Business

Winter wheat futures hit decade low amid dip on US crop prices

Prices of wheat, corn and oats have dipped in the U.S. but things are looking good for sugar, cotton and orange juice.

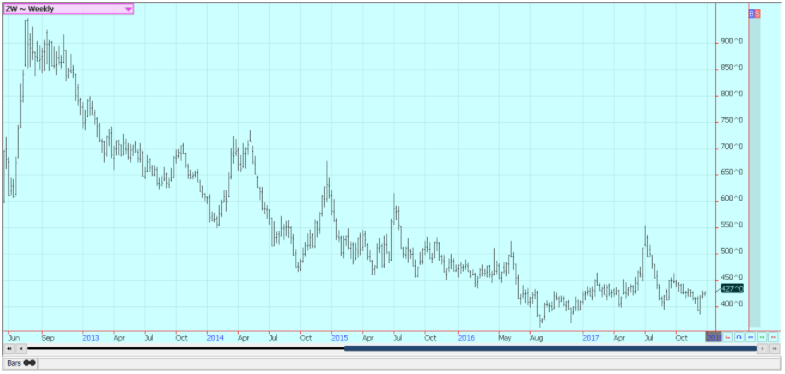

Wheat

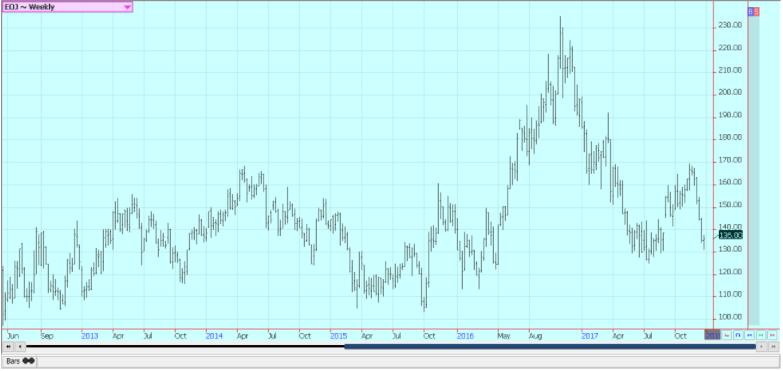

US markets closed slightly higher on the week in all three markets. Support came from reports of potentially damaging cold in winter wheat areas of the US that could cause damage. Ideas are that the funds will soon need to cover at least part of a significant short position, and these ideas have helped support the markets at the current time.

The market is noting dry conditions in western Kansas and other parts of the western Great Plains and the La Nina winter weather forecast. In fact, a drought has developed in the region and could become serious. The crop has not established itself well due to the dry weather. It has turned very cold in most areas of the central US, and winter wheat is vulnerable to winter-kill in the Great Plains from Kansas to the south. Wheat crops in the Midwest are also seeing the extreme cold, but there is less concern heard in the market about crops in this region. Temperatures should remain very cold for the coming week.

The market continues to be worried about Russia and its ability to control the world wheat offer and price. Russia is still exporting a lot of wheat and has said that it expects another very big crop as the weather going into dormancy in winter wheat areas has been very good. World estimates in general remain large and US offers will need to be low to take business. However, the US prices are in fact low and increased demand is possible. The weekly charts show that both winter wheat markets and Minneapolis spring wheat markets remain in sideways trends. Futures in winter wheat are at low prices not seen in the last decade. Minneapolis prices are holding just above important support areas on the weekly charts.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

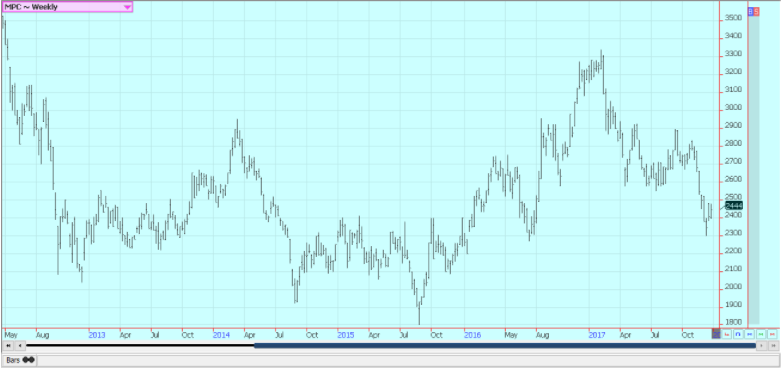

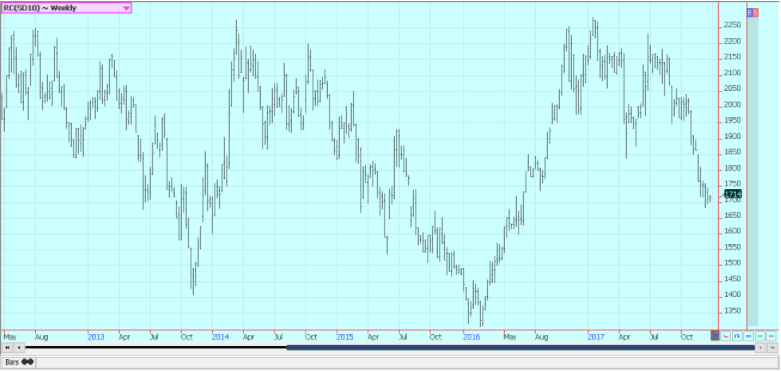

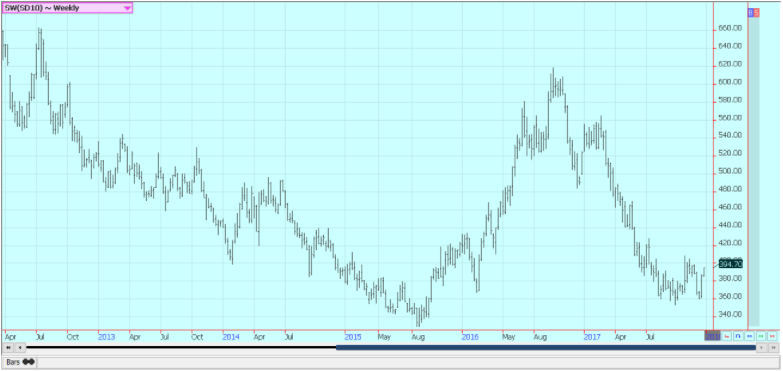

Corn

Corn and oats closed slightly lower in holiday trading last week. Some speculative buying was seen in corn as funds and other large speculators continue to hold record or near record short positions in this market. However, the buying was not as impressive as it could have been as the funds seem to interpret the current fundamental picture as bearish. Demand in the US has been very strong from the ethanol sector and USDA will likely need to increase corn consumption from this sector again this month in the supply and demand updates. It could easily add another 25 million bushels to the demand side of the data.

Questions continue about corn demand from the feed sector, but the animals are out there to feed, and the current cold weather implies that more corn will be needed for good weight gains. The trade is also looking at the dry weather in southern Brazil and Argentina. There were some light rains reported over the weekend, but forecasts for this week are hot and dry again. Ideas of big supplies and less than great demand keep pulling the market down fundamentally, but it has been the funds who have established a huge and near record short position in futures.

Farmers are not selling much corn even in the last part of the harvest due to weak basis and futures price levels. Basis levels have improved, but farmer offers remain down due to the weaker futures prices, although some year-end selling was reported last week. Corn planting is reported to be active in Argentina and southern Brazil. Not much selling is reported in South America. La Nina has started and could continue to create dry weather in South America that could really hurt yields. US prices are cheap now and trends in the market are sideways.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and Soybean Meal

Soybeans and Soybean Meal were mixed, but continued to find support from the continued reports of drought in far southern Brazil and parts of Argentina. Soybeans have been stronger due to fears of potential crop losses in southern Brazil and Argentina, and conditions are expected to be hot and dry again this week after some light showers were reported over the weekend. The other fundamental reason for soybeans to work lower was fears of reduced Chinese demand and ideas of improved planting conditions in Brazil and the big production last year in South America that has had Brazil offering for the entire year.

Brazil has been able to capture more business that otherwise would have gone to the US due to the huge crop last year. However, US soybeans are very well priced right now and demand news over the last couple of weeks has improved in a big way as daily sales announcements are once again being seen. China imported 8.684 million tons of soybeans in November and has now imported 85.990 million tons for the calendar year with one month of data left to go. Brazil accounted for 2.760 million tons and the US accounted for 4.661 million tons. Only 665,000 tons came from Argentina. US prices are good enough and the questions about South American production potential are strong enough that the US is in good position now to keep exports high well into the spring.

Weekly Chicago Soybeans Futures © Jack Scoville

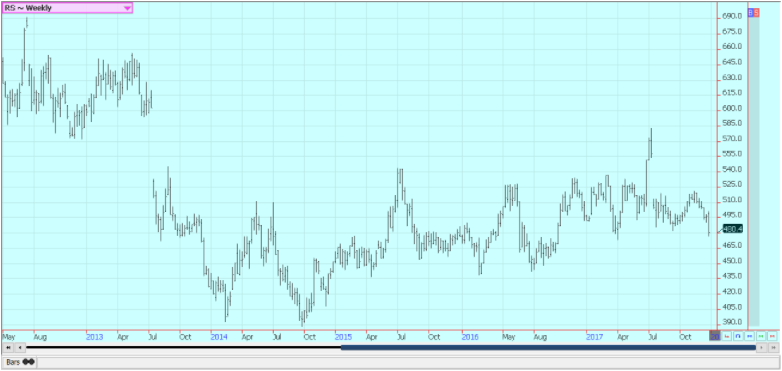

Rice

Rice closed lower for the week again in holiday market trading. It was a very good week for export sales in the US, with over 100,000 tons sold for the first time in about a month. The sales were primarily to Asia, but small amounts were also sold into Latin America. China imported 310,000 tons of rice in November, with about 187,000 coming from Vietnam and 75,000 from Thailand. Pakistan sold 29,000 tons. China has now imported 3.567 million tons of Rice in the calendar year with one month of data yet to be released. Imports are 15% higher than a year ago.

Of note was a small import of rice from the US. The small amount would seem to indicate that someone is testing US rice quality to see if it can be imported and sold commercially inside China. China could import a lot of US rice down the road, and it looks like another baby step has been taken in that direction. Seasonal considerations imply that January should give the market somewhat weaker prices, but futures already fell a lot in December. US supplies are short enough and US demand is good enough to imply that any down side price action should be limited and that further rallies are possible for the first half of this year if not longer.

Weekly Chicago Rice Futures © Jack Scoville

Palm Oil and Vegetable Oils

World vegetable oils prices were lower again last week, and trends in all three futures markets remain down. The export demand for palm oil has recovered this month and has been higher when compared to last month. That was great news for some markets that needed some bullish news. The increased demand came despite the Indian import tariff increase in the last few weeks. India is the largest importer of vegetable oils in the world and buys a lot of palm oil and soybean oil.

Private sources reported weaker exports from Malaysia for November, and demand so far in December has not improved. However, China released strong economic data last week, and there are hopes that demand from that country can improve. Canola trends are down due to some farm selling and weakness in Chicago and Malaysia. It has turned cold in the Prairies and the harvest is over, so farmers are not as willing to sell. However, deliveries to elevators have been strong due in part to forward selling earlier in the year.

Farmers in the US are not selling a lot of Soybeans, either, and prices are trying to turn higher. US demand for soybean oil in bio fuels should remain strong as the US moved to put punitive tariffs on imports from Indonesia and Argentina. China imported 546,908 tons of palm oil in November, with 375,185 tons coming from Indonesia and 171,615 tons coming from Malaysia. It imported just 16,000 tons of soybean oil, mostly from Russia and Ukraine.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Cotton was higher again last week and nearby months made new contract highs in response to another week of good export sales and on ideas that overall demand has been underestimated. The export sales were down from previous weeks, but still good overall given that it is the holiday period and as prices have already moved significantly higher. The cotton quality has been dropping as the harvest moves forward, and the lower quality seems to be the biggest effects from the hurricanes seen during the growing season and then the freeze in the west at the tail end of the growing season.

Some traders say that USDA is seriously underestimating demand for the fiber, while the others look to the high USDA ending stocks estimates and suggest that any demand can be easily met. The demand bulls are winning the battle of ideas and price right now. Farmers are reported to be quiet sellers right now. Harvest conditions are good in just about all areas.

World production seems to be dropping. India announced lower production estimates last week due to some pest problems and uneven rains in some growing areas. Gujarat, in particular, has had its problems, with a dry stretch early and then flooding rains. Now the reports of losses from pests imply that the country will offer less competition for the US in the world market. The US stands in place to do a lot of business this year, so prices overall should stay relatively strong.

Weekly US Cotton Futures © Jack Scoville

Frozen Concentrated Orange Juice and Citrus

FCOJ closed higher on Friday and a little higher for the week. The market has now given back the gains it had in reaction to the damage caused by Hurricane Irma and is diving further into support established last August. Overall weather conditions are considered good in Florida at this time, with mostly dry and warm conditions. The harvest is progressing well and fruit is being delivered to processors and the fresh fruit packers.

Trees in Florida that are still alive now are showing fruits of good sizes, although many have lost a lot of the fruit. Florida producers are actively harvesting and performing maintenance on land and trees. Processors mostly getting packinghouse eliminations along with field-run fruit. FCOJ processors are also getting imports from Brazil, Mexico, and Europe. Funecitrus, the Brazilian industry association, now estimates oranges production at 385.6 million boxes, up 3% from the previous estimate and up from 245.31 million boxes in the previous year.

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower in New York and in London for the first part of last week. The funds and other speculators continued to sell with the new downtrend seen on the charts in both markets. The selling started to abate last Wednesday, but Little new buying interest was noted. We were in Vietnam for the last week and saw some farms near the city of Da Lat. Trees were full of fruit and the fruit was turning color. Some harvesting was being seen, and mills were open and producing green coffee. It looked like a good crop was coming in this area from our farm visits.

The country is looking to replant trees as has been done in parts of Latin America and knows it must improve quality to get better prices. This effort looks to be the focus of the government and industry for the next few years. Internal prices in Vietnam remain at high levels compared to London. The situation seems little changed in Latin America. Brazil exports are reduced at about 2.8 million bags on what is called reduced inventories held by exporters and producers.

Many are concerned about the potential for reduced Brazil production due to earlier drought and the cold and dry winter, although some exporters suggest that the loss potential has been greatly overestimated. There is plenty of rain in some areas now There are also reports of short crops in parts of Central America and some areas in South America due to the lack of farmer investment from the low prices.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures were higher last week and New York futures are not close to important resistance areas on the daily and weekly charts. Price action has been strong due to the strong demand for ethanol that has diverted some Brazil mill production away from sugar. Mills in Brazil have decided to make more ethanol as world crude oil and products prices have been very strong.

Ideas are that these prices can continue strong as OPEC and Russia have agreed to keep production constrained compared to world demand. There are also ideas that index funds will add significantly to long positions in the rebalancing operations later this month. The rebalancing could cause significant new buying for the market.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

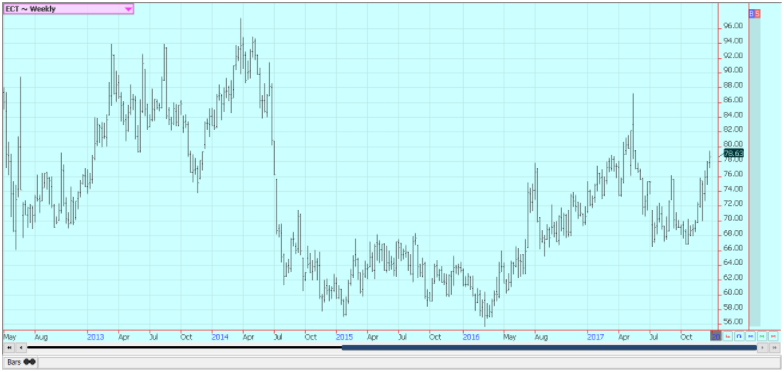

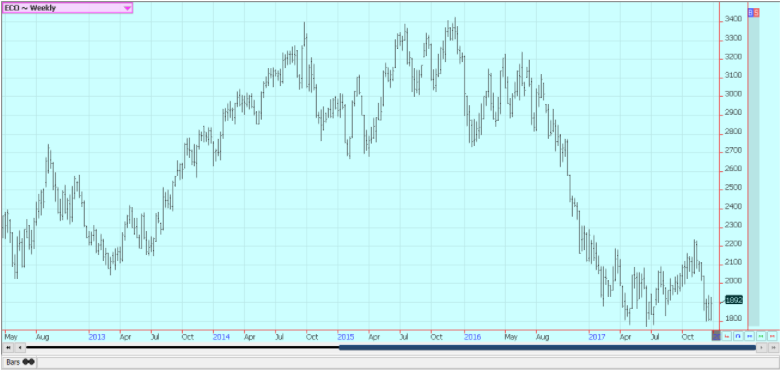

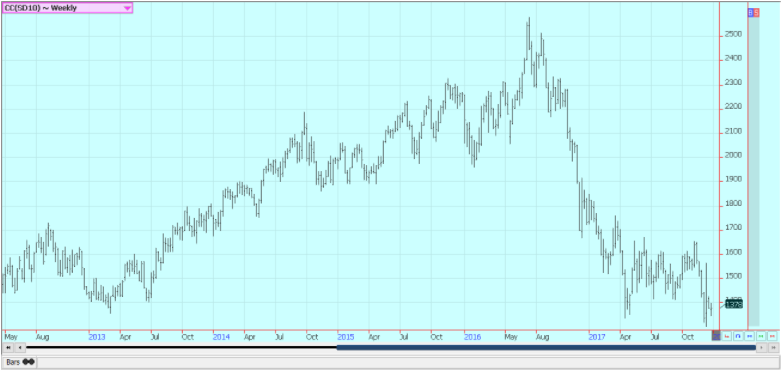

Cocoa

Futures closed lower and finished the year on a weak note. Trends are sideways down in New York and have turned down in London for the short term. Weekly charts show that New York might be forming a bottom. Arrivals have been good in West Africa and are reported to be good in Southeast Asia so far this season. However, arrivals in West Africa have been behind year-ago levels when they were expected to be above year-ago levels.

Prices are weak overall due to the ongoing harvest but have found some good buying interest at current levels as some are now viewing the market as cheap. Current prices in New York are as low as they have been for at least five years. World supply ideas remain high. Harvest reports show good production will be seen this year in West Africa. The growing conditions in other parts of the world are generally good. East Africa is getting better rains now. Good conditions are still seen in Southeast Asia and harvest should be strong now amid mostly dry weather.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

(Featured image via DepositPhotos)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Markets2 weeks ago

Markets2 weeks agoSilver Dips Sharply, While Gold Gains Amid Mixed Stock Market

-

Africa5 days ago

Africa5 days agoMorocco’s Tax Reforms Show Tangible Results

-

Africa2 weeks ago

Africa2 weeks agoTunisia Holds Interest Rate as Inflation Eases, Debate Grows

-

Fintech7 days ago

Fintech7 days agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

You must be logged in to post a comment Login