Mining & Energy

Black Gold, Red, White & Blue: Why BGX Is Built for the “Drill, Baby, Drill” Era

BGX is shaping up as an ideal high-upside play in the “Drill, Baby, Drill” era as it aggressively expands into Indiana’s low-cost Illinois Basin to capitalize on pro-drilling policies, rapid permitting, and near-term production opportunities. Its strategic onshore assets, combined with prudent diversification and strong management, offer substantial growth potential with limited downside.

Since the day Donald Trump revived the Republican Party’s “Drill, Baby, Drill” slogan, reactions from oil and gas analysts have been mixed. And understandably so. While the strategy is, without doubt, one that will boost U.S. oil and gas production, it is not without its threats and opportunities.

On the one hand, Trump-era pro-oil energy policies, marked by reduced regulations, expanded drilling permits, and a strong focus on U.S. energy independence, present a potential boon for U.S.-focussed oil and gas juniors like Black Gold Exploration Corp. (BGX) [CSE: BGX | FSE: P30]. On the other hand, the policies have also been seen as a potential threat to established oil and gas majors like BP [NYSE: BP] and Shell [NYSE: SHEL].

Immediately, the most obvious consternation among investors and analysts has been the potential downward pressure on oil and gas prices (although additional U.S.-friendly Trump measures, such as tariffs on Venezuelan oil buyers, should offset some of this pressure). Secondary to this, we also see concerns about the potential impacts on large producers with diversified offshore holdings as Trump promises that America will become “dominant” as it “exports American energy all over the world.”

However, concerns among some investors go deeper than these more obvious effects. The deeper reality of the situation is that the policy shift has created a growth-friendly climate that threatens to disrupt the more “shareholder value”-oriented policies seen at oil and gas majors in recent years, all while favoring growth-led juniors like BGX.

Why Growth-Focussed Juniors Like BGX Are Set to Boom While the Majors Lag

In recent years, two major events have been fundamental in shaping the direction that established oil and gas majors have taken.

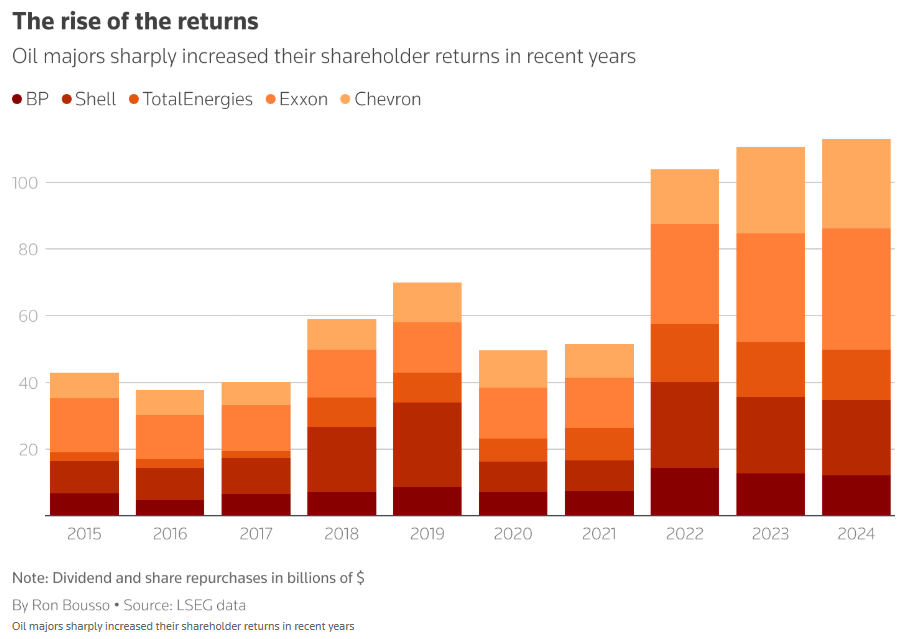

The first was the 2014-2016 oil price crash, which saw investors demand big oil pivot away from growth investments to instead focus on delivering better returns. This saw a pivot away from growth-based policies requiring heavy CapEx towards delivering short-term shareholder value programs.

The second major event shaping this shift away from growth-based strategies was, of course, the COVID-era 2020 oil price crash, which only served to accelerate the shift. A report published recently by Reuters nicely illustrates the scale of this tectonic shift.

Even to this day, we’re still seeing majors double down on these “shareholder value” programs. For instance, just yesterday, Shell [NYSE: SHEL] announced it was aiming to “enhance shareholder distributions from 30-40% to 40-50% of cash flow” by “continuing to prioritise share buybacks.” BP [NYSE: BP] made a similar announcement earlier this month.

Naturally, the “Drill, Baby, Drill” mandate poses a threat to such strategies. With a slight downward pressure on oil and gas prices as production increases, and increased capital expenditures necessitated by such a mandate eating into free cash flows, oil and gas majors could face reduced capacity to maintain the substantial “shareholder value” programs that have been so very much in vogue.

However, through all the noise and despite the “threats”, there is one message that has been consistently clear: US oil and gas production is tipped to enter an era of strong growth. This is the signal we’re hearing loud and clear from all corners.

For its part, the US Energy Information Administration (EIA) recently forecasted strong growth in crude and gas production, with new records due to be set in both 2025 and 2026. The agency has also made similar forecasts for natural gas production, particularly with increased demand placing strong downward pressure on inventories.

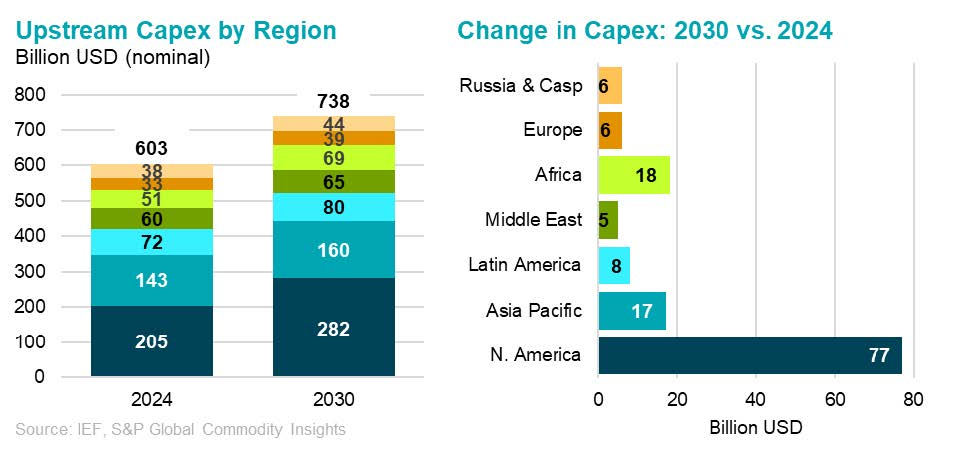

These forecasts dovetail nicely with recent International Energy Forum (IEF) forecasting, which suggests a strong uptick in upstream oil and gas investment in the US. By 2030, annual upstream oil and gas CapEx in the U.S. is expected to increase by $77 billion per annum.

All of this leads us to a single question: With oil and gas majors facing uncertainty in the “Drill, Baby, Drill” era, despite clear signals that U.S. oil and gas is set to boom, then who, exactly, is set to benefit the most?

The answer, of course, is small- to mid-sized independents, along with oil and gas juniors like Black Gold Exploration [CSE: BGX | FSE: P30] with advanced U.S.-based projects in the works.

Why BGX Will Be One of the Biggest Winners in the “Drill, Baby, Drill” Era

For background, BGX [CSE: BGX | FSE: P30] is a Vancouver-based oil and gas junior with properties in Argentina and the United States that has, since mid-2024, been aggressively expanding its footprint in the oil-rich land in Indiana’s Illinois Basin.

This rapid expansion kicked off in August 2024 with an initial acquisition of a 30% ownership stake in a group of oil and gas leases in Vigo County, Indiana, along with the corresponding seismic and other geological data. Since then, BGX has rapidly expanded its holdings in the basin, with further announcements of acreage expansions in a JV with LGX Energy coming in October 2024, and again in January of this year, giving it interest in a total of almost 1,000 acres of oil-rich land.

Further to this, BGX also acquired a 10% working interest in the single-well Fritz 2-30 project in February and immediately announced the commencement of drilling operations the same month. The project, which is located in the productive Terra Haute Reef Bank, is targeting a minimum of 10 stacked pay zones, which could deliver cash flow as early as mid-2025. Success here could also unlock offset drilling opportunities, with BGX holding an option to participate in any further development on the surrounding 210-acre Area of Mutual Interest (AMI).

In short, the past 6 or so months have seen BGX undertake a rapid expansion into U.S.-based projects, which has it poised to take full advantage of the current pro-oil era in the United States. However, BGX’s advantages extend beyond a mere presence in the U.S. In particular, BGX has:

- Prime U.S. Onshore Assets: Indiana’s Illinois Basin is a historically productive basin which has produced over 4 billion barrels of oil to date, with an estimated 4.1 billion barrels of recoverable oil remaining. Further, it has also proven to be a low-cost basin with shallow reserves and easy drilling.

- Friendly Jurisdiction with Minimal Bureaucracy: Indiana has long been recognized as having a friendly environment with fast development and permitting timelines coupled with lower royalty and lease rates compared with other states. Under the Trump-led “Drill, Baby, Drill” agenda, permitting and development timelines are expected to shrink even more.

- High Leverage to Rising Domestic Oil Demand: While BGX also holds properties in Argentina, its recent pivot to a heavily U.S.-centric approach since Q3/Q4 last year has positioned it perfectly to benefit maximally from Trump’s push to end reliance on foreign oil imports in favor of onshore producers — a push that will mainly benefit small-cap producers and juniors like BGX.

Looking further ahead, BGX’s strategy now involves riding these tailwinds with a dual focus on exploration and bringing assets to production centered around the Illinois Basin. This will see BGX maintaining an active exploration and drilling program in partnership with LGX, where we can expect the JV to drill additional exploratory or development wells throughout 2025 and 2026. Simultaneously, BGX will continue working to bring the Fritz prospect to production, thus generating early cash flows which will help to fund further exploration, and production of potential offset wells.

Taken as a whole, the above strategy outlines BGX as a heavily growth-focused company, standing it in stark contrast to the oil and gas majors whose diversified offshore holdings and de-growth strategies are facing more uncertainty in the Trump era. This, combined with its highly-prospective Illinois Basin projects is precisely why BGX stands out as being a major potential beneficiary of the “Drill, Baby, Drill” era.

BGX’s Long-Term Prospects

While there’s little question over the viability or potential of BGX’s [CSE: BGX | FSE: P30] current U.S.-focussed strategy, there are other lingering questions over its capacity to execute said strategy successfully. That is, does its financial and market strategy support its ambitions, and does its team have the experience to execute? Additionally, we also need to raise questions about whether such a heavy U.S. focus could backfire in the case that Trump’s domestic oil promises fail to bear their promised fruits.

In answering the first question, we find that BGX’s exploration and revenue plans are underpinned by reasonably prudent financial management and market positioning. For instance, while the company has issued equity to fund its acquisitions, it has appeared careful to balance dilution with leveraged deals, furthering its own interests.

The Illinois Basic acquisition, for example, was done via a share exchange which saw BGX offer 480,000 of its shares in exchange for 100% of Energy Holding Americas 1 Inc. (EHA1), a special purpose vehicle, which we can circumstantially infer was likely set up by LGX Energy to attract outside investors. As such, BGX likely acquired more than just the rights to the lease holdings; it likely secured the strategic alignment of LGX affiliates who are now BGX shareholders, thus ensuring deeper alignment than the resulting JV alone might imply.

Further to this, we can also see BGX actively working to ensure it’s able to secure better terms when it inevitably needs to raise. To this end, it has been engaging with marketing firms to help broaden investor awareness. For instance, in September 2024, BGX announced it had engaged a marketing firm to enhance market visibility in Germany and then in February this year, they announced that they had engaged a marketing firm to further strengthen its market presence. These efforts should help to broaden its shareholder base and raise awareness, thus facilitating capital raises on better terms.

In turning our attention to the capacity of the team to execute on the company’s strategy, we again see the signs of a company exercising great prudence. BGX is currently led by a strong team with a blend of technical oil and gas expertise, along with strong financial leadership. BGX CEO Francisco Gulisano, for instance, has a background as an experienced petroleum engineering professional with over 15 years’ experience certifying oil and gas reserves. We see a similar depth of experience across the team, with CFO Maryam Amin Shanjani (CPA) bringing decades of accounting and executive experience, including prior experience at development-stage natural resource companies like Andover Mining Corp.

Looking further ahead, we also find that BGX is much better positioned than some other juniors to ensure long-term success. While it’s true that the company has made a heavy pivot to a U.S.-first strategy in the wake of Trump’s “Drill, Baby, Drill” promises, the company’s not putting all its eggs in one basket. In fact, prior to its heavy investment in U.S.-based exploration and production, BGX’s flagship project was its El Carmen project — a 2,000-hectare block in the San Jorge Basin.

Recap: BGX Set to Boom in “Drill, Baby, Drill” Era With Additional Long Term Prospects

Despite the uncertainty that Trump’s “Drill, Baby, Drill” mandate has thrown over the broader oil and gas industry, some things are crystal clear. Notably, a rapid expansion in both production and upstream CapEx in the U.S. And while this may have some negative implications for oil and gas majors currently more concerned with dividend and share buyback programs, for growth-led, U.S.-focussed juniors like BGX [CSE: BGX | FSE: P30], there’s never been a better time.

Of course, nothing is ever 100% certain, and it’s always possible that Trump’s policies will fail to deliver their desired effects. If this happens, that will certainly have negative consequences for any junior too heavily invested in the U.S. However, in the case of BGX, we’ll likely see a company that, in the worst case scenario, returns to more or less the same state that it’s in today.

To understand this position, we need only look at the company’s share price history, which has predominantly traded sideways in the $0.20-$0.25 range as investors sit and wait for updates on its ongoing projects. As a reminder, this history dates back to before the company’s pivot to a more heavily U.S.-focused approach. All that’s really happened since then is a sharp increase in volume after investor interest naturally spiked.

As such, any failure on the Trump administration’s part will likely have little bearing on BGX, leaving plenty of potential upside with very minimal downside risk. With that said, this minimal downside risk only exists so long as BGX’s share price remains undervalued, which is to say, it likely only exists for a limited time. However, we anticipate BGX will start dropping results from its Illinois Basin drill program imminently. After that, we can only assume that it’s only a matter of time until investors stop sitting on their hands and pull the trigger on BGX.

__

(Featured image by WORKSITE Ltd. via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions, including with regards to potential earnings in the Empire Flippers affiliate program. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa2 weeks ago

Africa2 weeks agoAgadir Allocates Budget Surplus to Urban Development and Municipal Projects

-

Cannabis3 days ago

Cannabis3 days agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions

-

Biotech2 weeks ago

Biotech2 weeks agoVolatile Outlook for Enlivex Therapeutics as Investors Await Clinical Catalysts

-

Markets6 days ago

Markets6 days agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam