Featured

What’s next for the US dollar?

People don’t understand gold. They don’t understand the U.S. dollar either. Mostly, it’s the same people.

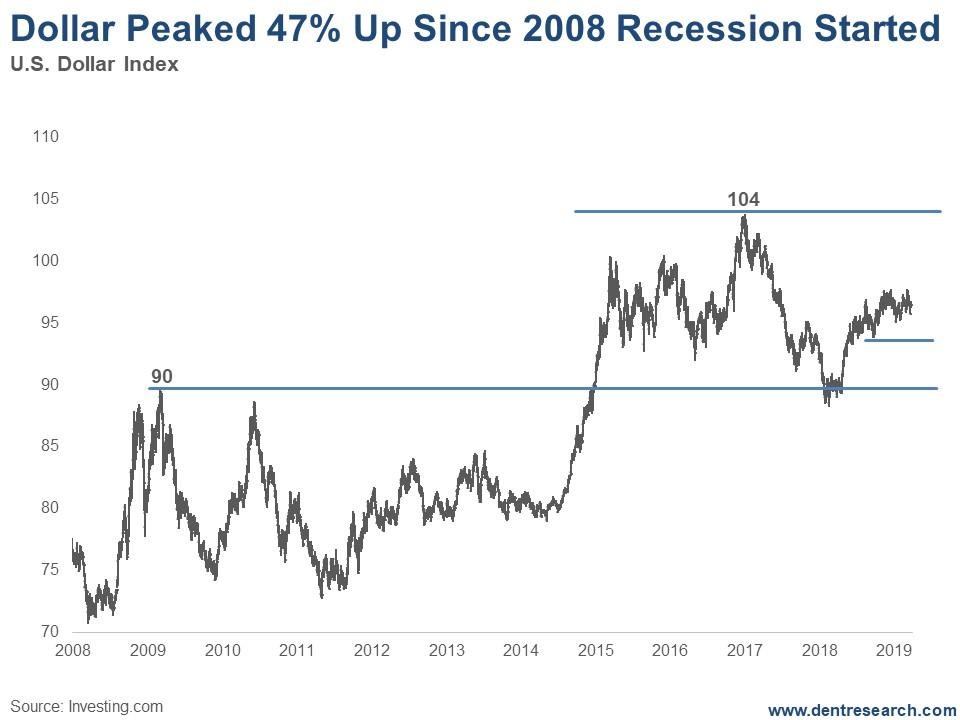

Gold bugs thought we were debasing the dollar by printing our way out of the 2008/9 financial crisis. Ha! Actually, the dollar has been rising since the start of that recession. The dollar, not gold, is actually the safe haven for the markets.

Right now, it’s range bound, but the dollar strengthened as much as 47 percent, at its best, during the last 11 years.

The dollar saw its best rally in mid- to late-2008 when Lehman Brothers was collapsing and the financial system was in dire straits.

Do you remember what gold did during that turmoil? It fell 33 percent. Silver lost 50 percent of its value. So much for “safe haven.”

But, like I said, the Greenback has been in a trading range, between 89 and 104.

Is the dollar about to crash?

Late last week, Bloomberg published an article saying that the Fed’s recent “surprise” move – to hold the benchmark rate steady for the rest of 2019 – could spell disaster for dollar bulls.

Besides this being the time of year when the Greenback typically peaks, followed by some weakness, are these “experts” right?

I don’t think so. Not with Brexit on the horizon.

The thing is, and it shocks me that the “experts” seem to miss this all the time: Currencies trade relative to each other.

The U.K. is set to leave the EU by either next week or by May 23 if the British Parliament is willing to accept Prime Minister Theresa May’s deal. She’s even offered to resign in return for a “yes” vote.

Either way, the deal isn’t pretty and disruptions will ripple through the continent. Any weakness in the euro could prop our dollar up, regardless of what the Fed does.

This speaks to the fact that we remain the “best house in a bad neighborhood.” Even with our crazy money printing, we only capped out at 26 percent of GDP. The European Central Bank (ECB) printed 42 percent of the Eurozone’s GDP. Japan printed 100 percent of its GDP.

I don’t see the dollar crumbling in the near term. In fact, I expect it to stay in its current trading range, with first support at recent lows around 93 or 94, and ultimate support around 89.

What to do when it rallies

Ultimately, I expect it to rally at least one more time, up towards around 120 or 122, a move we could see into the next crisis, between 2020 and 2022. Since the coming crash and financial crisis should be much worse than what we endured in 2008, in the 1980s, or even the 1930s, the dollar should shoot higher.

But, once we hit 120 or so, I’m neutral on the dollar. At that point, it would be time to start taking money out of the U.S. dollar, Treasury, and AAA corporate bonds and putting it back to work in the stock market and commodities, including gold.

It would be best to do this around late 2022 or so.

For now, though, don’t pay too much mind to the “experts.” The dollar remains a safer haven than gold. And the stock market – in the Dark Window event we’re experiencing now – is the play to be to make money.

(Featured image by Atstock Productions via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

-

Crypto1 day ago

Crypto1 day agoCrypto Markets Surge on Inflation Optimism and Rate Cut Hopes

-

Biotech1 week ago

Biotech1 week agoSpain Invests €126.9M in Groundbreaking EU Health Innovation Project Med4Cure

-

Biotech4 days ago

Biotech4 days agoAdvancing Sarcoma Treatment: CAR-T Cell Therapy Offers Hope for Rare Tumors