Featured

Why Rice Supplies Are Tight and Demand Is Holding Together

Rice was higher in reaction to the slow progress seen in Rice planting and emergence in the US. The slow progress and wet and cold conditions in Arkansas have many looking for a lower planted area and all planted area is expected to be less, anyway, due to high input costs against the price of Rice. The overall rally is expected to continue and more contract highs are very possible.

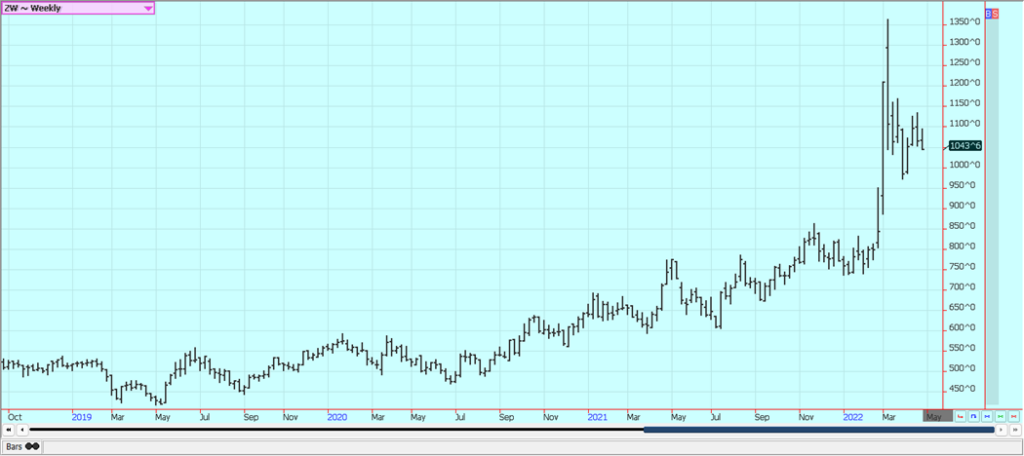

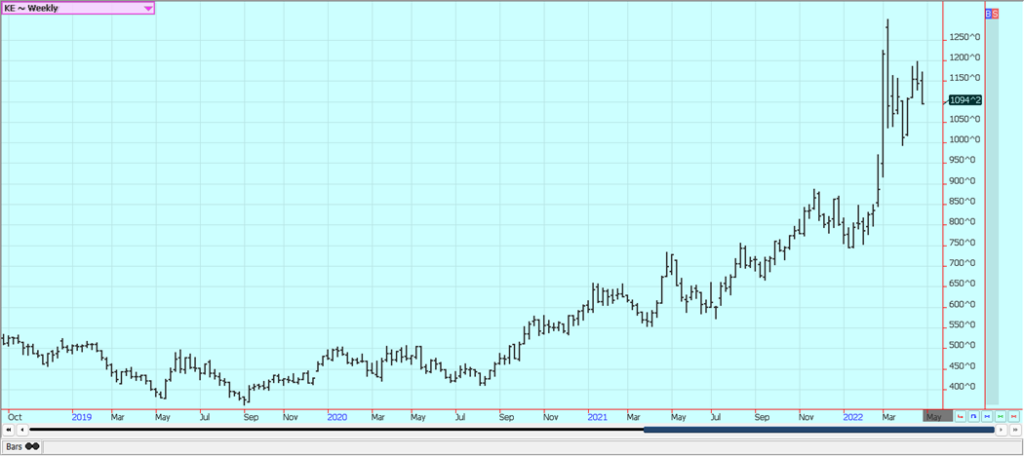

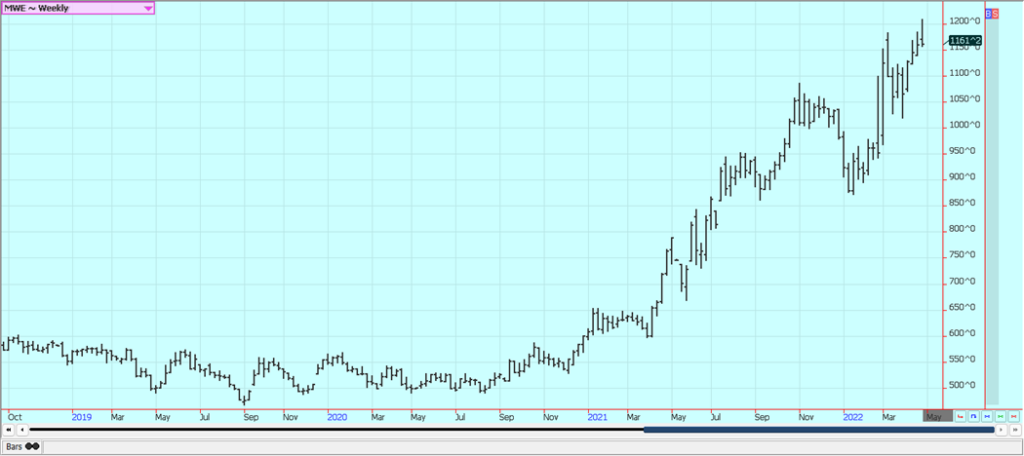

Wheat: Wheat markets were lower, with Winter Wheat markets sharply lower on Friday due to some forecasts for light precipitation in the western Great Plains in the coming week and on reports of more Russian Wheat offers into the world market and Spring Wheat falling in sympathy with the Winter Wheat markets despite bad weather that is still in the forecast for US and Canadian growing areas. Trends are sideways in Chicago SRW and Minneapolis Spring and down in HRW. Russia have been offering into the world market at relatively cheap prices but the Wheat is moving from the Black Sea although a lot of ships are scared to go on those waters. Hard Red Winter Wheat was a little lower on forecasts for some light to moderate precipitation to fall in JHRW growing areas of the western Great Plains this week and more cold weather is forecast for the northern Great Plains and Canadian Prairies. The western US Great Plains remained too dry and crop conditions were very poor and the war continued in Ukraine with little if any ideas of a cease fire mentioned. Ports are closed in Ukraine but Russian shippers and exporters are offering and some sales are being reported at Black Sea ports despite the high insurance costs associated with the boats coming into the sea. Ukraine can rail the exports to the EU for shipment but the amount that can be moved is very limited. Romania is taking the Ukrainian grain and shipping it.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

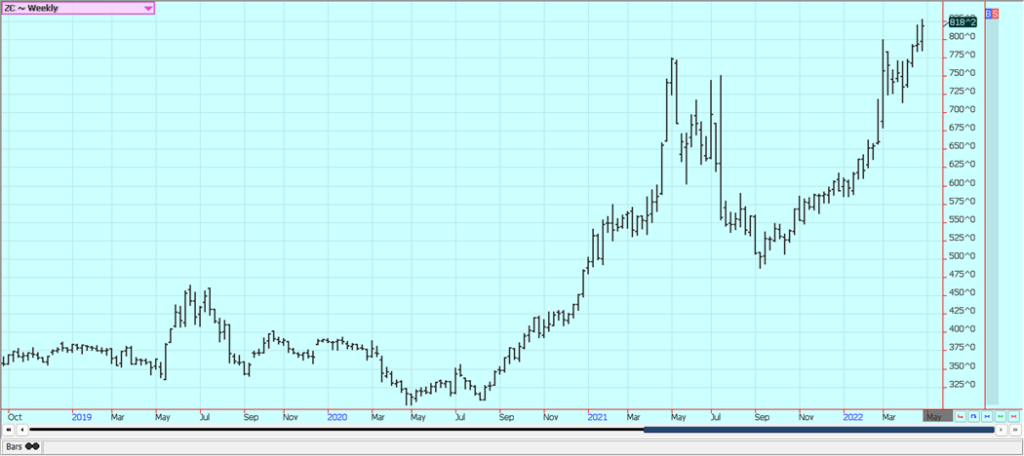

Corn: Corn closed higher last week again in response to cold and wet Midwestern weather and on demand ideas. Oats were lower. The price strength for the nearby months as better demand for American Corn due to the loss of export potential from Ukraine went against the cheaper South American offers. China bought another 1.088 million tons this week and that brings the three week total to about 3.5 million tons. New crop futures spent the day higher on forecasts for cold weather for the US Midwest. More rain should arrive in the Midwest over the weekend and could continue next week. The crop planting progress is slow already and the market will start to worry about yield loss soon. It already thinks there is reduced planted area because of the March planning intentions reports from USDA. The potential loss of Ukraine exports of Corn makes the world situation tighter. The ports remain closed and Ukraine can rail out to the EU in limited amounts. China has a Covid outbreak again and has closed some cities and some ports in response. The moves are harsh but China has a no tolerance policy about the pandemic. The closings of cities and ports will hurt the economy as people can’t make or spend money and hurt imports as there will be fewer places to unload cargoes. However, China has been a very big buyer of US Corn over the last couple of weeks as they need the feed and Ukraine cannot currently offer any supply. President Biden has said he will permit the use of higher ethanol blends in gasoline this Summer in an effort to control inflation and high fuel prices.

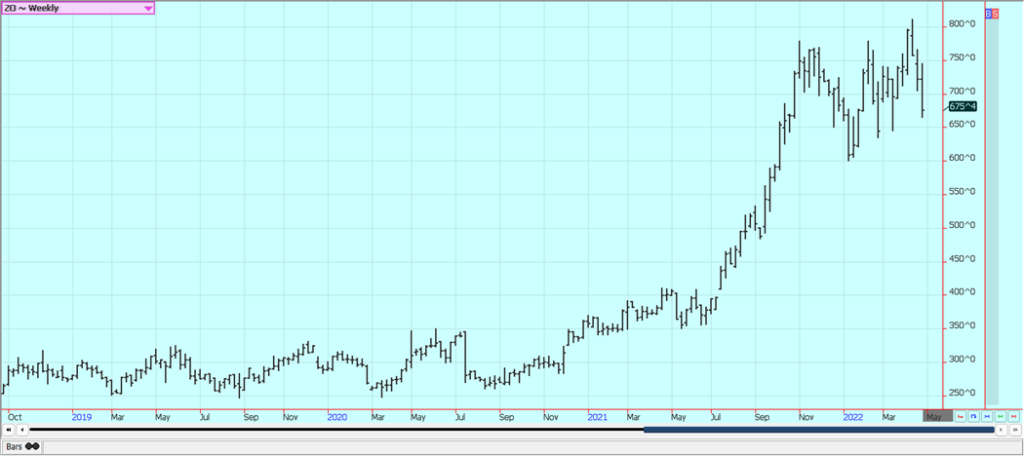

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans were a little lower and Soybean Meal closed lower last week while Soybean Oil closed higher on the reduced production from South America and on increasing concerns in the US about the cold and wet Midwest weather keeping farmers from the fields for planting. The weekly chart trends are sideways for Soybeans, down for Soybean Meal, and up for Soybean Oil. Ideas are that the cold and wet weather now could mean less Corn and more Soybeans get planted. Traders are worried about demand moving forward as the US Dollar is very strong and China is locking down due to Covid. Demand has been strong even with a slower export pace from the US with NOPA showing a higher crush rate. Soybean Oil has been the leader to the upside and was higher yesterday. The market had been told last week that all Palm Oil exports from Indonesia were banned.. President Biden has said he will support expanded use of bio fuels this Summer in an effort to control higher fuel prices. More sanctions are now threatened for Russia due to what the world is seeing in Ukraine right now. There are still worries about Chinese demand because of Covid lockdowns there. China has been a major buyer of US Soybeans this year after a very slow start due to the problems in South America and bought Soybeans again yesterday. They are buying for this year and already have booked a large amount of new crop Soybeans to cover future needs. Most of the current buying is for next year. Ideas are that the Chinese economy could slow down due to the Covid lockdowns there and cause the country to purchase less Soybeans in the world market.

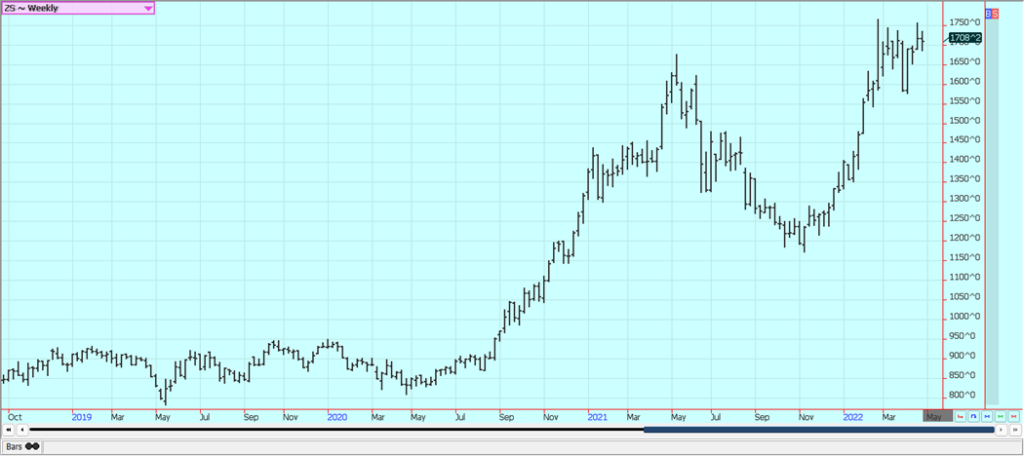

Weekly Chicago Soybeans Futures:

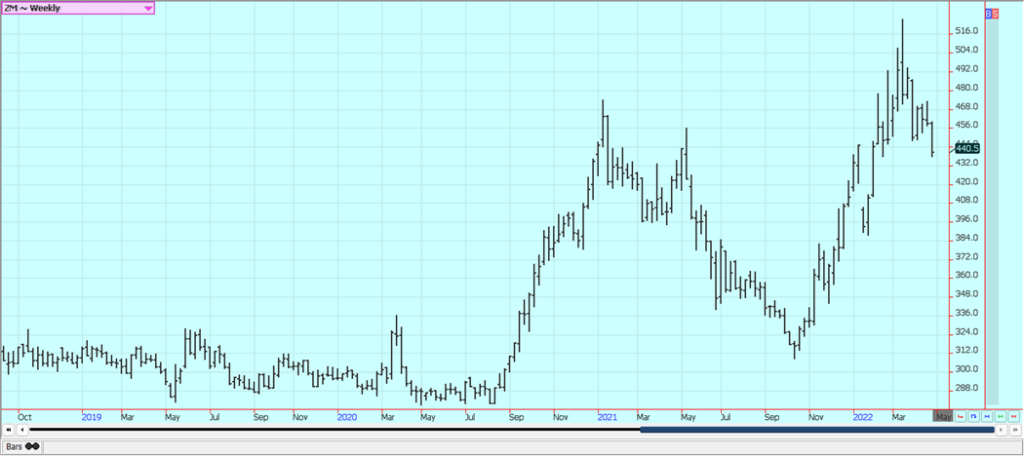

Weekly Chicago Soybean Meal Futures

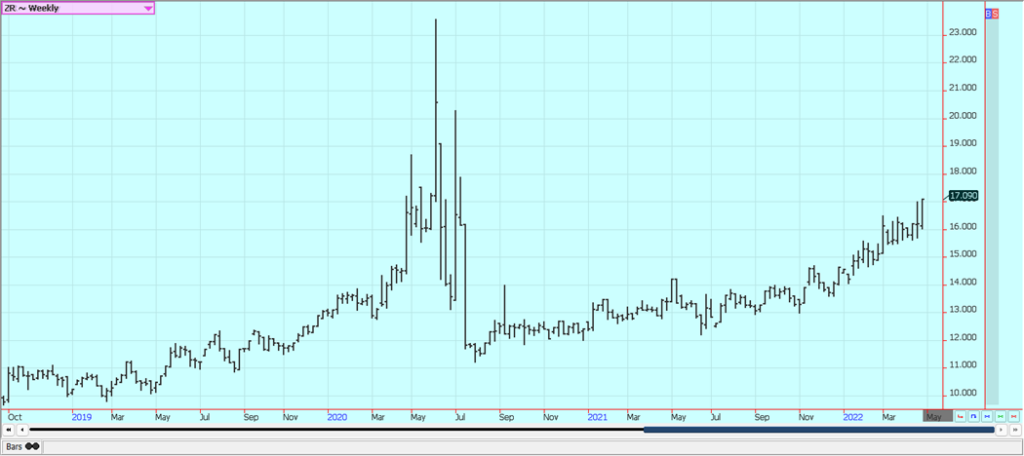

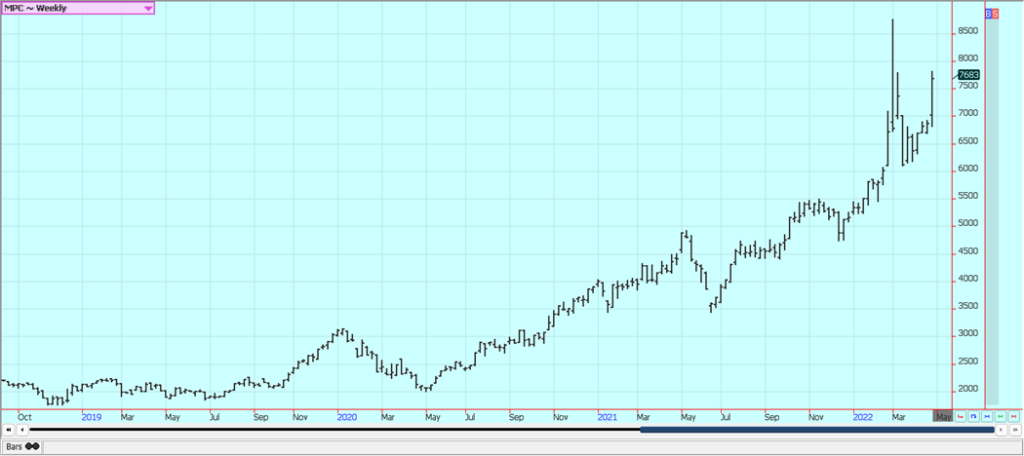

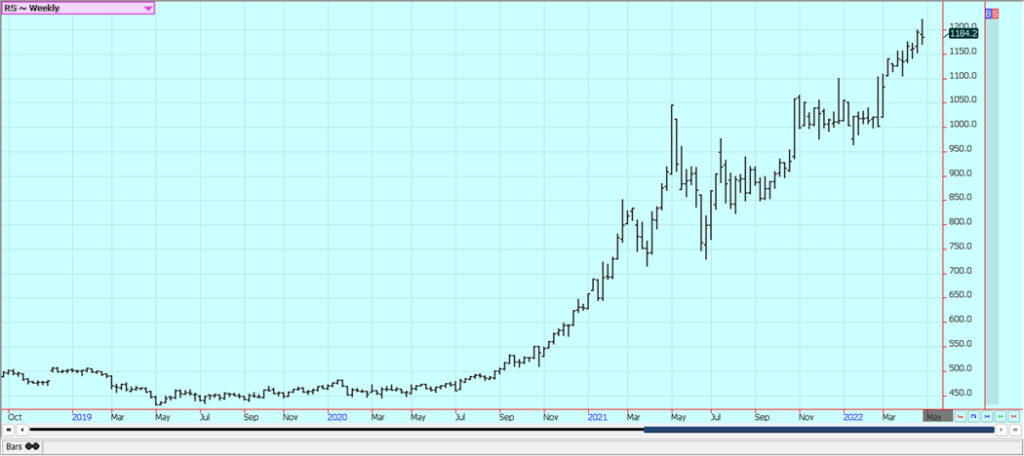

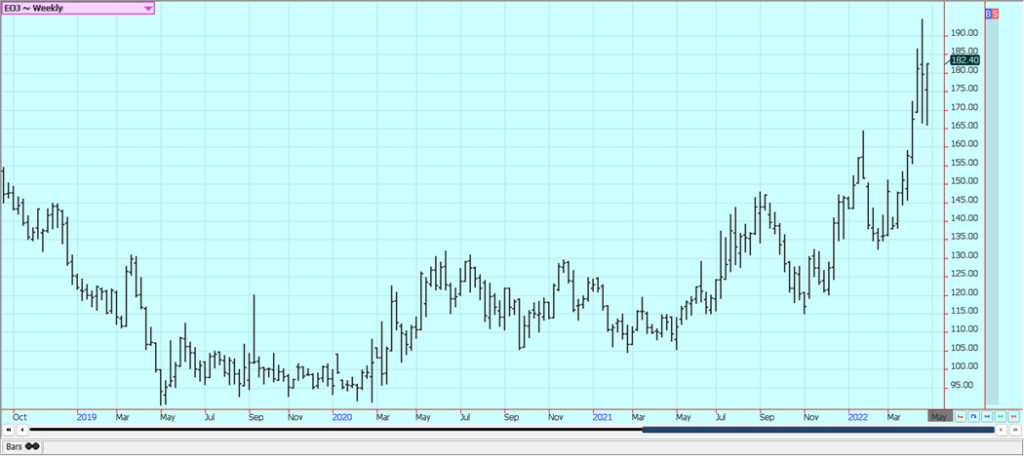

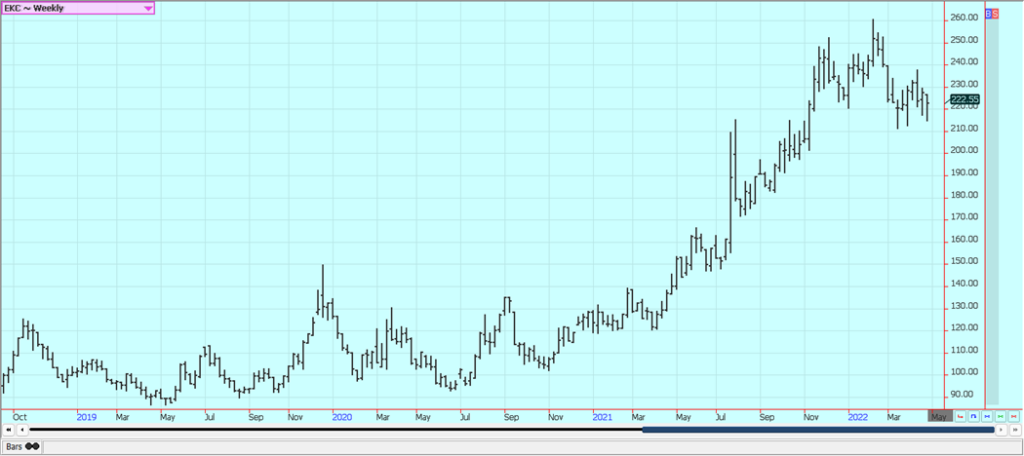

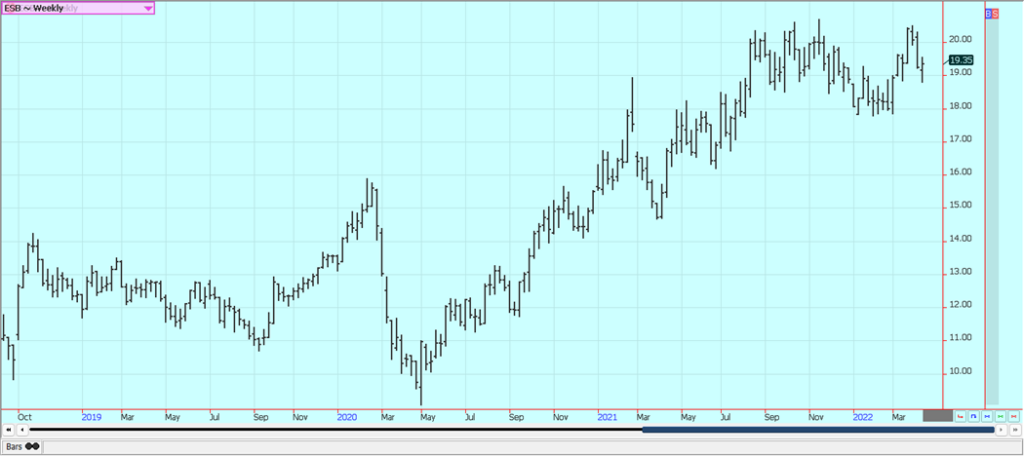

Rice: Rice was higher in reaction to the slow progress seen in Rice planting and emergence in the US. The slow progress and wet and cold conditions in Arkansas have many looking for a lower planted area and all planted area is expected to be less, anyway, due to high input costs against the price of Rice. The overall rally is expected to continue and more contract highs are very possible. It looks like supplies are tight and demand is holding together in this market. The cash market is showing that domestic mill business is around everywhere in light to moderate volumes. Export sales have been weaker in the last few weeks. Producer sales are reported to have been way ahead of average early in the marketing year so stocks on hand in first hands are reported to be lower than normal.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was higher as the Indonesian export ban supported buying interest in Malaysia and also in Chicago Soybean Oil. The Indonesian ban on Palm Oil products imports is now in effect and a ban on Crude Palm Oil exports is coming, according to the Indonesian government. The industry estimates the ban could last through the month of May, but the government has made no such prediction. Hopes for better demand from India keep the market supported. A new Covid outbreak is reported in China and cities and infrastructure has been shut down, including some airports and water ports. The economy could slow down and affect demand. Production from Malaysia is expected to increase as well as the Covid lockdowns finally go away and as the weather is good for production. Canola was higher last week and made new highs for the move. It is reported to be very dry and has been cold for planting. StatsCan said that Canadian farmers intend to reduce planted area for Canola this year and use the area to plant Wheat instead. There are ideas of reduced Sunflower export potential from Russia and Ukraine. The market is worried about South American production as well. Canada produced a very short crop of Canola last year so supplies are tight. Supplies are not likely to improve much with the projections for reduced planted area this week from StatsCan.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was higher in old crop months on Friday and in all months last week despite a stronger US Dollar that continued to hurt overall price action and as speculators worried that inflation and central bank actions to counter inflation could hurt demand. The trade is also worried about Chinese demand due to the Covid lockdowns there. New crop months were lower on Friday as some forecasts for showers were seen in Great Plains growing areas. Support had come from dry weather forecasts for the Great Plains and on news late last week that India has waived import taxes on Cotton until September. India will now try to increase imports as world and US Cotton is now lower cost to importers, but prices for imported Cotton are still very high. Production of the next US crop is at risk now due to dry weather in general for the western Great Plains. There was talk about less demand for the market in part from Fed moves to control the inflation now seen in the US and around the world. Traders are getting worried about a potential recession caused by Fed tightening. China could be imports due to Covid and is also closing down a number of cities as the Covid spreads through the nation. China has been buying even with the port closures and domestic difficulties caused by renewed Covid lockdowns. Traders are worried about Chinese demand moving forward.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ was higher last week on ideas and reports of less supplies and on inflation concerns. First Notice Day for May contracts should be today and some speculators were liquidating May long positions before the end of the week. Inflation and central bank actions to counter inflation have many concerns about how consumers will be affected and what the buying power of consumers might be in the end. The market now knows it is short Oranges and short juice production but is also worried about domestic demand destruction as pills are becoming cheaper again. The greening disease has taken its toll on the US crop and the previous Brazil crop was down significantly due to drought. The weather remains generally good for production around the world for the next crop. Brazil has some rain and conditions are rated good, but it is drier now and some tree stress could develop soon. Weather conditions in Florida are rated mostly good for the crops with some showers and warm temperatures. The Florida Dept of Citrus said that FCOJ stocks are now 30.2% less than last year.

Weekly FCOJ Futures

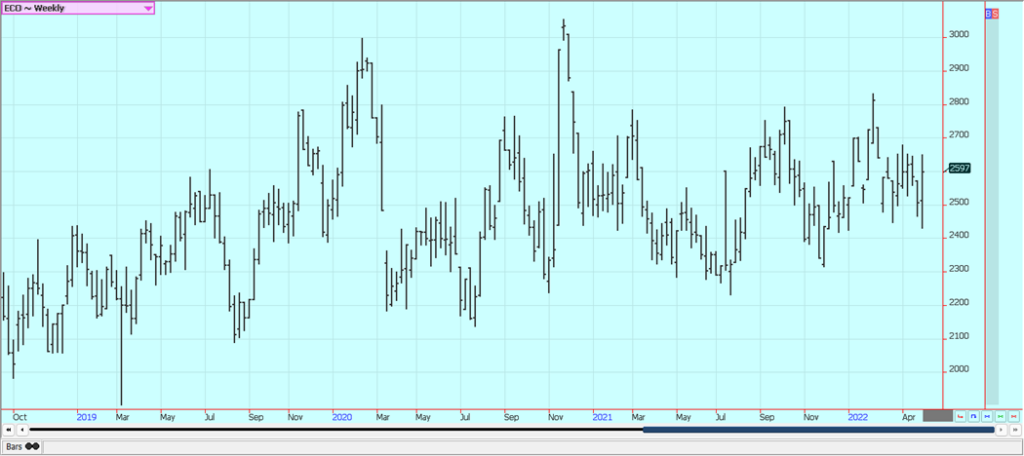

Coffee: New York and London were lower to start last week, then rebounded and entered back into sideways trends. A stronger US Dollar and concerns about inflation continue and what the central banks might do to counter inflationary tendencies are also important. Arabica offers remain down as the Brazilian Real remains very strong, but there are still some Robusta offers hitting London. The US Dollar has also been very strong. Ideas are that demand could get hurt as inflation and central bank actions hurt buying power from consumers. Deliveries from Vietnam and Brazil Robusta are noted to be decreasing as the harvest is now complete. Indonesian offers are increasing due to plentiful stocks inside the country. Arabica deliveries from Brazil are less in part due to less production and in part due to a stronger Real that has cut prices paid to farmers inside the country. Less deliveries are reported from Vietnam now as producers have sold most of the crop and are holding the rest and waiting for higher prices. Good growing conditions for the next crop in Brazil are still around but flowering is reported to be uneven this year in at least some areas.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

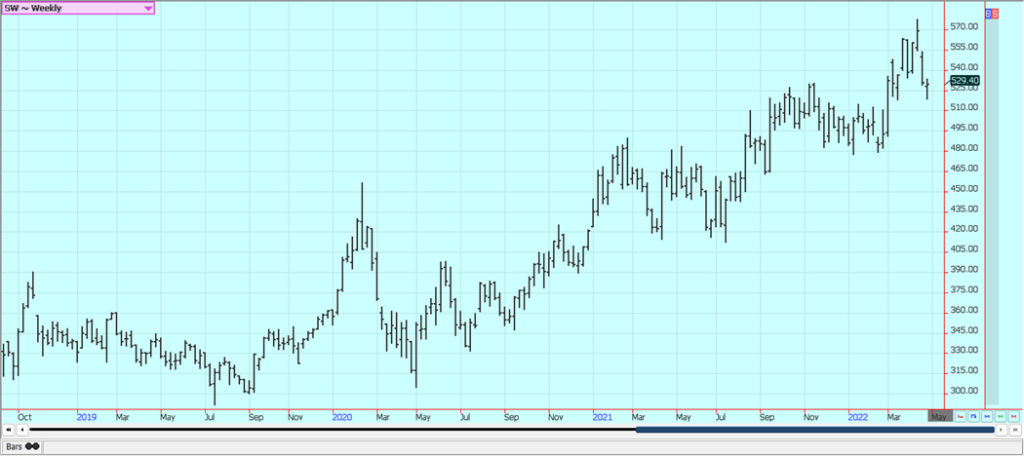

Sugar: New York and London were higher Friday and closed mixed for the week, with New York slightly higher and London slightly lower. Speculators were worried about inflation and what actions the central banks could take to combat it. Ideas are that consumer demand could be hurt, but the market was considered oversold and demand appeared. The US Dollar was strong and has been strong to drive up the price in local currencies of the importers and exporters, but the sell side knows futures have fallen and are holding. Increased offers from India and Thailand are expected if the market continues to rally. Pakistan is also increasing its offers due to good crops there. The US government is permitting refiners to blend 15% ethanol into the fuel mixtures instead of 10% for the coming Summer, but most of the Ethanol will come from Corn. India and Thailand expect improved crops this year. Thailand expects to produce about10 million tons of sugar this year, up 33% from last year. India said it could produce more than 9.0 million tons of Sugar. Brazil could also have better Sugarcane production this year but the strengthening Real implies that most of the refining will be for Ethanol and not Sugar.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

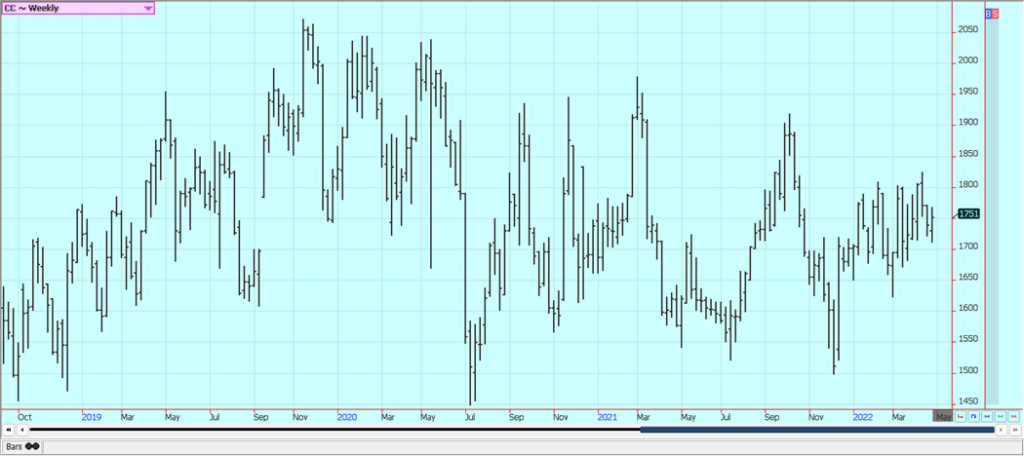

Cocoa: New York and London closed higher last week. The trends are now up on the daily charts and mixed on the weekly charts. The weather is good for harvest activities in West Africa, but some are concerned about dry weather that could affect the yields for the midcrop harvest. Some showers are in the forecast for West Africa and have been for several weeks, but the precipitation was less than normal last week and net drying is reported. The weather is good in Southeast Asia. Ghana arrivals have been below year ago levels, but Ivory Coast arrivals are ahead of last year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Anna Hoch-Kenney via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, sthttps://pixabay.com/photos/laboratory-care-health-medical-2821207/aff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoFidovet, a Small Italian Multinational Pet Food Company Raises Money on Mamacrowd

-

Fintech3 days ago

Fintech3 days agoDruo Processes $50 Million in International Transactions

-

Cannabis1 week ago

Cannabis1 week agoJuicyFields – the Largest Investment Fraud in the Cannabis Industry

-

Fintech24 hours ago

Fintech24 hours agoQonto, Ledger, and Younited Credit, Leading Trio of the French Fintech Ecosystem