Featured

Agricultural stock news every investor needs to know

The market has been short in Corn as farmers have been holding. That means that there is very little Corn available to the domestic and international cash market. There is a big crop of Oranges out there with not many outlets for consumption. Good growing conditions and increased oranges production estimates by USDA this season have been bearish.

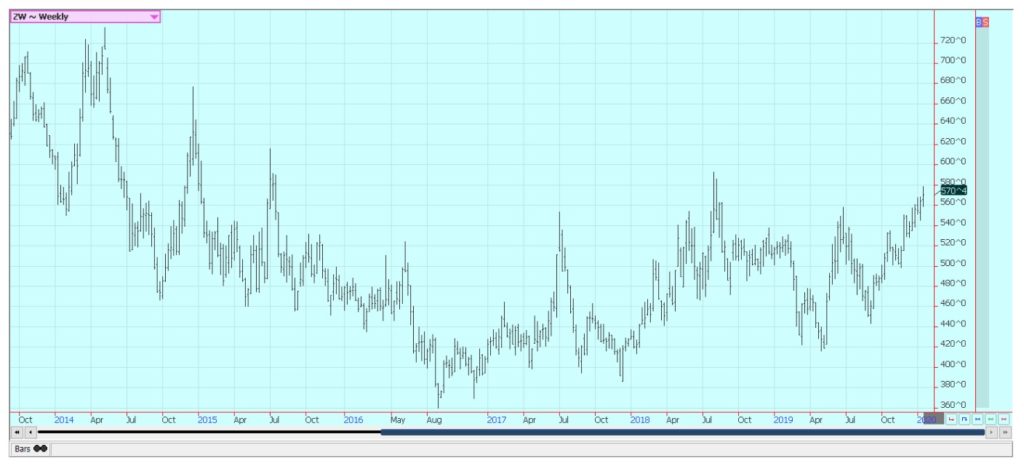

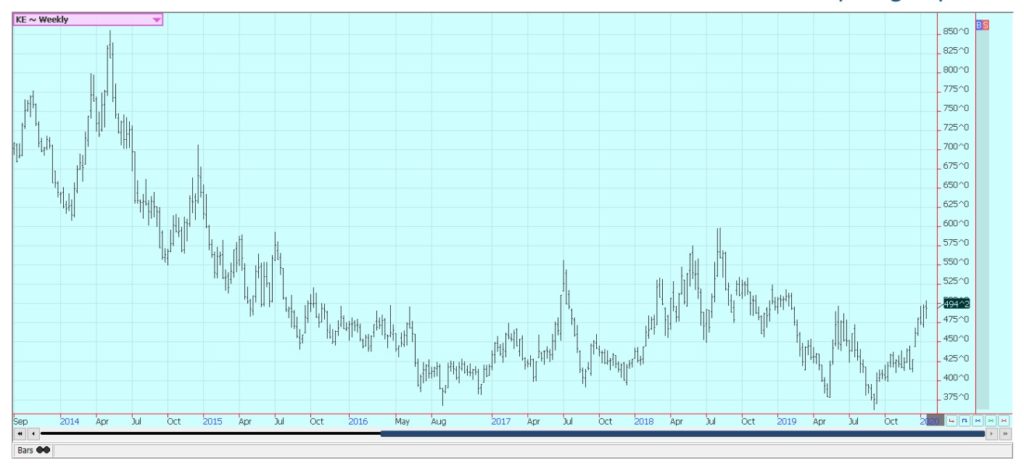

Wheat

Wheat markets were mixed for the week with Chicago SRW and Minneapolis Spring markets a little higher and Chicago HRW fractionally lower. Chart patterns are bullish in all three markets and all are looking forward to increased demand for US Wheat. World markets rallied in the face of reduced production potential for Australia and the Russian supply situation. Russia has less Wheat this year and prices in the Black Sea region have strengthened. The Ruble has also been firmer against the US Dollar and this has also caused Russian prices to form in the world market. World prices will still be dictated by what happens in Europe and the Black Sea area and US prices will most likely remain a follower as the US tries to compete for sales. The lack of production in Russia and in the southern parts of the world means higher prices for now. US farmers planted less Wheat than any time in the last 100 years so no real change in the world scenario of less supply is indicated.

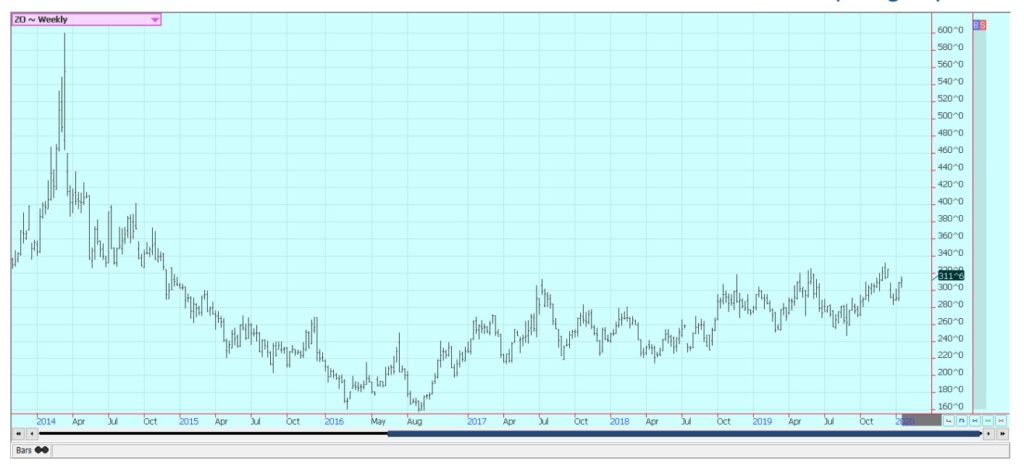

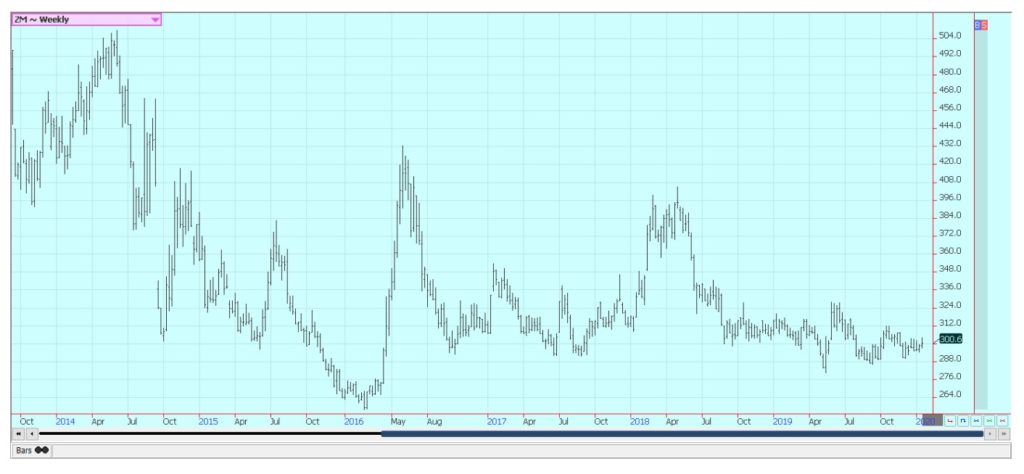

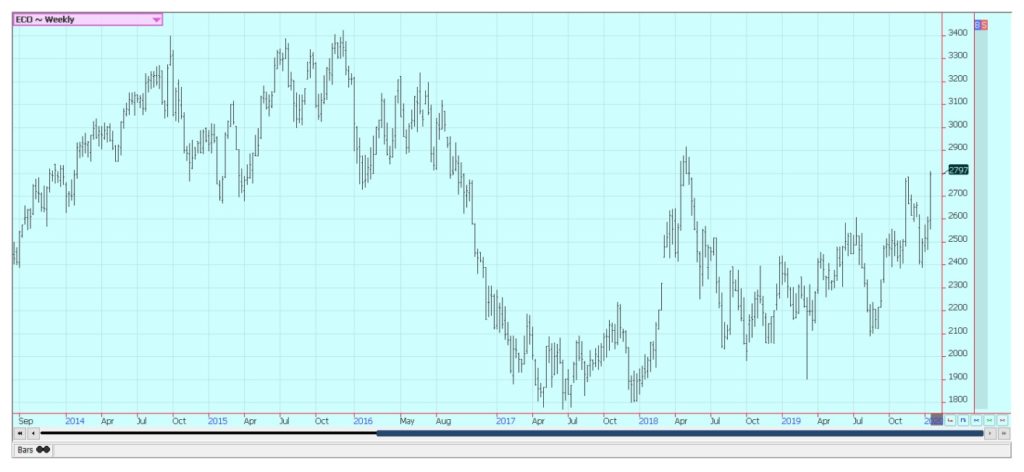

Corn

Corn and Oats moved a little higher last week. The main driver remains demand or rather the lack of identified demand over the short term. Export demand has been disappointing and ethanol and other industrial demand has started to improve but faces an uncertain road ahead. Much of the improved ethanol demand will be seen if and when China starts to buy. Feed demand was improved as seen in the latest quarterly stocks report. That report showed less supplies on hand than expected. There is little Corn available to the domestic cash market. The market has been short in Corn as farmers have been holding. That means that there is very little Corn available to the domestic and international cash market. The weekly chart patterns are bullish for both markets. Corn could trade to 405 and then 420 based off the weekly charts and basis the nearby futures contract.

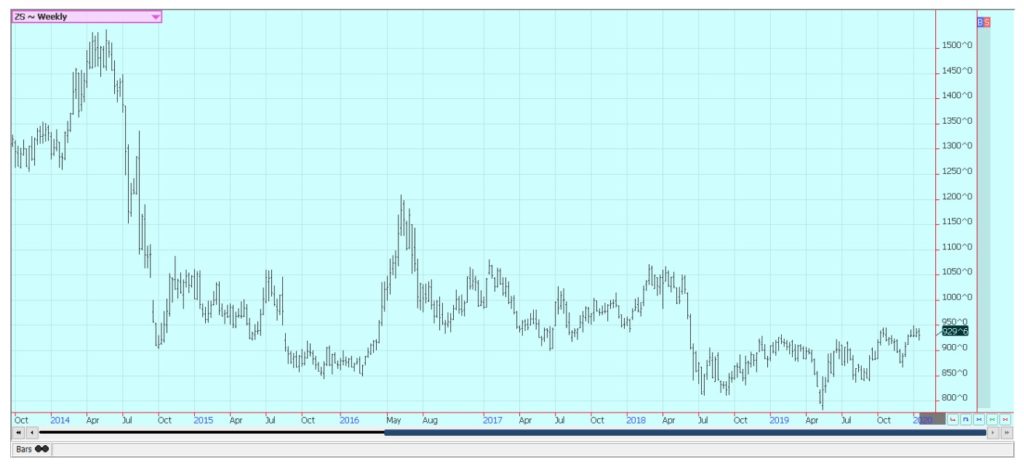

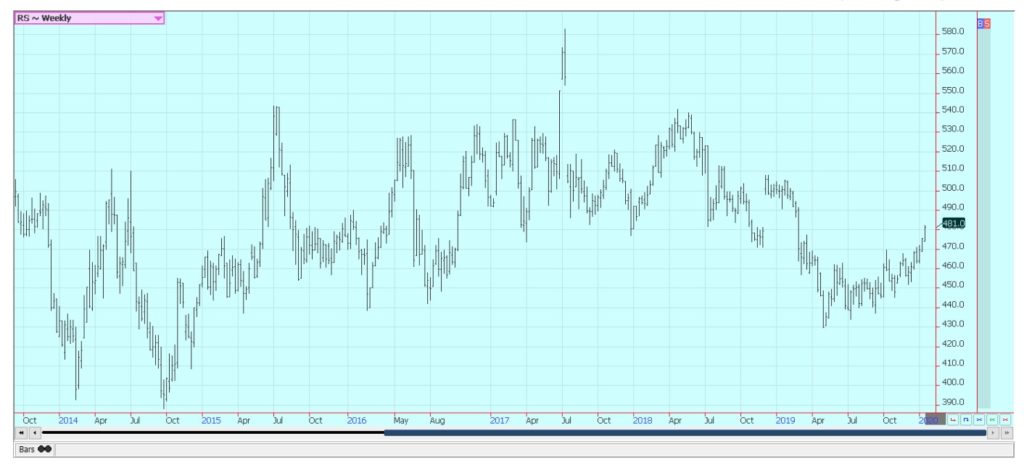

Soybeans and Soybean Meal

Soybeans were a little lower and Soybean Meal were slightly higher for the week. Soybean Meal rallied on spread trading against Soybean Oil which was lower for the week. It was a narrow trading range in Soybeans. The news that the US and China had reached agreement on a Phase One deal that covered agricultural goods was bullish. A signing ceremony was held in the US on January 15 and new buying from China is expected. A lot will depend on the price of US Soybeans and those from Brazil and Argentina. Lower prices there will hurt overall demand here. China will return in the end to buy at least as many Soybeans as it did before the trade war, but when is the main problem and is compounded by good growing conditions and ideas of big crops in South America. Many US producers have put their Soybeans into storage and not selling. This has caused basis levels to firm in the country and at the Gulf of Mexico.

Rice

Rice was sharply higher for the week and made new highs for the move. The tone remains firm but some speculators and producers have been selling. The weekly charts still display a bullish market. Prices are profitable for producers at this time. Some are also selling the next crop and the trade and open interest in the September contract is relatively large for the time of year. More selling from producers of the next crop is expected on any further rally attempts. Demand for US Rice remains generally positive and the export sales pace in general has been very good. The US domestic market is now quiet with the harvest mostly done and no one real interested in selling. Mills and exporters are thought to be covered.

Palm Oil and Vegetable Oils

World vegetable oils markets were mixed, with Palm Oil and Soybean Oil closing lower and Canola a little higher. Soybean Oil closed lower after finding some selling interest on competition from Argentina and the weakness in Palm Oil. Palm Oil was hurt by the political spat between India and Malaysia. Indian government officials objected when the Malaysian Prime Minister made comments about the new immigration policy of the Indian government that could discriminate against Moslems. The Indian government has asked importers to refrain from buying Malaysian Palm Oil instead of Indonesian or other competitors. Demand for Palm Oil from Chia could take a hit with the new trade agreement between the US and China. The trends in Palm Oil turned down on the weekly charts last week. Soybean Oil trends are also down, but Canola trends are sideways to up at this time.

Cotton

Cotton was slightly lower last week despite the strong up move on Friday. The weekly charts still show bullish trends and ideas are that further price gains are coming. A catalyst for the rally has been the trade deal between the US and China. China has been buying Cotton from the US and Brazil as it needs higher quality Cotton to blend with its domestic production. It did not really buy last week but will probably resume buying once the new trade deal is signed on January 15. The market has not been able to move a lot in terms of price for the last month as the harvest has been ongoing amid some stressful conditions. The harvest is now about over and certified stocks are now leveling off.

Frozen Concentrated Orange Juice and Citrus

FCOJ was lower for the week and the situation remains bearish. Futures are back to trading at the lower levels of the trading range on the weekly charts. There is a big crop of Oranges out there with not many outlets for consumption. Good growing conditions and increased oranges production estimates by USDA this season have been bearish. The weather has been great for the trees as there have been frequent periods of showers and no severe storms so far this year. Many areas have been dry lately and irrigation is being used. Crop yields and quality should be high for Florida this year. Inventories of FCOJ in the state are high and are more than 34% above last year.

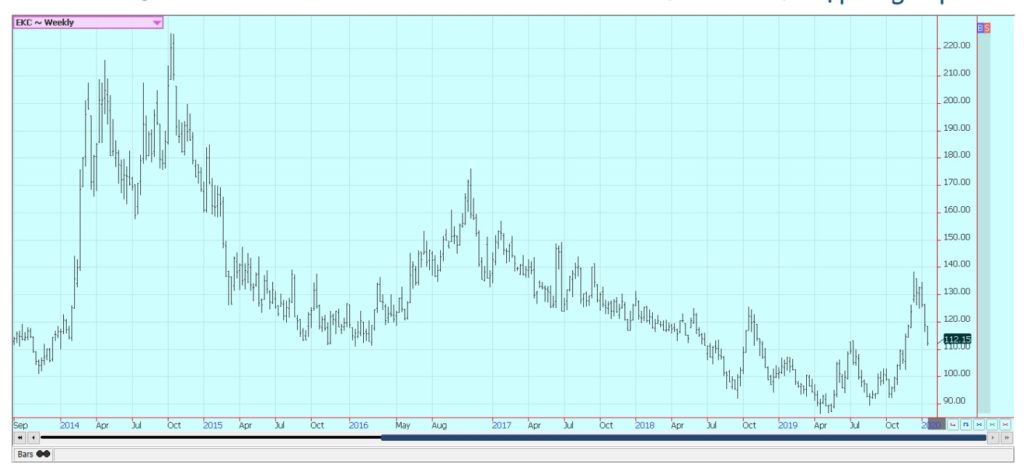

Coffee

Futures were lower for the week in New York and in London. The weekly charts suggest that further price weakness is possible. Rains were reported in Brazil Coffee areas. The Brazilian crop is developing well but some exporters are out of previous crop supplies to sell. They might have found some more to sell in the last week as offers were said to increase from the country due to the weakness in the Real. It is dry in other parts of Latin America. Central America has had less than normal rains, especially in Honduras. Peru is also too dry right now. The Asian harvest is underway but producers do not seem to be selling on ideas that prices are too low. Vietnam exports remain behind a year ago, but the market anticipates bigger offers. Vietnamese crops are expected to be big despite uneven growing conditions earlier in the year.

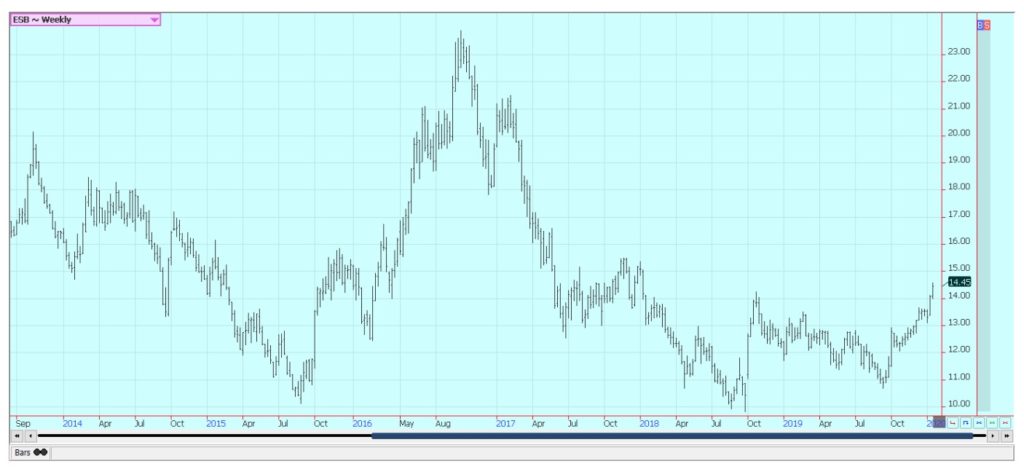

Sugar

The markets closed higher. The US Dollar has turned weaker and this was a signal for Brazil to step up its export pricing program. Reports indicate that little is on offer from India. Thailand might also have less this year due to reduced planted area and erratic rains during the monsoon season. There is still more than enough Sugar for any demand and that India will have to sell sooner or later. Reports from India indicate that the country is seeing relatively good growing conditions and still holds large inventories from last year. However, these supplies are apparently not moving despite relatively strong world prices. Reports of improving weather in Brazil imply good crops there.

Cocoa

Futures closed higher in New York and mixed in London and made new highs for the move. It was an outside day down in London so maybe that market is about done with the current rally. Funds and other speculators were the best buyers in New York but were more two sided in trading in London. Producers were sellers in both markets. Harvest is now active in West Africa and the results so far are very good. Ideas are that demand is currently very strong due to the current price action. The reports from West Africa imply that a big harvest is possible in the region. Ivory Coast arrivals are strong and are above year ago levels. The weather in Ivory Coast is good. The weather is too dry in Nigeria and there are fears that the mid crop is not developing well at this time.

—

(Featured image by Loretta Rossiter from Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Impact Investing6 days ago

Impact Investing6 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Biotech2 weeks ago

Biotech2 weeks agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Business4 days ago

Business4 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech2 weeks ago

Fintech2 weeks agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich