Business

TopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [XM Affiliate Program]

This week, we’re gonna talk about money. No, not making money (actually, we will… just later). Instead, we’re gonna talk about money for money’s sake. Why’s that? Because a big affiliate opportunity is incoming, of course. And while we’re at it, we’ll take a quick look at the XM affiliate program. Why? Because it’ll be one of the best ways to monetize the opportunity ($650 CPA commissions).

Normally, we here at TopRanked.io like to talk about making money online.

But as they say, you gotta understand money to make money. So this week we’re just gonna talk about money.

So let’s kick things off with an appropriate affiliate program.

TopRanked.io Affiliate Partner Program of the Week — XM Affiliate Program

Since we’re talking about money this week, we thought it was the perfect time to drop an affiliate program that’s 100% about money.

And yep, that means we’re gonna look at a forex affiliate program. Specifically, the XM affiliate program.

Let’s take a look under the hood.

XM Affiliate Program — What You’re Promoting

If you’re gonna promote with the XM affiliate program, then you’re gonna be promoting a forex trading platform.

Well, technically it’s not just forex. The XM affiliate program will also let you promote oil, CFDs, metals, and a bunch of other instruments. But that’s pretty standard for most Forex platforms, so you probably already guessed that part about the XM affiliate program from the outset.

The XM affiliate program also includes all the other usual stuff that comes with a Forex platform. You know, Metatrader 4 and 5, a solid web platform and, most importantly, tons of leverage for your XM affiliate program referrals to trade with (Up to 30:1).

Basically, if any other forex platform out there has it, the XM affiliate program does to.

The only difference is, the XM affiliate program will probably pay you better for promoting it. So let’s move on to commissions.

XM Affiliate Program — What You’ll Be Earning

Now to the juicy XM affiliate program details — the commissions.

Lucky for me (less to write), the XM affiliate program keeps the program pretty simple. Most affiliates in the XM affiliate program will be working on a CPA basis.

As for what the rates and qualifying criteria are in the XM affiliate program, let’s start with the rates.

They start out at $150 a pop. But that’s only in Latvia. After that, the XM affiliate program CPA rates climb fast and high, all the way up to $650 for top-tier countries.

That’s pretty good if you ask me.

XM Affiliate Program — Here’s What’s Next

So, you’ve made your mind up already and you wanna join the XM affiliate program right now?

Great. Go here to sign up for the XM affiliate program.

If, however, you’re a bit more hesitant about the XM affiliate program, here’s a second option. Head on over to TopRanked.io for our full XM affiliate program review.

Affiliate News Takeaways

This week, we’re going to talk money. Money and BRICS, that is.

And no, we’re not talking about some virtual currency in Minecraft or anything like that.

We’re here to talk about that little alliance between Brazil, Russia, India, China, and South Africa.

Oh, actually. I almost forgot something so that’s not quite accurate.

Last year, the BRICS took a leaf out of the LGBT playbook.

Sorry, I mean the lgbtqia2s+ playbook.

Basically, last year the BRICS decided to go all ‘diversity’ on us and is now known as BRICS+. That means it also includes a bunch of other countries. Namely, Iran, Egypt, Ethiopia, and the United Arab Emirates.

That list was also supposed to include Argentina. But then the chainsaw guy got elected and said “eff it, we’re gonna do things our own way… but not really our own way.”

Long story short, Milei decided to hitch his wagon to the almighty horse we otherwise know as mighty mighty ‘merica — but more on that soon.

For now, all you need to know is two things.

First, BRICS+ is a thing.

And second, BRICS+ is getting serious about “de-dollarizing” themselves.

In fact, just this week news broke that they’re already apparently working on a payments system to get the ball rolling.

Also, fun fact — the BRICS+ presidency rotates on an annual basis. This year, it’s Russia. This is important for two reasons.

Yes, the guy who announced the WIP de-dollarizing payment system was named Sergey.

And yes, you can imagine that Sergey is probably a little more motivated than most to get this de-dollarization over the line.

Now, as for what de-dollarization actually means in real terms, there are a couple of big things here. First, BRICS+ members want to move away from the greenback as their primary “foreign reserve currency”. Second, they want to move away from the USD being their primary currency for international trade.

Now, we’re not actually here to talk about politics, so I’ll leave out the whole spiel about why each member actually wants to do this.

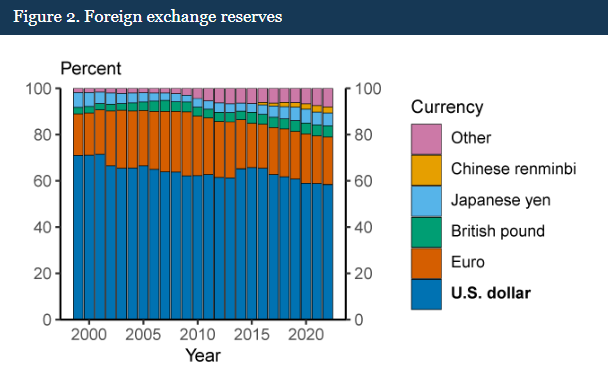

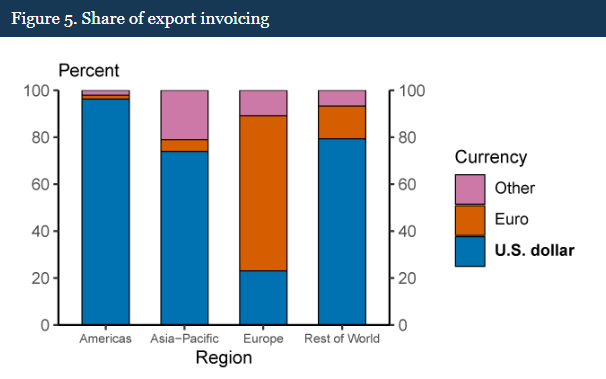

Instead, I’ll just drop a couple of tables for now, courtesy of The Fed so we can look at the impact.

That first table shows how much of the world’s “foreign exchange reserves” are currently held in USD. Basically, more than half are.

As for the second table, it shows that, apart from in Europe, the US dollar is at the center of all international trade in a very big way.

The effect of this means there’s a lot of “demand” for US dollars around the world. After all, if you want to “hold” US dollars in reserve, then you need to buy US dollars. And, if you want to trade in USD, then you also need to buy USD.

Now, for those of you who can remember Econ 101, you might remember that “demand” makes up one-half of the pricing equation. The higher the demand for something is (given a limited supply), the higher the price goes.

In other words, when people want to buy greenbacks, the sticker price of a greenback goes up.

Thus, theoretically, a massive chunk of the value of the US Dollar is tied simply to the fact that it’s the currency the world uses to hold reserves and trade with. Strip away a portion of that demand, and, theoretically, the USD should drop in price.

Got that?

Good.

Hopefully, right about here is the point where you should be wondering how “big” the BRICS countries are. At least, economically. After all, if they ditch their dollars, that means they’re not only gonna stop buying US dollars.

They’re also going to want to sell off a bunch of them, too.

Now, remember that whole supply/demand thing?

Yep. If the BRICS+ de-dollarize in a universe where our principles from Econ 101 still apply, that should impact the price of the USD.

So how much?

Well, that I won’t pretend to know. Instead, I’ll just give you some numbers to put the scale of it all into perspective.

Specifically, I’ll give you foreign currency reserves and GDP for the OG BRICS countries, along with Argentina and the good ol’ US of A.

| Country | GDP | Foreign Currency Reserves |

| United States of America | 25.44 trillion | 242 billion |

| Brazil | 1.92 trillion | 353 billion |

| Russia | 2.24 trillion | 606 billion |

| India | 3.42 trillion | 651 billion |

| China | 17.96 trillion | 3.2 trillion |

| South Africa | 405 billion | 53 billion |

| Argentina | 631 billion | 21 billion |

Basically, if you add everything up, you’ll find two things.

In terms of GPD, the OG members of BRICS have a higher combined GDP.

Add the + members in, and they’re well ahead of the USA. In fact, in terms of Gross World Product (like GDP, but for the world), BRICS+ makes up about 36% of the world economy.

And if you combine their forex reserves, that totals up to almost $5 trillion — about 40% of global forex reserves ($12 trillion)

That’s gonna make a pretty big impact.

Oh, and as for why I keep mentioning Argentina — that’s because the new president — the Chainsaw Guy aka Javier Milei — promised to “dollarize” Argentina when he got elected.

Now, whether he can is yet to be seen — his plans have been stalled for the time being. But the bigger point of including this was simply to point out that even if one country dollarizes as the BRICS+ de-dollarizes, that one country will barely move the needle on the demand for USD.

In other words, there’s not much out there to save the USD from a probable collapse if the BRICS de-dollarize.

So, now we’ve got the basics of a possible imminent collapse of the USD out of the way, let’s get to the affiliate opportunities. I mean, that’s what you came for, isn’t it?

Takeaway

Look, don’t take any of the above as financial advice. Whether the USD collapses or not is a little more complicated than that.

But, plenty of people are already buying into a similar narrative. So now you have the basic gist of the narrative, you have everything you need to get started selling stuff to people who buy into the narrative.

So what are you gonna sell?

Well, I have three main opportunities for you.

Affiliate Opportunity #1

The first one you might have already guessed — gold.

Basically, gold is a pretty popular option for people looking to protect themselves against the collapse of a fiat currency. The basic belief here is that an ounce of gold has remained rock solid in value since the dawn of men’s suits. (The saying goes that an ounce of gold bought you a fine toga back in the day of the Romans. And that same ounce will now buy you a decent men’s suit today.)

So, let’s say you wanna sell to the gold-loving crowd. What do you promote?

Well, there aren’t that many options here. However, one of the few options just so happens to be an absolute cracker of an affiliate program. So go check out our Goldco affiliate program review if you wanna learn more.

Oh, and I almost forgot. You can buy gold (well, not physically) with XM. That makes the XM affiliate program another great option.

Affiliate Opportunity #2

Our next opportunity is kinda like gold 2.0. Wanna guess what it is?

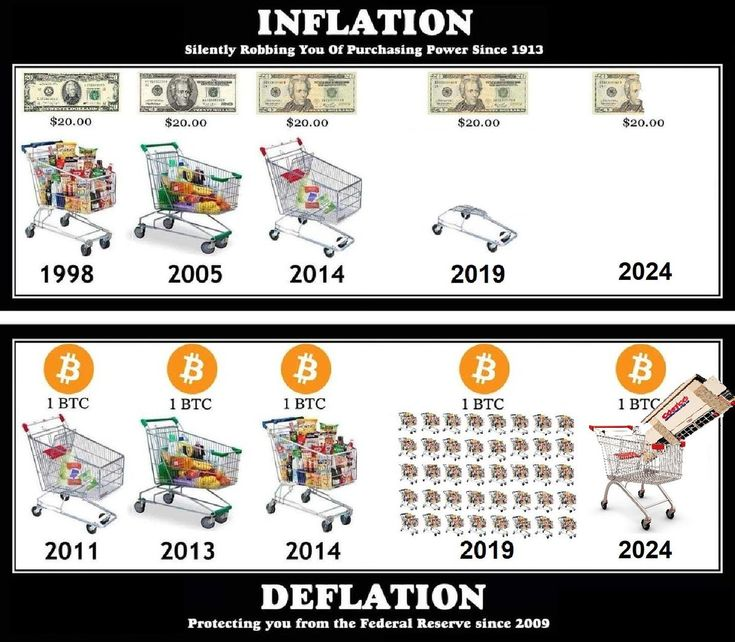

Yeah, it’s crypto. Especially Bitcoin.

Again, you probably already know this. But I’m going to repeat it anyway. People like Bitcoin because it’s different from “fiat”. Yes, its price is a little more wild than gold. But, it’s limited in supply, and it’s generally pretty decoupled from USD fluctuations.

In fact, it usually has an inverse relationship to the mighty greenback — when the dollar goes up, Bitcoin goes down, and vice versa.

Now, as for how you can promote Bitcoin as an affiliate, fortunately, you’ve got more options than with gold. But, to help keep things simple for you, I’ll simply pull up two from the archives: our Coinmama affiliate program review, and our KuCoin affiliate program review.

Oh, and yeah, you can also promote Bitcoin with the XM affiliate program. Again, not actual Bitcoin, but BTCUSD CFDs. So again, that makes the XM affiliate program a viable option.

Affiliate Opportunity #3

So far, the affiliate opportunities we’ve looked at are mostly if you want to sell to people looking to protect themselves from a dollar collapse.

But what if you wanna sell to someone a little more like yourself?

You know, someone who’s out to get filthy effing rich?

Well, in that case, your best bet is to educate people on the opportunity to do just that in a USD crisis. That is, you teach them to short the dollar. You know, like do Forex trading and stuff.

Now, obviously, this one’s gonna be a little harder to generate commissions on.

That’s because people buying forex to make bank on a USD collapse aren’t gonna be the usual “draw pretty pictures on charts/get robo signals” types. Instead, they’ll be more of the buy-and-hold type.

The big implication here is that their trading volume will be relatively low. That means rev share’s probably not what you’re after here. It also means that CPA might be a little harder than usual to get. That’s because most Forex affiliate programs put a minimum trading requirement on “qualified customers”.

But that’s okay.

It just means you’re gonna have to target the right audience. And by right audience, I mean an audience that has money. And the best part is, usually, that audience resides in countries that earn you the biggest CPA commissions with the XM affiliate program.

So just do that.

Closing Thought

This week, the Financial Times published this interview with Danny Rimer (a VC).

Now, I don’t really care about most of the article. What I do care about is the title and subheading:

Index Ventures’ Danny Rimer: ‘The talent is what’s going to drive the difference’ — Markets and technology matter, says the VC veteran, but people are the decisive factor in choosing investments.

So, we’re here to talk about affiliate marketing. What does a VC from the startup world have to do with us?

Well, that comes down to most things being pretty universal.

Here’s an example to prove my point about universality. Let’s rewrite the subheading.

“Recipes and ingredients matter, but the chef is the deciding factor.”

Now that you see how universal it is, let’s apply it to affiliate marketing.

“Niches and affiliate programs matter, but the affiliate marketer is the deciding factor.”

In other words, you can grab all the methods and opportunities out there, partner them with the best affiliate programs around, and still come out with nothing if you, the affiliate marketer, aren’t up to the task.

The same thing applies in reverse. A great affiliate marketer can probably take a dud program and promote in a dying niche and still make bank.

Now, does that mean all hope is lost if you’re not a great affiliate marketer today?

Not quite.

Danny, the guy in the interview seems to value one thing more than anything else.

That is, people who learn by experience.

Especially those who’ve failed (or who worked somewhere that failed) and taken something away from it.

In other words, if you can learn from your mistakes, and then pair that with a great opportunity and a solid niche, you’re gonna eventually win.

Now, obviously we can’t help you make those mistakes. And, if you’re really gonna learn from those mistakes, then you’re probably going to need to go that alone, too.

But here’s something we can help you with — a solid niche and affiliate program.

For the niche, scroll back up and read the news. And for the program… yeah, you guessed it — go try out the XM affiliate program.

__

(Featured image by SevenStorm JUHASZIMRUS via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Cannabis1 week ago

Cannabis1 week agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

-

Cannabis2 weeks ago

Cannabis2 weeks agoWhen a Cutting Becomes a Cannabis Plant: Court Clarifies Germany’s Three-Plant Rule

-

Crowdfunding3 days ago

Crowdfunding3 days agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Africa1 week ago

Africa1 week agoMASI Surge Exposes Market Blind Spot: The SAMIR Freeze and Hidden Risks