Crypto

Is Bitcoin the future of commerce?

Has Bitcoin truly redefined finance and commerce through its digital banking system? Is it the future and the new face of fiat money?

The idea of digital money—convenient and untraceable, liberated from the oversight of governments and banks—had been a rumored and popular topic since the birth of the internet. Over the past few years, no matter where you turn, you cannot escape hearing the terms “blockchain,” “cryptocurrency” and the infamous “Bitcoin.” But if you are not a hip millennial or an investor trying to jump on the trend, you may be wondering: what exactly are cryptocurrencies? Is this just a bubble waiting to explode, or is it the future of commerce and the further digitization of our lives?

What exactly is Bitcoin?

It’s a new currency that is quite remarkable for what isn’t: It’s not the money you can hold in your hand, it’s not yet recognized by most retail stores, and it’s not issued or backed by any particular national government. At its core, bitcoin and others of its kind are sets of software protocols for generating digital tokens and for tracking transactions in a way that makes it hard to counterfeit or re-use tokens. A bitcoin has value only to the extent that its users agree that it does.

Bitcoin’s origins

The original software framework was laid out in a white paper titled “A Peer-to-Peer Electronic Cash System” in 2008 by a group or person going by the pseudonym Satoshi Nakamoto, of which his real identity is unknown. For many years, virtual currencies have been used in online games. The core idea behind bitcoin was the blockchain, which can be described as a “publicly visible, largely anonymous online ledger that keeps track of and records Bitcoin transactions.”

The basics of how it works

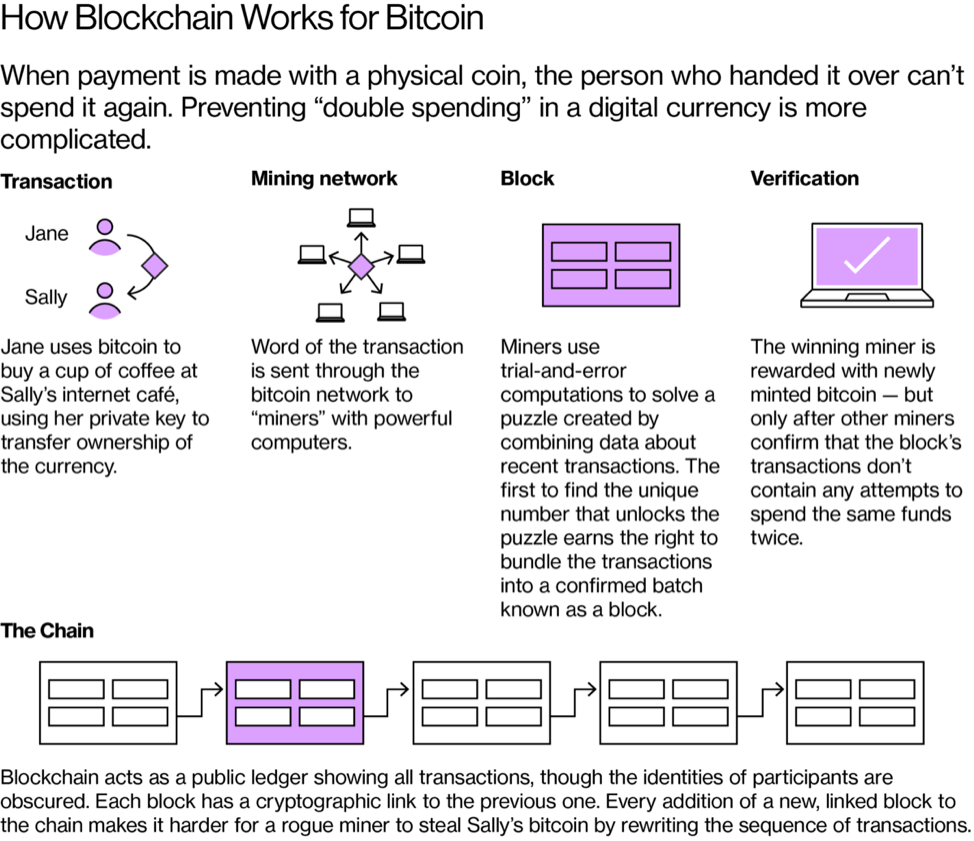

Let’s think about what happens when you transfer money from your bank account to another account. The bank verifies that your account has the funds, subtracts the amount from one spot in a giant database of accounts and balances it maintains, and credits it in another. You can see the result if you log on to your account, but the transaction is under the bank’s control.

Now, you are trusting the bank to remove the correct amount of cash, and the bank is also making sure you can’t spend that money again. The blockchain or distributed-ledger technology is a database that performs those tracking functions—but without the bank or any other central authority.

(Sources: Bloomberg, Bloomberg Quick Take)

Who is performing the banking function in the Bitcoin ecosystem?

It is done by a consensus on a decentralized network. The bitcoin transactions can be made through sites offering electronic “wallets” that upload the information or data to the network. New transactions are bundled together into a batch and broadcasted to the network for verification by so-called bitcoin miners.

Who can become a miner?

Technically, anyone can be a bitcoin miner, so long as you have really fast computers, a ton of electricity and the interest and capability to solve complex mathematical equations. The transaction data in each batch is encrypted by a formula that can be unlocked only through a sort of trial-and-error guessing on a massive scale. The miners put large-scale computing power to work as they compete to be the first to solve it. If a miner’s answer is verified by others, the data is added to a linked chain of data blocks, and the miner is rewarded with a newly issued bitcoin.

However, bitcoin is not without controversies. Mining such digital currency can contribute to a worldwide concern: pollution. How so? Cryptocurrency mines consume a lot of energy, as mentioned before, and since they require a huge amount of electricity, they also use fuels. For example, these mines in China require coal-generated electricity, and you know how coals are partly responsible for the increasing concern about global warming. Also, a TNW contributor wrote a pretty detailed article about the hardware behind the mining if you want to learn more.

What is the blockchain’s appeal?

Crypto fanatics see it as a totally new way of doing all kinds of business. In theory, costs could lower without a central middleman doing work of keeping transactions, and charging for it. Venture capitalists, banks and stock exchanges have thrown a lot on capital investment into developing blockchain technology, while large retailers such as Wal-Mart Inc. are experimenting with using blockchain for ensuring food safety.

Central banks are even considering issuing blockchain-based official currencies. And other types of blockchain emerged, often using their own cryptocurrencies to facilitate transactions. The most well known is the ethereum blockchain, which is also sometimes referred to as a platform for so-called smart contracts.

Why has the price of Bitcoin spiked so much?

The initial price of bitcoin, set in 2010, was less than one cent. Now it has gone past $16,000. And it is the only blockchain project that has crossed over into mainstream recognition so far. Additionally, its value has increased more than 1,000 percent in just the past year.

The vast amount of speculative investors and the expectations of more have contributed to the pricing surge. The CME Group and other derivatives trading exchanges are planning to offer bitcoin futures contracts, which possibly increased bitcoin’s appeal.

Another factor at play is the fact that bitcoin’s software guarantees there will be a finite supply, which has stoked the investors’ fear of missing out. Last Nov. 29, Bloomberg reported that bitcoin exchange Coinbase received an overwhelming amount of traffic when bitcoin’s price rose past $11,000, which rendered its service temporarily unavailable to some users. Every week, there are new crypto focused hedge funds opening up, of which there are already more than a hundred. Most of them are investing at least part of their funds in bitcoin.

Google announced on March 14 that it is cracking down on cryptocurrency-related advertising. The company is updating its financial services-related ad policies, which goes into effect in June 2018, to ban any ads about cryptocurrency-related content, including initial coin offerings (ICOs), wallets, and trading advice. Google’s hard-line approach follows a similar ban that Facebook announced earlier this year.

Bitcoin and the next dozen largest digital currencies by market cap are down at least 6% in the past 24 hours, and all except for one have declined over 12% in the past week. According to Forbes contributor Chuck Jones, “the biggest reason for today’s drop is Facebook posting an update to its Advertising Policy.” Its “Prohibited Content” section added the 29th policy titled “Prohibited Financial Products and Services.” Bitcoin has now down fallen to $8,300.

Bitcoin’s wild ride

(Source: WSJ Market Data Group)

Is this a bubble?

It quite possibly is. JPMorgan Chase & Co. CEO Jamie Dimon said bitcoin is a “fraud,” comparing it to tulip mania and predicting a collapse, even while his own bank is considering offering bitcoin futures to their clients. Some cynics have been quick to infer some kind of hypocrisy here.

Billionaire fund manager Mike Novogratz stated that cryptocurrencies are “the biggest bubble of our lifetimes,” and last year, he was planning to launch a $500 million hedge fund in cryptocurrencies but has cautioned and since delayed those plans, stating “we didn’t like market conditions and we wanted to re-evaluate what we’re doing.” Raymond Dalio, the founder of Bridgewater Associates, also said that “Bitcoin is a bubble.”

And only a few mainstream investors have bought large sums of bitcoin, brushing off concerns about cybersecurity and liquidity, as well as more run-of-the-mill fears of investment losses. Founders Fund, the venture-capital firm co-founded by Peter Thiel, has placed a bet and amassed hundreds of millions of dollars of the volatile cryptocurrency.

“While I’m skeptical of most of them, I do think people are a little bit underestimating bitcoin, specifically, because it is like a reserve form of money,” Mr. Thiel claimed at an investment conference crowd in Saudi Arabia last October, “If bitcoin ends up being the cyber equivalent of gold, it has great potential.”

Perhaps the most enthusiastic investor of them all is the infamous Tim Draper, one of the founding partners of leading venture capital firms Draper Associates and DFJ. He purchased almost 30,000 bitcoins in 2014 and expects that bitcoin and other cryptocurrencies will be the primary means of payment in five years. He told CNBC, “In five years you’re going to walk in and try to pay fiat [a government-backed currency like the U.S. dollar] for a Starbucks coffee, and the barista is going to laugh at you, because they’re going to say, ‘What is this? Are you counting out pennies? Give me shells?’”

So depending on who you talk to, bitcoins value could double again—or it could collapse and go down to zero.

Investing in cryptocurrencies

Investing in cryptocoins or tokens is highly speculative, and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment.

There are a number of ways to buy it, but all have different risks. People can buy the coins directly from exchanges such Coinbase. You can use Coinlist.me, which reviews exchanges and offers live streaming prices and the market capitalization of all cryptocurrencies. Accredited investors can also invest in vehicles like the Bitcoin Investment Trust, which also keeps track of bitcoin’s price. Very soon, investors will be able to invest through their investment brokers, and possibly in bitcoin exchange-traded funds, once regulators feel comfortable with the idea.

I cannot stress this enough: even plenty of people who believe in bitcoin’s future think some wild volatility rides still lie ahead. As in the proof from the surge to over $11,000 last Nov. 29, 2017, which dropped currently by 24 percent.

And yes, there are ways to bet on a crash. So while the cryptocurrency boom has produced a lot of excitement and wealth, it’s still a largely unregulated space and has spawned countless high-profile scams. If you interested in learning about so-called cryptocurrency billionaires, you can check out the list that Forbes made.

The true believers behind blockchain platforms like Ethereum argue that a network of distributed trust is one of those advances in software architecture that will prove, in the long run, to have historic significance. That promise has helped fuel the huge jump in cryptocurrency valuations. But in a way, the possible Bitcoin bubble may ultimately turn out to be a distraction from the true significance of the blockchain.

The real promise of these new technologies, many of their “evangelists” believe, lies not in displacing our currencies but in replacing much of what we now think of as the internet while at the same time returning the online world to a more decentralized and egalitarian system. If you believe the advocates, the blockchain is the future. However, it is also a way of getting back to the internet’s roots.

So like the editor of Bloomberg views says, “Bitcoin is a poor currency and a crazy investment—but the technology behind it is a real breakthrough.” By reducing the need for central intermediaries, the blockchain holds out the promise of processing transactions of various kinds more efficiently than today. Many banks and exchanges are exploring these types of new applications.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Markets2 weeks ago

Markets2 weeks agoShockwaves of War: U.S. Strikes Iran, Markets Teeter, Global Risks Rise

-

Fintech1 day ago

Fintech1 day agoRipple Targets Banking License to Boost RLUSD Stablecoin Amid U.S. Regulatory Shift

-

Crypto1 week ago

Crypto1 week agoCoinbase Surges: Bernstein Targets $510 as COIN Hits Highest Price Since IPO

-

Markets4 days ago

Markets4 days agoCoffee Prices Decline Amid Rising Supply and Mixed Harvest Outlooks

You must be logged in to post a comment Login