Crypto

What Happens to NFTs Once the Kids Get Bored with Random JPEGs?

There’s no doubt about it. NFT projects like Crypto Punks have taken the world by storm. But what happens to the rest of the low-value copycat projects that have cropped up since? Chances are, most will slip into obscurity unless they bring something more to the table. But what is that something more, and where do we find these projects? Let’s take a look at where the future of NFTs is.

Living in this post-Beeple day and age, every man and his grandma seem to be in on the NFT craze. And no, that’s not a typo. Need proof? How about Taira (Pronounced Tie-EAR-a) — a 96-year-old artist who recently (December last year) took a leap into the world of NFTs?

Hi! I'm TAÏRA, a 96-year-old artist from Connecticut, ready to make my mark in the NFT world! #nft pic.twitter.com/9bDWaqkYtT

— Taira (Pronounced Tie-EAR-a) (@TairaArtist) December 31, 2021

And in case you were wondering how many of these NFT things are actually selling, well… you know the saying about selling hotcakes? Good.

Currently, Snack and Bakery estimate that market to be worth about $601.9 million per annum. Meanwhile, NFTs are turning over at a rate of $5 billion per month. And that’s just through OpenSea alone. Yeah, hotcakes don’t even come close.

So if NFTs are selling like hotcakes (only better), and even your grandma is getting in on the action, what should you do? How about getting ahead of the curve and investing in the next generation of NFTs that are set to rock the market once people get bored with mass-produced JPEGs?

Here’s what you need to know.

NFTs Are So Much More Than JPEGs

While collecting the current generation of NFTs can be a whole lot of fun, it’s also a backward way of doing things. If we ignore the blockchain factor in the equation for a moment, what we’re really left with is something a whole lot like trading cards and other collectibles. (Makes a whole lot more sense to see grandma getting in on NFTs now, doesn’t it?)

So the first thing to do if you’re going to get smart about NFT collecting and investing is to get familiar with the broader crypto/web3 ecosystem. It’s the ecosystem that laid the foundation for NFTs. And it’s the ecosystem in which NFTs will ultimately evolve.

The second thing you’re going to need to do is to realize that NFTs are (or at least should be) about a whole lot more than just JPEGs. While this is the use that brought them to prominence, it’s far from their limits. Heck, you can even mint your kid’s first birthday on the blockchain if you really want.

Actually, scratch that. Here’s a better idea.

Tokenize All the Things

The reason why NFTs are about so much more than just JPEGs is really quite simple. The T in NFT is for Token. Scraping the first dictionary definition that a quick Google search gives, we see that means they are “a thing serving as a visible or tangible representation of a fact, quality, feeling, etc.”

What happens when we take this definition and run with it is that we quickly see how many things in life are, in fact, tokens.

Certificate of authenticity? Token. Gym membership card? Token. Shareholder’s certificate? Token.

If you want to see how this plays out in the NFT world, an easy place to start is sports clubs. Here, several teams are already playing with NFTs as membership tokens. Fans holding these tokens have indelible proof of their membership and, in return, are granted all the usual membership benefits, plus more.

But remember. This is still slightly backwards thinking. While NFTs are certainly useful here, they’re still just replacing everyday items with something digital. Sure, it’s on the blockchain, but do you really need the blockchain to support your favorite sports team?

Maybe. Maybe not. Time will tell. In the meantime, however, something much better is brewing.

The Best Idea Yet

Even if you haven’t been paying attention to what’s happening in Web3, you’ve probably heard at least something about decentralization. This is the great promise of blockchain and Web3.

While it’s still early days, there are already some areas of the ecosystem that are coming into full maturity. One of the most promising of these is Decentralized Autonomous Organizations, or DAOs for short.

The basic premise here is not all that dissimilar to share ownership. Token holders own a stake in the DAO, and generally have a say in the running of the DAO. Of course, in reality, the exact structure is open to many variables. But this is the elevator-pitch version of it.

What makes this form of NFT ownership so interesting is that it adds a massively multi-dimensional depth to it. We have the security of the blockchain. We (can) have the fun of collectible NFTs (but not all DAOs do this). And we also have a share in exciting projects that rarely fit into traditional business models.

Here’s What One of the Better DAOs Looks Like

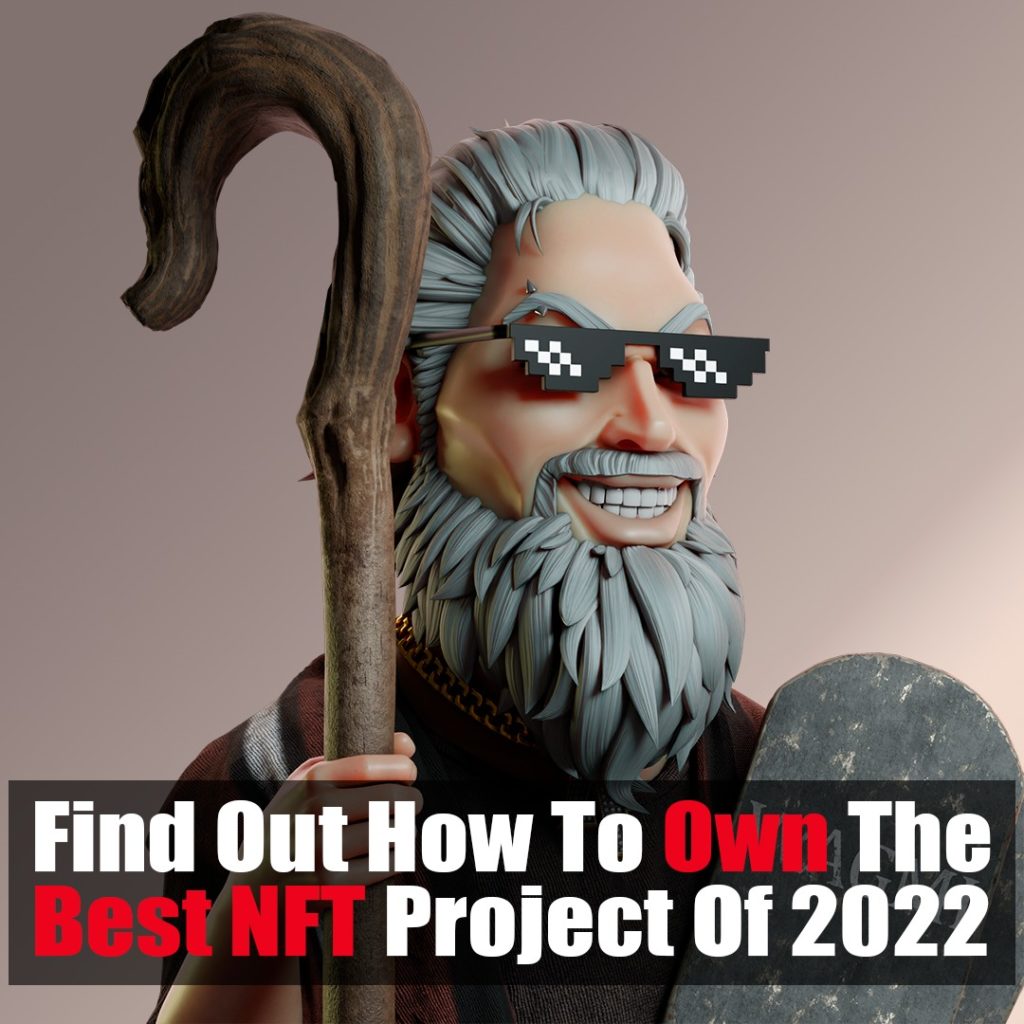

So DAOs sound great in theory. But understanding exactly how exciting is a little hard without a good concrete example. For that, let’s take a look at The Holy Dao, which is tied to the Holy Ones NFT project.

To start with the NFT, we obviously have the biggest hallmarks of a great NFT—great art, and a great concept. In this case, that concept is the coming together of great figures from various religious traditions. Think Moses, Jesus, Vishnu, and Buddha. Out of work (God is dead, remember?), they decide to reinvent themselves, uniting around a message of coexistence over division and hate.

Moving onto the DAO itself, membership is via Holy Ones NFTs (of which there are… wait for it… 6,666), and each NFT will entitle its holder to one vote. But why bother voting? What does it achieve?

This is where the Holy Dao gets interesting, as the list of privileges and entitlements (not to mention fun stuff) is long. This includes invites to the Holy-Owner-Only forums and events (both virtual and IRL), early access to H.O. presales, whitelists, and airdrops, and access to exclusive metaverse-ready avatars and wearables.

But what’s most interesting is not the goodies. It’s the fact that Holy One’s NFT holders receive access to The Holy Treasury (initial Holy Ones NFT mint-profits), along with ongoing 20% royalties from all game and other metaverse projects managed by the DAO.

Get in Before Grandma Does

If there’s one thing to take away from this, it’s that a vast majority of NFTs today are going to fade into obscurity in short order. Sure, there’s a handful that has reached the sort of legendary status needed to survive the ages. But the rest are pretty much the same as every aspiring artist out there: doomed to a lifetime of obscurity and ramen.

Projects like the Holy Ones/Holy Dao, however, bring something to the market which is worth getting excited about. Even if no one eventually cares about the project’s original art, the incorporation of other businesses under the umbrella of a DAO built up around a fun (and slightly cheeky) concept gives it real lasting power.

__

(Featured image by Shubham Dhage via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Impact Investing7 days ago

Impact Investing7 days agoCDP Approves €1.5 Billion Package to Boost Industry, Renewables, and International Development

-

Crypto2 weeks ago

Crypto2 weeks agoUniswap and BlackRock Partner to Launch BUIDL in DeFi

-

Impact Investing2 days ago

Impact Investing2 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Biotech1 week ago

Biotech1 week agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments