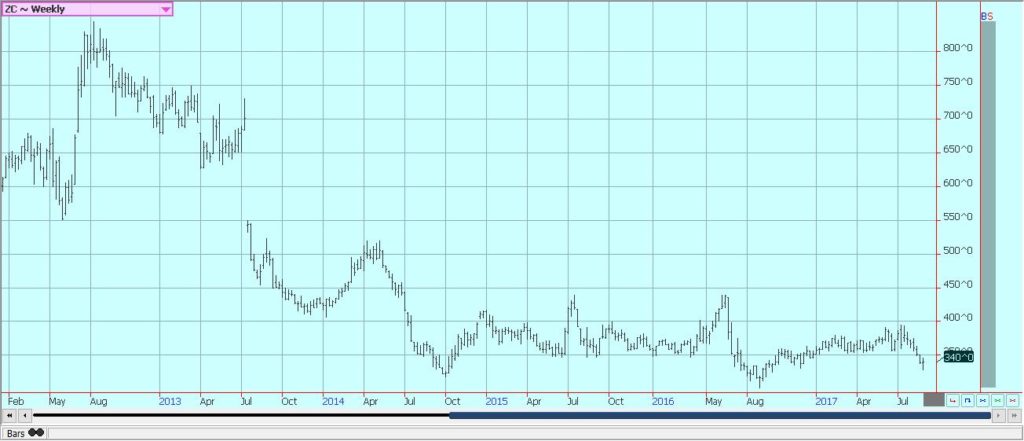

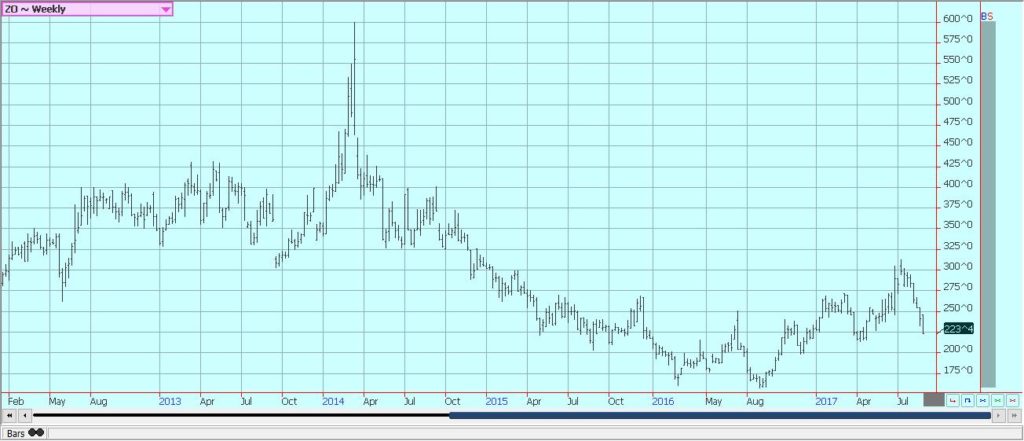

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and Soybean Meal

Soybeans were higher and soybean meal was mixed last week as short covering from speculators surfaced. Producer selling had been somewhat active going into the September delivery period that began on Thursday but dropped significantly once the deliveries got under way. Some of the private production estimates were released late last week and the estimates generally show the potential for strong production and production above 4.0 billion bushels. More private estimates will be released this week, then the major wire services will release average estimates.

There will be some cool temperatures in the forecast this week, and the crop needs warm weather to realize its best production potential. The crop was planted late in many areas and is only starting to set and fill pods now. The weather has been variable. Parts of Iowa and Missouri and central and southern Illinois have been dry and topsoil moisture levels are low. Crops in the east have been too wet, and the plants are very small in Ohio and much of Indiana and into Michigan. Eastern Illinois showed some of the same features as other eastern states. The crop progress is behind last year. Western areas have also had variable conditions ranging from too dry to very good depending on the area. The crop has the potential for solid yields, but no record yields are expected.

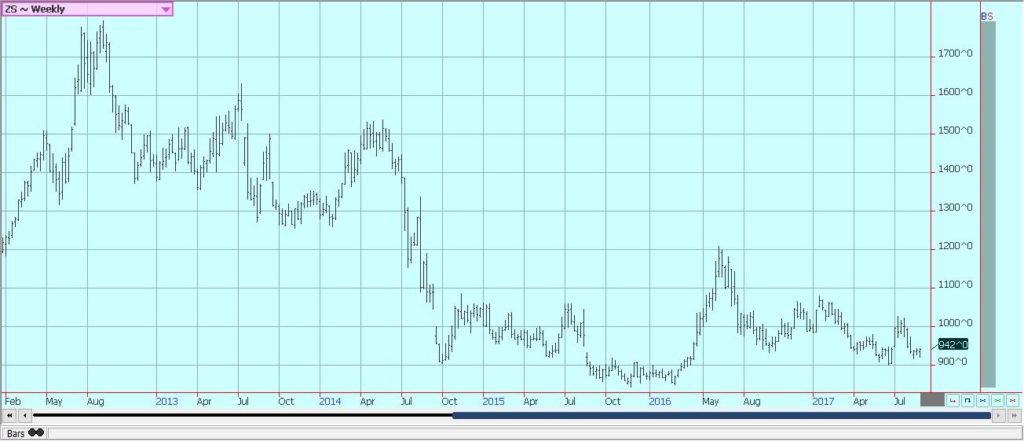

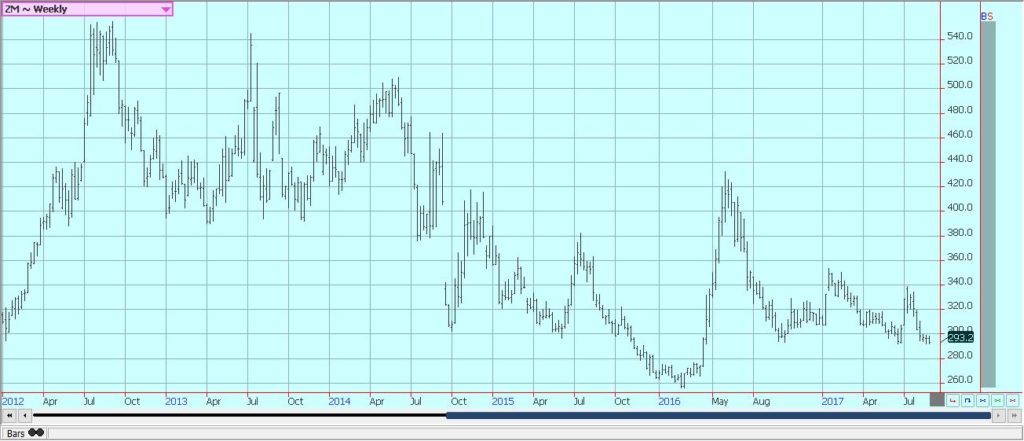

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

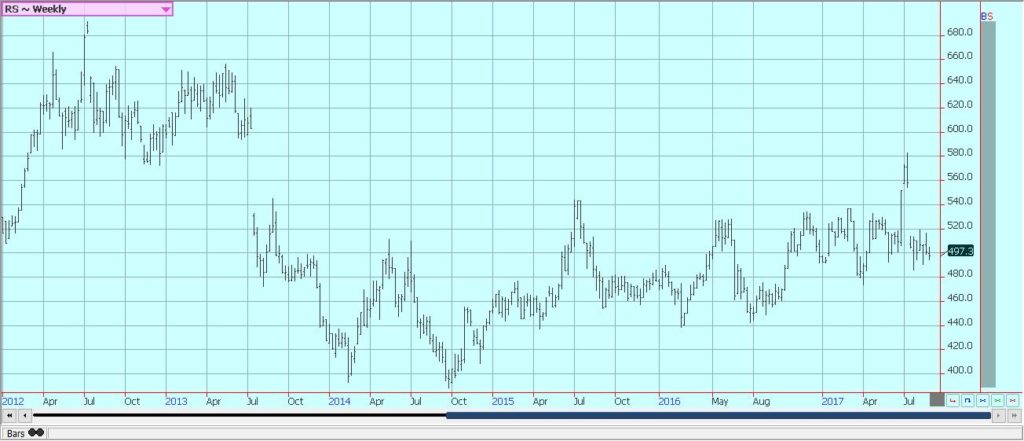

Rice

Rice closed higher on Friday and higher for the week. Harvey moved through Louisiana to wreak havoc there, but no one is talking about serious losses to rice yet. Ideas are that about a quarter of the Texas crop and about 15% of the Louisiana crop were still waiting to be harvested, and these crops could be damaged or lost due to all of the rain and high water. It is also possible that some rice in storage was hurt as the water rose and flooded out some facilities. Loss reports will become available this week.

The export sales report was not strong as prices have moved higher and as buyers want to see the quality of the crop before doing anything. Crops are now ready for harvest in areas from Mississippi to Missouri. Mississippi farmers will get a lot of rain from Harvey that will delay harvest. Arkansas and Missouri will start the harvest very soon if the weather permits. It has been cool, so the crop has been taking a while to get mature. Crop potential in these states is an open question due primarily to harsh weather at the start of the growing season and variable conditions for much of the year, but producers seem to expect good quality crops.

Asian prices remain soft. The Asian market has been weaker in the last few weeks as the next harvest comes closer in many countries. Growing conditions are improved in India as the monsoon has been better, but coverage of rains has been spotty until now and there are still chances for weaker production than expected in India this year. Most of Indochina and Southeast Asia have seen good weather.

Weekly Chicago Rice Futures © Jack Scoville

Palm Oil and Vegetable Oils

World vegetable oils markets were mixed again last week, with soybean oil higher and palm oil and canola lower. Palm oil futures gave back the gains from the previous week as concerns about demand and stronger production surfaced again. Demand has been good this year, but export demand was less than last month according to the private surveyors. There are ideas that production has now topped out and that trends will be for lower monthly production for the next several months. However, it might not matter if production drops if export demand continues to weaken.

Price trends remain up for palm oil, but prices are back at breakout areas after the selling last week. Soybean oil rallied again last week as the US government moved to impose dumping duties on imports of Argentine and Indonesian bio fuels. The market also rallied on the strength in petroleum products caused by the arrival of Hurricane Harvey. Harvey caused a lot of refining operations to close and caused products prices to rally. Ideas are that the stronger petroleum products prices could translate into higher demand for bio fuels.

Canola was lower in part on the stronger than expected production estimates released by the Canadian government on Thursday. Farmers have not really been selling yet, but probably will need to start soon as the futures market is showing that weaker prices are now possible. A primary negative for prices remains the strength of the Canadian Dollar against the US Dollar.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

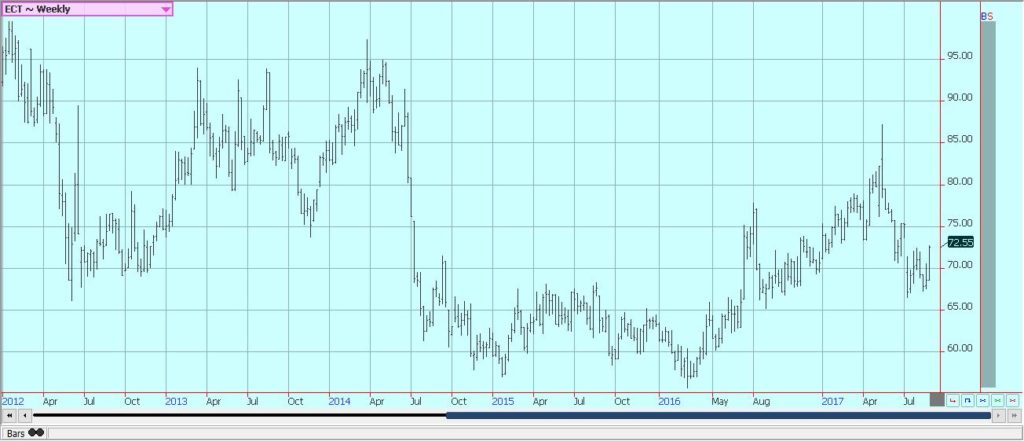

Cotton

Cotton was rallied and made new highs for the move as Hurricane Harvey hammered southeast Texas. The storm brought big rains of up to five feet into Texas and potentially hurt the quality and harvest progress in some areas of the state. Reports indicate that about 600,000 acres of high-quality cotton could be damaged or destroyed in southern parts of the state. Some traders suggest that half a million bales of cotton were destroyed. Cotton in the Texas Panhandle was not affected in any big way.

Big rains were seen in the Delta last week as well. Bolls are open or are opening now in just about all production areas. West Texas conditions have improved with recent precipitation. Delta and Southeast areas have also had generally good conditions and good production is expected as the storm did not bring heavy rains to these areas except for parts of Louisiana and Mississippi.

There is strong production potential in Asia, and mostly in India and Pakistan due to improved monsoon rains. Some rains are expected in most areas this week amid relatively moderate temperatures. Chinese growing conditions are good. It has been very hot and dry in Turkey. Areas to the south of Russia are in good condition.

Weekly US Cotton Futures © Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ closed higher on Friday and a little higher for the week as some tropical storms threaten to hit the US. Irma has formed in the Atlantic and has the potential to move into Florida. The storm is still several days away from hitting the USD, and there is potential for a front to move south and east from the Midwest this week to protect the eastern seaboard. Both the daily and weekly charts show sideways trends.

The market price remains generally weak due to ideas of better production potential for the coming harvest and reports of weak demand. Florida weather until now is very good as it is now drier, but showers are still around. The demand side remains weak and there are plenty of supplies in the US. Trees now are showing fruits of good sizes and overall conditions are called good. Brazil crops remain in mostly good condition and production estimates are climbing after recent rains.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower last week, with commercials scale down buyers and speculators doing much of the selling. The trends are still down on the charts in New York, but sideways in London. Brazil is now at harvest, and traders and producers are reporting low quality and small beans. There is some concern about dry weather there as recent rains have caused the first flowering in many areas. There is some talk that the rains and flowering came too early and that at least some flowers could be aborted if an extended dry period arrives now.

Cash market conditions in Central America remain quiet as that part of the world is between harvests. There is coffee to sell, but little buying interest from major roasters. Colombia has reported some difficult growing conditions, but exports have held well as production appears to be good due to younger trees that are more vigorous and produce better under more stressful conditions.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

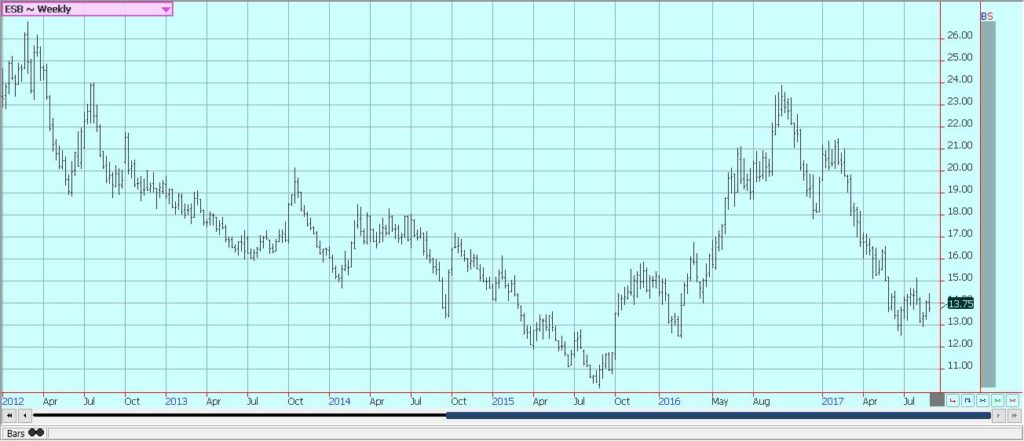

Sugar

Futures in London and New York were lower last week in trading related to Hurricane Harvey and the damage it created to the US petroleum refining capacity. The storm dumped up to five feet of rain in the Houston area, and Houston is the center for a lot of the petroleum refining in the US. The refiners were forced to close for several days due to the flooding seen in and around the city from the extreme rains. Some refineries were getting ready to open over the holiday weekend and more will open this week.

In the meantime, the need for ethanol might increase as the trade expects higher prices in the short term for gasoline and fuel to increase. Sugar tried to rally on the news, but could not hold on Friday and closed lower. Both markets show that short term bottoms have formed on the daily charts, but both markets still show down trends on the weekly charts. Ideas are that there will be plenty of sugar available to the market this year after several years when production was below demand.

The big harvest in Brazil continues, although some of the processing has switched to ethanol due to tax changes. Production potential in India and Thailand seems improved for now as monsoon rains have been better than last year. It is raining in much of India as the monsoon is active. Just about all areas have seen some precipitation and the only spots with too much rain now are Bangladesh and northeast India. Pakistan appears to have good conditions. Thailand is getting enough rains for a good crop this year. The rest of Southeast Asia is seeing average to above average rains so far this year.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

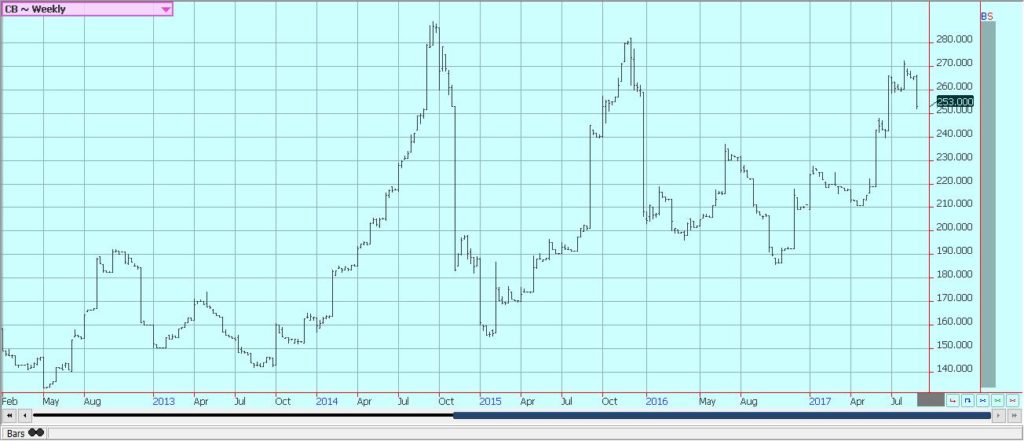

Cocoa

Futures markets were higher last week and are now challenging the upper end of a broad trading range. The market is between harvests in West Africa, so offers are less and selling is with less urgency. The next harvest gets underway in the next month or so and a good crop is expected in West Africa and also Southeast Asia. The demand should continue to increase if prices remain relatively cheap and as retail prices continue to move lower in important consuming areas like Europe.

Grinders and chocolate manufacturers are able to make plenty of money with current differentials. The next production cycle still appears to be big since the growing conditions around the world are generally good. Offers from West Africa have been very strong until recently, and now offers have backed off as prices have moved into a trading range. Ivory Coast has already sold 1.32 million tons of cocoa into the world market.

West Africa has seen much better rains this year and now getting some showers mixed with the hot and dry weather. Growing conditions are good. East African conditions are too dry but there are still crops growing. Good conditions are still being reported in Southeast Asia as it has turned seasonally drier in growing areas of Indonesia and Malaysia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

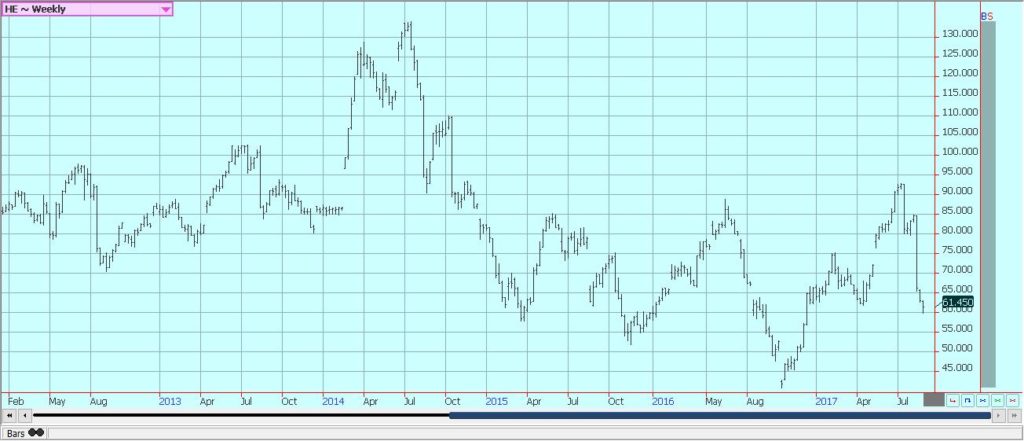

Dairy and Meat

Dairy markets were lower again last week. The trade expects higher butter prices due to very good demand and adequate supplies. However, futures were lower last week and closed the week on a weak note. Cheese prices have been relatively weak and also made new lows for the move. Demand is good for cream, but cream has generally been available to meet the demand. Cream demand for butter has been very good.

Cream demand for butter has been very good. Demand for ice cream has been mixed depending on the region but is becoming less now as the US summer comes to a close. Cheese demand still appears to be weaker and inventories appear high. US production conditions have featured some abnormally hot weather in the west that is hurting milk production. Production in the rest of the country has been strong.

US cattle and beef prices were lower and trends in cattle futures remain down. The beef market remains weaker in the last couple of weeks, although somewhat better last week. Cattle prices have been under pressure since the release of the monthly cattle on feed report and the semiannual inventory report that showed bigger supplies are coming. It is the threat of increased supplies down the road that keeps the packers from buying aggressively.

Feedlots are filled and cattle will continue to be offered to the cash market. However, ideas are that more supplies are coming as weight per carcass is high and more cattle is coming to the market. Demand will turn lower and will shift to roasts and things like that now that the Summer is ending and there is less for the barbeque.

Pork markets and lean hogs futures were weaker on a seasonal trend to lower demand. Ideas are that futures are too cheap to cash and that th spread between the two need to come together more than they are now. Demand has been lower for the last couple of weeks and this has affected pricing. Demand starts to work lower as most of the Summer buying is done. Buying will start to shift away from grill items to items for the oven. There are plenty of supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech7 days ago

Biotech7 days agoVolatile Outlook for Enlivex Therapeutics as Investors Await Clinical Catalysts

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoInter IKEA Launches Electric Truck Fleet to Decarbonize Heavy-Duty Logistics in Italy

-

Markets2 days ago

Markets2 days agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

-

Markets1 week ago

Markets1 week agoCotton Market Weakens Amid Demand Concerns and Bearish Trends

You must be logged in to post a comment Login