Business

AG Weekly: U.S. market stabilizing, Europe’s wheat of bad quality

EU data released last week show that demand there is lagging year-ago levels due to the bad quality of much of the EU Wheat produced last year.

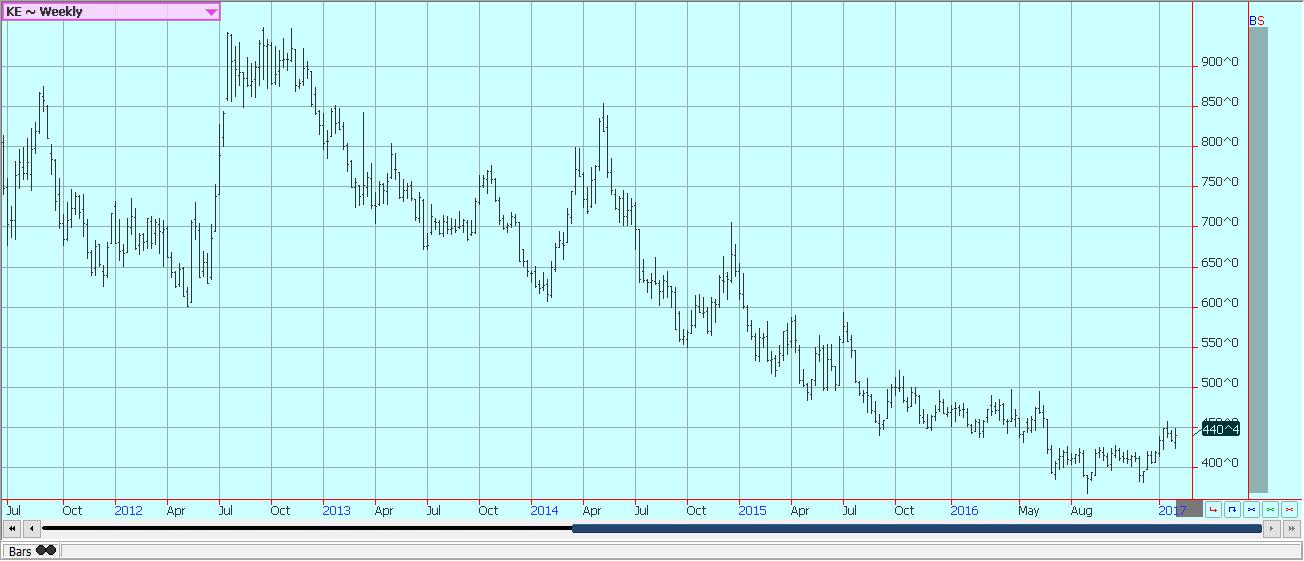

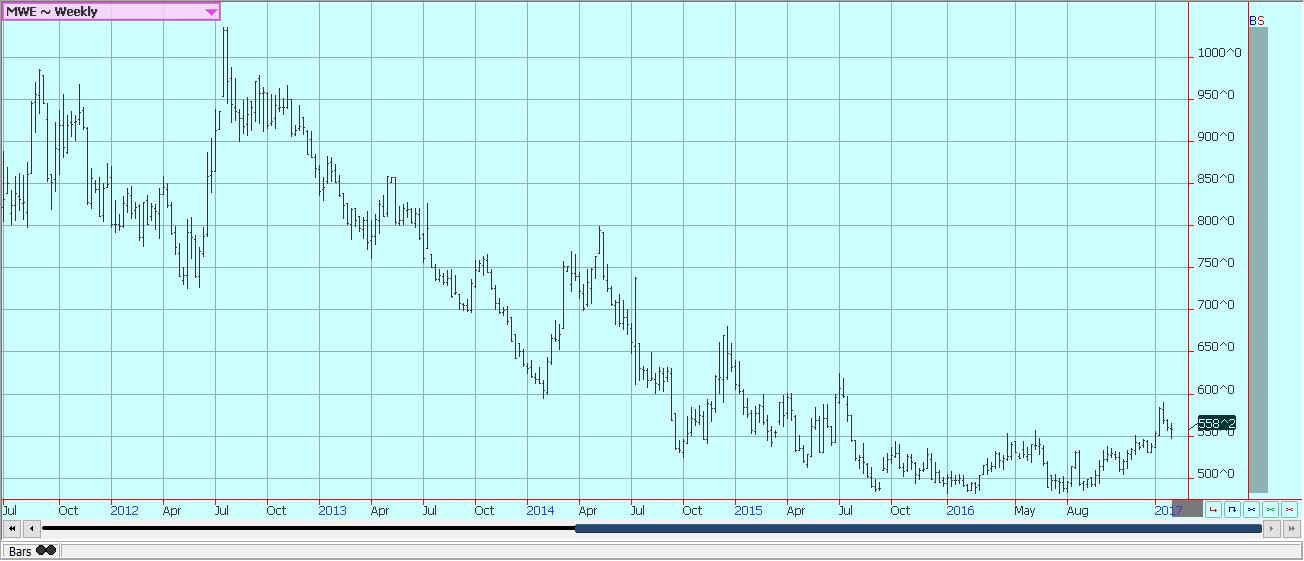

Although lower on Friday, U.S. wheat markets were higher last week. The U.S. remains a good participant in the world market with competitive prices.

Wheat

The Commitments of Traders reports showed a shift in attitudes as commercials were the main buyers and speculators were the main sellers in data released last Friday and as of last Tuesday. Ideas that world production and US production potential is less in the coming year combined with firming world prices keep support in the futures market. Algeria bought 580,000 tons of Wheat in world markets last week, but it is unclear if the US won any part of that tender.

On the other hand, EU data released last week show that demand there is lagging year ago levels due to the bad quality of much of the EU Wheat produced last year. US export sales are primarily for HRW and HRS as the world seeks out quality Wheat. That has helped support HRS and HRW futures on spreads against SRW, where the demand has been much more limited. USDA will show big world stocks again in its monthly updates later this week. Canada showed stocks of over 25 million tons last week, and this was above year ago levels and higher than trade expectations. Much of the stocks are still in first hands. The big world supplies and competitive nature of the market continues to limit upside potential for futures prices, and the markets faded a bit from multi month highs last week. But, the reduced US planted area for Winter Wheat and the potential for reduced planted area worldwide due to the current depressed prices and an increased speculative appetite to own agricultural futures should keep prices trading with a firm tone.

Weekly Chicago Wheat Futures © Jack Scoville

Weekly Kansas City Wheat Futures © Jack Scoville

Weekly Minneapolis Wheat Futures © Jack Scoville

Corn

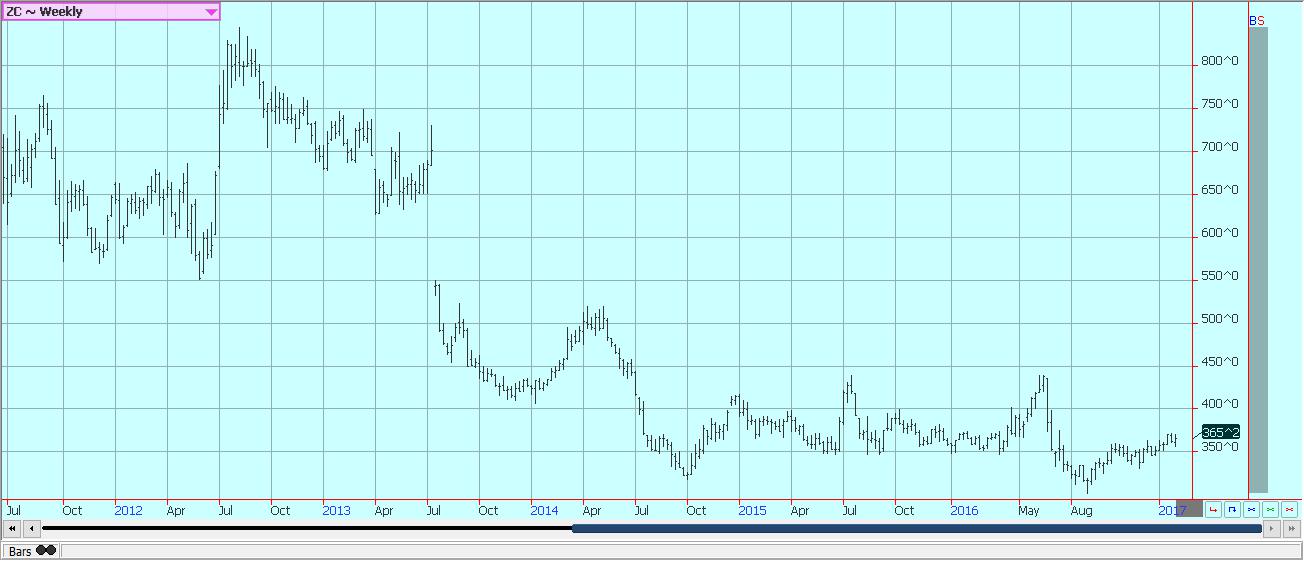

Corn closed higher for the week, but faded from the $3.70 per bushel in the March contract again. However, the weekly charts show that the market is holding above an important support level at about $3.60 per bushel in the March contract. Chart trends remain up. The Commitments of Traders reports issued on Friday showed that Commercials were buyers and speculators were sellers in the week ending last Tuesday. This data goes against the general narrative that speculators are doing all of the buying. Demand for Corn has been stronger than expected, especially on the export and energy fronts. Export demand was strong again last week at over 1.0 million tons and more analysts now expect USDA to increase export demand by at least 25 million bushels in the updates later this week. Ethanol demand has been running at record levels the last three weeks, and it looks like USDA will be forced to increase this demand by up to 50 million bushels in the next updates. US farmers appear undersold in Corn. They face little world competition as South America is still out of the market and is likely to be out of the market until this Summer. There is not much Corn there and internal pipelines will need to be filled before much export can be made. Offer prices, if any can be found, remain very higher and well above US values. The big price spread could last into the Summer. Growing conditions are said to be good in Brazil, and the Safrinha crop is being planted as the Soybeans get harvested. Heavy rains are possible this week to slow the progress down. Conditions have improved in Argentina due to recent rains. Crop losses are still expected from the previous bad weather.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

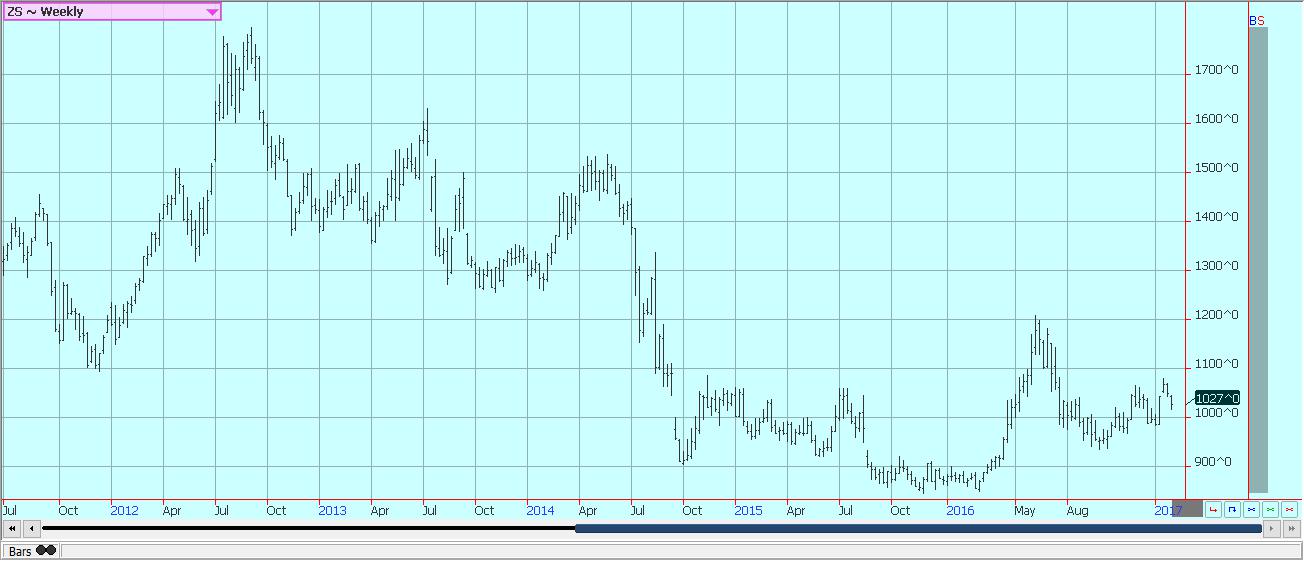

Soybeans and Soybean Meal lower last week in slow trading. It was a generally slow week as many Asian traders were out of the office for the Lunar New Year. The US market anticipated reduced US demand as the Brazil harvest comes to market. The harvest there has been moving right along despite reports of rains in areas ready for harvest. Mato Grosso is already 31% harvested. The state and surrounding areas are expected to get some heavy rains this week, but the rapid harvest pace until now should keep concerns to a minimum. Production ideas currently appear to be near 105 million tons. Argentina has seen improved crop conditions due to recent rains in southern areas and drier conditions in flooded areas. These general weather trends are expected to continue this week. Production estimates for Argentina now range from 41 to 54 million tons, down from 55 to 57 million tons early in the growing season. USDA has room to increase Soybean export demand in the supply and demand updates this week, but might choose to wait to see if everything sold is actually exported before making further adjustments to this area.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures © Jack Scoville

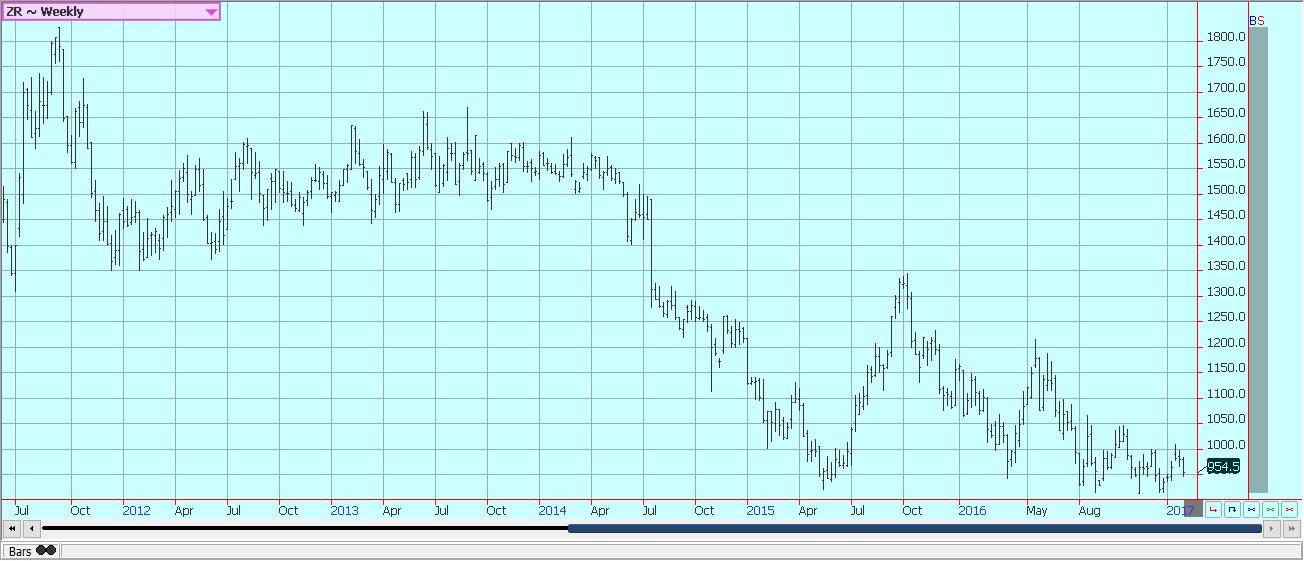

Rice

World markets were firm last week and US futures were lower. The world market continues to firm despite news that Thailand will soon look to liquidate another big tranche of the stocks the current government inherited when the previous government decided to overpay for Rice and bought tremendous amounts. The world market seems to have bottomed and is now moving sideways to higher. Trading in futures markets was generally slow. However, prices did move lower one day last week when it was learned that Iraq had bought no Rice at its US and its international tender. The lack of demand was a blow to the market that is suffering from less demand, anyway. Futures pushed back to a support area on the daily and weekly charts near 950 March, and so far this level is holding. However, the tone of the market is weak. The domestic cash market remains generally slow, with both buyers and sellers not showing much interest. US farmers are still making final planting decisions and there is still widespread talk that those with alternatives will choose to plant other crops that appear to have better profit potential. The weak tone and slow trading, but mostly sideways price action overall implies that a low is forming. It might take solid indications of less US production in the coming year to cause US futures tro rally, but overall downside potential should be limited.

Weekly Chicago Rice Futures © Jack Scoville

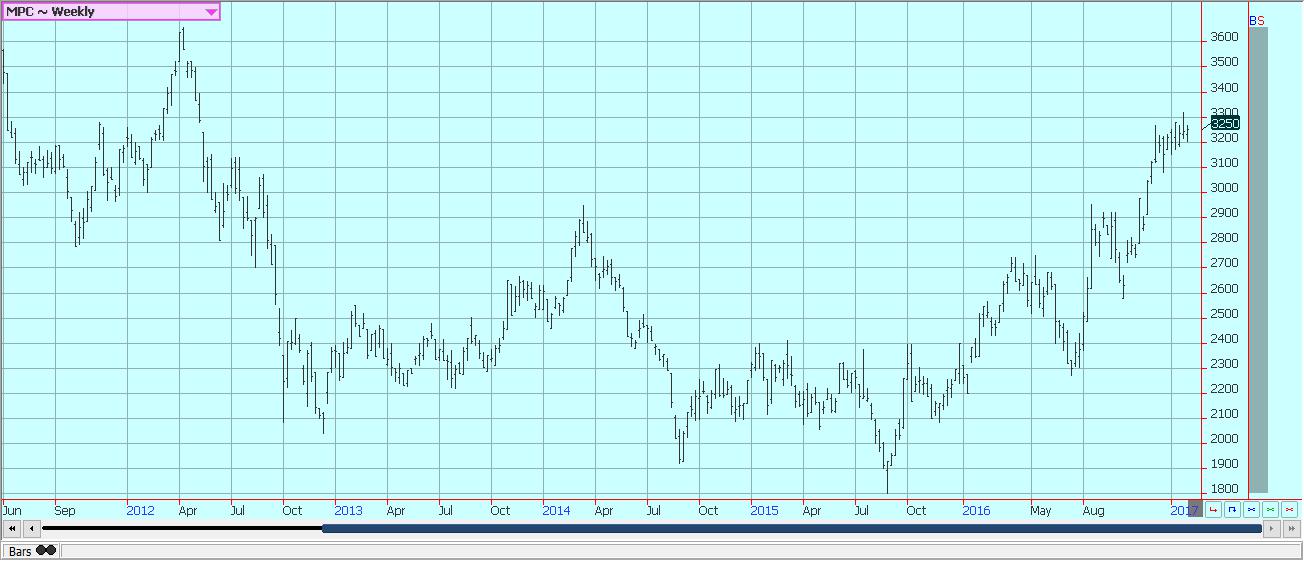

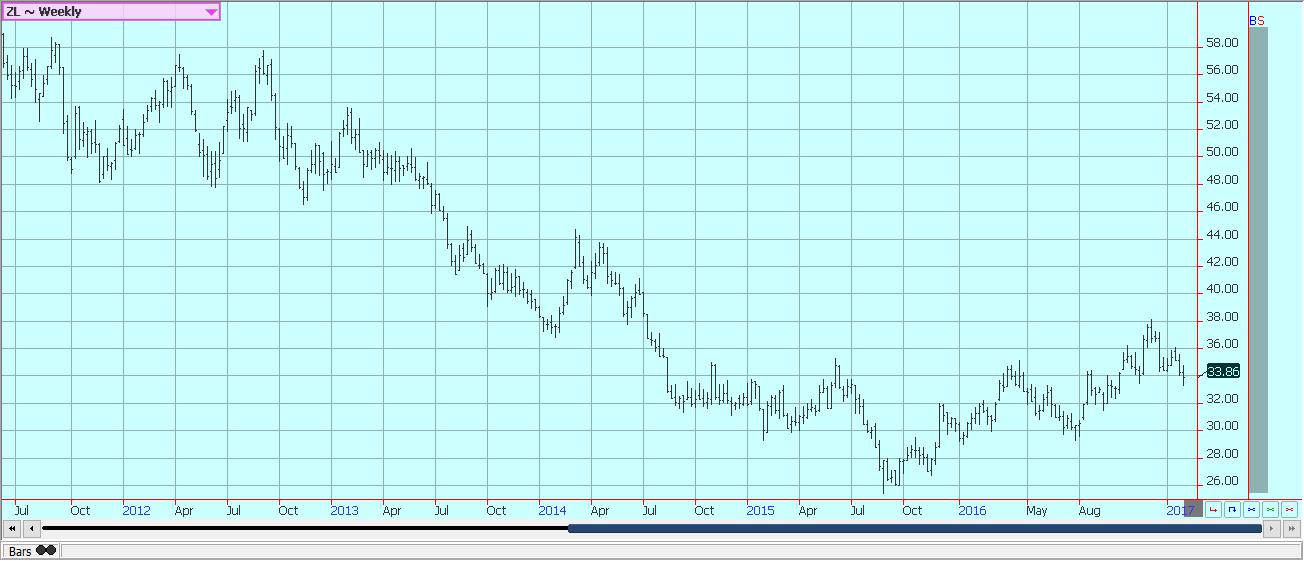

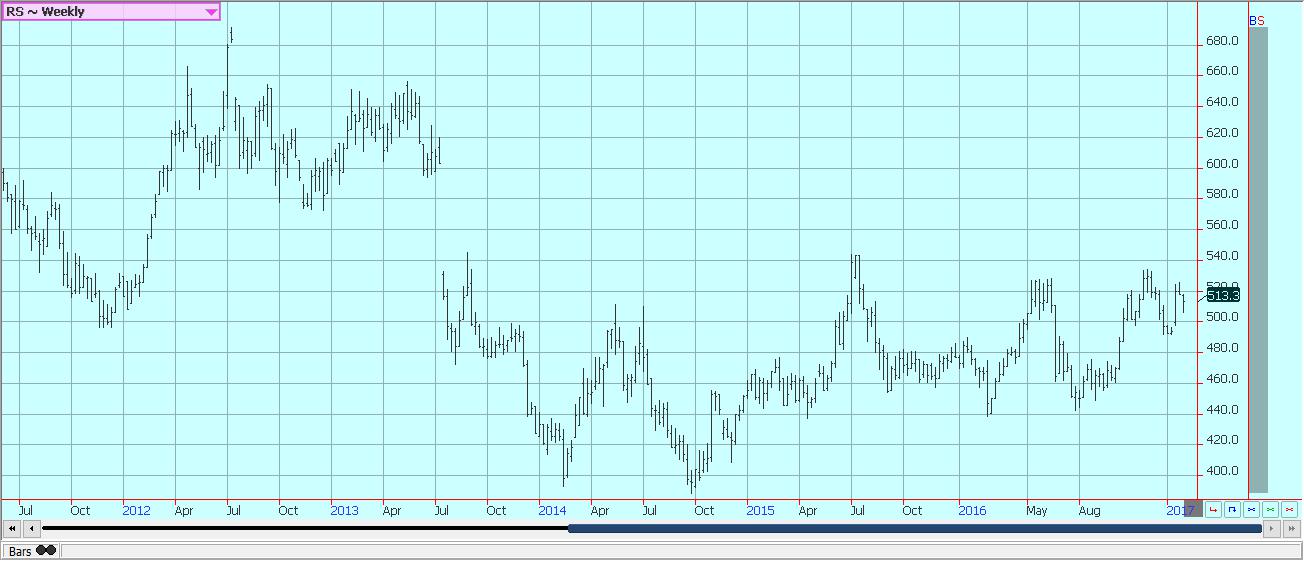

Palm oil and vegetable oils

World vegetable oils markets were mixed again last week. Soybean Oil turned weaker, and Canola was a little lower in narrow range trading. Palm Oil was a little higher, but remained caught between competing fundamentals. Export demand was about 8% above last month, according to data from the private sources. ITS said that January exports were 1.174 million tons, from 1.086 million in December. SGS estimated exports at 1.157 million tons, from 1.109 million last year. Ideas are that production will start to increase in the next couple of months for seasonal reasons. The rains have greatly improved this year after the El Nino induced droughts of last year and these better rains are expected to result in improved production. Production normally starts to increase in the Spring due to the effects of the rainy season. Just about all major analysts are calling for significantly increased production this year, with many looking for at least a 10% jump in production. Indonesia released data showing that internal supplies are tight. The country has been pushing exports and has been the major seller to China and India with Malaysia trailing well behind. Palm Oil markets are preparing for a move up or down at this time. A lot will depend on the demand that needs to stay higher. The weekly charts still show up trends but the market is sideways for the short term. Final targets for the up move are at about 3500 Ringgit per ton if the trend can get started again.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures © Jack Scoville

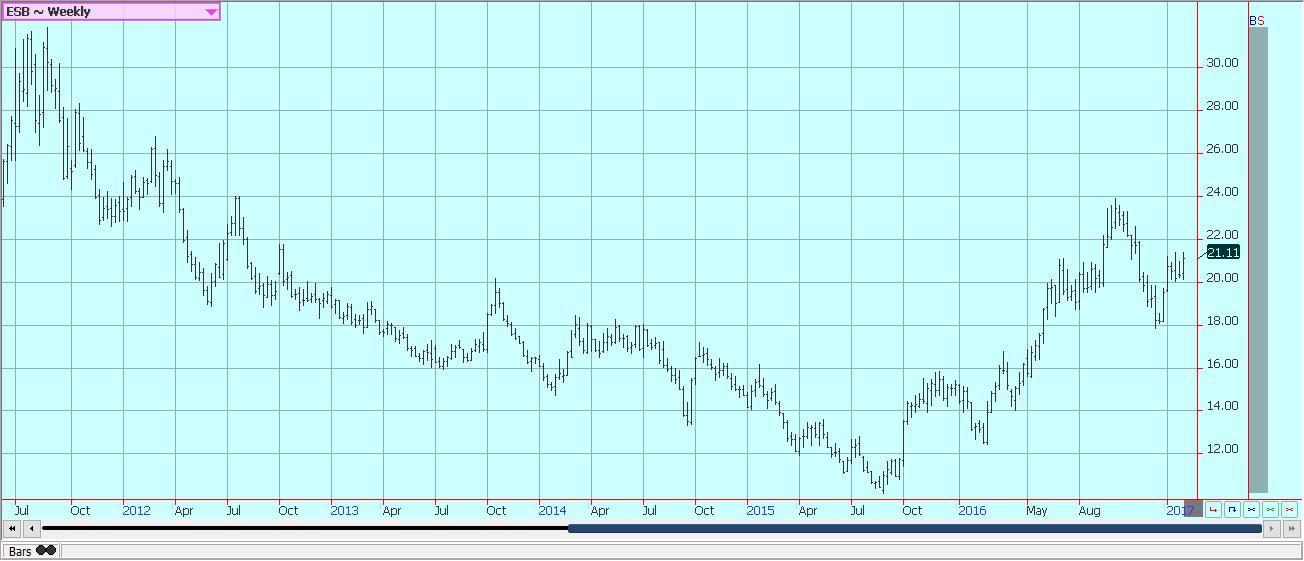

Cotton

Futures were higher and broke through important resistance at 7500 March in the latter part of the week. Next target for the market is a weekly high at 7780 March, but chart patterns suggest that prices can now move over 8000 in the near term. The weekly charts show that the longer term uptrend remains intact. The market found buying interest as export demand remained very strong at over 325,000 bales. It was lower than the previous week, but still a strong week of sales and one that implies that USDA has underestimated demand. It is possible that USDA will increase its export demand again in the latest supply and demand estimates that will be released later this week. The strong buying comes as the second biggest exporter in the world, India, remains mostly out of the market due to its internal currency changes. There is Cotton moving in the internal market, but it is not making its way to the export market as mills there take all sales for internal use. The weekly USDA classing report suggests that the harvest is about over now as classing is getting closer to USDA production expectations and volumes tendered for classing have tailed off. The reports have shown that about 70.5% of the Cotton has been tenderable this year, but quality is tailing off as the harvest comes to a close as is normal. Speculators are the major longs and commercials are the major shorts. This may start to change as trade talk suggests that the commercials have to price a significant amount on call Cotton before First Notice Day for March contracts in the next couple of weeks. The commercials have been bearish the market due to ideas of big US domestic supplies, but the stronger than expected demand and ideas that more inflation is coming have been the main factor behind the buying by speculators.

Weekly US Cotton Futures © Jack Scoville

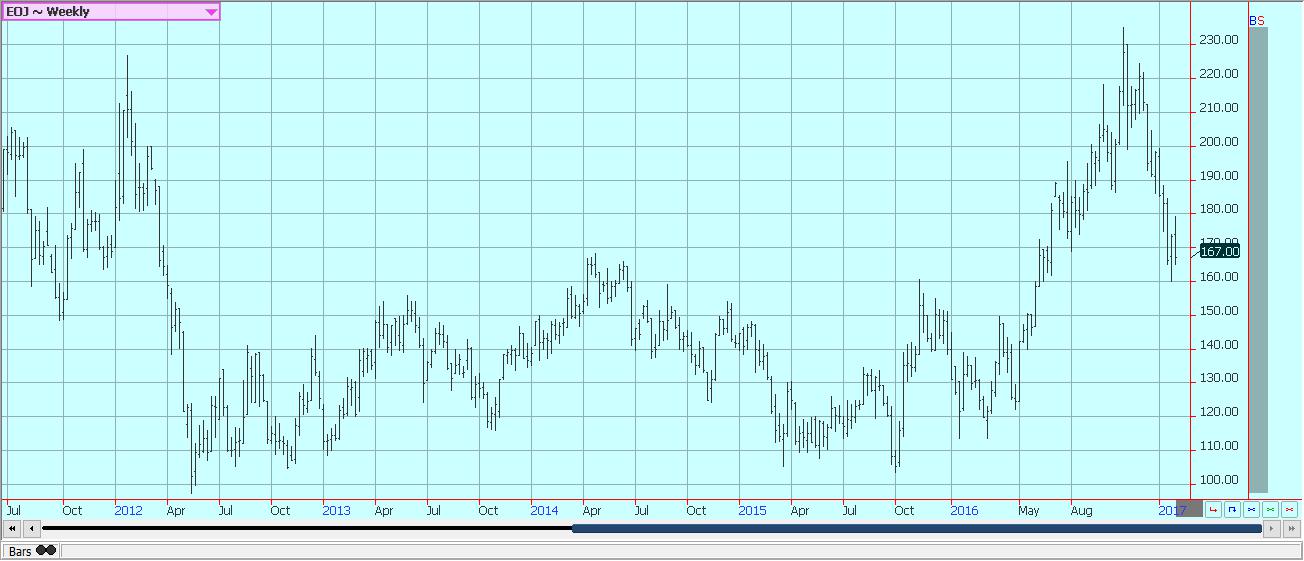

Frozen concentrated orange juice and citrus

FCOJ tried to move higher again last week, but the short covering rally faded and the market closed lower. Chart patterns suggest that there is more down side potential with final objectives near or below 150.00 basis the nearest futures contract. The Florida harvest remains active amid good weather conditions. Early and Mid oranges are being harvested for processing. The Valencia harvest is underway and that fruit is also moving to processors. It is still too dry for the trees and irrigation is being used frequently. Demand for Orange Juice inside the US is still a big problem. It is currently at its lowest level since records started being kept in 2002, and there are no real prospects for improvement right now as consumers have plenty of alternatives. Sao Paulo state is getting good weather and crop conditions are called good. Brazil should be able to fill world demand this year.

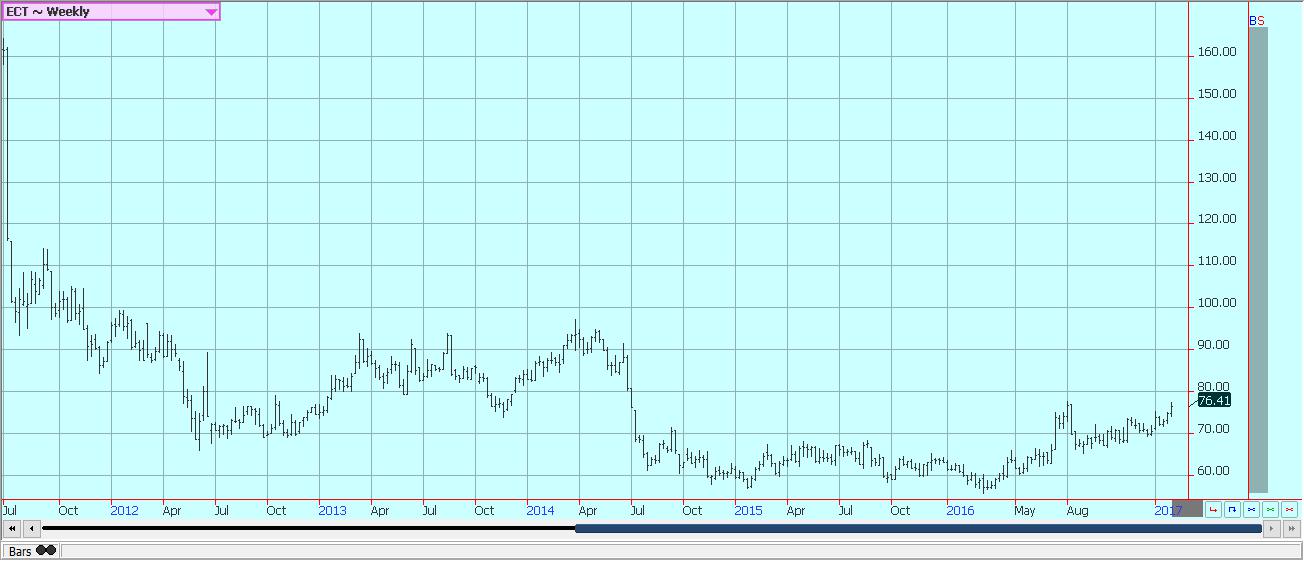

Weekly FCOJ Futures © Jack Scoville

Coffee

Futures were lower last week as the weather started to change in Brazil. The dry northeast areas are expected to get some beneficial rains this week. The rains come late to help the crop currently being developed, but any rains will be welcome in a part of the world that has seen very little precipitation for many months and remains in extreme drought. There is less production in Brazil this year, in part because it is the second year of the biennial cycle and in part due to the drought in northeast Brazil. Production ideas range from 45 to 50 million bags after a harvest in excess of 50 million bags last year. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. That has created the best demand in years for inferior qualities of Coffee from the rest of Latin America. The buying has been done at weaker differentials. Differentials for better qualities are stable. Demand seemed to go quiet last week in Central America, but offers are still available. The charts show that both New York and London have been rallying, but that the forecasts for rains in northeastern Brazil hurt the bullish momentum.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures moved higher last week and are now testing the top end of the recent trading range. Chart patterns suggest that another move higher is coming and that a test of resistance between 2250 and 2300 basis the nearest futures contract is not out of the question. News of less than expected production in Brazil combined with less on offer from India and Thailand provide the best reasons for higher prices. Thailand did offer Raw Sugar from government storage last week and sold the entire tender. China was also active as the government auctioned Sugar into the internal market. India continues to debate the need for imports. The government is saying no imports are needed and has maintained a high import tariff. However, mills are closing early this year as there is little Cane to process. The Sugar Association there thinks that imports would happen if the government would lower tariffs. Many outside analysts concur, and suggest that imports of at least 2.0 million tons of White Sugar are coming. Internal prices are moving higher. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent, but normal. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remain too dry. Northeast Brazil could see some very beneficial rains this week. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures markets were lower and moved to new lows on the charts in New York and in London. The lower prices are starting to hurt West Africa exporters who sold cheap and did not cover in domestic cash markets. Ivory Coast has voided the sales contracts and auctioned Cocoa to international buyers. It was able to move about 200,000 tons last week. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. The Cocoa needs to start moving. Many exporters can no longer buy as storage in West Africa has been filling up and as demand in consuming countries has not been all that strong. The demand from Europe is reported improved, but still weak overall, and the North American grind has been weaker than anticipated. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

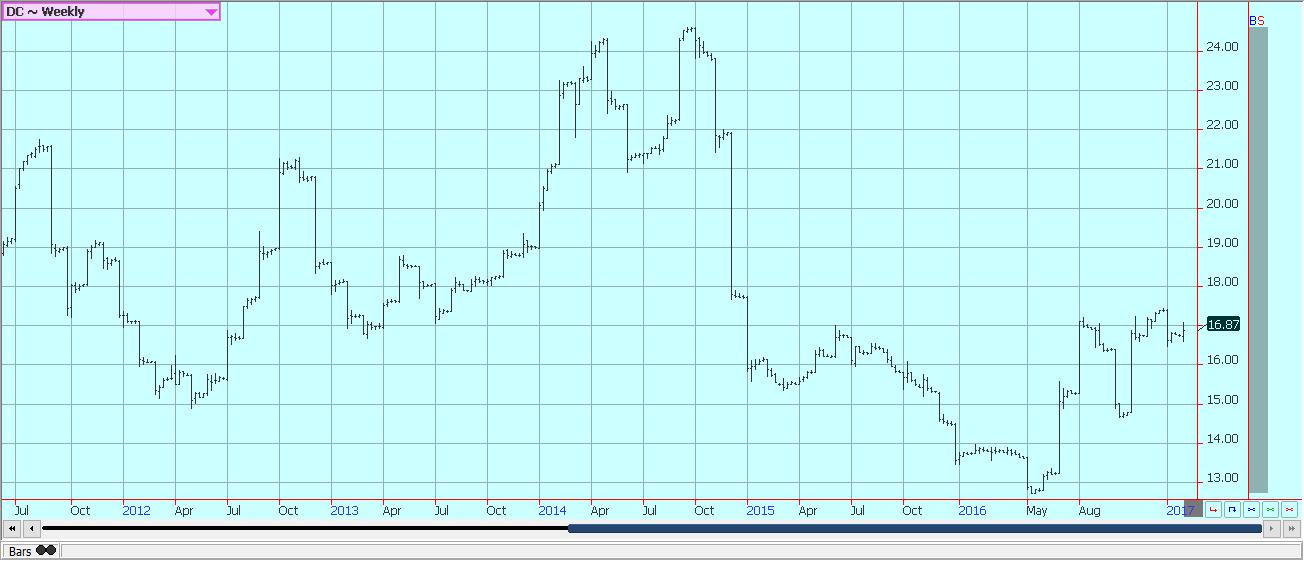

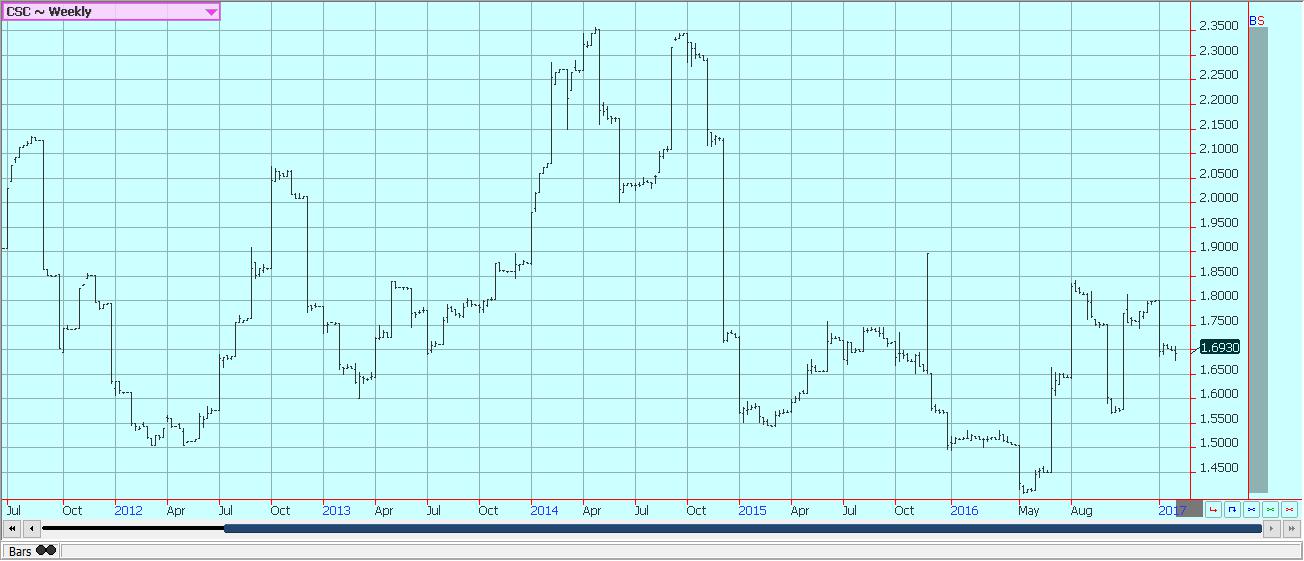

Dairy and meat

Dairy markets were mixed as good supplies of milk remain available to the market. Demand is good enough to meet current production, and prices have been stable. Production has been seasonally strong in the east and west and stable in the Midwest. Butter and cheese manufacturers report that inventories are starting to increase as there is a lot of milk available. This is especially true for Butter, where bulk supplies are going to storage. Cheese supplies are mostly in line with demand right now. Demand is starting to wane for Butter as US prices are above international prices. Cheese demand is also lower with most of the immediate demand met. Butter manufacturers are mostly producing bulk butter for inventories, but there is increasing print butter production in the Midwest. Cheese demand is being met with adequate to strong milk supplies and manufacturing is active. Aged inventories are increasing. Dried products prices are mixed. Whey prices are mixed to strong, and whole milk prices are stable. NDM prices are stable to weak. International markets are featuring higher prices due to reduced production. Production is less in Europe and Russia. Export demand for New Zealand has increased due to stronger demand from China. Production is in a short term decline due to poor pasture conditions. On the other hand, hay supplies in Australia are good even with reports of lower production in January. South American prices are firm as raw milk production goes into a seasonal decline. Argentina is seeing weaker production due to big storms in central and northern areas that has also affected production in parts of Uruguay. Export demand from both countries has been strong, especially from Brazil and Russia. Brazil production is down on hotter weather, especially in southern areas.

US cattle and beef prices were low last week. Auction markets in the Great Plains were $2.00 to $4.00 per hundredweight lower with moderate volumes traded. Beef prices were weaker, and packer margins are still in the red. The Cattle on Feed report showed on feed and marketings at the high end of expectations and placements well above expectations. The semiannual Cattle inventory reports showed increased inventories at all levels, implying that there will be no shortage of Cattle available to the market for quite a while. Australia has less to offer and very high prices. Herd culling has slackened in both Australia and New Zealand. Pasture conditions in both countries is better than a year ago on colder and wetter weather seen until now. Conditions in Australia are very good and surplus hay is reported in many areas. New Zealand now needs drier weather to promote growth.

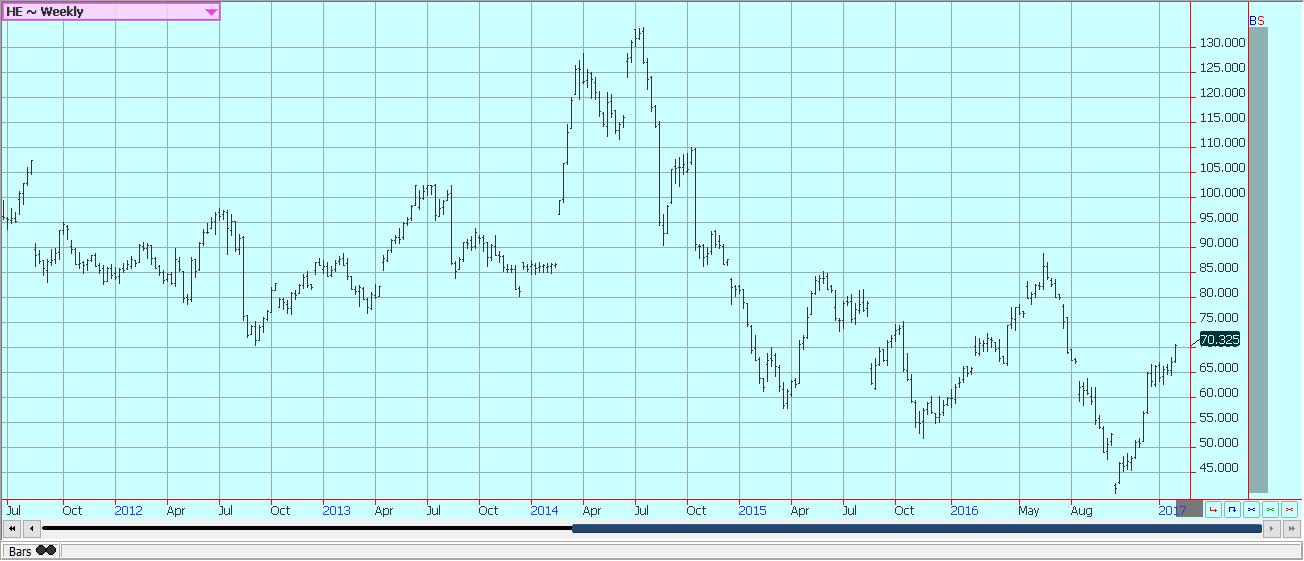

Pork markets have been firm, and live hog futures trends are mostly up. Pork demand remains stronger than expected and ham prices have been contra seasonally strong. News reports of very strong Pork Belly prices were seen last week as bellies in cold storage have really dropped. Pork prices have trended higher in retail and wholesale markets. Export prices have been strong as well. Packer demand has been very good as packers move to meet the strong domestic and world demand. The charts show that the market could remain higher, and strong demand ideas should continue to support the market overall.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoTariff Turmoil Sends Bitcoin and Ethereum Lower as Crypto Markets Face Mounting Pressure

-

Crypto1 day ago

Crypto1 day agoBitcoin Surges Past $72K as Crypto Market Rallies and Kraken Secures US Banking License

-

Crypto1 week ago

Crypto1 week agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Biotech3 days ago

Biotech3 days agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

You must be logged in to post a comment Login