Business

Medical professionals seek solutions over increasing financial health crisis

Medical professionals could benefit the most in financial wealth management to ensure they have support until they retire.

While all set to earn a six-figure income, medical professionals are hard-pressed to make critical financial decisions that would support them until retirement age. This is due to unpaid student loans, anti-worker policies, and growing cost of living.

Just as patients seek favorable health solutions, medical professionals are also in need of financial wealth management, says Financial Planning. Despite being undoubtedly one of the “smartest” and most hardworking of sectors, many medical professionals are unable to enjoy financial freedom. According to Think Advisor, financial literacy answers this problem.

We can’t fault doctors, along with other medical professionals, for dedicating countless hours on memorizing facts and medical terms, and most importantly, saving lives; the tradeoff, however, is that they tend to neglect their financial wellness. For their own sake, though, health professionals should be mindful of the financial hurdles and be able to address them through various means.

Medical pros hurdles

Financial planning experts say that financial education should start even before the huge paychecks come in—which usually range from $55,000 for medical residents to $285,000 for radiologist.This way, professionals can prepare for financial challenges smoothly, and make informed decisions.

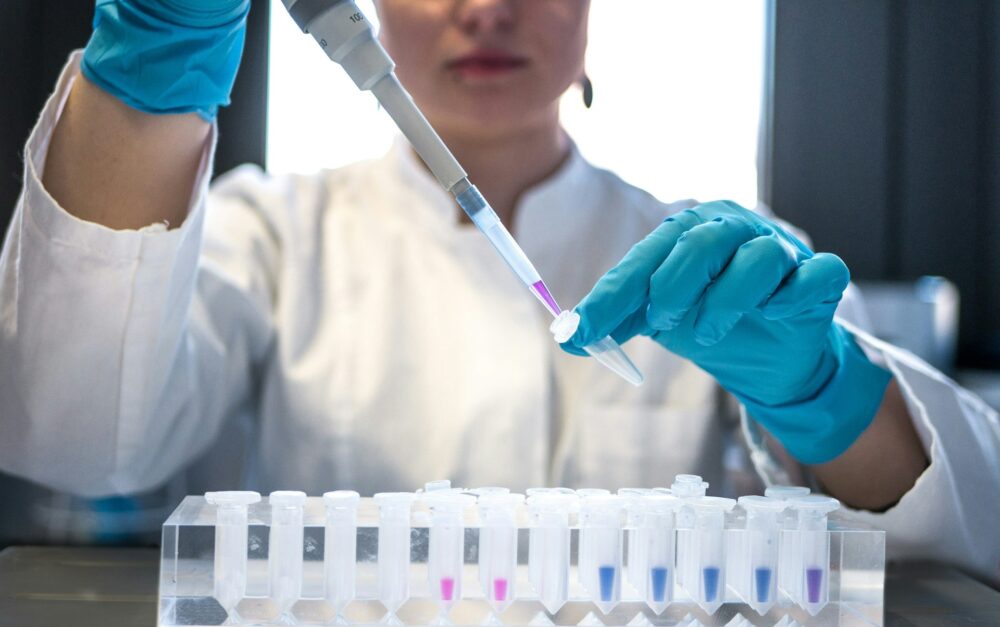

Student loans deteriorate the financial wellbeing of medical professionals. (Source)

However, this seems easier said than done. Hefty student loans burden medical professionals right before they even graduate. Fifty years ago, medical school education only costs $15,000 while the average cost today is about $204,000. The amount is indeed staggering. The Association of American Medical College noted that 79 percent of these students graduate with a debt of $100,000.

Financial experts advise on paying students loans within ten years to avoid financial strain due to interests. Doctors who decide to work in public service are exceptions to the rule. Their student loans are waived after 10 years of repayment.

Financial solutions

Study Finance is one of several online courses teaching basic finance. Teaching fundamental applied finance, the website offers step-by-step modules, which make it easier to learn topics. Given the years of experience in reading medical books, doctors will find the modules easy to read and understand.

On the other hand, time is some doctors’ hurdle to financial literacy. Many find it hard to squeeze the time needed for additional learning while they are busy examining and treating patients. One way they can be financially literate is to keep themselves updated with financial news and events.

Busy medical professionals can benefit from a key advantage of technological advancements: the availability of mobile business news apps. Particularly designed to be informative and accessible, many news apps can keep them updated with the latest news business and finance. For example, the unique mobile news app called Born2Invest offers 80-word curated news from around the world.

The popular app is available for Android and iOS platforms. CEO and founder Dom Einhorn said the unique selling point of their app is engagement. Another is having updated content 24 hours a day, seven days a week. “Most importantly, we aim to deliver a unique, reader experience no matter the location,” Einhorn said in an exclusive interview.

Since medical professionals may be too busy to take courses, the next best thing is to learn the ropes through flexi-time sources. With today’s technological advancements, there is a vast amount of learning waiting, and all it takes is a simple click.

-

Biotech2 weeks ago

Biotech2 weeks agoWhat Financial Impact Can the Health Sector Expect from the Metaverse Integration

-

Biotech3 days ago

Biotech3 days agoGrifols Announces Positive Results from Fanhdi Phase IV Study

-

Biotech1 week ago

Biotech1 week agoAI Will Revolutionize Mental Health, Generating 2.5 Billion in Spain

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoOpstart Buys Majority Stake in BackToWork

You must be logged in to post a comment Login