Featured

Building your second income: How to achieve dividend growth

Save up for the future with the help of a second income that you can grow through dividend growth.

Wouldn’t it be nice to have a second income to preserve your living standard in your old days or even grant you financial independence before reaching retirement age? These thoughts are owned by many. Yet, while most people only dream about financial safety or even freedom, others build their financial future on top of a growing dividend income.

Some of these dividend builders present their efforts on the internet, posting their growing stream of dividend income every month. I call these people income heroes and analyze their aggregated effort to show even more people that creating a solid dividend income for anyone is possible.

The analyses trace the dividend growth since January 2015, trying to present the big picture of common success when it comes to dividend growth.

So, let’s start.

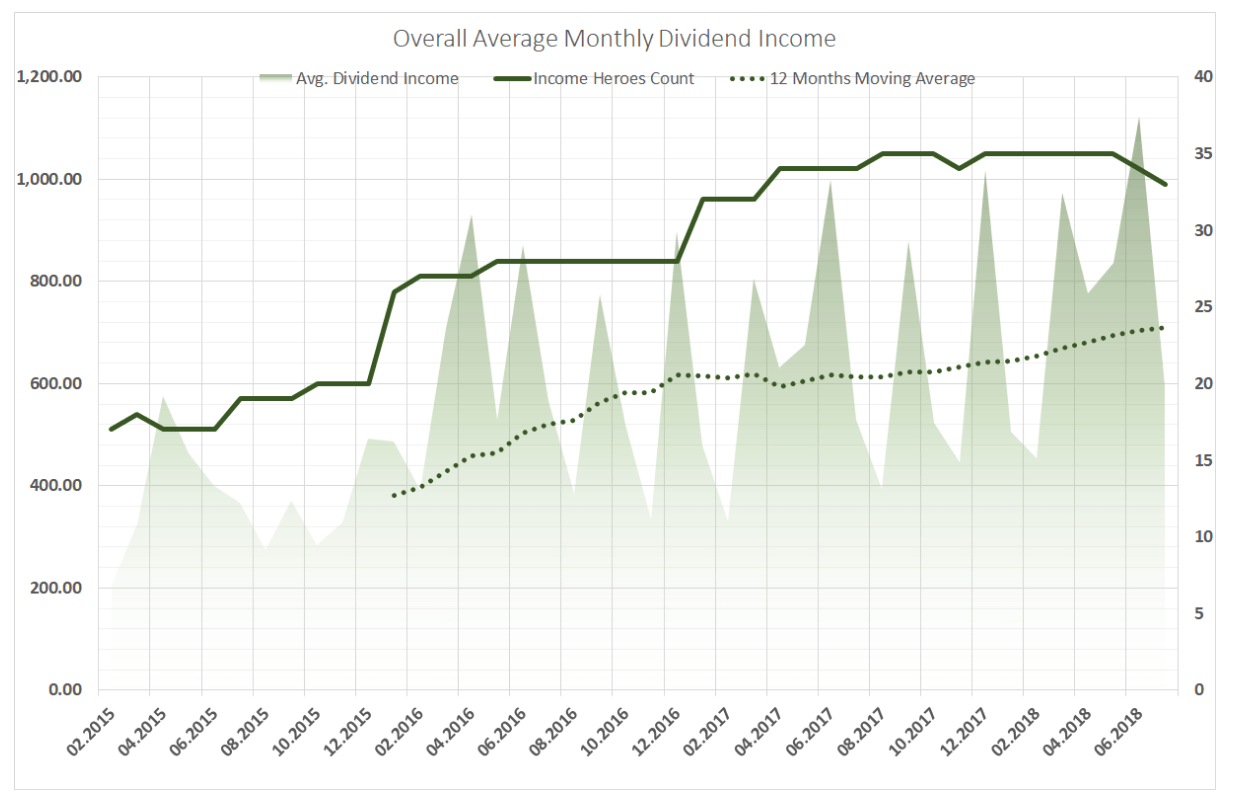

Average dividend income growth

The chart below analyzes the average monthly dividend income of the finance bloggers. The left axis displays the dividend income while the right axis shows the number of bloggers analyzed. Starting in 2015, dividend income was between $500 and $600. Yet, within the last 12 months, the $1,000 barrier was knocked down twice with a record of $1,222 in June 2018.

The average dividend income of the finance bloggers is growing. ©Torsten Tiedt

In general, the increase in the dividend income depends on different factors.

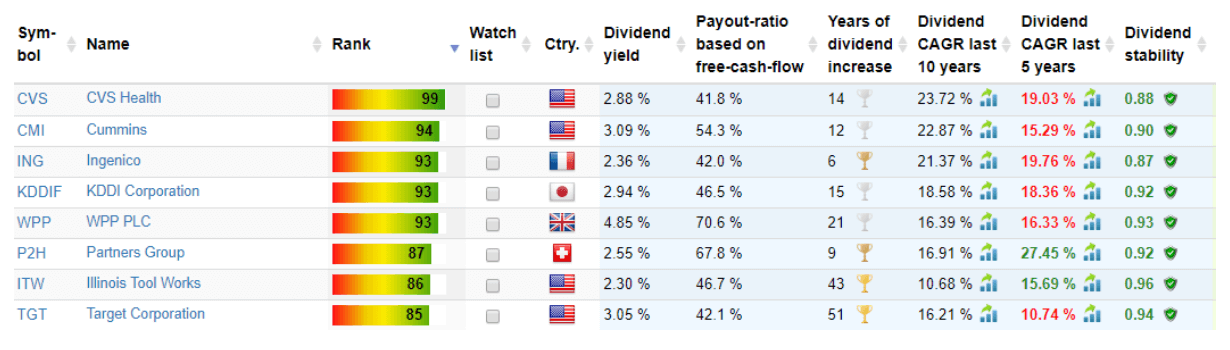

Dividend increase of the stocks invested

There are companies with a yearly dividend increase of 10 percent, 15 percent and even more. Investing in such companies rewards patient investors with a dynamic dividend increase over time. The table below represents a small sample of such dividend stocks including some dividend-related metrics.

Some dividend stocks with high dividend increase over the last years. ©Torsten Tiedt (Source)

When selecting dividend stocks, investors face the decision if they prefer a combination of high dividend yield but lower dividend increase (a strategy called “dividend income”) or the combination of lower dividend yield but higher dividend increase (a strategy called “dividend growth”). There is no right or wrong. The decision purely depends on your preferences.

Your income and savings rate

The more capital you invest, the faster your dividend income grows. The key metrics are your available income and savings rate.

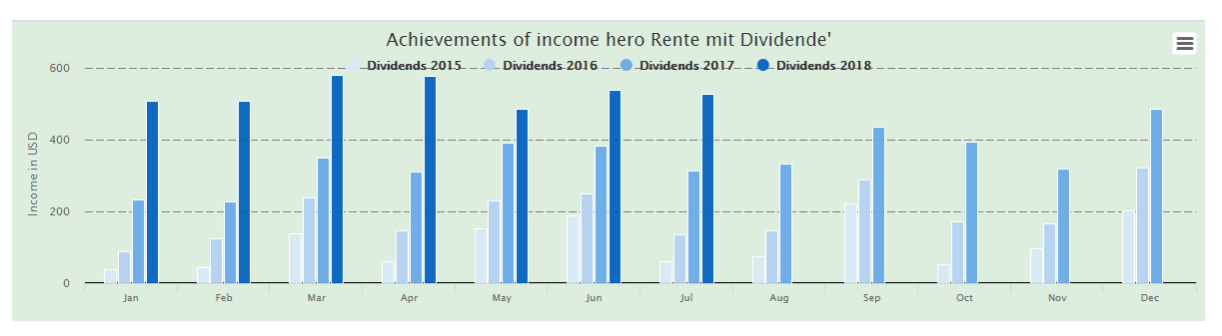

Some blogger shine with a very disciplined savings rate allowing them to increase their dividend income like a clockwork. The chart below shows the dividend increase of the German veteran blogger “Rente-Mit-Dividende” (pension with dividends).

A German finance blogger investing each month like a clockwork ©Torsten Tiedt

Dividends are rewarding right from the start

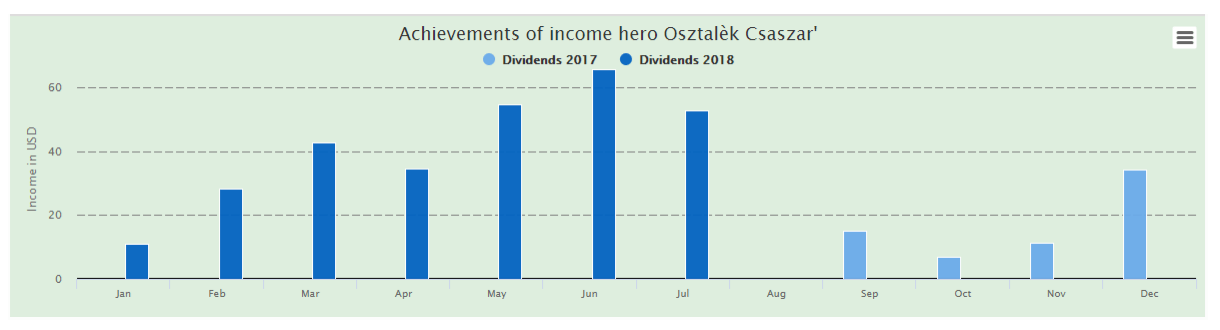

The most recent blogger in the analysis is Osztalèk Csaszar from Hungary. Growing dividends are not restricted to the U.S. or Western Europe, but anywhere in the world including countries with lower per capita income. Although the absolute numbers are still low, his monthly dividends are growing at a fast pace. One of the most motivating facets of dividend investing is the fast increase of dividend income by percent in the first years.

Osztalèk Csaszar from Hungary: still small portfolio, yet nicely increasing dividends. ©Torsten Tiedt

The dividend rhythm—volatility which isn’t

Although the average monthly dividends nicely increase over time, heavy differences from month to month exist. If this were about stock prices, we would call this high volatility. Yet, in this case, the reason is that most companies don’t pay monthly dividends but rather pay dividends each quarter (e.g., mostly in the U.S.) or even only once a year (e.g., in Germany).

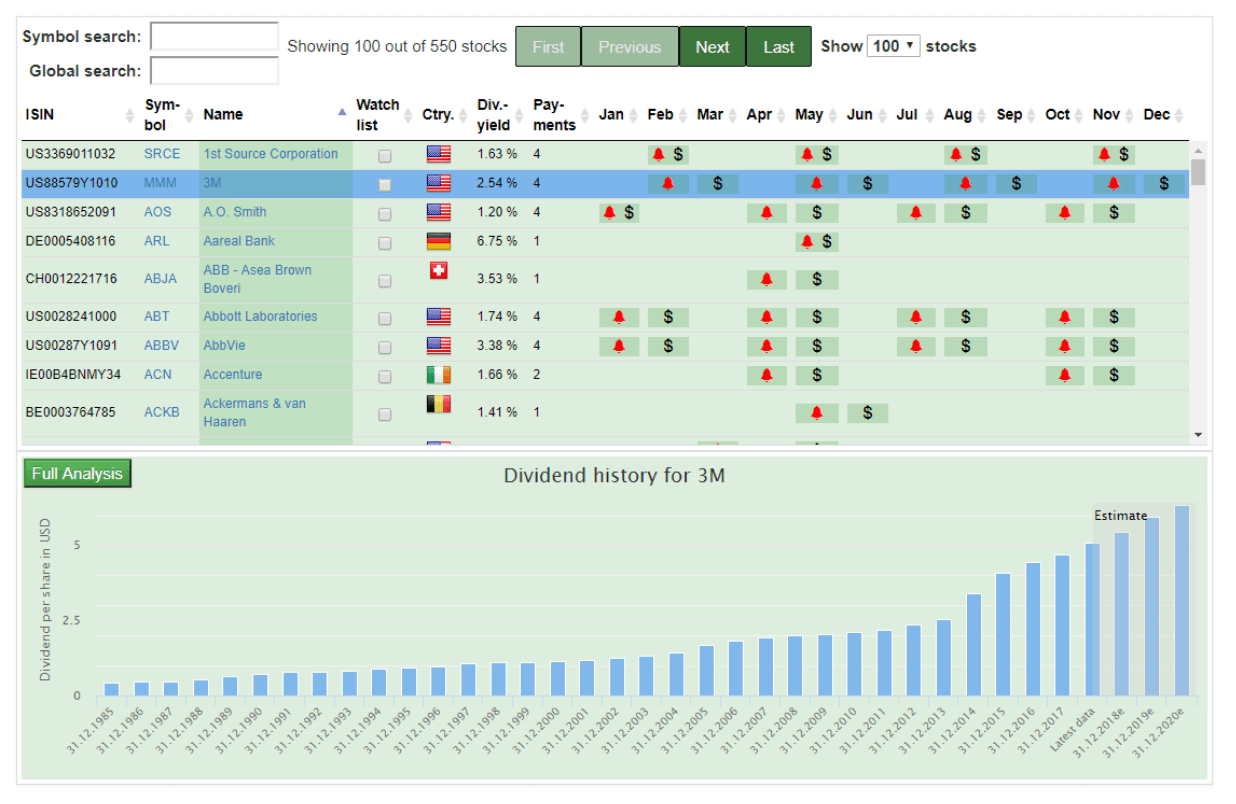

This dividend calendar reveals the dividend rhythm by showing the month of the ex-date and the payment date. If you prefer a rather balanced dividend income throughout the year, this free resource is invaluable.

A free dividend calendar showing the dividend payment rhythm and more. ©Torsten Tiedt

Dividend growth compared to the same month of the previous year

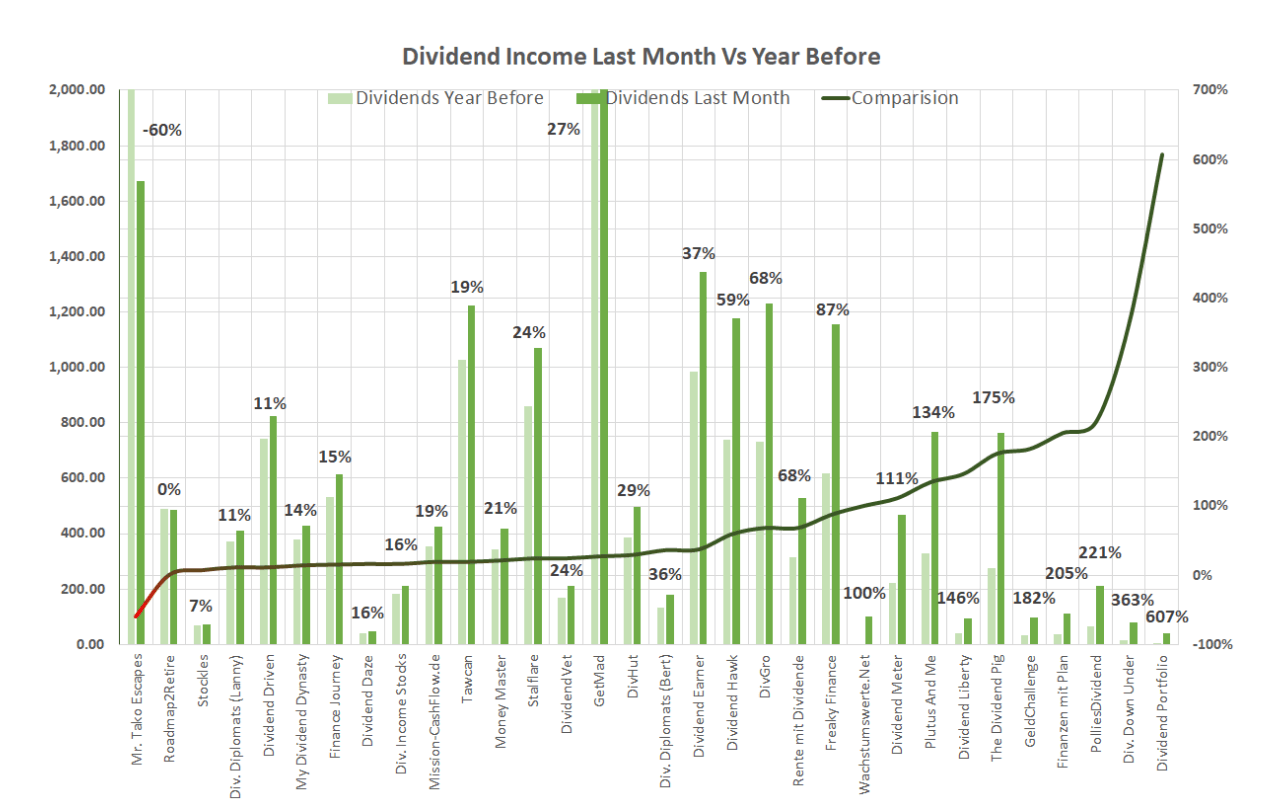

Amongst dividend bloggers, this comparison is very popular. The increase in percentage is symbolic of the progress of the last year.

Dividend growth comparing last month to the same month of the previous year. ©Torsten Tiedt

Dividend growth throughout the ranks is impressive. Especially smaller portfolios manage to increase their dividends by 100 percent and more. Yet, even larger portfolios with monthly dividends of $1,000 still grew dividends by 60 percent and more.

Dividend growth of last 12 months compared to same period a year before

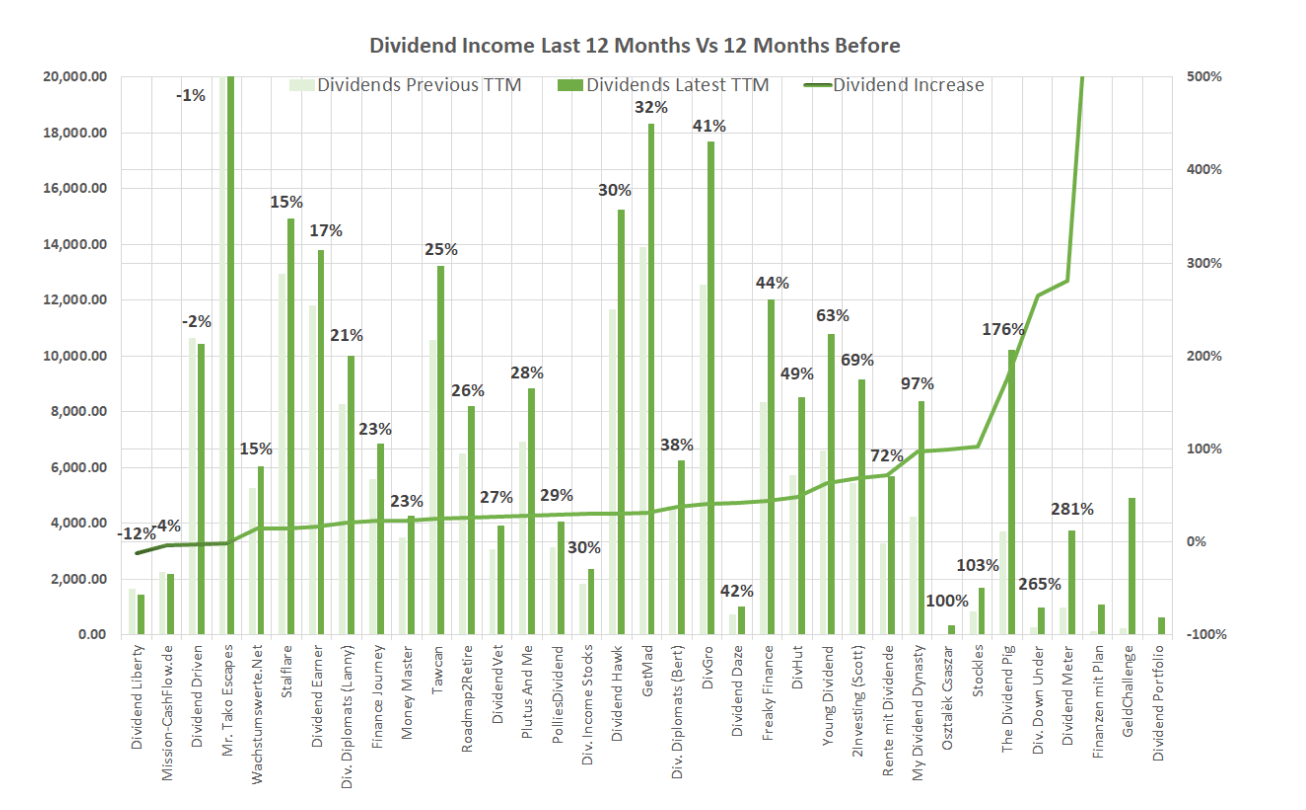

Even more meaningful, but also more demanding to analyze, is the comparison of last to previous 12 trailing months. Doing so neutralizes shifts in dividend rhythm.

Dividend growth comparing current to previous 12-month period. ©Torsten Tiedt

This way the dividend increase gets both more realistic and moderate. Yet, the height of the dividend increase remains impressive. Double-digit growth is the rule. Even large portfolios with a 12 trailing months dividend income of $10,000 and more manage to grow by 15 percent, 20 percent and more. Smaller portfolios break the 100 percent barrier multiple times.

Conclusion: Dividend income for anyone

My personal motto is “quality stocks for anyone.” In the same vein, I’d like to add: “dividend income for anyone.” Finance bloggers provide an example which makes their effort so valuable that I call them Income Heroes.

If you are on the edge to become a dividend investor in need of a last motivation boost, it may be helpful to witness some individual success stories on Income Heroes. Be aware that all these people with different backgrounds mostly gathered the required knowledge on their own. You can do this, too.

(All graphs and charts are courtesy of DividendStocks.Cash)

(Featured image by Making Money via Flickr. CC BY-SA 2.0.)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto4 days ago

Crypto4 days agoThe Crypto Market Rally Signals Possible Breakout Amid Political Support and Cautious Retail Sentiment

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEuropeans Urge Strong Climate Action Amid Rising Awareness and Support

-

Crypto7 hours ago

Crypto7 hours agoBitcoin Hits New Highs in USD, But Euro Investors See Limited Gains

-

Crypto1 week ago

Crypto1 week agoXRP vs. Litecoin: The Race for the Next Crypto ETF Heats Up

You must be logged in to post a comment Login