Featured

Why New York Raw Sugar and London White Sugar Trends Are Down

New York was lower again last week on ideas of bigger supplies. London also closed lower as White Sugar supplies and production are expected to increase after being short recently. New York Raw Sugar and London White Sugar trends are down on the daily charts as India is reported to have a big crop of Sugarcane coming

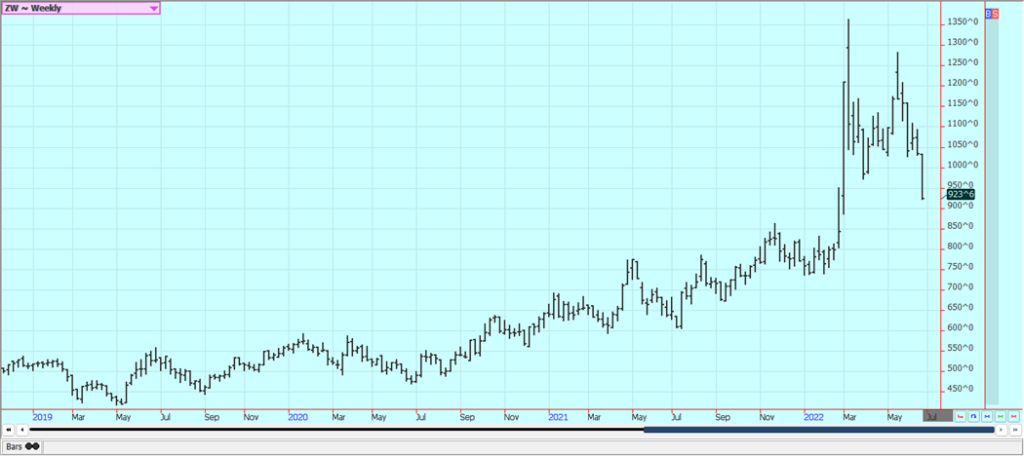

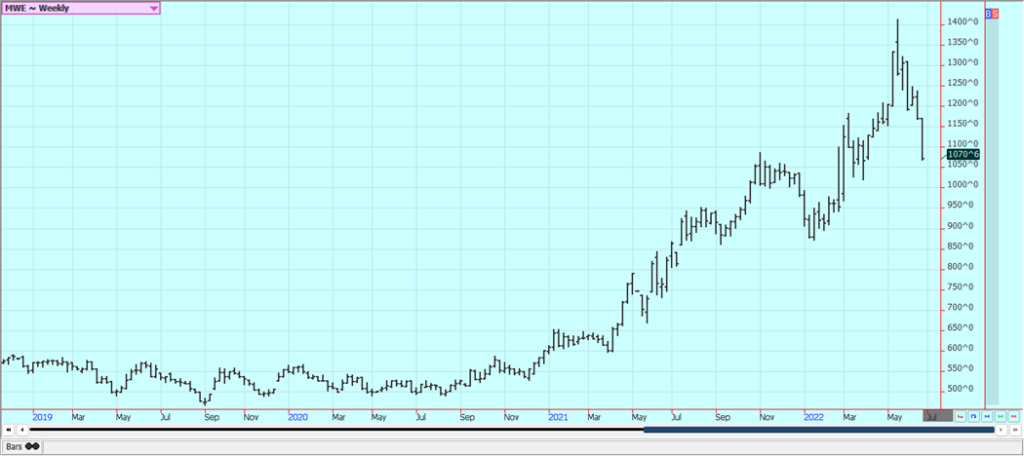

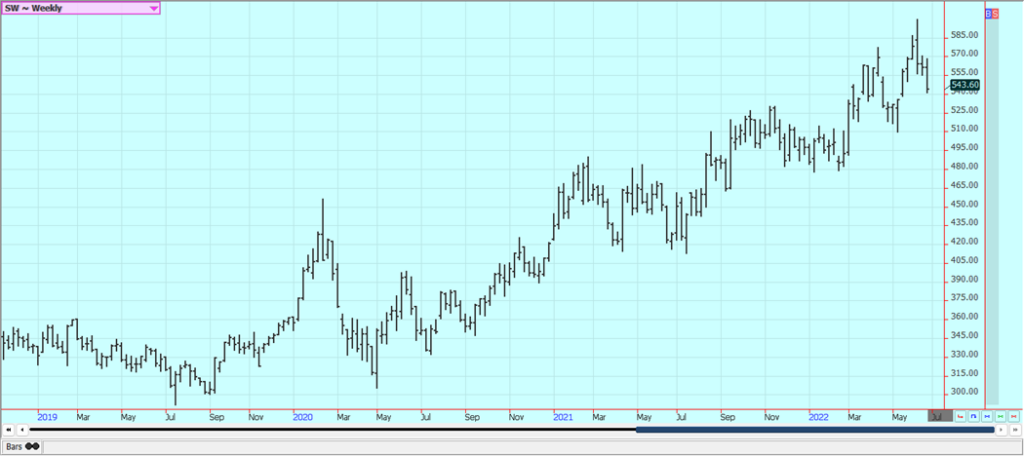

Wheat: Wheat markets were lower last week as the Winter Wheat harvest is expanding through the Great Plains and Midwest. Trends are down in all three markets. What prices were lower as more reports surfaced that Russia had bombed the export terminals of Binge and Viterra in Ukraine. This news might not lead to more demand for US Wheat and weaker world cash prices took futures down. Futures should form a harvest low earlier in the harvest due to the small crop size. Yield reports have been weakening in Kansas despite recent rains that have helped kernel size and test weight. The US western Great Plains got some rainfall and the rains fell in some of the areas most in need of some precipitation. Hot and dry weather is back for this week to southern areas while northern areas have more moderate weather. It is turning warmer and drier farther north to give hope to Spring Wheat farmers that they can plant crops. Europe is too hot and dry and India and Pakistan are both past major heat waves and dry conditions.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

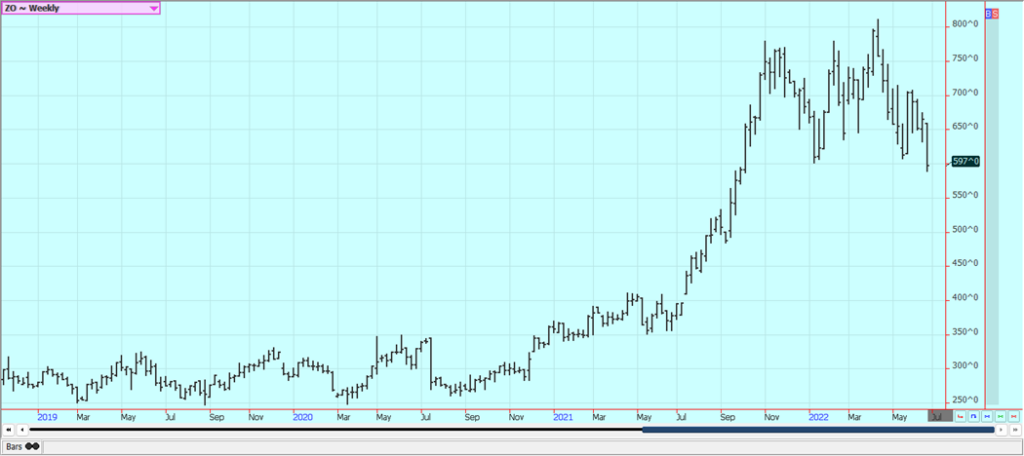

Corn: Corn closed lower for the week on outlooks for less hot and still dry weather for the current week and on-demand concerns. Corn has emerged under what is considered good conditions but it has been hot in the Midwest. More moderate temperatures are forecast for the rest of the week and the weekend. This will be good for a while but continued hot and dry weather could hurt yields down the road. Stress could start to de4velop next week if the hot and dry weather returns as forecast. The weather was variable last week with periods of rain and cool temperatures and then warm and dry conditions and hot and dry weather is expected early this week before the temperatures moderate. Many think the top end of the yield has been taken off the Corn crop due to the delayed planting but others look at the crop condition rating and expect improved yields. It already thinks there is reduced planted area because of the March planning intentions reports from USDA and the bad planting weather.

Weekly Corn Futures

Weekly Oats Futures

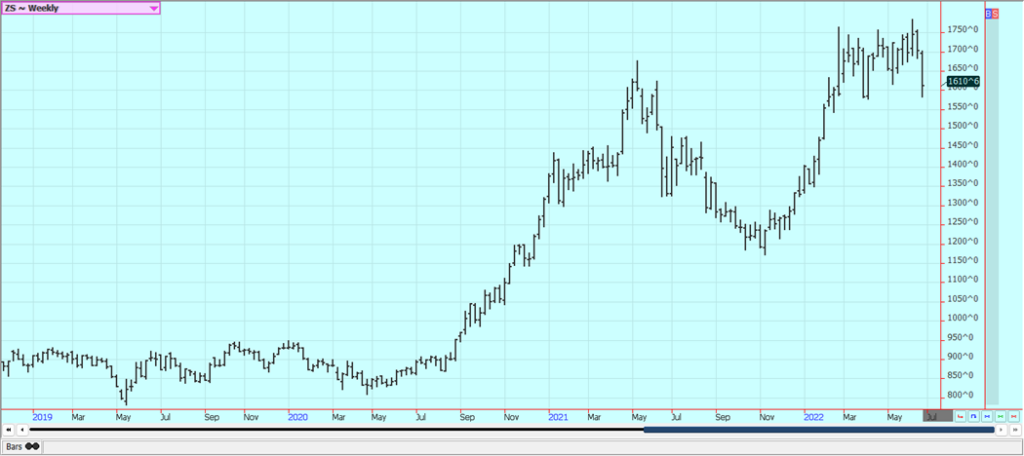

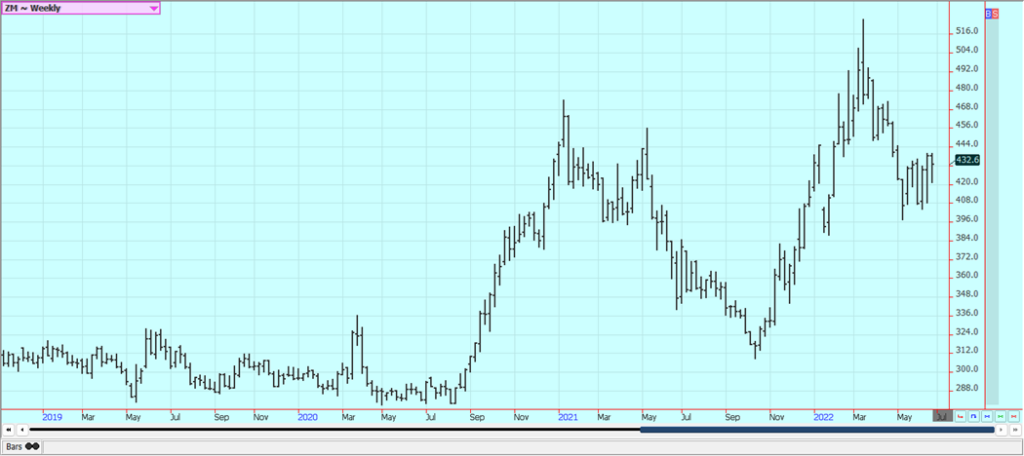

Soybeans and Soybean Meal: Soybeans and Soybean Oil were sharply lower as warm and dry weather invades the US and as demand concerns hurt for both markets. Soybean Meal was a little lower in range trading last week. The heat is passing now and it will be less hot but still dry for the rest of the week and the weekend. US cash market is still running low on Soybeans but there are still renewed Chinese lockdowns. There is less Chinese demand for Soy products due to the lockdowns there and China is starting to renew the lockdowns now as Covid cases have risen in number. China has been a major buyer of US Soybeans this year after a very slow start due to the problems in South America. They are buying for this year and already have booked a large amount of new crop Soybeans to cover future needs. Most of the current buying is for next year.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was lower last week but held within the weekly range for much of the week. The speculators have been the best sellers lately even with perceived bullish fundamental news. Ideas are that the good export sales reported last week were just a bump and reports indicate that domestic demand is a little soft, too. Growing conditions are said to be deteriorating due to hot and dry weather in Texas expanding to include Arkansas. There are still ideas of less production of US Rice this year. The emergence remains behind and acreage estimates are still down for the next crop. Some traders note that it will be difficult to move Rice at current price levels and they are worried about domestic and export demand moving forward.

Weekly Chicago Rice Futures

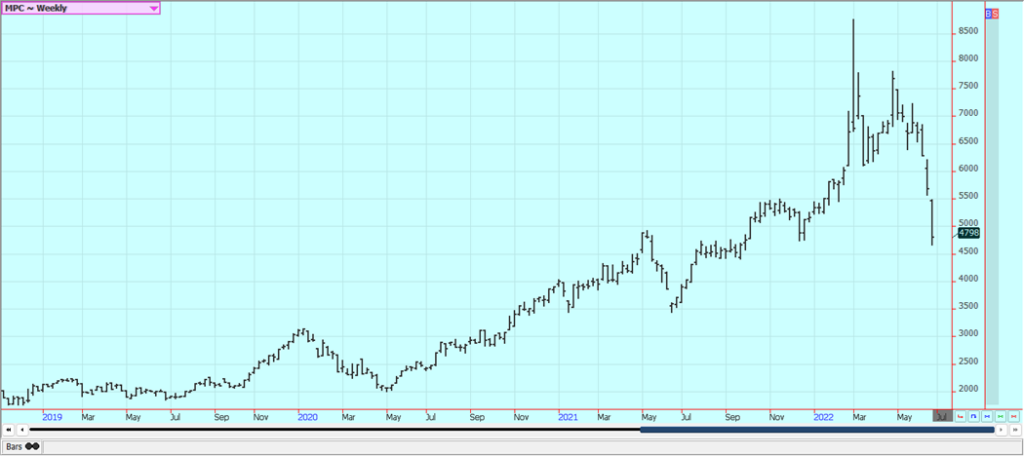

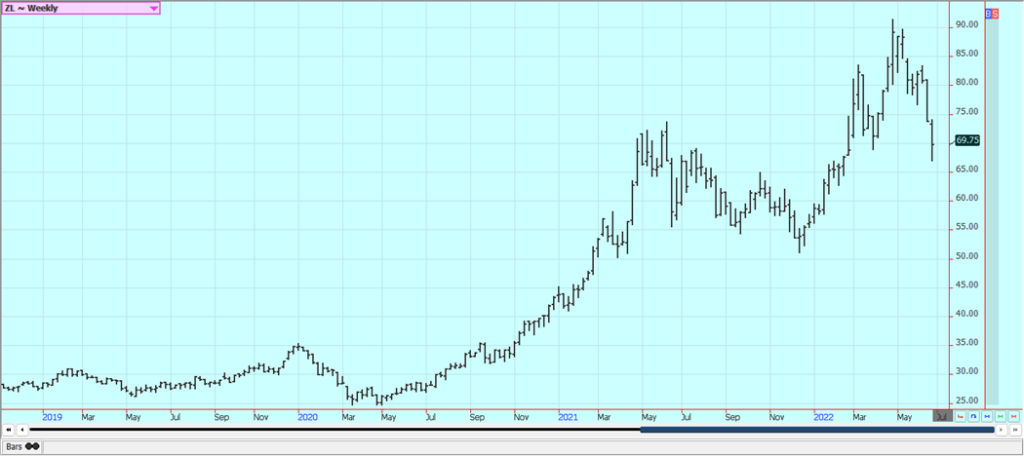

Palm Oil and Vegetable Oils: Palm Oil closed the week sharply lower although the market did trade sideways in the last half of the week. Export reports from the private sources are showing the weaker demand this month. The Indonesian government is now imposing a revised tax scheme on exporters to increase export sales and is allowing more export permits to be issued. Some analysts think Palm Oil is topping out anyway due to reduced demand ideas. Hopes for better demand from India keep the market supported, but Chinese demand could be less. A new Covid outbreak is reported in China and cities and infrastructure has been shut down, including some airports and water ports. The economy could slow down and affect demand. Production from Malaysia is expected to increase as well as the Covid lockdowns finally go away and as the weather is good for production. Canola was sharply lower last week along with other vegetable oils markets. Ideas of poor demand have hit this market as well as the others. The crops are going in the ground and the growing conditions are much improved. It is reported to be very dry and has been cold for planting but better planting weather is coming now as it is now much warmer. There are ideas of reduced Sunflower export potential from Russia and Ukraine. The market is worried about South American production as well. Canada produced a very short crop of Canola last year so supplies are tight.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was sharply lower last week on demand fears and on ideas of improving weather for the new crop Cotton. There continues to be talk of a big recession here in the US and around the world. Traders worry that the continued Chinese lockdowns will hurt demand for imported Cotton for that country and that a weaker economy in the west will hurt demand from the rest of the world. There are forecasts for hot and dry weather to return this week after some showers in West Texas and the rest of the Great Plains over the last couple of weeks. The crop conditions are better than expected after a very hot and dry period in West Texas and the rest of the western Great Plains. The Indian weather is cooler and wetter and conditions appear good. There were ideas that production potential is slipping further due to the previous hot and dry weather in West Texas and the rest of the western Great Plains. Chinese demand was shown in the weekly export sales report. Chinese demand could become less due to the Covid lockdowns there be trimming imports due to Covid and has closed a number of cities as the Covid spreads through the nation. The cities and ports are shut down again as Covid returns.

Weekly US Cotton Futures

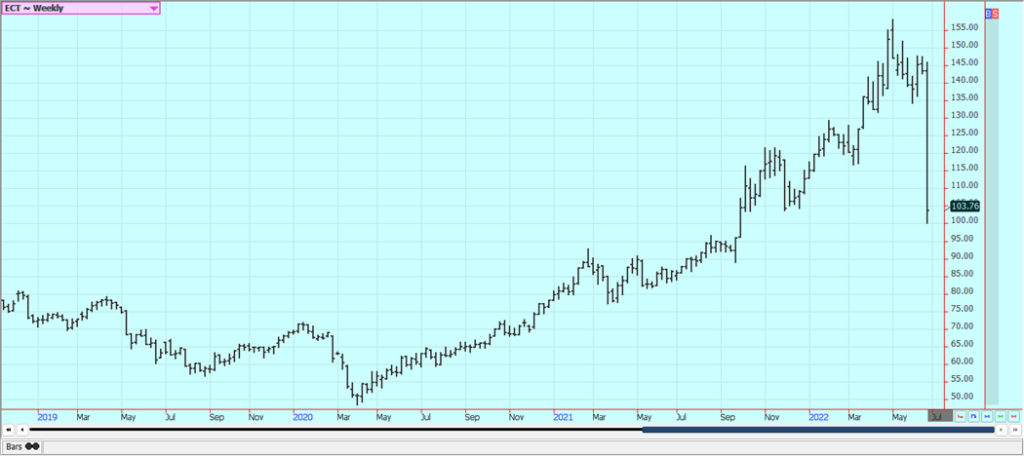

Frozen Concentrated Orange Juice and Citrus: FCOJ was lower last week and trends are down on the charts. The fall has been dramatic since the market made new contract highs earlier this month. The weather remains generally good for production around the world for the next crop. Brazil has some rain and conditions are rated good. Weather conditions in Florida are rated mostly good for the crops with some showers and warm temperatures.

Weekly FCOJ Futures

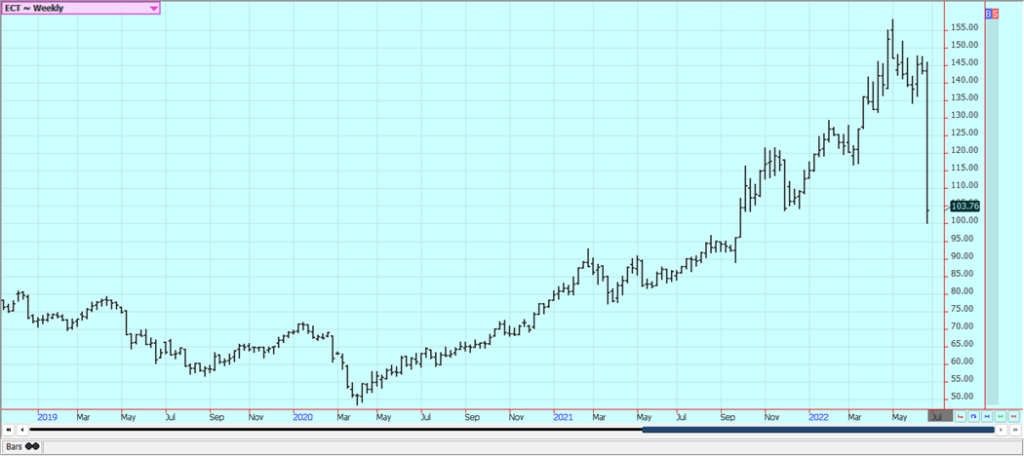

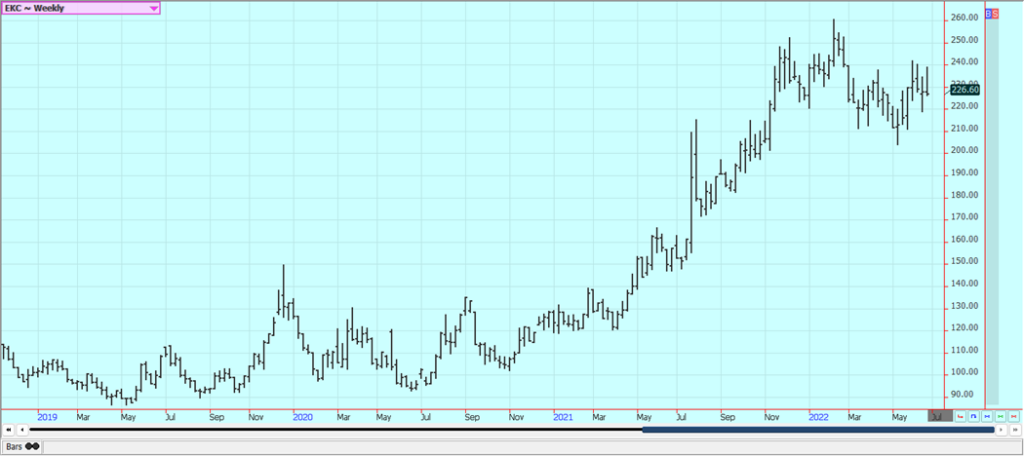

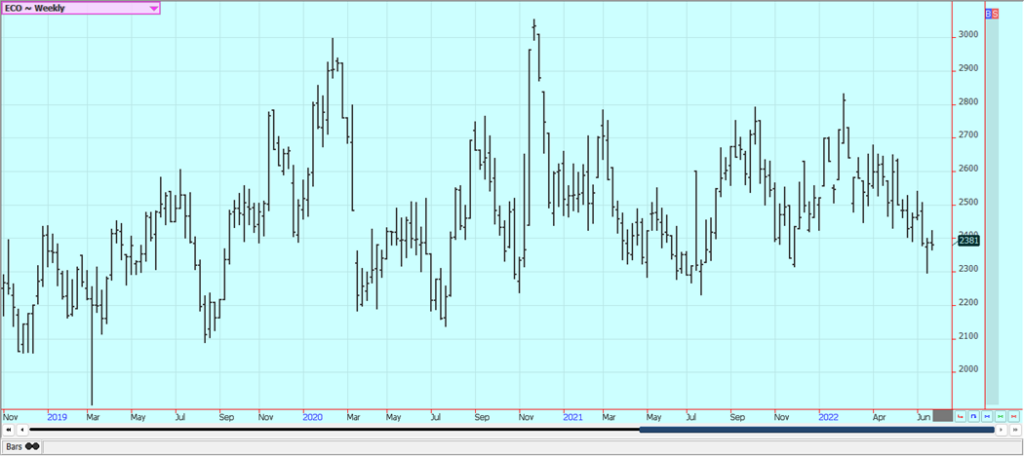

Coffee: New York closed much lower and London closed lower Friday and both markets were lower for the week on what appeared to be fund-related selling that showed up mostly in the second half of the week. There did not appear to be much news to account for the selling. Less demand for Vietnamese Coffee was hurting the London price action. Demand for Coffee overall is thought to be less as the world economic situation changes for the worse but the strong cash market means that even less Coffee is on offer. In fact, certified stocks in New York are becoming low. There is less Coffee on offer from origin, with Brazil offering less and Central America offering less as well. Temperatures are near to above normal in Brazil and there are no forecasts for frosts or freezes in the short term but the market fears that a freeze could develop.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

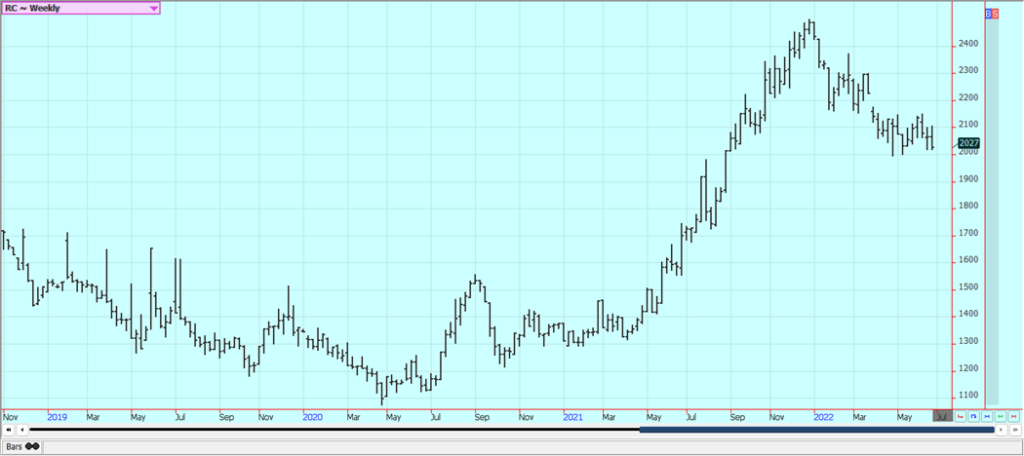

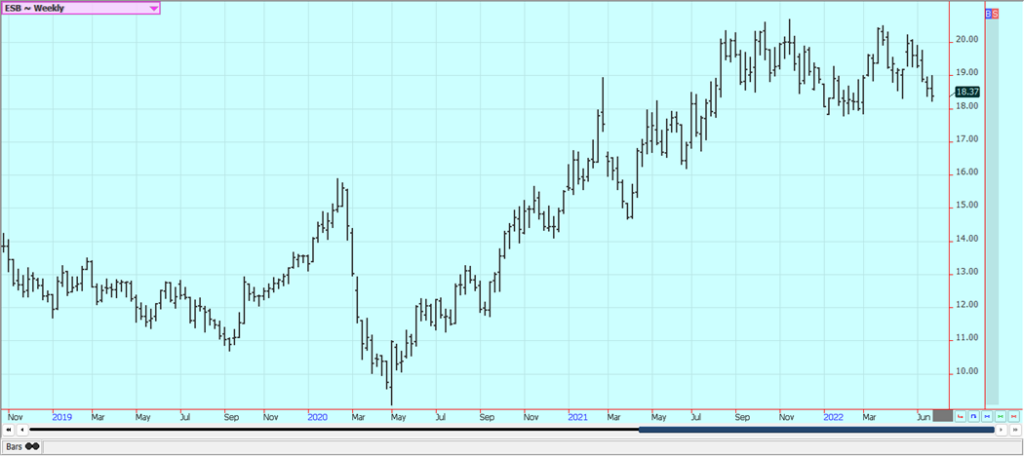

Sugar: New York was lower again last week on ideas of bigger supplies. London also closed lower as White Sugar supplies and production are expected to increase after being short recently. New York Raw Sugar and London White Sugar trends are down on the daily charts as India is reported to have a big crop of Sugarcane coming and as Brazil is harvesting its crop of Sugarcane and turning most of it into Ethanol but some Sugar is making it into export channels. Sugar production from these countries is expected to be surplus or at least in line with demand. Thailand is still offering and exporting. Reports from India indicated that conditions are generally good for Sugar production. The Indian weather service is predicting a normal monsoon season this year.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

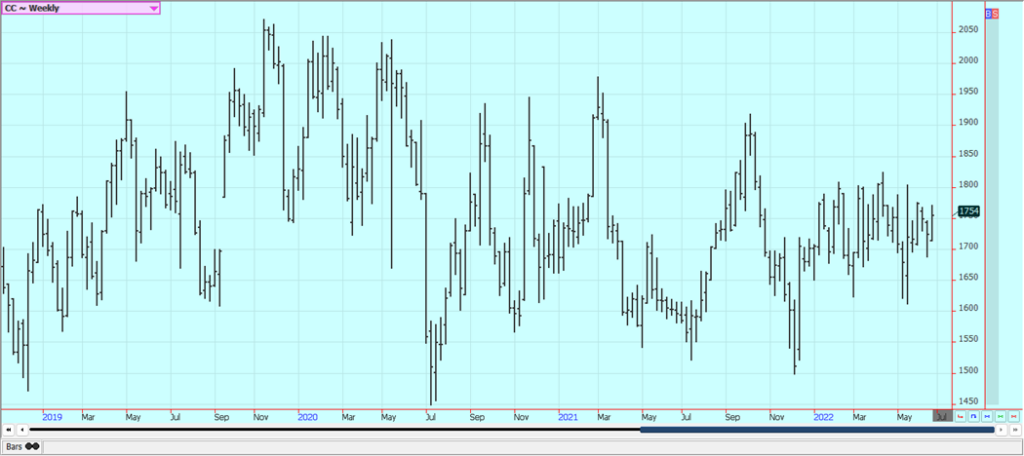

Cocoa: New York and London were higher Friday on what appeared to be speculative buying despite weak demand ideas. The daily chart show that both markets could be forming bull flags formations in sideways trading Both cocoa markets are also showing signs of a bottom on the daily charts. Reports of sun and dry weather along with very good soil moisture keep big production ideas alive in Ivory Coast. Some very good rains were reported last week. Ideas are still that good production is expected from West Africa for the year. The weather is good for harvest activities in West Africa. Current reports from Ivory Coast indicate that the weather is a good mix of sun and rain so a good midcrop production is expected. The weather is good in Southeast Asia.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by WebTechExperts via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Markets3 days ago

Markets3 days agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

-

Markets1 week ago

Markets1 week agoCotton Market Weakens Amid Demand Concerns and Bearish Trends

-

Business1 day ago

Business1 day agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Best Technology Affiliate Programs]

-

Fintech1 week ago

Fintech1 week agoFintech Alliances and AI Expand Small-Business Lending Worldwide