Featured

Wheaton Precious Metals Corporation is on the up

The resolution of the tax issues removes the cloud that this stock was laboring under and deterring investors.

In 2010, we became big fans of the “streaming model” and as it was known then, Silver Wheaton Corporation (SLW) which has been very kind to us over the years. On the 8th September 2010, we penned a short piece entitled “Silver Prices: Dare To Dream.A short snippet follows:

Now, remember if you don’t have dreams, they can’t come true, so line up a few things that are unique in terms of dreams to you and then prepare the road map of how to achieve them. We won’t bore you with our dreams as they vary from the simplistic to the ridiculous. However, our road map consists of holding a core position in the physical metals along with a small list of mining stocks and some cash for trading purposes. At the moment we utilize the recommendations as stated in our premium options trading service to boost our returns along with the occasional more cavalier trade being posted on our sites.

In this instance our road map involves taking a spread of Call Options on our favourite stock, SLW, with the following purchases.

December 2010 $26.00 Calls @ $1.55

December 2010 $30.00 Calls @ $0.58

December 2010 $35.00 Calls @ $0.18

January 2011 $26.00 Calls @ $2.00

January 2011 $27.00 Calls @ $1.64

This trade was thought by some to be a bit of a stretch, however, if you are in the business of predictive analysis, you do need to arrive at an actionable conclusion and put your hard-earned cash on the line. We were very fortunate as all of these trades returned more than a 100 percent profit.

A brief update on this stock

Today, Silver Wheaton Corporation has a new name: Wheaton Metals Corporation (WPM). Historically, it concentrated its efforts on silver streaming, but today its sales are generated more or less 50:50 between gold and silver.

Silver Wheaton Corporation has a market capitalization of $10.395B billion, an EPS (TTM) of $0.96, P/E Ratio (TTM) of 24.15, a 52-week low of $15.08 and a high of $25.24. The current stock price is $23.18.

In the fourth quarter of 2018, Wheaton generated almost $110 million in operating cash flow, bringing total operating cash flow for the year to over $475 million. The strong cash flow generation was founded on the production of over 370 thousand ounces of gold, 24 million ounces of silver and 14 thousand ounces of palladium, all in excess of the company’s guidance. In addition, Wheaton had record gold production and sales in 2018.

Tax dispute settlement

The last few years, WPM has operated under the cloud of a dispute with the taxation authorities and we decided to leave well alone until a resolution was forthcoming. This resolution has now been found and is summed by the following statement:

On December 13, 2018, the Company reached a settlement with the CRA which provides for a final resolution of Wheaton’s tax appeal in connection with the reassessment of the 2005 to 2010 taxation years under transfer pricing rules related to income generated by the Company’s foreign subsidiaries outside of Canada. The terms of the settlement provide that foreign income on earnings generated by Wheaton’s wholly-owned foreign subsidiaries will not be subject to tax in Canada. The transfer pricing principles reached in the settlement will apply to taxation years after 2010, including the 2011 to 2015 taxation years which are currently under audit and on a go forward basis subject to there being no material change in facts or change in law or jurisprudence. In addition, the settlement provided that the service fee charged by the Company for the services rendered to its foreign subsidiaries will be adjusted by, first, including the capital-raising costs incurred by the Company for the purpose of funding precious metals purchase agreements entered into by the Company’s foreign subsidiaries and secondly, increasing the mark-up on costs incurred by the Company that are charged to the foreign subsidiaries, including attributable capital-raising costs, from 20% to 30%.

Having removed this stumbling block, we are now taking a second look at this company as it has been on our Watch List for some time.

Outlook

Wheaton’s estimated attributable production in 2019 is forecast to be 365,000 ounces of gold, 24.5 million ounces of silver and 22,000 ounces of palladium, resulting in gold equivalent production of approximately 690,000 ounces.

For the five-year period ending in 2023, the company estimates that average, annual gold equivalent production will amount to 750,000 ounces.

Average cash costs in the fourth quarter of 2018 were $409 per gold ounce sold, $4.66 per silver ounce sold.

With an interest in acquiring Wheaton Precious Metals and I have been in touch with them recently. As I understand it the cash cost of gold was $409/oz and silver was $4.67/oz for the full year 2018. However, if we include the acquisition cost (the upfront payment) the total cost of acquiring an ounce would be roughly $828/oz gold and roughly $9.36 silver. So, we do need to be aware of these costs especially if the metals drop to lower levels.

Dividends

Wheaton Precious Metals recently declared

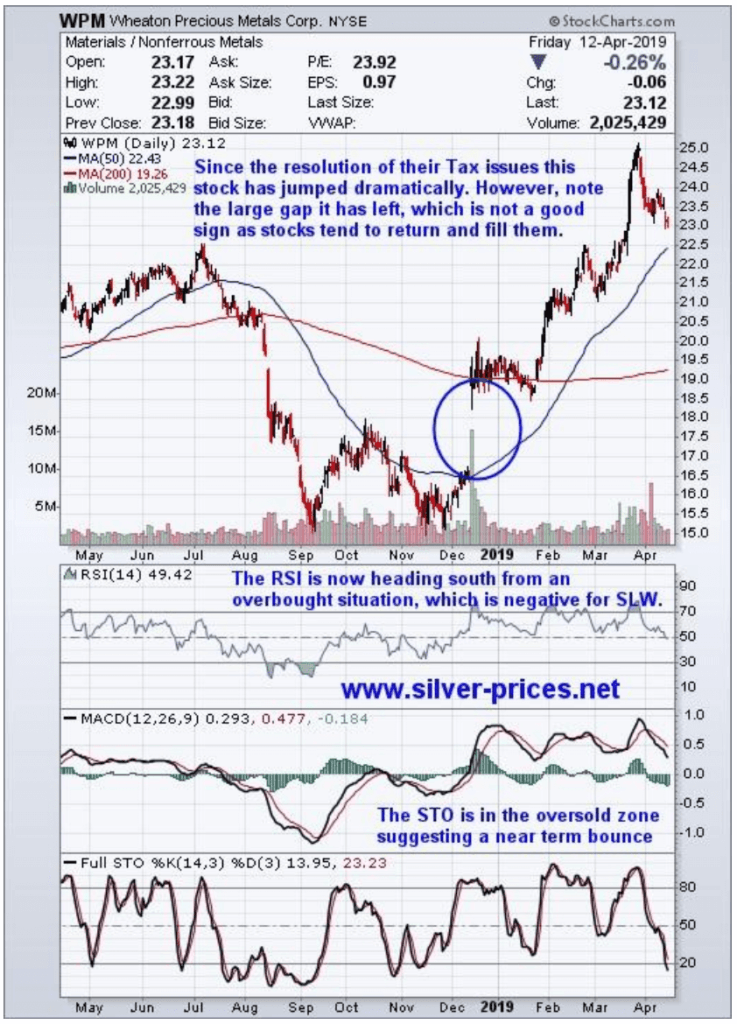

A quick look at the chart for WPM

Following the resolution of their issues with the tax authorities, the stock jumped on heavy volume, leaving a gap from $16.50 to $19.00 in December 2018. Having hit $25.00, some of the

The resolution of the tax issues removes the cloud that this stock was laboring under and deterring investors.

This company is one of the largest precious metals streaming companies in the world and should do very well once both gold and silver rally in earnest.

To acquire the stock now for the longer term should prove to be a profitable trade, however, we will remain patient until a dip presents itself before placing a trade by either going long or via the use of a well thought out options strategy.

(Featured image by corlaffra via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Markets7 days ago

Markets7 days agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

-

Markets2 weeks ago

Markets2 weeks agoCotton Market Weakens Amid Demand Concerns and Bearish Trends

-

Business4 days ago

Business4 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]

-

Fintech2 weeks ago

Fintech2 weeks agoFintech Alliances and AI Expand Small-Business Lending Worldwide