Business

Asian cotton production could provide competition in the marketplace

Cotton export demand has faded in the last couple of weeks, but the overall demand remains good.

Latest news from the agriculture market: Cotton export demand was cut on a year to year basis to 14.0 million bales, from 14.5 million in the current year as Asian production could recover and provide more competition in the marketplace.

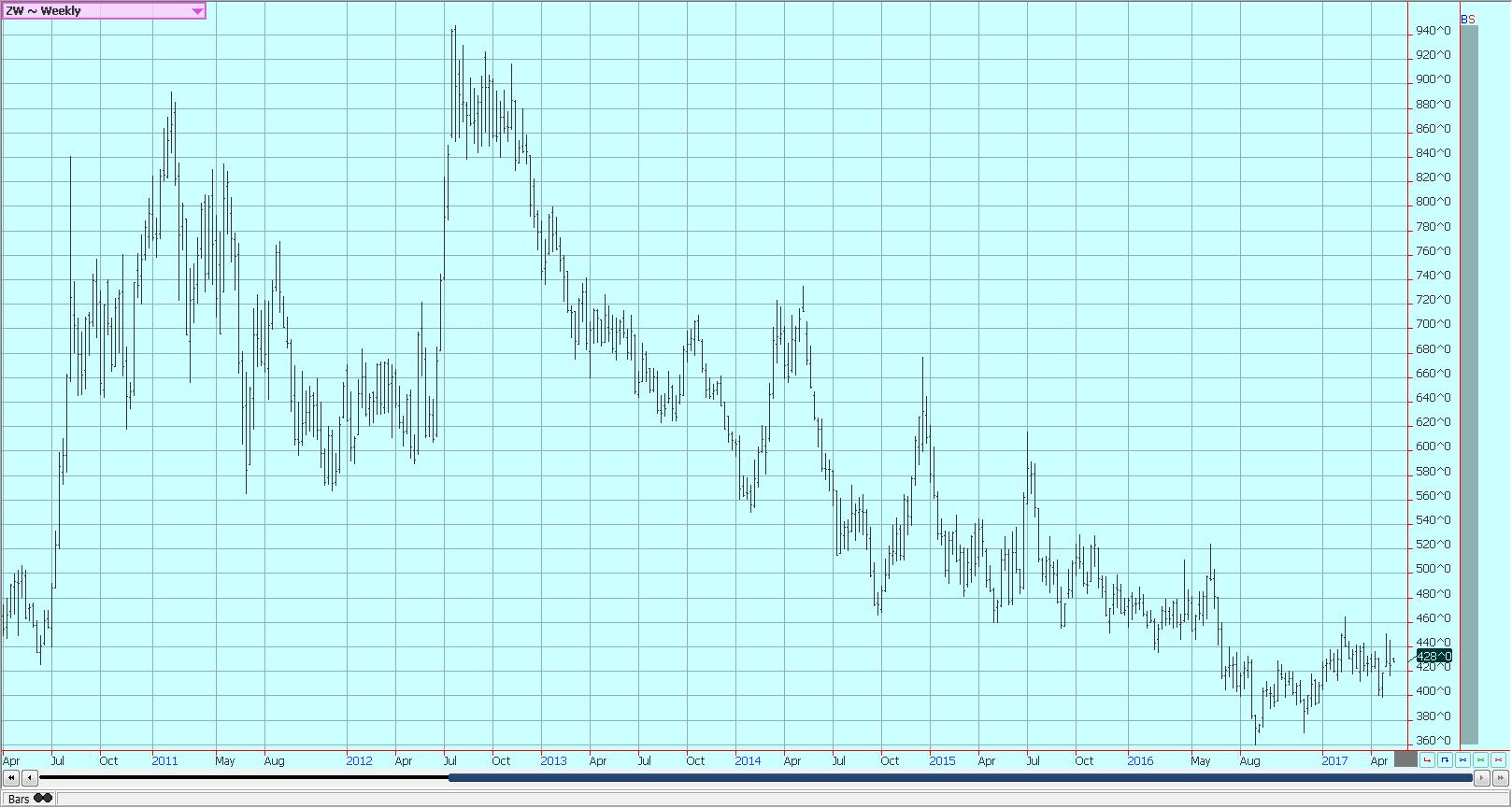

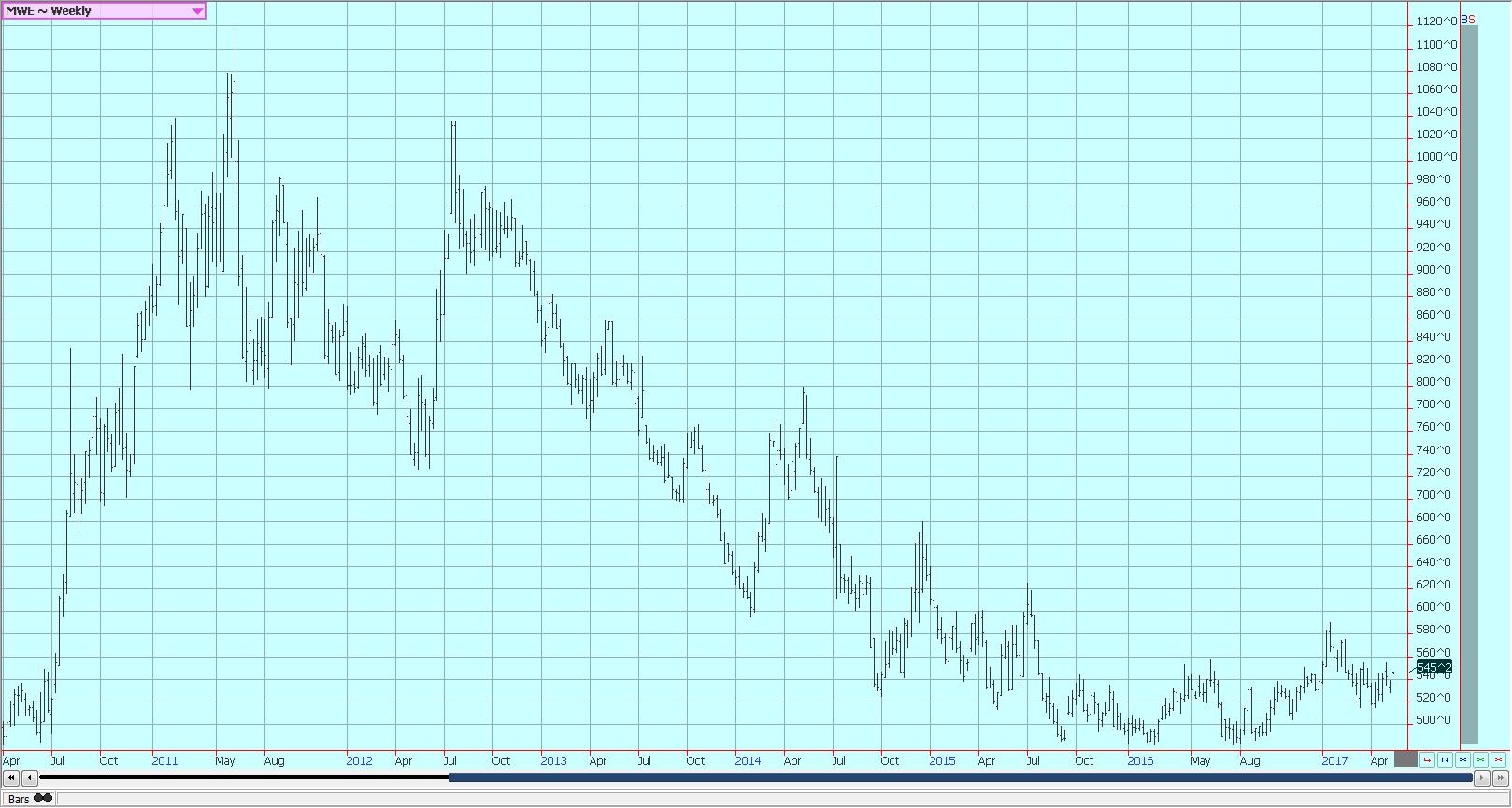

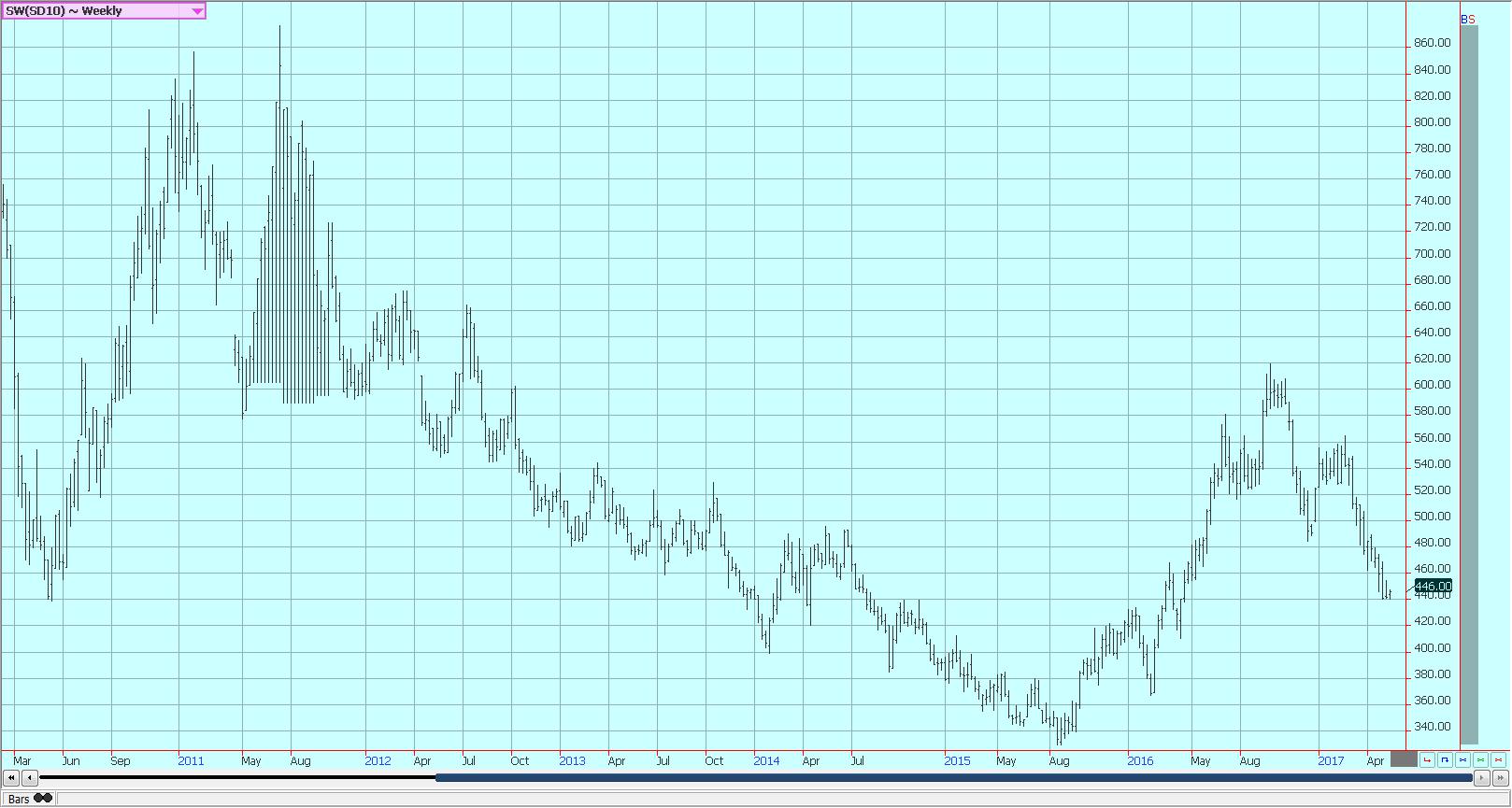

Wheat

US markets were lower as selling developed before the USDA production data and in response to ideas of higher production that were generated from the Kansas Wheat Tour. However, USDA showed less than expected production and prices started to rally again late in the week. USDA estimated all winter wheat production at 1.25 billion bushels, down 35% from last year. The biggest drop was in Hard Red Winter production which is estimated down 32% from last year at 737 million bushels. Soft Red Winter production was 297 million bushels, down 14% from 2016, and White Winter was 212 million bushels, down 13% from 2016. Hard Red Winter Wheat production was below average trade guesses and was the biggest surprise in the report.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

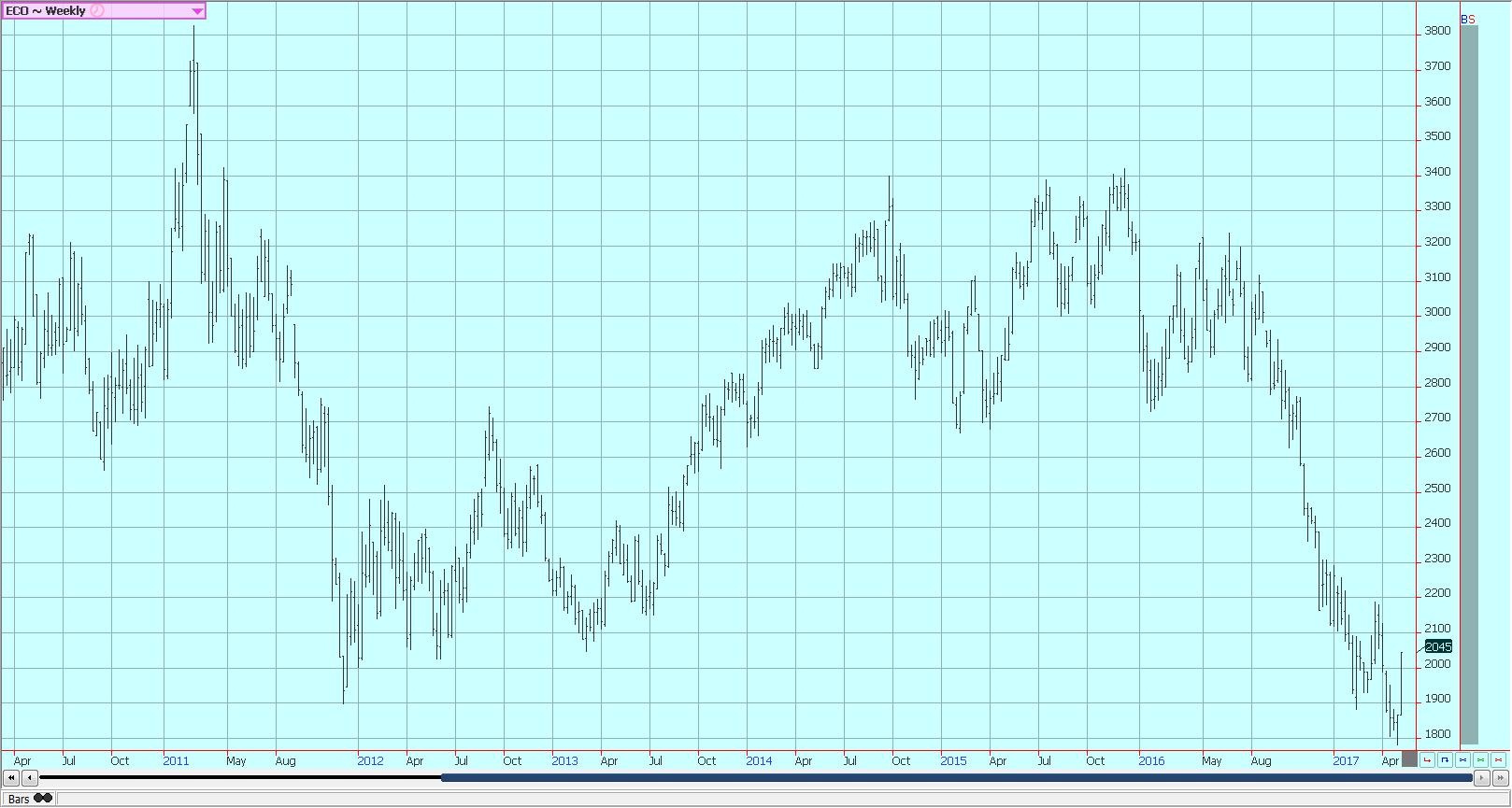

Corn

Corn remained in a narrow trading range last week and the weekly charts show sideways trends. The market remains a weather market, but farmers have been able to work on wet spots and get a lot of the crop planted. USDA showed that planting progress was as good as could be hoped for last week, and a big jump in planting progress is expected in the reports that will be released on Monday afternoon.

The weather remains less than perfect for farmers with forecasts for more rain, and the rain and cool temperatures have not only inhibited planting progress but initiate emergence of the crop. Extensive replanting might be needed in some areas of the Midwest where the rains and cool weather have most affected the crop. Production ideas could be overstated for those reasons.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

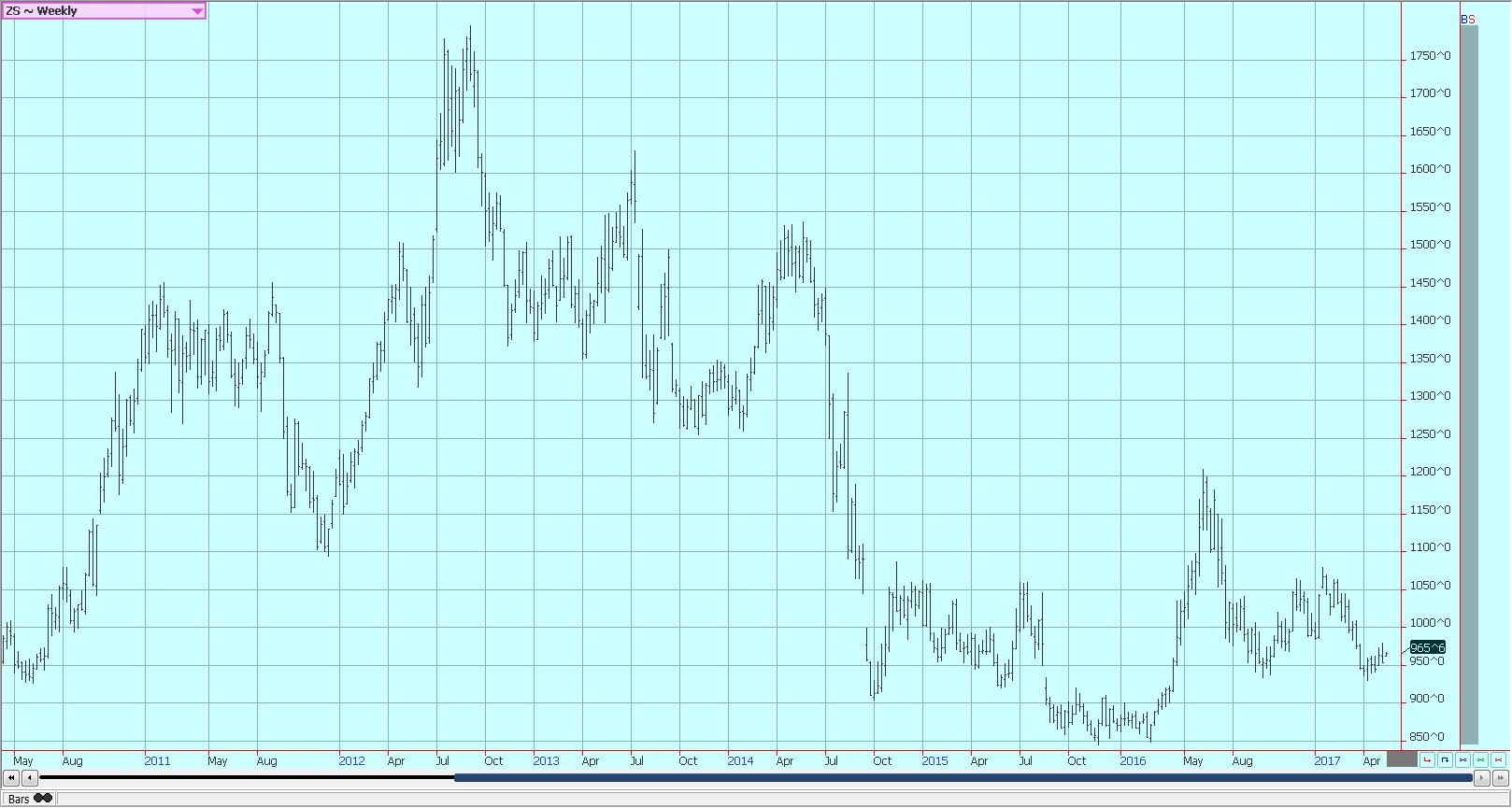

Soybeans and soybean meal

Soybeans and soybean meal were both lower last week. The selling is related primarily to the threat of strong competition in the short term from South America. However, Brazil producers remain very reluctant sellers amid the political problems inside the country and both Brazilian and Argentine producers are unhappy with the strength of their currencies against the US Dollar as they earn less in local terms for exported soybeans and products.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

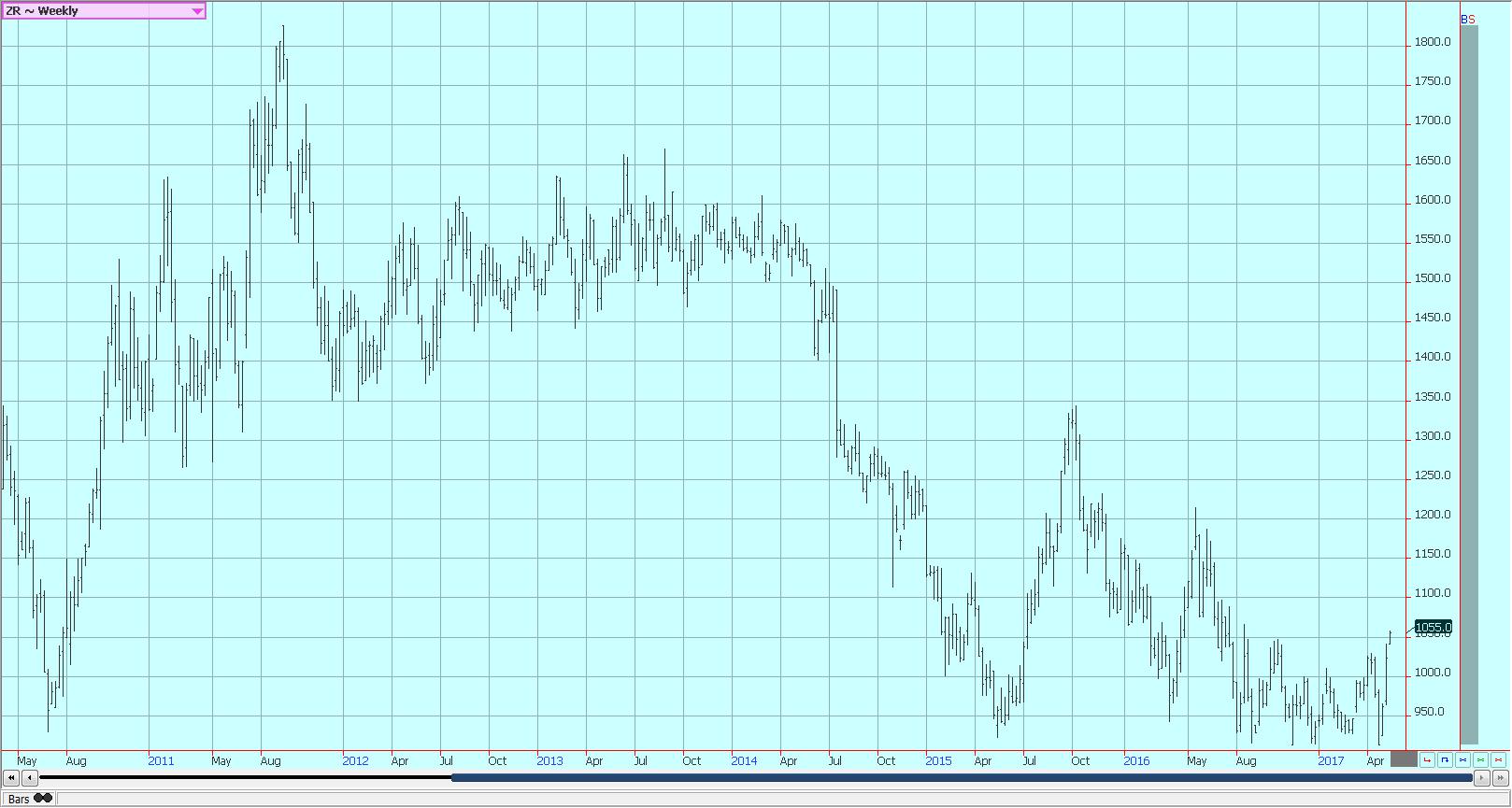

Rice

Rice reacted to the USDA reports with a sharp rally for the second half of the week. The reports were considered bullish for prices as USDA cut production more than the trade expected. Production for the coming year was projected at 201 million hundredweight, from 224.1 million for the current year. Demand was cut on the domestic side which was a surprise for many market participants as demand for the last few years has been rather stable. In addition, immigrants from Asia and Latin America generally eat a lot of rice, so demand ideas usually trend slightly higher on a year to year basis.

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils markets were higher last week. Palm oil was the strongest market as export demand held relatively well and on mixed production ideas. The demand was about 12% higher on a month to month basis in Malaysia in the data reported by the private surveyors. Reports from the interiors of both countries suggest that trees in both Indonesia and Malaysia have been slow to respond to improved conditions, and MPOB production in the last few months has been generally below trade expectations.

Weekly Malaysian Palm Oil Futures © Jack Scoville

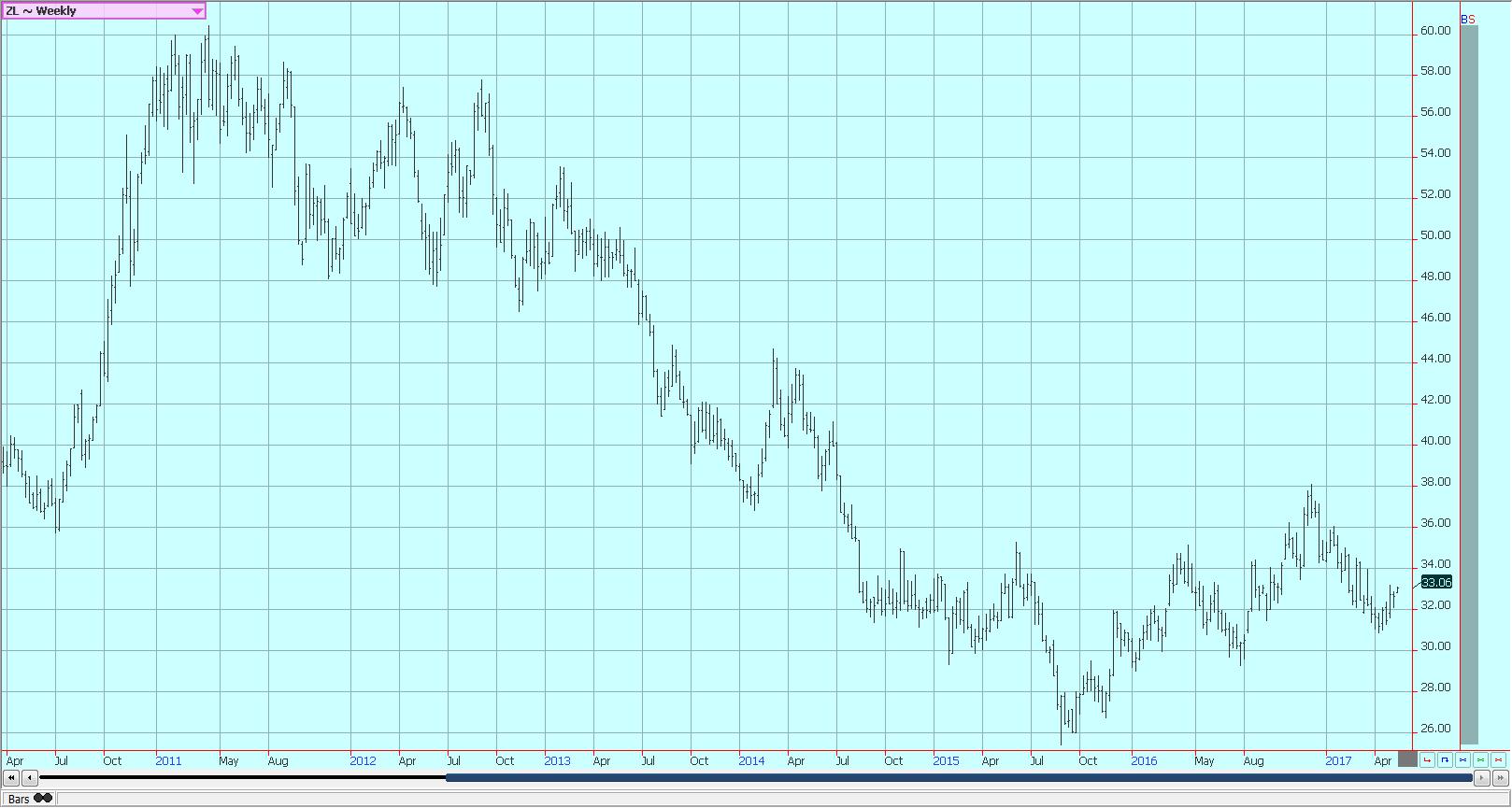

Weekly Chicago Soybean Oil Futures © Jack Scoville

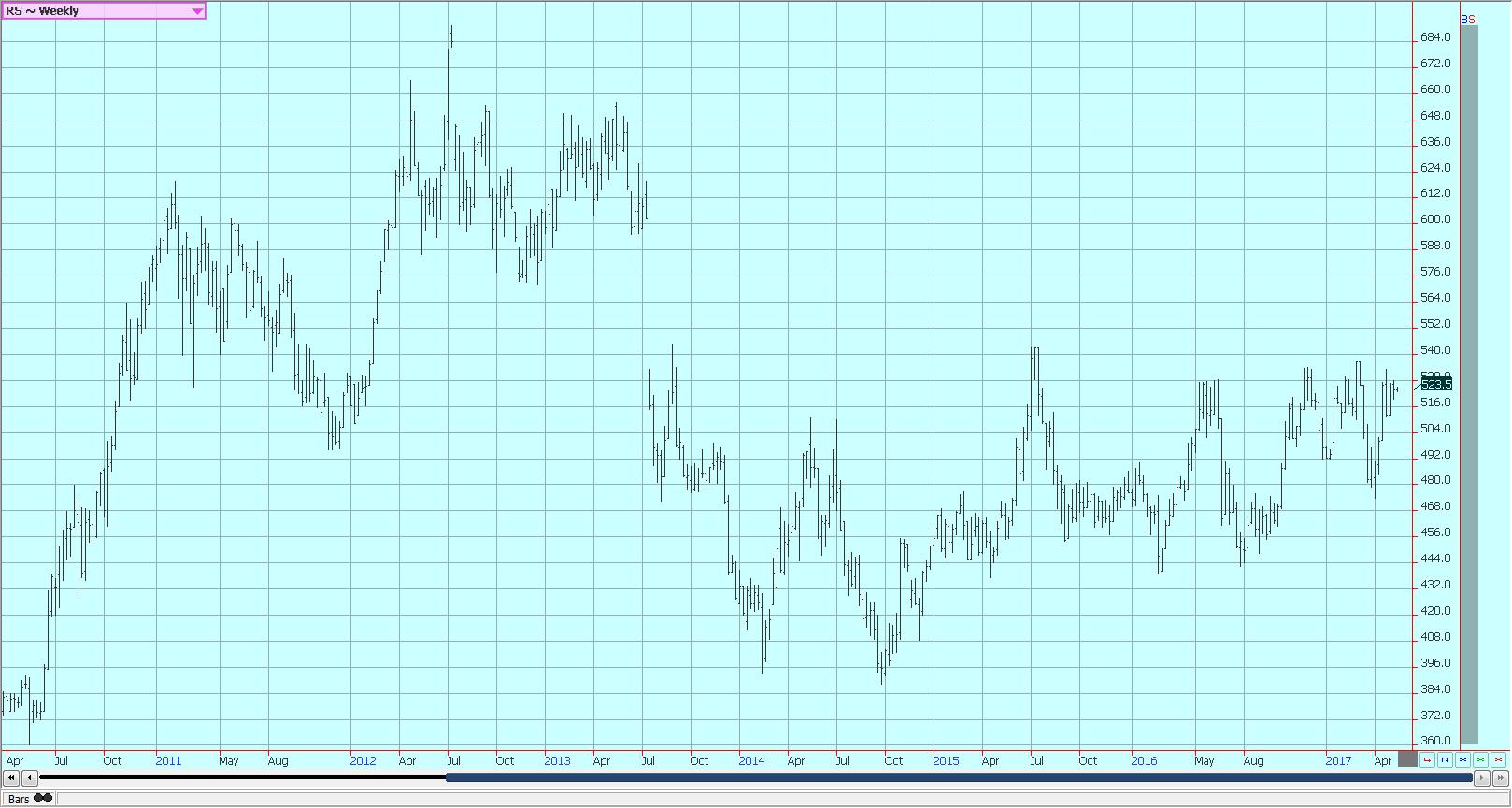

Weekly Canola Futures © Jack Scoville

Cotton

Planting progress was slow last week due to the rains and cold temperatures and should be much more active this week as the weather is expected to improve. WASDE showed the potential for a big US crop as it estimated production at 19.20 million bales, from 17.17 million in the current year. Export demand was cut on a year to year basis to 14.0 million bales, from 14.5 million in the current year as Asian production could recover and provide more competition in the marketplace.

Weekly US Cotton Futures © Jack Scoville

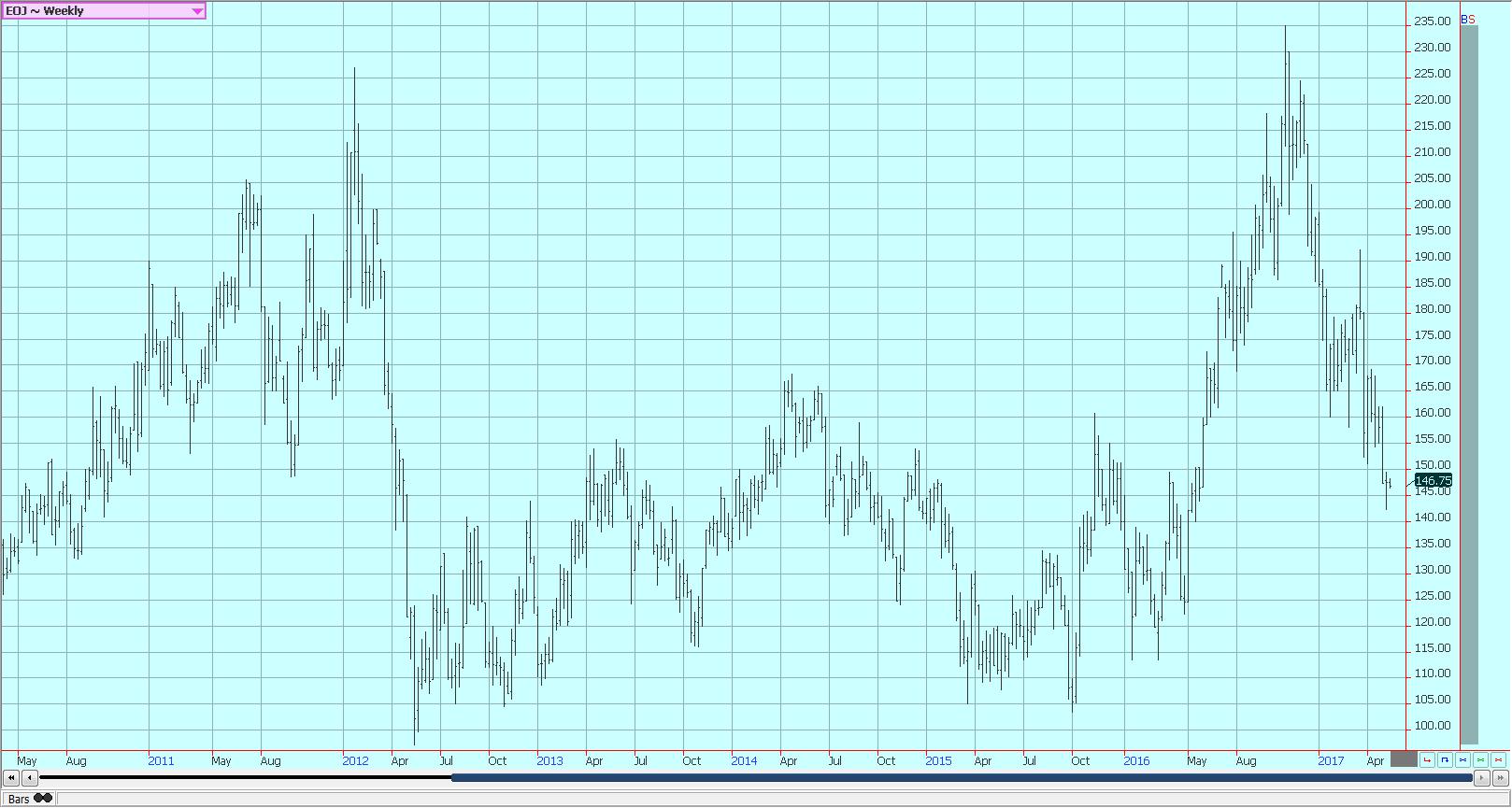

Frozen concentrated orange juice and citrus

FCOJ closed lower in mostly quiet trading. USDA increased Florida production to 68 million boxes, from 67 million in the previous report. IBGE in Brazil increased production estimates for that country, so the news was rather negative for futures traders. Brazil has been exporting FCOJ to the US to cover the short Florida crop. The Florida Movement and Pack report showed imports were over 7 million gallons last period, from under 5 million a year ago.

Weekly FCOJ Futures © Jack Scoville

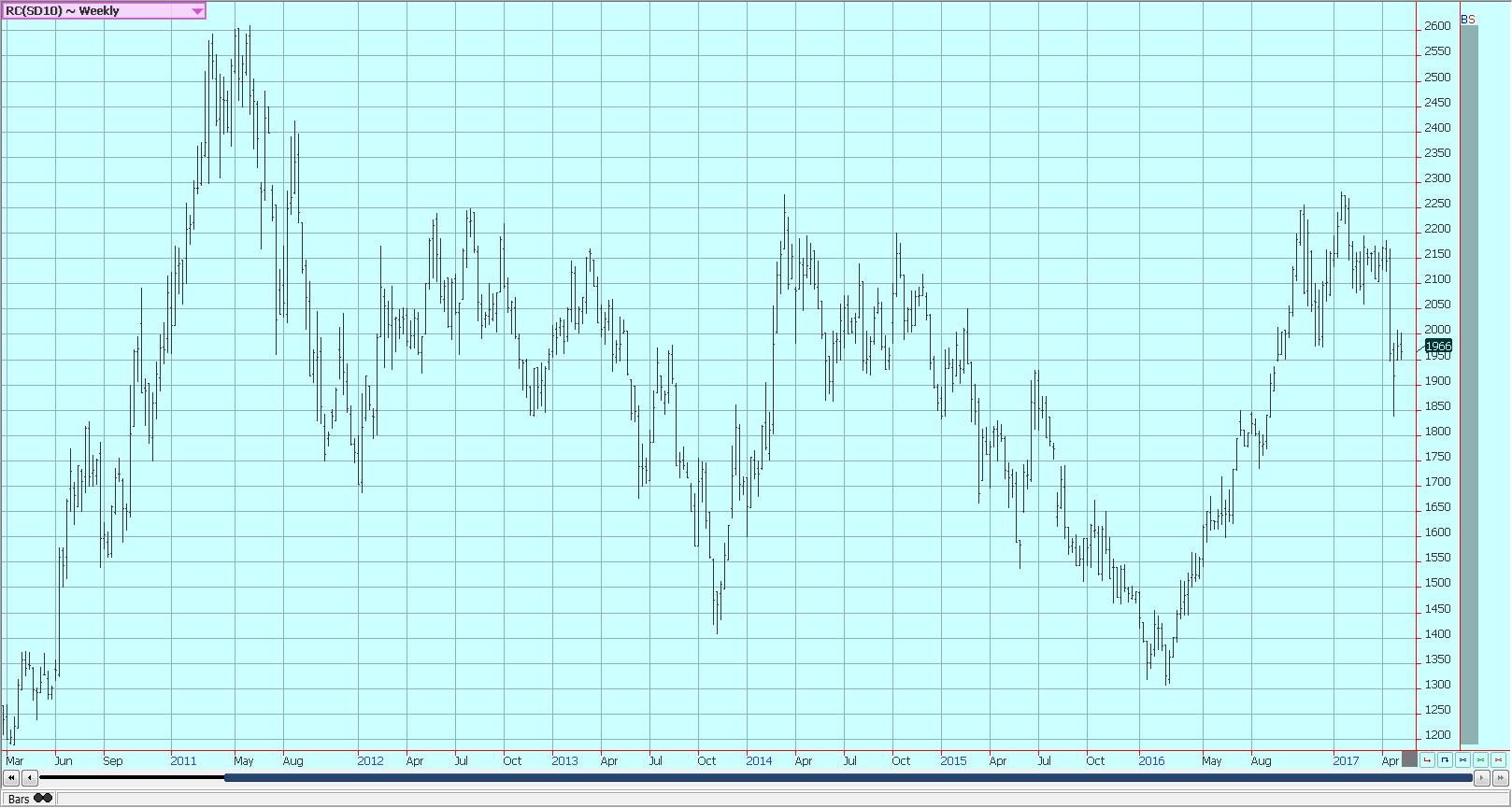

Coffee

The market action remains less than strong overall due to ideas of good supplies and reports of weak demand. The cash market remains slow. Offers remain in the cash market, and differentials are stable. Buyers remain quiet and appear ready to use already contracted supplies. New York has featured some buying support from commercials as they fix prices for differentials purchases, but there was plenty of speculative and commercial selling last week as well.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

It was mostly a sideways week in New York and London, and New York moved away from support areas, but really did nothing to change the overall chart patterns. Ideas are that prices can remain generally weak, and futures are still below breakdown points on the weekly charts. The fundamentals are changing from a tight supply situation to one with more supplies available to the market. Production conditions have been better this year in Brazil, and a better harvest is anticipated in the next couple of months despite the weak start as demonstrated in the initial UNICA data a couple of weeks ago.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

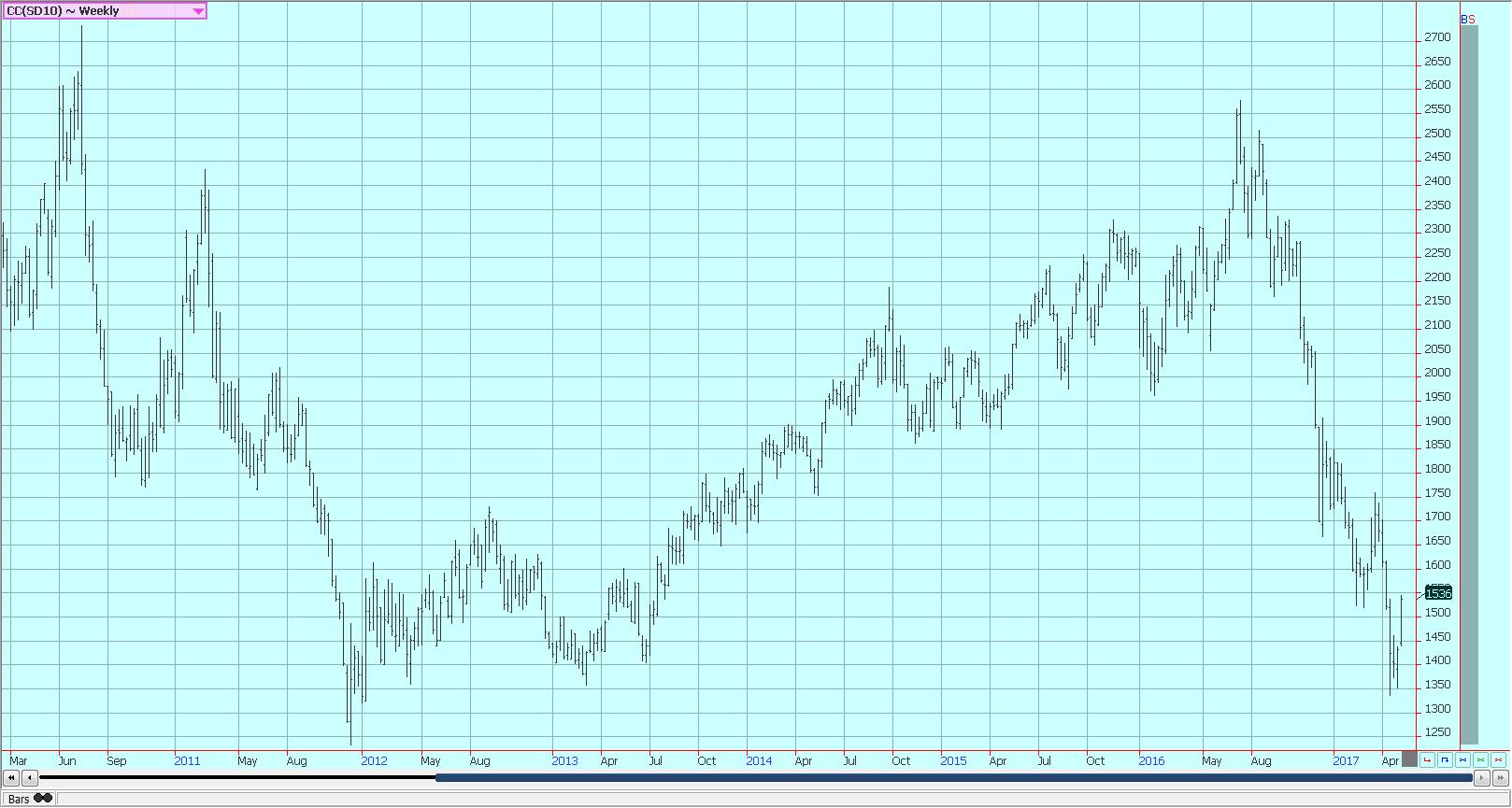

Cocoa

Futures markets were higher last week as both markets showed that at least a short term low has been made on the daily charts. The mid crop harvest is in full swing in West Africa, and ideas are that the quality of the mid crop is good. The demand from Europe is reported weak over all, and the North American demand has been weaker.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

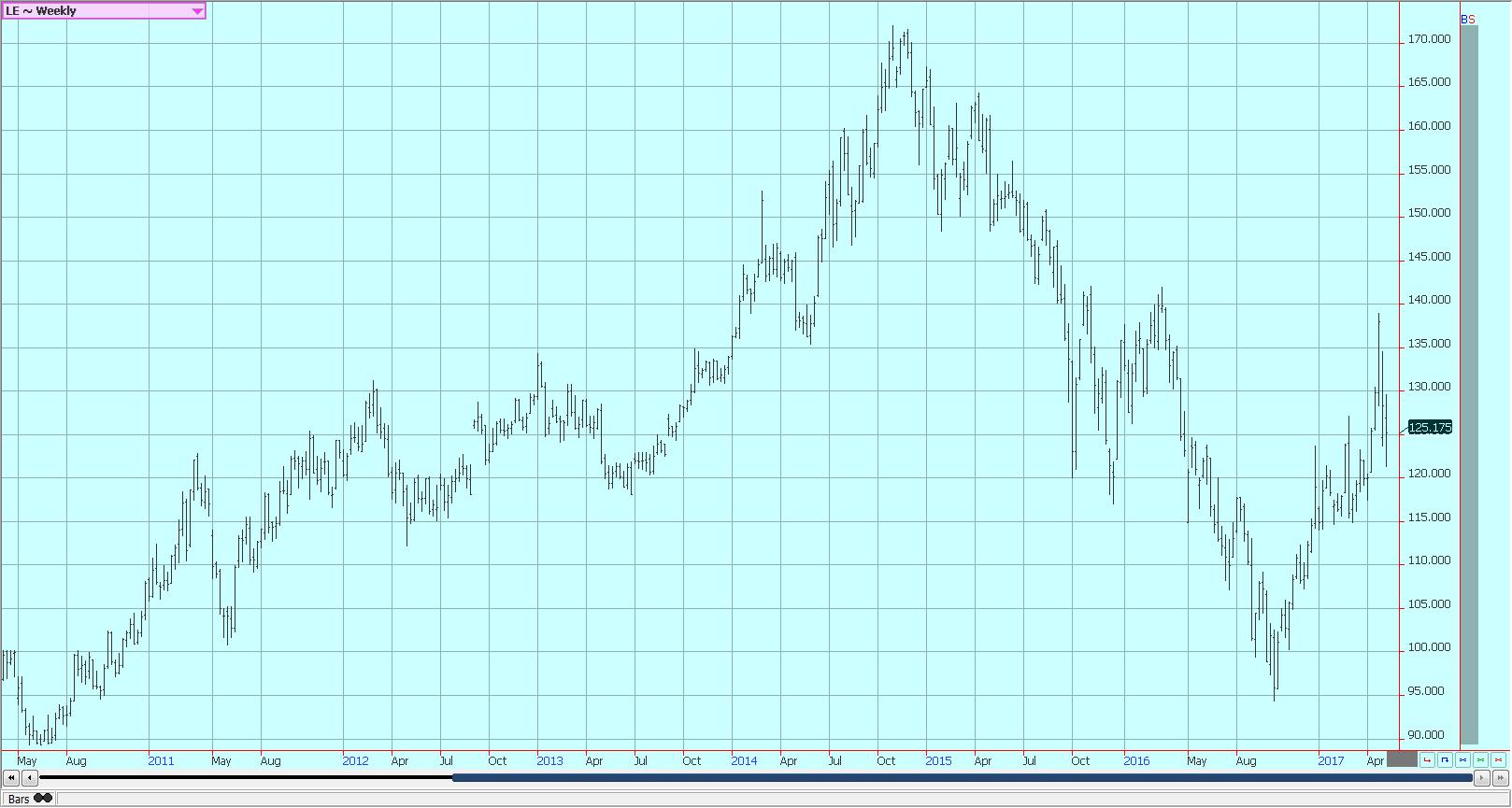

Dairy and meat

Dairy markets were higher and made new highs for the move. The daily charts imply that a seasonal low was made a couple of weeks ago and that a trend to higher prices should continue It looks like the annual US flush is over. Supplies are strong seasonally in all areas of the US. Demand is good for cream, and cheese makers are displaying increasing demand.

US cattle and beef prices were higher. The beef market has been strong, but packers paid lower prices for cattle last week after the big move higher in prices that was seen in the previous week. Feedlots are very current with supplies and are pulling cattle ahead in order to take advantage of the high prices. The trade is worried about a trend change to down given that the market has been very strong, but the cash market keeps holding and demand is also holding. April went off the Board on Friday and now June is too cheap when compared to cash prices. That implies that the market will need to rally again this week.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

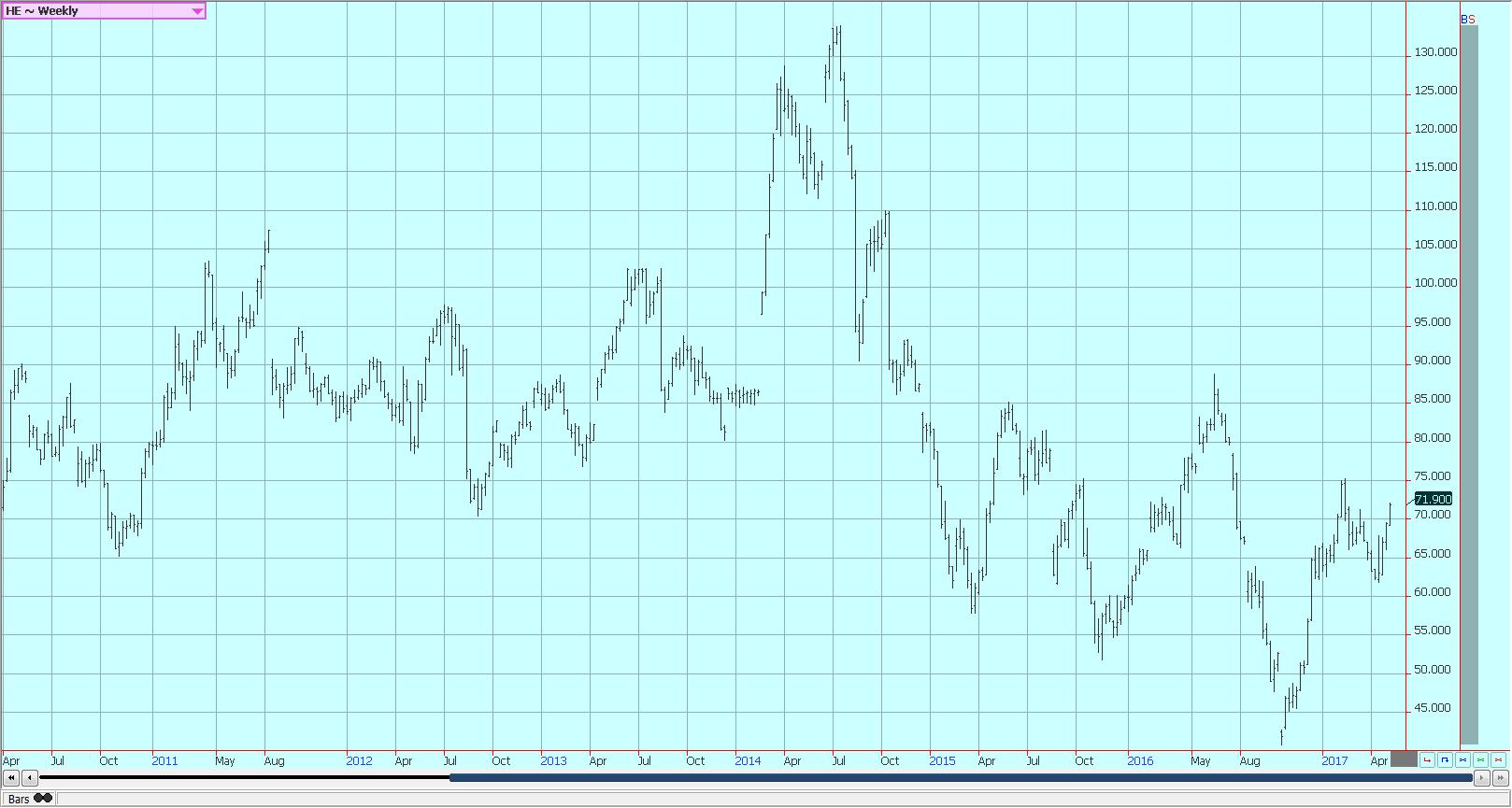

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto6 days ago

Crypto6 days agoCoinbase Surges: Bernstein Targets $510 as COIN Hits Highest Price Since IPO

-

Africa2 weeks ago

Africa2 weeks agoBank of Africa Launches MAD 1 Billion Perpetual Bond to Boost Capital and Drive Growth

-

Markets1 day ago

Markets1 day agoCoffee Prices Decline Amid Rising Supply and Mixed Harvest Outlooks

-

Crypto1 week ago

Crypto1 week agoBitcoin Recovers After U.S. Strikes Iran, While Altcoins Face Sharp Losses

You must be logged in to post a comment Login