Markets

Weekly market update: Tarullo’s resignation clears way for bank regulation

Tarullo was also known as a monetary dove and was consistently on the side of caution when it comes to raising interest rates. Tarullo will still be around for the March FOMC.

The most important Trump event of the week for markets was the resignation of Fed Governor Daniel Tarullo.

The resignation of Tarullo should clear the way for bank deregulation. The stock market cheered and bank stocks took off with the S&P Bank Index rising 0.35% on Friday. Over the next year, there are a total of 3 positions on the Fed that the Trump administration can fill due to terms being up.

Tarullo was also known as a monetary dove and was consistently on the side of caution when it comes to raising interest rates. Tarullo will still be around for the March FOMC.

The big fear is that this is a start of an assault on the independence of the Fed. Markets will not treat an assault on the Fed’s independence very well. This is not an argument in support of the Fed that has faced numerous criticisms over the past several years particularly for its zero interest rate policy and attempts at quantitative easing (QE). All major central banks have faced the same criticism whether it is the Fed, the ECB or the BOJ. However, it is important that its independence is ensured and separate from political machinations and influence. A comparable comparison for Canada would be political interference in the operation and decisions of the Bank of Canada (BofC). That would be a recipe for chaos.

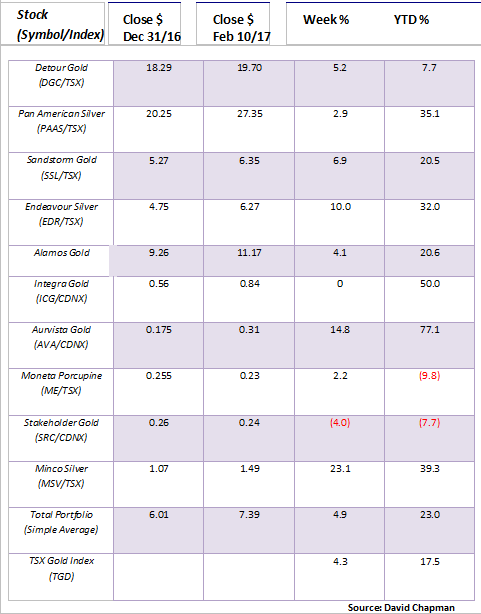

Model Portfolio

Our model portfolio continues to outperform the market and the TSX Gold Index (TGD). Up now 23% year to date simple average. Big winner continues to be Aurvista Resources (AVA) tacking on another 14.8% again this past week now up 77.1% in 2017. The big cap winner continues to be Pan American Silver (PAAS) up 35.1% in 2017 with Endeavour Silver (EDR) tacking on 10% this past week now up 32% in 2017. Both Moneta (ME) and Stakeholder Gold (SRC) are lagging. Minco Silver (MSV) also enjoyed a strong up week.

© David Chapman

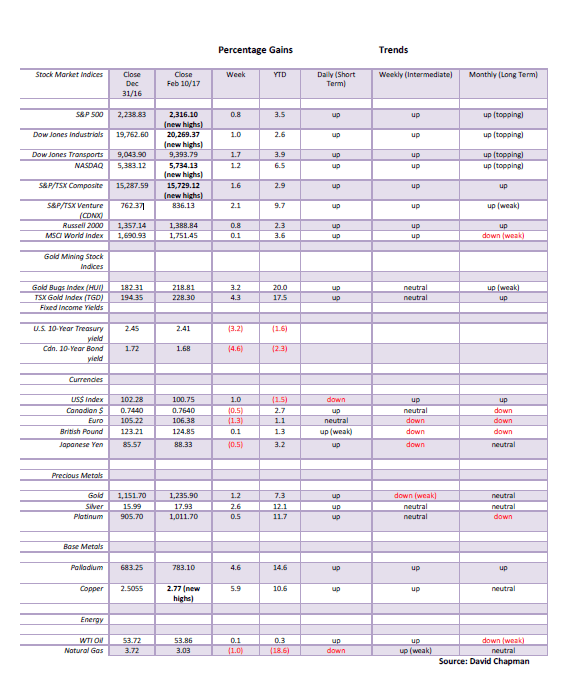

MARKETS AND TRENDS

© David Chapman

Note: for an explanation of the trends, see the glossary at the end of this article

Note: New highs refers to new 52 week highs.

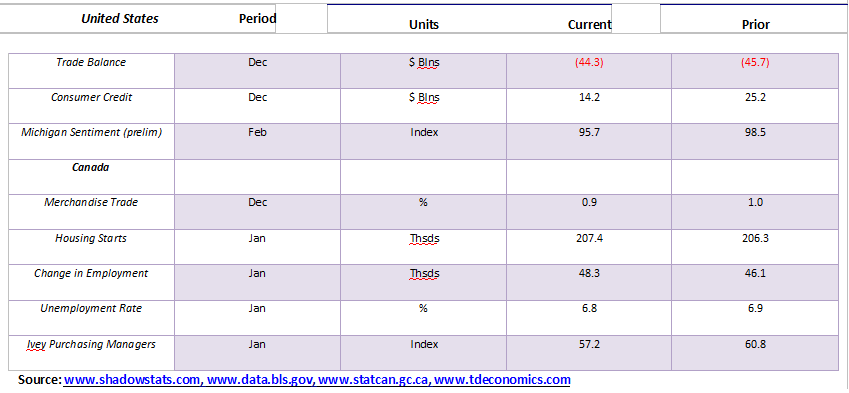

Key Economic Numbers Week February 6-10, 2017

(Source)

(Source: www.shadowstats.com, www.data.bls.gov, www.statcan.gc.ca, www.tdeconomics.com)

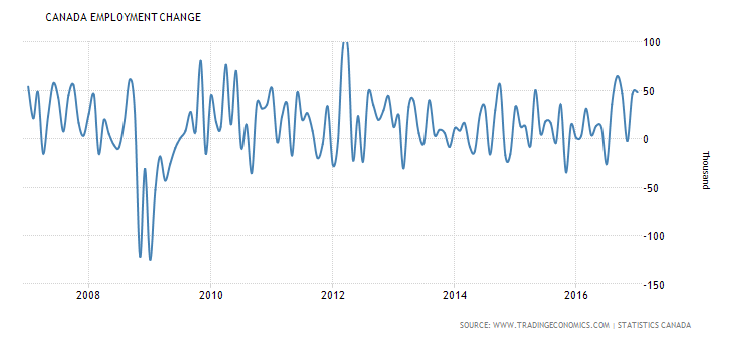

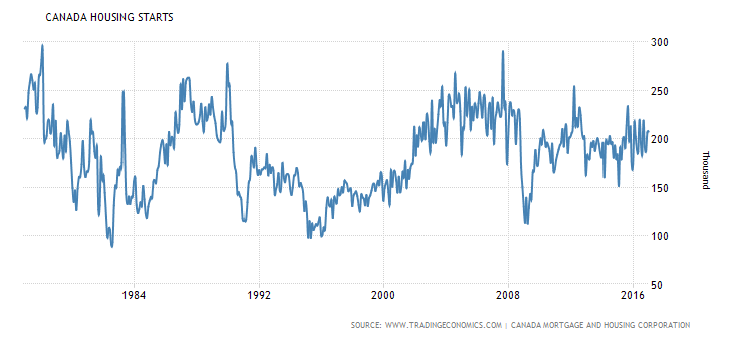

Is the Canadian economy really doing better? Well judging from the numbers this past week one would think so. For the second month in a row, Canada came in with a trade surplus. The prime reason was an improvement in trade with the US. That ought to please us Canadians but then we have to deal with Trump who is looking to lash out at anyone with a trade surplus with the US. Our leader meets with Trump on Monday. Maybe they will talk about trade. Housing starts continued to improve and given population growth in the country as a whole, this is an area that should see continued growth. But the real surprise of the week was the employment number. Canada’s equivalent of the US’s nonfarm payroll jumped 48,300 in January far surpassing the expected 5,000 decline. This is on top of the 46,100 jobs created in December 2016. The headline unemployment rate fell to 6.8% from 6.9%. Canada, like the US, publishes a number of different unemployment rates. For example, if Canada’s unemployment rate was calculated as it is in the US the unemployment rate would fall to 6.1% from 6.8%. The US publishes a higher unemployment rate known as U6 that includes part-time workers for economic reasons plus discouraged workers no longer counted as a part of the headline unemployment rate but have been out of work under one year but more than six months. The US’s latest U6 unemployment rate is 9.4%. The comparable number in Canada known as R8 is 10.3%. There is no comparable unemployment comparable to Shadow Stats rate currently at 22.9% but some studies have estimated that Canada’s is much lower around 12%. While the jobs number of January was great to keep in mind that full-time employment only increased by 15,800 while part-time employment jumped 32,400. The bulk of the jobs created over the past year have been part-time jobs, jobs that usually come with few if any benefits. Canada’s part-time labor force now represents roughly 20% of the labor force. The labor force participation rate for January jumped to 65.9% from 65.8% the previous month. In the US the labor force participation rate is lower at 62.9%.

(Source)

One has to like the upward slope of housing starts in Canada. As noted population growth is helping spur this sector. The expectations are that it should continue even if it doesn’t set any new records.

(Source)

My sense of this market is that we are rising on the basis of “buy the rumor” and “sell the news”. “Buy the rumor” – we are going to build a wall, we are going to have a huge infrastructure program, we are going to boost our military, we are going to deregulate particularly the financial industry, and we are going to bring in massive tax cuts. Result – buy defense stocks, commodity stocks, aerospace stocks, technology stocks, construction companies stocks, infrastructure stocks, and many more. The question is how far away are we from the news?

The low seen in February 2016 was an important one. In Elliott terms, we have labeled it wave 4 up from the major March 2009 low. Wave 2 was the 2011 EU debt crisis low. This suggests to us that we are in the process of wave 5 to the upside. We believe wave 1 and 2 are complete but we can’t quite say the same thing for wave 3 up. The small pullback in December was too shallow and too short-lived to be considered wave 4. Result it might have been a minor wave 2 coming up from the low of early November 2016. Wave 1 up from the 2009 low was a total of 703 S&P 500 points. If the current wave were equal then we could advance to 2,513. At a Fibonacci 61.8% advance, we could get to 2,244. We have now past that point. Above 2,350 the odds increase that we could rise to 2,513.

It is interesting to note that at 1,059 wave 3 to the upside that lasted from the 2011 low to the top in May 2015 was almost exactly 50% longer than wave 1. If that relationship holds for the current wave 3 advance then we could terminate around 2,390. Following that a somewhat more severe correction could set in before the market advances for the 5th and final wave to the upside.

The current market wavers under 2,250 and starts to breakdown under 2,200. But in the interim, the “Trump” rally continues.

(Source)

The percentage of S&P 500 stocks trading above the 200 day MA continues to languish below the highs seen in August 2016. So far the potential head and shoulders top continues to be in play. The high on this move is at current levels 75.80 vs. the highs on the left shoulder of 77 and 77.60. This is a divergence as the S&P 500 index has moved to new all-time highs. A number of other bullish percent indices and volatility indices are also registering divergences. It is a warning and not a suggestion that the market is making a top. Think of as one big long yellow light. You can still make a turn if you are in the intersection but it would not be a wise idea to proceed through the intersection.

(Source)

Here is the TSX Composite. Like the US markets, the TSX Composite hit new all-time highs this past week. If the markets are excited about US stocks, Canadian stocks usually benefit as well. One could argue that the market is a bit of one trick pony. The biggest winner has been the TSX Financial Services sub-sector which of course contains the banks. Canada’s banks are benefitting from the thought of deregulation in the US. It is expected that Canadian banks will benefit as well and allow more ease of access into the US market which is the market that the Canadian banks believe they can expand.

The RSI indicator is not as yet over 70, a level that might indicate that the TSX Composite is becoming overbought. Overbought signs are just an indication that the market is becoming too frothy as it does not tell us when a top would actually occur. Nonetheless, like its US counterparts, the TSX could have further to go on this run. We could eventually go as high as 17,360. The TSX Composite may be heavily weighted with banks but it the TSX Composite is also commodities particularly gold, metals and energy. Those markets may be the ones that help propel the TSX Composite to new heights.

(Source)

We have said it before and we will say it again the TSX Venture Exchange (CDNX) is still in its early stages of a major upswing. It is pretty definitive now that the low in early 2016 at 466 was a major significant low. The first wave up advanced 382 points. The wave 2 correction retraced 35.9% of the advance just shy of the Fibonacci 38.2% retracement. Wave 3 to the upside is still in its early stages and could reach as high as 1,285 a level about 54% higher than current levels. The junior mining sector particularly junior gold miners are leading the way.

(Source)

We are not convinced that the recent rise in interest rates (fall in prices as prices move inversely to interest rates) is over yet. Our chart of the iShares 20-year Treasury Bond ETF (TLT) tried to rebound this past week and thus far it has failed the previous high at 122.87. Unless we are able to break out over that level and at least test the underbelly of the falling 100-day MA and the 165-day EMA near 124/125 then odds favor a return to the downside. A breakdown under 118 would most likely signal that another downside was underway. Under 116.50 and new lows below 116.24 are assured.

Remember that the TLT is representing the top credit which in this case is the US Treasury. But just as the Trump agenda is driving the stock market higher it is also driving interest rates higher. Spending plans on infrastructure, a wall, defense coupled with financial de-regulation and tax cuts are all stimulative for the economy but would also signal higher interest rates in order to ensure things do not get out of hand. Grant you as with much of the Trump agenda these are just “rumors” at this stage and none have been approved. But then that is how markets act. They are anticipating the events.

Higher interest rates for US government Treasuries of course influence rates for everything else from mortgages to car loans to commercial loans. As interest rates rise especially if they rise too high it eventually sows the seeds of the next financial crisis as there is just too much debt.

(Source)

While the US$ Index managed to bounce back this past week we couldn’t help but notice that gold appeared to ignore the move. Gold and the US$ Index normally move inversely to each other but this past week even as the US$ Index rose gold also rose. One of the main catalysts for the rise this past week for the US$ Index was the Trump administration’s tax cut plans. The tax cuts are viewed as stimulative thereby helping to push the stock market and the US$ higher.

Technically, however, the US$ Index is stuck right now in the middle of a no man’s land. The US$ Index fell to a level of support around 99 and has since rebounded. The question is does the US$ continue the advance and move to new highs to our original targets of 106-108 or does the US$ Index run out of steam reverse and start a decline? We have labeled the chart to suggest that we could be forming a head and shoulders top pattern. Remember these patterns are just potential patterns they are not definitive. A move up through 102 would bust the potential H&S pattern and suggest that the high of 103.81 should fall. Once above that level then a run to our long-held target zones of 106-108 should get underway.

The other scenario, of course, is that the US$ Index remains below 102 and does form a head and shoulders top pattern. The breakdown would be under 99 and would initially target a move down to the 92-94 range. The up move this past week did not have a lot of conviction. That may be why gold did not react negatively to the rising US$. Instead gold may be sensing an impending crisis that takes the US$ lower.

(Source)

The Cdn$ is struggling here at 76/77. The 200 day MA is currently at 76.20 and while the Cdn$ is testing the level it has not as yet broken through. We circled a couple of high volume drops that occurred recently but then the move down to the most recent low at 73.61 happened on reduced volume. The rise to 77.15 also happened on reduced volume. Not encouraging if one is looking for a break through to higher prices. Nonetheless, most technicals are positive for the Cdn$ but it needs to convince us that it can break firmly up through 77. Once that happens then a move towards 80 should get underway. The Cdn$ currently has considerable support down through 75 but a breakdown under 75 could suggest a test of the recent low at 73.61 and possible new lows. Since peaking at 80.25 back in April 2016 the Cdn$ largely drifted lower but 2017 has seen the Cdn$ start an advance with higher highs and higher lows. What we would like to see is a pickup in volume to convince that the advance is real.

(Source)

As we noted in our comments about the US$ Index, gold rose this past week despite a rise in the US$ Index. We view this as a positive. Gold appears to be forming a rising channel. An uptrend is defined as a series of rising highs and rising lows. So far we only have the one pullback to judge the current uptrend. The first rise to $1,220.10 was most likely minor wave 1 with the pullback to $1,179.70 minor wave 2. The pullback held the 50-day MA. Gold has now been challenging the 100 day MA and the 165-day EMA. The week ended with gold closing above both MA’s. The key now is to break out above the low of October 7, 2016, at $1,243.20. The high this past week was at $1,246.60. Once over $1,250 gold should easily rise to the next resistance of $1,260 to $1,270 where the 200 day MA is currently at $1,266. Only a break back under $1,220 could change the current uptrend scenario. If we are right on our scenario that we are now in a third wave to the upside we could see an upside explosion at any time. Major resistance is at $1,300/$1,310 but once above that level, the market should advance towards the highs of July 2016 at $1,377.

(Source)

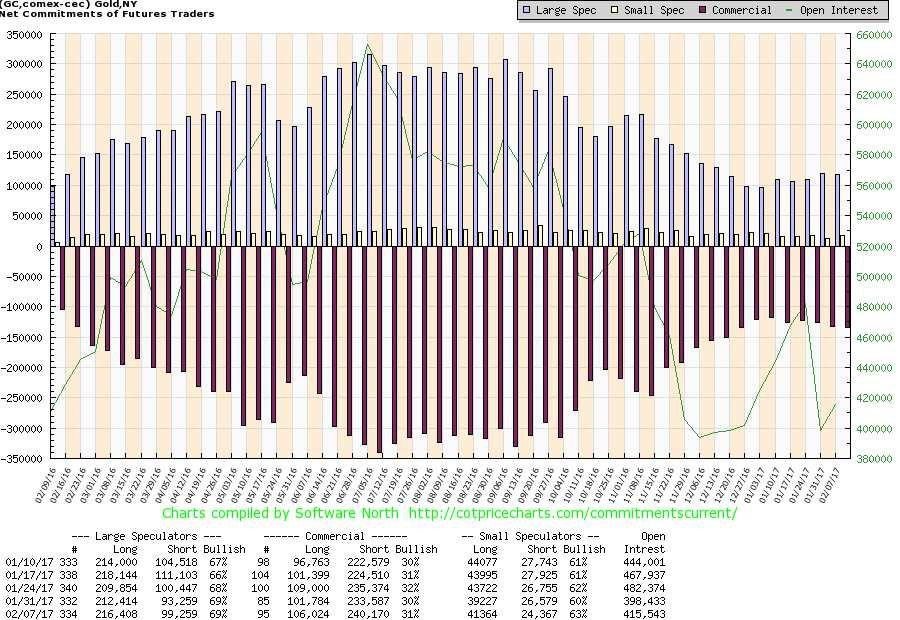

The commercial COT improved slightly this past week from 30% to 31%. While long open interest jumped roughly 5,000 contracts short open interest jumped about 7,000 contracts. The commercial COT has been hovering in the 30/32% range for the past 8 to 10 weeks. The large speculators COT (hedge funds, managed futures etc.) appears to be stuck in a range of 67/69%. It was unchanged this past week at 69% despite a rise of about 4,000 contracts in long open interest and about 6,000 contracts rise for short open interest. It is all kind of neutral here but there is no sign from the commercials that are becoming bearish again.

(Source)

Looking once again at a weekly chart of gold we feel confident that the low seen in December 2015 was an extremely important one. No matter how we count the decline from the high of September 2011 to the December 2015 low it tells us that it was an important low. The rise since then has unfolded in a manner that suggests that we all we are witnessing is a correction to the long 2011/2015 decline. Wave A completed at $1,377.50 and it is very possible that wave B ended at $1,124.30. C waves can be quite powerful and as a minimum, it should take us back to the 2011 highs just above $1,900. A minimum objective would be at least a rise to $1,875. A more optimistic scenario could take us to $2,250.

If there is a concern on all of this the scenario suggests that once this C wave is complete it could be followed by an equally devastating collapse. But that is down the road at some point. We will keep you informed as to when we believe this market is topping out. Just remember that gold (and silver) tend to spike rather than form rolling tops. Gold can be emotional.

(Source)

If gold and the US$ tend to move inversely to each other, gold tends to move in tandem with the Japanese Yen. This chart covers a period of 10 years and the comparison couldn’t be starker. As the Yen goes so goes gold. It would be nice to think that the two diverge at tops and bottoms but it was completely the case during this period. The top in 2011 saw both gold and the Yen top in tandem.

However, at the bottom in 2015 we note that while gold made a new low the Yen did not. A divergence potentially signaling that a trend change could be due.

(Source)

For comparison’s sake here is gold and the US$ Index. The relationship isn’t as tight as gold/Yen but it is reasonable. If the US$ Index is rising gold tends to fall and vice versa. Gold bottomed in December 2015 just as the US$ was topping out. By the time gold topped in July 2016, the US$ Index was already in the early stages of a rise. Once again the US$ Index topped in December 2016 and the gold started a rise.

This past week’s action where both gold and the US$ Index is not unusual as there are numerous examples of the two moving in tandem. But generally, the two are in a constant see-saw. President Trump’s threats to start trade wars with Mexico and China amongst others could be the undoing of the US$ and in turn, help spark a rise in gold.

(Source)

Silver is now challenging its 200 day MA. This is the last key MA that needs to be overhauled. Once over the next key level of resistance is at $18.50. Above that level and especially above $20 odds favour new highs above $21.23. Potential targets could be up to $26.75/$27.00 as a minimum. Further potential targets can be seen up to $28. The caveat is that silver needs to hold about $16.75. A breakdown under that level could be put the strong rebound underway in question. Silver tends to lead gold and it was noteworthy this week that silver gained 2.6% vs. gold’s gain of 1.2%. Silver is now up 12.1% on the year vs. gold’s gain of 7.3%. It is noteworthy that platinum is also beginning to move and is now up 11.7% on the year. The star, however, has been palladium jumping 14.6% thus far in 2017.

(Source)

Copper broke out to new 52 week highs this past week. Driving the rise in copper prices are some supply shortages but the strongest impetus has come from speculative demand from China and rising expectations on Trump’s $1 trillion infrastructure spending and even Trump’s “wall”. With the RSI at 63, it is not as yet at levels that would start to set off alarm bells that the market is seriously overbought.

Yet many now believe that copper is overdone and could be vulnerable to a correction. This has come this week as copper prices broke out of triangle formation and are actually most likely starting a new up leg. This move should take copper prices over $3. Rising copper prices are also positive for gold.

(Source)

Gold stocks have generally been on fire since the beginning of the year as the Gold Bugs Index (HUI) is up 20% and the TSX Gold Index (TGD) has jumped 17.5%. From the December 2016 lows the HUI is up 36.9% while the TGD has jumped 32.5%. This past week the TGD jumped over the 200 day MA. It was brief before a pullback but by Friday’s close the TGD managed to close over this key MA. The question now is can the TGD hold this level? The HUI didn’t quite make it over its 200 day MA closing a couple of points under the level. The Gold Miners Bullish Percent Index is currently at 60.71. It is a level that is actually kind of sweet spot. At the December low the index had fallen to 7.14. The July 2015 saw the index at an unheard of level of 100. While 60 is high it is not as yet at levels that suggest that a top may soon in the making. That doesn’t even enter the equation until the index is over 75. During the long decline from September 2011 to the low of December 2015 the index often failed in the 45/55 zone. It is encouraging we are through that level and the index should rise to the 75 or higher level in the near future.

GLOSSARY

Trends

Daily – Short-term trend (For swing traders)

Weekly – Intermediate-term trend (For long-term trend followers)

Monthly – Long-term secular trend (For long-term trend followers)

Up – The trend is up.

Down – The trend is down

Neutral – Indicators are mostly neutral. A trend change might be in the offing.

Weak – The trend is still up or down but it is weakening. It is also a sign that the trend might change.

Topping – Indicators are suggesting that while the trend remains up there are considerable signs that suggest that the market is topping.

Bottoming – Indicators are suggesting that while the trend is down there are considerable signs that suggest that the market is bottoming.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business2 weeks ago

Business2 weeks agoFed Holds Interest Rates Steady Amid Solid Economic Indicators

-

Crypto13 hours ago

Crypto13 hours agoBitcoin Surges Toward $110K Amid Trade News and Solana ETF Boost

-

Fintech1 week ago

Fintech1 week agoMuzinich and Nao Partner to Open Private Credit Fund to Retail Investors

-

Crypto4 days ago

Crypto4 days agoBitcoin Traders on DEXs Brace for Downturn Despite Price Rally

You must be logged in to post a comment Login