Featured

With demand still low, futures markets have seen better days

Cotton futures were higher for the week with support coming from dry weather in Texas and resistance from weaker demand as seen in the weekly export sales report. The demand for US Cotton in the export market was weaker last week, but has been strong even with the Coronavirus causing disruptions at the retail level around the world

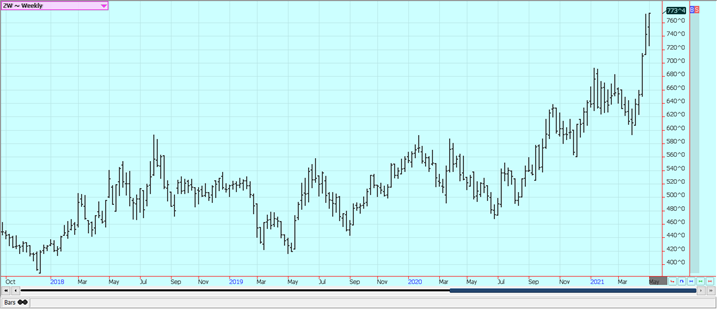

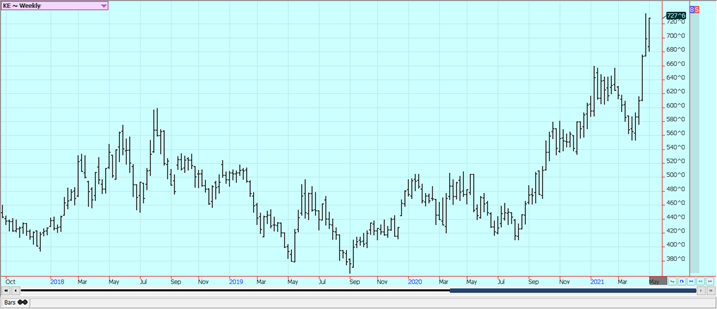

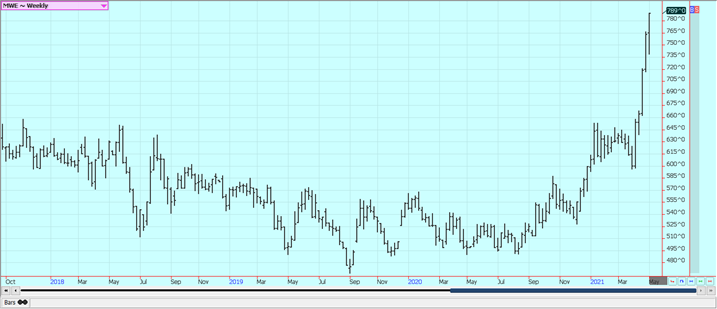

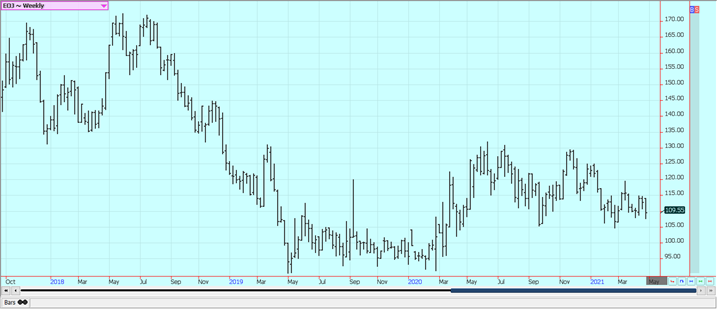

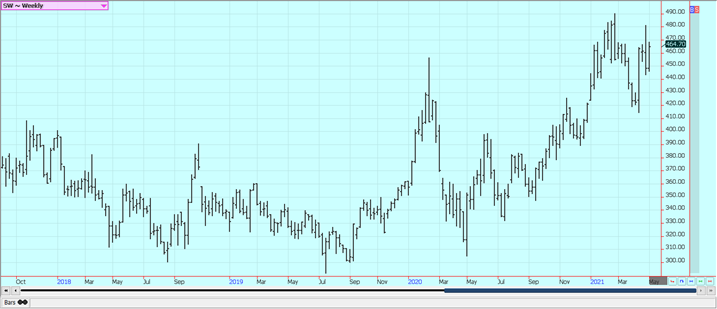

Wheat: Wheat markets were higher. Mostly dry conditions are in the forecast for this week in western Texas. Minneapolis was higher as dry conditions remain in the northern Great Plains and Canadian Prairies. Precipitation is expected in western areas but eastern areas should stay dry. Wheat remains a weather market, but the demand side has been weak. The weather remains too dry and is cool in the northern Great Plains and in the Canadian Prairies and farmers have planted into dry and cold soils. The Great Plains should stay mostly dry or get scattered showers but some big rains are forecast for the southern Midwest over the next few days. Demand remains disappointing but the production might not be there for better demand in the coming year. Corn prices are high so demand for feed wheat could increase.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

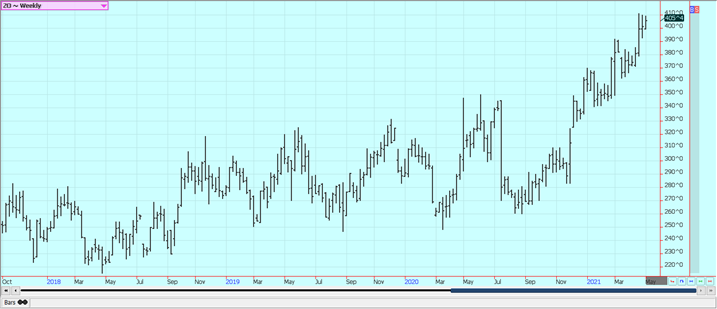

Corn: Corn closed higher as the market demonstrated more concern about the Safrinha crop production in Brazil. The weekly export sales report released last Thursday was called poor. Western sections of the Midwest got crops planted with speed, but eastern areas were slower. Emergence has been slow due to cold temperatures. Temperatures will be cooler this week and there will be precipitation to keep farmers from the fields. Overall planting conditions should be fairly good over the next week. There are also concerns about the production potential for the Safrinha crop in Brazil as growing areas have been warm and dry and look to stay that way longer term. Reports indicate that crops are being stressed due to the lack of rain. It is drier in central and parts of northern Brazil, and farmers have finally harvested the Soybeans area and planted the Winter Corn. The Winter Corn crop progress is well behind normal and it has been dry in major growing areas. There are worries that US Corn is priced out of the world market as US Corn is the highest price of any offering nation, but the lack of product4ion of the second crop in Brazil should mean stronger demand for US Corn. Demand for US Corn has been coming at a stronger pace than estimated by USDA and it looks like US ending stocks can be significantly less than current projections by the end of the year.

Weekly Corn Futures:

Weekly Oats Futures

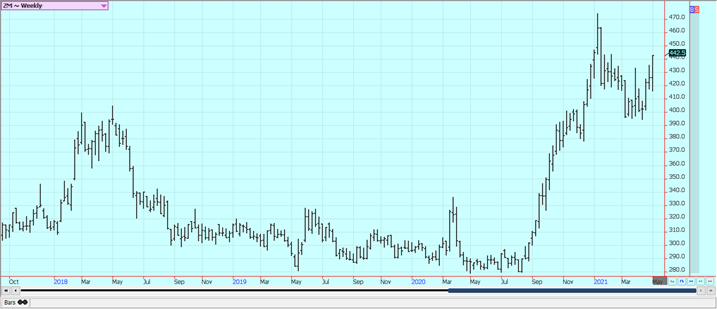

Soybeans and Soybean Meal: Soybeans and Soybean Meal were higher while Soybean Oil lost ground. The rally has been led by demand amid a very tight stocks situation here in the US. The weekly export sales report showed less demand, but still more than the trade expected. There is still crush demand and export demand even though the demand is less now than before and the market thinks the US is going to run out of Soybeans unless demand can be rationed with high prices. Some of that rationing is going on as US prices are much above offers from South America. The US does not have a lot of Soybeans in the country anymore as most producers have already sold. Buyers are scrambling for what is left. Brazil is rapidly exporting Soybeans. Harvest activities are done now.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

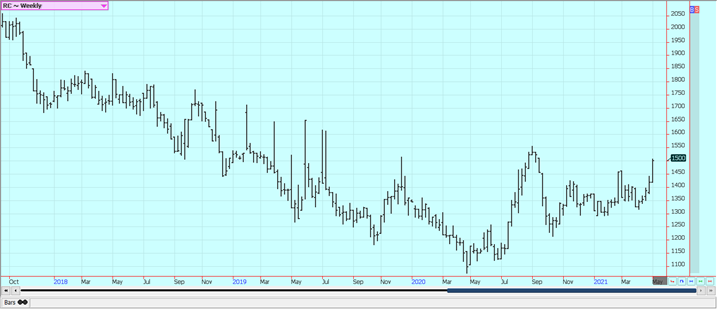

Rice: Rice prices were higher and closed on a strong note. The cash market is working through PL-480 tenders for milled Rice. Texas and Louisiana are almost out of Rice, but there is Rice available in the other states, especially Arkansas. Asian and Mercosur markets were steady to lower last week. New crop months were a little higher but July was the real mover. New crop Rice is almost completely planted in Texas and in Louisiana. Mississippi and Arkansas are actively planting around the rains.

Weekly Chicago Rice Futures

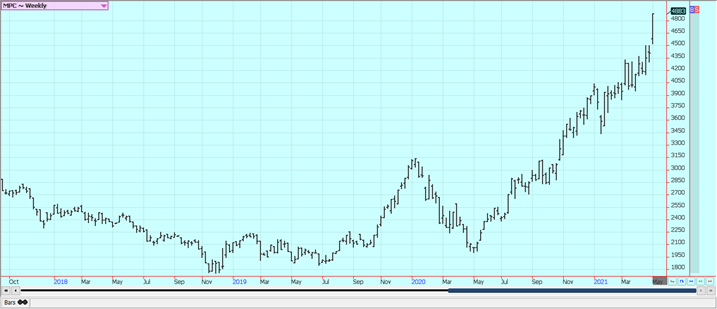

Palm Oil and Vegetable Oils: Palm Oil was higher for the week on good demand and worries about supplies inside Malaysia. Supplies in Indonesia are likely to increase this year according to the government there. The private sources showed that export demand is running ahead of last month so far this month, but the market fears the loss of Indian demand due to the big Coronavirus outbreak there. Ideas of tight supplies are still around but MPOB did show higher than expected ending stocks in its March data. Canola was higher on ideas of tight supplies combined with a drought in the Canadian Prairies. There was some rain and snow in eastern growing areas to improve the situation. Worries about South American production are supporting both markets as is cold and dry weather in the Prairies. Demand is thought to be great with crush margins favoring a lot of production of vegetable oils to feed the demand. The demand for biofuels is about to increase and is one reason to see much stronger Soybean Oil and Canola prices.

Weekly Malaysian Palm Oil Futures:

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

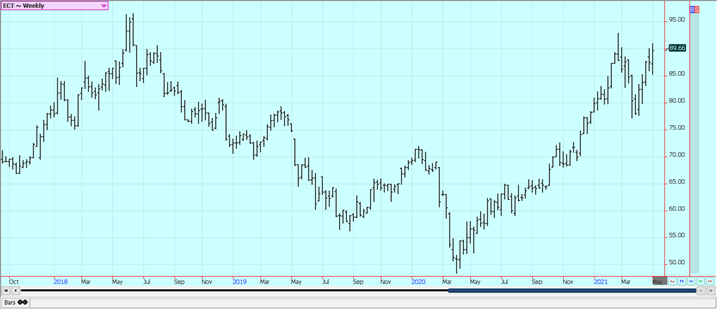

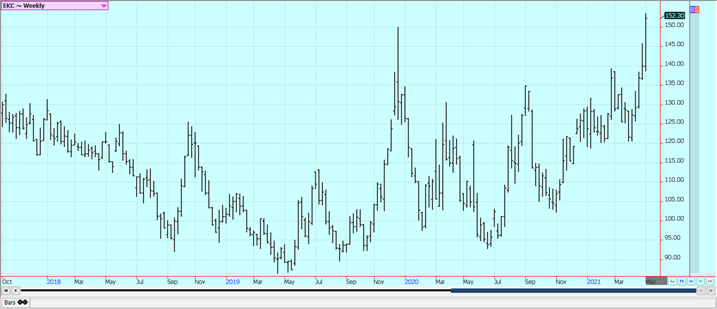

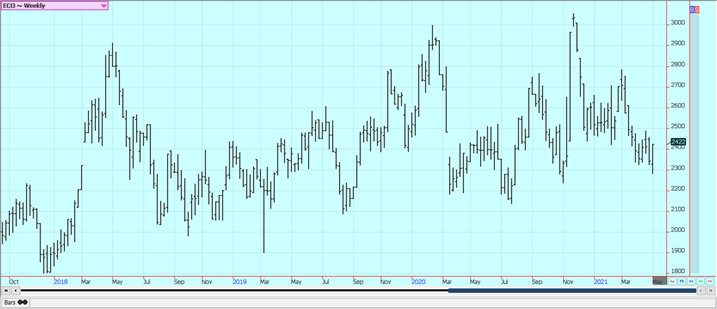

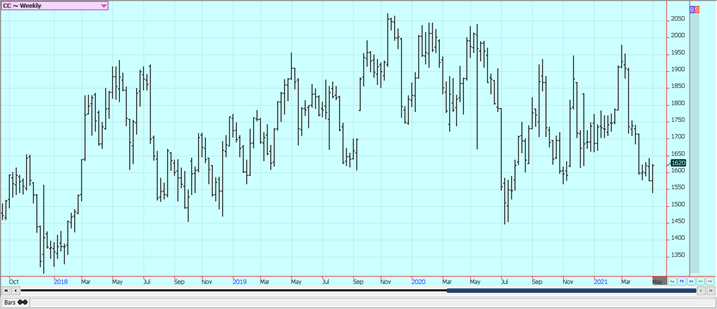

Cotton: Futures were higher for the week with support coming from dry weather in Texas and resistance from weaker demand as seen in the weekly export sales report. The demand for US Cotton in the export market was weaker last week, but has been strong even with the Coronavirus causing disruptions at the retail level around the world. The US stock market has been generally firm to help support ideas of a better economy here and potentially increased demand for Cotton products. It is dry in western and southern Texas. Some showers are reported in western areas to help there, but it is still dry overall.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher after making new lows for the move last week. The price action suggests that prices might have gotten too cheap. The weather in Florida is good with a few showers or dry weather to promote good tree health and fruit formation. The hurricane season is coming and a big storm could threaten trees and fruit. That is still a couple of months away. It is dry in Brazil and crop conditions are called good even with drier than normal soils. Stress to trees could return if the dry weather continues as is in the forecast. Mexican crop conditions in central and southern areas are called good with rains, but earlier dry weather might have hurt production. It is dry in northern and western Mexican growing areas.

Weekly FCOJ Futures

Coffee: New York and London were higher with the current and future Brazil weather in focus. Fears of dry weather impacting Brazil’s production continued. It remains generally dry there and there are no forecasts for any significant rains in Coffee areas. It was dry at the flowering time as well. It is also the off-year in the two-year production cycle. Production conditions elsewhere in Latin America are mixed with good conditions reported in northern South America and improved conditions reported in Central America. Conditions are reported to be generally good in Asia and Africa.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

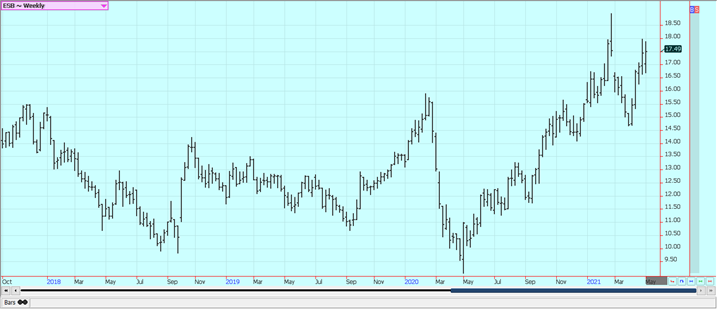

Sugar: New York was higher last week as the drought conditions continued in Brazil. London closed higher in sympathy with New York. Fears of dry Brazilian weather continued. The primary growing region has been dry in Brazil with little or no rain in the forecast. Production has been hurt due to dry weather earlier in the year. The seasonal crush is off to a slow start and Sugar content of the cane is reduced in initial industry reports from the center-south of Brazil. India is exporting Sugar and is reported to have a big cane crop this year. Thailand is expecting improved production after drought-induced yield losses last year. The EU had big production problems last year but is expecting much better production this year.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: New York and London closed higher. The harvests are over in West Africa. Ports in West Africa have been filled with Cocoa. European demand has been slow as the quarterly grind data showed a 3% decrease from a year ago in grindings. This has been caused by less demand created by the pandemic. Asian demand improved. North American data showed improved demand. But, the supplies are there for any increased demand.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

—

(Featured image by Oldiefan via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Fintech2 weeks ago

Fintech2 weeks agoKraken Launches Krak: A Game-Changing Peer-to-Peer Crypto Payment App

-

Crypto2 days ago

Crypto2 days agoThe Crypto Market Rally Signals Possible Breakout Amid Political Support and Cautious Retail Sentiment

-

Impact Investing1 week ago

Impact Investing1 week agoEuropeans Urge Strong Climate Action Amid Rising Awareness and Support

-

Crypto5 days ago

Crypto5 days agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up