Markets

America’s Fiscal Reckoning: Debt Surge, Deficit Spiral, and the Looming Bond Crisis

America faces a fiscal crisis as debt soars to $37 trillion and annual deficits approach $2 trillion. Interest payments now exceed defense spending, and the debt may hit $67 trillion by 2035. Credit ratings are falling, bond markets face turmoil, and investor confidence is waning. A financial reckoning, akin to the UK’s 2022 crisis, looms.

We find it mandatory to now put a bright spotlight on America’s dire fiscal condition.

America’s debt rose from less than $6 trillion in 2000 to over $37 trillion today. Our debt is now 720% greater than our annual revenue. The Nation’s annual deficit for fiscal 2025 is projected to be $1.9 trillion, or 6.2% of GDP.

The US Government now spends more on interest payments on the National Debt ($1.11 Trillion) than National Defense ($1.10 Trillion). The CATO Institute projects that the US government will pay $2 trillion in interest payments on all this debt in the next 10 years.

The America’s trade deficit also hit a new record, rising to $1.1 trillion over the last 12 months; that is 10 times more than in 2000

By 2035, according to the CBO, the annual fiscal deficit will rise to $2.7 trillion, and the National debt will reach over $58 trillion, which is nearly 130% of GDP. But this is under the assumption that the Tax Cut and Jobs Act (TCJA) sunsets as scheduled and we get an additional $4 trillion in revenue. But both parties have shown no willingness to cut spending. And so, a plan to increase the debt and deficits, along with a $4 trillion increase in the debt ceiling is well underway in Washington.

However, in addition to the $4 trillion extra debt from the continuation of the TCJA, you must add in the President’s plan to eliminate taxes on tips, overtime, and Social Security, as well as making $10,000 of auto loan interest deductible, which would add $2.5 trillion more to the debt pile. Of course, the hope is that some of this debt increase will be offset by the additional revenue we might garner from the economic growth engendered by tax cuts. But that growth could be offset by soaring interest rates from all this new debt that is being piled on top of an already untenable fiscal situation.

When you add it all up, instead of adding the CBO’s projected $22 trillion in new debt over the 10-year horizon, the US will add nearly $28 trillion. But again, that is, if interest rates are quiescent and economic growth remains strong throughout the decade. The $28 trillion will, of course, be much worse if we have a recession in the next decade, which is virtually guaranteed to occur as the US has averaged a recession every 6.5 years since WWII.

Therefore, a more realistic estimate is that the US will add about $30 trillion in new debt in the next decade, bringing the total to around $67 trillion. For reference, it took 250 years of US history to accumulate the current $37 trillion debt.

This situation in America is so obviously horrendous that even Moody’s has started paying attention

The credit ratings agency cut the United States’ sovereign credit rating down one notch, citing the growing burden of financing the federal government’s budget deficit, which is already over $1 trillion with five months left in the fiscal year.

The deficit in America has so far increased by 13% from the previous fiscal year. Moody’s also highlighted the rising cost of rolling over existing debt amid high and rising interest rates, saying, “As a result, we expect federal deficits to widen, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024.” The Moody’s downgrade finally lines the rating’s agency up with both Standard and Poor’s and Fitch’s rating downgrades.

There are now 11 countries with a higher credit rating than the US. They are Australia, Canada, Denmark, Germany, Liechtenstein, Luxembourg, Netherlands, Norway, Singapore, Sweden, and Switzerland.

America is heading for what has now become known as a Liz Truss moment

Liz Truss became Prime Minister of the United Kingdom on September 6, 2022, after being chosen by the Conservative Party leadership election. She resigned from the position on October 20, 2022, just 49 days later. Truss’s demise came about when she tried to push through a large package of tax cuts without offsetting reductions in spending. Investors revolted, dumping long-term UK bonds and sending yields soaring more than 150 basis points in just a few days. The US should soon suffer the same fate.

After all, how high will yields have to climb before the Treasury market attracts enough buyers to finance the avalanche of new issuance? The Fed is still in a muted version of QT and is certainly not now engaged in the broad expansion of its balance sheet. Also, foreigners are no longer willing to park their trade surpluses and savings in US debt due to sanctions, confiscations, tariff wars, stubborn inflation, and insolvency concerns.

And now, since the bond bubble is bursting globally, they also have the option of buying and holding their own debt because their domestic interest rates are rising. For example, Japan, the largest foreign holder of US debt, has seen its benchmark borrowing rate spike over 1.5% after being negative in nominal terms from 2016 thru 2021.

In the end, the US simply does not have the savings to meet the tsunami of supply. Unfortunately, the nation’s printing press will be forced to supplant the free market.

The result should be extreme interest rate volatility and a full revolt in bond prices. At least until the Fed assents to an aggressive bond-buying program. But that will only exacerbate the current inflation problem in America, which has already eviscerated the bottom three quintiles of consumers.

Chaos in the bond market will not be kind to the real estate and equity bubbles. Does your typical set-it-and-forget-it portfolio manager have 60% of your portfolio in long-term bonds and 40% in risky equities? Instead, investors may be far better off owning the short end of the yield curve right now while actively trading the equity portion according to the second derivative of inflation and growth. Maintaining maximum flexibility has become the best option for success.

__

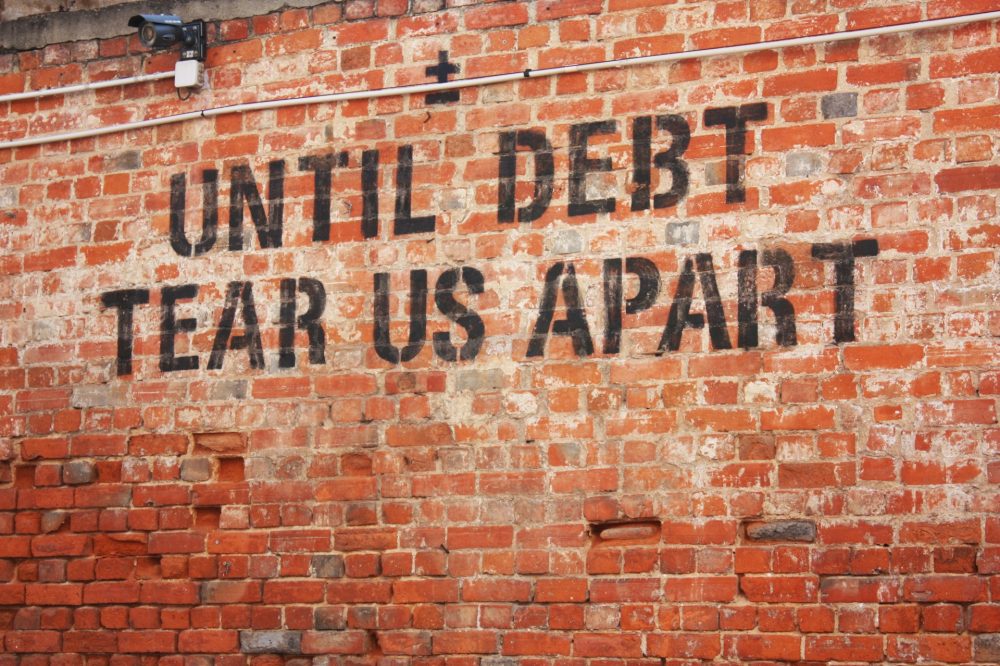

(Featured image by Julie Ricard via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEU Backs 90% Emissions Cut by 2040 and Delays ETS2 Rollout

-

Markets6 days ago

Markets6 days agoMarkets, Jobs, and Precious Metals Show Volatility Amid Uncertainty

-

Biotech2 weeks ago

Biotech2 weeks agoDNA Origami Breakthrough in HIV Vaccine Research

-

Cannabis3 days ago

Cannabis3 days agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns